Flooring nail gun Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441349 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Flooring nail gun Market Size

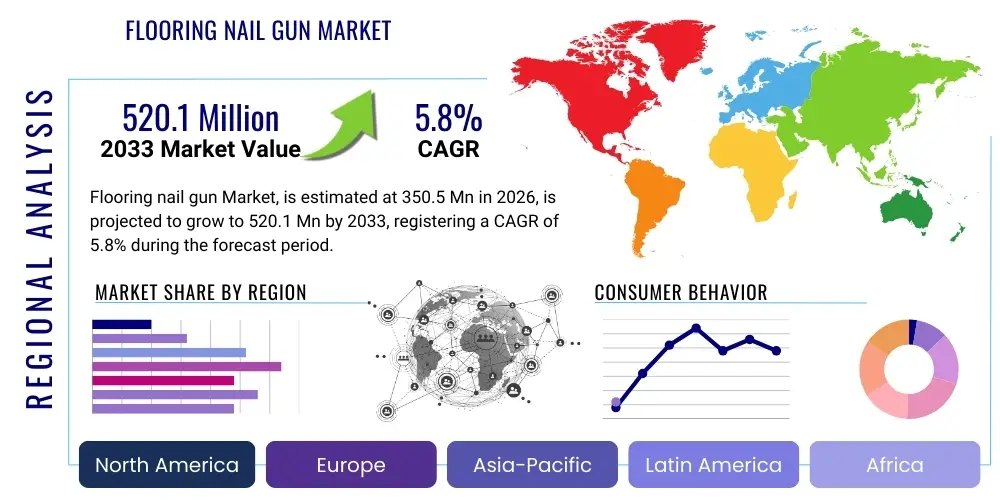

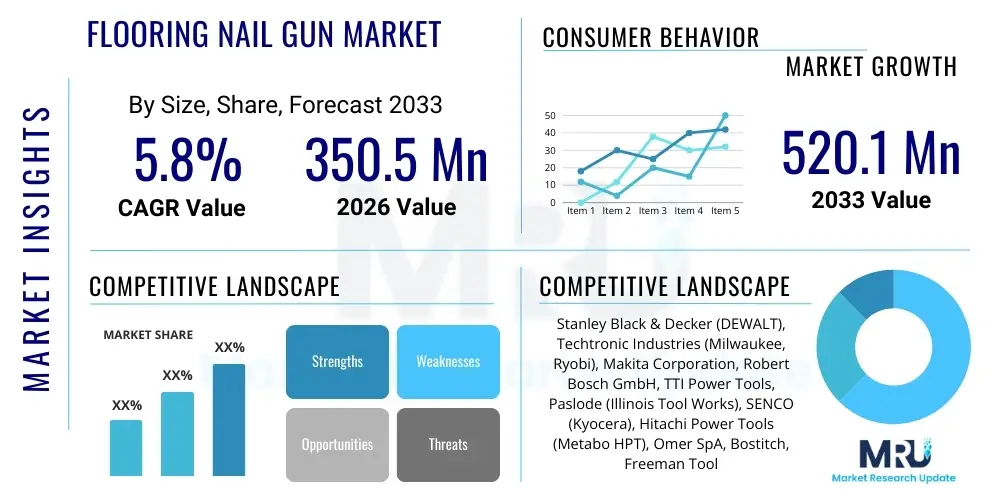

The Flooring nail gun Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $350.5 Million in 2026 and is projected to reach $520.1 Million by the end of the forecast period in 2033.

Flooring nail gun Market introduction

The Flooring nail gun Market encompasses specialized pneumatic, cordless, and manual tools designed specifically for fastening hardwood, engineered wood, and subflooring materials. These devices significantly enhance the efficiency and precision of flooring installation compared to traditional hammering methods, reducing labor time and ensuring secure, concealed fastenings. Product innovations focus heavily on ergonomics, weight reduction, and power optimization to meet the demanding requirements of professional contractors and the growing segment of advanced DIY users. The shift towards lightweight, durable materials in tool construction, combined with advancements in battery technology for cordless models, defines the current technological trajectory of the industry. These tools are indispensable in both new construction and renovation projects globally, driven primarily by favorable macroeconomic conditions stimulating the residential and commercial real estate sectors.

Major applications of flooring nail guns span across residential housing projects, large-scale commercial developments, and facility maintenance requiring robust and aesthetic flooring solutions. In residential settings, nail guns are crucial for installing traditional tongue-and-groove hardwood floors, minimizing visible fasteners and ensuring long-term structural integrity. Commercial applications often involve larger coverage areas and more continuous use, necessitating industrial-grade, highly reliable pneumatic systems. The primary benefit derived from utilizing these tools is substantial time savings and consistent fastening depth, which is vital for warrantied flooring installations. Furthermore, specialized nail guns, such as cleat nailers and staplers, cater to different flooring materials and thicknesses, ensuring the market offers tailored solutions for nearly every application scenario.

The market expansion is fundamentally driven by the resurgence in global housing starts and increasing disposable incomes leading to higher investment in home remodeling and renovation activities. Driving factors include the continuous push for higher construction productivity standards, regulatory requirements favoring precise installation techniques, and the steady improvement in the power-to-weight ratio of cordless flooring nailers, which offer unparalleled maneuverability and ease of use in confined spaces. The move away from older, less efficient installation methods is also fueling demand, particularly in developing economies undergoing rapid urbanization and infrastructure development.

Flooring nail gun Market Executive Summary

The Flooring nail gun market exhibits robust growth driven primarily by structural shifts in global construction and pervasive technological adoption. Current business trends indicate a strong preference for cordless (battery-powered) flooring nailers over traditional pneumatic models, particularly among professional contractors seeking flexibility and reduced reliance on air compressors. Key manufacturers are focusing on integrating brushless motor technology and high-capacity lithium-ion batteries to extend runtime and durability, positioning cordless tools as the premium, high-efficiency solution. Supply chain resilience, following recent global disruptions, has become a strategic focus, with companies investing in localized manufacturing or diversification of sourcing to stabilize production and reduce lead times for specialized fasteners and accessories integral to the tools' operation.

Regional trends highlight North America and Europe as mature markets characterized by high adoption rates of advanced tools and a strong replacement cycle for existing professional equipment. These regions are major centers for innovation, particularly in ergonomic design and safety features. Conversely, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by explosive growth in residential construction, massive government investment in infrastructure, and the increasing modernization of traditional building techniques in countries like China, India, and Southeast Asia. Latin America and MEA show gradual uptake, often prioritizing cost-effective pneumatic solutions, but are gradually moving towards cordless technology as infrastructure improves and labor costs rise.

Segment trends demonstrate the dominance of the residential application segment due to the sheer volume of housing projects and renovation work. Within product types, pneumatic nailers remain essential in large, fixed installation environments due to their raw power and consistent performance under heavy load, but the Cordless segment is rapidly gaining market share across all application areas. Companies are increasingly segmenting their offerings based on user sophistication, providing industrial-grade tools for contracting firms and more user-friendly, feature-light options for the rapidly expanding DIY and small-scale renovation market. Specialized cleat nailers, designed for optimal fastening in hardwood, continue to command a premium, reflecting sustained demand for high-quality, long-lasting flooring installations.

AI Impact Analysis on Flooring nail gun Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Flooring nail gun Market center around automation of precision tasks, optimization of tool manufacturing processes, and predictive maintenance capabilities. Common themes explored by end-users and manufacturers include whether AI can facilitate the perfect angle and depth setting automatically based on flooring material recognition, how AI-driven analytics can improve the efficiency of assembly lines producing the tools, and the potential for smart nailers equipped with sensors to monitor wear, usage patterns, and scheduled maintenance requirements. Expectations are high regarding enhanced quality control during high-speed production and the development of 'smart' fasteners that interact with robotic placement systems, though currently, AI's primary influence remains embedded in the manufacturing supply chain rather than direct tool operation in the field.

- AI-driven Predictive Maintenance: Utilizing sensors within high-end nail guns to forecast component failure (e.g., driver blades, seals) based on usage data, minimizing unexpected downtime for professional contractors.

- Manufacturing Optimization: Implementation of AI and machine learning algorithms in the tool production line to optimize material flow, reduce waste, and perform automated, high-speed visual inspection for quality assurance of critical components like firing mechanisms and housing integrity.

- Supply Chain Resilience: AI analytics used to predict demand fluctuations for specific nail gun types and associated fasteners across regional markets, improving inventory management and logistical efficiency.

- Ergonomics and Design: Machine learning models analyzing biomechanical data collected from extensive field testing to design lighter, more balanced, and vibration-dampening tool bodies, enhancing user comfort and reducing risk of injury.

- Automated Calibration Systems: Future integration of AI in cordless nailers enabling automatic adjustment of air pressure or striking force based on real-time feedback from the wood density being penetrated, ensuring optimal fastener seating depth without manual intervention.

DRO & Impact Forces Of Flooring nail gun Market

The Flooring nail gun Market dynamics are shaped by a complex interplay of drivers that propel demand, restraints that challenge growth, and opportunities that promise future expansion, all culminating in specific impact forces on market development. Key drivers include the ongoing recovery and expansion of global residential construction, particularly multi-family dwellings and large-scale remodeling projects, which mandate fast and reliable flooring installation methods. Furthermore, the persistent demand for high-quality, durable hardwood and engineered flooring materials necessitates the precision offered by specialized nail guns, supporting market momentum. These drivers are heavily amplified by the increasing professionalization of construction trades globally, where efficiency tools are seen as necessary investments rather than optional expenses.

However, market growth is tempered by significant restraints. The primary impediment is the high initial investment cost associated with professional-grade pneumatic or high-end cordless nail gun systems, including the necessary complementary equipment such as air compressors or specialized batteries and chargers. Additionally, the periodic maintenance and replacement costs of specialized fasteners (cleats and staples), coupled with the need for specialized training for optimal use and maintenance, can limit adoption, particularly among small contractors or in cost-sensitive emerging markets. Regulatory hurdles related to noise pollution and worker safety standards in various jurisdictions also necessitate continuous product adaptation, imposing R&D costs on manufacturers.

Opportunities for market expansion are largely concentrated in the technological advancements and geographical whitespace. The sustained growth of the cordless segment, driven by improvements in battery energy density and brushless motor efficiency, presents a massive opportunity for manufacturers to capture the premium segment. Geographically, untapped potential lies in the APAC and Latin American markets, where rising middle-class disposable income is stimulating a shift from concrete and tile flooring to wood and laminate options. Furthermore, the development of multi-function nail guns capable of handling a variety of flooring types (e.g., convertible cleat/staple nailers) addresses contractor flexibility requirements, maximizing tool utilization and driving replacement demand. The resultant impact forces strongly favor efficiency and portability, compelling manufacturers to prioritize ergonomic, battery-powered solutions.

Segmentation Analysis

The Flooring nail gun Market is comprehensively segmented based on product type, operation mode, application area, and distribution channel, providing a multi-dimensional view of demand concentration and technological preference. Segmentation by product type—pneumatic, cordless, and manual—is the most influential, reflecting fundamental differences in power source, mobility, and typical end-use environment. Pneumatic tools dominate industrial and high-volume applications due to sustained power, while cordless nailers are rapidly capturing the market share in residential and renovation sectors due to their unmatched portability and ease of use. Understanding these segment dynamics is crucial for strategic planning, allowing manufacturers to tailor their product development pipelines and marketing strategies to specific user requirements and regional market maturity levels.

- By Product Type:

- Pneumatic Flooring Nailers (Air-powered)

- Cordless/Battery-Powered Flooring Nailers

- Manual Flooring Nailers

- By Application:

- Residential Construction and Renovation

- Commercial Construction (Office Spaces, Retail, Hospitality)

- Industrial Facilities

- By Operation Mode:

- Cleat Nailers (primarily for solid hardwood)

- Staplers (primarily for engineered wood and subflooring)

- Dual-Function Nailers/Staplers

- By Distribution Channel:

- Online Retail

- Offline Retail (Specialty Tool Stores, Home Improvement Centers)

- Direct Sales to Contractors

Value Chain Analysis For Flooring nail gun Market

The value chain for the Flooring nail gun market begins with the upstream analysis, focusing on the sourcing of critical raw materials, including specialized high-grade aluminum and engineered plastics for housings, and hardened steel alloys for internal components such as driver blades, pistons, and firing pins. Key upstream activities involve precision machining, motor manufacturing (for cordless variants, focusing on brushless technology), and the complex production of specialized fasteners (cleats and staples), where quality control is paramount to prevent tool jamming and ensure effective fastening. Efficiency in upstream supply directly correlates with the final product's reliability and cost structure, making stable supply relationships for materials like lithium-ion battery cells crucial for manufacturers of cordless models.

The midstream stage involves the design, assembly, and rigorous testing of the nail guns. Manufacturers focus heavily on optimizing ergonomics, minimizing vibration, and ensuring compliance with international safety standards (e.g., ANSI, CE). Distribution forms the core of the downstream analysis, differentiating between direct and indirect channels. Direct sales are often utilized for large contracting firms or institutional buyers, providing specialized customer service and bulk pricing. Indirect channels, which dominate consumer and small-to-medium contractor sales, rely on extensive networks of authorized distributors, large brick-and-mortar home improvement centers (BHDs), and increasingly, specialized e-commerce platforms, maximizing geographical reach and availability.

The final element of the downstream chain involves service and after-market support, including the supply of replacement parts, maintenance services, and the crucial supply of proprietary or specialized fasteners. This post-sale support enhances brand loyalty and captures recurring revenue. Direct distribution channels facilitate closer feedback loops from professional end-users, enabling rapid product iteration and improvement, whereas indirect channels emphasize inventory management and promotional strategies to drive retail sales volume. Overall, the value chain demonstrates a shift towards vertical integration or highly controlled supplier partnerships to maintain quality standards for high-precision components essential for tool performance.

Flooring nail gun Market Potential Customers

The primary customer base for the Flooring nail gun market consists predominantly of professional flooring contractors, general construction firms specializing in residential and commercial finishes, and dedicated woodworkers or cabinet installers requiring precise fastening solutions. These professional end-users prioritize durability, consistent performance under heavy use, and speed, often opting for high-powered pneumatic systems or robust, long-lasting cordless models. Their purchasing decisions are heavily influenced by the tool's reliability, warranty coverage, and the availability of specialized, brand-compatible fasteners. The demand from this segment is cyclical, tied directly to the health of the housing and commercial real estate sectors, driving bulk purchases and long-term relationships with tool suppliers.

A rapidly expanding segment of potential customers includes the proficient Do-It-Yourself (DIY) enthusiast and small-scale renovators, particularly in developed economies. These buyers, while perhaps not requiring continuous daily use, seek tools that simplify complex tasks like hardwood floor installation, offering professional results without the need for extensive trade experience. They are attracted to lighter, more intuitive cordless models that eliminate the need for an air compressor setup. Their purchasing decisions are often made through retail home improvement centers and online marketplaces, prioritizing ease of use, safety features, and overall value proposition over industrial-grade durability.

Furthermore, rental companies and vocational training institutions represent a steady, indirect customer segment. Rental fleet operators require durable, multi-user compatible tools that can withstand high turnover and varied operator skill levels, focusing on ease of maintenance and readily available parts. Training institutions invest in current technology to prepare future professionals, driving demand for the latest battery-powered and ergonomic models. These diverse customer profiles necessitate a tiered product offering from manufacturers, ensuring different price points and feature sets are available across the various distribution channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350.5 Million |

| Market Forecast in 2033 | $520.1 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker (DEWALT), Techtronic Industries (Milwaukee, Ryobi), Makita Corporation, Robert Bosch GmbH, TTI Power Tools, Paslode (Illinois Tool Works), SENCO (Kyocera), Hitachi Power Tools (Metabo HPT), Omer SpA, Bostitch, Freeman Tools, NuMax, Porta-Nails, Spotnails, PrimeSource Building Products, Grip-Rite, A.F. Supply. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flooring nail gun Market Key Technology Landscape

The technology landscape of the Flooring nail gun Market is undergoing rapid transformation, largely driven by advancements in cordless power solutions and materials science. The most significant shift is the widespread adoption of Brushless Motor Technology in battery-powered nailers. Brushless motors offer superior energy efficiency, translating directly into longer battery life per charge and greater sustained power output compared to older brushed motors. This efficiency allows cordless flooring nailers to compete effectively with traditional pneumatic models in terms of driving force and operational consistency. Furthermore, manufacturers are focusing intensely on proprietary battery management systems (BMS) integrated with high-density Lithium-Ion cells to optimize charging cycles, monitor heat dissipation, and maximize the overall lifespan of the battery packs, addressing a key historical constraint of cordless tools.

Ergonomic engineering and material innovation represent another core technology focus. Companies are utilizing advanced computational fluid dynamics and stress analysis during the design phase to minimize tool weight while maximizing structural durability. The use of specialized lightweight, high-impact composite materials in tool housings helps reduce user fatigue during prolonged use, a critical concern for professional flooring installers. Key technical features now common in modern nail guns include anti-marring bases to protect finished floor surfaces, sequential firing modes for improved safety, and precise depth-of-drive adjustments, often incorporating tool-free mechanisms for rapid field adjustments based on differing wood hardness and thickness specifications.

Future technological developments are moving towards 'smart' or connected tools. This involves integrating Bluetooth connectivity into high-end nailers to allow users or fleet managers to track tool location, monitor usage statistics (e.g., number of nails fired, operational hours), and receive low battery warnings or predictive maintenance alerts via smartphone applications. While currently nascent, this connectivity is expected to become standard, offering unprecedented levels of operational management for large construction firms. Coupled with continuous innovation in fastener technology—such as specialized cleat coatings to enhance corrosion resistance and grip—the industry is focused on delivering optimized performance, safety, and operational efficiency across all tool platforms.

Regional Highlights

Regional dynamics significantly influence the adoption and type of flooring nail guns utilized worldwide. North America is the dominant market, characterized by mature construction industries, high labor costs, and a strong preference for high-quality, professional-grade tools. The region, particularly the United States, drives innovation in the cordless segment due to the necessity for job-site portability and stringent worker safety regulations. The extensive renovation and remodeling sector, alongside stable housing starts, ensures consistent demand for both premium pneumatic and advanced battery-powered flooring nailers. Manufacturers often launch their most sophisticated, high-end products in this region first.

Europe represents another key market, emphasizing high standards for ergonomics, noise reduction, and environmental efficiency. German and Scandinavian markets show high adoption of tools compliant with strict safety norms. While pneumatic tools maintain a strong presence in established workshops and large construction sites, the transition to cordless solutions is accelerating rapidly, supported by robust infrastructure and high consumer acceptance of battery technology. Demand in Eastern Europe is increasing as construction techniques modernize, favoring imported, reliable tool brands.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by rapid urbanization, significant infrastructure investment, and rising home ownership rates, particularly in China and India. Although pricing sensitivity is high, leading to a prevalent use of basic pneumatic and even manual tools, the increasing complexity and scale of residential and commercial projects are gradually driving demand for faster, more reliable nail guns. Japan and Australia, with their sophisticated construction sectors, mirror the trends seen in North America and Europe, focusing on high-end cordless and specialized fastening equipment.

- North America (USA, Canada): Market leader in terms of value and technological adoption, strong demand for cordless tools, high replacement cycle driven by professional contractors.

- Europe (Germany, UK, France): Focus on safety, ergonomics, and noise compliance; rapid conversion from pneumatic to high-performance cordless systems in residential sectors.

- Asia Pacific (China, India, Japan, Australia): Highest growth rate; dual market structure featuring high-volume, cost-sensitive demand alongside sophisticated demand for specialized tools in developed sub-regions.

- Latin America (Brazil, Mexico): Emerging market potential; driven by infrastructural improvements and increasing formal construction practices, though often favoring cost-effective pneumatic systems.

- Middle East & Africa (MEA): Growth linked to mega-projects in the GCC countries and ongoing residential development; demand focused on durable, heavy-duty equipment suitable for harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flooring nail gun Market.- Stanley Black & Decker (DEWALT, Bostitch)

- Techtronic Industries Co. Ltd. (Milwaukee, Ryobi)

- Makita Corporation

- Robert Bosch GmbH

- Kyocera Corporation (SENCO)

- Metabo HPT (Koki Holdings Co., Ltd.)

- Paslode (Illinois Tool Works Inc.)

- Omer SpA

- Beck Fastener Group

- Fasco America

- PrimeSource Building Products

- Porta-Nails Inc.

- Spotnails

- Grip-Rite

- Freeman Tools

- NuMax

- A.F. Supply

- Aerosmith Fastening Systems

- Cadex Tools

- Max USA Corp.

Frequently Asked Questions

Analyze common user questions about the Flooring nail gun market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift from pneumatic to cordless flooring nail guns?

The primary factor driving the shift is the demand for increased portability, eliminating the need for cumbersome air compressors and hoses, coupled with significant improvements in brushless motor technology and high-capacity lithium-ion battery life, making cordless tools powerful and reliable for professional use.

Which type of flooring nailer is best suited for solid hardwood installation?

Cleat nailers are the preferred and often mandated tool for solid hardwood floor installation as they use specialized L-shaped or T-shaped fasteners (cleats) that tightly secure the tongue and groove without damaging the wood surface, providing superior holding power compared to standard staples.

How does the Flooring nail gun market address environmental and sustainability concerns?

Manufacturers address sustainability by focusing on energy-efficient brushless motors in cordless tools, utilizing lighter and more recyclable composite materials in tool construction, and optimizing packaging. Additionally, the move away from oil-dependent pneumatic systems reduces lubricant waste on job sites.

What are the key differences between cleat nailers and flooring staplers?

Cleat nailers use specialized fasteners (cleats) designed specifically for solid wood, offering exceptional grip and preventing movement. Flooring staplers use staples and are generally preferred for installing engineered wood, subflooring, or thinner materials where faster installation speed and a broader surface contact area are advantageous.

Which geographical region is expected to demonstrate the highest growth in the flooring nail gun market?

The Asia Pacific (APAC) region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR), driven by massive investment in residential infrastructure, rapid urbanization, and the modernization of construction practices across key developing economies such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager