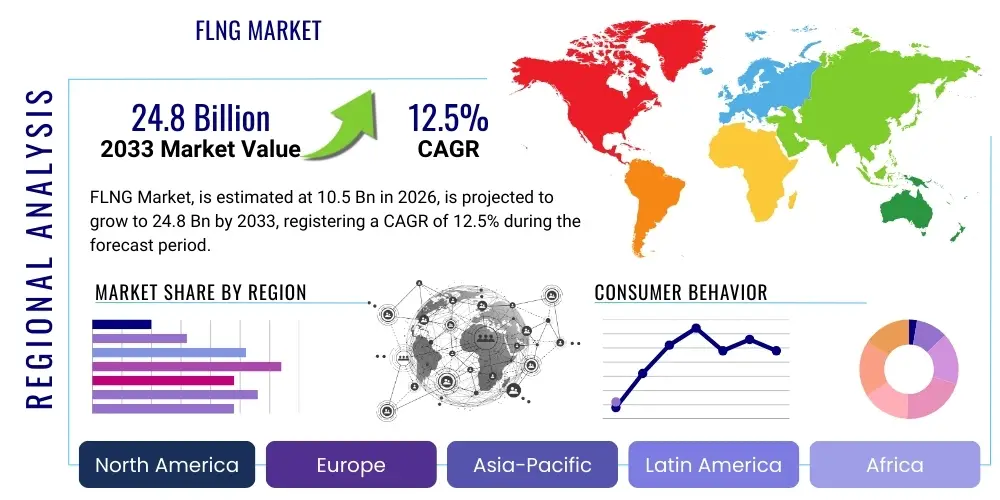

FLNG Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441112 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

FLNG Market Size

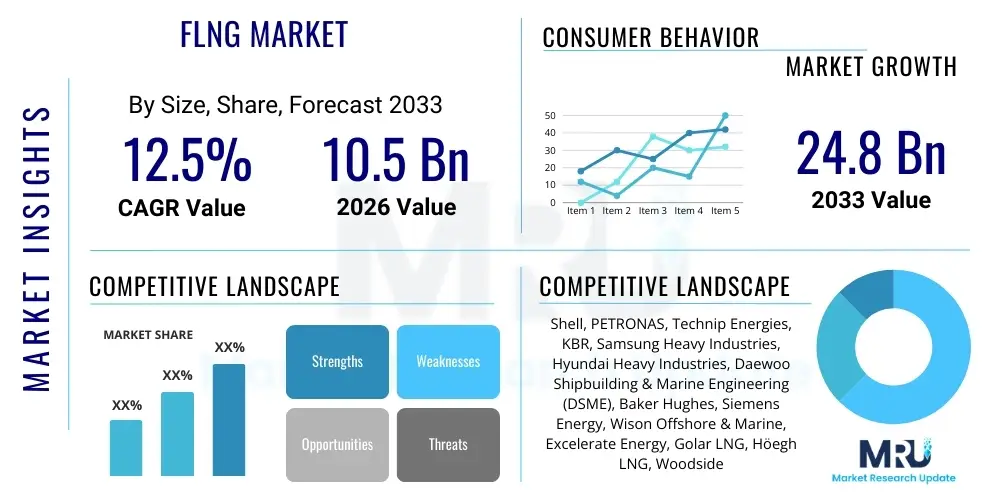

The FLNG Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $24.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for natural gas, considered a transitional fuel, coupled with technological advancements enabling the exploitation of stranded offshore gas fields previously deemed uneconomical. The high capital expenditure associated with conventional onshore LNG facilities makes FLNG solutions increasingly attractive, particularly in regions characterized by challenging geopolitical climates or deep-water environments.

FLNG Market introduction

Floating Liquefied Natural Gas (FLNG) represents a revolutionary technological paradigm within the energy sector, integrating gas production, liquefaction, storage, and offloading onto a single maritime vessel or platform. This mobile, offshore solution eliminates the need for extensive onshore infrastructure, offering significant flexibility and reducing environmental impact footprints associated with large-scale land development. FLNG vessels are strategically deployed to monetize remote or stranded offshore gas reserves, thereby enhancing global energy security and supply diversification. The primary applications span the entire spectrum of natural gas exploitation, from initial well stream processing to final LNG export, addressing geographical constraints and accelerating time-to-market compared to fixed facility alternatives. The adoption of FLNG technology is predicated on its superior economic viability for specific field types and its inherent scalability.

The product description encompasses large-scale maritime assets—often purpose-built or converted LNG carriers—equipped with sophisticated gas processing modules, including pre-treatment systems for contaminant removal, cryogenic liquefaction units, vast storage tanks, and advanced mooring and turret systems. Major applications involve the development of offshore fields lacking pipeline access to existing infrastructure, monetizing associated gas that would otherwise be flared, and providing flexible regional supply hubs. The inherent benefits of FLNG technology include faster deployment times, lower environmental disturbance on shorelines, mobility allowing relocation to different fields, and reduced overall upfront project complexity compared to traditional mega-train LNG projects.

Driving factors propelling this market include the global push towards cleaner energy sources, where natural gas plays a crucial role as a bridge fuel away from coal. Furthermore, technological leaps in cryogenic engineering and marine stability systems have de-risked large-scale FLNG projects. The increasing prevalence of deep-water exploration activities and the discovery of small to medium-sized offshore gas pockets that are uneconomical for fixed platforms solidify the investment thesis for FLNG solutions. Geopolitical shifts demanding decentralized energy supply chains also contribute significantly to the market's positive trajectory, making modular, rapid-deployment solutions highly desirable.

FLNG Market Executive Summary

The FLNG market is experiencing robust momentum, driven primarily by favorable business trends focused on capital efficiency and supply chain resiliency within the oil and gas industry. Key business trends indicate a shift towards modularized construction and standardized vessel designs, which lowers construction risk and accelerates project timelines. Energy companies are increasingly utilizing FLNG to unlock value from marginal fields, transitioning away from costly, fixed infrastructure models. Furthermore, collaborative partnerships between major energy producers, shipyards, and specialized technology providers are defining the competitive landscape, fostering innovation in areas like hull design and liquefaction efficiency. The current macroeconomic climate, marked by volatility in commodity prices, reinforces the appeal of FLNG projects due to their relatively lower exposure to onshore regulatory hurdles and quicker returns on investment.

Regionally, the market exhibits dynamic growth concentrated in specific geographic areas rich in stranded gas reserves and possessing supportive regulatory frameworks. Asia Pacific (APAC) and the Middle East & Africa (MEA) are prominent growth areas. APAC’s demand is fueled by energy security concerns and rapid industrialization requiring massive gas imports, making flexible FLNG imports highly valuable. In MEA, particularly in emerging gas provinces off the coast of Africa, FLNG provides the critical infrastructure required for rapid monetization of deep-water discoveries without requiring substantial national debt financing for large onshore facilities. North America and Europe, while having developed onshore infrastructure, see niche applications for FLNG, often focusing on advanced technological deployment and operational optimization in challenging Arctic or harsh environment settings.

Segment trends highlight the dominance of newly built FLNG vessels over converted carriers, reflecting increasing confidence in purpose-built designs optimized for efficiency and scale. The segment focusing on small-scale and mid-scale FLNG is witnessing high adoption rates, catering specifically to smaller fields and localized energy demand, which broadens the scope of recoverable reserves. By process, the mixed-refrigerant technologies remain highly prevalent due to their proven reliability, though single-mixed refrigerant and nitrogen-based cycles are gaining traction for specific operational profiles. Investment is heavily skewed towards deployment in water depths exceeding 500 meters, indicating the market’s focus on deep-sea resource extraction, which demands advanced mooring and subsea systems. These integrated trends underscore a market maturation where FLNG is no longer viewed as a speculative technology but as a commercially viable and often preferred solution for offshore gas development.

AI Impact Analysis on FLNG Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the FLNG sector predominantly center on operational efficiency, predictive maintenance capabilities, and safety enhancements in remote, high-stakes environments. Common questions address how AI can optimize the liquefaction process under variable sea states and weather conditions, the potential for AI-driven anomaly detection in cryogenic machinery, and the use of machine learning algorithms for optimizing hydrocarbon inventory management and minimizing emissions. Users are highly interested in quantifying the ROI derived from implementing AI tools for reducing operational downtime, a critical factor given the immense financial implications of any stoppage on an FLNG vessel. Furthermore, regulatory bodies and operators seek clarity on AI's role in enhancing cybersecurity measures for critical offshore infrastructure, ensuring data integrity, and compliance with increasingly stringent environmental regulations.

The core expectation is that AI will transform FLNG operations from reactive maintenance schedules to highly predictive and autonomous systems. Specifically, stakeholders anticipate that AI will resolve key challenges related to the harsh operating environment, labor scarcity, and the complexity of managing highly integrated, multi-disciplinary systems remotely. AI is viewed as instrumental in managing the vast amount of sensor data generated by thousands of monitoring points across the vessel, converting this data into actionable intelligence for process optimization. This integration is essential for maintaining high availability and asset integrity, which are paramount in deep-water, multi-billion dollar installations. The successful deployment of AI is expected to significantly lower operational expenditures (OPEX) and improve overall safety metrics.

The successful implementation of AI involves the deployment of edge computing capabilities on the vessel, enabling real-time data processing, coupled with centralized cloud-based machine learning platforms for continuous model training and refinement. This dual-pronged approach ensures that operational decisions can be made instantaneously on the vessel, while strategic optimization benefits from global fleet-wide data analysis. The market expects a transition where AI not only monitors performance but actively controls specific sub-systems, such as flare minimization routines or complex refrigeration loops, resulting in unparalleled levels of energy efficiency and environmental performance compliance. The long-term vision positions FLNG vessels as highly autonomous, data-driven smart assets.

- AI-driven Predictive Maintenance: Reduces unscheduled downtime by forecasting equipment failure, crucial for high-cost offshore assets.

- Optimized Liquefaction Process: Machine learning adjusts cryogenic parameters in real-time based on feedstock quality and environmental variables, maximizing efficiency.

- Enhanced Safety and Risk Management: Computer vision and behavioral analytics monitor personnel and vessel integrity, reducing human error potential.

- Autonomous Operation Capabilities: AI algorithms facilitate remote and semi-autonomous control of utility systems and cargo handling.

- Supply Chain and Inventory Optimization: Predictive analytics manages spare parts inventory and logistics for remote locations efficiently.

- Emissions Reduction: Advanced modeling minimizes flaring and optimizes power generation, ensuring compliance with environmental standards.

DRO & Impact Forces Of FLNG Market

The FLNG market trajectory is shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the global prioritization of natural gas as a cleaner alternative to coal, the monetization potential of previously inaccessible or stranded offshore gas fields, and the increasing flexibility offered by mobile processing units over fixed infrastructure. Restraints primarily involve the substantial upfront capital expenditure (CAPEX) required for project initiation, the technical complexity and specialized regulatory environment inherent to deep-water maritime assets, and ongoing concerns related to project financing and risk allocation among consortium partners. Opportunities abound in emerging gas basins in Africa and Southeast Asia, the increasing demand for smaller, modular FLNG solutions catering to marginal fields, and continuous technological innovation focusing on enhanced efficiency and robustness. These forces collectively propel the market forward while necessitating meticulous risk management and strategic resource deployment, defining the operational and financial viability of future projects.

The impact forces currently exerting the greatest pressure on the FLNG market are regulatory evolution and geopolitical stability. Stringent global environmental regulations, particularly concerning methane emissions and carbon capture, force operators to invest heavily in advanced process technology, acting as both a restraint on cost and an opportunity for innovators. Geopolitical instability in key gas-producing and consuming regions directly influences investment decisions and project scheduling. High commodity price volatility, particularly the spread between crude oil and natural gas prices, also significantly impacts the economic feasibility and Final Investment Decision (FID) timing for new FLNG projects. Furthermore, the specialized nature of the supply chain—requiring specialized deep-water construction yards and highly skilled engineering talent—creates bottlenecks that can delay project delivery, exerting constant pressure on contractors and operators to manage complexity effectively.

Technological advancement acts as a pervasive positive impact force, continually driving down the levelized cost of producing LNG offshore. Improvements in hull design enhance stability in harsh environments, while innovations in proprietary liquefaction technologies increase thermal efficiency and reduce the overall footprint of the processing plant mounted topside. The increasing standardization of modular components, often built onshore and integrated offshore, reduces fabrication risk and accelerates commissioning times. Concurrently, the increasing cost of conventional onshore construction and land acquisition globally further amplifies the attractiveness of the FLNG model. Navigating the regulatory landscape, particularly maritime and offshore safety standards set by classification societies, remains a critical requirement for market entry and sustained operation, ensuring that high safety and environmental protection standards are rigorously met throughout the project lifecycle.

Drivers:

- Monetization of Stranded Offshore Gas Reserves: Unlocking previously uneconomical fields.

- Demand for Cleaner Fuels: Natural gas’s role as a lower-carbon bridge fuel.

- Reduced Time-to-Market: Accelerated project timelines compared to onshore LNG facilities.

- Geographical Flexibility: Mobility allows rapid relocation and deployment in diverse locations.

Restraints:

- High Initial Capital Expenditure (CAPEX): Significant upfront investment required for vessel construction.

- Technological Complexity and Integration Risk: Managing sophisticated cryogenic and marine systems simultaneously.

- Stringent Regulatory and Safety Requirements: Compliance with complex international maritime and environmental laws.

- Financing and Project Risk Allocation: Challenges in securing long-term financing for multi-billion dollar projects.

Opportunities:

- Development of Small and Mid-Scale FLNG Solutions: Targeting smaller or marginal fields efficiently.

- Emerging Gas Basins: New discoveries in East Africa, the Mediterranean, and Southeast Asia.

- Technological Standardization: Use of modular design to reduce construction costs and schedule.

- Carbon Capture and Storage (CCS) Integration: Opportunities to retrofit or design FLNG vessels for lower emissions.

Impact Forces:

- Geopolitical Instability: Affects project security, market access, and investment flows.

- Environmental Regulations: Drives demand for high-efficiency, low-emission technology.

- Commodity Price Volatility: Directly impacts project profitability and FID timing.

- Supply Chain Specialization: Reliance on highly specialized shipbuilding and EPC contractors.

Segmentation Analysis

The FLNG market is comprehensively segmented based on its structural characteristics, application scale, and technological implementation, providing granular insights into market dynamics and investment pockets. Segmentation by type differentiates between newly built dedicated FLNG vessels, offering optimal performance and longevity, and converted existing LNG carriers (LNGCs), which provide a faster, though often less scalable, deployment option. Segmentation by scale—Small-scale, Mid-scale, and Large-scale—reflects the differing requirements of gas field sizes and intended market capacities. Furthermore, segmentation by technology focuses on the proprietary liquefaction processes employed, such as Mixed Refrigerant (MR), Single Mixed Refrigerant (SMR), and Nitrogen-based cycles, which are crucial differentiators in operational efficiency and footprint. This multi-faceted segmentation allows stakeholders to accurately gauge market penetration, competitive strengths, and future growth areas tailored to specific operational contexts and reserve profiles.

- By Type:

- Newbuild Vessels

- Converted Vessels (LNGC Conversions)

- By Vessel Size/Capacity (Billion Cubic Feet per Day - BCFD or Million Tons Per Annum - MTPA):

- Small-Scale FLNG (Typically below 1.0 MTPA)

- Mid-Scale FLNG (Typically 1.0 MTPA to 3.0 MTPA)

- Large-Scale FLNG (Typically above 3.0 MTPA)

- By Technology/Liquefaction Process:

- Mixed Refrigerant (MR)

- Single Mixed Refrigerant (SMR)

- Nitrogen Refrigerant Cycle

- Proprietary Technologies (e.g., APCI, Shell DMR)

- By Water Depth:

- Shallow Water (Up to 300 meters)

- Deep Water (300 to 1,500 meters)

- Ultra-Deep Water (Above 1,500 meters)

Value Chain Analysis For FLNG Market

The FLNG value chain is characterized by high integration and specialized technical requirements, spanning from initial resource development to final gas delivery. The upstream segment involves exploration, appraisal, and field development, including the highly complex subsea production systems (SPS) and flow assurance technologies necessary to deliver raw gas to the floating facility. This phase requires specialized geological expertise and high-risk capital investment. The midstream is the core of the FLNG operation, encompassing the detailed engineering, procurement, and construction (EPC) of the vessel, the installation and hook-up offshore, and the commencement of the processing and liquefaction operations. Given the bespoke nature of each FLNG project, managing the EPC phase—often executed through joint ventures between large construction yards and offshore energy specialists—is critical to mitigating schedule and cost overruns.

Downstream activities include the storage of the produced LNG onboard the vessel, the sophisticated ship-to-ship transfer operations necessary for offloading the liquefied gas, and the final maritime transport to global regasification terminals and end-users. The distribution channel is predominantly characterized by long-term take-or-pay agreements and specialized charter arrangements for LNG carriers. Direct distribution involves the project owner selling LNG directly to a utility or major trading house under long-term contracts, ensuring stable revenue streams and financing support. Indirect distribution may involve the project owner selling the LNG to a third-party trader who then markets the product globally, offering greater market flexibility but potentially higher price exposure. Both direct and indirect models rely heavily on efficient maritime logistics and access to key international shipping lanes, underscoring the importance of strategic positioning.

The complexity of the value chain demands seamless integration between subsea technology providers, specialized EPC contractors, vessel classification societies, and end-market participants. Upstream costs are heavily influenced by water depth and reservoir characteristics, while midstream costs are dominated by steel fabrication, specialized process modules, and high-specification turbomachinery. Successful project execution hinges on rigorous supplier pre-qualification and robust quality control, particularly for cryogenic equipment and the advanced mooring systems that secure the vessel in challenging offshore conditions. The integrated nature of FLNG minimizes interface risk compared to multi-site onshore facilities but concentrates technical complexity within a single high-value asset.

FLNG Market Potential Customers

Potential customers and end-users of FLNG technology are primarily large multinational Energy Companies (IOCs) and National Oil Companies (NOCs) that own and develop offshore gas assets, alongside independent exploration and production (E&P) firms seeking innovative solutions for marginal fields. IOCs and NOCs utilize FLNG as a strategic tool to diversify their production portfolios, optimize capital allocation by reducing reliance on fixed infrastructure, and accelerate the monetization of deep-water discoveries in politically stable and unstable regions alike. These major players are often the primary drivers behind large-scale FLNG newbuild projects, acting as the ultimate buyers of the engineering and construction services.

Furthermore, specialized midstream energy infrastructure companies and consortiums focused solely on infrastructure ownership represent a growing customer base. These entities, often backed by private equity or infrastructure funds, contract with asset owners to finance, build, and operate the FLNG facility, charging a tariff for gas processing services. This model allows E&P companies to focus on resource extraction while transferring midstream CAPEX and operational risk to specialized infrastructure partners. The final downstream buyers of the product—the liquefied natural gas—are global utilities, power generation companies, industrial manufacturers, and LNG trading houses located predominantly in Asia Pacific, Europe, and Latin America, who rely on the stable, flexible supply chain enabled by FLNG exports.

The core buyer motivation is the achievement of optimal Net Present Value (NPV) for offshore gas projects, which FLNG often facilitates by enabling quicker start-ups and reducing environmental impact assessments compared to extensive onshore developments. Specifically, potential customers prioritize solutions that offer high operational uptime, exceptional safety records, and demonstrated efficiency in variable offshore conditions. They seek partnership with technology providers and shipyards that can deliver reliable, bespoke solutions tailored to reservoir specifics, ensuring that the chosen FLNG concept maximizes gas recovery and minimizes operating expenses (OPEX) over the field life. The decision-making process is highly collaborative, involving technical, financial, and governmental stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $24.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell, PETRONAS, Technip Energies, KBR, Samsung Heavy Industries, Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering (DSME), Baker Hughes, Siemens Energy, Wison Offshore & Marine, Excelerate Energy, Golar LNG, Höegh LNG, Woodside Energy, ENI, TotalEnergies, McDermott International, Keppel Offshore & Marine, JGC Holdings, Chiyoda Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FLNG Market Key Technology Landscape

The FLNG market is fundamentally defined by highly advanced and specialized technological innovations across three major domains: marine infrastructure, gas processing, and subsea integration. Marine technology centers on hull design and mooring systems, which must ensure stability and survivability in extreme weather and high sea states, often utilizing proprietary turret mooring systems (Internal or External) to allow the vessel to weathervane and remain connected to the subsea infrastructure for decades without disconnection. Advanced anti-sloshing technology within the LNG storage tanks is critical to managing liquid movement during severe conditions, safeguarding the vessel's structural integrity and preventing process upsets during offloading operations. Hull fabrication techniques have also evolved to prioritize weight reduction and modularity, facilitating the integration of heavy topside process modules.

The core technical differentiation lies in the liquefaction technology utilized topside. The Mixed Refrigerant (MR) process remains the industry standard due to its robustness and proven track record in traditional onshore plants, adapted for the space and weight constraints of a floating facility. However, technologies like the Single Mixed Refrigerant (SMR) and various proprietary cycles (e.g., Shell’s DMR and the use of nitrogen expander cycles) are gaining prominence, particularly in smaller-scale and niche applications, due to their potential for enhanced energy efficiency and reduced equipment footprint. These systems rely on high-efficiency turbomachinery—compressors and drivers—that must perform reliably under continuous motion and vibration, requiring specialized engineering tolerances and dynamic analysis.

Furthermore, seamless subsea integration is paramount for connecting the gas reservoir to the floating processing facility. This involves complex subsea trees, manifolds, risers, and flowlines, all managed by sophisticated subsea control systems that ensure flow assurance—preventing hydrate formation and managing slug flow—under high pressure and extreme temperatures deep underwater. Digitalization, including advanced sensor networks and remote monitoring capabilities, forms a critical technological layer, enabling operators to manage complex assets from onshore control centers, ensuring operational optimization and regulatory compliance with minimal human intervention offshore. The trend is toward fully integrated control systems that link subsea, processing, and marine functions into a single digital platform, utilizing fiber optic cables and high-bandwidth satellite communication.

Regional Highlights

Regional dynamics play a crucial role in shaping the investment landscape and deployment strategy for FLNG projects globally. The primary areas of activity are dictated by the presence of large, stranded gas fields and the maturity of regulatory and financial frameworks. The following regions are key market contributors:

- Asia Pacific (APAC): APAC is a dominant consumer region for LNG, driving significant interest in FLNG as a flexible import and potential export solution, especially in countries like Australia, Malaysia, and Indonesia which possess substantial offshore reserves. Market growth here is propelled by energy security needs and the utilization of FLNG to develop smaller, geographically dispersed fields, minimizing environmental impact on sensitive coastlines.

- Middle East and Africa (MEA): This region is poised for explosive growth due to major gas discoveries off the coasts of Mozambique, Mauritania, Senegal, and various Gulf states. FLNG offers these nations a rapid, cost-effective path to monetize resources and secure export revenues without heavy investment in onshore pipeline infrastructure, making it a preferred technology for resource developers and governments alike.

- North America: While primarily focused on onshore gas production (shale gas), the Gulf of Mexico (GOM) maintains potential for niche FLNG applications, particularly involving associated gas monetization or small-scale export solutions. North American firms are major technology developers and providers in the sector, exporting expertise globally, especially in subsea and liquefaction technology.

- Europe: Europe exhibits limited direct FLNG deployment due to mature offshore infrastructure and focus on renewable energy, but European energy companies (IOCs) are major investors in global FLNG projects in other regions. European technology providers and classification societies remain pivotal in setting technical standards and providing specialized equipment for the global market.

- Latin America: Countries such as Brazil and Argentina, possessing significant deep-water and frontier gas resources, offer strong long-term potential for FLNG. Challenges relate primarily to complex regulatory frameworks and capital mobilization, though the need for flexible gas infrastructure remains high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FLNG Market.- Shell

- PETRONAS

- Technip Energies

- KBR

- Samsung Heavy Industries

- Hyundai Heavy Industries

- Daewoo Shipbuilding & Marine Engineering (DSME)

- Baker Hughes

- Siemens Energy

- Wison Offshore & Marine

- Excelerate Energy

- Golar LNG

- Höegh LNG

- Woodside Energy

- ENI

- TotalEnergies

- McDermott International

- Keppel Offshore & Marine

- JGC Holdings

- Chiyoda Corporation

Frequently Asked Questions

Analyze common user questions about the FLNG market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of FLNG over conventional onshore LNG terminals?

The primary advantage is the ability to monetize stranded or remote offshore gas fields that lack existing pipeline connectivity, offering faster deployment, reduced environmental impact on shorelines, and mobility, which lowers the overall project risk profile for certain reserve types.

Which regions are currently leading the investment and deployment of FLNG projects?

The Middle East and Africa (MEA), driven by large-scale deep-water discoveries in Mozambique and off the coast of West Africa, and the Asia Pacific (APAC) region, including Malaysia and Australia, are leading global investment and deployment activities in the FLNG sector.

What are the greatest technical risks associated with FLNG vessel operation?

Key technical risks include managing structural integrity and motion effects in severe sea states, ensuring the efficiency and reliability of cryogenic liquefaction processes under constant movement, and maintaining seamless operational linkage with complex subsea infrastructure (flow assurance).

How is environmental sustainability addressed in FLNG project development?

FLNG projects generally have a lower physical footprint compared to onshore plants, reducing coastal habitat disruption. Sustainability is further addressed through advanced systems designed to minimize methane slippage, reduce flaring through process optimization, and integrate energy-efficient liquefaction cycles.

What is the difference between a Newbuild and a Converted FLNG vessel?

A Newbuild FLNG vessel is purpose-designed and optimized for the specific field and process requirements, offering maximum efficiency and lifespan. A Converted vessel involves retrofitting an existing LNG carrier, offering lower initial costs and quicker delivery but often presenting limitations in size and processing capacity optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager