Foam Roller Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441875 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Foam Roller Market Size

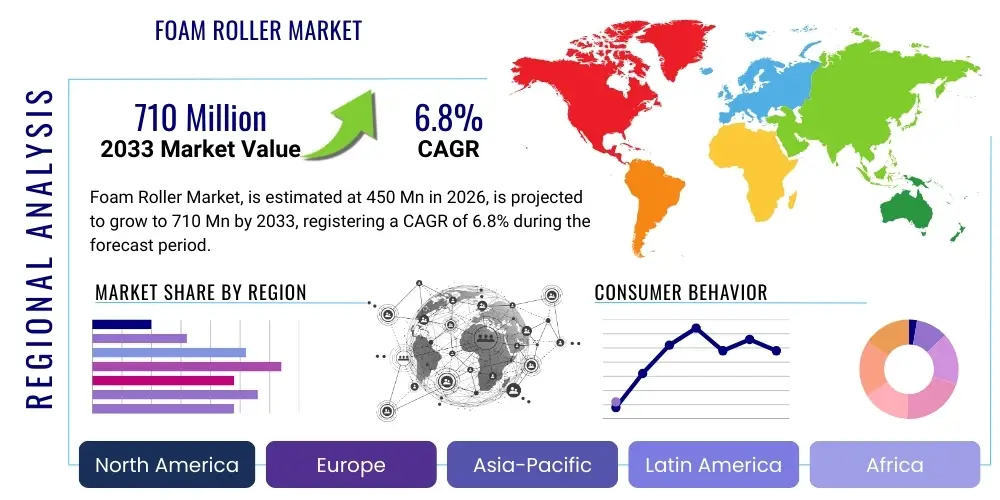

The Foam Roller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $710 Million USD by the end of the forecast period in 2033.

Foam Roller Market introduction

The Foam Roller Market encompasses the global trade and utilization of cylindrical self-myofascial release tools designed to aid muscle recovery, flexibility, and performance enhancement. Initially utilized primarily in professional sports and physical therapy settings, foam rollers have rapidly transitioned into mainstream consumer fitness products. This expansion is heavily driven by increasing global awareness regarding preventative healthcare, the benefits of self-care, and the rising participation rates in athletic and fitness activities, particularly among non-professional populations. The market includes diverse product types varying in density, material, texture, and technological integration, catering to a wide spectrum of user needs ranging from deep tissue massage to gentle warm-up routines.

Foam rollers are essentially dense cylinders used for applying pressure to specific muscle groups, simulating the effects of massage therapy. The core products are typically manufactured from materials like EPP (Expanded Polypropylene), EVA (Ethylene-Vinyl Acetate), or dense PVC, offering varying levels of firmness. Major applications span physiotherapy and rehabilitation, where they are integral for treating muscular imbalances and promoting recovery from injuries, and general sports and fitness, serving as essential tools for pre-workout stretching and post-workout cool-downs. Furthermore, the burgeoning demand for home fitness solutions, accelerated by global lifestyle changes, has cemented the foam roller's status as a staple piece of equipment in home gyms.

The primary benefits derived from consistent foam roller use include improved blood circulation, enhanced muscle flexibility, reduction of delayed onset muscle soreness (DOMS), and the breakdown of muscle knots or trigger points. These attributes directly support athletic longevity and overall physical well-being. The market is characterized by continuous product innovation, particularly the introduction of smart rollers with integrated vibration technology and connectivity features that provide data feedback on pressure application and intensity, elevating the user experience beyond traditional manual rolling.

Driving factors for market growth are multifaceted, centering predominantly on the pervasive trend of fitness and wellness consciousness across developed and developing economies. The increasing prevalence of musculoskeletal issues resulting from sedentary lifestyles, coupled with recommendations from fitness professionals and physical therapists endorsing self-myofascial release (SMR), fuels consumer adoption. Additionally, the affordability and portability of foam rollers, making them accessible alternatives to professional massage services, significantly contribute to their market penetration, establishing them as fundamental components of modern recovery protocols.

Foam Roller Market Executive Summary

The global Foam Roller Market is experiencing robust growth fueled by converging macro-trends in preventative health and at-home fitness. Key business trends indicate a strong move toward product diversification, with manufacturers increasingly investing in technologically advanced rollers such as vibrating models and those featuring ergonomic designs tailored for specific body parts. Strategic partnerships between foam roller manufacturers and digital fitness platforms, offering guided recovery sessions, are becoming crucial differentiators, enhancing perceived value and utility. Furthermore, sustainability in manufacturing materials—moving towards recycled or biodegradable foam options—is emerging as a vital competitive factor, appealing to environmentally conscious consumers and influencing purchasing decisions.

Regionally, North America maintains the leading market share due to high disposable incomes, deeply embedded fitness culture, and high awareness of sports injury prevention and recovery techniques. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, driven by rapidly expanding middle-class populations, increasing urbanization leading to sedentary jobs requiring recovery aids, and growing government initiatives promoting sports and wellness. European market stability is supported by established healthcare systems that often integrate SMR tools into rehabilitation programs, ensuring sustained, moderate growth. Competitive intensity is high, focusing on price points for standard rollers and feature differentiation for premium, vibrating segments.

Segmentation trends highlight the dominance of the Sports & Fitness application segment, though the fastest growth is observed within the Physiotherapy & Rehabilitation category, driven by clinical recommendations. By product type, standard EPP rollers remain volume drivers due to their cost-effectiveness, yet the Vibrating Foam Roller sub-segment is capturing significant market value due to its superior efficacy in deep tissue work and premium pricing. Distribution channel evolution shows a definitive shift toward Online Retail, which offers greater product variety, detailed user reviews, and comparative pricing, making it the preferred purchasing platform for educated consumers globally, especially for higher-end, specialized products.

AI Impact Analysis on Foam Roller Market

The integration of Artificial Intelligence (AI) and associated technologies into the Foam Roller market is primarily focused on enhancing personalized user experiences, optimizing usage efficiency, and providing objective feedback. Common user questions revolve around whether AI can truly replace the intuition of a physical therapist, how 'smart' rollers use data to guide technique, and the reliability of digital feedback on muscle recovery status. Users are particularly keen on understanding how AI can ensure they apply the correct pressure and target the specific trigger points without requiring expert supervision. The underlying expectation is that AI should transform the manual, subjective process of foam rolling into a quantifiable, objective, and therapeutically effective recovery session, accessible to everyone regardless of their anatomical knowledge.

AI’s influence is manifesting through connectivity and data processing capabilities embedded in high-end vibrating rollers. These smart devices utilize sensors to monitor pressure, duration, and movement patterns. AI algorithms then analyze this data against biomechanical models and established SMR protocols to provide real-time audio or visual feedback via connected mobile applications. This personalized guidance helps users avoid common errors, such as rolling too quickly or applying insufficient pressure, thus maximizing the physiological benefits of self-myofascial release. Furthermore, AI-driven applications can track a user's recovery progress over time, recommending optimal rolling routines based on their daily activity levels, sleep quality, and perceived muscle soreness, thereby linking recovery directly to performance metrics.

While AI will not replace the holistic assessment capabilities of a human physiotherapist, it significantly democratizes access to expert-level guidance for routine recovery maintenance. Future AI integration is expected to include predictive analytics—for instance, identifying areas of high muscular tension before the user feels acute pain, thereby shifting the focus further toward preventative care. This technological evolution enhances product differentiation for manufacturers, justifying premium pricing and establishing a new frontier of recovery tools that leverage data science to improve physical outcomes. This convergence of fitness technology and recovery science positions the market for sustained value growth.

- AI-enabled personalized recovery coaching via companion apps.

- Real-time sensor-based pressure and technique feedback optimization.

- Predictive analytics for early detection of muscular imbalances or stress points.

- Automated customization of rolling routines based on performance data and training load.

- Integration with broader digital health ecosystems (wearables, fitness trackers).

DRO & Impact Forces Of Foam Roller Market

The Foam Roller Market is fundamentally shaped by a robust set of Drivers (D) centered on wellness trends and accessibility, offset by structural Restraints (R) related to user education and product maturity, while vast Opportunities (O) emerge from technological enhancement and demographic expansion. The combined impact forces suggest a market characterized by high consumer acceptance but needing differentiation strategies to maintain margin growth. The primary driving force—the massive shift towards preventative self-care and functional fitness—continues to overshadow localized restraints related to perceived discomfort and the need for proper technique, ensuring a positive overall market trajectory.

Drivers: A key driver is the increasing incidence of lifestyle diseases and chronic back pain, prompting individuals to seek affordable, non-pharmaceutical solutions for pain management and mobility improvement. The proliferation of digital fitness content and social media influencers advocating for recovery tools rapidly spreads product awareness and validates usage. Furthermore, the high ROI (Return on Investment) for consumers, stemming from the foam roller's dual function in warm-up/cool-down and injury rehabilitation, makes it an attractive investment compared to recurring professional services. The convenience of at-home use ensures compliance and continuous demand across various consumer segments, from casual users to elite athletes.

Restraints: Significant restraints include the initial discomfort experienced by novice users, which can lead to early abandonment. More critically, the lack of proper user education regarding rolling technique can render the product ineffective or, worse, potentially harmful, demanding substantial investment in instructional content from manufacturers. The market's high degree of maturity, especially in the standard foam roller category, results in intense price competition and commoditization, eroding profit margins for entry-level products. Furthermore, skepticism exists among some traditional medical professionals regarding the scientific long-term efficacy compared to manual therapy, although this stance is slowly evolving with new research.

Opportunities: Major opportunities reside in expanding into specialized demographics, such as the aging population requiring gentle mobility aids, and targeted industrial applications, focusing on workplace wellness programs to reduce musculoskeletal claims. Technological innovation presents the strongest opportunity; the transition to smart, connected, and vibrating rollers allows companies to command premium prices and establish proprietary ecosystems based on performance data. Additionally, expansion into emerging markets (e.g., specific regions within APAC and MEA) where fitness infrastructure is nascent but growing, provides long-term untapped potential for market penetration and establishing brand loyalty early.

Segmentation Analysis

The Foam Roller Market is highly segmented across Product Type, Material, Application, and Distribution Channel, reflecting the diverse needs of consumers ranging from casual home users to professional athletes and clinical patients. Understanding these segmentations is critical for market players to tailor product development, pricing strategies, and distribution networks effectively. The segmentation framework reveals that product innovation—specifically within the vibrating and specialized texture categories—is driving value growth, while volume remains concentrated in the basic, lower-cost segments utilizing traditional materials like EPP. The dominance of the Sports & Fitness application highlights the core market identity, yet strong growth in the clinical sector signals diversification.

Analysis by material showcases a persistent reliance on expanded polymers for their balance of durability and cost, though there is an observable shift towards higher-density, premium materials like high-grade EVA for enhanced deep-tissue effectiveness. The distributional analysis underscores the ongoing digital transformation of retail, making online platforms the primary conduit for reaching a global, information-seeking customer base. Manufacturers must therefore ensure strong digital presence, optimized listings, and robust e-commerce logistics to capture market share across all segment categories and capitalize on prevailing consumer purchasing habits.

- By Product Type: Standard, Textured/Bumpy, Vibrating, Half, Others (e.g., specialized shapes).

- By Material: EPP (Expanded Polypropylene), EVA (Ethylene-Vinyl Acetate), PVC (Polyvinyl Chloride), Others (e.g., natural cork, bamboo composites).

- By Application: Physiotherapy & Rehabilitation, Sports & Fitness, Home Use.

- By Distribution Channel: Online Retail, Specialty Stores (Sporting Goods), Supermarkets/Hypermarkets, Pharmacies/Drug Stores.

Value Chain Analysis For Foam Roller Market

The value chain of the Foam Roller Market begins with the upstream procurement of raw materials, primarily various types of polymers such as EPP, EVA, and PVC, alongside specialized components like battery systems and vibration motors for high-end models. Upstream analysis focuses heavily on material sourcing and efficient manufacturing processes, where cost control through bulk purchasing of polymers and specialized molding techniques are paramount. Manufacturers aim for materials offering optimal density, resilience, and longevity while increasingly prioritizing sustainable sourcing to meet growing consumer and regulatory demands for eco-friendly products. Supply chain resilience, particularly the management of polymer price volatility and ensuring a reliable flow of electronic components, is a major focus area in the current geopolitical climate.

The midstream involves manufacturing, branding, and distribution logistics. Production facilities often leverage automated molding and finishing processes to ensure consistency in product density and texture. Branding is crucial, transforming a simple cylindrical tool into a recognized recovery aid, necessitating investments in industrial design, packaging, and instructional content. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves selling through proprietary brand websites or exclusive clinical supply chains, offering higher margins and control over customer experience. Indirect distribution, which accounts for the majority of the market volume, relies heavily on large e-commerce platforms and global retail chains.

Downstream analysis focuses on reaching the end-user through various points of sale and post-purchase support. The effectiveness of the indirect channel is highly dependent on logistics efficiency, retailer partnerships, and merchandising efforts within specialty fitness stores. Online Retail has significantly optimized the downstream segment by removing geographical barriers and enabling direct-to-consumer relationships, facilitating quicker product launches and iterative design based on direct user feedback. Post-sale support, especially instructional videos and access to proprietary rolling programs (often via app integration for smart rollers), enhances perceived value and drives brand loyalty, completing the comprehensive value proposition offered to the end-user.

Foam Roller Market Potential Customers

Potential customers for the Foam Roller Market are broadly categorized into three major groups: the Athletic/Fitness Enthusiast, the Clinical/Rehabilitation Patient, and the General Wellness/Sedentary Professional. The Athletic/Fitness Enthusiast segment, encompassing gym-goers, runners, yogis, and competitive sports players, represents the highest volume of consumers. These buyers typically seek high-performance rollers, often textured or vibrating models, focused on maximizing recovery speed and improving athletic output. Their purchasing decisions are often influenced by endorsements from trainers, coaches, and credible social media sources, prioritizing durability, specific textures for deep tissue massage, and advanced technological features that offer measurable results.

The Clinical/Rehabilitation Patient segment includes individuals recovering from injuries, undergoing physical therapy, or managing chronic pain conditions such as fibromyalgia or sciatica. This segment, driven heavily by referrals from medical professionals (physical therapists, chiropractors), tends to prioritize softer, half-size, or specialized ergonomic rollers that allow for gentler, controlled pressure application. For these customers, therapeutic validation, material quality, and adherence to medical standards are more important than competitive pricing or advanced technology. They are primarily reached through specialty medical suppliers and pharmaceutical distribution channels, ensuring clinical suitability and safety.

Finally, the General Wellness/Sedentary Professional segment comprises individuals with sedentary jobs who seek simple, cost-effective tools to combat stiffness, improve posture, and alleviate mild back pain associated with long periods of sitting. This segment requires entry-level, standard EPP rollers that are affordable, easy to use, and require minimal technique instruction. These customers are highly sensitive to price and convenience, making general retail channels (Supermarkets/Hypermarkets) and large mass-market online retailers the most effective routes for penetration. The educational component is critical here, focusing marketing messages on simple pain relief and general mobility improvement rather than complex athletic performance metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $710 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TriggerPoint, TheraBand (Performance Health), Hyperice, RumbleRoller, Gaiam, Nike, Adidas, Rephlex, AcuRite, 321 STRONG, PTP, Pro-Tec Athletics, RAD, Rollga, Blackroll, OPTP, Brazyn, Moji, Foamology, Stamina Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foam Roller Market Key Technology Landscape

The technological landscape of the Foam Roller Market is rapidly evolving beyond simple molded foam products, driven by the consumer demand for enhanced efficacy and measurable results. The most significant technological advancement is the integration of high-frequency vibration technology. Vibrating foam rollers utilize internal motors to deliver targeted oscillatory input, which is scientifically proven to penetrate deeper into muscle tissue, increase circulation, and reduce pain perception more effectively than static rolling. This technology allows users to achieve self-myofascial release with less physical effort and potentially shorter session times, substantially enhancing the therapeutic value and forming the basis for the premium segment of the market.

Connectivity and smart features represent the secondary tier of technological progress. Advanced rollers incorporate sensors (pressure/movement) and Bluetooth connectivity, linking the physical product to mobile applications. These apps utilize data processing capabilities—often underpinned by AI algorithms—to guide users through specific routines, track consistency, and analyze applied pressure patterns. This shift transforms the product from a static recovery tool into an interactive, personalized coaching device. Furthermore, the development of new high-density, closed-cell polymer formulations (such as proprietary EVA blends) contributes to technological progress by offering superior durability, hygiene standards (easier to clean), and customized firmness profiles tailored for elite performance or sensitive rehabilitation needs.

Material science is also playing a crucial role, particularly in lightweight yet robust design, often utilizing hollow core designs with internal PVC structures wrapped in high-density foam to maintain structural integrity while minimizing weight for portability. The pursuit of sustainable technology, including the use of recycled plastics and naturally sourced materials like cork or bamboo composites, reflects an industry effort to align product innovation with environmental responsibility. The convergence of biomechanical insight, motor technology, sensor integration, and material science defines the competitive technological edge in the contemporary foam roller market, pushing average selling prices upwards and expanding the utility of these recovery devices.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the high expenditure on sports recovery, extensive penetration of organized fitness activities, and strong consumer awareness of SMR benefits. The US and Canada boast high adoption rates of premium and vibrating foam rollers, supported by a dense network of specialized retail stores and a mature e-commerce infrastructure. Technological innovation and early adoption of connected fitness devices cement North America’s position as a market leader.

- Europe: The European market shows steady and sustained growth, bolstered by comprehensive public and private healthcare systems that often incorporate foam rolling into standard physical rehabilitation protocols. Germany, the UK, and France are key contributors, characterized by a preference for high-quality, durable materials and increasing demand for certified clinical-grade products. Emphasis on holistic wellness and outdoor fitness further drives consumption.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market over the forecast period. Growth is spurred by rising disposable incomes, rapid urbanization, and a burgeoning interest in Western-style fitness culture, particularly in countries like China, India, and Australia. While price sensitivity remains a factor in developing nations, rapid expansion of gym chains and increasing health consciousness are accelerating the adoption of basic and mid-range foam rollers.

- Latin America (LATAM): Growth in LATAM is moderate, influenced by fluctuating economic stability but demonstrating significant potential, particularly in Brazil and Mexico. The market is driven by increasing participation in popular sports and a growing young, athletic demographic. Affordability is a major factor, leading to a higher penetration of basic EPP rollers, though premium brands are gaining traction in major metropolitan centers.

- Middle East and Africa (MEA): The MEA region is characterized by nascent market development. Growth is concentrated in the Gulf Cooperation Council (GCC) countries, propelled by substantial government investment in public health, large-scale sporting events, and luxury fitness facilities. The high-end consumer segment in the UAE and Saudi Arabia shows a preference for technologically advanced and branded recovery tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foam Roller Market.- TriggerPoint

- TheraBand (Performance Health)

- Hyperice

- RumbleRoller

- Gaiam

- Nike

- Adidas

- Rephlex

- AcuRite

- 321 STRONG

- PTP

- Pro-Tec Athletics

- RAD

- Rollga

- Blackroll

- OPTP

- Brazyn

- Moji

- Foamology

- Stamina Products

Frequently Asked Questions

Analyze common user questions about the Foam Roller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the Foam Roller Market?

The Foam Roller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% from 2026 to 2033, driven primarily by increasing global health consciousness and the demand for self-myofascial release tools.

Which product type dominates the market, and which is growing fastest?

Standard (EPP) foam rollers currently account for the largest volume share due to cost-effectiveness. However, the Vibrating Foam Roller segment is exhibiting the fastest growth in terms of market value, owing to advanced technology and superior efficacy in deep tissue recovery.

How is AI impacting the performance and utility of foam rollers?

AI integration is enhancing foam roller utility through smart, connected devices that provide personalized, real-time feedback on pressure, technique, and duration via mobile applications, transforming the subjective rolling process into a quantifiable, objective recovery protocol.

Which distribution channel is most critical for future market expansion?

Online Retail is identified as the most critical distribution channel for future expansion, facilitating global reach, offering greater product variety, and serving as the primary platform for sales of high-end, technologically sophisticated foam rollers.

What are the primary restraints hindering market growth in developed regions?

Primary restraints include the high commoditization of basic foam products, intense price competition, and the necessity for extensive user education to prevent improper technique, which can limit the perceived therapeutic benefit for novice users.

Is the use of EPP material diminishing due to environmental concerns?

While EPP (Expanded Polypropylene) remains a dominant material due to its low cost and durability, the market is seeing a definite trend towards sustainable alternatives, including recycled plastics and natural materials like cork, driven by manufacturers seeking eco-conscious differentiation.

What role does the physiotherapy and rehabilitation application play in market dynamics?

The Physiotherapy & Rehabilitation segment provides critical validation and sustained demand, ensuring the adoption of foam rollers in clinical settings. This application segment is vital for market stability and drives innovation toward specialized, therapeutic product designs.

Which region offers the greatest growth opportunity for manufacturers?

The Asia Pacific (APAC) region offers the greatest long-term growth opportunity due to rising middle-class populations, increasing urbanization, and the rapid expansion of organized fitness and wellness facilities across key emerging economies.

How are manufacturers ensuring their products stand out in a saturated market?

Manufacturers are employing differentiation strategies by investing heavily in high-end vibration technology, integrating smart sensors and AI-driven applications, and focusing on sustainable material sourcing and ergonomic designs for targeted body parts.

Are foam rollers effective for managing chronic pain conditions?

Foam rollers are frequently recommended by physical therapists to manage and alleviate chronic pain conditions, such as lower back stiffness and mild sciatica, by improving local blood flow and reducing trigger points, forming a core component of self-managed musculoskeletal care.

What is the significance of the shift toward home use in the market?

The shift toward home use, accelerated by global events and lifestyle changes, has made foam rollers a staple item in home gyms. This trend boosts sales volumes across all price points, highlighting the demand for convenient, accessible self-care tools.

What are the typical end-users for high-density EVA foam rollers?

High-density EVA foam rollers are typically preferred by athletic individuals, professional trainers, and seasoned users who require extreme firmness and durability for intensive deep tissue work and the release of severe muscle knots or fascia restrictions.

How does the value chain manage material cost volatility?

The value chain manages material cost volatility in polymer sourcing through strategic long-term contracts with suppliers, diversification of material sources, and leveraging large-scale automated manufacturing to optimize processing efficiency and reduce per-unit production costs.

What challenges do new entrants face regarding distribution?

New entrants face challenges in establishing distribution partnerships with major specialty stores and mass retailers. Overcoming this often requires heavily relying on optimized Online Retail channels, strong digital marketing, and competitive pricing strategies to gain initial visibility.

Is there a recognized standard density for effective myofascial release?

While there is no single mandated standard density, professional consensus typically recommends mid-to-high density foam for effective myofascial release, ensuring sufficient pressure is applied to the fascia without causing excessive pain or bruising, leading to materials like high-density EVA or EPP being favored.

What are the key differences between textured and smooth foam rollers?

Textured (bumpy) foam rollers are designed to mimic a therapist's fingers and thumbs, targeting specific trigger points and providing a deeper, more localized massage, whereas smooth rollers offer a broad, even pressure distribution over larger muscle groups, suitable for general muscle sweep and circulation improvement.

How do smart foam rollers ensure technique correction?

Smart foam rollers utilize pressure sensors to detect imbalances or insufficient rolling speed. They communicate this data to a connected app, which provides immediate auditory or visual cues, acting as a virtual coach to correct user technique and maximize the therapeutic session.

What impact is sustainability having on product innovation?

Sustainability is driving innovation toward using recycled polymers, cork, and bamboo composites. Manufacturers are focusing on durable, long-lasting designs and minimal packaging to reduce environmental footprint, appealing to a growing segment of environmentally conscious consumers.

Why is North America the leading market despite saturation?

North America maintains market leadership due to high per-capita spending on fitness, established consumer education regarding self-care tools, and continuous rapid adoption of premium, high-tech products like vibrating and connected recovery devices, sustaining high market value.

Are foam rollers primarily used before or after workouts?

Foam rollers are used both before and after workouts. Pre-workout rolling helps to increase blood flow and prepare muscles for activity (dynamic stretching), while post-workout rolling is crucial for reducing muscle soreness (DOMS) and accelerating fascia recovery.

How important are social media and influencer endorsements in driving sales?

Social media and influencer endorsements are highly important, particularly for the Athletic/Fitness Enthusiast segment. They act as powerful validation tools, providing demonstration and credibility, which directly influences purchasing decisions for mid-range and premium products.

What is the competitive landscape like for the vibrating foam roller segment?

The vibrating segment is highly competitive but characterized by differentiation based on battery life, motor strength, frequency settings, and technological features (connectivity, app integration). Key players like Hyperice and TriggerPoint hold strong positions due to patent protection and early market entry.

What are the market implications of the high prevalence of sedentary lifestyles globally?

Sedentary lifestyles serve as a major market driver, creating a massive potential customer base experiencing musculoskeletal discomfort. This fuels demand for simple, accessible tools like foam rollers to alleviate tightness associated with prolonged sitting, bolstering the Home Use segment.

What distinguishes a clinical-grade foam roller from a consumer model?

Clinical-grade foam rollers are often distinguished by specific material certifications, medical-grade density consistency, and ergonomic designs approved by physical therapists, focusing on safe and targeted rehabilitation rather than just athletic performance enhancement.

What is the average price range for entry-level foam rollers?

Entry-level, standard EPP foam rollers typically fall within the $15 to $30 USD range, reflecting their commoditized nature, making them accessible to the general consumer and mass-market retail channels.

How are small businesses innovating within this market?

Small businesses often innovate by focusing on niche products, such as specialized ergonomic shapes (e.g., for specific spinal alignment), unique materials (e.g., cork), or highly specialized digital content delivery, carving out segments not fully addressed by large multinational brands.

Is there an observable trend toward softer or firmer rollers?

The market shows a bifurcated trend: continued high volume demand for basic, medium-to-firm rollers for general fitness, alongside increasing demand for both extremely soft (for delicate rehabilitation) and extremely firm/textured rollers (for intense athletic recovery and deep tissue work).

How does increased awareness of chronic pain contribute to sales?

Increased awareness of chronic pain, particularly among older demographics, drives sales by positioning foam rollers as an effective, non-invasive, and affordable tool for daily pain management, often recommended as a first line of defense before seeking complex medical interventions.

What measures are manufacturers taking to overcome the restraint of 'initial discomfort'?

Manufacturers address initial discomfort by offering lower-density, softer options for beginners and by producing extensive instructional content, including guided beginner rolling videos via apps, ensuring a gentler introduction to SMR techniques.

What competitive advantage does patenting specialized roller textures provide?

Patenting specialized roller textures (e.g., unique grid systems or specific bumps) provides a critical competitive advantage, allowing manufacturers to claim superior efficacy in muscle manipulation and prevent competitors from replicating their specific deep tissue massage feel, justifying higher price points.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Foam Roller Market Statistics 2025 Analysis By Application (Commercial Use, Family Use, The commercial holds an important share in terms of applications, and accounts for 58 Percent of the market share.), By Type (Hollow Foam Roller, Solid Foam Roller), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Foam Roller Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hollow Foam Roller, Solid Foam Roller), By Application (Commercial Use, Family Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager