Floor Sealer and Finisher Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442128 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Floor Sealer and Finisher Market Size

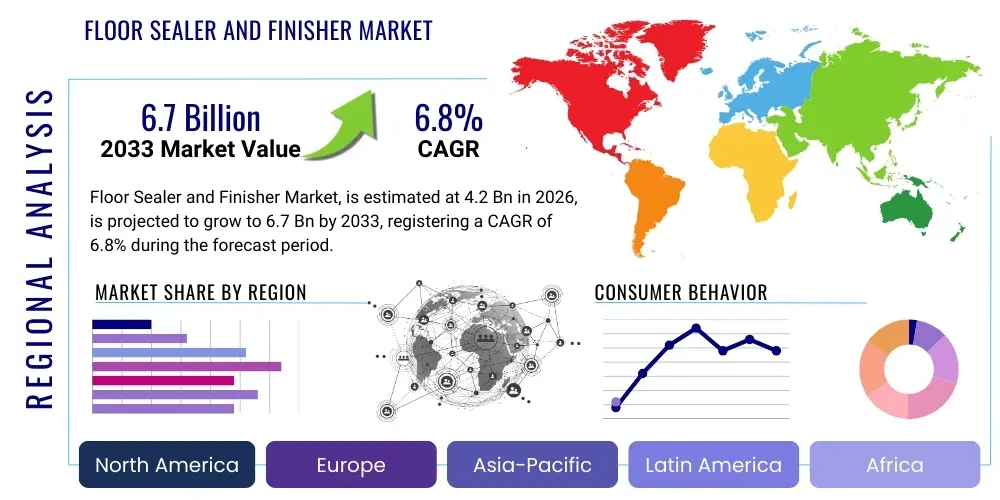

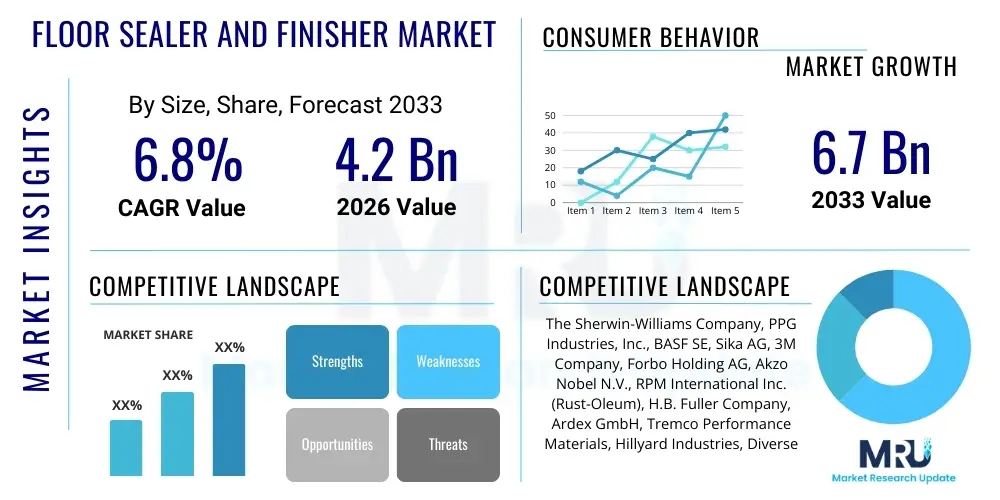

The Floor Sealer and Finisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

The steady growth trajectory is primarily attributed to rapid global urbanization, coupled with significant expansion in the commercial and industrial real estate sectors, which necessitates durable and aesthetically pleasing floor maintenance solutions. Increased investments in infrastructure development, particularly in emerging economies of Asia Pacific and Latin America, are bolstering demand for high-performance sealers and finishers designed to withstand heavy traffic and rigorous cleaning protocols. Furthermore, regulatory shifts favoring sustainable and low volatile organic compound (VOC) formulations are compelling manufacturers to innovate, driving premium product adoption and consequently increasing the overall market value.

Market expansion is also fueled by evolving consumer preferences in the residential sector, where homeowners are increasingly seeking professional-grade sealants to protect high-value flooring materials such as hardwood, concrete, and luxury vinyl tiles (LVT). The perceived longevity and reduced maintenance costs associated with properly sealed floors act as significant catalysts for market penetration. Innovations in application technologies, including automated dispensing systems and UV-curable coatings, are improving efficiency for large-scale projects, making high-quality finishing solutions more accessible and economically viable across various end-user segments. This convergence of regulatory push, technological advancement, and construction growth underpins the robust forecast for the floor sealer and finisher industry through 2033.

Floor Sealer and Finisher Market introduction

The Floor Sealer and Finisher Market encompasses a wide range of chemical formulations applied to flooring surfaces to enhance durability, protect against wear, moisture, stains, and chemical damage, and improve aesthetic appeal and ease of maintenance. These products, which include specialized coatings like polyurethane, acrylic, epoxy, and penetrating sealers, serve critical functions across diverse environments, ranging from high-traffic commercial facilities like hospitals and schools to industrial warehouses and private residential settings. Major applications span concrete sealing in manufacturing plants, wood floor protection in sports facilities, and resilient floor finishing in retail outlets. Key benefits derived from these products include extended floor life, superior gloss retention, slip resistance, and reduced long-term cleaning costs. The primary driving factors for market growth include stringent maintenance standards in institutional environments, accelerated global construction activities, particularly in non-residential sectors, and consumer demand for environmentally sustainable, low-odor, and high-performance sealing solutions that comply with global health and safety standards.

Floor sealers penetrate the porous surface of the flooring material, creating a protective barrier against external contaminants, while floor finishers form a protective layer on the surface, primarily enhancing appearance and wear resistance. The distinction often blurs as many products offer dual functionality. The increasing sophistication of flooring materials, such as micro-cement and polished concrete, demands specialized sealers that can chemically bond with the substrate, ensuring maximum adhesion and long-term protection. This technological evolution mandates continuous product development and formulation adjustments by leading market players to address specific substrate requirements and environmental exposure conditions, thereby solidifying the market’s dynamism.

Furthermore, the maintenance industry plays a pivotal role in the demand cycle, with professional cleaning and facility management services driving recurring revenue streams. The emphasis on hygiene and safety, exacerbated by global health concerns, has heightened the need for antimicrobial and easy-to-sanitize floor surfaces, thus increasing the adoption rate of high-solids, durable finishing coats in healthcare and food processing sectors. These factors collectively contribute to a resilient and expansive market landscape where performance, sustainability, and application efficiency are the core competitive metrics determining success and market share.

Floor Sealer and Finisher Market Executive Summary

The Floor Sealer and Finisher Market is characterized by robust business trends centered on sustainability and technological innovation, specifically the proliferation of water-based and bio-based formulations to meet escalating environmental regulations, notably regarding Volatile Organic Compounds (VOCs). Business strategies are increasingly focused on vertical integration and strategic partnerships to secure raw material supply chains and expand application expertise across specialized industrial sectors like aerospace and automotive manufacturing, where specific chemical resistance is paramount. Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market due to massive urbanization, infrastructure investment, and burgeoning manufacturing activities, driving unprecedented demand for affordable, durable concrete sealers. North America and Europe, while mature, remain crucial due to early adoption of high-performance, premium products and strict adherence to environmental compliance, pushing innovations in UV-curing and nanotechnology-enhanced finishes. Segmentation trends highlight the dominance of acrylic and polyurethane chemistries owing to their versatility and cost-effectiveness, though epoxy-based systems are commanding higher growth in industrial and heavy-duty applications requiring superior chemical and abrasion resistance, reflecting a strong market pull toward application-specific high-performance solutions.

Key segment dynamics also show a decisive shift in the end-user landscape. While the commercial sector (including hospitality and retail) remains a bedrock for decorative and maintenance finishes, the industrial sector (warehouses, factories, logistics hubs) is experiencing the most significant uptake of high-solids, long-life sealing systems designed to minimize downtime. This shift is driven by the global expansion of e-commerce and subsequent proliferation of large-scale logistics facilities that require flooring capable of withstanding constant forklift traffic and chemical exposure. Furthermore, the residential segment is showing strong demand for DIY-friendly and aesthetically superior products, particularly clear coats that preserve the natural look of materials while providing necessary protection.

In terms of competitive landscape, market consolidation continues, with major multinational chemical companies leveraging their extensive R&D capabilities to launch new generations of specialized sealers, particularly those offering multifunctional benefits such as anti-microbial properties or enhanced light reflectivity. Smaller, niche players, however, are competing effectively by focusing on specialized, eco-friendly formulations or hyper-local service models. Overall, the market remains highly competitive, driven by product differentiation, regulatory compliance, and the ability to deliver integrated solutions covering both initial installation and ongoing maintenance requirements, ensuring sustained long-term revenue generation across all geographic and application verticals.

AI Impact Analysis on Floor Sealer and Finisher Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Floor Sealer and Finisher Market primarily revolve around optimizing application efficiency, improving quality control, predicting maintenance schedules, and formulating new materials. Key themes identified include the expectation that AI-driven robotics will automate the application process in large industrial settings, minimizing human error and reducing installation time significantly. Users are also highly interested in how AI can be used to analyze sensor data from treated floors to predict wear patterns, determining the optimal timing for resealing, which shifts the industry from reactive to predictive maintenance models. Concerns often center on the initial cost barriers of implementing these advanced systems and the potential need for highly specialized personnel to manage AI-integrated machinery. The market anticipates that AI will streamline complex product development by simulating molecular interactions, accelerating the time-to-market for novel, sustainable, and high-performance finishing compounds.

The integration of AI extends far beyond simple automation. Machine learning algorithms are being employed in quality control systems using image recognition technology to detect imperfections, inconsistencies in thickness, or curing issues immediately during the application phase. This proactive quality assurance is critical, especially in sensitive environments like cleanrooms or food processing facilities where floor integrity is paramount. Moreover, AI models are now analyzing vast datasets related to climate, substrate composition, and traffic intensity to recommend the precise sealer formulation and application technique for specific project conditions, moving away from generalized recommendations towards highly customized, data-backed solutions. This optimization reduces material waste and guarantees performance, significantly enhancing contractor reliability and customer satisfaction.

While the actual chemical formulation process remains highly specialized, AI assists chemists by predicting the performance characteristics of new low-VOC and bio-based raw materials before physical synthesis is attempted. This capability drastically cuts down on expensive, time-consuming laboratory trials, accelerating the transition to sustainable product lines mandated by global environmental frameworks. The long-term expectation is that AI will be foundational in creating "smart floors" integrated with sensors, wherein the finishing coat itself provides data on structural integrity, temperature, and environmental conditions, leading to entirely new revenue streams based on data services tied to floor performance monitoring.

- AI-guided robotic application systems increase uniformity and reduce installation costs in large-scale commercial projects.

- Predictive maintenance analytics, driven by machine learning, optimize resealing schedules based on real-time wear data, extending floor lifespan.

- Computer vision and AI algorithms enhance quality control by detecting application flaws instantly during the curing process.

- AI accelerates R&D for novel, sustainable, low-VOC formulations by simulating material performance and chemical stability.

- Supply chain optimization using AI minimizes raw material costs and ensures timely delivery of specialized components.

- Implementation of "smart floor" technologies where finish performance data is continuously analyzed for proactive monitoring.

DRO & Impact Forces Of Floor Sealer and Finisher Market

The Floor Sealer and Finisher Market is powerfully influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces driving its evolution. Primary drivers include the massive increase in global commercial and industrial construction, particularly the construction of logistics warehouses and data centers which require robust, dust-free, and chemically resistant floors. Strict governmental regulations promoting workplace safety and hygiene standards, especially in healthcare and food & beverage processing, necessitate the use of high-grade, non-slip, and easy-to-clean floor finishes, creating persistent demand. Conversely, the market faces significant restraints, chiefly the stringent global regulations regarding Volatile Organic Compound (VOC) emissions, which force manufacturers into costly reformulations and increase the price of compliant products. Additionally, the fluctuating prices and supply volatility of petrochemical-derived raw materials, such as specific monomers and resins essential for high-performance sealers, pose a continuous financial challenge for maintaining consistent pricing and production scalability.

Opportunities within the market are predominantly concentrated in the rapid innovation of sustainable chemistries, specifically the development and commercialization of bio-based, solvent-free, and ultra-low VOC products that cater to high-value green building initiatives and certification programs like LEED. There is also a substantial opportunity in emerging markets across APAC and MEA, where rapid industrialization is creating vast, untapped demand for basic concrete protection and long-life industrial coatings. Furthermore, the adoption of specialized application technologies, such as advanced spray systems and UV-curing methods, represents a significant growth pathway by offering faster curing times and superior performance for professional contractors, thereby minimizing facility downtime and increasing project throughput. These technological and geographic opportunities counterbalance the restraints related to raw material costs and environmental compliance.

The cumulative impact forces manifest as a strong push towards product specialization and premiumization. The necessity of adhering to strict environmental standards (a major restraint) paradoxically drives innovation (an opportunity) in high-performance, sustainable products (a key driver). The impact forces compel companies to invest heavily in R&D to bridge the performance gap between traditional solvent-based systems and new water-based alternatives, ultimately leading to a higher average selling price and improved profit margins across the industry. The market is thus defined by a fundamental tension between cost containment and the imperative to deliver technologically advanced, environmentally responsible, and application-specific floor solutions that meet ever-increasing end-user expectations for durability and safety.

Segmentation Analysis

The Floor Sealer and Finisher Market is comprehensively segmented based on product type, resin chemistry, application method, and end-user industry, enabling a granular understanding of demand dynamics across various market verticals. Segmentation by product type distinguishes between high-performance sealers designed for substrate penetration and protective finishers focused on surface aesthetics and wear resistance, highlighting differences in formulation and application intent. Resin chemistry segmentation is crucial, differentiating between acrylic, polyurethane, epoxy, and methyl methacrylate (MMA) systems, each offering distinct properties concerning durability, chemical resistance, curing time, and cost, which dictates suitability for industrial versus commercial use. Furthermore, end-user segmentation is critical, showing varied requirements across industrial facilities, commercial spaces (retail, healthcare), and residential applications, each demanding specific regulatory compliance and performance characteristics from the floor coating system.

The dominance of specific segments is heavily correlated with regulatory environment and construction cycles. For instance, the industrial sector currently dominates consumption due to the increasing need for high-solids, heavy-duty epoxy and polyurethane sealers capable of protecting concrete floors in logistics and manufacturing hubs. Within the resin chemistry segment, water-based acrylics and urethanes are experiencing the fastest growth, primarily driven by strict North American and European VOC regulations and increased acceptance of their improved performance characteristics, reducing dependence on volatile solvent-based systems. Application methods, such as spray, roller, or specialized trowel application, also define market niches, with automated and high-efficiency systems gaining traction in large-scale projects aiming for rapid turnaround and minimal site disruption.

Analyzing these segments allows stakeholders to pinpoint high-growth areas. The healthcare segment, for example, consistently demands specialized antimicrobial, non-porous, and chemical-resistant finishes suitable for rigorous cleaning protocols. Conversely, the residential segment prioritizes ease of application, aesthetic variety, and low odor, boosting the demand for consumer-grade acrylic and wax finishes. The interplay between these segments demonstrates the market’s responsiveness to both industrial performance requirements and consumer-driven aesthetic demands, underscoring the necessity for a diversified product portfolio to maximize market penetration and effectively address the full spectrum of floor protection needs.

- By Product Type:

- Sealers (Penetrating Sealers, Surface Sealers)

- Finishers/Coatings (Waxes, Polishes, Urethane Finishes, Floor Paints)

- By Resin Chemistry:

- Acrylic

- Polyurethane (Waterborne, Solvent-borne, UV-curable)

- Epoxy (100% Solids, Waterborne)

- Methyl Methacrylate (MMA)

- Wax and Other Natural Formulations

- By End-Use Sector:

- Industrial (Manufacturing, Warehousing, Logistics, Automotive)

- Commercial (Healthcare Facilities, Retail, Education, Hospitality)

- Institutional (Government, Public Infrastructure)

- Residential (Single-family Homes, Multi-unit Dwellings)

- By Application Method:

- Roller Applied

- Trowel Applied

- Spray Applied (Airless, Conventional)

- By Form:

- Water-Based (Low-VOC)

- Solvent-Based (Traditional High-Performance)

- 100% Solids

Value Chain Analysis For Floor Sealer and Finisher Market

The value chain for the Floor Sealer and Finisher Market begins with the Upstream Analysis, which involves the sourcing and production of critical raw materials, primarily specialized petrochemical derivatives such as acrylic monomers, epoxy resins, polyurethane prepolymers, and high-performance solvents, along with essential additives like flow modifiers, UV stabilizers, and pigments. Suppliers of these chemical intermediates, who often face high capital intensity and strict quality control standards, exert moderate negotiating power, as proprietary resin formulations are key competitive differentiators. Maintaining stable sourcing channels and mitigating volatility in crude oil prices are primary concerns at this stage. Manufacturers then engage in compounding and formulation, where advanced chemical engineering is applied to convert raw materials into application-specific sealers and finishes, a process increasingly focused on developing sustainable, low-VOC alternatives to comply with evolving global environmental mandates.

The Midstream component of the value chain involves manufacturing, quality assurance, and distribution. Manufacturers often operate highly automated facilities to ensure product consistency and scale production efficiently. Distribution channels are complex and multifaceted, utilizing both Direct and Indirect approaches. Direct channels typically involve major manufacturers selling high-volume, highly technical industrial sealers directly to large construction firms, specialized applicators, or facility management companies, necessitating strong technical support and on-site expertise. Indirect channels dominate the residential and smaller commercial segments, utilizing a network of third-party distributors, wholesalers, building material retailers (e.g., home improvement stores), and specialized paint and coatings dealers. The reliance on established dealer networks, particularly for consumer-grade products, requires strong logistical capabilities and effective inventory management to ensure product availability across diverse geographic regions.

Downstream Analysis focuses on the application and end-user segments. Specialized contractors and professional applicators are crucial, as the performance of the finish heavily relies on correct preparation, mixing, and application techniques. These professionals serve as vital intermediaries, often influencing product selection based on job requirements and experience. The final stage involves the end-users—industrial, commercial, and residential customers—who consume the product and drive demand for long-term performance and maintenance. The long lifecycle of floor finishes means recurring revenue is generated primarily through maintenance protocols and scheduled re-applications, influenced heavily by the initial product quality and application success. Effective management of the distribution channel, particularly the strong linkage between technical support and applicator training, is essential for optimizing value capture throughout the entire supply chain.

Floor Sealer and Finisher Market Potential Customers

Potential customers for the Floor Sealer and Finisher Market represent a broad spectrum of entities requiring durable, protective, and compliant flooring solutions, segmented primarily by the degree of performance and regulation required. The largest segment of potential buyers includes professional construction companies and general contractors undertaking large-scale commercial and industrial projects, such as the building of new warehouses, logistical centers, airport hangars, and automotive manufacturing plants, where high-performance epoxy and polyurethane systems are mandatory to resist chemicals, abrasion, and heavy machinery traffic. Facility Management (FM) companies also constitute a massive recurring customer base, responsible for the ongoing maintenance and lifecycle management of existing commercial properties like shopping malls, office complexes, and convention centers, driving demand for re-coating and aesthetic maintenance finishes.

A second critical customer segment is institutional end-users, encompassing governmental bodies and organizations with specialized requirements, including hospitals, schools, universities, military facilities, and public infrastructure projects. These entities prioritize hygiene, slip resistance, compliance with specific health standards (e.g., USDA or FDA approval for food service areas), and longevity, leading to the adoption of specialized antimicrobial and low-odor, quick-curing systems. Residential consumers form the third significant tier, although their buying behavior is often channeled through large retail home improvement stores or specialized flooring installers. This group seeks easy-to-apply, aesthetically pleasing, and durable sealants for high-value flooring such as hardwood, concrete garage floors, and luxury stone tiles, with convenience and low environmental impact (low VOCs) being key purchasing drivers.

Niche customers, such as specialized flooring contractors focused on decorative concrete or athletic facility flooring, also represent high-value potential. These professionals require tailored products, such as high-gloss, pigmented sealers or flexible coatings suitable for sports surfaces. The purchasing decisions across all segments are strongly influenced by product efficacy, compliance certifications, long-term cost of ownership (durability vs. re-application frequency), and the availability of localized technical support. Manufacturers must target these diverse groups with differentiated product lines and distribution strategies that address the varying needs for technical complexity, regulatory compliance, and installation ease.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Sherwin-Williams Company, PPG Industries, Inc., BASF SE, Sika AG, 3M Company, Forbo Holding AG, Akzo Nobel N.V., RPM International Inc. (Rust-Oleum), H.B. Fuller Company, Ardex GmbH, Tremco Performance Materials, Hillyard Industries, Diversey Holdings Ltd., Bona AB, Tnemec Company, Inc., Seal-Krete/Quikrete, Koster American Corporation, Resinous Flooring International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floor Sealer and Finisher Market Key Technology Landscape

The Floor Sealer and Finisher Market is undergoing a rapid technological transformation, primarily focused on enhancing performance, environmental sustainability, and application efficiency. A pivotal advancement is the proliferation of high-solids and 100% solids epoxy and polyurethane systems, which drastically reduce VOC content while delivering superior film thickness and durability in a single coat, addressing both regulatory compliance and end-user demands for minimal facility downtime. Furthermore, UV-curable coatings represent a significant step forward, utilizing specialized chemistry that cures instantly when exposed to ultraviolet light, allowing for immediate return to service in high-traffic commercial environments like hospitals and retail stores, a feature impossible with traditional air-curing or moisture-curing systems. This rapid curing technology minimizes project timelines and optimizes labor efficiency, positioning it as a premium solution in time-sensitive applications.

Nanotechnology is playing an increasingly crucial role in enhancing the functional properties of floor finishes. Manufacturers are incorporating nano-scale additives, such as ceramic particles or silica, into resin matrices to significantly improve abrasion resistance, scratch hardness, and chemical stability without compromising the coating's clarity or color. These nano-enhanced formulations deliver unparalleled longevity and resistance to mechanical wear, critical in demanding industrial environments. Additionally, the development of sophisticated water-based technologies has successfully overcome historical performance limitations, with new generation acrylic and polyurethane dispersions offering solvent-like performance in terms of durability and gloss, coupled with the benefit of ultra-low odor and simplified cleanup, facilitating broader adoption in residential and occupied commercial buildings.

Beyond material science, application technology is also evolving rapidly. Automated and robotic application systems are being deployed for massive industrial floors, ensuring precise and uniform coverage across vast areas, thereby reducing labor costs and improving consistency—a significant factor in performance guarantee. Smart coating technology is also emerging, where finishes are engineered with embedded sensors or indicator chemistry capable of signaling physical degradation, chemical exposure, or the need for maintenance, moving the industry toward predictive floor asset management. This holistic focus on advanced chemistry, application efficiency, and integrated maintenance technology defines the modern competitive landscape of floor sealers and finishers.

Regional Highlights

- North America: The North American market is characterized by maturity, high environmental compliance, and a strong preference for high-performance, specialized coating systems. Strict VOC regulations, particularly in California and surrounding areas, drive demand for water-based, low-odor, and 100% solids epoxy formulations. The U.S. remains the largest consumer, primarily due to expansive commercial construction (office spaces, healthcare facilities) and massive investment in modern logistics and e-commerce warehousing infrastructure, requiring durable concrete sealers. Canadian market growth is stable, focusing on sustainable building practices and cold-weather application solutions. Adoption of premium technologies like UV-cured coatings is significantly higher here due to the emphasis on minimizing operational downtime and maximizing life-cycle value.

- Europe: Europe is defined by stringent REACH regulations and a strong commitment to green building standards, positioning it as a leader in sustainable floor finish innovation. Western European countries (Germany, UK, France) demand high-quality, bio-based, and solvent-free sealers, often certified by eco-labels. The industrial sector, particularly automotive and chemical manufacturing, drives the consumption of heavy-duty polyurethane and epoxy coatings for safety and chemical resistance. Eastern Europe is experiencing faster growth rates, fueled by increasing foreign direct investment in manufacturing and infrastructure upgrades, standardizing floor specifications closer to Western European norms. The emphasis is heavily placed on long-term durability and resistance to harsh cleaning agents.

- Asia Pacific (APAC): APAC represents the fastest-growing and largest regional market due to unprecedented urbanization and industrial expansion, particularly in China, India, and Southeast Asian nations. Massive construction activity across residential, commercial, and, crucially, industrial sectors (factories, energy plants) fuels explosive demand. While cost-effectiveness often dictates product choice, leading to high consumption of basic acrylic and solvent-based sealers, increasing environmental awareness and the adoption of international manufacturing standards are gradually pushing the market toward higher-quality, low-VOC products. Japan and South Korea, being technologically advanced, focus on premium, specialized coatings including sophisticated anti-microbial and anti-static finishes for high-tech manufacturing cleanrooms.

- Latin America (LATAM): The LATAM market, led by Brazil and Mexico, demonstrates solid growth driven by infrastructure investment and an expanding commercial sector (retail, tourism). Market demand is sensitive to economic stability but shows a strong trajectory toward modernization of industrial facilities, requiring robust concrete protection. Price remains a crucial factor, favoring domestically produced or regional formulations, but there is growing recognition of the long-term benefits of high-performance coatings, especially for facilities handling valuable exports or complex logistics operations. The need for basic floor protection against moisture and wear is pervasive across the region.

- Middle East and Africa (MEA): The MEA market is largely driven by large-scale government-funded infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) related to tourism, logistics hubs, and urban development mega-projects. The high temperatures and harsh environmental conditions necessitate specialized sealers with superior UV resistance and thermal stability. Africa’s growth is nascent but promising, supported by industrialization efforts, particularly in South Africa and Nigeria, where basic, durable sealers for manufacturing and public facilities are in high demand. Compliance with stringent fire safety and thermal performance standards is a key driver in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floor Sealer and Finisher Market.- The Sherwin-Williams Company

- PPG Industries, Inc.

- BASF SE

- Sika AG

- 3M Company

- Forbo Holding AG

- Akzo Nobel N.V.

- RPM International Inc. (Rust-Oleum)

- H.B. Fuller Company

- Ardex GmbH

- Tremco Performance Materials

- Hillyard Industries

- Diversey Holdings Ltd.

- Bona AB

- Tnemec Company, Inc.

- Seal-Krete/Quikrete

- Koster American Corporation

- Resinous Flooring International

- MAPEI S.p.A.

- DuPont de Nemours, Inc.

Frequently Asked Questions

Analyze common user questions about the Floor Sealer and Finisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between water-based and solvent-based floor sealers?

Water-based sealers contain low or zero Volatile Organic Compounds (VOCs), making them environmentally preferred, low-odor, and easier to apply and clean up, suitable for residential and occupied commercial areas. Solvent-based sealers offer superior durability, chemical resistance, and faster cure times for heavy industrial applications but emit higher VOCs and require specialized ventilation.

Which resin chemistry is best suited for high-traffic industrial concrete floors?

Epoxy (especially 100% solids) and high-performance polyurethane sealers are best for high-traffic industrial concrete floors. Epoxy provides excellent compressive strength and chemical resistance, while polyurethane offers superior abrasion resistance and flexibility, making them ideal for heavy machinery, forklifts, and chemical exposure in manufacturing and logistics.

How do VOC regulations impact the future growth of the floor sealer market?

VOC regulations are driving innovation toward sustainable, high-solids, and bio-based formulations. These mandates increase R&D investment but ultimately expand the market for premium, compliant products, pushing traditional solvent-based systems out of sensitive markets like North America and Europe, thereby accelerating the adoption of advanced waterborne technology globally.

What is the role of nanotechnology in modern floor finishing products?

Nanotechnology involves integrating nano-scale particles (like silica or ceramic) into sealers and finishes to dramatically increase scratch resistance, surface hardness, and long-term durability without altering the aesthetic appearance. This improves the performance lifecycle of the coating, especially under heavy mechanical stress.

In which region is the demand for floor sealers and finishers currently growing the fastest?

The Asia Pacific (APAC) region is experiencing the fastest growth, primarily due to large-scale infrastructure investments, rapid urbanization, and accelerated industrialization across major economies like China and India, creating immense demand for both basic and advanced floor protection solutions in new construction projects.

The Floor Sealer and Finisher Market is strategically positioned for significant expansion, driven by macroeconomic factors such as global construction boom and microeconomic influences including technological breakthroughs in sustainable chemistry. The demand profile is highly differentiated, requiring manufacturers to maintain diversified product portfolios catering to the stringent performance needs of the industrial sector, the aesthetic and hygiene requirements of the commercial sector, and the ease-of-use demands of the residential consumer. Success in this highly competitive arena hinges on continuous innovation in low-VOC formulations, optimization of supply chains, and the strategic adoption of AI and automation in application processes to enhance efficiency and quality control across large-scale projects. The shift toward specialized, application-specific products, especially those offering enhanced durability and reduced environmental impact, will be the defining characteristic of market leadership throughout the forecast period ending in 2033. Regional dynamics, particularly the burgeoning opportunities in Asia Pacific, necessitate tailored market entry strategies that balance cost-effectiveness with advancing regulatory compliance, ensuring long-term sustainable growth and market dominance in specialized coating solutions.

Further analysis of the competitive landscape indicates that mergers, acquisitions, and strategic technical partnerships aimed at acquiring niche application expertise or specific material technologies will continue to consolidate market power among the major global chemical players. Smaller, innovative firms specializing in bio-based materials or advanced application equipment may become prime targets for acquisition, allowing larger companies to quickly adapt to evolving regulatory pressures and consumer demand for eco-friendly products. The focus on life cycle cost analysis, where the initial investment in a high-quality sealer is justified by reduced maintenance and extended floor life, is increasingly influencing procurement decisions across all end-user sectors, moving the market away from low-cost, low-performance commodity products towards premium, performance-guaranteed systems. This structural shift underpins the projected robust CAGR for the global Floor Sealer and Finisher Market.

The imperative for infrastructure resilience, particularly concerning critical national assets like hospitals, data centers, and food processing facilities, will cement the essential role of advanced floor sealers and finishers. These critical environments require coatings that not only offer mechanical protection but also provide features such as anti-microbial properties, electrostatic dissipation, and extreme chemical resistance, often dictated by sector-specific regulatory bodies. This high barrier to entry for specialized formulations ensures that R&D intensive firms will maintain a significant competitive edge. Furthermore, the rising labor costs globally increase the appeal of self-leveling and quick-curing systems that minimize installation time and complexity. The market outlook remains exceptionally positive, fueled by an uncompromising global focus on asset protection, safety standards, and environmental responsibility, driving the overall market valuation toward the projected USD 6.7 Billion by 2033.

The commitment to sustainability is reshaping not only the product chemistry but also the entire manufacturing process, with leading companies investing in circular economy initiatives aimed at reducing waste and utilizing renewable energy sources in production. The implementation of digital tools, including AI-driven inventory management and predictive sales analytics, allows manufacturers to better anticipate regional demand fluctuations and optimize production schedules, reducing lead times and improving supply chain responsiveness, which is critical in an industry dealing with materials having defined shelf lives. This emphasis on operational excellence and environmental stewardship provides a double advantage: fulfilling corporate social responsibility mandates while simultaneously appealing to increasingly environmentally conscious commercial clients and institutional buyers who prioritize suppliers with verifiable sustainability credentials in their procurement criteria.

In conclusion, the Floor Sealer and Finisher Market is positioned as a high-growth sector within the broader construction chemicals industry, underpinned by non-discretionary maintenance requirements and transformative technological advancements. The trajectory is clearly defined by the migration from traditional solvent-borne systems to sophisticated water-based, UV-cured, and nanotechnology-enhanced alternatives. Geographically, while established markets provide the innovation framework, emerging economies provide the volume growth opportunity. Stakeholders who prioritize performance, sustainability, and application efficiency will be best placed to capitalize on the sustained demand generated by global infrastructure development and evolving industrial safety standards through the projected forecast period. The market’s resilience against economic cycles, owing to the consistent need for floor maintenance and protection, further solidifies its appealing investment profile.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager