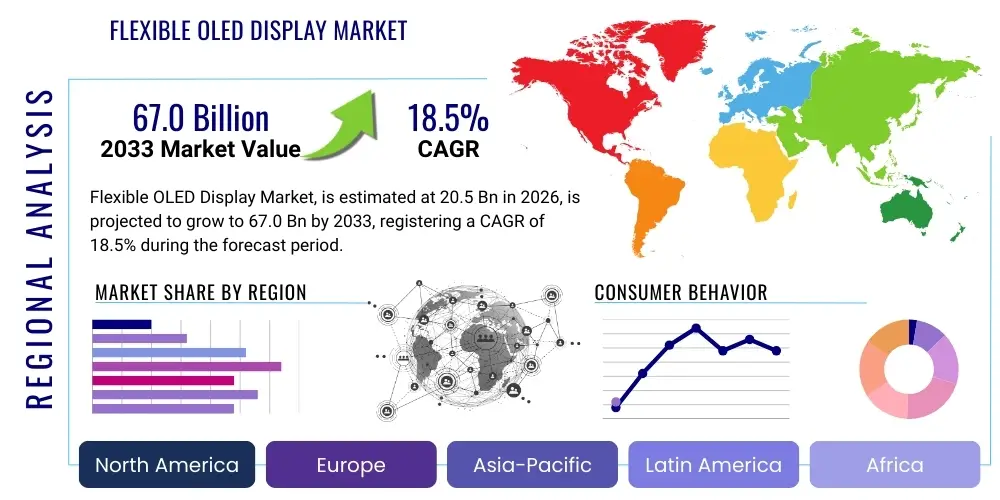

Flexible OLED Display Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441380 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Flexible OLED Display Market Size

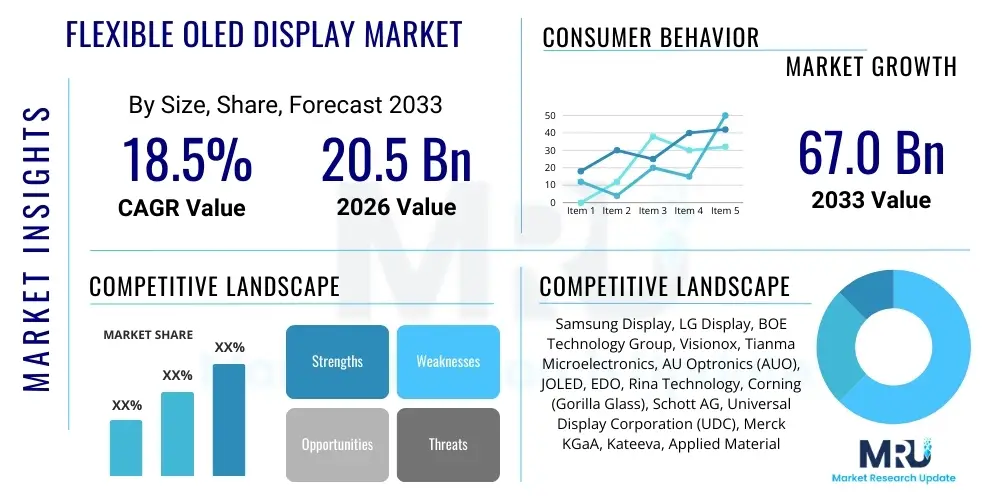

The Flexible OLED Display Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 67.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating adoption of flexible displays in high-end consumer electronics, particularly smartphones, smartwatches, and emerging foldable devices, offering consumers superior display quality and innovative form factors previously unattainable with rigid display technologies. Furthermore, increasing investments in production capacity expansion, technological advancements in thin-film encapsulation (TFE), and the development of more durable flexible substrates are critical elements supporting this substantial market expansion.

The market valuation reflects significant confidence from major display manufacturers, who are transitioning a substantial portion of their production capacity toward flexible OLED fabrication lines (Gen 6 and higher). The move towards mass-market deployment of foldable phones and rollable screens in the automotive and smart home sectors is elevating the demand for sophisticated, large-area flexible panels. Geographic expansion, particularly across emerging economies in Asia Pacific, coupled with competitive pricing strategies and diversified application portfolios, ensures sustained revenue growth throughout the forecast timeframe, solidifying flexible OLEDs as a fundamental component of next-generation digital interfaces.

Flexible OLED Display Market introduction

The Flexible OLED Display Market encompasses the production and commercialization of Organic Light Emitting Diode displays fabricated on flexible substrates such as plastic (polyimide) or thin glass, enabling these screens to be bent, folded, or rolled without compromising display performance. Unlike traditional rigid OLEDs or LCDs, flexible OLEDs utilize thin-film encapsulation techniques and flexible backplanes, making them thinner, lighter, and far more durable against impact. This technological superiority allows for revolutionary product designs, moving beyond conventional flat screens into novel form factors that enhance user interaction and device portability, fundamentally reshaping the design philosophies of modern consumer electronics.

Major applications of flexible OLED displays include premium smartphones (curved, edge-to-edge, and foldable designs), advanced smartwatches and wearables, automotive interior displays, and increasingly, flexible tablets and laptops. Key benefits driving the market adoption include superior image quality characterized by perfect blacks, high contrast ratios, wide viewing angles, and rapid response times. Moreover, their inherent flexibility facilitates highly ergonomic designs and offers enhanced durability compared to rigid glass panels, making them ideal for devices exposed to rugged environments or requiring complex geometric integration, such as head-up displays (HUDs) and curved digital signage.

The primary driving factors sustaining market momentum are the increasing penetration of 5G technology, which necessitates advanced mobile interfaces capable of higher data consumption and seamless multitasking, and the consumer appetite for differentiated, premium electronic products. Furthermore, original equipment manufacturers (OEMs) are heavily marketing foldable and rollable devices as the next major upgrade cycle, directly spurring demand for high-volume, reliable flexible OLED panels. Continuous innovation in material science, focusing on extending display lifetime, reducing power consumption, and improving folding mechanisms, further solidifies the market’s positive growth outlook.

Flexible OLED Display Market Executive Summary

The Flexible OLED Display Market Executive Summary highlights a period of intense technological competition and rapid commercialization, dominated by major display manufacturers in South Korea and China. Business trends indicate a strategic shift towards increasing manufacturing yield rates for Gen 6 flexible OLED fabrication lines, prioritizing efficiency in producing complex multi-layer panel structures required for foldable smartphones. Investment heavily targets advanced processes like laser lift-off (LLO) and precise thin-film deposition techniques, aiming to lower production costs and democratize flexible display technology beyond the ultra-premium segment. Furthermore, strategic partnerships between display makers and material suppliers are critical for securing next-generation materials, such as durable polyimide substrates and efficient light-emitting materials, driving core business competitiveness.

Regionally, Asia Pacific maintains its undisputed leadership, anchored by the dominant production capabilities of South Korea and the burgeoning manufacturing capacity and robust demand in China. This region acts as both the global manufacturing hub and the largest consumer market for flexible display integrated devices. North America and Europe are significant consumers, driven by high disposable incomes and strong adoption rates for high-end foldable smartphones and automotive display applications. Regional trends indicate a growing emphasis on localization of supply chains outside of core APAC manufacturing centers, especially for specialized flexible electronics used in military, aerospace, and advanced medical devices, although the core volume production remains concentrated in East Asia.

Segment-wise, the market is primarily segmented by Application, Display Type, and End-Use Industry. The smartphone segment currently represents the largest market share due to the widespread adoption of flexible displays for curved edge designs and foldable devices. However, the Automotive Display segment is projected to exhibit the highest future growth rate, driven by the shift towards immersive, integrated cockpit experiences featuring large, continuous, and irregularly shaped display surfaces. Panel manufacturing complexity and the transition toward medium and large flexible panels (for notebooks and monitors) are key segment trends, necessitating manufacturers to diversify their product mix and invest in dedicated fabrication lines optimized for larger substrate handling.

AI Impact Analysis on Flexible OLED Display Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Flexible OLED Display Market predominantly center on how AI can enhance manufacturing efficiency, improve display performance, and drive next-generation application development. Key concerns revolve around the integration of AI-powered quality control systems to manage the extreme precision required in flexible panel fabrication, optimizing material usage, and predicting potential defects during the rolling or folding processes. Users are also keen to understand how AI-driven personalized content delivery and display management (such as dynamic refresh rate adjustment based on user activity) will necessitate specific characteristics in flexible display hardware, thereby influencing future design specifications and material science requirements.

AI’s influence is projected to be transformative across the flexible display value chain, starting from design optimization where AI algorithms simulate millions of complex folding and bending cycles to identify material stress points and ensure long-term durability, thereby accelerating R&D cycles. In manufacturing, AI-powered predictive maintenance and yield enhancement systems are crucial for maintaining the high cost-efficiency and quality required for mass production, especially given the sensitivity of flexible substrates to contamination and processing variations. Furthermore, AI contributes significantly to the development of smarter, more interactive displays in end-use applications like automotive cockpits, where machine learning analyzes driver behavior and ambient conditions to adjust display brightness, curvature, and information density dynamically.

The symbiosis between AI and flexible OLEDs is also evident in the development of augmented reality (AR) and virtual reality (VR) devices. Flexible micro-displays, driven by AI algorithms for high-speed rendering and distortion correction, are essential for creating truly immersive and lightweight headsets. As devices become more personalized and context-aware, enabled by edge AI, flexible OLEDs provide the ideal low-power, high-resolution interface needed to convey complex information rapidly. This convergence ensures that AI not only optimizes the production of flexible OLEDs but also expands their functional scope in future intelligent consumer and industrial products, necessitating continuous innovation in substrate flexibility and pixel density.

- AI-Enhanced Manufacturing Yields: Utilizing machine learning for defect detection and optimization of thin-film encapsulation (TFE) and deposition processes, significantly reducing waste in high-cost flexible substrate production.

- Predictive Maintenance: AI algorithms analyze real-time data from fabrication equipment to anticipate failures, minimizing downtime in G6 flexible OLED lines.

- Material Stress Simulation: AI modeling accelerates the development of durable polyimide and protective films by simulating mechanical stresses during folding and rolling, improving device longevity.

- Dynamic Display Adjustment: AI-driven software optimizes pixel refresh rates, brightness, and color accuracy based on content type and ambient lighting, maximizing power efficiency in flexible devices.

- Personalized AR/VR Interfaces: AI dictates rendering and optical correction in flexible micro-displays, enhancing the immersive experience and reducing visual latency in wearable electronics.

DRO & Impact Forces Of Flexible OLED Display Market

The Flexible OLED Display Market is propelled by powerful growth drivers, notably the accelerating consumer adoption of foldable smartphones, which represents the pinnacle of mobile innovation and provides a significant volume requirement for flexible panels. The inherent benefits of OLED technology, such as perfect black levels, high contrast ratios, and extreme thinness, combined with the form factor flexibility, make them irreplaceable in high-end portable devices and emerging applications like smart wearables and large curved automotive screens. Furthermore, substantial R&D investments by industry giants like Samsung Display and LG Display into durability improvements (e.g., Ultra-Thin Glass or UTG technology) and cost reduction methodologies are crucial drivers maintaining market momentum and expanding application horizons.

However, the market faces significant restraints, primarily centered around high initial manufacturing costs associated with Gen 6 flexible lines and the complexity of achieving high yields compared to traditional rigid displays. Technical challenges, particularly related to the long-term durability of the flexible stack-up, including the protective cover layers and the folding mechanism itself, remain a concern for widespread consumer trust. Furthermore, the dominance of a few key players in the supply chain for critical materials (like polyimide substrates and specialized encapsulation films) creates potential supply constraints and limits pricing flexibility, acting as a brake on rapid cost reduction and mass-market penetration in lower-tier segments.

Opportunities abound, particularly in the expansion into non-traditional display sectors. The automotive industry presents a massive opportunity, requiring expansive, aesthetically integrated flexible displays across the dashboard and cabin. Similarly, the development of truly flexible, rollable TVs and large digital signage represents a new frontier for high-margin, large-area panel applications. The ongoing development of micro-LED technology, while a potential long-term threat, also drives innovation in encapsulation and substrate handling, pushing OLED manufacturers to continuously improve their flexible solutions. Impact forces, driven by high capital expenditure requirements and stringent intellectual property protections surrounding manufacturing processes, consolidate market power among established players, creating high barriers to entry for new competitors and ensuring technological dominance remains concentrated.

Segmentation Analysis

The Flexible OLED Display Market segmentation provides a granular view of revenue streams based on the core characteristics of the displays and their specific end-use environments. The market is fundamentally segmented by Display Type (primarily categorized by the nature of the backplane technology), Application (defining the device where the display is integrated), and End-Use Industry (specifying the commercial sector utilizing the final product). Analyzing these segments helps stakeholders identify high-growth areas, allocate resources efficiently, and tailor product development to meet diverse industrial needs, ranging from demanding automotive specifications to high-volume consumer electronics requirements.

The Display Type segment distinguishes between categories such as AMOLED (Active-Matrix OLED) and PMOLED (Passive-Matrix OLED), with AMOLED overwhelmingly dominating the flexible space due to its superior efficiency, large size capabilities, and high resolution necessary for modern devices. Within Applications, smartphones command the majority market share, though emerging segments like tablets, laptops, and specialized industrial equipment are gaining traction. The growing trend toward medium-sized flexible panels (10-17 inches) for notebooks and monitors is a critical driver for revenue diversification beyond mobile devices.

The End-Use Industry breakdown reveals that Consumer Electronics is the largest volume segment, followed by the rapidly expanding Automotive sector. The Healthcare and Industrial sectors, though smaller in volume, represent high-value opportunities due to the unique requirement for flexible, durable, and highly reliable displays in medical monitoring devices, flexible sensors, and ruggedized industrial interfaces. Understanding the specific performance benchmarks required by each industry, such as temperature tolerance in automotive or sterilization resilience in healthcare, is crucial for segment-specific strategic planning and technology roadmap development.

- By Display Type:

- Active Matrix Organic Light Emitting Diode (AMOLED)

- Passive Matrix Organic Light Emitting Diode (PMOLED)

- By Application:

- Smartphones and Tablets (Foldable and Curved)

- Wearable Devices (Smartwatches, Fitness Bands)

- Television and Digital Signage (Rollable and Curved Displays)

- Laptops and Monitors

- Automotive Displays (Dashboard, Center Stack, Rear Seat Entertainment)

- Other Specialized Applications (Medical, Military, Industrial)

- By End-Use Industry:

- Consumer Electronics

- Automotive

- Healthcare

- Industrial and Military

- By Substrate Material:

- Polyimide (PI)

- Ultra-Thin Glass (UTG)

Value Chain Analysis For Flexible OLED Display Market

The Value Chain Analysis of the Flexible OLED Display Market is characterized by highly complex, capital-intensive processes starting from raw material sourcing and culminating in final product integration. The upstream segment involves the supply of critical materials, where specialized chemical and material science companies provide essential components such as polyimide (PI) substrates, thin-film encapsulation (TFE) materials, organic light-emitting materials, and sophisticated semiconductor equipment. This segment requires high precision and proprietary expertise, leading to a concentrated supply base where control over quality and innovation in materials directly impacts the performance and cost-effectiveness of the final display panel.

The core manufacturing stage is dominated by large-scale display panel manufacturers, primarily in South Korea and China, who undertake the highly technical processes of backplane fabrication (using LTPS or oxide TFTs), organic material deposition (via fine metal masks or inkjet printing), and advanced encapsulation techniques. This stage requires multi-billion dollar capital expenditure for Gen 6 fabs and is characterized by intense intellectual property competition. Direct distribution channels are prevalent for high-volume sales, where panel manufacturers supply directly to major OEMs (Original Equipment Manufacturers) like Apple, Samsung Electronics, and automotive Tier 1 suppliers, ensuring precise technical specification alignment and managed logistics for sensitive components.

The downstream segment includes the integration and sales of finished electronic products. OEMs integrate the flexible displays into their final products, which are then sold through indirect channels (retailers, e-commerce platforms) or direct-to-consumer models. The shift towards foldable devices has increased the complexity of the downstream market, requiring specialized assembly and testing processes. The high entry barriers and complex technological dependencies throughout the value chain emphasize the need for robust partnerships and strategic vertical integration to ensure supply reliability and quality control, especially given the rapid pace of iteration in flexible display technology.

Flexible OLED Display Market Potential Customers

The Flexible OLED Display Market targets a broad yet discerning customer base, primarily consisting of high-volume Original Equipment Manufacturers (OEMs) who are developing next-generation consumer and commercial products. The core end-users are manufacturers of high-end mobile devices, including smartphones, tablets, and laptops, where flexible displays are integral to achieving sophisticated curved aesthetics, thin profiles, and the revolutionary functionality of foldable and rollable designs. These customers prioritize panel performance metrics such as refresh rate, color gamut, power efficiency, and, crucially, long-term mechanical durability under repeated stress.

A rapidly expanding customer segment is the Automotive industry, encompassing global car manufacturers and their Tier 1 suppliers. These buyers require robust, large-area flexible panels for integration into modern vehicle cockpits, replacing traditional gauges and creating seamless digital surfaces across the dashboard and door panels. Automotive applications demand displays that meet stringent safety standards, exhibit extreme temperature tolerance, and offer unique form factors that conform to complex interior architectural curves, significantly boosting the demand for specialized, high-reliability flexible OLEDs.

Furthermore, specialized industrial buyers, including manufacturers of high-end medical monitoring equipment, ruggedized field computing devices, and advanced military interfaces, constitute a high-value customer base. These sectors require flexible displays that offer unique attributes such as portability, resistance to physical shock, and enhanced optical clarity in diverse operating conditions. The demand here is driven less by volume and more by customization and compliance with stringent industry-specific regulations, fostering a market for tailor-made, low-volume flexible display solutions that maximize durability and functionality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 67.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Display, LG Display, BOE Technology Group, Visionox, Tianma Microelectronics, AU Optronics (AUO), JOLED, EDO, Rina Technology, Corning (Gorilla Glass), Schott AG, Universal Display Corporation (UDC), Merck KGaA, Kateeva, Applied Materials, SDC, Japan Display Inc. (JDI), MicroOLED, Pioneer Corporation, E Ink Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible OLED Display Market Key Technology Landscape

The technological landscape of the Flexible OLED Display Market is defined by continuous innovation across material science, manufacturing processes, and structural design. A foundational technology is the use of Polyimide (PI) film as the substrate, replacing traditional glass to provide the necessary flexibility and thinness. However, PI requires complex processes like Laser Lift-Off (LLO) to separate the fabricated OLED structure from the temporary carrier glass, adding significant steps and cost. Recent advancements include the adoption of Ultra-Thin Glass (UTG) as the cover window for foldable devices, which offers superior hardness, feel, and optical clarity compared to traditional plastic film protectors, significantly improving the perception of durability in consumer products.

Another crucial technology is the implementation of Low-Temperature Polycrystalline Silicon (LTPS) or Oxide Thin-Film Transistors (TFTs) for the backplane, which drives the individual pixels (AMOLED). LTPS offers high mobility necessary for high-resolution and high refresh rate flexible displays, particularly important for mobile and AR/VR applications. Furthermore, achieving effective Thin-Film Encapsulation (TFE) is vital, as it protects the highly sensitive organic layers from moisture and oxygen ingress. TFE involves depositing multiple alternating inorganic and organic layers, often using sophisticated equipment like Spatial ALD (Atomic Layer Deposition), ensuring the display can withstand mechanical bending without degradation.

Manufacturing advancements, specifically the shift to Gen 6 flexible OLED fabrication lines, allow for efficient mass production on large substrates, leading to better economies of scale. Technologies like high-precision deposition techniques, including Fine Metal Mask (FMM) evaporation for RGB sub-pixels or the emerging trend of Inkjet Printing (IJP) for large-area and simplified deposition, are constantly being refined. These process improvements aim not only for cost reduction but also for environmental sustainability by minimizing material usage and energy consumption, further solidifying the technological basis for sustained market expansion across various flexible form factors.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the Flexible OLED Display Market, dominating both production and consumption. South Korea and China house the world's largest fabrication facilities, benefiting from massive government support, concentrated technical expertise, and deep supply chain integration. South Korea, home to Samsung Display and LG Display, leads in technological maturity, especially for foldable and rollable panels. China, driven by aggressive investment from players like BOE and Visionox, is rapidly expanding capacity, fueling both domestic and global market penetration, particularly in the mass market smartphone segment. The region's high disposable income growth and cultural affinity for cutting-edge consumer electronics ensure its continued status as the primary demand center.

- North America: North America is a critical consumption market, driven by the strong presence of major technology OEMs (like Apple) and the early adoption of high-end foldable devices. Although production capacity is limited, the region excels in R&D, material science (e.g., specialized glass and chemical suppliers), and application development, particularly in advanced military, aerospace, and specialized medical display systems. The robust automotive sector in the US and Canada is increasingly integrating large, high-resolution flexible OLEDs into luxury and electric vehicles, representing a high-value, albeit volume-constrained, market segment for flexible displays.

- Europe: Europe represents a significant market for specialized applications, especially in the premium automotive sector (Germany, Italy), where leading luxury vehicle manufacturers are defining the future of interior design using integrated curved and flexible displays. Additionally, Europe holds a strong position in high-end medical device manufacturing and niche industrial applications, requiring flexible screens tailored for durability and specific form factors. The market growth here is steady, driven by integration into IoT devices, advanced robotics, and the ongoing modernization of professional infrastructure demanding sleek, interactive display interfaces.

- Latin America & Middle East and Africa (MEA): These regions are emerging markets primarily driven by the increasing availability of affordable, flexible-display-integrated smartphones imported from APAC. While local manufacturing is negligible, demand growth tracks the rising affluence and urbanization rates, particularly in Brazil, Mexico, the UAE, and Saudi Arabia. The adoption is currently focused on consumer electronics, but future growth is expected from infrastructure development and commercial sectors, including digital signage and transportation displays, as technology costs continue to decrease and regional connectivity improves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible OLED Display Market.- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Visionox Technology Inc.

- Tianma Microelectronics Co., Ltd.

- AU Optronics Corp. (AUO)

- Japan Display Inc. (JDI)

- Universal Display Corporation (UDC)

- Corning Incorporated

- Schott AG

- Merck KGaA

- Kateeva

- Applied Materials, Inc.

- EDO (Everdisplay Optronics)

- Rina Technology Co., Limited

- Pioneer Corporation

- MicroOLED

- FlexEnable Limited

- Sumitomo Chemical Co., Ltd.

- Nippon Electric Glass Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Flexible OLED Display market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Flexible OLED Displays over standard displays?

The primary technical advantage is the use of flexible substrates (like polyimide or UTG) and Thin-Film Encapsulation (TFE), which allows the display to be bent, folded, or rolled without functional degradation. This enables thinner, lighter devices and revolutionary form factors, offering superior durability and impact resistance compared to rigid glass panels.

Which application segment is expected to show the highest growth rate?

The Automotive Display segment is expected to show the highest growth rate, driven by the shift towards fully digital cockpits, continuous display surfaces across dashboards, and the increasing integration of curved and large-area flexible OLEDs to enhance vehicle aesthetics and functionality.

What are the main challenges facing the mass production of Flexible OLEDs?

The main challenges include the high capital expenditure required for Gen 6 flexible fabrication lines, the complexity of achieving high manufacturing yields (especially for TFE and deposition), and ensuring the long-term mechanical durability and reliability of the flexible stack, particularly the protective cover window (UTG or plastic film) under repeated folding cycles.

How is AI influencing the Flexible OLED Manufacturing process?

AI is crucial for enhancing manufacturing efficiency by implementing high-speed, high-precision defect detection systems, optimizing material deposition parameters, and utilizing predictive maintenance across sensitive fabrication equipment. AI simulation also accelerates the R&D cycle for testing material durability under stress.

Which geographical region dominates the production of Flexible OLED Displays?

The Asia Pacific (APAC) region, particularly South Korea and China, overwhelmingly dominates the global production of Flexible OLED Displays. This dominance is due to established technological leadership, enormous investments in Gen 6 fabrication capacity, and highly integrated supply chain ecosystems within these countries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager