Food and Beverage Coding and Marking Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443222 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Food and Beverage Coding and Marking Equipment Market Size

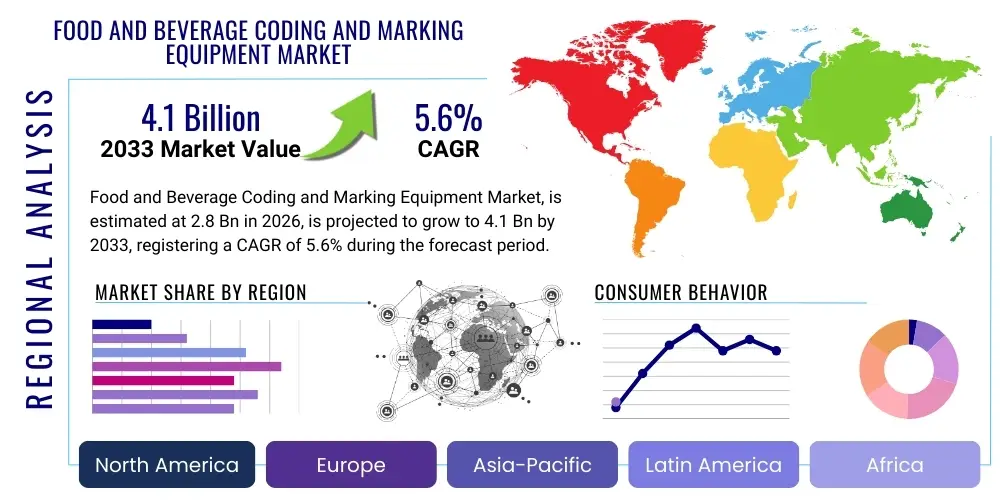

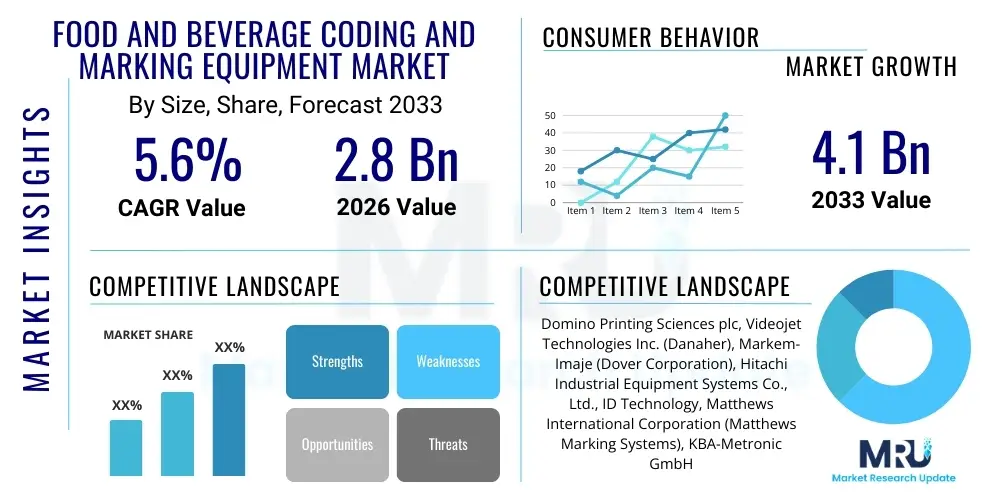

The Food and Beverage Coding and Marking Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

The consistent demand for product traceability, anti-counterfeiting measures, and stringent regulatory compliance across global food supply chains are the primary factors propelling this valuation growth. As manufacturing processes in the food and beverage industry become more automated and high-speed, the reliance on advanced, integrated coding solutions, such as Continuous Inkjet (CIJ) and Laser Marking Systems, increases significantly. These solutions ensure durability and legibility on diverse substrates, including glass, plastic, metal, and flexible packaging.

Food and Beverage Coding and Marking Equipment Market introduction

The Food and Beverage Coding and Marking Equipment Market encompasses highly specialized machinery designed for printing essential information—such as expiry dates, batch codes, barcodes, serial numbers, and traceability data—directly onto primary, secondary, and tertiary packaging materials utilized within the food and beverage sectors. This equipment is crucial for ensuring product safety, facilitating inventory management, and complying with complex governmental and international labeling standards. Key product offerings include Continuous Inkjet (CIJ) printers, Thermal Inkjet (TIJ) printers, Laser Marking Systems, Thermal Transfer Overprinters (TTO), and Large Character Marking (LCM) systems, each optimized for specific applications, speed requirements, and substrate types found in high-volume production environments.

Major applications of these systems span the entire production lifecycle, from bottling lines for carbonated soft drinks and brewing facilities for beer, to high-speed packaging lines for processed foods, snacks, and dairy products. The core benefits derived from implementing advanced coding and marking technology include enhanced operational efficiency through reduced errors, robust defense against product diversion and counterfeiting, and immediate recall capabilities facilitated by accurate serialization. Furthermore, consumer trust is fortified when products display clear, tamper-proof dating information, which is a growing expectation in mature and emerging markets alike.

Driving factors for market expansion include the global shift towards packaged and ready-to-eat foods, which mandates highly reliable marking solutions. Simultaneously, government bodies worldwide, such as the FDA in the US and EFSA in Europe, are continuously updating traceability mandates, compelling manufacturers to invest in equipment capable of generating high-resolution, machine-readable codes. The proliferation of complex promotional coding schemes and the necessity for unique item-level identification further solidify the market's positive trajectory, pushing innovation toward faster, more durable, and environmentally friendly marking technologies.

Food and Beverage Coding and Marking Equipment Market Executive Summary

The Food and Beverage Coding and Marking Equipment Market is characterized by robust technological integration and significant investment driven by regulatory stringency and high consumer demand for safety assurance. Business trends indicate a strong move toward integrated Industry 4.0 solutions, featuring remote monitoring capabilities, predictive maintenance powered by IoT, and seamless integration with Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) platforms. Key players are focusing intensely on developing sustainable consumables, such as vegetable-based inks and solvent-free marking solutions, to address growing corporate environmental responsibility mandates, alongside miniaturization of equipment footprints to suit space-constrained production facilities.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, a burgeoning middle class demanding higher quality packaged foods, and massive infrastructural investments in processing plants across countries like China, India, and Southeast Asia. North America and Europe, while mature, maintain leadership in terms of technological adoption, driven by stringent mandates like the Food Safety Modernization Act (FSMA) and robust serialization requirements for packaged goods. These regions prioritize sophisticated, high-speed laser and thermal marking systems that ensure precision and long-term operational stability.

Segment trends reveal that the Continuous Inkjet (CIJ) technology continues to dominate the market share due to its versatility, cost-effectiveness, and ability to mark non-contact high-speed lines on almost any substrate. However, Laser Marking Systems are experiencing the highest growth rate, particularly in the beverage and pharmaceutical-adjacent food segments, due to their permanent marking capabilities and elimination of consumable costs (inks and solvents), aligning perfectly with long-term sustainability goals. Furthermore, the prepared food and beverage sectors remain the largest application segments, necessitating reliable marking on complex and often oily or moist surfaces, pushing manufacturers to innovate specialized inks and durable printheads.

AI Impact Analysis on Food and Beverage Coding and Marking Equipment Market

User queries regarding AI's impact on coding and marking equipment often center on how these intelligent systems can transition traditional marking processes from reactive to predictive, thereby reducing costly line downtimes and ensuring flawless compliance. Key themes identified include the capability of AI-driven vision systems to instantaneously verify code legibility and placement, far exceeding human inspection reliability. Users are keen to understand how AI algorithms can optimize consumable usage (ink, ribbon) based on real-time environmental factors and production schedules, and how machine learning can be applied to predictive maintenance schedules, anticipating component failure long before it occurs in high-stress production environments. The expectation is a reduction in total cost of ownership (TCO) and a substantial improvement in Overall Equipment Effectiveness (OEE).

The integration of Artificial Intelligence (AI) and Machine Learning (ML) transforms the operational effectiveness of coding equipment by offering unprecedented levels of accuracy and predictive capability. AI algorithms are being deployed primarily in conjunction with high-resolution vision systems to perform complex Quality Assurance (QA) tasks, such as reading data matrix codes and ensuring 100% readability across high-speed lines. This is critical in preventing miscoded products from reaching the market, which is a major source of recalls and regulatory fines. AI not only verifies the presence and quality of the code but can also dynamically adjust print parameters (e.g., contrast, droplet size) in real-time based on substrate variability or line speed fluctuations, ensuring optimal output consistency.

Furthermore, AI is pivotal in enhancing the reliability and lifespan of the equipment itself. By analyzing historical performance data, temperature fluctuations, motor loads, and printhead degradation rates, AI systems can generate precise, actionable insights for predictive maintenance. This shift from time-based or reactive maintenance to condition-based servicing dramatically reduces unscheduled downtime—a critical metric in the fast-paced food and beverage industry. These smart capabilities allow plant operators to forecast ink or solvent replenishment needs accurately, manage inventory efficiently, and minimize operational expenditure associated with premature component replacement, thus establishing a competitive advantage through superior process control.

- AI-driven Vision Systems: Instantaneous, 100% verification of code legibility, placement, and grading (AEO/ISO standards).

- Predictive Maintenance: Utilization of ML models to forecast component failure and optimize maintenance schedules, maximizing uptime.

- Consumables Optimization: Algorithms predict and manage ink, solvent, or ribbon usage based on real-time production variables and environmental conditions.

- Dynamic Parameter Adjustment: Real-time self-correction of coding parameters (e.g., print resolution, contrast) to maintain consistency despite line speed or substrate changes.

- Automated Compliance Reporting: AI systems generate auditable reports, simplifying regulatory adherence and traceability documentation.

DRO & Impact Forces Of Food and Beverage Coding and Marking Equipment Market

The Food and Beverage Coding and Marking Equipment Market is fundamentally shaped by a dynamic interplay of regulatory demands (Drivers), high initial investment costs (Restraints), advancements in sustainable technologies (Opportunities), and the overarching pressure of supply chain security (Impact Forces). The essential need for transparency and accurate product tracking—mandated by global food safety laws—serves as the core catalyst for market growth, ensuring that investment in modern, high-speed coding solutions is non-negotiable for manufacturers aiming for global distribution.

Drivers: Stricter global traceability and serialization regulations, such as those governing expiration dates and allergen labeling, compel manufacturers to adopt high-resolution, durable marking equipment. The surging consumer demand for product information, often accessed via QR codes or 2D barcodes printed on packaging, necessitates advanced coding technologies. Furthermore, the continuous increase in automation and high-speed packaging lines requires equipment capable of rapid, accurate, and non-contact printing solutions that seamlessly integrate into complex manufacturing environments without bottlenecking throughput.

Restraints: Significant restraints include the high initial capital expenditure associated with purchasing and implementing sophisticated systems like high-power laser markers or complex serialization solutions. The recurring operational cost of consumables, such as specialized inks and solvents required for CIJ and TIJ printers, can present a financial burden, particularly for smaller or regional processors. Additionally, the need for highly skilled labor to operate, maintain, and troubleshoot advanced integrated systems creates an operational bottleneck in regions with lower levels of technical specialization.

Opportunities: Major opportunities lie in the development and adoption of environmentally friendly marking technologies, including solvent-free inks, UV-curable inks, and chemical-free laser etching, aligning with industry goals for green packaging. The expansion of smart factory concepts (Industry 4.0) opens avenues for market players offering fully networked, IoT-enabled coding devices capable of remote diagnostics and centralized data management. Furthermore, unmet demand in emerging markets for robust, yet affordable, entry-level coding equipment provides fertile ground for market expansion.

Impact Forces: The overarching force is the constant pressure for enhanced supply chain security and anti-counterfeiting measures. Counterfeit food products pose significant health risks and financial damage, driving the adoption of covert, sophisticated coding techniques like invisible UV inks or complex serialization schemes. The second major impact force is the necessity for operational flexibility; production lines must switch rapidly between different product SKUs, requiring coding equipment that offers minimal changeover time and seamless integration into highly flexible production schedules.

Segmentation Analysis

The Food and Beverage Coding and Marking Equipment market is segmented based on technology type, application area, and end-user vertical, reflecting the diverse requirements of modern food production. Technology segmentation is critical, as it defines the equipment’s capability in terms of speed, substrate compatibility, marking permanence, and environmental impact. Applications range widely, covering primary packaging (direct contact with food) to tertiary packaging (pallets), demanding different levels of durability and code size. End-user classification helps manufacturers tailor solutions specific to high-speed liquid filling (beverages) versus complex, intermittent solid filling (processed foods), addressing unique challenges such as moisture, temperature, and texture.

The market analysis reveals that Continuous Inkjet (CIJ) remains the foundation of the industry due to its adaptability to curves and high-speed non-contact printing on virtually any substrate, dominating volume metrics. However, the fastest evolution is seen in Laser Marking Systems, driven by the desire to eliminate consumables and achieve permanent, high-definition marks on materials like PET and glass. The processed food sector, including prepared meals and frozen goods, utilizes a broad spectrum of technologies due to diverse packaging formats, while the beverage sector strongly favors high-speed, reliable laser and CIJ solutions tailored for rapid bottling and canning lines.

- Technology Type:

- Continuous Inkjet (CIJ) Printers

- Thermal Inkjet (TIJ) Printers

- Laser Marking Systems (Fiber, CO2, UV)

- Thermal Transfer Overprinters (TTO)

- Print and Apply Labelers

- Large Character Marking (LCM) Systems

- Application:

- Primary Packaging (e.g., bottles, cans, pouches)

- Secondary Packaging (e.g., boxes, cartons)

- Tertiary Packaging (e.g., pallets, shrink wrap)

- End-User Vertical:

- Beverages (Soft Drinks, Alcoholic Beverages, Water)

- Dairy Products (Milk, Cheese, Yogurt)

- Processed Foods (Snacks, Confectionery, Frozen Meals)

- Bakery and Confectionery

- Meat, Poultry, and Seafood

- Fruits and Vegetables

- Code Type:

- Batch Codes and Date Codes (Expiry, Manufacturing)

- Barcodes (1D and 2D/QR Codes)

- Serialization and Traceability Codes

Value Chain Analysis For Food and Beverage Coding and Marking Equipment Market

The value chain for coding and marking equipment begins with raw material suppliers providing specialized components, including electronic circuitry, printhead components, and chemical inputs necessary for ink and solvent manufacturing. The upstream analysis focuses heavily on the procurement of precision components and the chemical formulation of consumables, which must meet stringent health and safety standards for the food industry. Differentiation in this stage is often achieved through proprietary ink formulas designed for adhesion on challenging surfaces (e.g., oily films, condensation-prone plastics) or for high-speed drying.

Midstream activities involve the design, assembly, and testing of the equipment itself, where major OEMs leverage their expertise in systems integration, ensuring compatibility with existing production lines and regulatory mandates. This stage is marked by significant R&D investment, focusing on improving uptime, reducing maintenance complexity, and enhancing connectivity (IoT capability). Equipment manufacturers must also manage extensive global supply chains to deliver large, complex machinery and consumables efficiently.

Downstream analysis highlights the critical role of distribution channels, which include direct sales teams for major, customized projects and a network of specialized local distributors and integrators for servicing small to medium enterprises (SMEs). Direct channels are often utilized for complex laser and high-end CIJ systems requiring intricate installation and ongoing technical support, particularly in high-volume multinational food and beverage corporations. Indirect channels, utilizing trained local partners, are essential for penetrating regional markets, providing rapid maintenance, and distributing consumables. The final stage involves extensive post-sales support, encompassing training, scheduled maintenance, and the rapid supply of specialized consumables, directly impacting customer satisfaction and market loyalty.

Food and Beverage Coding and Marking Equipment Market Potential Customers

Potential customers for coding and marking equipment are overwhelmingly end-users involved in industrial-scale processing, packaging, and distribution of consumer-ready food and beverage products. These buyers are primarily categorized into large multinational corporations (MNCs) that require standardized global solutions and high-throughput systems, and small to medium-sized enterprises (SMEs) that prioritize affordability, ease of use, and local technical support. The buying decision is complex, dictated by regulatory compliance risk, expected production volumes, packaging material diversity, and the necessity for seamless integration with existing plant infrastructure and manufacturing execution systems (MES).

Specific target buyers include bottling companies utilizing high-speed rotary fillers, demanding laser coders or specialized CIJ systems for printing on glass or aluminum at thousands of units per minute. Dairy processors, dealing with cold and moist environments, require robust, IP-rated equipment and specialized pigmented inks for marking cartons and flexible film. Further key buyers are large processed food manufacturers that utilize TTO or Print and Apply Labeling systems for secondary packaging, ensuring accurate case coding and pallet identification for logistics and retail distribution purposes. These customers seek equipment that guarantees absolute traceability from raw ingredient to consumer shelf, minimizing liability and facilitating swift crisis management in the event of a product recall.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Domino Printing Sciences plc, Videojet Technologies Inc. (Danaher), Markem-Imaje (Dover Corporation), Hitachi Industrial Equipment Systems Co., Ltd., ID Technology, Matthews International Corporation (Matthews Marking Systems), KBA-Metronic GmbH, Squid Ink Manufacturing, Inc., Linx Printing Technologies (Danaher), Macsa ID, S.A., Weber Packaging Solutions, SATO Holdings Corporation, Control Print Limited, REA JET (KBA-Group), KHS Group, Newcode Partnership, Inkjet Inc., Bizerba SE & Co. KG, HSA Systems, Allen Coding Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food and Beverage Coding and Marking Equipment Market Key Technology Landscape

The technological landscape of the Food and Beverage Coding and Marking Equipment market is highly dynamic, driven by the need for increased speed, operational flexibility, and reduced environmental footprint. Continuous Inkjet (CIJ) printing remains the cornerstone technology, utilized for its ability to print non-contact, high-speed codes on complex surfaces such as the curved bottom of cans or the uneven surface of flexible film. Recent advancements in CIJ focus on specialized pigmented inks that adhere better to difficult substrates and intelligent fluid management systems that minimize solvent consumption and emissions, thereby improving sustainability profiles while maintaining high throughput essential for bottling and canning lines.

Thermal Inkjet (TIJ) technology is rapidly gaining traction, particularly for printing high-resolution, machine-readable codes like QR and Data Matrix codes onto porous materials (cardboard) and flat, non-porous surfaces (labels). TIJ systems are favored for their low maintenance requirements, clean operation, and compact size, making them ideal for integration into secondary packaging lines and smaller production facilities. The primary innovation in TIJ involves developing faster printhead technology and highly specialized, quick-drying inks that can maintain pristine code quality at increasing line speeds, challenging the dominance of TTO in some carton marking applications.

Laser Marking Systems—encompassing CO2, Fiber, and UV lasers—represent the most significant technological shift, offering a permanent, consumables-free marking solution. CO2 lasers are widely used for marking plastic (PET) and glass packaging in the beverage sector, etching high-definition codes by removing or changing the surface layer. Fiber lasers are employed for metal substrates (cans), and UV lasers are emerging for heat-sensitive plastics due to their low-heat marking process. While the initial investment is higher, the long-term benefit of zero consumable costs, coupled with high reliability and resistance to industrial washing or abrasion, makes laser technology increasingly preferred for premium, traceable products where code permanence is paramount.

Regional Highlights

The regional dynamics of the Food and Beverage Coding and Marking Equipment Market are dictated by varying regulatory environments, levels of industrial automation, and consumer purchasing power, resulting in diverse growth rates and technological preferences across major geographical areas. Asia Pacific (APAC) currently exhibits the highest growth potential, largely fueled by burgeoning populations, rapid urbanization, and a major shift from traditional unpackaged goods to standardized, industrial-scale processed and packaged foods. Countries like China and India are seeing massive investments in new food processing infrastructure, necessitating immediate adoption of modern coding equipment to meet newly imposed domestic quality and traceability standards.

North America and Europe constitute the most mature segments of the market, characterized by saturation in basic coding needs but high demand for advanced, integrated solutions aligned with Industry 4.0 principles. In these regions, growth is driven primarily by replacement cycles for older equipment and the need to upgrade to systems capable of high-complexity serialization, anti-counterfeiting measures, and seamless data exchange with MES/ERP platforms. European markets, in particular, prioritize sustainable solutions, pushing manufacturers toward laser technology and eco-friendly ink formulations, driven by stringent EU environmental directives and advanced consumer awareness regarding packaging waste.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets characterized by foundational growth. LATAM markets are rapidly modernizing their food processing industries, increasing the adoption of entry-level and mid-range CIJ and TIJ solutions for essential date and batch coding. MEA, especially the Gulf Cooperation Council (GCC) countries and South Africa, is seeing steady demand propelled by increasing regulation on food imports and local manufacturing expansion, particularly in the beverage and packaged goods sectors. These regions prioritize robust equipment that can withstand challenging environmental conditions, such as high temperatures and dust, and often rely on local distributors for technical support and consumables supply.

- Asia Pacific (APAC): Highest CAGR; driven by rapid industrialization, urbanization, and mass adoption of packaged food; key markets include China, India, and Southeast Asia focusing heavily on CIJ and basic TIJ solutions for volume production.

- North America: Market leader in technology adoption; strong emphasis on traceability (FSMA compliance) and serialization; high demand for advanced Laser Marking Systems and integrated vision inspection technologies.

- Europe: Mature market focusing on sustainability and high-precision coding; driven by EU regulatory compliance and a preference for laser etching and environmentally compliant TTO ribbons and bio-inks.

- Latin America (LATAM): Moderate growth fueled by infrastructure modernization; increasing regulation prompts investment in CIJ systems for essential date coding and anti-counterfeiting in beverage and basic processed food sectors.

- Middle East & Africa (MEA): Growth centered on local manufacturing expansion and import regulation; preference for durable, low-maintenance equipment capable of operating in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food and Beverage Coding and Marking Equipment Market.- Domino Printing Sciences plc

- Videojet Technologies Inc. (Danaher)

- Markem-Imaje (Dover Corporation)

- Hitachi Industrial Equipment Systems Co., Ltd.

- Matthews International Corporation (Matthews Marking Systems)

- Linx Printing Technologies (Danaher)

- Macsa ID, S.A.

- KBA-Metronic GmbH

- Squid Ink Manufacturing, Inc.

- ID Technology

- Weber Packaging Solutions

- SATO Holdings Corporation

- Control Print Limited

- REA JET (KBA-Group)

- KHS Group

- Bizerba SE & Co. KG

- Newcode Partnership

- Allen Coding Systems

- Inkjet Inc.

- HSA Systems

Frequently Asked Questions

Analyze common user questions about the Food and Beverage Coding and Marking Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most common coding technology used in the food and beverage industry?

The most widely adopted technology is Continuous Inkjet (CIJ) printing, favored for its versatility, high-speed non-contact application, and ability to mark complex substrates like curved bottles and flexible films used extensively in food and beverage packaging.

How do new food safety regulations impact the demand for coding equipment?

Stringent food safety regulations (e.g., FSMA, EU Directives) mandate enhanced product traceability and unique identification (serialization), driving high demand for advanced coding equipment, especially laser markers and systems capable of printing high-density 2D barcodes like QR and Data Matrix codes.

What are the primary advantages of Laser Marking Systems over Inkjet Printers?

Laser Marking Systems offer permanent, high-resolution codes and eliminate the ongoing cost and environmental burden of consumables (inks and solvents). They are highly reliable for applications requiring indelible marks, such as glass bottles and high-quality plastic containers.

What is the role of Industry 4.0 and IoT in modern coding and marking?

Industry 4.0 integration enables remote monitoring, centralized data management, and predictive maintenance for coding equipment. IoT connectivity allows for real-time diagnostics, automatic data transfer to MES/ERP systems, and optimization of coding parameters across large-scale production lines, significantly boosting OEE.

Which geographical region is experiencing the fastest growth in this market?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, driven by rapid industrial expansion, increasing domestic consumption of packaged foods, and massive investment in modern food and beverage processing infrastructure across key economies like China and India.

The Food and Beverage Coding and Marking Equipment Market serves as a critical infrastructural component for global supply chain integrity, directly influencing consumer safety and brand reputation. Manufacturers are continuously seeking advanced solutions that bridge the gap between high production speeds and regulatory compliance. The market is witnessing a fundamental shift driven by sustainable practices, with increasing adoption of laser etching and solvent-free inks to minimize environmental impact associated with packaging waste and VOC emissions. This shift is particularly pronounced in mature economies like Europe and North America where corporate sustainability goals are aggressively pursued. The competitive landscape is dominated by a few global players who invest heavily in R&D to develop proprietary consumables and sophisticated software integration tools. These tools are designed to maximize equipment uptime, a non-negotiable factor in the high-volume, low-margin environment of the food and beverage sector. Technological convergence, marrying coding systems with sophisticated vision inspection systems powered by AI, ensures that every product leaving the plant carries a legible and accurate code. This automation of quality control drastically reduces the risks associated with product recalls due to coding errors, which can be devastating both financially and reputationally. The beverage segment, encompassing everything from soft drinks and bottled water to craft beer and spirits, places immense pressure on coding equipment to perform reliably at exceptionally high line speeds, often in challenging moist or temperature-controlled environments. This pushes innovation towards robust, high IP-rated equipment. Conversely, the processed food segment, involving diverse packaging types (flexible pouches, rigid cartons, trays), requires versatile equipment capable of quick changeovers and printing on multiple substrates, making TIJ and TTO systems highly relevant alongside the versatile CIJ technology. Traceability demands are becoming more granular, moving beyond simple batch codes to unique item identifiers (UIDs), which necessitates greater printing precision and data management capacity. This regulatory tightening acts as a powerful, non-cyclical driver for consistent market growth regardless of broader economic fluctuations. The rise of private label brands and localized food production also contributes to market fragmentation, creating opportunities for smaller, specialized equipment manufacturers who can offer tailored, cost-effective solutions for regional processors. The market is not just about placing a mark on a product; it is about establishing a secure, auditable digital identity for every packaged item, supporting end-to-end transparency in the food supply chain. The need for precise and durable marking on primary packaging, which often faces harsh conditions like freezing, pasteurization, or retort processes, requires highly specialized ink formulations. For example, sterilization processes demand inks that can withstand extreme heat without discoloration or smearing, maintaining full legibility post-treatment. Similarly, marking equipment used in chilled environments, such as dairy and frozen food facilities, must be engineered to handle condensation and low temperatures without degradation of performance or print quality. This requirement for specialized performance across various production environments ensures continuous technological refinement and market differentiation among leading equipment suppliers. Furthermore, the integration with enterprise systems facilitates instantaneous data sharing, allowing manufacturers to track product origin, production time, and destination in real-time, greatly simplifying inventory management and enabling highly targeted product withdrawals if necessary. This shift towards data-rich coding is fundamental to meeting the sophisticated demands of modern retail and logistics networks. The complexity of operating and maintaining these advanced systems necessitates comprehensive training and robust service contracts, forming a significant revenue stream for market incumbents. The development of user-friendly interfaces and remote diagnostics is key to minimizing reliance on highly specialized on-site engineers, particularly beneficial for operations in geographically dispersed locations.

The growth trajectory of the Food and Beverage Coding and Marking Equipment Market is inextricably linked to global demographic shifts, particularly the expansion of the middle class in emerging economies who demand packaged, safe, and easily traceable food products. This demographic pressure necessitates continuous capital investment in automated packaging lines. Sustainability remains a central theme, impacting both the hardware and consumables segments. Manufacturers are heavily exploring alternatives to solvent-based inks, including UV-curable inks that instantly dry upon exposure to UV light, eliminating the need for solvents, and thus reducing VOC emissions. This aligns with corporate mandates aimed at achieving carbon neutrality and minimizing industrial waste. Laser technology is poised to capture increasing market share specifically because it is a consumables-free operation, offering a compelling long-term environmental benefit alongside operational cost savings. The competitive strategy among key players increasingly revolves around total cost of ownership (TCO) rather than just initial purchase price. This includes factors such as expected lifespan of components, maintenance intervals, cost and efficiency of consumables, and energy consumption. Equipment that offers superior energy efficiency and minimal waste generation provides a significant competitive advantage in tender processes, particularly with large multinational food and beverage corporations committed to aggressive environmental targets. Small character inkjet (CIJ) printers continue to see innovation focused on achieving faster line speeds without compromising code integrity. This involves refining the jetting technology, improving charging electrode designs, and developing advanced drop placement accuracy mechanisms, which are crucial for maintaining print quality on extremely fast beverage canning lines. The movement toward flexible packaging (pouches, film) for snacks and prepared meals fuels the demand for Thermal Transfer Overprinting (TTO) and specialized CIJ systems designed for difficult, non-porous films. TTO systems are essential for high-resolution date and variable data printing on labels and flexible packaging, delivering clean, crisp images that are readable by automated systems. The integration of coding equipment into fully automated palletizing and warehousing systems represents the final frontier of traceability. Large Character Marking (LCM) systems are critical here, applying high-visibility codes directly onto secondary and tertiary packaging (boxes and pallets), facilitating automated scanning and tracking through the distribution center and logistical network. The global food industry’s reliance on efficient, transparent supply chains guarantees sustained, resilient growth for the coding and marking equipment sector throughout the forecast period, driven by both regulation and operational efficiency requirements. The ongoing push for serialization in the food supply chain, similar to that seen in the pharmaceutical industry, particularly for high-value goods like specialty foods, is a powerful market accelerator. This requires equipment capable of generating and managing unique identifier codes for every single unit produced, necessitating high-performance software and connectivity features.

The market for coding and marking equipment is heavily influenced by materials science innovation. The development of new packaging materials—such as biodegradable plastics, metalized films, and thinner gauge materials—requires corresponding innovation in inks and laser technologies to ensure adequate adhesion, contrast, and code durability. Manufacturers must constantly test and validate their equipment and consumables against these evolving packaging formats to remain competitive. For instance, coding onto recycled or slightly textured packaging demands robust printing heads and specialized ink formulations to ensure codes remain clear and compliant, presenting a continuous technical challenge. Furthermore, the increasing prevalence of e-commerce and direct-to-consumer sales models necessitates enhanced coding on the outer shipping cartons. This often drives demand for high-resolution Thermal Inkjet (TIJ) systems or large character drop-on-demand (DOD) systems capable of printing shipping labels and product information directly onto porous cardboard in high quality. The ability of the equipment to interface directly with warehouse management systems (WMS) is paramount in this context. The competition among key market players is intensifying, leading to strategic mergers and acquisitions focused on consolidating technological capabilities, particularly in the fast-growing laser and vision inspection segments. This allows leading companies to offer comprehensive, end-to-end coding and verification packages, simplifying the purchasing process for large multinational customers. The services component, including installation, preventative maintenance, and provision of certified consumables, constitutes a crucial part of the total market value and serves as a major differentiator among competitors. Companies that can provide reliable, rapid global technical support gain a significant advantage in securing long-term contracts with major food and beverage manufacturers. The core function of coding and marking equipment, ensuring the safe and compliant delivery of food products, secures its position as an essential, resilient investment for the global manufacturing sector. The projected growth reflects both the mandatory regulatory compliance upgrades and the proactive adoption of high-tech automation solutions designed to future-proof production facilities against increasingly complex global supply chain demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager