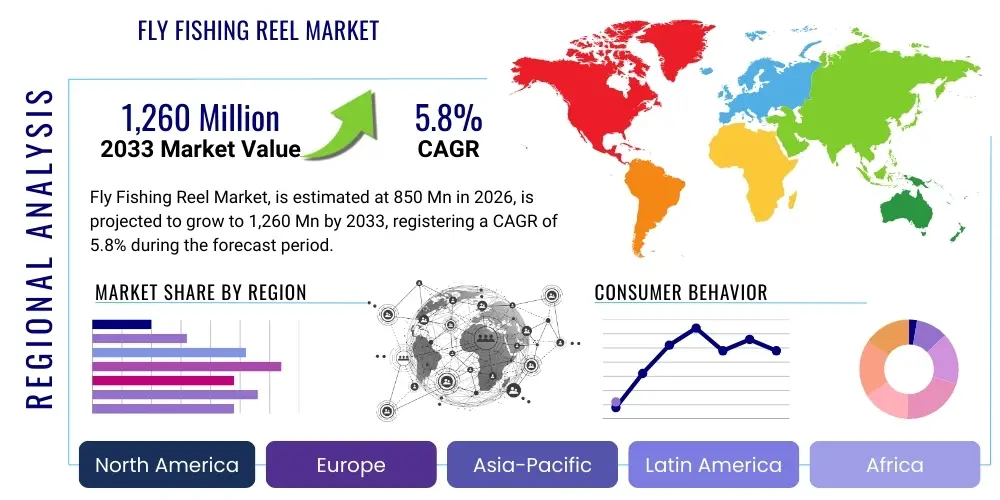

Fly Fishing Reel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442675 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Fly Fishing Reel Market Size

The Fly Fishing Reel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is underpinned by increasing consumer participation in outdoor recreational activities and the rising global disposable income allocated to premium sporting goods. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,260 Million by the end of the forecast period in 2033, demonstrating a significant expansion in both volume and value, driven particularly by the saltwater and premium drag system segments.

The valuation reflects a growing trend towards specialized equipment designed for specific fishing environments and species. While traditional freshwater fly fishing remains a core consumer base, the acceleration of demand for high-performance, corrosion-resistant reels suitable for harsh saltwater conditions contributes disproportionately to the market's revenue growth. Manufacturers are continually innovating materials and drag technologies, such as fully sealed and oversized disc drag systems, which justify higher average selling prices and enhance market size figures.

Furthermore, the increased focus on sustainability and durability in outdoor gear influences purchasing decisions. Consumers are shifting away from lower-end, disposable equipment towards investment-grade reels that offer extended longevity and reduced environmental impact through longevity. This shift, coupled with effective digital marketing strategies targeting both seasoned anglers and newcomers interested in the experiential aspects of fly fishing, solidifies the optimistic financial projections for the forecast period.

Fly Fishing Reel Market introduction

The Fly Fishing Reel Market encompasses the manufacturing, distribution, and sale of specialized mechanisms used in fly fishing to store line, balance the rod, and manage the drag applied to a fish. These products, fundamentally distinct from conventional spinning or baitcasting reels, are designed specifically to handle the delicate presentation and long casts associated with fly lines, and they play a critical role in mitigating the stress exerted by fighting fish through sophisticated drag systems. The market is highly specialized, catering to a demographic that values precision engineering, aesthetic quality, and reliable performance under varied environmental conditions, ranging from high mountain streams to tropical flats.

The primary product categories within this market include Single Action (or conventional), Multiplier, and Automatic reels, with Single Action models dominating due to their simplicity, reliability, and precision engineering capabilities. Major applications span diverse angling scenarios, broadly categorized into freshwater fishing—targeting species like trout, salmon, and bass—and saltwater environments, focusing on powerful species such as bonefish, permit, and tarpon. The benefits derived from advanced fly reels include enhanced line retrieval rates, superior heat dissipation in the drag mechanism crucial for fighting large fish, reduced risk of reel failure due to environmental ingress (sealed systems), and ergonomic design that minimizes fatigue during prolonged use.

Key driving factors accelerating the market’s growth include the global increase in leisure time and participation in outdoor activities post-pandemic, the rise of fly fishing tourism in ecologically pristine areas, and significant advancements in material science, particularly the use of aerospace-grade aluminum and carbon fiber composites. These technological innovations allow manufacturers to produce lighter, stronger, and more durable reels, thus constantly renewing the consumer base's desire for upgrades. Effective marketing campaigns emphasizing the aspirational and technical aspects of fly fishing further contribute to sustained demand and market expansion globally.

Fly Fishing Reel Market Executive Summary

The Fly Fishing Reel Market is experiencing a period of sustained robust growth, predominantly driven by innovation in drag technology and an expanding affluent consumer base seeking high-quality recreational gear. Business trends indicate a strong move toward product customization, limited edition releases, and vertical integration by key manufacturers to control material quality and precision machining, thereby sustaining premium pricing strategies. There is a noticeable investment in lightweight, sealed, large arbor designs, optimizing performance for both freshwater and challenging saltwater conditions. Furthermore, e-commerce and direct-to-consumer (D2C) channels are rapidly gaining prominence over traditional specialty retail, enhancing brand reach and improving margin profiles for market leaders.

Regionally, North America remains the dominant revenue generator, characterized by a deeply entrenched fly fishing culture and a high average expenditure per angler, particularly in high-value segments like salmon and large trout fishing. However, the Asia Pacific (APAC) region, specifically countries like Japan, Australia, and New Zealand, is demonstrating the highest CAGR, fueled by rising disposable incomes and governmental promotion of eco-tourism and outdoor sports. Europe maintains a strong presence, especially in Scandinavia and the UK, focusing on classic reel designs alongside high-tech modern options. Regulatory stability regarding recreational fishing licenses and conservation efforts across these regions provide a favorable operating environment for market participants.

Segmentation trends highlight the increasing preference for fully Machined Aluminum reels over die-cast alternatives due to superior durability and precision. The Disc Drag mechanism segment holds a substantial market share, rapidly displacing older Click-and-Pawl systems in medium to heavy-duty applications, driven by its superior stopping power and adjustability. The Freshwater application category, specifically the trout fishing segment, still accounts for the largest volume, but the saltwater application segment offers higher profitability and growth potential due to the stringent engineering requirements and consequently higher average selling prices of saltwater-specific reels, necessitating corrosion resistance and high line capacity.

AI Impact Analysis on Fly Fishing Reel Market

User queries regarding AI's influence in the Fly Fishing Reel Market frequently center on whether artificial intelligence can truly enhance a traditional, skill-based recreational activity. Common themes include the potential for AI-driven manufacturing optimization, personalized gear recommendations based on environmental data (e.g., local water conditions, target species), and the use of machine learning in supply chain logistics to predict seasonal demand for specific reel types (e.g., saltwater vs. freshwater reels). Users also express concerns about maintaining the artisanal quality and craftsmanship often associated with high-end reels if production processes become too automated. The general expectation is that AI will primarily impact the efficiency and marketing sides of the business rather than the end-user fishing experience itself, ensuring highly specialized reels are available precisely when and where they are needed, minimizing inventory bottlenecks and maximizing consumer satisfaction through data-driven precision manufacturing.

- AI-driven Predictive Maintenance: Utilizing sensor data within CNC machining equipment to anticipate wear and tear, ensuring uninterrupted production of high-tolerance reel components and maintaining quality control standards.

- Supply Chain Optimization: Employing machine learning algorithms to forecast demand for niche materials (e.g., specialized aluminum alloys, carbon fiber, proprietary drag materials) and optimize inventory levels across global distribution networks, reducing lead times.

- Personalized Marketing and Product Recommendation: AI analyzing angler profiles, historical purchases, and geographic location to recommend the most suitable reel model, drag type, and line capacity, increasing conversion rates for high-value products.

- Automated Quality Inspection: Using computer vision systems during assembly to verify the precise alignment, drag smoothness, and finish quality of the reels, significantly reducing manual inspection errors.

- E-commerce Chatbots and Customer Service: Implementing sophisticated AI assistants to handle technical product queries (e.g., spool capacity, gear ratios, drag settings) instantaneously, enhancing the online retail experience.

DRO & Impact Forces Of Fly Fishing Reel Market

The fundamental market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and overall Impact Forces. The primary driver is the increasing global interest in outdoor recreational activities, often viewed as a meditative escape, which fuels demand for premium, durable fishing equipment. Coupled with this is continuous technological advancement, specifically in lightweight, high-strength materials and fully sealed, maintenance-free drag systems that offer superior performance and justify premium pricing. However, these drivers are counterbalanced by significant restraints, primarily the high initial cost barrier for entry-level anglers, which limits mass-market adoption compared to conventional fishing methods, and the dependence on favorable environmental regulations and stable fish populations.

Market opportunities abound, particularly through geographic expansion into emerging markets in Asia where middle-class leisure spending is rising, and through targeting younger demographics via digital platforms and social media campaigns that emphasize the aesthetic and skill-based aspects of fly fishing. The push toward saltwater fly fishing, which requires more specialized and higher-priced gear, represents a significant high-growth opportunity. Furthermore, manufacturers can leverage the demand for environmentally conscious products by utilizing sustainable materials and processes, resonating with the core values of the angling community.

The dominant impact forces operating on the market include the stringent regulatory environment surrounding recreational fishing, which can either suppress or encourage participation, and macro-economic factors such as global inflation rates affecting raw material costs (e.g., aluminum, titanium). Consumer spending elasticity also plays a crucial role; while dedicated anglers are often price-insensitive regarding high-end gear, economic downturns can severely impact the uptake of mid-range products. The overall technological impact force is profoundly positive, compelling constant innovation and rendering older reel designs obsolete, thereby stimulating the upgrade cycle among existing users and maintaining market vitality.

The market faces ongoing challenges related to intellectual property rights protection for novel drag systems and precision machining techniques, as counterfeits of high-end reels can erode brand value and market share. Successfully navigating the global supply chain volatility, especially securing reliable sources for specialized, corrosion-resistant components, remains a critical operational challenge, requiring significant investment in global logistics and supplier diversification strategies. The strategic management of these impact forces will determine the success and sustainability of market participants over the forecast period.

Segmentation Analysis

The Fly Fishing Reel Market is systematically segmented based on Type, Mechanism, Material, Application, and Distribution Channel to provide a granular view of market dynamics and consumer preferences. This detailed segmentation allows manufacturers to tailor product development, marketing strategies, and pricing structures to specific angler profiles and geographical demands. The market structure reveals a clear differentiation between mass-produced entry-level products and highly technical, precision-machined reels, reflecting varying levels of angler expertise and budget. Understanding these segments is crucial for identifying areas of high growth, such as the saltwater and premium material segments, which generally command higher margins and exhibit faster value growth.

Segmentation by Material, particularly the distinction between Machined Aluminum and Die-Cast Aluminum, reveals significant divergence in quality perception and pricing power. Anglers seeking maximum durability, reduced weight, and superior tolerances invariably opt for machined reels, pushing the average selling price upward. Conversely, the segmentation by Application clearly divides the market based on required performance; saltwater reels, necessitating sealed drag systems and superior corrosion resistance, represent a niche but highly lucrative segment demanding specialized engineering and advanced polymer components. This differentiation drives specialization among manufacturers and encourages focused R&D investment.

The Distribution Channel segmentation is undergoing a rapid evolution, with the shift towards online retail and D2C models disrupting traditional specialty store dominance. While specialty stores continue to provide vital educational resources and hands-on experience, the logistical efficiencies and wider inventory access offered by e-commerce platforms are accelerating their market share capture. Analyzing these segment performance metrics reveals critical insights into consumer behavior, allowing businesses to optimize their inventory allocation and promotional spending based on regional demand nuances and seasonal consumption patterns, maximizing overall market penetration.

- By Type: Single Action Reel, Multiplier Reel, Automatic Reel

- By Mechanism: Disc Drag System, Click-and-Pawl System, Sealed Drag System (Sub-segment of Disc Drag)

- By Material: Machined Aluminum, Die-Cast Aluminum, Graphite/Composite

- By Application: Freshwater Fishing (Trout, Salmon, Bass), Saltwater Fishing (Bonefish, Tarpon, Permit)

- By Distribution Channel: Specialty Retail Stores, Online Retail (E-commerce), Department and Sporting Goods Stores, Direct-to-Consumer (D2C)

Value Chain Analysis For Fly Fishing Reel Market

The value chain for the Fly Fishing Reel Market begins with the upstream segment, involving the sourcing and processing of high-grade raw materials, primarily aerospace-grade aluminum billets, stainless steel, and specialized polymers for drag components. This stage is characterized by high precision requirements and strong supplier relationships, as material quality directly dictates the reel's performance and longevity. Key upstream activities include CNC machining, precision casting, and advanced finishing processes such as anodizing, which often requires significant capital investment in specialized manufacturing facilities. Efficiency in the upstream segment, focusing on waste reduction and material optimization, is crucial for maintaining competitive manufacturing costs and adhering to strict quality standards demanded by the premium nature of the product.

The midstream involves the core manufacturing, assembly, quality control, and branding. Most high-end manufacturers employ in-house or closely monitored production to ensure proprietary technologies, especially drag system components, are accurately produced and protected. After assembly and rigorous testing (e.g., drag heat resistance, corrosion testing), the products enter the downstream distribution phase. Distribution channels are varied, encompassing direct sales, indirect sales through independent distributors, specialty fishing shops, and increasingly, major e-commerce platforms. The dominance of the distribution channel impacts the final price and market reach, with specialty stores offering personalized expertise and D2C models offering margin retention and direct customer feedback loops.

Direct channels, such as brand-owned websites and flagship stores, offer enhanced brand control and enable manufacturers to cultivate deeper relationships with their core customer base, often through warranty programs and custom engraving services. Indirect channels, primarily specialty retailers, rely on their expert staff to educate consumers and provide hands-on product comparisons, serving as vital touchpoints for complex, high-investment purchases. Optimization across the entire value chain requires seamless integration between material procurement (upstream) and final customer engagement (downstream), ensuring that product quality remains paramount from raw billet to the final cast on the water.

Fly Fishing Reel Market Potential Customers

The primary potential customers and end-users of fly fishing reels span a diverse range of anglers, categorized mainly by their experience level, target species, and spending capacity. The core demographic includes experienced, often affluent recreational anglers who view fly fishing as a specialized lifelong pursuit and are consistent buyers of high-end equipment. These users typically invest in multiple specialized reels for different applications, such as large arbor reels for saltwater species requiring high retrieval rates, and lighter click-and-pawl systems for small stream trout fishing. Their purchasing decisions are heavily influenced by technological specifications, brand heritage, and aesthetic appeal.

A rapidly expanding segment consists of novice and intermediate anglers who are entering the sport, often driven by the popularity of outdoor lifestyle media and accessible educational content. These customers seek reliable, durable, and cost-effective reels, generally falling into the mid-range price bracket, characterized by die-cast or entry-level machined aluminum construction. Marketing efforts aimed at this group focus on ease of use, complete starter kits, and robust customer support, facilitating the transition into the sport. Conversion of these beginners into long-term, high-value customers is a key strategic objective for market leaders.

Furthermore, specialized segments include professional fishing guides, outfitters, and competitive anglers. These buyers prioritize absolute reliability, minimal maintenance, and warranty support, as their gear operates under extreme daily use conditions. Their purchasing power, though smaller in volume, holds significant influence due to their role as product testers and influencers within the wider fishing community. Manufacturers often collaborate closely with these professional users for product testing and endorsement, leveraging their credibility to drive sales among the recreational consumer base, targeting buyers looking for 'guide-tested' equipment that promises uncompromising performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orvis, Sage, Abel, Lamson Waterworks, Penn Fishing, Shimano, Hardy, Ross Reels, Redington, Pflueger, TFO (Temple Fork Outfitters), Cheeky Fishing, Tibor, Nautilus, 3-Tand, Seigler Fishing Reels, Bauer Premium Fly Reels, Loop Tackle Design, Galvan Fly Reels, Echo Fly Fishing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fly Fishing Reel Market Key Technology Landscape

The technology landscape of the Fly Fishing Reel Market is highly concentrated on precision engineering, material science innovation, and proprietary drag mechanisms designed for maximum reliability and angler control. The transition from traditional bronze or plastic components to advanced materials like marine-grade anodized aluminum (often 6061-T6 or 7075-T6) and carbon fiber composites is the most defining technological trend. This shift reduces overall reel weight without compromising structural integrity, crucial for minimizing fatigue during long casting sessions. Furthermore, the integration of Large Arbor designs has become standard, improving line retrieval rates and reducing line memory, providing a significant performance advantage over older standard arbor reels.

The core technological battleground remains the drag system. Modern high-end reels almost exclusively feature Disc Drag systems, employing proprietary materials like Rulon, carbon fiber, or cork, often stacked in complex configurations to offer smooth, consistent, and powerful stopping force. A critical advancement is the development of fully Sealed Drag Systems, which utilize O-rings and specialized seals to prevent water, salt, or debris ingress. This technology is mandatory for reels used in harsh saltwater environments and significantly extends the life and reliability of the internal mechanism, justifying the premium price points associated with this feature and driving technological differentiation among key players.

Beyond core mechanics, sophisticated Computer Numerical Control (CNC) machining processes are central to the technological landscape. CNC allows for extremely tight tolerances, producing reels where every component fits precisely, resulting in negligible wobble and enhanced durability. Surface finishing technologies, such as Type III hard anodization, are also crucial for corrosion resistance. The incorporation of computer-aided design (CAD) and simulation software allows engineers to test and optimize structural designs and drag performance under simulated load conditions before physical prototyping, accelerating the product development lifecycle and ensuring the technological superiority of new models released to the market.

Regional Highlights

The regional analysis of the Fly Fishing Reel Market reveals distinct growth patterns and consumer preferences across the globe, heavily influenced by local fishing cultures, climate, and economic development. North America, encompassing the United States and Canada, stands as the most mature and significant revenue contributor. This region boasts extensive freshwater fisheries (e.g., Rocky Mountain streams, Great Lakes tributaries) and high-spending coastal saltwater opportunities, fueling massive demand for both highly technical and heirloom-quality reels. The established presence of industry giants and a strong D2C infrastructure further cement its market leadership, with specialized regional demand driving innovation in rod and reel pairings for species like Pacific salmon and various trout subspecies.

Europe represents a substantial and technologically sophisticated market, particularly in Western European countries like the UK, Germany, and Scandinavia. European demand is characterized by a high appreciation for classic design combined with modern performance, driving sales of both traditional Click-and-Pawl reels and the latest sealed disc drag systems tailored for Atlantic salmon and sea trout. Regulatory support for river restoration and conservation also contributes positively to market stability. Meanwhile, the Asia Pacific (APAC) region is poised for explosive growth, primarily centered in Australia, New Zealand, and increasingly, China and Japan, where a rapidly growing middle class is adopting fly fishing as a leisure activity. This region exhibits the highest CAGR, driven by investment in infrastructure and the promotion of ecological tourism, focusing on both high-end imported reels and locally manufactured cost-effective alternatives.

Latin America and the Middle East & Africa (MEA) are emerging markets, currently contributing a smaller, yet growing, share of global revenue. Latin America, particularly countries like Argentina and Chile, draws significant high-end tourism focusing on world-class fisheries, requiring specialized, heavy-duty gear. MEA growth is highly localized, driven by niche safari fishing operations and expatriate communities. Future expansion in these regions is heavily reliant on improvements in local economic stability, development of retail distribution networks, and successful adaptation of products to suit unique environmental conditions, such as extreme heat and highly abrasive fishing conditions. North America and Europe, however, will remain the primary centers for R&D and high-value manufacturing.

- North America: Dominant market share fueled by a robust fly fishing culture, high consumer spending, and strong demand for premium, precision-machined reels (e.g., Orvis, Sage territory).

- Europe: Stable market with a strong emphasis on tradition, quality craftsmanship, and demand for specialty reels suitable for salmon and large freshwater species across the UK and Nordic countries.

- Asia Pacific (APAC): Fastest growing region; high adoption rate driven by rising disposable incomes in countries like Japan, Australia, and New Zealand, emphasizing specialized gear for coastal and tropical fisheries.

- Latin America: Niche, high-value market driven by international fly fishing tourism in Patagonia and other remote areas, requiring robust and specialized equipment.

- Middle East and Africa (MEA): Emerging regional demand focused on specific tourism sectors and local exotic fisheries; growth dependent on infrastructure development and accessibility of specialized retailers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fly Fishing Reel Market, assessing their financial performance, product portfolios, strategic initiatives, and market influence. These companies are instrumental in setting technological standards and dictating global pricing dynamics.- Orvis

- Sage

- Abel

- Lamson Waterworks

- Penn Fishing

- Shimano

- Hardy

- Ross Reels

- Redington

- Pflueger

- TFO (Temple Fork Outfitters)

- Cheeky Fishing

- Tibor

- Nautilus

- 3-Tand

- Seigler Fishing Reels

- Bauer Premium Fly Reels

- Loop Tackle Design

- Galvan Fly Reels

- Echo Fly Fishing

Frequently Asked Questions

Analyze common user questions about the Fly Fishing Reel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the premium fly fishing reel segment?

Growth in the premium segment is primarily driven by technological advancements, specifically fully sealed disc drag systems and precision CNC machining of aerospace-grade aluminum. These features offer superior durability and performance in challenging environments, attracting experienced, high-spending anglers seeking investment-grade equipment.

How does the type of drag mechanism impact reel performance?

The drag mechanism is crucial for controlling a fish during a fight. Disc drag systems offer superior, adjustable stopping power and heat dissipation, ideal for large, fast-running fish (e.g., salmon, tuna). Conversely, Click-and-Pawl systems are simpler, lighter, and often preferred for smaller species like trout where delicate line control and sound feedback are prioritized.

Which geographical region holds the largest market share for fly fishing reels?

North America (specifically the United States and Canada) holds the largest market share. This dominance is due to a highly established recreational angling culture, extensive water resources, high consumer disposable income allocated to leisure equipment, and the strong physical presence of leading global manufacturers.

What is the current trend regarding reel materials and manufacturing processes?

The prevailing trend favors precision-machined aluminum (specifically 6061-T6 or 7075-T6 alloys) reels over die-cast or composite alternatives, particularly in mid-to-high price points. This is due to the superior strength-to-weight ratio and ability of CNC machining to achieve extremely tight mechanical tolerances necessary for reliable, smooth drag operation.

What role does e-commerce play in the distribution of fly fishing reels?

E-commerce, including brand D2C channels and large online retailers, is playing an increasingly critical role, gaining market share from traditional specialty stores. The online channel offers wider product selection, price transparency, and convenient direct delivery, facilitating market expansion and reaching younger, digitally savvy consumers globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager