Flow Cytometer Reagents Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441146 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Flow Cytometer Reagents Market Size

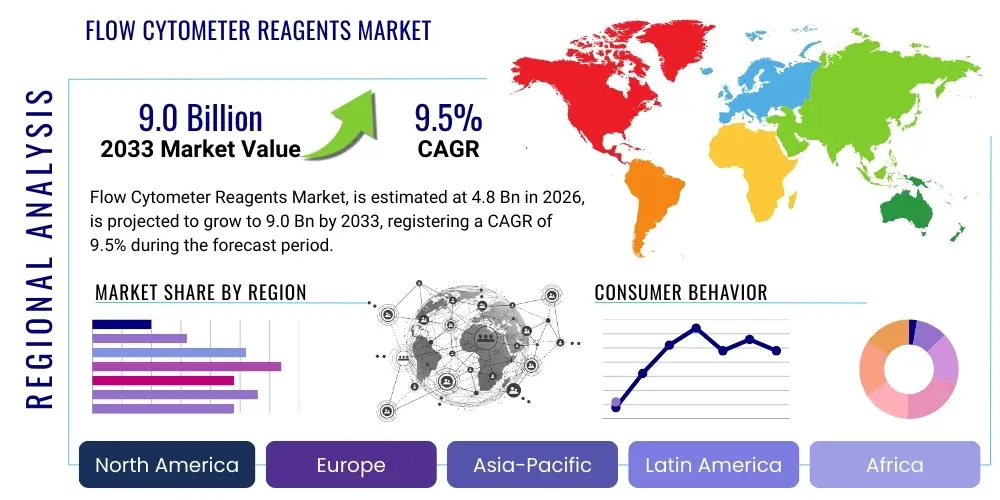

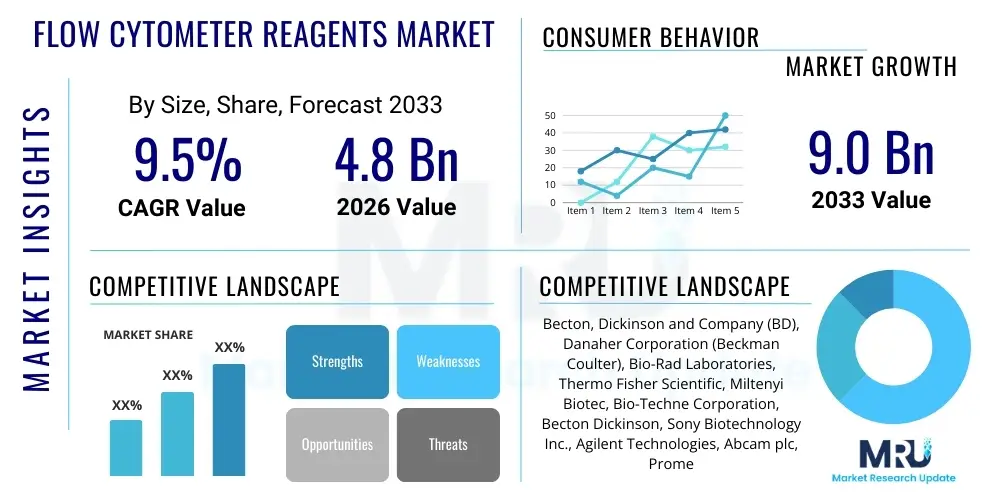

The Flow Cytometer Reagents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Flow Cytometer Reagents Market introduction

The Flow Cytometer Reagents Market encompasses specialized chemical compounds and biological materials essential for performing flow cytometry experiments. Flow cytometry is a powerful laser- or impedance-based technology used to rapidly analyze physical and chemical characteristics of particles, primarily cells, in a fluid suspension. Reagents, which include monoclonal antibodies conjugated with fluorochromes, specific dyes, stains, fixation buffers, and permeabilization solutions, are critical components that enable the identification, quantification, and sorting of cellular populations based on surface and intracellular markers. The increasing adoption of flow cytometry in complex biological research and clinical diagnostics drives the demand for highly specific and diverse reagent panels.

Major applications for these reagents span across immunology, hematology, oncology, drug discovery, and microbial analysis. In the research domain, flow cytometer reagents facilitate deep dives into cellular signaling pathways, apoptosis studies, and characterization of novel cell lines. Clinically, they are indispensable for diagnosing blood cancers, monitoring HIV progression (CD4/CD8 counts), and cross-matching tissues for transplantation. The inherent benefits of these reagents lie in their ability to provide multi-parametric analysis at a single-cell level with high throughput, ensuring precision and reliability in complex biological measurements.

The primary driving factors for market expansion include escalating investment in personalized medicine and companion diagnostics, rapid technological advancements leading to the introduction of multi-color flow cytometers requiring larger and more complex reagent panels, and the rising prevalence of chronic diseases, particularly cancer and autoimmune disorders, necessitating precise cellular analysis for effective treatment monitoring. Furthermore, increasing funding for life science research and governmental initiatives supporting cell therapy development globally significantly boost reagent consumption.

Flow Cytometer Reagents Market Executive Summary

The Flow Cytometer Reagents Market is experiencing robust growth fueled by continuous innovation in fluorochrome technology and multiplexing capabilities. Business trends indicate a strong focus on developing ready-to-use reagent kits and standardized assay panels, streamlining laboratory workflows and reducing experimental variability. Key market players are prioritizing strategic acquisitions and collaborations with academic research institutions to expand their product portfolios, particularly targeting highly demanded areas like immunotherapy and stem cell research. There is a noticeable shift towards customized reagent solutions tailored for specific research protocols, enhancing market niche specialization and profitability. Supply chain efficiency and regulatory compliance concerning clinical-grade reagents remain central challenges and competitive differentiators.

Regionally, North America maintains the dominant market share, primarily due to the presence of leading pharmaceutical companies, extensive R&D infrastructure, and favorable reimbursement policies for advanced diagnostics. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by significant government investment in healthcare modernization, expanding clinical trial activities in countries like China and India, and the increasing adoption of advanced diagnostic technologies in emerging economies. Europe holds a substantial market position, supported by strong academic research funding and early adoption of novel flow cytometry techniques in clinical settings, particularly in countries like Germany and the UK.

Segment trends reveal that the consumption of antibodies is the largest segment by product, driven by the need for highly specific detection markers in complex biological samples. Within applications, the research segment holds the majority share, attributable to the constant demand for cellular analysis in basic science and preclinical drug development. However, the clinical diagnostics segment is anticipated to exhibit accelerated growth due to the integration of flow cytometry in standard clinical laboratory practices for disease monitoring and diagnosis. End-user analysis highlights academic and research institutes as primary revenue generators, while pharmaceutical and biotechnology companies show increasing demand due to the intensive use of flow cytometry in drug screening and quality control for cell therapies.

AI Impact Analysis on Flow Cytometer Reagents Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Flow Cytometer Reagents Market predominantly revolve around how AI can enhance data interpretation, optimize reagent panel design, and improve diagnostic accuracy, thereby driving efficiency and potentially standardizing the use of complex reagent combinations. Users are keen to understand if AI-driven analysis tools can mitigate the inherent complexity and subjectivity often associated with manual gating and data analysis in multi-color flow cytometry experiments, which directly influences reagent selection and validation. There are specific expectations regarding AI’s role in predicting optimal fluorochrome combinations (to minimize compensation issues) and identifying novel cellular subpopulations based on subtle marker expression patterns that current manual methods might overlook. Concerns often center on data privacy, the validation process for AI-driven diagnostic insights, and the potential need for highly standardized reagents suitable for automated interpretation pipelines.

The introduction of AI is fundamentally transforming the consumption and application of flow cytometer reagents by demanding higher quality, consistency, and specificity from manufacturers. AI algorithms excel at handling the massive, high-dimensional datasets generated by modern 18-color or 30-color panels, allowing researchers to utilize much larger and more complex arrays of reagents than previously feasible. This capability increases the demand for comprehensive reagent kits designed for high-parameter cytometry, thereby favoring vendors who offer extensive, validated fluorochrome libraries. Moreover, AI aids in the standardization of laboratory protocols globally, ensuring that reagent performance across different labs is consistent, which is paramount for generating reliable input data for machine learning models. This optimization reduces the requirement for extensive, costly manual optimization runs, subtly shifting demand towards pre-optimized, standardized reagent cocktails.

Furthermore, AI is instrumental in accelerating the identification and validation of novel biomarkers. By analyzing large cohorts of patient or experimental data, AI can pinpoint unique cellular profiles requiring new, specialized antibodies and reagents. This predictive capability shortens the time-to-market for novel diagnostic and research reagents, driving innovation in areas like minimal residual disease (MRD) monitoring in oncology and advanced immunophenotyping. The integration of AI tools with flow cytometry platforms necessitates that reagent manufacturers provide comprehensive metadata and quality control certifications, ensuring seamless integration into automated workflows, thereby setting new benchmarks for product quality and data transparency within the market.

- AI-driven optimization of multi-color panel design reduces compensation errors, accelerating complex reagent adoption.

- Automated gating and cellular population identification increase the utility of high-dimensional reagent data.

- Predictive modeling shortens the development cycle for novel biomarker-targeting reagents.

- Enhances standardization of sample preparation and reagent usage protocols across clinical trials and research.

- Enables personalized medicine by improving diagnostic accuracy using complex, large reagent panels.

- Drives demand for high-quality, validated, and digitally traceable reagent lots compatible with automated systems.

DRO & Impact Forces Of Flow Cytometer Reagents Market

The growth trajectory of the Flow Cytometer Reagents Market is significantly influenced by a confluence of accelerating drivers, persistent restraints, and emerging opportunities, collectively shaped by complex impact forces within the life sciences ecosystem. Key drivers include the exponential rise in global cancer prevalence necessitating precise cellular profiling, the surging investment in biopharmaceutical R&D focused on cell and gene therapies, and continuous technological refinements in flow cytometers that support higher-parameter analysis (e.g., spectral cytometry). These factors create sustained demand for specialized, high-affinity antibodies and diverse fluorochromes. Conversely, restraining factors such as the high initial cost associated with sophisticated flow cytometry instruments, leading to restricted adoption in lower-resource settings, and the complexities inherent in multi-color panel development, demanding highly skilled technical expertise, temper market expansion. Opportunities arise from the untapped potential in emerging markets, the shift towards adopting disposable and microfluidic flow cytometry systems, and the development of point-of-care diagnostics utilizing simplified reagent kits. These dynamics are amplified by impact forces originating from stringent regulatory frameworks governing clinical reagents and the constant pressure for cost reduction in healthcare systems globally.

The impact forces manifest primarily through regulatory scrutiny and technological obsolescence. Regulatory bodies, especially the FDA and EMA, are increasing their oversight on clinical-grade reagents used in diagnostic settings, demanding extensive validation and standardization, which increases R&D costs for manufacturers but ensures product reliability. Simultaneously, the rapid evolution of technology, such as the transition from conventional to spectral flow cytometry, necessitates continuous adaptation of existing reagent portfolios and investment in new fluorochrome chemistries to remain competitive. Furthermore, the growing trend toward decentralized testing and the push for automation in clinical laboratories compels manufacturers to design reagents that are stable, easy to use, and integrable into automated platforms. These external pressures mandate continuous quality improvement and strategic patent filing to protect proprietary dye and labeling technologies.

In terms of specific market dynamics, the high specificity required in applications such as minimal residual disease (MRD) monitoring provides a significant growth opportunity, driving the market towards highly sensitive and validated ready-to-use reagent panels. However, the lack of universal standardization across different instrument platforms and reagent manufacturers continues to pose a restraint, creating compatibility challenges for end-users and often leading to vendor lock-in. Overcoming these challenges, potentially through global consortia or open-source validation standards, represents a major market opportunity. The increasing focus on companion diagnostics also solidifies the market, as specific reagent panels become mandatory for identifying patient eligibility for targeted therapies, thereby ensuring long-term revenue streams tied to successful pharmaceutical product launches. Thus, strategic positioning focusing on validated, high-parameter reagent solutions is critical for market leadership.

Segmentation Analysis

The Flow Cytometer Reagents Market segmentation provides a detailed map of the diverse product offerings and their utilization across various biological and clinical domains. Segmentation by Product Type reveals the market's heavy reliance on monoclonal and polyclonal antibodies, followed by dyes, stains, buffers, and specialized kits, each serving distinct functional roles in cell analysis. The Application segmentation highlights the dominance of research-related activities, although clinical diagnostics are rapidly gaining prominence due to expanding disease screening programs. Further analysis based on End-User clearly shows the academic and governmental research sectors as foundational revenue sources, closely followed by the high-value commercial segments comprising pharmaceutical and biotechnology companies.

- By Product Type:

- Antibodies (Monoclonal Antibodies, Polyclonal Antibodies)

- Dyes and Stains (Fluorescent Dyes, Tandem Dyes, Viability Dyes)

- Kits and Assays (Apoptosis Kits, Cell Cycle Kits, Intracellular Staining Kits)

- Buffers and Solutions (Fixation Buffers, Permeabilization Buffers, Sheath Fluids)

- By Application:

- Research Applications (Immunology, Cell Signaling, Genomics, Proteomics)

- Clinical Diagnostics (Hematology, Oncology, HIV/AIDS Monitoring, Organ Transplantation)

- Drug Discovery and Development (Target Validation, High-Throughput Screening, Toxicity Testing)

- By End-User:

- Academic and Research Institutes

- Hospitals and Clinical Testing Laboratories

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

Value Chain Analysis For Flow Cytometer Reagents Market

The value chain for the Flow Cytometer Reagents Market begins with highly specialized upstream activities involving the synthesis and sourcing of proprietary fluorochromes, development of high-affinity antibodies through hybridoma or recombinant technologies, and manufacturing of essential biochemical components like buffers and fixatives. Key players often maintain strong intellectual property protections over their proprietary dye chemistries, ensuring control over the initial cost and quality. This stage demands rigorous quality control to ensure batch-to-batch consistency, which is crucial for high-parameter flow cytometry applications. Suppliers of raw materials include chemical synthesis firms, cell culture media manufacturers, and specialized biological material providers.

Midstream activities involve the complex process of conjugation—linking antibodies to fluorophores—followed by formulation, purification, and packaging into standardized kits or individual vials. This conjugation step requires highly sophisticated bioconjugation chemistries to maintain both antibody activity and fluorochrome stability. After manufacturing, reagents enter the distribution channel. Direct distribution channels are often employed for high-volume or highly sensitive products to major pharmaceutical clients and core academic labs, allowing vendors greater control over shipping conditions and immediate technical support. Indirect distribution utilizes regional distributors and specialized third-party logistics (3PL) providers, particularly in geographically diverse or emerging markets, broadening market reach but adding layers of complexity to temperature-controlled logistics.

Downstream analysis focuses on the end-user adoption in academic, clinical, and industrial settings. The technical support provided by manufacturers is a critical element in the downstream value chain, as flow cytometry experiments are often complex and require application-specific guidance regarding panel design, instrument setup, and data analysis. The consumption stage involves the integration of reagents into automated laboratory workflows and advanced diagnostic platforms. Efficiency and reliability at this final stage directly influence repeat purchase decisions. The market structure strongly favors vendors who can integrate robust manufacturing, controlled logistics, and comprehensive technical training into their overall offering, ensuring high customer satisfaction and minimized variability in results.

Flow Cytometer Reagents Market Potential Customers

The primary customers for flow cytometer reagents are diverse organizations deeply involved in cellular and molecular biology research, clinical diagnostics, and therapeutic development. Academic and governmental research institutes constitute a foundational customer base, utilizing reagents for basic scientific inquiry, disease modeling, and training future scientists. These organizations rely heavily on high-quality, research-grade antibodies and bulk orders of buffers and stains, often driven by grant funding cycles and specific research goals. Their needs are frequently focused on exploring novel targets and adopting new fluorochrome technologies to push the boundaries of cellular phenotyping.

Hospitals and clinical testing laboratories represent a crucial and rapidly growing segment, primarily focusing on clinical-grade, FDA- or CE-marked reagents for routine diagnostic applications such as leukemia/lymphoma immunophenotyping, monitoring of immune deficiencies (e.g., HIV), and cross-matching for transplantation. These customers prioritize regulatory compliance, reliability, standardized assay performance, and ready-to-use kits that minimize manual intervention and ensure rapid turnaround times essential for patient care. Their purchasing decisions are heavily influenced by ease of use and compatibility with established clinical instrumentation.

Pharmaceutical and biotechnology companies represent the highest-value customer segment, utilizing reagents extensively throughout the drug discovery and development pipeline. This includes high-throughput screening for drug candidates, toxicity testing, quality control for cell and gene therapy products (e.g., CAR T-cells), and biomarker identification during clinical trials. These companies often require custom panel development, bulk supply of proprietary antibodies, and highly characterized reagents meeting strict quality management system requirements (e.g., GMP standards). Contract Research Organizations (CROs) serving the biopharma sector also represent significant buyers, procuring reagents to support outsourced clinical trial sample processing and analysis across multiple therapeutic areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton, Dickinson and Company (BD), Danaher Corporation (Beckman Coulter), Bio-Rad Laboratories, Thermo Fisher Scientific, Miltenyi Biotec, Bio-Techne Corporation, Becton Dickinson, Sony Biotechnology Inc., Agilent Technologies, Abcam plc, Promega Corporation, Sartorius AG, Takara Bio Inc., F. Hoffmann-La Roche Ltd, Enzo Life Sciences, Merck KGaA, Sysmex Corporation, Luminex Corporation, BioLegend (now part of PerkinElmer), Cell Signaling Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flow Cytometer Reagents Market Key Technology Landscape

The technological landscape of the Flow Cytometer Reagents Market is characterized by rapid innovation centered on enhancing spectral resolution, increasing the number of detectable parameters, and improving fluorochrome brightness and stability. A major technological advancement driving reagent development is the widespread adoption of spectral flow cytometry. Unlike conventional flow cytometry, which uses filters to isolate specific fluorescence emission peaks, spectral flow cytometry utilizes multiple detectors to capture the entire emission spectrum of each fluorochrome. This necessitates the development of new reagent panels optimized for spectral unmixing, favoring ultra-bright, narrow-emission dyes and requiring minimal spectral overlap to achieve high resolution in complex panels (up to 40 colors). Vendors are heavily investing in synthesizing novel polymer and small-molecule fluorophores designed specifically to maximize signal separation in spectral systems, such as advanced fluorescent proteins and quantum dots, although the latter faces regulatory constraints in certain applications.

Another crucial technological focus is the development of oligonucleotide-conjugated antibodies for high-parameter single-cell analysis methods, such as mass cytometry (CyTOF) and DNA barcoding techniques. While CyTOF itself does not use fluorescent reagents, the associated sample preparation and cellular barcoding techniques often require metal-conjugated antibodies or DNA-based labels that function similarly to traditional flow cytometry reagents in terms of cellular targeting. The rising trend of multiplexing is also driving the development of advanced reagent kits that combine viability markers, cell cycle stains, and internal controls into integrated, standardized cocktails. These ready-to-use kits significantly reduce human error and preparation time, catering directly to the needs of busy clinical and high-throughput research laboratories seeking automation compatibility. This shift towards pre-titrated and pre-optimized solutions represents a technological pivot toward simplified complex analysis.

Furthermore, reagent technology is adapting to support emerging applications in cell and gene therapy (CGT) manufacturing quality control. This domain requires reagents manufactured under stringent Good Manufacturing Practice (GMP) conditions, demanding robust documentation, traceability, and sterility. Technological improvements in reagent manufacturing processes focus on achieving these high quality assurance standards, including transitioning from animal-derived components to recombinant sources for antibody production, ensuring maximal safety and consistency for therapeutic products. The convergence of flow cytometry with microfluidics and miniaturized instrumentation is also pushing the demand for highly concentrated, stable, and low-volume reagent formulations suitable for point-of-care or resource-limited settings. The constant competitive pressure forces manufacturers to continually launch reagents with improved photostability and brighter signals to maintain technological relevance.

Regional Highlights

- North America (NA): North America is the leading market globally for flow cytometer reagents, largely driven by the colossal concentration of major market players, advanced healthcare infrastructure, and exceptionally high spending on pharmaceutical and biotechnology R&D. The US specifically leads in adopting cutting-edge technologies like spectral flow cytometry and high-dimensional analysis, necessitating continuous demand for complex, high-parameter reagent panels. Favorable government funding for cancer research and immunology studies, coupled with robust regulatory frameworks that encourage the commercialization of clinical diagnostics, solidify the region's dominance. Furthermore, the strong presence of top-tier academic institutions and cancer research centers ensures a continuous pipeline of complex biological research requiring state-of-the-art reagents.

- Europe: The European market holds the second-largest share, characterized by high adoption rates in countries like Germany, the UK, and France. Growth is supported by substantial government investment in public health and life science research through programs such as Horizon Europe. The market benefits from established regulatory harmonization (EMA) that facilitates cross-border collaboration and product approval. Europe is a strong adopter of flow cytometry in both clinical hematology diagnostics and academic research, particularly focusing on autoimmune diseases and infectious disease monitoring. The mature market structure promotes competition, driving manufacturers to offer high-quality, cost-effective reagent solutions and pre-validated kits.

- Asia Pacific (APAC): APAC is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily fueled by improving healthcare access, increasing government focus on expanding biomedical research infrastructure (especially in China and India), and the growing prevalence of chronic diseases requiring advanced diagnostic tools. Increased foreign direct investment in the region’s pharmaceutical and biotech sectors, coupled with expanding clinical trial activities, significantly boosts the demand for high-volume reagents. Countries like Japan and South Korea are early adopters of advanced flow cytometry techniques, while emerging economies present large, untapped markets with growing budgetary allocations for medical technology procurement.

- Latin America (LATAM): The LATAM market is developing steadily, marked by increasing investments in medical infrastructure and a growing awareness of advanced diagnostic methodologies, particularly in Brazil and Mexico. Market penetration is often constrained by budget limitations and reliance on indirect distribution channels. However, efforts to standardize clinical laboratories and increasing collaboration with global research bodies are creating pockets of opportunity, particularly for cost-effective and standardized reagent solutions targeted towards infectious disease monitoring and basic research applications.

- Middle East and Africa (MEA): The MEA region is currently a smaller contributor but offers significant future potential, driven by heavy government spending on specialized medical cities (e.g., Saudi Arabia, UAE) and efforts to combat infectious diseases and rising cancer rates. Adoption is highly concentrated in specialized clinical centers and research institutions in oil-rich nations. Challenges include fragmented healthcare systems and high dependence on imported reagents. The focus is primarily on established clinical diagnostic panels, though research investment is slowly expanding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flow Cytometer Reagents Market.- Becton, Dickinson and Company (BD)

- Danaher Corporation (Beckman Coulter)

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Miltenyi Biotec

- Bio-Techne Corporation

- Sony Biotechnology Inc.

- Agilent Technologies

- Abcam plc

- Promega Corporation

- Sartorius AG

- Takara Bio Inc.

- F. Hoffmann-La Roche Ltd

- Enzo Life Sciences

- Merck KGaA

- Sysmex Corporation

- Luminex Corporation

- BioLegend (now part of PerkinElmer)

- Cell Signaling Technology

- eBioscience (Thermo Fisher Scientific)

Frequently Asked Questions

What are the primary factors driving the growth of the Flow Cytometer Reagents Market?

The market growth is primarily driven by the increasing global incidence of chronic diseases like cancer, requiring precise cellular diagnostics; rising investment in pharmaceutical research for cell and gene therapies; and continuous technological advancements enabling higher-parameter, multi-color flow cytometry analysis.

Which product segment holds the largest share in the Flow Cytometer Reagents Market?

The Antibodies segment holds the largest market share, specifically due to the high demand for monoclonal antibodies conjugated with fluorochromes, which are essential for specific and accurate identification and quantification of diverse cellular markers in both research and clinical settings.

How is spectral flow cytometry influencing reagent development?

Spectral flow cytometry requires reagents optimized for spectral unmixing, driving manufacturers to develop novel, ultra-bright, and spectrally distinct fluorochromes and dyes (e.g., polymer dyes) to maximize the number of simultaneously detectable cellular parameters, pushing the limits of current multi-color panel design.

What role does the clinical diagnostics application play in market expansion?

The clinical diagnostics application is expanding rapidly, fueled by the integration of flow cytometry into standard hospital protocols for disease monitoring, particularly in hematological malignancies and immune deficiency status, creating high, consistent demand for standardized, regulatory-compliant (IVD-grade) reagent kits.

Which geographical region is projected to experience the fastest growth in the market?

The Asia Pacific (APAC) region is projected to register the fastest growth, primarily attributed to increasing governmental funding for biomedical research, rapid healthcare infrastructure development, and growing adoption of advanced diagnostic technologies in major emerging economies like China and India.

The preceding analysis underscores the dynamic nature of the Flow Cytometer Reagents Market, characterized by fierce competition in technological innovation, particularly concerning fluorochrome chemistry and high-parameter panel design, driven by the escalating global demands for precise cellular analysis across oncology, immunology, and therapeutic development. Market participants must strategically focus on standardization, automation compatibility, and expansion into high-growth APAC clinical segments to secure sustained market leadership in the coming decade. The increasing integration of AI further solidifies the need for quality, standardized reagents, shifting competitive focus towards data integration and workflow optimization.

In response to the growing complexity of biological systems being studied, researchers are constantly demanding reagents that offer superior brightness-to-noise ratios and improved photostability. This demand directly impacts the research and development pipeline of reagent manufacturers, who are continually synthesizing next-generation dyes, such as specialized tandem dyes and novel proprietary polymer dyes, designed to overcome the limitations of traditional fluorophores in multi-laser systems. The ability to minimize spectral overlap through superior dye selection remains a critical differentiator in this highly technical sector.

The convergence of flow cytometry with molecular diagnostics, often involving techniques like RNA-based flow cytometry (RNA-Flow) or protein analysis alongside traditional immunophenotyping, necessitates the development of specialized lysis and permeabilization buffers and hybridization reagents that maintain cellular integrity while allowing access to intracellular targets. This intersection is particularly relevant in personalized medicine, where comprehensive molecular and cellular profiling is essential for targeted therapy selection and monitoring treatment efficacy at a single-cell level. The continued evolution of these supporting reagents is as critical as the antibody development itself.

Regulatory harmonization is increasingly influencing the market, particularly in Europe and North America, where clinical diagnostics require in-vitro diagnostic (IVD) status. This places a premium on vendors who can supply validated, batch-tested reagents with extensive documentation suitable for clinical environments. The shift towards GMP-grade manufacturing for reagents used in quality control of cell and gene therapy products further elevates the entry barrier and highlights the importance of quality assurance as a core competitive advantage, moving beyond simple research-use-only products.

The educational component remains vital to the market ecosystem. As reagent panels become more complex, end-users require substantial technical training in panel design, compensation settings, and data interpretation. Leading vendors often integrate comprehensive technical support, application specialists, and online educational resources as part of their product offering, recognizing that successful reagent adoption is highly correlated with user expertise. This service dimension adds significant value to the overall product package, especially for novel or high-parameter reagents.

The overall market trajectory indicates a strong, sustained growth trajectory, underpinned by fundamental scientific needs and accelerated by technological breakthroughs. While pricing pressure remains a restraint, the unique value proposition offered by highly specific, application-optimized reagent panels ensures premium pricing in specialized segments, such as oncology and advanced immunology, securing healthy profit margins for innovators. Strategic partnerships between instrument manufacturers and reagent suppliers will continue to shape the market landscape, offering integrated, validated, end-to-end solutions that simplify complex cellular analysis for global laboratories.

The geographical shifts are particularly noteworthy. While the established markets of North America and Europe provide stability and high volume, the APAC region's growth is exponential, representing a long-term strategic imperative for multinational corporations seeking market diversification. Success in APAC hinges on adapting pricing models, establishing robust local distribution networks, and offering products tailored to regional disease prevalence and resource limitations, such as simpler, highly stable reagent kits suitable for less advanced laboratory environments while still delivering reliable results.

Innovation in buffer and solution chemistry is often overlooked but critical for maintaining the viability and integrity of fragile cells, such as primary patient samples or immune cells used in clinical trials. Specialized fixation and permeabilization reagents that minimize antigen degradation and maintain optimal cell morphology are constantly being refined. This foundational segment, while low-margin, is essential for the functionality of the entire flow cytometry workflow and represents an indirect driver for the sales of high-value antibodies and fluorochromes.

The competitive environment is characterized by a blend of large, diversified life science conglomerates offering comprehensive instrument-reagent portfolios and specialized niche players focusing exclusively on novel fluorochrome chemistries or application-specific kits. Consolidation via mergers and acquisitions remains a persistent trend, as larger players seek to quickly absorb innovative technologies and specialized reagent lines, enhancing their ability to offer integrated, single-vendor solutions across the entire workflow, from sample preparation to final analysis. This M&A activity influences pricing strategies and market access globally.

Ultimately, the Flow Cytometer Reagents Market is a high-technology sector where precision, standardization, and continuous innovation are paramount. The sustained demand from critical research fields and the expanding requirements of clinical diagnostics ensure that investment in novel dyes, superior antibody conjugation techniques, and standardized, ready-to-use kits will continue to define market success and drive substantial financial returns throughout the forecast period.

Further analysis of the Restraints segment reveals that the lack of highly trained technical staff competent in performing complex multi-color flow cytometry experiments acts as a significant barrier, especially in emerging markets. Designing and validating a 15-color panel requires specialized knowledge in immunology, spectral properties, and instrument calibration. This constraint often forces smaller labs to rely on simpler, less informative panels, thereby limiting the consumption of high-end, specialized reagents. Manufacturers attempt to mitigate this by developing software-driven panel builders and offering extensive training courses, but the skill gap persists globally.

Another profound technological challenge impacting reagent use is the compensation issue inherent in conventional flow cytometry, where spectral overlap between different fluorochromes necessitates complex mathematical adjustments. While spectral cytometry partially addresses this, the reliance on high-quality, single-stained controls remains absolute. This dictates that reagent manufacturers must not only supply the specific antibodies but also rigorously validated compensation beads and single-color controls, adding complexity and cost to the overall reagent purchase process for the end-user. Ensuring the stability and consistency of these control materials is a major quality control focus.

In terms of regional opportunities, beyond the major economies of APAC, untapped potential lies within certain regions of Eastern Europe and specific countries in LATAM where major public health initiatives are being launched. These initiatives, often targeting infectious diseases, tuberculosis, or large-scale vaccination programs, necessitate robust immune monitoring capabilities, creating a focused but substantial demand for standardized, clinical-grade T-cell and B-cell phenotyping reagents. Successfully accessing these governmental procurement channels requires strict adherence to international quality standards and competitive volume pricing.

The push for personalized medicine further elevates the demand for ultra-sensitive reagents capable of detecting minimal residual disease (MRD) in cancer patients post-treatment. MRD detection requires extremely low limits of detection (e.g., 1 cell in 10,000 to 1,000,000), necessitating not just brighter fluorochromes but also specialized lysis and wash buffers that preserve rare cells. The reagents utilized in these high-stakes clinical applications command premium pricing and demand the highest levels of validation and batch control, representing a high-value niche within the clinical segment.

Furthermore, the competitive landscape is shifting due to the rise of specialized Contract Manufacturing Organizations (CMOs) that focus solely on the production of custom antibodies and fluorochrome conjugates for both research and IVD companies. This outsourcing trend allows smaller innovators to rapidly scale up production without massive capital expenditure, democratizing access to high-quality reagent manufacturing capabilities. However, it also introduces complexity in supply chain management and intellectual property protection, which manufacturers must carefully navigate.

The increasing focus on cell viability and functionality assays, especially in the context of cell therapy development and high-throughput screening, has created a robust sub-segment for viability dyes, membrane potential probes, and functional indicators (e.g., calcium flux dyes). These reagents enable researchers and quality control teams to assess not just the presence but the health and activity of cells, moving flow cytometry beyond mere counting and phenotyping. Innovation in this area centers on developing dyes that are minimally cytotoxic and compatible with live-cell sorting protocols.

Finally, the long-term impact of regulatory efforts like the European Union's In Vitro Diagnostic Regulation (IVDR) is creating a seismic shift in how clinical-grade reagents are developed and marketed in Europe. IVDR demands far more rigorous clinical evidence, traceability, and post-market surveillance for diagnostic reagents than previous regulations. This regulatory pressure forces manufacturers to either upgrade their existing IVD portfolios significantly or phase out products that do not meet the new, elevated standards, indirectly favoring larger players with the financial resources to navigate these compliance hurdles, thereby potentially consolidating market share.

This dynamic market environment confirms that sustained innovation in fluorochrome technology, adaptation to regulatory shifts, and strategic positioning in fast-growing application areas, particularly clinical diagnostics and CGT quality control, are essential strategic imperatives for all major stakeholders in the Flow Cytometer Reagents Market. The focus on high-parameter, standardized, and automation-compatible reagents will dictate competitive success over the next decade.

The segment of Kits and Assays is projected to witness one of the highest growth rates, driven by the convenience and reliability they offer to laboratories seeking validated, standardized results. These kits typically include pre-titrated antibodies, necessary buffers, and detailed protocols for specific applications such as phospho-protein analysis, cellular proliferation tracking, and intracellular cytokine staining. The increasing preference for turnkey solutions, which minimize the need for individual component sourcing and validation, particularly in clinical settings where standardization is critical, significantly boosts this segment's revenue performance globally.

Furthermore, the role of sheath fluids and specialized buffers, though often considered commodity items, is technically crucial. Sheath fluid quality directly impacts the stability of the hydrodynamic focusing within the flow cytometer, influencing signal precision and data quality. Market players are investing in high-purity, standardized sheath fluid formulations and specialized detergents/surfactants to improve cell handling and reduce background noise, indirectly enhancing the effective performance of the high-value antibody reagents themselves. These ancillary products form an essential, non-negotiable part of the overall market expenditure.

The geographical analysis of North America should also account for the significant market influence exerted by the National Institutes of Health (NIH) and various governmental health agencies. NIH funding priorities often dictate the trajectory of basic and translational research, leading to peaks in demand for specific types of reagents aligned with funded research grants, such as those related to neuro-immunology or specific infectious disease outbreaks. Manufacturers must track these funding patterns closely to align their product development and inventory management strategies, ensuring that specialized reagents are readily available when research surges occur.

In Europe, the emphasis on quality and public health outcomes often leads to widespread adoption of quality control initiatives, such as the implementation of external quality assessment (EQA) schemes for flow cytometry testing. These schemes necessitate that clinical labs utilize highly consistent and certified reagents, promoting the use of centralized procurement and standardized multi-site validation studies. This structured approach to quality assurance drives long-term revenue stability for vendors who can demonstrate consistent batch-to-batch product performance and provide comprehensive technical documentation.

The rapidly expanding footprint of Contract Research Organizations (CROs) is changing the consumption profile within the End-User segment. CROs manage large, often multinational clinical trials requiring massive throughput and highly standardized data generation across multiple sites. They typically purchase reagents in bulk and demand vendor agreements that ensure global logistical support and rapid replenishment, focusing heavily on reagents that are pre-validated for specific clinical trial protocols and compatible with harmonized instrument platforms, thus accelerating the volume of high-quality reagent sales worldwide.

In summary, the Flow Cytometer Reagents Market is highly responsive to both technological push (new fluorochromes, spectral capabilities) and market pull (personalized medicine, CGT quality control). Success in this market demands a multi-faceted approach encompassing high-quality manufacturing, strategic distribution, regulatory agility, and strong customer technical support, ensuring that the specialized reagents effectively meet the increasingly demanding requirements of modern cellular analysis across all critical end-user sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager