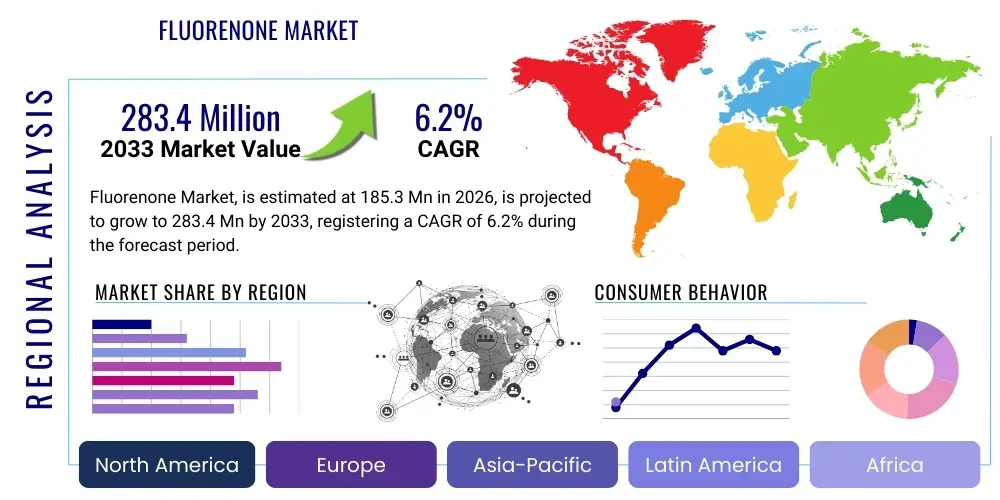

Fluorenone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443641 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Fluorenone Market Size

The Fluorenone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 145.2 Million in 2026 and is projected to reach USD 235.9 Million by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing application of Fluorenone derivatives in high-performance polymers, specialized pharmaceutical intermediates, and advanced photochemistry applications across diverse industrial sectors. The shift towards solvent-free and high-purity synthesis methods also contributes significantly to market valuation growth, especially in technologically advanced economies where regulatory standards demand superior product quality.

Fluorenone Market introduction

Fluorenone, an important chemical intermediate, is derived from fluorene and is characterized by its distinct ketone functionality and rigid tricyclic structure, making it highly valuable in advanced organic synthesis. This compound serves as a foundational building block for synthesizing specialized pharmaceutical compounds, particularly in oncology and antivirals, due to the unique reactivity and stability afforded by its molecular structure. Furthermore, Fluorenone is integral to the production of high-performance polymers, including polyimides and polyetherketones, which are essential components in the aerospace, automotive, and electronics industries where high thermal stability and mechanical strength are paramount. The market is defined by rigorous quality control standards and proprietary synthesis techniques aimed at achieving ultra-high purity levels necessary for sensitive applications such as photoinitiators and organic semiconductors.

Major applications of Fluorenone span across several critical industrial segments. In the chemical industry, it is widely utilized as a precursor for synthesizing various dyes, pigments, and agrochemicals, optimizing product effectiveness and environmental profiles. Its role as a photosensitizer and photoinitiator is also expanding rapidly, especially in the development of UV-curable coatings and inks used in 3D printing and advanced microelectronics fabrication, thereby capitalizing on the growing demand for rapid curing processes and precise material deposition. The market benefits significantly from ongoing research and development focused on novel Fluorenone-based conductive materials and energy storage solutions, positioning it as a key enabling chemical for future technological advancements.

Key driving factors supporting the sustained growth of the Fluorenone market include the accelerating pace of innovation in specialized polymer chemistry and the increasing global regulatory push for high-purity pharmaceutical excipients and Active Pharmaceutical Ingredients (APIs). The intrinsic benefits of Fluorenone, such as its excellent thermal and chemical resistance, coupled with its reliable synthetic pathways, ensure its preferred status over alternative intermediates in demanding applications. Geographical expansion of manufacturing facilities, particularly in Asia Pacific economies, and strategic collaborations between major chemical manufacturers and end-users further solidify the market trajectory, addressing global supply chain complexities and facilitating access to emerging industrial clusters.

Fluorenone Market Executive Summary

The Fluorenone market is currently characterized by robust business trends driven by high-value applications in pharmaceutical synthesis and specialized material engineering. A primary trend involves the adoption of continuous flow chemistry techniques for Fluorenone production, moving away from traditional batch processes, which enhances efficiency, purity, and safety, consequently lowering operational costs and improving scalability for bulk industrial requirements. Furthermore, sustainability initiatives are prompting manufacturers to explore bio-based feedstocks for Fluorenone synthesis, aligning with global green chemistry principles and offering a competitive advantage in environmentally conscious markets. Strategic capacity expansions and mergers and acquisitions aimed at consolidating raw material supply chains and penetrating niche application segments are shaping the competitive landscape, emphasizing innovation in product delivery and technical support.

Regional trends indicate that Asia Pacific remains the dominant and fastest-growing region, powered by expansive manufacturing bases in China, India, and South Korea, which cater to burgeoning electronics, automotive, and bulk chemical demands. North America and Europe, characterized by stringent regulatory environments, focus heavily on premium, high-purity Fluorenone grades predominantly utilized in advanced pharmaceutical research and specialized aerospace polymer fabrication. Growth in emerging markets like Latin America and the Middle East is accelerating, albeit from a lower base, fueled by increasing foreign direct investment into chemical manufacturing infrastructure and the localized development of plastics and coatings industries, thereby creating new avenues for Fluorenone consumption.

Segment trends highlight the dominance of the Pharmaceutical Grade segment, commanding the highest revenue share due to the indispensable role of Fluorenone derivatives in proprietary drug synthesis, where purity specifications are exceptionally high. The Polymer and Photoinitiator segment is projected to exhibit the fastest growth rate, propelled by the surge in demand for UV-cured materials essential for advanced packaging, rapid prototyping (3D printing), and microelectronic component manufacturing, leveraging Fluorenone's efficient photosensitivity. Within the application matrix, specialized monomers derived from Fluorenone for high-temperature resistant polyimides are seeing exponential demand, driven by technological advancements in electric vehicle batteries and high-speed computing infrastructure requiring superior insulating and dielectric properties.

AI Impact Analysis on Fluorenone Market

User queries regarding AI's impact on the Fluorenone market predominantly center on how artificial intelligence can optimize complex synthesis pathways, improve quality control and purity assessment, and accelerate the discovery of novel Fluorenone derivatives for pharmaceutical applications. Key themes identified include the potential for AI-driven materials informatics to predict the performance characteristics of new Fluorenone-based polymers, the implementation of machine learning (ML) models for predictive maintenance in manufacturing facilities, and the automation of spectroscopic analysis to ensure ultra-high purity levels required by the drug industry. Concerns often revolve around the high initial investment required for integrating sophisticated AI platforms and the necessity for specialized data scientists and chemists capable of training and managing these complex models within traditional chemical production environments. Expectations are high regarding significant cost reduction and faster time-to-market for new Fluorenone applications through automated research and development processes.

The integration of AI into Fluorenone production processes promises a paradigm shift in manufacturing efficiency and product innovation. Machine learning algorithms are being employed to model and optimize reaction parameters, such as temperature, pressure, and catalyst concentration, drastically reducing the experimental cycles required to achieve optimal yield and purity in Fluorenone synthesis, which traditionally involves complex separation steps. Furthermore, AI-powered image recognition systems and automated microscopy are enhancing real-time quality assurance, particularly crucial for detecting minute impurities or structural defects in polymer formulations containing Fluorenone intermediates, thereby reducing batch failures and ensuring compliance with stringent industrial standards. This intelligent automation moves manufacturing closer to 'lights-out' operation in critical synthesis stages.

Beyond manufacturing, AI is revolutionizing the discovery phase for new Fluorenone-based materials. Generative AI models are capable of proposing novel molecular structures derived from Fluorenone that exhibit desired physical, electronic, or biological properties, significantly accelerating the pipeline for new drug candidates and advanced polymer development. By analyzing vast databases of chemical reaction data and material properties, these models can prioritize synthesis targets with the highest probability of success, minimizing costly and time-consuming laboratory work. This enhanced predictive capability not only solidifies Fluorenone's relevance as a chemical scaffold but also unlocks new, previously unexplored application spaces, driving long-term market valuation growth by fostering intellectual property development.

- AI-driven optimization of Fluorenone synthesis reaction kinetics and thermodynamic parameters for enhanced yield and reduced energy consumption.

- Machine Learning models for predicting the stability and performance characteristics of novel Fluorenone-derived polymers and photoinitiators.

- Automated spectroscopic data analysis (e.g., NMR, HPLC) using deep learning for real-time, high-precision purity verification in pharmaceutical grade production.

- Utilization of generative AI for the virtual screening and design of new Fluorenone-based APIs (Active Pharmaceutical Ingredients) targeting specific biological pathways.

- Implementation of predictive maintenance protocols in Fluorenone production plants using sensor data processed by AI to minimize operational downtime.

- Supply chain risk assessment and optimization for Fluorenone raw material sourcing using advanced forecasting algorithms.

DRO & Impact Forces Of Fluorenone Market

The Fluorenone market is fundamentally shaped by the synergistic interplay of significant driving factors (D), stringent restraining elements (R), and compelling growth opportunities (O), creating a complex matrix of impact forces. The primary drivers revolve around the accelerated growth in pharmaceutical R&D, specifically in areas requiring highly pure synthetic intermediates like Fluorenone, coupled with the global surge in demand for advanced materials used in high-tech sectors such as aerospace and microelectronics. Restraints include the inherent high cost and complexity associated with the specialized synthesis and purification of high-grade Fluorenone, often involving environmentally challenging intermediate processes, alongside the volatile pricing and supply chain unpredictability of key precursors like fluorene. However, significant opportunities exist in developing sustainable, green chemistry synthesis routes and expanding applications into emerging areas such as flow batteries and advanced display technologies, which require the unique electrochemical properties of Fluorenone derivatives. The combination of these factors dictates market momentum, often forcing manufacturers to invest heavily in process innovation to overcome cost barriers while leveraging application diversity.

The core Impact Forces affecting the market are centered around technological innovation and regulatory pressures. The high impact force of 'Technological Advancements in Material Science' pushes the market forward, as new Fluorenone-based polymers consistently offer superior performance over conventional materials, ensuring continuous demand replacement cycles. Conversely, the ‘Regulatory Scrutiny on Chemical Manufacturing’ poses a high restraining force, particularly concerning occupational safety, wastewater management, and solvent use, compelling manufacturers to adopt capital-intensive compliant technologies. The bargaining power of buyers is moderate to high, especially large pharmaceutical and polymer corporations that demand high volumes under strict long-term contracts, putting downward pressure on prices for standard grades. The threat of substitutes remains a continuous, moderate force, primarily from structurally similar aromatic ketones or alternative polymer precursors, although Fluorenone's unique combination of properties often makes substitution difficult in high-performance niche applications, protecting premium segment pricing.

Consequently, the strategic success in the Fluorenone market hinges on achieving cost leadership through process intensification and securing reliable, long-term supply agreements for raw materials. Companies that successfully navigate the complex regulatory environment by implementing advanced effluent treatment and reducing their carbon footprint through green synthesis will gain a significant competitive edge, especially in European and North American markets. The long-term trajectory is overwhelmingly positive, driven by irreplaceable functional roles in advanced technological ecosystems, ensuring that while short-term volatility related to raw material pricing may persist, the fundamental demand base remains strong across high-growth end-user industries, justifying continued investment in capacity expansion and product diversification efforts.

Segmentation Analysis

The Fluorenone market segmentation provides critical insights into the diverse applications and purity requirements that define demand dynamics across various industries. The market is primarily segmented based on Grade Type, which fundamentally reflects the required purity level (e.g., Pharmaceutical Grade, Industrial Grade, Reagent Grade), correlating directly to end-user sensitivity and regulatory compliance. Further segmentation is analyzed by Application, identifying key consumption areas such as Polymer Synthesis (including polyimides and polyetherketones), Pharmaceutical Intermediates (APIs and precursors), Photoinitiators and Dyes, and other specialized chemical uses. Geographical segmentation highlights regional consumption patterns, manufacturing hubs, and prevailing regulatory frameworks, essential for market entry strategies and supply chain optimization, reflecting the mature demand in Western economies and rapid expansion in Asia Pacific's manufacturing sector.

Understanding these segments is vital for stakeholders, as pricing power and growth rates vary significantly depending on the segment purity and specific end-use. For instance, the Pharmaceutical Grade segment, though smaller in volume, commands a substantial premium due to the rigorous quality assurance protocols and intellectual property protection surrounding drug intermediates. Conversely, the Industrial Grade segment, utilized primarily in bulk polymer manufacturing and general chemical synthesis, operates on higher volume and narrower margins, necessitating efficient, large-scale production techniques. The ongoing technological advancements related to Fluorenone, such as the development of specialized conductive polymers, are simultaneously creating new sub-segments within the Application category, particularly in advanced materials and clean energy technologies, underscoring the market's dynamic nature and potential for targeted product development initiatives.

- By Grade Type:

- Pharmaceutical Grade Fluorenone

- Industrial Grade Fluorenone

- Reagent Grade Fluorenone

- High-Purity Electronic Grade Fluorenone

- By Application:

- Polymer Synthesis (Polyimides, Polyetherketones, Polycarbonates)

- Pharmaceutical Intermediates and Active Pharmaceutical Ingredients (APIs)

- Photoinitiators and Photosensitizers (UV Curing, 3D Printing)

- Dyes and Pigments Production

- Specialty Chemicals and Research

- Advanced Materials (Conductive Polymers, Organic Semiconductors)

- By End-User Industry:

- Pharmaceutical and Biotechnology

- Electronics and Semiconductor

- Automotive and Aerospace

- Paints, Coatings, and Inks

- Chemical Manufacturing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Fluorenone Market

The Value Chain for the Fluorenone market begins with the upstream segment involving the sourcing and refining of raw materials, primarily Fluorene, which is a component extracted from coal tar distillation or petroleum cracking processes. This stage is critical, as the purity and consistent supply of Fluorene directly influence the final product quality and manufacturing cost of Fluorenone. Upstream providers face technological challenges related to efficient separation and purification techniques to deliver the required precursor material, often operating within highly specialized chemical processing facilities. The midstream manufacturing process involves the critical oxidation of Fluorene to Fluorenone, necessitating controlled reaction conditions and specialized catalysis, followed by intensive purification steps, such as recrystallization or chromatographic separation, particularly for pharmaceutical and electronic grades. This manufacturing step is capital-intensive and subject to rigorous environmental compliance checks, forming the highest value-addition stage in the chain.

The downstream segment encompasses the conversion of bulk Fluorenone into specialized derivatives, monomers, and final formulations by secondary processors or directly incorporated into end-user products. For example, in the pharmaceutical sector, Fluorenone serves as a key intermediate for synthesizing complex drug molecules; in the polymer sector, it is converted into specialized monomers before polymerization. This downstream customization requires deep technical expertise and often involves proprietary synthesis routes protected by intellectual property, driving higher margins for specialized derivative manufacturers. The downstream market is characterized by a fragmented user base demanding tailored specifications, contrasting with the concentrated upstream supply of high-purity Fluorene.

Distribution channels for Fluorenone are bifurcated into direct and indirect routes. Direct distribution typically involves long-term contracts between large Fluorenone manufacturers and major pharmaceutical or polymer producers, ensuring just-in-time delivery of high-volume, standardized grades, often accompanied by extensive technical support and quality certifications. Indirect distribution relies on global and regional chemical distributors and specialized traders, who manage inventory, handle smaller orders, and provide logistical services to fragmented or geographically dispersed end-users, particularly for reagent grade and smaller volume industrial clients. The choice of channel is heavily influenced by the grade purity required, the volume, and the geographic distance, with direct sales dominating the high-purity, high-volume segments due to stricter quality control requirements and the necessity of direct quality audits.

Fluorenone Market Potential Customers

The primary potential customers and end-users of Fluorenone are major integrated pharmaceutical companies, specialized polymer manufacturers, and high-tech electronics producers globally. Pharmaceutical companies constitute a critical customer segment, utilizing Fluorenone as a key synthetic building block for novel therapeutic agents, including candidates for cancer treatment, antivirals, and central nervous system disorders, valuing extremely high purity and consistent supply necessary for regulatory approval processes. Polymer manufacturers, particularly those focusing on engineering plastics for demanding applications, form another crucial customer base. These companies purchase Fluorenone to produce polyimide monomers and specific high-performance polyetherketones, which are vital for components used in aerospace structural materials, high-temperature industrial insulation, and advanced automotive parts requiring lightweight, superior thermal stability.

Additionally, the electronics and semiconductor industry represents a rapidly expanding customer segment, particularly through the demand for Photoinitiator and Photosensitizer grade Fluorenone. These materials are essential for UV-curing processes used in manufacturing printed circuit boards (PCBs), encapsulants, and photoresists used in lithography for semiconductor fabrication, where high reaction efficiency and minimal residue are mandatory. Specialty chemical houses and research laboratories also serve as essential, albeit smaller-volume, customers, procuring Fluorenone for academic research, developing novel dyes, and creating specialized chemical reagents. The buying decision across all segments is highly influenced by certification documentation (e.g., ISO, GMP compliance), consistency in batch quality, and the supplier's capacity to handle complex logistics and regulatory paperwork associated with chemical intermediates.

The emerging potential customer base includes companies involved in next-generation energy storage solutions, specifically those developing advanced flow batteries and high-efficiency organic solar cells (OPVs). Fluorenone derivatives show promising electrochemical properties for use as electrolytes or active layer components in these energy devices. This segment places a premium on unique chemical structures and highly customized synthesis, positioning it as a high-growth area for suppliers capable of offering tailored solutions and engaging in collaborative research partnerships. Focusing sales efforts on these innovation-driven end-users requires sophisticated technical engagement and a strong patent portfolio related to material science applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.2 Million |

| Market Forecast in 2033 | USD 235.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TCI Chemicals, MilliporeSigma, Alfa Aesar, BASF SE, Tokyo Chemical Industry Co., Ltd. (TCI), Santa Cruz Biotechnology, Acros Organics, J&K Scientific, Loba Chemie Pvt. Ltd., Clearsynth, Fisher Scientific, Merck KGaA, Sinopharm Chemical Reagent Co., Ltd. (SCRC), Chemwill Asia Co., Ltd., Matrix Scientific, VWR International, Central Drug House (CDH), Aarti Industries Ltd., Haihang Industry Co., Ltd., Hangzhou Dayang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorenone Market Key Technology Landscape

The key technology landscape of the Fluorenone market is dominated by advancements in catalytic oxidation and high-efficiency separation techniques aimed at maximizing yield and product purity while minimizing environmental impact. Traditional synthesis methods often relied on strong oxidizers and harsh conditions, posing significant safety and waste management challenges. Modern industrial processes increasingly employ advanced catalytic systems, such as transition metal catalysts or enzymatic methods, to facilitate the selective oxidation of Fluorene to Fluorenone under milder, more environmentally benign conditions, leading to substantial reductions in energy consumption and byproduct formation. Furthermore, the adoption of continuous flow reactors is revolutionizing production, offering superior control over reaction kinetics, ensuring batch-to-batch consistency, and dramatically improving the intrinsic safety profile of large-scale chemical manufacturing, critical for high-volume Industrial Grade production.

In the purification sector, which dictates the premium pricing of Pharmaceutical and Electronic grades, sophisticated separation technologies are paramount. Technologies like Simulated Moving Bed (SMB) chromatography and supercritical fluid extraction (SFE) are being increasingly utilized to achieve ultra-high purity levels (typically >99.9%) required for sensitive applications where even trace impurities can affect performance or drug efficacy. These advanced separation techniques enable manufacturers to efficiently remove structurally similar byproducts and unreacted starting materials, a crucial step given the structural complexity of Fluorenone and its precursors. Ongoing research focuses on developing membrane-based separation technologies to provide energy-efficient alternatives to traditional distillation and crystallization processes, promising further cost reduction and scalability improvements across the midstream value chain.

The technological evolution also encompasses process analytical technology (PAT) and digitalization, driven by the demand for real-time quality control. Integration of advanced sensors, inline spectroscopic techniques (e.g., Raman and near-infrared spectroscopy), and centralized data analytics platforms allows for continuous monitoring of reaction parameters and immediate adjustments, thereby ensuring optimal process performance and regulatory adherence. This technological pivot toward intelligent manufacturing not only enhances product consistency but also facilitates the collection of comprehensive data required for AI-driven process optimization, cementing the foundational role of technology in maintaining competitive advantage in the high-purity Fluorenone market segment, especially against low-cost producers utilizing older, less efficient synthesis routes.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the Fluorenone market and is projected to exhibit the highest growth rate during the forecast period. This dominance is attributed to the presence of large-scale chemical manufacturing hubs, particularly in China and India, which serve as global supply centers for industrial-grade Fluorenone utilized in polymer synthesis and bulk chemical production. The region benefits from lower operational costs, relatively relaxed environmental regulations compared to Western counterparts (though regulation is rapidly tightening), and robust demand from burgeoning end-user industries like electronics, automotive, and construction. South Korea and Japan are key consumers of high-purity Fluorenone for advanced semiconductor and display technology applications, driving innovation in electronic-grade materials. The strategic focus on expanding local pharmaceutical manufacturing capabilities further solidifies APAC's position as the pivotal market for both production and consumption.

- North America: North America represents a mature, high-value market segment characterized by strong demand for Pharmaceutical Grade and high-performance polymer-grade Fluorenone. The United States is the primary consumer, driven by extensive R&D activities in the biotechnology and specialized chemical sectors. Regulatory stringent bodies like the FDA necessitate stringent quality control and high purity standards, leading manufacturers in this region to focus on specialized, high-margin products and custom synthesis services. The aerospace industry and advanced defense manufacturing sectors also contribute substantially, demanding Fluorenone derivatives for high-thermal stability polymer applications. Investment in new chemical infrastructure tends to focus on process efficiency and green chemistry initiatives rather than mass volume production.

- Europe: Europe holds a significant market share, driven by strong regulatory frameworks (e.g., REACH) emphasizing sustainability and safety, which encourages the adoption of advanced, cleaner synthesis technologies. Germany, France, and the UK are key markets, utilizing Fluorenone extensively in the production of specialized coatings, high-end automotive components, and pharmaceutical intermediates. The European market is a leader in applying Fluorenone derivatives in sustainable paints and UV-curable inks, responding to consumer preference for environmentally friendly and low-VOC products. The established chemical industrial base and continuous innovation in material science ensure sustained demand for high-quality, certified Fluorenone products, necessitating high compliance levels from all suppliers.

- Latin America (LATAM): The Latin American market is currently emerging but shows promising growth potential, primarily centered around Brazil and Mexico. Demand is largely driven by localized expansion of the automotive sector, construction chemicals, and agricultural chemical production. While manufacturing capacity is lower compared to APAC, increasing foreign investment and the establishment of local formulation facilities are expected to boost the consumption of industrial-grade Fluorenone. Market growth is heavily dependent on macroeconomic stability and infrastructure improvements in the regional chemical supply chain, aiming to reduce reliance on expensive imports for core chemical intermediates.

- Middle East and Africa (MEA): The MEA region is characterized by nascent but rapidly developing market structures, particularly in the GCC countries (UAE, Saudi Arabia) where large investments are being made in diversifying the industrial base away from oil and gas. Demand for Fluorenone is focused on the construction industry (specialty polymers and coatings) and the development of local pharmaceutical formulation capabilities. South Africa acts as a regional hub for chemical distribution. Future growth is strongly linked to government industrialization policies and the establishment of sophisticated manufacturing facilities that require advanced chemical inputs like Fluorenone derivatives for high-performance end products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorenone Market.- TCI Chemicals (Tokyo Chemical Industry Co., Ltd.)

- MilliporeSigma (Part of Merck KGaA)

- Alfa Aesar (Part of Thermo Fisher Scientific)

- BASF SE

- Santa Cruz Biotechnology

- Acros Organics

- J&K Scientific

- Loba Chemie Pvt. Ltd.

- Clearsynth

- Fisher Scientific International Inc.

- Merck KGaA

- Sinopharm Chemical Reagent Co., Ltd. (SCRC)

- Chemwill Asia Co., Ltd.

- Matrix Scientific

- VWR International (Part of Avantor)

- Central Drug House (CDH)

- Aarti Industries Ltd.

- Haihang Industry Co., Ltd.

- Hangzhou Dayang Chemical Co., Ltd.

- Nantong Chem-Base Chemical Co., Ltd.

- Jinan Boss Chemical Industry Co., Ltd.

- Yancheng Hongda Chemical Co., Ltd.

- Sichuan Fine Chemical Co., Ltd.

- Shanghai Nanxiang Reagent Co., Ltd.

- Shandong Great Chemical Co., Ltd.

- Suzhou Chemical Industrial Co., Ltd.

- Changzhou High-Tech Chemical Co., Ltd.

- Guangzhou Chemical Reagents Factory

- Zhejiang Xinhua Chemical Co., Ltd.

- Wuhan Pharmacia Chemical Co., Ltd.

- Hubei Zhengyuan Chemical Co., Ltd.

- Anhui Chem-Star Chemical Co., Ltd.

- Jiangsu Changsheng Chemical Co., Ltd.

- Shaanxi Sinuote Bio-Tech Co., Ltd.

- Hunan Nutramax Inc.

- Nanjing Chemical Reagent Co., Ltd.

- Xiamen Pioneer Chemical Co., Ltd.

- Fujian Haida Chemical Co., Ltd.

- Tianjin Chemical Reagent Institute

Frequently Asked Questions

Analyze common user questions about the Fluorenone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Fluorenone in the pharmaceutical industry?

Fluorenone serves as a critical synthetic intermediate and building block for synthesizing complex Active Pharmaceutical Ingredients (APIs), especially in oncology, antiviral, and CNS drug research, where its unique tricyclic structure imparts specific biological and physiochemical properties to the final drug molecule.

Which geographical region leads the global demand and production of Fluorenone?

Asia Pacific (APAC), particularly China and India, leads in both the global production capacity and consumption of Fluorenone, driven by vast chemical manufacturing capabilities and burgeoning demand from the electronics and polymer synthesis sectors.

How do Grade Types (e.g., Pharmaceutical vs. Industrial) impact Fluorenone market pricing?

Pharmaceutical Grade Fluorenone commands a significantly higher price premium compared to Industrial Grade due to the requirement for ultra-high purity (>99.5%), stringent regulatory compliance (GMP), and specialized, capital-intensive purification techniques needed to eliminate trace impurities for drug safety.

What technological advancements are currently defining the future of Fluorenone synthesis?

The future of Fluorenone synthesis is defined by the adoption of green chemistry principles, specifically through continuous flow chemistry reactors and advanced catalytic oxidation methods, aiming to improve yield, reduce solvent usage, and enhance process safety and efficiency.

What are the major growth drivers for the Fluorenone market through 2033?

Key growth drivers include sustained investment in specialized polymer materials for aerospace and automotive lightweighting, increasing adoption of UV-curable coatings and photoinitiators in 3D printing and microelectronics, and the continuous expansion of pharmaceutical R&D pipelines globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager