Foaming Coffee Creamer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443279 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Foaming Coffee Creamer Market Size

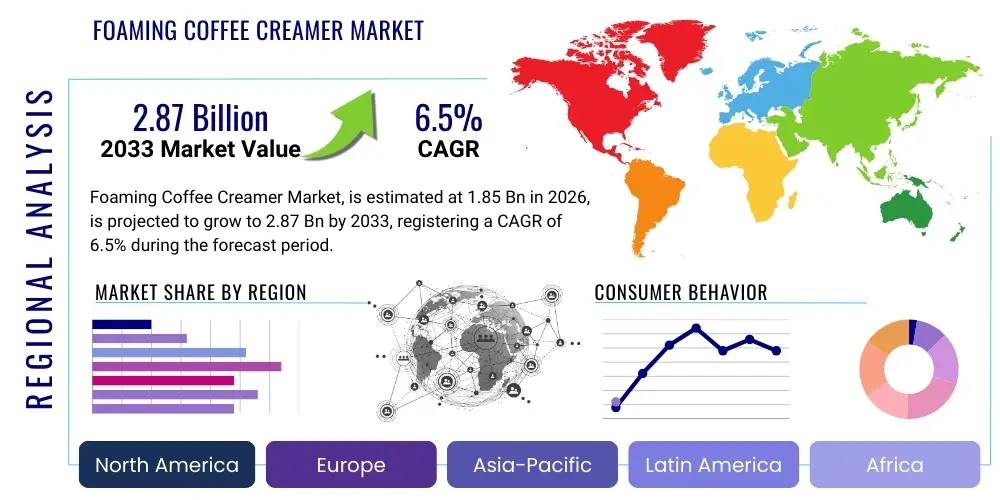

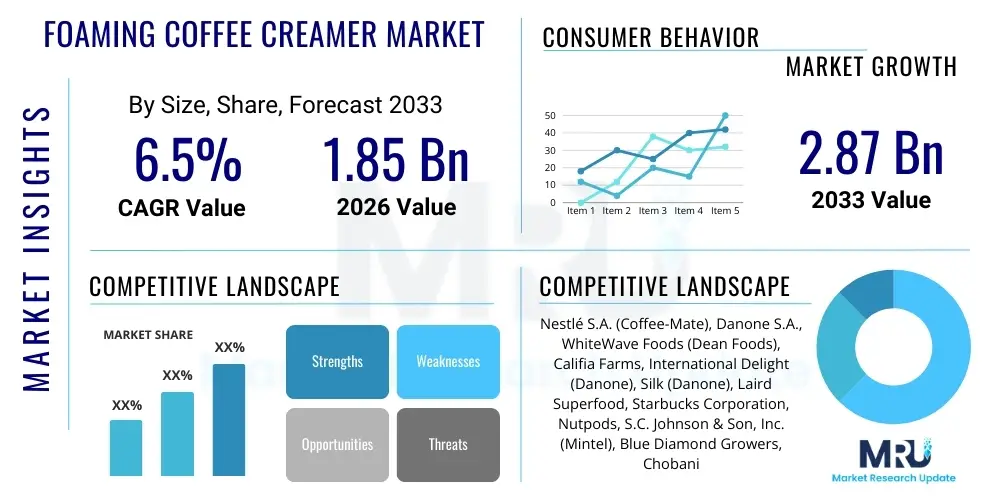

The Foaming Coffee Creamer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

The valuation reflects robust consumer demand for convenient, café-quality beverage experiences at home. Foaming creamers offer an enhanced textural element, mimicking the richness and froth of professional espresso drinks, which appeals strongly to Millennials and Gen Z consumers seeking premiumization in their daily routines. Market expansion is further fueled by ongoing innovations in flavor profiles and functional ingredients, including clean labels and added protein or vitamin fortifications.

Growth is predominantly driven by North America and Europe, regions characterized by high per capita coffee consumption and established retail infrastructures. However, emerging markets in Asia Pacific are showing accelerated adoption rates due to rising disposable incomes and the increasing Westernization of dietary habits. Manufacturers are focusing heavily on supply chain efficiency and product diversification, particularly in the booming plant-based segment, to capture a broader consumer base and sustain the projected high-growth trajectory through 2033.

Foaming Coffee Creamer Market introduction

The Foaming Coffee Creamer Market encompasses products specifically designed to provide a frothy, airy texture when added to hot coffee or other beverages, replicating the mouthfeel of beverages typically prepared using professional steam wands. These products are available in liquid and powdered forms, utilizing advanced emulsification and stabilization technologies to achieve their characteristic foam upon mixing. Major applications span home consumption, office use, and small commercial settings, offering consumers an accessible way to elevate their standard cup of coffee.

These creamers offer significant benefits, including convenience, consistent quality, and a variety of flavor options (such as vanilla, caramel, hazelnut, and seasonal specialties) that surpass traditional non-foaming alternatives. The primary driving factors for market growth include the rising global consumer interest in gourmet coffee experiences, the increasing preference for convenient at-home preparation, and the widespread success of non-dairy formulations, which appeal to health-conscious and lactose-intolerant consumers. Furthermore, aggressive marketing and product placement strategies by leading food and beverage conglomerates are accelerating consumer awareness and trial rates across all key demographics.

The market environment is highly competitive, characterized by frequent new product launches centered around clean ingredients, sustainability, and unique textural enhancements. Product descriptions often highlight ease of use—simply pour or scoop and stir—making them appealing to busy consumers. The functional aspect of creating a luxurious froth without specialized equipment solidifies their position as a high-value addition to the daily coffee ritual, positioning the market for sustained, rapid growth over the next decade.

Foaming Coffee Creamer Market Executive Summary

The Foaming Coffee Creamer market is undergoing dynamic transformation, spearheaded by key business trends emphasizing clean-label ingredients, plant-based alternatives, and functional food attributes. Leading manufacturers are investing heavily in R&D to optimize foaming stability across various temperature ranges and coffee types, ensuring a consistently premium consumer experience. Strategic partnerships between creamer producers and leading coffee retailers are also emerging, aimed at cross-promotion and expansion into new distribution channels, including foodservice and ready-to-drink (RTD) formats.

Regionally, North America maintains market dominance due to high discretionary spending on premium groceries and a mature culture of coffee consumption outside the traditional espresso format. However, the Asia Pacific region is forecast to exhibit the highest CAGR, propelled by urbanization, increasing adoption of convenience foods, and the rapid expansion of organized retail in countries like China and India. European growth is steady, driven primarily by strong demand for non-dairy options, particularly oat and almond bases, aligning with regional sustainability and dietary preferences. Regulatory standards regarding ingredient disclosure and allergen labeling are becoming increasingly stringent across these key geographies, influencing formulation choices.

Analysis of segment trends reveals that the plant-based category, especially oat milk and coconut cream variants, is significantly outpacing traditional dairy-based growth. Flavor innovation remains critical, with complex, dessert-inspired, and ethnic flavors gaining traction over classic profiles. Distribution channel trends show accelerated growth through the e-commerce segment, capitalizing on subscription models and direct-to-consumer strategies that offer convenience and personalized purchasing options. This shift necessitates robust digital marketing strategies and optimized supply chain logistics for cold-chain management where applicable.

AI Impact Analysis on Foaming Coffee Creamer Market

Analysis of common user questions regarding AI's impact on the Foaming Coffee Creamer market reveals significant consumer curiosity and business expectation regarding operational efficiency, personalized product development, and predictive demand forecasting. Key themes center on whether AI can enhance flavor discovery, optimize supply chain resilience, and personalize consumer communication. Users frequently ask about AI's role in identifying niche flavor trends before they hit mainstream popularity and how machine learning (ML) can improve the stability and texture of complex, multi-component creamer formulations, particularly in non-dairy bases. A prevailing concern is ensuring that automation driven by AI maintains the perceived quality and artisanal appeal of premium coffee experiences, rather than leading to generic, mass-produced products.

- AI-driven sensory analysis and flavor profiling accelerates the development of novel and hyper-personalized creamer tastes, reducing time-to-market for trending flavors.

- Machine learning algorithms optimize manufacturing processes, ensuring consistent foaming stability and texture quality across diverse production batches and ingredient variations.

- Predictive analytics enhance supply chain management by forecasting demand fluctuations based on seasonal trends, social media sentiment, and weather patterns, minimizing waste and stockouts.

- AI-powered customer relationship management (CRM) facilitates hyper-targeted marketing campaigns, recommending specific creamer flavors and formulations based on individual purchasing history and demographic profiles.

- Robotics and automation, guided by AI, increase packaging speed and accuracy, particularly in high-volume production facilities, leading to lower operational costs.

- Computer vision systems are implemented for quality control during emulsification and mixing stages, immediately identifying inconsistencies in ingredient dispersion that might compromise foaming capability.

DRO & Impact Forces Of Foaming Coffee Creamer Market

The Foaming Coffee Creamer market is shaped by a confluence of accelerating drivers, structural restraints, and emerging strategic opportunities, collectively defining the impact forces across the industry landscape. Drivers include the global premiumization trend in daily beverages, the convenience factor associated with at-home preparation, and intense innovation in plant-based ingredients catering to dietary restrictions and ethical preferences. These drivers are fundamentally expanding the addressable market beyond traditional coffee consumers to include a broader wellness-focused demographic seeking functional benefits in their daily intake.

However, market expansion faces notable restraints, primarily centered around the cost sensitivity of raw materials, particularly specialized emulsifiers and stabilizers necessary for consistent foaming properties. Furthermore, regulatory scrutiny regarding the nutritional profile (especially sugar and saturated fat content) of flavored creamers poses a challenge, forcing manufacturers to reformulate products for 'better-for-you' positioning. Maintaining product stability, preventing phase separation, and ensuring a long shelf life, particularly in liquid refrigerated formats, adds complexity and cost to the logistics chain.

Opportunities for high growth are abundant, focusing on geographical expansion into underserved emerging markets, the development of sophisticated functionality (e.g., keto-friendly, high-protein creamers), and strategic alliances with coffee machine manufacturers for co-branded solutions. The overall impact forces suggest a highly dynamic and competitive environment where innovation in clean-label technology and efficient distribution logistics will be paramount for securing sustained market share, particularly as global consumers continue to demand both indulgence and nutritional integrity.

Segmentation Analysis

The Foaming Coffee Creamer Market is segmented across several critical dimensions, enabling manufacturers to precisely target diverse consumer needs and preferences. Key segmentation hinges upon ingredient composition (dairy vs. plant-based), format (liquid vs. powder), flavor profiles (traditional, seasonal, and gourmet), and distribution channels. The proliferation of specialized diets and lifestyle choices, such as veganism and keto, has made the ingredient composition segment the most influential driver of new product development and subsequent market share shifts. Understanding these segments is crucial for accurate forecasting and tailored marketing strategies designed to capture specific demographic pockets seeking customized coffee enhancements.

The segmentation structure reflects the market's evolution from a simple convenience product to a sophisticated, specialized additive. For example, the flavor segment has moved far beyond basic vanilla and hazelnut, now featuring highly complex, dessert-inspired options (like salted caramel mocha or pumpkin spice latte variations) that blur the line between beverage enhancement and treat. Similarly, the distribution channel breakdown highlights the growing importance of online platforms, which offer direct access to artisanal and niche creamer brands that may not be available in traditional supermarket settings, fundamentally altering consumer purchasing patterns.

- By Type:

- Dairy-Based (Traditional, Lactose-Free Dairy)

- Non-Dairy/Plant-Based (Oat, Almond, Coconut, Soy, Pea Protein)

- By Format:

- Liquid (Refrigerated and Shelf-Stable)

- Powdered (Instant and Single-Serve Packets)

- By Flavor:

- Vanilla

- Caramel

- Hazelnut

- Original/Unsweetened

- Seasonal/Limited Edition (e.g., Pumpkin Spice)

- Gourmet/Specialty (e.g., Chocolate, Irish Cream)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Foodservice/Commercial

- By Application:

- Home Use

- Commercial/Office Use

- Cafes and Restaurants

Value Chain Analysis For Foaming Coffee Creamer Market

The value chain for the Foaming Coffee Creamer Market begins with upstream activities, focusing heavily on sourcing specialized ingredients. This includes high-quality milk solids, various plant bases (oats, almonds, coconut), specialty sugars, and crucially, sophisticated emulsifying and stabilizing agents necessary to create and maintain the desirable foam structure. Key challenges in the upstream segment involve securing sustainable and ethically sourced plant-based components and managing commodity price volatility for dairy inputs. Efficient ingredient procurement and quality assurance protocols are vital to ensure the final product delivers consistent foaming performance.

Midstream processing involves complex formulation, blending, homogenization, and pasteurization processes, often requiring proprietary technology to stabilize the foam-generating properties within the liquid or powdered matrix. Manufacturing excellence focuses on minimizing processing time while maximizing shelf stability and sensorial attributes. The downstream segment involves packaging (both bulk and single-serve), warehousing, and distribution. Given the increasing prominence of liquid, refrigerated creamers, cold-chain logistics management becomes a critical and cost-intensive component of the value chain, particularly when distributing across vast geographical regions.

Distribution channels are dual-pronged: direct and indirect. Direct distribution involves e-commerce fulfillment and direct sales to large commercial clients (foodservice), allowing for greater control over brand presentation and pricing. Indirect distribution relies heavily on partnerships with major retailers, wholesalers, and third-party logistics (3PL) providers to achieve maximum market penetration. The overall efficiency of the distribution network, particularly the seamless integration between physical retail and rapidly growing online channels, significantly determines the accessibility and market success of foaming creamer products.

Foaming Coffee Creamer Market Potential Customers

Potential customers for the Foaming Coffee Creamer market are highly diverse but primarily segment into three key user groups: convenience-seeking home consumers, specialty diet followers, and commercial enterprises. The primary end-user is the busy home consumer (Millennials and Gen Z being key targets) who values the ability to recreate expensive, café-style beverages instantly and affordably without the need for specialized equipment like espresso machines or milk frothers. These users prioritize ease of use, flavor variety, and aesthetic appeal in their morning routine, often using social media platforms to share their homemade creations.

The second major group comprises consumers adhering to specialty diets, including vegan, lactose-intolerant, ketogenic, and paleo individuals. This demographic drives the robust demand for advanced non-dairy foaming creamers made from oat, almond, or coconut bases, often seeking clean-label products with lower sugar content. These buyers are typically highly informed, focusing intensely on ingredient lists, nutritional value, and functional benefits, such as added collagen or MCT oils, positioning them as highly loyal, yet discerning, purchasers.

Lastly, the commercial sector, including small-to-mid-sized offices, catering services, and small independent coffee shops, represents a stable segment. These buyers utilize bulk or single-serve creamer formats to provide high-quality coffee enhancements to employees or patrons without the capital expenditure or operational complexity of managing fresh dairy and professional frothing equipment. For these commercial end-users, consistency, long shelf-life, and cost-effectiveness are the paramount purchasing criteria, ensuring a reliable supply of premium coffee additives for their operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A. (Coffee-Mate), Danone S.A., WhiteWave Foods (Dean Foods), Califia Farms, International Delight (Danone), Silk (Danone), Laird Superfood, Starbucks Corporation, Nutpods, S.C. Johnson & Son, Inc. (Mintel), Blue Diamond Growers, Chobani, HP Hood LLC, Creamer King Foods, Elmhurst 1925, Rich Products Corporation, Tate & Lyle PLC, SunOpta Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foaming Coffee Creamer Market Key Technology Landscape

The technological landscape of the Foaming Coffee Creamer market is dominated by advancements in emulsification science, stabilization systems, and specialized processing equipment designed to handle high-fat and high-protein content without separation. Key technologies involve micro-encapsulation techniques, which protect active ingredients and volatile flavor compounds until activation by hot liquid, ensuring a burst of freshness and consistent foam formation upon stirring. Furthermore, the industry leverages high-pressure homogenization (HPH) to create extremely fine and stable emulsions, which are crucial for the textural quality and shelf stability required, particularly in liquid, shelf-stable formats.

A major focus area is the development of non-dairy bases that can mimic the foaming performance of traditional dairy proteins. This involves utilizing specialized hydrocolloids, modified starches, and advanced protein isolates (like pea or rice protein) formulated to entrap air efficiently. The challenge lies in ensuring these ingredients perform consistently under acidic conditions, such as high-acidity coffee, without curdling or collapsing the foam. Continuous process improvement through aseptic processing and ultra-high-temperature (UHT) treatment ensures extended shelf life for liquid products while maintaining nutritional integrity and foam functionality.

In the powdered segment, spray drying remains the foundational technology, but it is being refined to create porous, low-density particles that dissolve instantly and produce a stable foam. Furthermore, packaging technology plays a supportive role, with innovations in barrier packaging and single-serve pods designed to protect the hygroscopic nature of powdered creamers and maintain the freshness of liquid varieties. These technological adaptations are critical competitive differentiators, allowing companies to offer superior textural experiences and cater to the demanding specifications of clean-label and functional ingredients.

Regional Highlights

Regional dynamics are critical drivers of the Foaming Coffee Creamer market, reflecting differences in consumption culture, ingredient availability, and regulatory frameworks. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributable to high consumer awareness of creamer products, a strong culture of daily coffee consumption, and rapid adoption of premium, convenient, and non-dairy alternatives. The region benefits from robust R&D spending by major global players and highly efficient retail distribution networks, leading to frequent flavor innovation and strong market penetration.

Europe represents a mature but rapidly evolving market, characterized by intense demand for plant-based and low-sugar options, aligning with the region's focus on health and sustainability. Countries such as Germany, the UK, and the Nordics show particularly high adoption rates for oat-based foaming creamers. European consumers often prioritize clean labels and verifiable sourcing, necessitating stringent supplier selection and formulation transparency from market entrants. The regulatory environment regarding food additives and labeling is also generally more stringent here than in other regions.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by expanding middle-class populations, Western dietary influence, and increasing urbanization. While coffee consumption is traditionally lower than in Western markets, the growth rate is accelerating, particularly in urban centers of China, South Korea, and Southeast Asian nations. Market players in APAC must focus on culturally relevant flavors and address diverse consumer preferences, often requiring smaller, more flexible packaging formats suitable for emerging modern retail channels. Latin America and the Middle East & Africa (MEA) remain emerging markets, where growth is primarily linked to the expansion of foodservice chains and rising income levels that permit discretionary spending on premium beverage enhancers.

- North America (Market Leader): Dominant due to high coffee consumption, consumer demand for convenience, and leading innovation in premium and plant-based foaming formulations.

- Europe (Sustainability Focus): Strong growth driven by clean-label mandates, high preference for non-dairy bases (especially oat), and stringent quality standards.

- Asia Pacific (Highest Growth Trajectory): Accelerated market penetration due to urbanization, increasing disposable incomes, and the adoption of Western coffee culture, creating demand for instant, high-quality foaming solutions.

- Latin America (Emerging Potential): Growth tied to expanding modern retail infrastructure and the increasing presence of multinational food and beverage companies.

- Middle East & Africa (Niche Growth): Focused expansion in urban hubs, often targeting expatriate communities and high-end retail sectors with premium imported options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foaming Coffee Creamer Market.- Nestlé S.A. (Coffee-Mate)

- Danone S.A. (International Delight, Silk)

- WhiteWave Foods (A subsidiary focusing on plant-based alternatives)

- Califia Farms

- Laird Superfood

- Starbucks Corporation (Through licensed retail products)

- Nutpods

- Blue Diamond Growers (Almond Breeze)

- Chobani

- HP Hood LLC

- Creamer King Foods

- Elmhurst 1925

- Rich Products Corporation

- Tate & Lyle PLC (Ingredient Supplier and Co-packer)

- SunOpta Inc. (Specializing in Plant-Based Ingredients)

- Kerry Group plc

- Mondelēz International

- J. M. Smucker Company (Dunkin' Creamers)

- Ripple Foods

- Coconut Cloud

Frequently Asked Questions

Analyze common user questions about the Foaming Coffee Creamer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Foaming Coffee Creamer Market?

The primary driver is the pervasive consumer trend toward premiumization and convenience, allowing consumers to easily replicate café-style, frothy coffee beverages at home without investing in expensive equipment. Additionally, the rapid innovation in delicious, stable plant-based (non-dairy) formulations is expanding the market reach significantly.

Which geographical region holds the largest market share for foaming coffee creamers?

North America currently holds the largest market share, driven by a deeply ingrained coffee culture, high household penetration of creamer products, and the continuous introduction of new, highly flavored, and functionally enhanced options by major manufacturers.

How are non-dairy creamers addressing the challenges of foaming stability?

Manufacturers utilize advanced food science technologies, including customized protein isolates (like pea and oat protein) and sophisticated hydrocolloids/emulsifiers, combined with high-pressure homogenization (HPH) techniques, to ensure non-dairy bases achieve and maintain a consistent, stable foam comparable to traditional dairy counterparts.

What is the projected Compound Annual Growth Rate (CAGR) for this market?

The Foaming Coffee Creamer Market is projected to exhibit a robust growth trajectory, forecasted to achieve a Compound Annual Growth Rate (CAGR) of 6.5% between the years 2026 and 2033, underscoring strong global consumer acceptance and product innovation.

What role does e-commerce play in the distribution of foaming coffee creamers?

E-commerce is a rapidly growing distribution channel, particularly for specialty, artisanal, and niche clean-label brands. Online platforms facilitate direct-to-consumer sales, offering convenience, subscription services, and direct access to specialized formulations that may not be stocked by traditional brick-and-mortar retail outlets.

The Foaming Coffee Creamer Market is poised for dynamic expansion, driven by continuous innovation that bridges the gap between indulgent experiences and health-conscious consumer demands. The strategic focus on plant-based ingredients, functional benefits, and optimized textural quality ensures the segment's sustained relevance within the broader global beverage market. Manufacturers achieving success will prioritize resilient supply chains, personalized marketing enabled by AI insights, and geographical expansion into high-growth APAC markets. The integration of advanced processing technologies to guarantee foam stability remains the core technical challenge and competitive differentiator across all key product formats. As consumer appetite for premium, convenient at-home beverage preparation continues to surge, the Foaming Coffee Creamer Market stands as a significant growth area within the food and beverage industry.

Future market analysis indicates a clear shift towards products that minimize artificial ingredients and prioritize transparent sourcing. This trend, coupled with the increasing adoption of personalized nutritional technologies, will likely necessitate modular manufacturing platforms capable of rapidly adapting to micro-trends in flavor and function. Investment in sustainable packaging and reduced carbon footprint certifications are also emerging as mandatory requirements for maintaining brand loyalty, especially among younger, environmentally aware consumer segments. The competitive intensity suggests that mergers, acquisitions, and strategic minority investments will continue to shape the vendor landscape, concentrating expertise in flavor science and stabilization technology among market leaders.

Furthermore, commercial applications present an untapped revenue stream. While home use currently dominates, the proliferation of self-service coffee stations in offices, hotels, and travel hubs represents a substantial opportunity for single-serve and bulk foaming creamer formats. Companies that successfully integrate their products into these commercial ecosystems through reliable dispensing systems and superior product performance will gain a critical advantage. Overall, the market remains highly attractive, characterized by strong consumer engagement and continuous technical refinement designed to deliver a consistently perfect, frothy cup of coffee every time, anywhere.

Innovation in flavor encapsulation and shelf-life extension technology remains pivotal for ensuring market vitality. Powdered foaming creamers, in particular, are benefiting from advancements that allow for flavor release upon contact with hot liquid, preserving volatile aroma compounds that often degrade in traditional processing methods. This technical refinement ensures that the perceived quality of the instant powdered product closely rivals that of its liquid, refrigerated counterpart. Strategic market positioning will increasingly rely on differentiating products not just by flavor, but by functional claims—such as enhanced energy, immune support, or gut health—integrating the creamer into the broader functional food ecosystem. This movement underscores the maturity of the market and the sophistication of consumer expectations regarding daily beverage additives. The need for precise temperature tolerance and consistency across various brewing methods (drip, espresso, pour-over) also drives ongoing investment in rheology and food chemistry R&D.

The regulatory outlook globally is tightening, particularly concerning artificial sweeteners and high fructose corn syrup content, which historically were staples in flavored creamer formulations. This regulatory pressure acts as both a restraint and an opportunity: while it mandates costly reformulation, it simultaneously rewards manufacturers who successfully innovate clean-label alternatives that maintain desired sweetness and textural profiles. Companies that proactively adapt to these health-oriented regulatory shifts are better positioned to capture the dominant share of future consumer spending, aligning their products with public health initiatives and increasing consumer scrutiny of nutritional labels. The intersection of health, convenience, and sensory indulgence is where the next phase of market growth will materialize.

Finally, emerging competitive threats include highly concentrated coffee concentrates and specialty instant coffee products that integrate creamer and foaming agents directly into the base product. While these represent alternatives, the dedicated foaming creamer market maintains its edge by offering customization and versatility, allowing consumers to control their coffee strength, milk base, and flavor intensity independently. To counteract competitive dilution, market leaders are focusing on multi-functionality, ensuring their foaming creamers are also suitable for cold beverages, cooking applications, and seasonal drink mixes, thus maximizing their utility and cementing their value proposition within the household grocery budget.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager