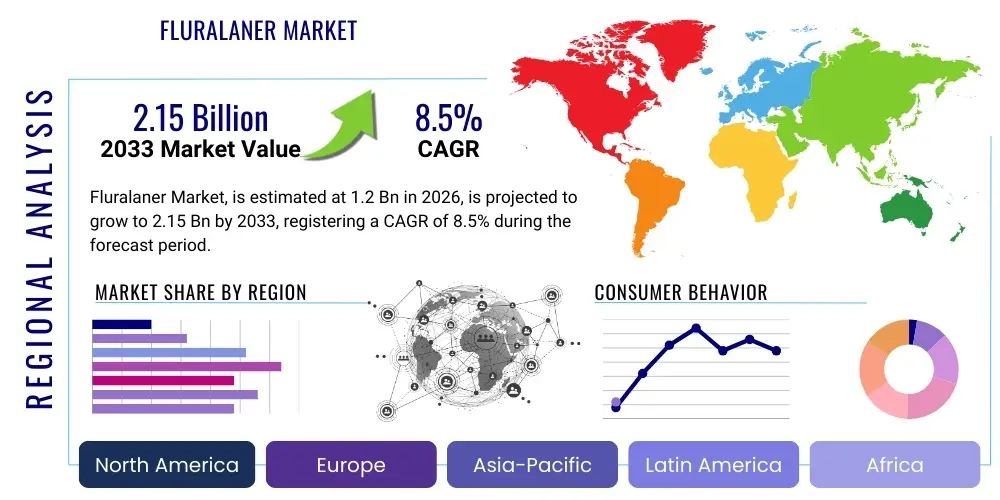

Fluralaner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443074 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Fluralaner Market Size

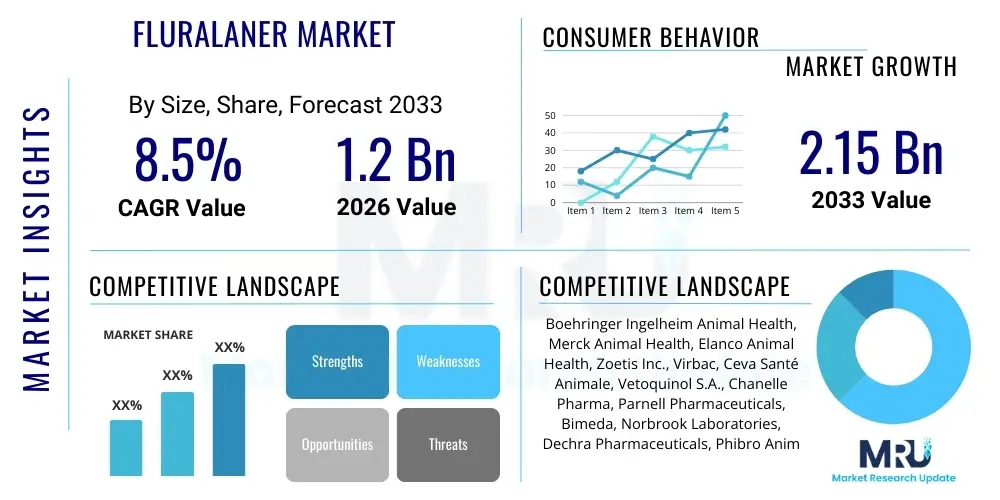

The Fluralaner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This robust expansion is primarily fueled by increasing global pet ownership, heightened awareness of parasitic diseases, and the demonstrated superior efficacy and convenience of the isoxazoline class of parasiticides. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033, driven by continuous innovation in sustained-release formulations and expanding indications beyond canine and feline applications into emerging markets.

Fluralaner Market introduction

Fluralaner is a potent, systemically administered insecticide and acaricide belonging to the isoxazoline chemical class. It functions primarily by inhibiting the arthropod nervous system, specifically acting as an antagonist on GABA- and glutamate-gated chloride channels, leading to irreversible paralysis and subsequent death of fleas and ticks. This highly effective mechanism distinguishes it from older classes of parasiticides, providing a significant advantage in areas facing resistance issues. Introduced initially as Bravecto, Fluralaner offers extended duration protection, typically lasting up to 12 weeks with a single oral or topical dose, thereby drastically improving owner compliance and ensuring continuous protection for companion animals.

The major applications of Fluralaner revolve around the treatment and prevention of infestations by ticks (including Ixodes ricinus, Dermacentor reticulatus, and Rhipicephalus sanguineus) and fleas (Ctenocephalides felis) in dogs and cats. Its clinical utility extends to treating certain types of mites, such as Demodex and Sarcoptes, making it a critical component in managing various dermatological conditions associated with these parasites. The product's ease of administration and proven safety profile across diverse breeds and life stages have cemented its status as a preferred choice among veterinary professionals worldwide, contributing significantly to market stability and growth.

Driving factors for the Fluralaner market include the global rise in discretionary spending on pet healthcare, the continuous threat posed by vector-borne diseases (like Lyme disease and Ehrlichiosis), and the convenience factor associated with extended efficacy. Regulatory approvals for new, innovative formulations, such as injectable versions providing even longer protection windows, are expected to further accelerate market penetration. Additionally, rigorous marketing efforts by key pharmaceutical players highlighting the necessity of year-round parasite prevention are instrumental in shaping consumer behavior and expanding the addressable patient population across developed and developing economies.

Fluralaner Market Executive Summary

The Fluralaner Market demonstrates robust business trends characterized by intense competition focused on formulation innovation and geographic expansion. Key pharmaceutical companies are strategically investing in R&D to develop combined treatments that integrate Fluralaner with heartworm and internal parasite preventatives, thereby offering comprehensive, single-product solutions that simplify dosing schedules for pet owners. The primary business trend involves securing intellectual property extensions and managing the competitive pressure from generic isoxazoline products that are anticipated to enter the market post-patent expiry for initial formulations. Strategic partnerships with major veterinary distributor networks and the establishment of robust e-commerce platforms are critical for maintaining market share in this high-value sector.

Regionally, North America and Europe currently dominate the market, driven by high pet insurance penetration, advanced veterinary infrastructure, and high consumer spending on prophylactic pet care. These regions set the benchmark for compliance and product adoption rates. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid urbanization, a burgeoning middle class in countries like China and India, and the consequential shift in companion animal status from working animals to family members. Latin America and the Middle East & Africa (MEA) present significant untapped opportunities, contingent upon successful educational campaigns regarding zoonotic disease risks and increasing accessibility of veterinary services.

Segment trends highlight the dominance of the canine segment due to the sheer size of the dog population and the established prevalence of flea and tick issues. Oral formulations currently lead the market in terms of revenue, preferred for their guaranteed ingestion and reduced risk of environmental contamination, although topical solutions maintain a strong position for specific user preferences. The professional channel, primarily veterinary clinics and hospitals, remains the most important distribution segment, acting not only as a point of sale but also as the primary source of prescription and expert recommendation, ensuring high-quality product endorsement and consumer trust.

AI Impact Analysis on Fluralaner Market

Common user questions regarding AI's impact on the Fluralaner market center on themes such as enhanced efficacy testing, predictive modeling for parasitic resistance emergence, and personalized dosing regimens for veterinary medicine. Users frequently inquire about how AI can accelerate the discovery of next-generation parasiticides (beyond current isoxazolines) or if AI-driven diagnostics will improve the targeting of Fluralaner treatment, reducing unnecessary usage. The key concerns revolve around data privacy, the cost implication of integrating advanced AI systems into standard veterinary practices, and ensuring that AI algorithms can accurately model complex biological systems like flea or tick nervous pathways. Expectations are high regarding AI’s ability to optimize supply chains and inventory management based on real-time disease outbreak prediction, ultimately lowering operational costs for drug manufacturers and distributors.

The immediate impact of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is most pronounced in the early stages of pharmaceutical development, particularly in virtual screening of chemical libraries to identify novel compounds with similar or superior activity profiles to Fluralaner. AI models can predict the pharmacokinetics and toxicology of drug candidates with greater accuracy and speed than traditional laboratory methods, significantly shortening the time-to-market for future isoxazoline derivatives or entirely new classes of ectoparasiticides. Furthermore, ML is increasingly utilized in analyzing large datasets relating to geographical parasite incidence and environmental factors, allowing manufacturers to optimize regional distribution and tailor marketing strategies based on precise, localized outbreak risk assessments.

In clinical practice, AI contributes through advanced image analysis tools that assist veterinarians in rapidly diagnosing dermatological conditions caused by mites and distinguishing them from other skin issues, thereby confirming the need for Fluralaner treatment more quickly. Over the long term, AI-driven epidemiology models will track resistance patterns across continents, enabling regulatory bodies and manufacturers to make proactive decisions regarding formulation changes or the rotation of different antiparasitic classes, safeguarding the longevity of Fluralaner’s effectiveness and maintaining the public health benefits derived from effective parasite control.

- Accelerated identification of novel isoxazoline analogs and improved target specificity through computational chemistry modeling.

- Predictive resistance mapping using Machine Learning to forecast geographical spread of Fluralaner resistance, optimizing treatment rotation strategies.

- Enhanced supply chain management and inventory optimization based on AI-driven regional disease outbreak forecasts.

- Integration of AI diagnostics (e.g., image recognition for mite identification) within veterinary practices to confirm parasitic infestation rapidly.

- Personalized veterinary medicine protocols, using AI to recommend precise Fluralaner dosing based on individual animal health data, weight, and regional risk exposure.

- Automation of regulatory submission documentation and compliance checks, streamlining the market entry process for new Fluralaner formulations.

DRO & Impact Forces Of Fluralaner Market

The Fluralaner market is highly dynamic, shaped by a powerful synergy of drivers related to pet healthcare demand and technological innovation, balanced against critical restraints concerning efficacy and regulatory scrutiny. Key market drivers include the pronounced efficacy and convenience of 12-week dosing schedules, which drastically improves pet owner compliance compared to daily or monthly treatments, resulting in superior parasite control outcomes. Simultaneously, the growing global prevalence of zoonotic diseases transmitted by fleas and ticks necessitates continuous prophylactic treatment, thereby institutionalizing the demand for highly effective products like Fluralaner. These drivers are amplified by the opportunity presented by expanding applications into non-traditional segments, such as ornamental animals and certain livestock sectors, broadening the total addressable market beyond core companion animal segments. The principal impact force is the strong backing and promotional support from the organized veterinary professional community, which relies on the documented safety and reliable performance of the product.

Conversely, significant market restraints include the potential for the development of parasite resistance to the isoxazoline class, a critical concern that drives research into alternative treatments and necessitates careful resistance monitoring by manufacturers and regulators. The relatively high cost of premium parasiticides like Fluralaner, particularly in price-sensitive emerging markets, acts as a barrier to widespread adoption, often leading to preference for older, cheaper, albeit less effective, treatments. Furthermore, regulatory hurdles, particularly in obtaining approvals for extended duration claims and combination products, require substantial investment in clinical trials, slowing down product diversification and market entry for new formulations. These restraints necessitate continuous research into resistance management and strategies to improve cost-effectiveness through optimized manufacturing processes.

Opportunities for sustained market growth lie in developing novel, sustained-release delivery systems, such as slow-release implants or enhanced topical solutions, which minimize administration frequency and maximize convenience. Expanding the therapeutic scope to include emerging parasite threats or utilizing Fluralaner in prophylactic measures against internal parasites through combination products represents a key growth strategy. The intensifying societal trend towards humanizing pets, where owners treat companion animals as family members and prioritize their preventative healthcare, ensures a long-term willingness to invest in high-quality, reliable solutions. The interplay of these forces ensures that while competition from other isoxazolines and traditional treatments persists, Fluralaner maintains a premium position based on its established efficacy profile and patient compliance benefits.

Segmentation Analysis

The Fluralaner market is fundamentally segmented across several critical dimensions, providing granular insights into consumption patterns and growth pockets. Key segmentation includes Animal Type (Canine, Feline, Others), Formulation Type (Oral, Topical), and Distribution Channel (Veterinary Clinics, Retail Pharmacies, E-commerce). The canine segment dominates, driven by the sheer population size of domestic dogs globally and the high incidence of tick-borne diseases. Oral formulations, particularly flavored chewables, are preferred by many pet owners due to the ease of ensuring the entire dose is administered and minimizing concerns about contact residue or bathing restrictions, contributing significantly to this segment's leading revenue share and high adoption rates.

Further analysis of the distribution channels reveals that veterinary clinics remain the primary and most influential segment. Vets act as gatekeepers, providing prescriptions and expert recommendations, which are crucial for premium products like Fluralaner. However, the rapidly expanding e-commerce and online pharmacy segment is gaining traction, particularly for repeat purchases, offering convenience and competitive pricing. This shift necessitates manufacturers adapting their sales and marketing strategies to maintain brand integrity and control pricing across diverse distribution platforms, balancing professional recommendation with consumer accessibility.

Geographic segmentation is also vital, distinguishing between mature markets like North America and Western Europe, characterized by high penetration and sustained, stable growth, and high-growth potential markets in Asia Pacific and Latin America, where rapid growth in pet ownership and improving veterinary standards are fueling exponential demand. Understanding these segmented needs allows companies to tailor product presentations, packaging sizes, and pricing strategies to maximize market penetration and ensure compliance with local regulatory standards for veterinary pharmaceutical distribution.

- Animal Type

- Canine

- Feline

- Others (e.g., Exotic Pets, Small Livestock)

- Formulation Type

- Oral Chewables

- Topical Solutions (Spot-ons)

- Injectable (Emerging)

- Distribution Channel

- Veterinary Clinics and Hospitals

- Retail Pharmacies and Pet Stores

- E-commerce and Online Pharmacies

- End-User

- Pet Owners

- Veterinary Professionals

- Breeders and Kennels

- Duration of Efficacy

- 12-Week Protection

- 8-Week Protection

- Shorter Duration/Other

Value Chain Analysis For Fluralaner Market

The value chain for the Fluralaner market begins with highly specialized upstream activities centered around complex chemical synthesis and active pharmaceutical ingredient (API) production. Fluralaner, being a patented molecule of the isoxazoline class, requires specific, often proprietary, synthesis pathways. Upstream participants are specialized chemical manufacturers or the large veterinary pharmaceutical companies themselves, who invest heavily in R&D to optimize synthesis yields, maintain high purity standards, and manage intellectual property rights. Control over the proprietary synthesis process is a significant competitive advantage, ensuring control over supply and quality before the molecule enters the formulation phase.

Midstream activities involve the conversion of the raw API into commercial dosage forms, predominantly oral chewables (e.g., flavoring and pressing) or topical spot-on solutions (e.g., solvent selection and packaging). This stage requires robust Good Manufacturing Practice (GMP) compliance, specialized formulation technologies (to ensure palatability for oral forms and stability/absorption for topical forms), and rigorous quality control. Distribution channels then move the finished product from manufacturing sites to end-users. Direct channels involve manufacturers selling directly to large veterinary corporate groups or through their own dedicated sales forces to independent clinics. Indirect channels rely heavily on major third-party veterinary distributors and wholesalers, which manage complex inventory logistics and last-mile delivery to thousands of smaller veterinary practices and retail locations.

Downstream activities involve professional consultation and sales points, primarily veterinary clinics, which prescribe and dispense the product. Veterinary endorsement is crucial, as Fluralaner is typically a prescription-only medicine (or available only via veterinary consultation in many regions). The final segment involves the end-user – the pet owner – who purchases and administers the product. The effectiveness of the overall value chain is highly dependent on effective collaboration between the manufacturers (for product efficacy and supply reliability) and the veterinarians (for prescription confidence and client education), ensuring sustained market uptake and high consumer compliance rates, which directly impact revenue realization.

Fluralaner Market Potential Customers

The primary and largest segment of potential customers for Fluralaner comprises companion animal owners, specifically dog and cat owners residing in urban and suburban areas of high-GDP countries, who demonstrate a high propensity for preventative healthcare spending. These individuals view their pets as family members and are highly motivated to invest in premium, effective parasite control to protect both the animal's health and their family from zoonotic risks. Convenience is a critical purchasing driver for this group; thus, the 12-week dosing schedule is highly appealing as it simplifies the monthly routine and reduces the risk of missed doses. Marketing efforts are targeted towards educating this segment on the long-term benefits of sustained efficacy and the potential consequences of untreated parasitic infestations.

A secondary, yet crucial, customer base consists of veterinary professionals, including general practitioners, veterinary dermatologists, and large animal specialists, who act as the essential prescribers and influencers. For this customer group, the decision-making process is centered on clinical efficacy, safety data, resistance management profiles, and client compliance potential. Manufacturers invest heavily in clinical data generation and continuous professional education to ensure veterinarians are confident in recommending Fluralaner over competing products. Establishing trust with this professional community is paramount, as their recommendation directly dictates product adoption rates within their respective clientele.

Furthermore, commercial operations such as professional breeders, boarding kennels, and increasingly, specialized livestock farms dealing with certain ectoparasitic issues, represent significant bulk buyers. These customers require highly reliable, scalable, and cost-effective parasite control solutions to maintain animal welfare standards and prevent localized outbreaks that could jeopardize their entire operation. While Fluralaner’s primary focus remains on companion animals, its application in managing specific mite infestations in breeding environments or laboratory animals expands the potential customer landscape into specialized institutional buyers who value proven efficacy and long-lasting protection protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boehringer Ingelheim Animal Health, Merck Animal Health, Elanco Animal Health, Zoetis Inc., Virbac, Ceva Santé Animale, Vetoquinol S.A., Chanelle Pharma, Parnell Pharmaceuticals, Bimeda, Norbrook Laboratories, Dechra Pharmaceuticals, Phibro Animal Health, ECO Animal Health, KRKA, d.d., Novo Mesto, Hester Biosciences, Biogenesis Bago, Nippon Zenyaku Kogyo Co., Ltd., Bayer Animal Health (now part of Elanco/Boehringer Ingelheim portfolio management). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluralaner Market Key Technology Landscape

The technology landscape surrounding the Fluralaner market is defined primarily by innovations in drug delivery and formulation science, aiming to maximize bioavailability and duration of effect. Fluralaner itself represents the technological advancement of the isoxazoline class, which selectively targets insect GABA receptors, offering a higher safety margin for mammals compared to older insecticide classes. Key technological advancements involve the development of highly palatable oral matrix systems (chewables) that ensure consistent delivery and absorption of the active ingredient regardless of the pet’s feeding habits. Sophisticated flavoring technologies are crucial here, ensuring high acceptance rates, which directly translate into treatment compliance and success. This formulation technology is proprietary and crucial for maintaining brand differentiation in a market with competing isoxazoline molecules.

Another significant technological focus is on optimizing topical delivery systems, which require complex solvent and excipient selection to ensure rapid dermal penetration and systemic absorption without causing local skin irritation. The precise technology of ‘spot-on’ application and spreading capacity across the skin surface post-application is critical for achieving the necessary blood plasma concentration for the systemic action to kill fleas and ticks. Furthermore, the emerging technology involves long-acting injectable formulations, requiring advanced polymer encapsulation or sustained-release depots to maintain therapeutic plasma levels of Fluralaner for six months or longer. This injectable technology represents a potential future game-changer by eliminating owner dependency for dosing and achieving 100% compliance in clinical settings.

Beyond the product itself, the technological landscape includes advanced analytical methods for monitoring drug stability, detecting minute traces of the API in biological samples, and perhaps most critically, high-throughput screening technologies used to rapidly identify and characterize new resistance mechanisms in target parasite populations. Molecular diagnostics, including Polymerase Chain Reaction (PCR) based assays, are increasingly employed to monitor the genetic profile of local flea and tick populations. This data, often integrated with AI platforms, informs manufacturers about the ongoing effectiveness of Fluralaner and guides the strategic development of second and third-generation parasiticides, ensuring the long-term viability and dominance of the isoxazoline class in veterinary medicine.

Regional Highlights

North America, particularly the United States, holds a dominant position in the Fluralaner Market due to the high density of companion animals, robust pet humanization trends, and high willingness among pet owners to spend on preventative healthcare, often supported by pet insurance plans. The sophisticated veterinary infrastructure and aggressive marketing campaigns promoting year-round tick and flea control ensure consistently high adoption rates for premium, extended-duration products like Fluralaner. Furthermore, the significant presence of vector-borne diseases in regions across the US drives demand, positioning Fluralaner as a crucial tool in public and animal health strategies. The competitive landscape here is mature, with intense focus on brand loyalty and new combination product introductions.

Europe represents the second largest market, characterized by strong regulatory oversight from the European Medicines Agency (EMA) and high standards for animal welfare. Countries such as Germany, the UK, and France exhibit strong demand, driven by large companion animal populations and environmental factors that favor tick survival (e.g., dense forest areas). The European market shows a preference for both oral and topical formulations, influenced by differing regional cultural practices regarding pet medication. The challenge in Europe involves navigating varied national reimbursement and veterinary dispensing laws, which require tailored market access strategies for manufacturers.

The Asia Pacific (APAC) region is projected to experience the fastest growth rate. This acceleration is attributed to the substantial economic growth leading to a rapid rise in pet ownership (especially in urban centers of China, India, and Southeast Asia) and improving access to Western-standard veterinary care. As disposable incomes rise and awareness of zoonotic disease prevention increases, there is a distinct shift away from traditional, less effective parasiticides towards premium, scientifically backed products like Fluralaner. Market penetration is currently lower than in Western regions, indicating vast untapped potential, particularly through expansion into Tier 2 and Tier 3 cities and leveraging digital platforms for consumer education.

Latin America (LATAM) and the Middle East & Africa (MEA) currently contribute smaller, but rapidly expanding shares. LATAM growth is supported by large-scale cattle and livestock industries, offering potential for off-label or emerging indications, alongside growing companion animal sectors in Brazil and Mexico. MEA presents unique logistical challenges but is seeing increased demand driven by expatriate populations and governmental efforts to modernize veterinary services, particularly in the UAE and South Africa. These regions require localized pricing strategies and formulation adaptations to overcome logistical complexities and affordability barriers.

- North America: Market dominance driven by high pet healthcare expenditure, established veterinary channels, and necessity for managing widespread tick-borne diseases.

- Europe: Strong, stable market with high welfare standards, focused on navigating heterogeneous national regulatory and distribution landscapes.

- Asia Pacific (APAC): Highest projected CAGR, fueled by rising disposable incomes, rapid urbanization, and increasing access to modern veterinary pharmaceuticals.

- Latin America (LATAM): Growth potential linked to expanding middle-class pet ownership and the large-scale livestock sector requiring effective parasite control solutions.

- Middle East & Africa (MEA): Emerging markets characterized by increasing urbanization and infrastructural improvements in veterinary services, demanding localized strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluralaner Market, primarily focused on companies holding intellectual property or dominant market share within the isoxazoline class of parasiticides.- Boehringer Ingelheim Animal Health (Manufacturer of NexGard, competitor in the isoxazoline space and key market participant post-acquisition activities)

- Merck Animal Health (Manufacturer of Bravecto, the leading Fluralaner product)

- Elanco Animal Health (Major player with diverse veterinary pharmaceutical portfolio)

- Zoetis Inc. (Global leader in animal health focused on innovation and parasiticides)

- Virbac (Specialist in companion animal health products)

- Ceva Santé Animale (Focus on animal health specialties and vaccines)

- Vetoquinol S.A. (International veterinary pharmaceutical company)

- Chanelle Pharma (European manufacturer with focus on generic and specialty veterinary products)

- Parnell Pharmaceuticals (Developing novel animal health solutions)

- Bimeda (Global manufacturer of veterinary pharmaceuticals)

- Norbrook Laboratories (International veterinary medicine manufacturer)

- Dechra Pharmaceuticals (Specialist in veterinary endocrine and dermatology products)

- Phibro Animal Health (Focus on animal nutrition and medicinal feed additives)

- ECO Animal Health (Developer of specialized animal health products)

- KRKA, d.d., Novo Mesto (Pharmaceutical company with a presence in veterinary medicine)

- Hester Biosciences (Indian animal health company expanding globally)

- Biogenesis Bago (Latin American animal health market participant)

- Nippon Zenyaku Kogyo Co., Ltd. (Japanese animal health company)

Frequently Asked Questions

Analyze common user questions about the Fluralaner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Fluralaner and how does it differ from traditional flea and tick medications?

Fluralaner is a potent ectoparasiticide belonging to the isoxazoline class, known for its unique mechanism targeting insect nervous system GABA channels. Its primary distinction is its long-lasting systemic protection, typically administered as a single oral dose providing up to 12 weeks of continuous efficacy, contrasting sharply with monthly or daily applications required by older classes like fipronil or permethrin.

Is Fluralaner resistance a significant threat to the market outlook?

While the emergence of resistance to any ectoparasiticide is a continuous threat, confirmed widespread clinical resistance specifically to Fluralaner remains low. The market maintains vigilance, employing strategic usage guidelines and continuous monitoring programs. Manufacturers are actively investing in new combination products and resistance tracking technologies to safeguard the compound's long-term effectiveness, making resistance a restraint but not an immediate market collapse factor.

Which geographical region exhibits the highest growth potential for Fluralaner?

The Asia Pacific (APAC) region, driven by rapid urbanization, increasing discretionary income, and burgeoning pet ownership across countries like China and India, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR). This growth is contingent upon expanding access to modern veterinary healthcare and successful consumer education campaigns regarding preventative parasitic control.

What are the primary factors driving the adoption of oral Fluralaner formulations over topical solutions?

The dominant adoption of oral Fluralaner formulations is driven by vastly improved compliance and guaranteed ingestion. Oral chewables eliminate concerns associated with topical applications, such as bathing restrictions, residue transfer to humans or furniture, and the possibility of the dose being ineffective due to improper application, offering veterinarians and owners higher confidence in treatment success.

How is technology, specifically AI, influencing future Fluralaner product development?

AI is significantly impacting the future of Fluralaner development by accelerating the discovery of novel analogs and optimizing drug targeting. Machine Learning algorithms are used to predict parasitic resistance patterns geographically and refine complex formulation stability, ensuring new products offer maximum efficacy and minimize the potential for resistance development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager