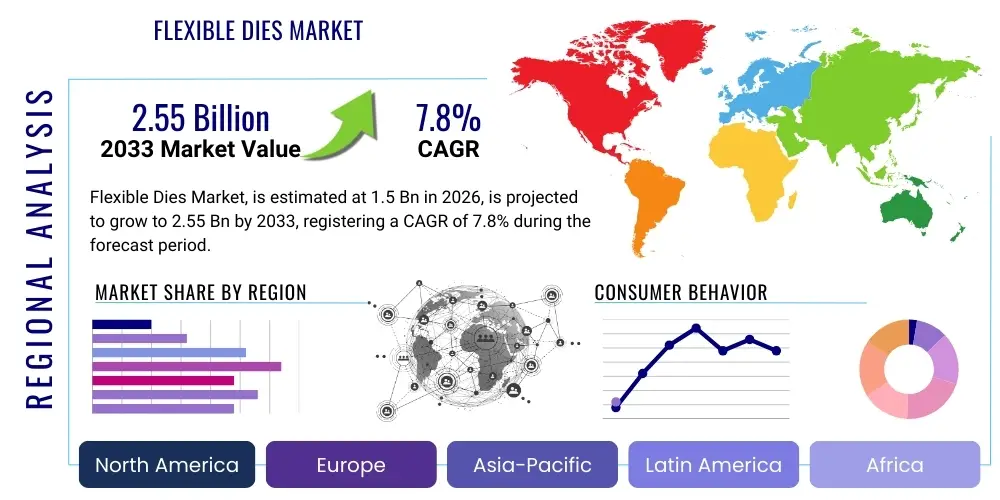

Flexible Dies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442239 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Flexible Dies Market Size

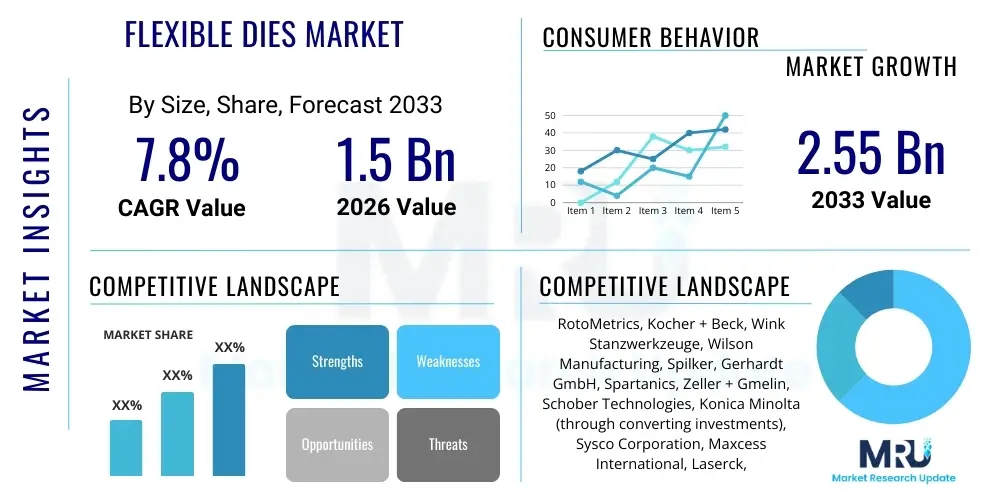

The Flexible Dies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Flexible Dies Market introduction

The Flexible Dies Market encompasses specialized rotary cutting tools essential for the high-speed conversion of materials in industries ranging from labeling and flexible packaging to medical device manufacturing and electronics fabrication. Flexible dies are precision-engineered, thin steel sheets chemically etched or laser-cut to extremely tight tolerances, allowing for intricate cutting, scoring, and perforating operations when mounted onto magnetic cylinders. These tools offer significant advantages over solid rotary dies, primarily concerning cost-efficiency, rapid setup, ease of storage, and superior flexibility for design changes. The core function of a flexible die is to facilitate continuous, high-volume production with unparalleled accuracy, ensuring minimal waste and maintaining optimal material integrity, a critical requirement for pressure-sensitive labels and complex multilayered substrates.

Major applications driving the demand for flexible dies include the production of self-adhesive labels for consumer goods, security labels, flexible pouches and stand-up bags, and die-cut components used in disposable medical products and electronic shielding. The market is heavily influenced by the proliferation of fast-moving consumer goods (FMCG) and the exponential growth of the e-commerce sector globally, both demanding vast quantities of highly specific labeling and packaging solutions. Furthermore, the advent of specialized coatings and advanced material treatments, such as surface hardening techniques, has extended the lifespan and precision of these dies, allowing them to handle abrasive or challenging materials like synthetic films and thicker tag stocks without degradation.

The primary benefits associated with adopting flexible die technology include remarkably fast turnaround times necessary for short-run jobs, significantly lower manufacturing costs compared to traditional solid tooling, and the versatility to integrate seamlessly into existing narrow-web and mid-web converting equipment. Key driving factors propelling market expansion involve technological advancements in magnetic cylinder stability and mounting systems, increased automation in the converting industry, and the growing complexity of label and packaging designs which mandate highly precise, custom-engineered cutting solutions. The global shift toward sustainable and thinner packaging materials also necessitates tooling that can execute complex cuts without damaging delicate substrates, solidifying the role of flexible dies as indispensable components in modern converting operations.

Flexible Dies Market Executive Summary

The Flexible Dies Market is characterized by robust growth underpinned by strong business trends focusing on integration, specialization, and sustainability. Key business trends include the consolidation among major die manufacturers to offer end-to-end tooling and maintenance solutions, the increasing adoption of digitally assisted manufacturing processes for faster die creation (Computer-to-Die technology), and a rising emphasis on precision coatings like tungsten carbide and ceramic variants to maximize tool longevity and performance when handling new abrasive substrates. Companies are also investing heavily in advanced inspection systems to ensure dies meet stringent quality standards required for high-security labels and specialized medical applications. The market structure remains competitive, with localized servicing capabilities often differentiating providers, especially in highly customized sectors.

Regional trends indicate that the Asia Pacific (APAC) region is expected to demonstrate the highest Compound Annual Growth Rate, driven by massive expansion in manufacturing capabilities, particularly in China and India, coupled with rising domestic consumption of packaged goods and increasing penetration of organized retail. North America and Europe, while representing mature markets, are focusing on adopting highly specialized and value-added flexible dies for complex applications such as smart labels (RFID/NFC integration) and eco-friendly packaging materials. These developed regions prioritize automation and operational efficiency, driving demand for dies compatible with advanced, high-speed rotary presses and requiring minimal operator intervention for setup and maintenance. Regulatory shifts toward sustainable packaging materials in Europe are particularly influencing tooling development to handle unique paper and bio-based films.

Segment trends reveal a significant surge in demand for dies optimized for flexible packaging applications, moving beyond traditional pressure-sensitive labels. This includes specialized dies for intricate cutouts, ventilation holes, and complex sealant layer scoring on pouches and flow wraps. Furthermore, the segmentation by material processed shows rising momentum for tooling capable of handling very thin films (sub-25 micron) used in high-efficiency labeling, as well as robust dies needed for abrasive security and holographic materials. Technology-wise, there is a clear trend toward dies engineered for variable depth cutting—allowing for kiss cutting and through cutting simultaneously—a necessity in multi-layer product construction. Segment performance is also increasingly tied to the adoption rate of magnetic cylinder technology, which provides the foundational platform for flexible die operation.

AI Impact Analysis on Flexible Dies Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Flexible Dies Market center predominantly on themes of design optimization, predictive maintenance, and operational integration with digital finishing systems. Users frequently ask if AI can reduce the iterative design cycles required for complex die layouts, particularly for nested patterns that maximize material yield, and whether AI algorithms can predict tool failure or degradation before it impacts production quality, thereby extending operational uptime. Another significant area of interest is how AI facilitates the seamless integration of flexible dies into hybrid or fully digital printing workflows, optimizing press speeds and cutting pressure based on real-time sensor data and material characteristics. These queries underline an industry-wide anticipation for AI to transform flexible die manufacturing from a reactive, experience-based discipline into a proactive, data-driven science, lowering operational expenditures and enhancing precision.

The integration of AI technologies, especially generative design and machine learning (ML), is fundamentally shifting the processes within the flexible die lifecycle, from initial CAD design to end-of-life management. Generative design algorithms can explore thousands of potential die geometries in minutes, optimizing factors like waste matrix removal stability, material utilization, and structural integrity of the die itself, leading to tooling solutions that were previously inaccessible through conventional human design processes. This accelerates time-to-market for complex labels and components. Furthermore, machine learning models, trained on historical data regarding material thickness, coating composition, run speed, and resulting die wear patterns, are enabling highly accurate predictive maintenance schedules. This transition minimizes unscheduled downtime, ensuring converters can maintain continuous high-volume production without fear of abrupt tool failure.

Beyond design and maintenance, AI enhances the operational performance of flexible dies within the converting press environment. Sophisticated sensors on rotary presses gather real-time data on cutting pressure, temperature, and substrate movement. AI models analyze this continuous data stream to dynamically adjust press settings—such as impression depth and speed—to compensate for minor material inconsistencies or temperature variations, ensuring uniform kiss-cutting depth across the entire web width, regardless of run length. This level of real-time optimization, powered by AI, translates directly into higher yield rates, reduced substrate waste, and superior finished product quality, thereby solidifying AI’s role as a critical enabler of next-generation high-precision converting operations.

- AI optimizes die geometry for maximum material yield and structural stability using generative design tools.

- Machine learning models enable predictive maintenance by analyzing sensor data to forecast tool wear and failure.

- Real-time cutting parameter adjustment is facilitated by AI to ensure consistent kiss-cut depth and reduce substrate waste.

- Automated quality control systems utilize AI for immediate detection of cutting errors or imperfections during high-speed production.

- AI integration assists in optimizing complex nesting layouts for multi-up designs, enhancing production throughput.

DRO & Impact Forces Of Flexible Dies Market

The dynamics of the Flexible Dies Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that shape its trajectory. A primary driver is the accelerating demand for intricate and customized labeling and packaging designs globally, fueled by brand differentiation strategies and stringent regulatory requirements for product traceability, requiring specialized and frequently replaced tooling. Concurrently, technological advancements in material science, particularly the introduction of highly durable and specialized die coatings (such as Tungsten Carbide and various Ceramic composites), are significantly extending the operational life and cutting precision of flexible dies, enabling them to process challenging substrates like abrasive thermal transfer materials and thin synthetic films effectively, thereby increasing the utility and market appeal of these tools.

However, the market faces significant restraints. The necessity for high-precision manufacturing environments and the substantial capital expenditure required for sophisticated laser etching and CNC finishing equipment limit the rapid expansion of manufacturing capabilities, creating bottlenecks. Furthermore, the inherent vulnerability of flexible dies to mishandling or improper setup compared to solid dies poses a training challenge for converters, increasing the risk of premature tool damage. Another constraint is the increasing competition from digital finishing technologies, particularly laser cutting systems, which offer rapid changeovers without physical tooling, posing an alternative for ultra-short runs. While laser cutting is currently higher cost and speed-limited in certain applications, its ongoing technological improvement represents a long-term competitive threat to conventional die cutting.

Opportunities for growth are concentrated in emerging economies, where the packaging and labeling industries are undergoing rapid modernization and adopting high-speed rotary converting equipment, creating a fresh demand base for flexible dies. Additionally, the development of hybrid converting solutions that integrate digital printing with conventional die-cutting offers a niche opportunity, requiring flexible dies engineered for seamless registration with digitally printed graphics. The strongest impact forces currently are the competitive pricing pressure exerted by Asian manufacturers and the rapid rate of technological obsolescence, forcing established manufacturers in North America and Europe to continuously innovate in material technology and coating durability. This continuous innovation cycle dictates market leadership and ensures that only vendors offering superior precision and lifespan can maintain profitability in the long run.

Segmentation Analysis

The Flexible Dies Market is strategically segmented across several critical dimensions, including application type, material processed, and the technological features of the die itself, providing granular insights into demand patterns across various industrial end-users. Application segmentation is crucial, with pressure-sensitive labels consistently dominating the market, followed closely by rapidly growing segments like flexible packaging and specialized die-cut components for medical and electronics industries. The diversity of substrate requirements—from ultra-thin BOPP films to thick synthetic tag stock and abrasive direct thermal materials—mandates specialized tooling, which forms the basis for material segmentation. Furthermore, the functional segmentation, encompassing standard dies, coated dies (e.g., ceramic or specialized polymers), and variable depth dies, reflects the industry’s need for tooling capable of handling complex converting requirements efficiently and reliably in high-volume settings.

Segmentation by material processed is becoming increasingly vital due to the industry’s shift toward sustainable and complex multi-layered substrates. Dies designed specifically for handling abrasive recycled paper stocks, bio-degradable films (PLA/PHA), or delicate specialty security materials require distinct metallurgical properties and advanced coatings to prevent rapid wear and ensure clean, non-stringing cuts. The market witnesses premium pricing for dies optimized for highly demanding materials, recognizing the advanced engineering required. Application-wise, the flexible packaging segment, which includes intricate scoring and precise window cutting for stand-up pouches, is experiencing above-average growth, driven by consumer preference for convenient and visually appealing food and non-food packaging solutions, necessitating larger format flexible dies and specialized registration features for web presses.

The technological segmentation highlights the market's trajectory towards performance enhancement and specialization. Coated dies, which employ surface treatments like Plasma Vapor Deposition (PVD) or Diamond-Like Carbon (DLC), command a significant market share due to their extended operational life and ability to maintain edge sharpness over millions of impressions, particularly in environments processing highly adhesive or abrasive substances. These advanced dies minimize the frequency of replacements, directly addressing operational cost concerns for converters. Moreover, the segmentation based on manufacturing method—chemical etching versus laser cutting and CNC finishing—indicates a gradual shift towards combined methods that leverage the speed of etching with the precision of post-etching CNC refinement, yielding tools of exceptional accuracy and robustness necessary for modern, high-tolerance converting operations.

- By Application:

- Pressure-Sensitive Labels (PSL)

- Flexible Packaging (Pouches, Wraps)

- Medical & Healthcare Components (Disposable patches, diagnostics)

- Electronics & Automotive Components (Gaskets, shielding materials)

- By Material Processed:

- Paper & Paperboard

- Film (BOPP, PET, Vinyl, PE)

- Synthetic & Specialty Stock (Thermal, Security, Foils)

- By Type/Coating:

- Standard Flexible Dies (Etched Steel)

- Coated Flexible Dies (Ceramic, Tungsten Carbide, DLC)

- Adjustable Depth/Anvil Dies

- Solid Dies (Used for comparison and high-end niche)

Value Chain Analysis For Flexible Dies Market

The value chain of the Flexible Dies Market begins with critical upstream activities centered on the procurement and preparation of specialized raw materials. This phase involves acquiring high-grade tool steel (often high-carbon, high-chrome varieties) characterized by specific hardness and machinability properties, along with the necessary chemical agents for etching processes, such as ferric chloride solutions. Suppliers in this segment must adhere to strict metallurgical specifications, as the quality of the base steel directly dictates the final precision and durability of the die cutting edge. Upstream efficiency is vital; reliable supply chains for consistent steel sheets are crucial, as fluctuations in material quality or price can significantly impact the overall cost structure and lead times for die manufacturers.

The midstream segment involves the core manufacturing processes, including chemical etching (photochemical milling) to create the cutting rule pattern, followed by precision grinding, heat treatment (hardening), and the application of specialized coatings (PVD/DLC) to enhance edge life and minimize friction. Advanced flexible die manufacturers utilize highly controlled cleanroom environments and sophisticated laser finishing techniques to achieve micrometer-level precision required for tight tolerance applications. The effectiveness of the midstream operation is the primary determinant of competitive advantage in the market, relying heavily on proprietary etching techniques and state-of-the-art automation to ensure repeatability and rapid production cycles, essential for meeting the just-in-time demands of converters.

Downstream activities involve distribution, sales, and aftermarket services. Distribution channels are typically dual: large, standardized die orders often go through specialized industrial distributors who manage inventory and logistics, whereas highly customized or complex dies (e.g., those requiring unique variable depths or specialized coatings) are frequently sold directly by the manufacturer, often accompanied by technical consulting and installation support. The post-sales service, including die repair, re-sharpening, and quality consultation, is an increasingly important element of the value chain, as converters seek to maximize their tooling investment. Direct distribution offers manufacturers greater control over branding and technical support, which is critical given the precision nature of the product, while indirect channels provide wider market reach, especially into smaller and geographically dispersed converting shops.

Flexible Dies Market Potential Customers

The primary consumers, or end-users, of flexible dies are companies operating high-speed rotary converting and finishing equipment that require precision material processing. This customer base is fundamentally categorized into narrow-web and mid-web label converters who utilize flexible dies extensively for pressure-sensitive label production across industries such as food & beverage, pharmaceuticals, and cosmetics. These converters prioritize tooling that guarantees high-speed throughput and impeccable registration accuracy, especially for complex die-cut shapes and security features. As pharmaceutical regulations become stricter, demanding perfect traceability labels, the demand for ultra-high-precision dies within this customer segment remains consistently strong, often necessitating specialized certification and validation processes for the tooling.

Another significant group of potential customers includes specialized flexible packaging manufacturers who use rotary cutting systems to create intricate cutouts, handles, vents, and seal profiles for pouches, bags, and blister packs. As the shift from rigid to flexible packaging continues globally, this customer segment requires robust flexible dies capable of cutting multi-layer polymer films and foils without snagging or leaving residual material (web fuzz). The specific requirements here often involve dies with unique bevel angles and anti-stick coatings designed to minimize residue build-up from polymer materials and adhesives, ensuring continuous press operation and reducing the need for manual cleaning and maintenance downtime.

Furthermore, niche but high-value customers exist within the medical device and electronics fabrication sectors. Medical end-users utilize flexible dies for precision die-cutting of wound dressings, diagnostic test strips, transdermal patches, and filtration media, where tolerance requirements are exceedingly tight, often measured in micrometers. In electronics, flexible dies are used to create components like gaskets, shielding materials, flexible circuitry substrates, and battery components. These applications demand tooling made with the highest possible metallurgical purity and specialized surface finishes to prevent contamination, making them crucial segments for manufacturers capable of delivering highly specialized, application-specific flexible die solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RotoMetrics, Kocher + Beck, Wink Stanzwerkzeuge, Wilson Manufacturing, Spilker, Gerhardt GmbH, Spartanics, Zeller + Gmelin, Schober Technologies, Konica Minolta (through converting investments), Sysco Corporation, Maxcess International, Laserck, Flexible Dies Inc., National Die, Technicut, Valley Cutting Dies, Lartec, Die-Cut Technologies, and Apex International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible Dies Market Key Technology Landscape

The technological landscape of the Flexible Dies Market is defined by continuous innovation in material science, manufacturing precision, and integration capabilities with modern printing presses. A central technology is the advancement in surface coating techniques, moving beyond standard chrome plating to sophisticated Plasma Vapor Deposition (PVD) and Diamond-Like Carbon (DLC) coatings. These specialized ceramic and hardened alloy coatings are crucial for significantly increasing the lifespan of the cutting edge, reducing friction during high-speed operation, and minimizing adhesive or material build-up (sticking), which is a common issue when processing highly tacky materials or complex synthetic films. The implementation of PVD/DLC technology allows converters to achieve much longer run lengths between die changes, directly contributing to improved overall equipment effectiveness (OEE).

Manufacturing technology has also seen significant evolution, with key players adopting hybrid production methods. While photochemical etching remains the foundational process for forming the base cutting rule geometry, advanced manufacturers now integrate high-precision CNC grinding and focused laser hardening processes post-etching. Laser hardening selectively hardens only the cutting tip to optimal Rockwell hardness levels without distorting the overall die structure, ensuring dimensional stability and extended edge retention. This combination of speed (etching) and precision (CNC/Laser) allows for the production of dies with incredibly tight tolerances (often within +/- 2 microns) and complex geometries, essential for intricate multi-layer applications like integrated product labeling and advanced security tags.

Furthermore, critical supporting technologies include the development of highly advanced magnetic cylinder systems and automated die handling equipment. Modern magnetic cylinders feature stronger, more consistent magnetic fields across the entire circumference, ensuring the flexible die is held securely and precisely, which is fundamental to achieving high-speed, perfect-registration cutting. The increasing adoption of automated measuring and registration systems utilizing high-resolution cameras and sensors on the press allows for near-instantaneous setup verification and adjustment. This technological convergence ensures that the high-precision manufacturing of the flexible die translates directly into high-precision performance on the production line, minimizing material waste and maximizing uptime for high-volume converting operations globally.

Regional Highlights

Regional dynamics in the Flexible Dies Market are stratified based on the maturity of the packaging industry, technological adoption rates, and local regulatory environments. North America represents a mature, high-value market characterized by a strong focus on advanced, specialized labels (e.g., RFID, smart packaging) and the medical sector. The demand here is driven by the necessity for operational efficiency, high automation, and stringent quality control, favoring flexible dies with superior coatings and long operational lifecycles. Investment in hybrid printing and finishing systems is prevalent, mandating tooling optimized for flawless digital-to-die registration.

Europe mirrors North America in its demand for high-precision tooling but is uniquely influenced by stringent sustainability regulations, such as those related to single-use plastics and packaging waste reduction. This regulatory environment drives demand for flexible dies specifically engineered to process novel, challenging eco-friendly substrates like thin barrier films and recycled paper stocks without compromising cutting integrity. The requirement for precision in cutting these delicate, often variable materials forces converters to opt for premium dies featuring advanced ceramic coatings and customized bevel geometries.

Asia Pacific (APAC) stands out as the primary growth engine for the flexible dies market. This region, spearheaded by manufacturing hubs in China, India, and Southeast Asia, is experiencing explosive growth in packaged consumer goods and e-commerce penetration. The market in APAC is characterized by enormous volume demands, driving the procurement of large quantities of standard and mid-level flexible dies. While price sensitivity is higher, the increasing shift towards quality and automation in major production facilities is gradually boosting the demand for higher-end, coated dies to improve production reliability and reduce maintenance costs associated with continuous, high-speed operations.

- North America: Focus on high-value specialty labels, medical components, high-speed converting automation, and demand for premium, coated flexible dies.

- Europe: Driven by sustainability mandates, requiring specialized dies for processing bio-degradable and recycled materials; strong emphasis on precision and reduced environmental impact.

- Asia Pacific (APAC): Leading market growth due to massive expansion in FMCG, e-commerce, and overall manufacturing capacity; high-volume demand coupled with increasing focus on quality upgrades.

- Latin America (LATAM): Emerging market potential, fueled by expanding industrialization and rising middle-class consumption, leading to modernization of packaging infrastructure and increased adoption of entry-level and standard flexible dies.

- Middle East and Africa (MEA): Growth concentrated in key GCC nations and South Africa, driven by investments in logistics and packaged food sectors, demanding robust tooling for harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible Dies Market.- RotoMetrics

- Kocher + Beck

- Wink Stanzwerkzeuge

- Wilson Manufacturing

- Spilker

- Gerhardt GmbH

- Spartanics

- Zeller + Gmelin

- Schober Technologies

- Konica Minolta (through converting investments)

- Sysco Corporation

- Maxcess International

- Laserck

- Flexible Dies Inc.

- National Die

- Technicut

- Valley Cutting Dies

- Lartec

- Die-Cut Technologies

- Apex International

Frequently Asked Questions

Analyze common user questions about the Flexible Dies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of flexible dies over solid rotary dies?

Flexible dies offer significantly lower initial cost, faster manufacturing turnaround times, simplified storage, and superior flexibility for design modifications, making them ideal for short-to-mid volume label and packaging converting runs requiring high precision.

How does specialized coating technology impact the lifespan and performance of flexible dies?

Advanced coatings like Ceramic, Tungsten Carbide, or DLC (Diamond-Like Carbon) increase the hardness and reduce friction at the cutting edge, dramatically extending tool life, particularly when processing abrasive, thick, or highly adhesive synthetic materials.

Which application segment holds the largest market share for flexible dies globally?

The Pressure-Sensitive Labels (PSL) application segment currently dominates the flexible dies market, driven by universal demand for product identification, tracking, and consumer branding across the FMCG, pharmaceutical, and retail sectors.

How is Artificial Intelligence (AI) being utilized in the flexible die manufacturing process?

AI is primarily used for generative design optimization to enhance material nesting and reduce waste, and in machine learning models for predictive maintenance, forecasting tool wear to minimize unexpected production downtime in converting operations.

What key factors are restraining the overall growth of the flexible dies market?

Key restraints include the high capital expenditure required for sophisticated precision manufacturing equipment, competition from emerging digital laser cutting technologies, and the necessity for skilled operator training to prevent premature die damage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager