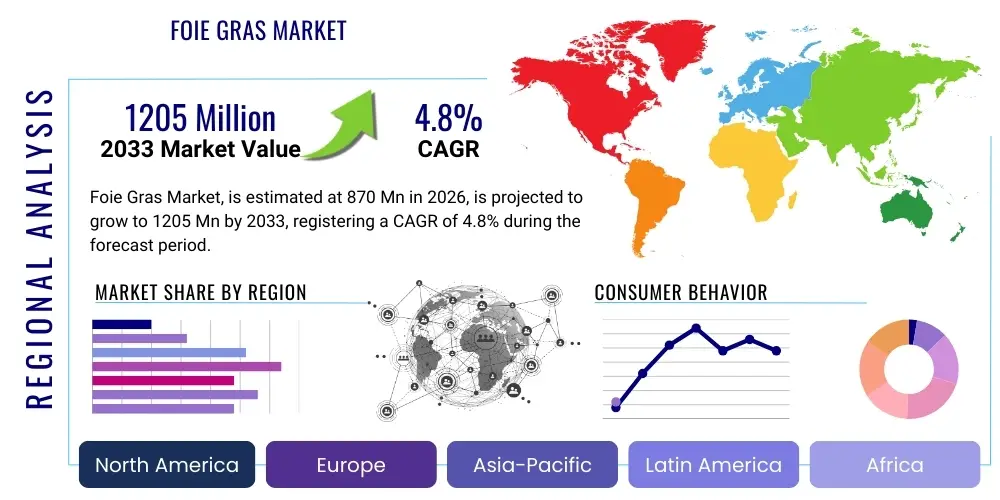

Foie Gras Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443349 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Foie Gras Market Size

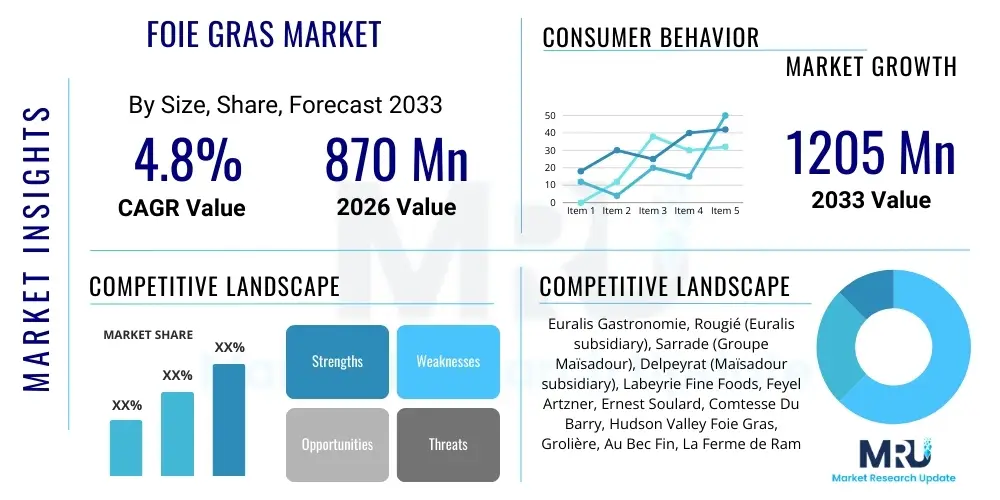

The Foie Gras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 870 million in 2026 and is projected to reach USD 1205 million by the end of the forecast period in 2033.

Foie Gras Market introduction

The Foie Gras market encompasses the production, distribution, and consumption of a luxury food product made from the liver of a duck or goose that has been specially fattened, typically through gavage. This delicacy is historically significant in French and Hungarian culinary traditions, highly valued for its distinct rich, buttery, and delicate flavor profile. The primary product variations include whole foie gras, blocks (Bloc de Foie Gras), and processed forms like mousse or terrine, catering to diverse consumer preferences and culinary applications ranging from fine dining appetizers to gourmet retail purchases for home consumption. Despite persistent ethical debates and legislative challenges in certain regions regarding production methods, the market maintains robust demand driven by the high growth in the luxury food segment and the expansion of high-end food service sectors globally.

Major applications of Foie Gras are predominantly found within the high-end hospitality sector, including Michelin-starred restaurants, luxury hotels, and specialized gourmet catering services, where it serves as a signature ingredient or main course component. These commercial applications demand the highest quality and consistency, often favoring Whole Foie Gras. Increasingly, sophisticated retail channels, such as specialty food stores and dedicated online gourmet platforms, are driving household consumption, particularly in affluent demographics seeking premium culinary experiences at home. The market benefits significantly from global tourism, cultural appreciation for French cuisine, and rising disposable incomes in emerging economies, enabling consumers to splurge on imported luxury goods, cementing its status as a high-end consumption marker.

Foie Gras Market Executive Summary

The Foie Gras market displays resilience driven by ingrained cultural consumption patterns in Western Europe and rapidly escalating demand in Asian luxury markets, particularly in high-growth urban centers where Western culinary traditions are gaining traction among the elite. Business trends highlight a pronounced shift towards ethically sourced or alternatively produced foie gras (when legally permitted), attempting to mitigate controversy surrounding traditional gavage methods, though these alternatives often face hurdles concerning authentic texture and flavor replication and regulatory acceptance. Key players are investing heavily in cold chain logistics optimization and advanced packaging technologies to ensure product quality retention across vast international supply chains, essential for a highly perishable luxury good and critical for maintaining market accessibility in distant export locations.

Regionally, Europe, led by France, remains the dominant market hub, both in terms of production volume and consumer expenditure, cementing its status as the global epicenter for Foie Gras consumption. Nevertheless, regulatory pressures in certain European Union members and North America are forcing market players to diversify production and sales channels toward supportive geopolitical areas, notably in Eastern Europe and certain parts of Asia and Latin America, which offer less stringent ethical regulations and lower operational costs. Segment trends reveal that Duck Foie Gras holds the majority market share due to its greater production volume and cost-effectiveness compared to the traditionally rarer Goose Foie Gras, serving as the accessible entry point for most consumers globally. Furthermore, the Food Service segment continues to be the most vital distribution channel, heavily influenced by global fine dining trends and the cyclical nature of high-end seasonal menus, demanding high-grade, premium product consistency.

AI Impact Analysis on Foie Gras Market

Analysis of common user questions regarding AI's influence on the Foie Gras market reveals primary concerns centered on production ethics, supply chain transparency, demand forecasting accuracy, and consumer segmentation for targeted marketing. Users frequently query whether AI can enhance non-gavage production methods, optimize feed conversion ratios, or provide better environmental monitoring in rearing facilities to improve animal welfare standards while maintaining product quality, thereby mitigating ongoing ethical scrutiny. Key expectations revolve around using predictive analytics for managing highly seasonal inventory, identifying emerging regulatory risks by monitoring legislative changes globally, and personalizing luxury consumer outreach across digital platforms, thereby addressing both operational efficiency and ethical consumption scrutiny simultaneously in a highly competitive niche market where brand reputation is paramount.

- AI-driven optimization of feed formulations and environmental control systems in rearing facilities, potentially minimizing stress and optimizing growth cycles, though full replacement of traditional husbandry knowledge remains challenging and requires careful integration with established farming practices.

- Enhanced predictive modeling for highly seasonal demand patterns in luxury retail and food service sectors, leading to significant reductions in waste and spoilage of this high-value, perishable product by optimizing ordering and production schedules based on real-time consumption data.

- Implementation of computer vision and machine learning for quality control checks during processing, ensuring uniformity in texture and size, crucial for maintaining premium pricing and brand reputation necessary for high-end exports and chef satisfaction.

- Advanced supply chain tracking and traceability using AI and blockchain technology to provide consumers with transparent information regarding the source, rearing conditions, and ethical certifications, addressing prevalent consumer concerns about production methods and enhancing trust in the luxury supply chain.

- Personalized digital marketing and pricing strategies deployed through AI, targeting affluent consumers based on sophisticated analysis of purchasing behavior, culinary preferences, and luxury brand engagement across international markets, thereby maximizing conversion rates in the high-margin retail sector.

DRO & Impact Forces Of Foie Gras Market

The Foie Gras market is primarily driven by the enduring appeal of luxury gourmet cuisine, strong cultural heritage, particularly in France, Hungary, and Spain, and increasing discretionary spending among high-net-worth individuals globally who view the product as a culinary staple of extravagance. Furthermore, the growth of the fine dining sector in emerging economies, particularly across Asia, catalyzes demand for imported, high-quality European delicacies. However, the market faces significant restraints, chiefly stemming from intense animal welfare activism and the subsequent governmental bans or stringent restrictions on gavage practices across key consumer markets such as the United Kingdom, California (USA), and potential future regulatory tightening within the EU, severely threatening market accessibility and production viability in traditional zones. The high cost of production, tied to specialized feeding and processing, also acts as a restraint, limiting consumer accessibility to the affluent segment.

Opportunities lie in the development and commercialization of ethically certified alternatives or laboratory-grown products that successfully replicate the texture and flavor profile without the controversial feeding process. These innovations are critical, allowing the industry to penetrate previously closed or ethically conscious markets and potentially commanding a premium for sustainability. The geographical expansion into supportive markets in Asia Pacific and Latin America, coupled with optimization of the shelf-stable preserved Foie Gras segment, offers diversified revenue streams. These forces create a substantial tension—between historical cultural demand and pressing ethical and legislative restraint—which defines the market’s current risk profile and mandates innovation in production and strategic distribution across international borders. The success of future market players will depend heavily on mitigating regulatory risk through technological adaptation and ethical assurance.

Segmentation Analysis

The comprehensive segmentation of the Foie Gras market is vital for dissecting consumption patterns, understanding regulatory pressures, and optimizing production strategies tailored to specific market demands. This segmentation allows producers to differentiate their offerings based on product characteristics, intended use, and accessibility points. The fundamental partitioning relies on the source bird, dividing the market into Duck Foie Gras, which dominates globally due to its scalability and favorable production economics, and the more exclusive, premium Goose Foie Gras. The intensity of market competition and the resilience against regulatory restrictions vary significantly across these segments, requiring nuanced strategic planning from leading industry participants, including managing different logistical requirements for fresh versus processed products based on the segment focus.

Furthermore, segmentation by form—ranging from raw, Whole Foie Gras (Foie Gras Entier) favored by professional chefs for its superior presentation and cooking versatility, to processed blocks, terrines, and mousses designed for retail convenience and longer shelf life—reflects varying consumer sophistication and application requirements. The Block of Foie Gras segment, often comprised of re-pressed pieces, offers a balance of luxury and affordability, appealing to the broader household market while ensuring efficient use of raw materials. Strategic marketing efforts are often segment-specific; for instance, premium branding emphasizing origin and traditional methods is crucial for the Whole Foie Gras segment, which targets the specialized HORECA sector, while convenience and ready-to-serve formats are key drivers in the processed retail sector, relying heavily on attractive packaging and accessibility in mainstream grocery chains. The global success of a producer is intrinsically linked to their ability to efficiently manage quality control and supply across these diverse product formats, often leveraging dual production lines for fresh and preserved goods.

The channel segmentation is equally critical, dividing sales into the powerful Food Service (HORECA) sector and the evolving Retail environment. The Food Service channel acts as a trendsetter and high-volume purchaser, driving demand for fresh and frozen products that meet exacting culinary standards and are often subjected to rigorous supplier audits. In contrast, the Retail segment, which includes hypermarkets, specialty food stores, and rapidly growing online platforms, focuses on value-added, preserved, and jarred varieties suitable for direct consumer purchase and gifting. The growth of specialized online gourmet retailers has provided a crucial avenue for high-end producers to bypass traditional retail bottlenecks and directly target affluent consumers in markets where brick-and-mortar specialty stores are scarce. Navigating this channel complexity requires robust inventory management systems and tailored logistics solutions to ensure the integrity of this highly prized, temperature-sensitive product throughout the entire distribution pipeline, balancing the speed requirements of fresh product with the stability needs of canned goods.

- By Type:

- Duck Foie Gras: Characterized by a robust flavor and texture, constituting the majority of the global market share due to efficient production cycles and lower comparative cost. Preferred for searing and standard culinary applications, highly versatile across various cuisines.

- Goose Foie Gras: A traditional, rarer, and highly valued segment, offering a more refined, delicate, and buttery flavor profile. Typically associated with premium pricing and specialized gourmet markets, often favored in historical or artisanal French preparations.

- Mule Duck Foie Gras: A hybrid product offering a balance between the robustness of duck and the texture refinement of goose liver, capturing a significant niche in European production, particularly favored for specific processed preparations.

- By Distribution Channel:

- Food Service (HORECA): Includes high-end restaurants, hotels, and institutional catering. Focuses on bulk, raw, or minimally processed whole livers; driven by professional demand and menu integration, requiring consistent supply and high grading standards.

- Retail: Covers consumer sales through physical and digital storefronts.

- Supermarkets & Hypermarkets: Targets mass affluent consumers with prepared products (blocks, terrines), relying on brand recognition and shelf appeal.

- Specialty Food Stores: Focuses on premium, high-grade, often artisanal or certified origin products, catering to knowledgeable gourmets and culinary enthusiasts seeking unique preparations.

- Online Retail: Fastest-growing sub-segment, offering direct-to-consumer access, crucial for reaching dispersed luxury buyers globally, necessitating advanced, temperature-controlled shipping protocols.

- By Application:

- Commercial: Predominant application, driving market volume, heavily influenced by global fine dining trends, seasonal menus, and international tourism recovery, demanding rigorous quality control.

- Residential/Household: Growing segment, focused on smaller, shelf-stable, or refrigerated processed products for home consumption, highly influenced by disposable income, culinary interest, and seasonal gifting trends.

- By Form:

- Whole Foie Gras (Foie Gras Entier): The highest quality designation, derived from a single, intact liver, favored for gourmet preparation and commanding the highest price point.

- Blocks of Foie Gras (Bloc de Foie Gras): Composed of re-pressed pieces of liver, offering a smooth texture; popular in the retail segment due to its versatility and relative cost-efficiency, often blended with other ingredients for flavor enhancement.

- Mousse and Pâté: Processed forms blended with other ingredients (e.g., truffle, seasonings), offering easier spreadability and appeal to novice consumers or as ingredients in ready-to-eat meals, increasing market penetration.

- Terrines: Cooked and molded liver preparations, often complex mixtures, offering extended shelf life under refrigeration, suitable for high-end deli and prepared foods counters.

- By Geography: North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA)

Value Chain Analysis For Foie Gras Market

The Foie Gras value chain is inherently constrained by specialized production requirements, making upstream integration highly impactful on final product quality and price. Upstream activities begin with the breeding and rearing of specific strains of ducks or geese that are genetically suited for fattening. This phase requires significant investment in specialized, climate-controlled barns and advanced veterinary systems to ensure animal health, particularly as producers face increasing pressure to adhere to voluntary or mandated welfare protocols, which adds complexity and cost. The procurement and milling of high-energy feed, primarily corn, is a major operational cost and risk factor, necessitating robust commodity risk management strategies to hedge against volatile grain prices. Producers often maintain vertical integration throughout the rearing and fattening stages to exert maximum control over quality, hygiene, and ethical compliance, distinguishing legitimate premium producers from lower-quality competitors and ensuring compliance with Protected Geographical Indication (PGI) standards.

The midstream segment involves the highly skilled process of gavage, harvesting, and initial processing. Harvesting must be executed rapidly and efficiently to preserve the liver’s pristine condition, minimizing bruising or degradation. Processing technologies are critical: raw livers are rigorously inspected, graded based on weight, color, and texture (Grade A, B, or C), and then prepared for either immediate freezing/shipping or further cooking and preservation. Key manufacturing activities include sterilization (for canning), emulsification (for blocks and mousse), and flash freezing using cryogenic methods. The complexity lies in selecting the optimal preservation method—such as partial cooking (mi-cuit) for short shelf life but superior flavor, or full sterilization (conserve) for multi-year stability—based on the target market’s logistical requirements and consumer preferences. Precision equipment ensuring airtight sealing and consistent cooking temperatures are technological necessities to maintain both safety and luxury quality standards across different product forms, adhering strictly to HACCP and ISO standards.

The downstream distribution network relies heavily on sophisticated logistics optimized for high-value, temperature-sensitive goods. The distribution channel is segmented into direct sales (farm gates, specialized market stands, and dedicated brand boutiques) and indirect sales through professional distributors and importers. Indirect channels handle the majority of international trade, utilizing specialized refrigerated transport (reefers) for maintaining the integrity of frozen and mi-cuit products across intercontinental routes, often requiring expedited customs clearance. Direct distribution to the HORECA sector minimizes handling time, preserving premium quality and maximizing margins for fresh product deliveries. For retail, especially online sales, robust secondary packaging solutions (insulating boxes, dry ice or gel packs) are mandatory to ensure the cold chain is unbroken until delivery. Successful downstream management requires deep market knowledge of import regulations, customs duties, and local consumer taste profiles, especially when distributing shelf-stable preserved Foie Gras, which requires less stringent temperature control but necessitates appealing, luxury-oriented packaging to justify the high price point and secure shelf space in competitive retail environments.

Foie Gras Market Potential Customers

The primary end-users and buyers of Foie Gras span distinct commercial and household segments, all unified by a demand for premium, high-status culinary ingredients and experiences. Commercial customers, representing the largest volume segment, include high-end restaurants, particularly those specializing in European or fusion cuisine, luxury hotels (which feature it in banqueting and fine dining outlets), and professional catering services that serve affluent clientele and major corporate events. These commercial buyers purchase in bulk, valuing consistent quality, specific dimensions (e.g., whole livers for searing), and reliable supply chains to meet demanding seasonal menu requirements, with purchasing contracts often emphasizing Grade A products and ethical certifications.

Residential or household consumers represent the growing retail segment, encompassing affluent individuals, gourmet food enthusiasts, and expatriates from foie gras-consuming cultures. These customers typically purchase smaller, prepared forms such as Bloc de Foie Gras, mousse, or terrines from specialty food stores or online gourmet retailers. Consumption patterns are often tied to holidays, special occasions, or upscale dinner parties, emphasizing convenience, shelf life (canned or jarred varieties being popular), and luxury branding suitable for gifting. The expansion of this segment is highly dependent on accessible retail distribution, effective educational marketing regarding preparation and serving techniques suitable for home use, and the successful translation of the product's premium image into a retail-ready format.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 870 Million |

| Market Forecast in 2033 | USD 1205 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Euralis Gastronomie, Rougié (Euralis subsidiary), Sarrade (Groupe Maïsadour), Delpeyrat (Maïsadour subsidiary), Labeyrie Fine Foods, Feyel Artzner, Ernest Soulard, Comtesse Du Barry, Hudson Valley Foie Gras, Grolière, Au Bec Fin, La Ferme de Ramon, Ariaké Japan, La Belle Gastronomie, Foie Gras South Africa, L'Isle Foie Gras, Paturages, Terres du Sud, Maison Montfort, Foie Gras de canard d'Alsace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foie Gras Market Key Technology Landscape

The technology landscape in the Foie Gras market is primarily focused on optimizing feed efficiency, ensuring highly controlled environments for animal welfare compliance, and advancing preservation and packaging techniques to maximize product longevity and maintain quality during global transit. In the upstream phase, sophisticated nutritional programming utilizes data analytics to tailor feed compositions based on the specific breed and stage of development, aiming to optimize liver quality and size while minimizing ethical controversies often linked to crude force-feeding methods. This involves developing specialized, highly nutrient-dense pellets and automated feeding systems that gradually increase caloric intake in a controlled manner, seeking to satisfy both production efficacy and emerging regulatory requirements, thereby attempting to redefine what constitutes "humane" fattening practices through technological precision.

Midstream technological advancements are crucial for maintaining the delicate flavor and texture, which are highly sensitive to processing conditions. This includes Cryogenic Freezing Technology (CFT) for rapid deep-freezing of raw livers, minimizing cell damage and preserving sensory attributes upon thawing, especially important for export markets requiring long shelf life and maintaining Grade A quality. Additionally, advanced sterilization and canning processes are employed for prepared products like blocks and pâtés. These methods ensure microbiological stability without compromising the rich mouthfeel or taste profile, a delicate balance that specialized vacuum packing equipment and precise temperature control systems facilitate. The adoption of Modified Atmosphere Packaging (MAP) for fresh, refrigerated Foie Gras further extends shelf life in the retail sector, crucial for reducing waste of this high-value, perishable item and allowing wider distribution domestically.

In addition to processing technology, digital transformation is impacting traceability and consumer trust. Blockchain integration is being explored by leading producers to create immutable records of the production lifecycle, from farm to fork, verifying ethical compliance and geographical origin claims, which is a powerful marketing tool in luxury markets. Furthermore, the burgeoning field of cellular agriculture represents a disruptive technology, with various startups actively developing laboratory-grown Foie Gras. Although currently in the research and development phase, successful scaling of cell-based products could potentially revolutionize the industry, allowing producers to enter markets with strict ethical bans, bypassing traditional farming and regulatory constraints entirely, representing the most significant long-term technological opportunity.

Regional Highlights

The geographical consumption and production patterns of Foie Gras are highly polarized due to deep-rooted cultural affinity in some regions and stringent regulatory restrictions in others. Europe fundamentally dictates the global market, accounting for the vast majority of both production and consumption, with France, Hungary, and Spain being the traditional powerhouses. France, the spiritual home of Foie Gras, drives innovation and sets the global quality benchmark, though domestic production faces continuous scrutiny regarding ethical mandates, leading to frequent policy debates and strategic adaptation by local producers. Hungary and Spain provide crucial alternative production bases, often benefiting from more permissive regulations regarding traditional methods or specializing in cost-efficient duck varieties, thus serving a significant portion of the international export market, particularly supplying preserved products to non-EU nations.

The Asia Pacific (APAC) region is emerging as the fastest-growing market, driven primarily by the rising middle class in China, Japan, and Singapore, who increasingly adopt high-end Western culinary trends and view imported luxury foods as status symbols. Urban centers in APAC represent lucrative destinations for imported, premium European Foie Gras, with consumption heavily concentrated in five-star hotels, luxury restaurants, and high-end retail chains catering to discerning consumers. North America, particularly the US (excluding California where production/sale is banned) and Canada, remains a significant, though constrained, market. Consumption in North America is stable among fine dining establishments and specialty retailers catering to high-income consumers, necessitating complex regulatory compliance for imports that must certify origin and adhere to stringent labeling laws regarding ingredients and handling.

- Europe: Dominant market share fueled by cultural heritage and mass consumption in France, Spain, and Hungary. Regulatory environment is complex, leading to shifts in internal production strategies and increased reliance on certified ethical sourcing methods to sustain demand, particularly for high-quality, mi-cuit products.

- Asia Pacific (APAC): Highest growth trajectory, driven by increasing affluence, urbanization, and the rapid expansion of luxury hospitality infrastructure in key economies like China, Japan, and South Korea. Focus on premium, high-quality preserved Foie Gras products due to long supply chains and logistics challenges.

- North America: Significant consumption concentrated in urban gourmet centers; however, market growth is hampered by localized legislative bans and public awareness campaigns against traditional production methods, necessitating strict adherence to import regulations and the exploration of locally sourced alternatives where permitted.

- Latin America & MEA: Niche but expanding markets, primarily confined to high-end hospitality sectors serving wealthy locals and international tourists in key cosmopolitan centers like Dubai, Rio de Janeiro, and Buenos Aires. Growth is volatile, highly dependent on macroeconomic conditions, currency stability, and access to reliable cold-chain infrastructure necessary for specialty food imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foie Gras Market.- Euralis Gastronomie

- Rougié (Euralis subsidiary)

- Sarrade (Groupe Maïsadour)

- Delpeyrat (Maïsadour subsidiary)

- Labeyrie Fine Foods

- Feyel Artzner

- Ernest Soulard

- Comtesse Du Barry

- Hudson Valley Foie Gras

- Grolière

- Au Bec Fin

- La Ferme de Ramon

- Ariaké Japan

- La Belle Gastronomie

- Foie Gras South Africa

- L'Isle Foie Gras

- Paturages

- Terres du Sud

- Maison Montfort

- Foie Gras de canard d'Alsace

Frequently Asked Questions

Analyze common user questions about the Foie Gras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining the growth of the Foie Gras Market?

The most significant restraint is the escalating ethical and legislative opposition to traditional gavage (force-feeding) methods, leading to outright bans on production and sales in major markets, thereby limiting geographical expansion and increasing regulatory risk for producers, particularly in high-volume Western markets.

Which geographical region holds the largest market share for Foie Gras?

Europe holds the largest market share, predominantly driven by high production volumes and deep-seated cultural consumption in key nations such as France, Spain, and Hungary. Europe also serves as the major global exporter of both fresh and preserved Foie Gras products.

How do Duck Foie Gras and Goose Foie Gras differ in market dominance?

Duck Foie Gras holds a significantly larger market share compared to Goose Foie Gras. Duck production is generally more voluminous, cost-effective, and provides a slightly stronger flavor profile, making it the industry standard for both commercial and retail applications globally.

What technological advancements are impacting the Foie Gras supply chain?

Key technological impacts include advanced cold chain logistics, sophisticated Modified Atmosphere Packaging (MAP) to extend shelf life for retail, and the potential application of AI for optimizing feed conversion, alongside the disruptive emergence of cellular agriculture research.

Are there viable ethical alternatives being commercialized in the Foie Gras sector?

Yes, research is progressing on "natural feeding" or non-gavage methods (often producing smaller livers but meeting ethical standards) and cellular agriculture (lab-grown) Foie Gras. While nascent, these alternatives present significant opportunities to access ethically sensitive consumer bases and bypass restrictive legislation in the long term.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager