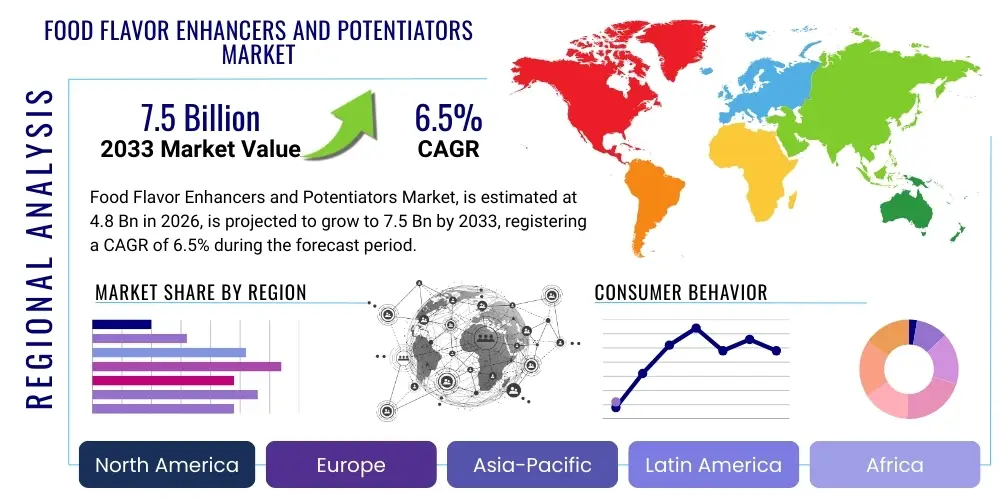

Food Flavor Enhancers and Potentiators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443037 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Food Flavor Enhancers and Potentiators Market Size

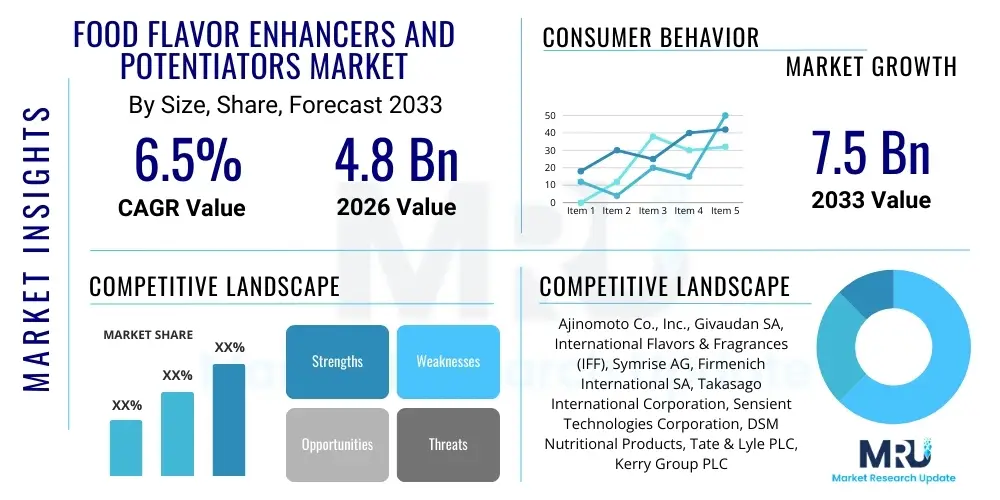

The Food Flavor Enhancers and Potentiators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Food Flavor Enhancers and Potentiators Market introduction

The Food Flavor Enhancers and Potentiators Market encompasses a diverse range of specialized ingredients designed to improve, modify, or amplify the existing flavor profile of food and beverage products without necessarily adding a distinct new flavor. These compounds are critical components in modern food formulation, addressing consumer demands for healthier, low-sodium, or low-sugar options that do not compromise on taste. Flavor enhancers, such as monosodium glutamate (MSG), nucleotides (IMP, GMP), and yeast extracts, function by stimulating taste receptors, primarily umami, thereby boosting the overall palatability and intensity of the product. Potentiators, often derived from natural sources, work synergistically with existing flavorants or taste compounds to extend their effect or heighten perception, enabling manufacturers to use lower concentrations of expensive flavor ingredients while achieving superior sensory results. The necessity for these ingredients is driven by globalization of food preferences, complexity in supply chains, and the ongoing shift towards processed and convenient foods, where natural flavors are often lost during processing and require reinstatement or enhancement.

Product categories within this market range from traditional, widely recognized enhancers like glutamates and hydrolyzed vegetable proteins (HVP) to advanced, clean-label potentiators derived from fermentation processes, botanical extracts, and specialized yeast fractions. Major applications span the entire food industry, including savory snacks, processed meats, soups and sauces, ready-to-eat meals, and increasingly, functional beverages and dairy alternatives. The primary benefits derived from the use of these ingredients include cost-efficiency in formulation, the ability to mask undesirable off-notes (especially common in high-protein or reduced-fat products), and the enhancement of the overall consumer eating experience, thereby boosting product loyalty and market competitiveness. Flavor enhancers are particularly crucial in ethnic cuisines and highly flavored products where depth of taste is paramount.

Key driving factors propelling market expansion include the exponential rise in global demand for processed and convenience foods, particularly in developing economies, necessitating standardized and intense flavor profiles. Furthermore, regulatory pressures and consumer-led movements demanding sodium reduction and sugar reduction in packaged goods have spurred intense innovation in the development of potentiators that can mimic the sensory impact of salt or sugar without contributing nutritional negatives. The shift towards natural and clean-label ingredients, driven by increased consumer awareness, is pushing the market towards natural flavor enhancers (e.g., yeast extracts, vegetable concentrates, mushroom powders) and away from synthetic alternatives, representing a significant trend that dictates research and development efforts across the industry. This dual pressure—demand for convenience and demand for clean label—establishes a robust foundation for sustained market growth.

Food Flavor Enhancers and Potentiators Market Executive Summary

The global Food Flavor Enhancers and Potentiators Market is experiencing robust growth, primarily fueled by shifting dietary preferences towards processed and ready-to-eat meals, coupled with heightened consumer focus on ingredient transparency and sodium/sugar reduction. Business trends highlight a strong push towards natural ingredient sourcing and fermentation technologies, where leading manufacturers are heavily investing in developing clean-label potentiators such as specialized yeast extracts and natural botanical compounds that offer superior flavor boosting capabilities and mask off-notes effectively. Mergers, acquisitions, and strategic partnerships remain a critical element of the competitive landscape, as major flavor houses seek to integrate advanced ingredient technologies and secure vertical control over specialized supply chains, ensuring access to unique raw materials and proprietary processing methods. The emphasis on sustainability in sourcing and production is also transforming business operations, with companies increasingly adopting ethical sourcing practices and waste reduction initiatives to align with global ESG standards and enhance brand appeal among conscious consumers. Innovation cycles are shortening, driven by rapid sensory science advancements and the need to address complex formulation challenges inherent in creating plant-based and low-calorie food matrices.

Regional trends indicate that Asia Pacific (APAC) remains the largest and fastest-growing market, driven by its massive population base, rapid urbanization, and deeply ingrained culinary traditions that prioritize intense savory flavors, particularly umami, making it a critical hub for glutamates and yeast extracts. North America and Europe, characterized by mature markets, exhibit strong demand for natural potentiators and sodium reduction solutions, spurred by stringent public health initiatives and high consumer adoption rates of functional and "better-for-you" products. Latin America is emerging as a high-potential region due to increasing disposable incomes and the Westernization of diets, creating new opportunities for global flavor companies to introduce advanced enhancing technologies into local food manufacturing sectors. These regional variations dictate differentiated product portfolios; while APAC focuses on fundamental flavor intensity, Western markets prioritize health-conscious flavor modification.

Segment trends underscore the dominance of the savory & snacks application segment, where flavor stability and intensity are paramount for consumer satisfaction and repeated purchase, necessitating robust flavor enhancement solutions. Within the product type segment, natural flavor enhancers, particularly yeast extracts, are witnessing accelerated growth, substantially outpacing their synthetic counterparts due to prevailing clean-label trends and regulatory scrutiny on artificial ingredients. Furthermore, the functional segment, encompassing flavor enhancers used in nutraceuticals and sports nutrition products to improve the palatability of often bitter or metallic protein and vitamin compounds, is rapidly gaining traction. The market structure remains moderately consolidated, with a few global flavor giants controlling a significant share, but the emergence of specialized biotech and fermentation startups focusing purely on natural potentiation technologies is driving innovation and fragmentation in niche segments. The shift in consumer preference from traditional, single-source flavor enhancers toward complex, multi-functional ingredient systems that offer flavor, mouthfeel, and masking properties simultaneously is a defining characteristic of current segment evolution.

AI Impact Analysis on Food Flavor Enhancers and Potentiators Market

Common user questions regarding AI's influence in the Food Flavor Enhancers and Potentiators Market frequently revolve around how artificial intelligence can accelerate new flavor discovery, optimize formulation complexity, and ensure regulatory compliance. Users inquire about the efficacy of machine learning in predicting consumer sensory responses to novel ingredient combinations and the feasibility of using generative AI to design customized flavor profiles tailored to specific regional or demographic tastes. Key themes include concerns about data privacy when feeding proprietary flavor libraries into AI models, the necessity for robust, high-quality sensory data to train these algorithms effectively, and the ethical implications of using AI to potentially manipulate flavor perception. Users generally expect AI to significantly reduce the time-to-market for new potentiators and enhance the precision of flavor delivery systems, especially in highly challenging matrices like plant-based meat substitutes and low-sodium snacks, summarizing a strong expectation for algorithmic precision and efficiency gains.

- AI-driven Predictive Modeling: Utilizing machine learning algorithms to predict the sensory impact and stability of new flavor molecules and enhancers, significantly reducing trial-and-error in R&D.

- Customized Flavor Generation: Employing generative AI to design unique, complex flavor systems and potentiator blends that cater precisely to nuanced consumer preferences in specific geographic regions or demographic groups.

- Optimizing Formulation Costs: AI assists in analyzing ingredient interactions to identify the minimal effective concentration of expensive flavor enhancers, thereby optimizing formulation costs and improving manufacturing efficiency.

- Supply Chain & Quality Control: Implementing AI and IoT sensors to monitor raw material quality and consistency (e.g., yeast strain performance, botanical extract purity), ensuring the reliable function of flavor enhancers.

- Regulatory Compliance Screening: AI tools rapidly analyze global food regulations (e.g., FDA, EFSA) against new flavor compounds, flagging potential compliance risks before market entry.

- Enhanced Sensory Analysis: Using AI to interpret and correlate human sensory panel data with chemical compound profiles, leading to a deeper understanding of potentiation mechanisms and effective flavor delivery.

DRO & Impact Forces Of Food Flavor Enhancers and Potentiators Market

The Food Flavor Enhancers and Potentiators Market is shaped by a critical balance of robust drivers, inherent restraints, and compelling opportunities, all contributing to dynamic impact forces. Major drivers include the relentless global expansion of the processed food industry, fueled by urbanization and the demand for convenience, which fundamentally relies on flavor enhancers to ensure product consistency and appeal across diverse consumer bases. Simultaneously, the global mandate to improve public health, particularly through the reduction of sodium, sugar, and artificial additives, presents a unique market opportunity for innovative potentiators that maintain or enhance palatability while meeting nutritional targets. However, the market faces significant restraints, primarily stemming from negative consumer perception, often linked to historical controversy surrounding synthetic ingredients like MSG, alongside increasing regulatory scrutiny regarding ingredient safety and labeling requirements, which necessitate costly and time-consuming product reformulation. The interaction of these factors creates powerful impact forces, where the technological imperative to deliver clean-label, high-performance ingredients is constantly tested against intense consumer skepticism and strict governmental oversight.

Specific drivers include rapid innovation in fermentation technology, which allows for the natural production of umami peptides and other flavor-boosting compounds from sustainable sources like yeast and fungi, appealing directly to the clean-label trend. The expansion of plant-based food alternatives is a further significant driver; these products often require sophisticated flavor enhancement and masking systems to overcome the inherent off-notes (such as beaniness or bitterness) associated with high concentrations of plant proteins, creating a high-value niche for specialized potentiators. Furthermore, the rising awareness of the umami taste profile, extending beyond Asian cuisine into global culinary applications, boosts the acceptance and incorporation of umami enhancers across varied food matrices. The effectiveness of these ingredients in cost-saving, by allowing the reduction of more expensive primary flavor components, also serves as a strong economic driver for industrial adoption.

Conversely, major restraints involve the high complexity and cost associated with developing and scaling up natural potentiation technologies, which often require complex extraction or fermentation processes and specialized intellectual property protection. Consumer resistance, driven by the desire for "whole foods" and a distrust of highly processed ingredients, even natural ones, poses a continuous challenge, often leading manufacturers to utilize proprietary blends described vaguely as "Natural Flavor" to avoid direct identification of the enhancers used. Regulatory environments vary significantly by region; for instance, strict labeling laws in Europe can complicate the market entry of certain novel ingredients, requiring manufacturers to tailor their portfolios regionally. The overarching opportunity lies in leveraging sustainability and functional health claims. Developing potentiators that can concurrently enhance flavor and offer functional benefits (e.g., improved digestion, immune support) opens lucrative avenues, particularly in the health and wellness segment. The market's dynamism ensures continuous pressure on R&D to deliver high-impact, transparently sourced, and widely acceptable flavor solutions.

Segmentation Analysis

The Food Flavor Enhancers and Potentiators Market is meticulously segmented across multiple dimensions—Type, Source, Application, and Form—reflecting the diversity of available products and their tailored uses across the food and beverage industry. Segmentation by Type (Natural, Artificial, Nature-Identical) reveals a clear market shift, with natural enhancers capturing the highest growth rate due to pervasive clean-label demands. The Source segmentation (Plant-based, Yeast, Microbial) highlights the critical role of biotechnology and fermentation, particularly the dominance of yeast extracts for umami and savory flavor delivery. Application segmentation demonstrates the market's reliance on major categories such as Savory & Snacks and Prepared Meals, where flavor uniformity and depth are essential. Understanding these segments is crucial for strategic planning, allowing ingredient suppliers to target high-growth areas like plant-based substitutes and low-sodium formulations, optimizing product development and market penetration strategies based on regional regulatory constraints and specific consumer needs.

- Type:

- Natural (e.g., Yeast Extracts, Vegetable Extracts, Hydrolyzed Vegetable Proteins (HVP))

- Artificial (e.g., Synthetic Dipeptides, Ethyl Maltol)

- Nature-Identical (e.g., Synthetic Vanillin, MSG)

- Source:

- Plant-based (e.g., Mushroom powders, Fruit extracts)

- Yeast (e.g., Autolyzed yeast, Yeast RNA)

- Microbial (e.g., Fermentation products)

- Application:

- Beverages (Juices, Functional Drinks, Sodas)

- Dairy & Frozen Desserts (Yogurt, Ice Cream, Cheese)

- Bakery & Confectionery (Bread, Cakes, Candies)

- Savory & Snacks (Chips, Processed Meats, Seasonings)

- Prepared Meals & Soups (Ready-to-eat meals, Canned foods)

- Form:

- Liquid (Aqueous solutions, Oils)

- Powder (Crystalline, Microencapsulated)

- Paste (Concentrated extracts)

Value Chain Analysis For Food Flavor Enhancers and Potentiators Market

The value chain for the Food Flavor Enhancers and Potentiators Market is highly specialized, beginning with the sourcing and processing of core raw materials, predominantly agricultural products (sugarcane, beet, grains, soybeans, yeast strains) and specialized chemicals. The upstream segment involves procurement and initial refinement, where purity and sustainability are paramount, particularly for natural enhancers like yeast extracts and plant-based proteins. Key activities in this stage include fermentation and sophisticated extraction processes, often relying on proprietary biotechnology to ensure high concentration and efficacy of the flavor compounds. Maintaining strict quality control at this stage is essential, as the effectiveness of the final potentiator depends heavily on the consistency and bio-availability of the precursor molecules. This upstream complexity often necessitates long-term contractual agreements between basic raw material suppliers and large flavor manufacturing companies.

The midstream stage constitutes the core manufacturing and blending process, where ingredient manufacturers, often large global flavor houses, utilize specialized R&D facilities to synthesize, purify, and compound the flavor enhancers and potentiators. This stage involves complex formulation science to create stable, application-specific products (e.g., heat-stable powders for baking or liquid concentrates for beverages). Direct distribution channels involve large-scale bulk sales directly to major Food & Beverage (F&B) multinational corporations (MNCs) who operate vast, integrated production facilities requiring large, consistent volumes. These relationships are often consultative, with flavor companies offering application support and sensory testing.

Indirect distribution involves sales through specialized chemical and food ingredient distributors who service small to medium-sized F&B enterprises (SMEs) that lack the infrastructure for direct procurement. Downstream activities involve the final application in various food products (snacks, beverages, sauces), leading to the final consumer purchase. The efficiency of the value chain is determined by the speed of innovation, the ability to rapidly scale production of clean-label alternatives, and the effectiveness of intellectual property protection surrounding novel potentiation technologies. Strategic investment in logistics and specialized storage (especially for sensitive liquid extracts) further optimizes the supply chain, ensuring product integrity until the point of application.

Food Flavor Enhancers and Potentiators Market Potential Customers

Potential customers for food flavor enhancers and potentiators are diverse, spanning the entirety of the packaged food and beverage manufacturing sector, driven by the universal need to improve product palatability and achieve cost efficiencies. The primary customer segment includes large multinational Food & Beverage corporations specializing in high-volume production of convenience foods, frozen meals, savory snacks, and mass-market processed meats. These entities require bulk volumes, consistent quality, and global regulatory support, often engaging in direct, long-term procurement contracts with flavor giants to ensure stability in their product formulations worldwide. A second significant segment includes manufacturers focused on health and wellness products, such as low-sodium, reduced-sugar, and plant-based alternatives, which are heavily reliant on advanced potentiators to mask off-tastes and deliver sensory satisfaction despite ingredient modifications. These customers seek highly specialized, natural, and highly effective potentiation systems.

The growing segment of small and medium-sized enterprises (SMEs) and artisanal food producers also represents a crucial customer base, typically accessing the market through indirect distribution channels. These customers, often focused on niche markets or specialized ethnic foods, require flexible ordering sizes and technical assistance to integrate complex enhancers into smaller-batch recipes. Furthermore, the quick-service restaurant (QSR) and food service industry represent indirect but significant customers; their centralized commissaries utilize flavor enhancers extensively in bases, marinades, and sauces to guarantee flavor consistency across vast franchise networks globally. The flavor industry's ability to cater to these varied customer needs—from bulk commodities for MNCs to tailored solutions for specialty producers—is essential for capturing comprehensive market share.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co., Inc., Givaudan SA, International Flavors & Fragrances (IFF), Symrise AG, Firmenich International SA, Takasago International Corporation, Sensient Technologies Corporation, DSM Nutritional Products, Tate & Lyle PLC, Kerry Group PLC, ADM (Archer Daniels Midland Company), Cargill, Incorporated, Synergy Flavors, Innova Flavors, Fufeng Group, Shandong Linghua Group Co., Ltd., Vedan International (Holdings) Limited, Diana Food (Symrise), Prinova Group LLC, Döhler Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Flavor Enhancers and Potentiators Market Key Technology Landscape

The technological landscape of the Food Flavor Enhancers and Potentiators Market is dominated by advancements in biotechnology, specifically fermentation and enzyme technology, which are essential for producing high-purity, natural flavor compounds. Modern fermentation techniques utilize specialized yeast, bacterial, or fungal strains to generate complex flavor precursors, such as nucleotides (IMP/GMP) and glutamates, or to produce customized peptides and amino acids that provide savory umami notes and function as effective potentiators. This approach allows manufacturers to move away from purely synthetic or chemically extracted ingredients towards clean-label solutions derived from natural processes, directly addressing prevailing consumer demands for ingredient transparency and health. Furthermore, advanced enzymatic hydrolysis techniques are crucial for breaking down protein sources (e.g., soy, wheat, dairy) into desirable HVP components, maximizing flavor impact and yield while carefully controlling the resulting flavor profile to avoid undesirable off-notes.

Another critical area of innovation involves delivery systems, notably microencapsulation and liposome technology. These technologies are employed to protect volatile flavor components and potentiators from degradation during high-temperature processing (like baking or extrusion) and throughout the product's shelf life. Microencapsulation ensures controlled, delayed release of the flavor compound, maximizing impact upon consumption and enhancing overall flavor perception longevity. This is particularly vital in savory snack coatings and powdered beverage mixes, where moisture and heat can rapidly diminish flavor potency. Research in molecular modeling and sensory science is also instrumental, leveraging computational tools to understand the exact mechanisms by which specific compounds interact with taste receptors, allowing for the precise design of potentiation molecules that target specific taste pathways, such as suppressing bitterness or intensifying sweetness.

Finally, the rapid adoption of Artificial Intelligence (AI) and High-Throughput Screening (HTS) is transforming the R&D pipeline. AI algorithms analyze vast datasets of chemical structures and sensory data to predict the flavor outcome and potentiation capacity of novel compounds, drastically accelerating the discovery phase. HTS facilitates the rapid testing of thousands of potential natural extracts and fermentation products, identifying promising candidates for commercialization more efficiently than traditional laboratory testing methods. The integration of these digital technologies, coupled with a focus on sustainable sourcing and waste valorization (e.g., extracting flavor components from food processing by-products), defines the modern technological edge in this highly competitive market space, ensuring continuous innovation in flavor optimization while minimizing environmental footprint.

Regional Highlights

Regional dynamics within the Food Flavor Enhancers and Potentiators Market are highly heterogeneous, dictated by local regulatory environments, culinary traditions, and the maturity of the processed food sector in each area. Asia Pacific (APAC) leads the market both in volume consumption and growth trajectory. This dominance is intrinsically linked to the cultural centrality of the umami taste profile in regional cuisines, driving massive demand for MSG, nucleotides, and yeast extracts in packaged noodles, sauces, and snacks. Rapid economic development, escalating urbanization, and the adoption of Westernized convenient food products in countries like China, India, and Southeast Asian nations further accelerate market expansion, making APAC the undisputed manufacturing and consumption hub for savory enhancers. Companies in this region focus on optimizing high-volume production and securing cost-competitive raw materials to meet the scale of local demand.

North America and Europe represent mature, high-value markets characterized by a strong consumer mandate for clean labels, natural ingredients, and functional health claims. In these regions, growth is primarily driven by the demand for sophisticated sodium and sugar potentiators that allow manufacturers to reduce traditional high-impact ingredients without sensory loss. European regulations, particularly concerning ingredient classification and labeling, are among the strictest globally, forcing companies to prioritize natural extracts, organic certification, and highly transparent sourcing practices. North America, conversely, sees strong investment in flavor masking technologies, essential for overcoming the off-notes in the rapidly expanding segments of high-protein sports nutrition and plant-based foods.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting significant growth potential. LATAM is benefiting from increasing per capita income, shifting lifestyles favoring packaged foods, and expanding food processing infrastructure, creating new avenues for the introduction of advanced enhancers and potentiators. The MEA market, while constrained by lower processing sophistication in some areas, shows strong demand in wealthier Gulf Cooperation Council (GCC) countries for premium, imported processed goods, driving the need for enhancers to ensure high quality and stability in challenging climate conditions. Both regions offer untapped potential for providers of cost-effective, high-impact flavor systems suitable for localized culinary profiles and adapting to regional religious and cultural dietary requirements.

- Asia Pacific (APAC): Dominates the global market, driven by high consumption of savory processed foods, vast populations, and deep culinary roots favoring umami taste. Key growth markets include China, India, and Japan.

- North America: Focuses on premium, natural, and clean-label potentiators. High adoption of sodium reduction solutions and sophisticated masking agents for plant-based and functional foods.

- Europe: Characterized by stringent regulatory oversight (e.g., EFSA). Market growth is reliant on highly transparent and sustainably sourced natural yeast extracts and vegetable concentrates for savory and low-sugar applications.

- Latin America (LATAM): Emerging market showing strong potential due to urbanization and industrialization of the food sector, demanding efficient and reliable flavor consistency solutions.

- Middle East and Africa (MEA): Growth centered in GCC nations, driven by consumer preference for high-quality packaged goods and the need for ingredient stability under high heat and humidity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Flavor Enhancers and Potentiators Market.- Ajinomoto Co., Inc.

- Givaudan SA

- International Flavors & Fragrances (IFF)

- Symrise AG

- Firmenich International SA

- Takasago International Corporation

- Sensient Technologies Corporation

- DSM Nutritional Products

- Tate & Lyle PLC

- Kerry Group PLC

- ADM (Archer Daniels Midland Company)

- Cargill, Incorporated

- Synergy Flavors

- Innova Flavors

- Fufeng Group

- Shandong Linghua Group Co., Ltd.

- Vedan International (Holdings) Limited

- Diana Food (Symrise)

- Prinova Group LLC

- Döhler Group

Frequently Asked Questions

Analyze common user questions about the Food Flavor Enhancers and Potentiators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a flavor enhancer and a flavor potentiator?

A flavor enhancer directly boosts a specific inherent flavor (like umami, sweetness, or saltiness), often by stimulating taste receptors (e.g., MSG for umami). A flavor potentiator, conversely, increases the perceived intensity or longevity of existing flavor components or masks undesirable off-notes without adding a distinct flavor itself, making the overall profile more impactful.

How is the clean-label trend impacting the demand for traditional enhancers like MSG?

The clean-label trend is significantly driving the substitution of traditional synthetic enhancers, including MSG, with natural alternatives. Demand is surging for ingredients like yeast extracts, natural vegetable concentrates, and specific microbial fermentation products, which offer similar umami and enhancement properties but align better with consumer preferences for natural sourcing and simpler ingredient lists.

Which application segment holds the largest market share for flavor enhancers?

The Savory & Snacks and Prepared Meals application segment currently holds the largest market share. This is driven by the extensive use of umami enhancers (such as yeast extracts and nucleotides) in ready-to-eat meals, soups, sauces, and snack seasonings to maintain consistent, intense flavor profiles crucial for consumer acceptance and repeatability.

What role do flavor potentiators play in addressing sodium reduction challenges?

Flavor potentiators are critical tools for sodium reduction. They heighten the perceived saltiness of a food product, allowing manufacturers to reduce the actual sodium content (NaCl) by 20% to 50% while maintaining equivalent sensory satisfaction, thereby helping companies meet public health mandates and consumer demands for healthier packaged goods.

What are the key technological advancements driving innovation in the market?

Key technological advancements include sophisticated fermentation techniques for producing natural umami peptides, the integration of AI and machine learning for predictive flavor modeling, and microencapsulation technologies designed to ensure the stability and controlled release of flavor compounds during processing and storage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager