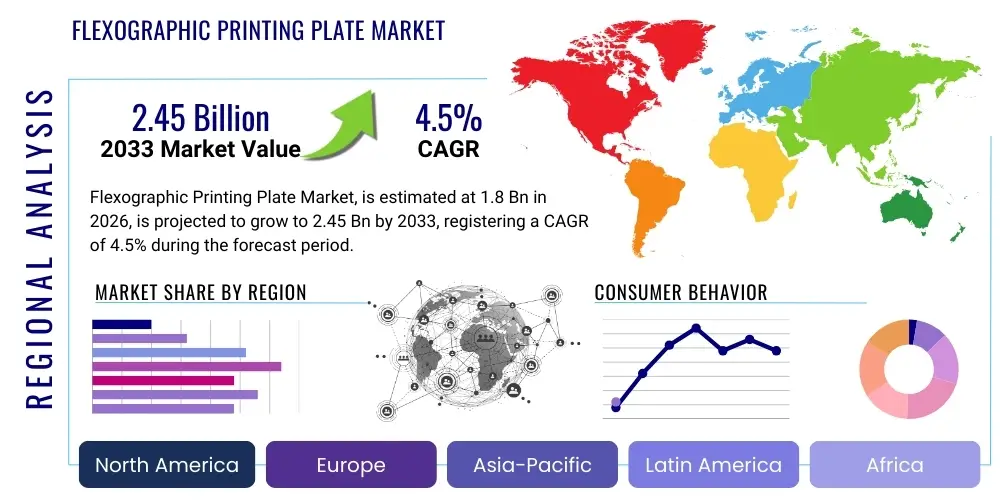

Flexographic Printing Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442700 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Flexographic Printing Plate Market Size

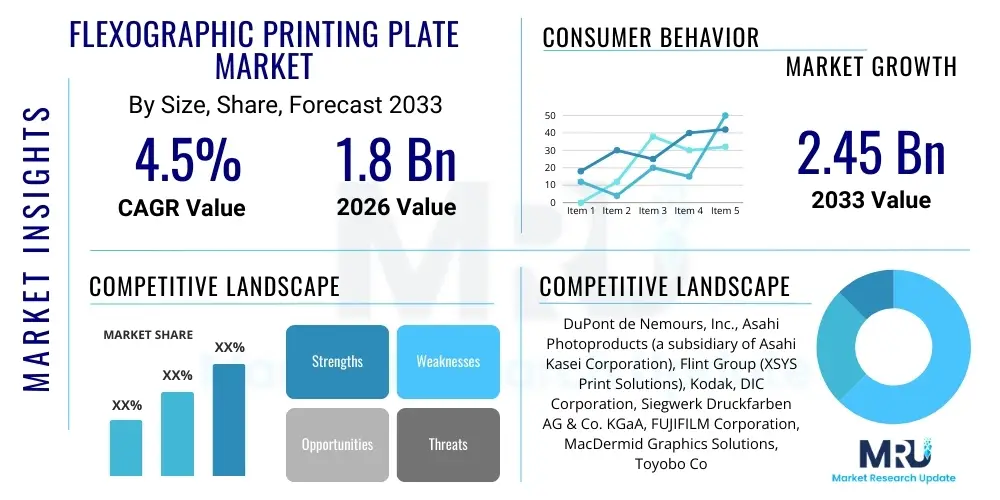

The Flexographic Printing Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

Flexographic Printing Plate Market introduction

The Flexographic Printing Plate Market encompasses the manufacturing, distribution, and consumption of resilient relief plates used in the flexographic printing process. Flexography, a modern variation of letterpress, is characterized by its ability to print on diverse substrates, including non-porous materials required for packaging, such as plastics, metallic films, and cellophane. These plates, typically made from photopolymer or rubber, transfer ink onto the substrate, enabling high-speed, continuous-run printing operations predominantly utilized in the packaging industry. The intrinsic versatility and efficiency of flexography make it the preferred method for high-volume jobs requiring variable repeat lengths and quick drying inks.

The product range within this market includes various plate types differentiated by their material composition, processing method (analog vs. digital), and application suitability (e.g., corrugated board, flexible packaging, labels). Photopolymer plates currently dominate the market due to their superior imaging quality, faster platemaking times, and environmental advantages over traditional solvent-based washout methods, especially with the rise of thermal and water-wash plate systems. Major applications driving demand include food and beverage packaging, pharmaceuticals, personal care product labels, and industrial wraps, all of which exhibit stable or accelerating consumption trends globally.

Key benefits of flexographic plates include their durability, cost-effectiveness for long runs, and compatibility with water-based and UV inks, aligning with increasing regulatory pressures concerning volatile organic compounds (VOCs). The driving factors for market expansion are fundamentally linked to the growth of the global packaging industry, particularly flexible packaging and self-adhesive labels. Furthermore, continuous technological advancements, such as high-definition (HD) flexo and flat-top dot technology, are improving print quality, allowing flexography to compete more effectively with offset and gravure printing technologies, thereby expanding its market penetration in premium packaging segments. This constant innovation cycle ensures the sustained relevance and growth trajectory of the flexographic printing plate sector.

Flexographic Printing Plate Market Executive Summary

The Flexographic Printing Plate Market is characterized by steady evolutionary growth, heavily dependent on global macroeconomic indicators tied to consumer goods and packaging consumption. Current business trends indicate a strong shift towards digital computer-to-plate (CtP) technologies, which streamline the platemaking process, reduce errors, and deliver enhanced print fidelity through advanced dot structures. Companies are increasingly investing in thermal processing systems, which eliminate the use of solvents and drastically reduce drying times, positioning them as environmentally superior and operationally faster solutions. Consolidation among major plate manufacturers and the strategic integration of plate production capabilities into large printing house ecosystems are observable structural trends, focusing on supply chain efficiency and standardized quality across global operations.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, expanding manufacturing bases, and the exponential growth of e-commerce, which necessitates vast amounts of protective and marketing packaging. North America and Europe, while mature, demonstrate stable demand driven by the shift towards sustainable packaging materials and high-quality graphics requirements for brand differentiation. These mature markets are leading the adoption of advanced technologies like UV LED curing systems and specialized screening software, demanding premium, high-resolution plates capable of handling complex artwork and extended gamut printing. This geographical divergence in market maturity dictates differing investment priorities between capacity expansion in APAC and technology upgrade focus in the West.

Segmentation analysis reveals that the Photopolymer Plate segment maintains dominance due to its technological advantages and versatility, with digital photopolymer plates exhibiting the highest growth rate. Application-wise, flexible packaging holds the largest market share, directly correlated with the global preference for lightweight, convenient, and single-serve packaging formats. The drive toward sustainability is creating a new competitive dynamic, favoring suppliers who can offer eco-friendly plate materials and solvent-free processing methods. Overall, the market remains highly competitive, driven by innovation aimed at improving plate longevity, reducing setup waste, and enhancing the graphic capabilities of the flexographic process, ensuring its dominant position in the high-volume packaging sector.

AI Impact Analysis on Flexographic Printing Plate Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Flexographic Printing Plate Market predominantly center around three key themes: predictive maintenance and quality control, optimization of the platemaking workflow, and supply chain automation. Users are keen to understand how AI algorithms can monitor plate wear patterns in real-time to schedule replacements proactively, thereby minimizing costly press downtime. Another significant area of interest is the use of AI in optimizing screening and imaging parameters during the prepress phase. Specifically, users ask if AI can analyze the complexity of artwork, the substrate type, and ink characteristics to automatically suggest the ideal flat-top dot structure or imaging resolution required, leading to less manual intervention and superior first-time-right plate production. Finally, the role of AI in forecasting material demand and optimizing inventory management for raw photopolymer resins and processing chemicals is a growing concern, aiming to achieve leaner operations and faster turnaround times.

The adoption of AI and machine learning (ML) within the flexographic supply chain is accelerating, particularly in systems integrated into digital imaging equipment (e.g., lasers and exposure units). AI algorithms are proving instrumental in performing highly sophisticated image analysis to detect minute flaws or inconsistencies in the digital file or the exposed plate surface before processing, significantly reducing plate rejects. Furthermore, AI is being deployed in optimizing the plate washing and drying cycles, analyzing variables such as solvent concentration, temperature, and exposure time to ensure consistent plate thickness and relief depth, crucial for repeatable print quality. This predictive quality assurance reduces material waste and labor costs associated with manual inspection, driving operational efficiency gains for major plate manufacturers and large-scale repro houses.

Looking forward, the influence of AI will extend beyond manufacturing into design and procurement. ML models will soon be capable of analyzing historical job performance data—including plate type used, substrate deformation, and specific anilox roll profiles—to offer optimized plate recommendations during the initial quoting phase. This intelligence helps end-users select the most appropriate and cost-effective plate for a specific job profile, ensuring maximum efficiency and print quality. While AI will not replace the fundamental chemical or mechanical processes of plate creation, it serves as a powerful layer of intelligence that enhances precision, speeds up preparation, and contributes to the overall stability and reliability of the flexographic printing process, reinforcing flexography’s competitive edge against other printing methods.

- AI-driven predictive maintenance optimizes plate usage and prevents unscheduled press stops.

- Machine Learning enhances prepress screening algorithms for improved dot stability and print quality.

- Automated quality control systems use AI vision to detect microscopic plate defects immediately post-imaging.

- AI models optimize raw material inventory forecasting for photopolymer resins and solvents.

- Data analytics informs optimal plate selection based on specific substrate and ink requirements.

DRO & Impact Forces Of Flexographic Printing Plate Market

The dynamics of the Flexographic Printing Plate Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. The primary driver is the sustained growth in the global flexible packaging sector, fueled by e-commerce expansion and changing consumer lifestyles demanding convenience packaging. Technological advancements, particularly in digital platemaking (CtP) and the refinement of flat-top dot technology, continuously enhance flexography's graphic capabilities, allowing it to successfully displace market share previously held by gravure printing for high-end applications. Furthermore, the increasing global emphasis on sustainability drives the demand for solvent-free thermal plate processing systems and water-wash plates, benefiting manufacturers positioned to offer these environmentally compliant solutions, thereby acting as a significant positive impact force.

However, the market faces notable restraints, chiefly the high initial investment required for digital platemaking equipment, which can be prohibitive for smaller printing houses, particularly in developing economies. Competition from advanced digital printing technologies, while still limited in terms of volume and speed compared to flexo, poses a long-term threat, especially in short-run and highly customized label printing segments. The volatility in the price of key raw materials, specifically petrochemical-derived photopolymer resins, creates margin pressures for plate manufacturers. These restraints necessitate strategic pricing and focused technological innovation to maintain cost competitiveness and justify the high capital expenditure required for flexographic infrastructure upgrades.

Significant opportunities exist in emerging markets, especially in Southeast Asia and Latin America, where the conversion from traditional analog printing to modern flexographic methods is accelerating. Another critical opportunity lies in the specialization of plates for specific high-growth areas, such as security printing and edible ink applications. The impact forces are further amplified by stringent global food safety and packaging regulations, demanding migration-compliant plates and inks, thereby raising the barrier to entry for standard plate manufacturers but creating premium opportunities for specialized compliant products. Overall, the market forces favor manufacturers who can deliver high-quality, sustainable, and high-speed platemaking solutions integrated seamlessly into modern, automated press environments.

Segmentation Analysis

The Flexographic Printing Plate market is comprehensively segmented based on three primary characteristics: type, application, and geography, providing a granular view of market dynamics and targeted opportunities. Analyzing the market by Type reveals the dominance of photopolymer plates, further subdivided into digital and analog variants, alongside the smaller but persistent segment of rubber plates used primarily for abrasive substrates or specialized industrial applications. Photopolymer materials offer superior chemical resistance, dimensional stability, and the ability to reproduce finer details, which is critical for high-resolution graphics, cementing their leading position. The digital segment, specifically, is growing fastest due to its inherent consistency and integration with computer-to-plate workflows, dramatically reducing human error and turnaround times.

Segmentation by Application highlights the crucial role of the packaging industry as the major consumer of flexographic plates. This segment is broken down into flexible packaging (pouches, wrappers), corrugated packaging (cardboard boxes, displays), labels and tags (self-adhesive and in-mold labels), and others (including envelopes, multi-wall bags, and decorative prints). Flexible packaging commands the largest market share owing to its ubiquitous use in food and beverage, personal care, and pharmaceutical industries, driven by consumer demand for product protection and shelf appeal. Corrugated packaging, while often utilizing lower-resolution plates, requires durable and thick plates capable of printing on uneven surfaces, maintaining a steady demand stream that is highly correlated with global logistics and e-commerce growth rates.

Geographical segmentation underscores the regional disparities in market maturity and growth potential. Asia Pacific represents the fastest-growing region, driven by massive manufacturing output and rising disposable incomes fueling domestic consumption, necessitating large volumes of packaging. North America and Europe prioritize technological sophistication and sustainability, leading the adoption of thermal plate processing and advanced screening technologies. This layered segmentation analysis is essential for strategic planning, allowing companies to allocate resources effectively based on the specific technological demands and growth trajectories within each segment and region, ensuring market penetration strategies are optimized for maximum impact and sustained competitive advantage across the value chain.

- By Type:

- Photopolymer Plates

- Digital Photopolymer Plates

- Analog Photopolymer Plates

- Rubber Plates

- By Application:

- Flexible Packaging

- Corrugated Packaging

- Labels and Tags

- Folding Cartons

- Others (e.g., Envelopes, Multi-wall Bags)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Flexographic Printing Plate Market

The Value Chain for the Flexographic Printing Plate Market is structured, beginning with the highly specialized upstream procurement of critical raw materials, primarily photopolymer resins, monomers, binders, and chemical additives. Upstream suppliers are typically global specialty chemical companies, and their pricing power often influences plate manufacturers' costs and margins significantly. Plate manufacturers then engage in complex formulation, extrusion, and lamination processes to create the raw plate material in sheet or roll form. This stage is capital-intensive and requires stringent quality control over material consistency and thickness uniformity, ensuring the subsequent platemaking (prepress) steps yield high-quality results. Innovation at this stage focuses on developing more resilient, environmentally friendly, and faster-processing polymer compositions.

The midstream involves the crucial platemaking process, where the raw plate is imaged using high-powered lasers (in digital CtP systems) and then processed through exposure, washing (solvent or thermal), and drying/finishing steps. This stage is often executed by specialized trade shops, repro houses, or integrated prepress divisions of large printing organizations. Distribution channels play a critical role, linking plate manufacturers to these diverse prepress and printing end-users. Direct sales models are common for major global players who offer specialized technical support and managed inventory programs to large, multinational printing groups, ensuring seamless supply and technical consistency across various geographical locations and reducing potential bottlenecks in the supply chain.

Downstream analysis centers on the end-user application within the printing industry, specifically flexible packaging converters, corrugated board producers, and label printers. The plates are used on flexographic presses for high-volume jobs, after which they are either reused or recycled. Indirect distribution involves working through authorized regional distributors and agents who provide localized inventory and technical services to smaller and medium-sized local printing companies that lack direct relationships with global manufacturers. The efficiency of this downstream segment relies heavily on quick plate delivery and technical compatibility, as printing schedules are often time-critical. Optimization across the entire chain is constantly sought, focusing on reducing waste and accelerating the overall cycle time from design conception to finished printed product.

Flexographic Printing Plate Market Potential Customers

The primary potential customers and end-users of flexographic printing plates are entities within the vast converting and packaging ecosystem that utilize high-speed, web-fed printing processes. This group includes flexible packaging converters that produce laminated films, shrink wraps, and pouches for food, beverages, and industrial products. These converters demand plates that offer high ink transfer efficiency, excellent durability for long runs, and the capability to print fine screens and high-resolution images necessary for brand differentiation on non-absorbent materials. Since food safety regulations are paramount, these buyers also prioritize plates compliant with migration standards and compatible with water-based or low-migration UV inks, making them a premium segment customer.

Another major customer segment consists of corrugated board manufacturers and converters. These users require thicker, softer plates optimized for printing on abrasive, uneven, and porous cardboard surfaces. While their resolution demands are generally lower than those of flexible packaging, the plates must withstand significant mechanical stress and deliver consistent color coverage across large format prints. The procurement decisions in this segment are often driven by plate longevity and cost-per-impression, favoring robust rubber or high-durometer photopolymer plates designed specifically for post-print corrugated applications, addressing the logistical needs of global shipping and product handling.

Furthermore, label and tag printers represent a highly dynamic segment, characterized by frequent job changes, shorter run lengths (relative to packaging), and an increasing requirement for variable data printing. These buyers often invest heavily in digital CtP technology to maximize speed and minimize waste associated with setup. Their plate requirements center on precision, compatibility with UV inks, and rapid turnaround times from the prepress stage, favoring digital photopolymer plates that integrate seamlessly into highly automated production environments. Pharmaceutical, cosmetic, and craft beverage label producers, in particular, represent high-value customers due to their relentless pursuit of graphic quality and strict regulatory compliance requirements for their self-adhesive products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours, Inc., Asahi Photoproducts (a subsidiary of Asahi Kasei Corporation), Flint Group (XSYS Print Solutions), Kodak, DIC Corporation, Siegwerk Druckfarben AG & Co. KGaA, FUJIFILM Corporation, MacDermid Graphics Solutions, Toyobo Co., Ltd., Konica Minolta, Techno-Graphic S.R.L., Anderson & Vreeland, Inc., Toray Industries, Inc., Mark Andy Inc., SPGPrints B.V., Schawk, Inc., Esko, Uflex Ltd., Trelleborg Group, Chemence Graphic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexographic Printing Plate Market Key Technology Landscape

The contemporary technological landscape of the Flexographic Printing Plate Market is dominated by digital imaging and solvent elimination methods, driving a revolution in quality and speed. Computer-to-Plate (CtP) technology, specifically using high-power fiber lasers to ablate a black layer (LAMS layer) on the photopolymer plate, is the foundational technology for producing digital plates. This method allows for the creation of precise, reproducible mask patterns directly from a digital file, enabling resolutions up to 5080 dpi and supporting complex micro-screening patterns. Continuous innovation in laser power and imaging algorithms ensures faster plate output and finer image detail, positioning digital platemaking as the industry standard for high-quality packaging and labeling applications where sharp text and smooth vignettes are essential.

Beyond imaging, plate processing technology is rapidly migrating away from traditional solvent washout systems due to environmental concerns and the time required for drying. Thermal plate processing systems, such as those employing non-solvent fibrous wicking materials (e.g., DuPont Cyrel FAST, Kodak Flexcel NX), utilize heat and pressure to remove the unexposed photopolymer, drastically reducing processing time from hours to minutes and eliminating the disposal costs and VOC emissions associated with solvents. Furthermore, the development of water-washable photopolymer plates, which use water or mild detergent solutions, offers another highly sustainable alternative, appealing particularly to smaller operations or regions with strict environmental regulations concerning solvent usage, thereby broadening market accessibility.

Crucially, the rise of flat-top dot technology, facilitated by integrated systems like UV main exposure units (e.g., Esko CDI Crystal, MacDermid LUX), has profoundly improved flexography's competitive stance. Flat-top dots—where the dot surface is flat rather than rounded—transfer ink more uniformly, reducing dot gain, especially in highlights, and extending plate life significantly. This capability is often coupled with advanced screening technologies, such as customized surface patterning (e.g., micro-cell structures, textured surfaces), which optimize ink laydown and transfer characteristics. These technological advancements collectively reduce setup waste, increase repeatability, and ensure that flexography can meet the stringent quality demands of premium packaging and brand identity, cementing its future viability in the printing market.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive consumer spending in emerging economies like China, India, and Southeast Asian nations. The region's expanding food processing and packaged goods sectors necessitate continuous investment in high-volume flexographic printing capacity. Demand is increasingly shifting toward digital plates and environmentally conscious processing as regulatory standards and quality expectations rise, though analog plates still hold a significant share due to the prevalence of small-to-medium enterprises (SMEs).

- North America: Characterized by high technological maturity, North America is a key adopter of premium digital plates and advanced thermal processing systems. The market demand is stable, focused heavily on efficiency, sustainability, and quality differentiation in the competitive retail environment. The region leads in the adoption of specialized applications such as high-definition (HD) flexo and expanded gamut printing for sophisticated labeling and flexible packaging.

- Europe: European markets exhibit strong emphasis on regulatory compliance, particularly concerning environmental impact (VOCs) and food contact safety (migration standards). This drives high demand for water-wash and thermal plates. Western Europe is a pioneer in implementing fully automated platemaking workflows, valuing consistent quality and rapid turnaround times. Eastern Europe shows promising growth, integrating modern flexo technology into newly developed packaging supply chains.

- Latin America (LATAM): Growth in LATAM is moderate but steady, largely influenced by macroeconomic stability in key economies like Brazil and Mexico. The market is transitioning from outdated technology to modern flexo solutions, creating opportunities for suppliers of cost-effective digital CtP solutions. Infrastructure development and rising domestic consumption are the primary drivers of packaging demand, fueling the need for reliable flexographic plates.

- Middle East and Africa (MEA): This region is an emerging market with significant infrastructure investments in the food and beverage industry, particularly in the Gulf Cooperation Council (GCC) countries. Plate consumption is increasing, albeit from a lower base, with a focus on importing established plate technologies. The market is fragmented, with significant potential for growth as local packaging industries mature and increase their output volume to serve regional demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexographic Printing Plate Market.- DuPont de Nemours, Inc.

- Asahi Photoproducts (a subsidiary of Asahi Kasei Corporation)

- Flint Group (XSYS Print Solutions)

- Kodak

- DIC Corporation

- Siegwerk Druckfarben AG & Co. KGaA

- FUJIFILM Corporation

- MacDermid Graphics Solutions

- Toyobo Co., Ltd.

- Konica Minolta

- Techno-Graphic S.R.L.

- Anderson & Vreeland, Inc.

- Toray Industries, Inc.

- Mark Andy Inc.

- SPGPrints B.V.

- Schawk, Inc.

- Esko

- Uflex Ltd.

- Trelleborg Group

- Chemence Graphic

Frequently Asked Questions

Analyze common user questions about the Flexographic Printing Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Flexographic Printing Plate Market?

The primary driver is the explosive and sustained growth of the global flexible packaging sector, fueled by increased consumer demand for packaged goods and the expansion of e-commerce requiring durable and visually appealing printing solutions.

What is the difference between digital and analog flexographic printing plates?

Analog plates require a physical film negative for image transfer, while digital plates (CtP) use a high-powered laser to directly image the plate surface from a digital file, resulting in superior registration, consistency, and higher resolution printing quality.

How is the market addressing environmental and sustainability concerns?

The market is addressing sustainability through the rapid adoption of solvent-free thermal processing systems (e.g., thermal washout technology) and the development of water-washable photopolymer plates, significantly reducing VOC emissions and waste associated with traditional solvent-based processes.

Which application segment holds the largest share in the Flexographic Printing Plate Market?

Flexible packaging holds the largest market share, driven by its extensive use across the food, beverage, and personal care industries, requiring high-quality, high-speed printing that flexography efficiently provides.

What are flat-top dots and why are they important in modern flexography?

Flat-top dots are dots imaged with a flat surface rather than a traditional rounded profile. They are important because they improve ink transfer consistency, minimize dot gain on press, and enhance plate durability, allowing flexography to achieve quality comparable to gravure printing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager