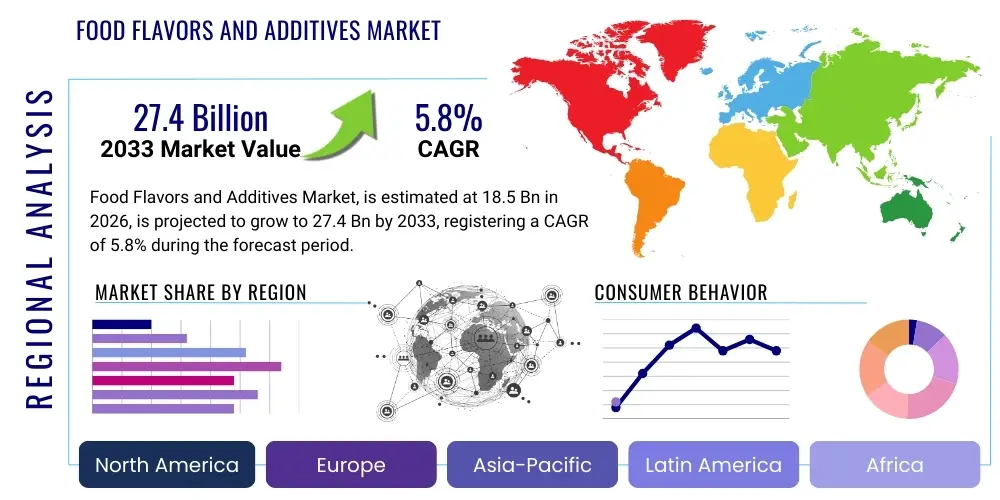

Food Flavors and Additives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443587 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Food Flavors and Additives Market Size

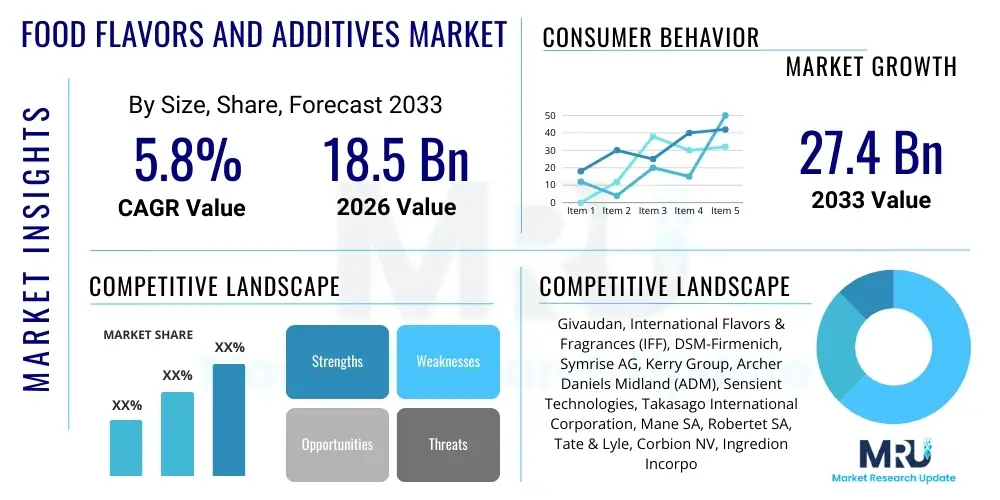

The Food Flavors and Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.4 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the evolving global consumer landscape, characterized by increasing demand for processed and convenience foods that do not compromise on sensory appeal. Factors such as urbanization, rising disposable incomes in emerging economies, and the continuous innovation in product development necessitate sophisticated flavor profiles and functional ingredients to ensure product differentiation and stability on the shelf.

Food Flavors and Additives Market introduction

The Food Flavors and Additives Market encompasses a broad spectrum of ingredients specifically designed to enhance the taste, aroma, appearance, texture, and shelf life of processed food and beverage products. These components are categorized into flavors (which enhance sensory attributes like taste and smell) and additives (which perform functional roles such as preservation, coloring, sweetening, and emulsifying). Major applications span the entire food industry, including beverages, dairy products, baked goods, confectionery, meat products, and savory snacks. The utilization of these ingredients is critical for meeting stringent consumer expectations regarding quality and experience, particularly as global supply chains require longer transit times and extended product freshness.

The core product description includes synthetic and natural flavor compounds, hydrocolloids, emulsifiers, preservatives, sweeteners, and colorants. The primary benefits derived from the incorporation of flavors and additives include improved palatability, enhanced nutritional value (in the case of certain fortification additives), prevention of microbial spoilage, and maintenance of desired physical characteristics, such as texture and consistency. The primary driving factors for market growth include the robust expansion of the convenience food sector, rapid technological advancements enabling the creation of authentic natural flavors, and a heightened focus on functional ingredients that offer health benefits beyond basic nutrition, aligning with the "better-for-you" trend prevalent globally.

Furthermore, regulatory bodies play a significant role in shaping the market, imposing strict guidelines regarding the types and concentrations of additives permissible in food products. This regulatory environment is simultaneously a constraint and a catalyst for innovation, pushing manufacturers towards natural, clean-label alternatives. The continuous pursuit of novel, culturally specific, and exotic flavor combinations, driven by globalization and consumer adventurousness, ensures sustained investment in research and development across the leading market participants, thereby securing the projected CAGR over the forecast period.

Food Flavors and Additives Market Executive Summary

The Food Flavors and Additives market exhibits dynamic business trends characterized by intense competitive innovation, strategic mergers and acquisitions focused on securing natural ingredient supply chains, and a definitive shift towards transparency and sustainability. Major flavor houses are investing heavily in biotechnology and fermentation processes to produce scalable, cost-effective natural flavors that meet clean-label requirements. This pivot is driving consolidation as companies seek to integrate specialized ingredient portfolios and expand geographic reach. Furthermore, the integration of digital tools, including Artificial Intelligence (AI) and machine learning, is accelerating flavor creation cycles, allowing companies to respond almost instantaneously to ephemeral consumer taste trends and optimize product formulations for sensory appeal and regulatory compliance, thereby redefining traditional R&D pathways.

Regionally, Asia Pacific (APAC) stands out as the primary engine of growth, fueled by massive population bases, rapid urbanization, and a burgeoning middle class demanding premium and Western-style processed foods. North America and Europe, while mature, remain crucial centers for innovation, particularly regarding functional additives (probiotics, fiber fortification) and certified organic and non-GMO flavors. Regulatory harmonization attempts within regional blocs, such as the European Union, influence ingredient standardization, whereas emerging markets often present opportunities for volume growth despite sometimes fragmented regulatory frameworks. The demand for authentic regional cuisines globally is also stimulating cross-border flavor development and ingredient sourcing, impacting global trade flows.

Segment trends underscore the dominance of natural segments. Natural flavors and natural colorants are witnessing accelerated adoption, often at the expense of their synthetic counterparts, reflecting consumer aversion to perceived chemical ingredients. In terms of application, the beverage sector, particularly the functional and health-focused beverage category (e.g., flavored waters, energy drinks, plant-based milks), is the most rapid adopter of innovative flavor technologies and low-calorie sweeteners. Simultaneously, the savory snacks segment is experiencing high growth, driven by the exploration of bold, globalized flavor profiles and the need for texture-enhancing additives that maintain crispness during shelf life. The convergence of flavor and function, where ingredients provide both sensory pleasure and health benefits (e.g., natural preservatives with antioxidant properties), is becoming the defining characteristic of successful new product introductions.

AI Impact Analysis on Food Flavors and Additives Market

User inquiries regarding AI's influence in the Food Flavors and Additives market frequently center on its ability to predict consumer preference, accelerate the discovery of novel flavor molecules, optimize formulation costs, and ensure product quality consistency across vast production scales. Users are keen to understand how AI bypasses the traditional, time-consuming human sensory evaluation processes and whether it can accurately model complex flavor interactions within a food matrix. Key concerns revolve around the ethical implications of creating 'perfect', hyper-palatable foods and the necessity for human expertise alongside algorithmic recommendations. The summarized expectations are that AI will fundamentally disrupt R&D speed, enabling quicker market entry for customized products and minimizing trial-and-error in flavor creation, ultimately leading to more personalized and efficiently produced food offerings tailored to specific demographic tastes and cultural requirements.

AI’s role transcends mere data processing; it is increasingly used in 'digital nose' and 'digital tongue' technologies, simulating human olfactory and gustatory perception using advanced sensor arrays coupled with machine learning algorithms. This capability allows researchers to rapidly screen thousands of potential flavor compounds from databases, predict their sensory profile and stability in specific food environments, and determine optimal dosage levels, significantly reducing the reliance on extensive human panels in the initial stages of formulation. Furthermore, generative AI models are now being trained on vast repositories of chemical structures and historical consumer acceptance data, enabling them to propose entirely novel molecular combinations that deliver specific desired flavor notes or functional characteristics (e.g., enhanced heat stability or reduced off-notes in plant-based proteins).

The application of AI extends deeply into supply chain optimization and quality control. Machine learning algorithms analyze supply volatility for natural raw materials, predicting potential shortages or price spikes for essential botanicals, allowing procurement teams to adjust sourcing strategies preemptively. In manufacturing, computer vision systems and analytical tools powered by AI monitor ingredient mixing and processing parameters in real time, ensuring that the final flavor delivery system, such as encapsulation beads or emulsions, maintains the intended profile and release mechanism. This holistic integration of AI from discovery to quality assurance elevates manufacturing precision and ensures high consumer satisfaction while minimizing waste and regulatory risk associated with variability.

- AI accelerates flavor creation cycle by predicting sensory outcomes from chemical structures.

- Machine learning optimizes ingredient dosage and reduces formulation complexity in multi-component food systems.

- Generative AI facilitates the discovery of novel, naturally derived flavor compounds and molecules.

- AI-driven consumer preference modeling predicts regional and demographic taste trends with high accuracy (Personalized Flavor Design).

- Supply chain risk management utilizes predictive analytics to stabilize sourcing of volatile natural ingredients.

- Automated quality control systems (digital noses/tongues) ensure batch-to-batch consistency in flavor intensity and profile.

DRO & Impact Forces Of Food Flavors and Additives Market

The dynamics of the Food Flavors and Additives Market are governed by powerful, often conflicting, forces of demand (driven by consumer desire for variety and health) and supply (constrained by resource availability and regulatory oversight). Key drivers include the global expansion of the processed food industry, especially in emerging markets where convenience is prized, and the universal consumer shift toward clean-label and natural ingredient declarations, which compels flavor houses to invest in complex natural extraction and bio-fermentation technologies. However, the market faces significant restraints, primarily regulatory hurdles concerning the approval and permissible limits of synthetic additives, coupled with extreme volatility in the pricing and availability of natural raw materials, often linked to climate change impacts and geopolitical instability affecting agricultural outputs. These restraints necessitate robust risk management strategies and diversification of sourcing. Opportunities are abundant in the field of personalized nutrition and the development of flavor modifiers that successfully mask the off-notes associated with sustainable protein sources (e.g., plant proteins, cultured meat), providing a fertile ground for high-margin, differentiated product offerings. The interplay of these forces defines the market’s trajectory.

The most significant impact force shaping the current market is the environmental and ethical sustainability mandate. Consumers increasingly demand evidence of sustainable sourcing, ethical labor practices, and reduced environmental footprint (e.g., lower carbon emissions, less water usage) for the ingredients used in their food. This force compels companies to adopt traceability technologies, often utilizing blockchain, to verify the provenance of botanicals and specialty ingredients. The second major impact force is the hyper-personalization of diet and taste. Technological advancements, including genetic sequencing related to taste receptor variations and localized market data analytics, are pushing product development away from mass-market flavors toward micro-targeted, niche profiles. This requires flavor companies to build scalable, flexible manufacturing platforms capable of producing small batches of highly specialized ingredients quickly, fundamentally changing production economics and inventory management.

The regulatory environment constitutes a constant, high-pressure impact force. Continuous review of existing additive approvals, such as titanium dioxide or specific colorants, alongside complex novel food application procedures (particularly relevant for biotech-derived flavors), dictates product innovation timelines and permissible market scope. Companies must invest heavily in regulatory affairs and toxicology testing to ensure compliance, which acts as a barrier to entry for smaller players. Conversely, the public health impetus, focusing on reducing sugar and sodium content globally, acts as a strong driver for innovation in flavor delivery systems and flavor enhancers that can maintain palatability in reduced-sodium or reduced-sugar formulations without relying on high-intensity artificial sweeteners, thereby demonstrating the dual influence of the regulatory and public health landscapes on strategic direction.

Segmentation Analysis

The Food Flavors and Additives market is highly fragmented yet structurally defined by its segmentation across ingredient type, functional category, application industry, and geography. Segmentation analysis is crucial as it highlights the divergent growth trajectories within the market; for instance, the rapid expansion of the natural flavors and functional additives segments contrasts sharply with the mature, slower growth rates observed in conventional, artificial segments. The fundamental driving factor behind segmentation growth is the consumer's willingness to pay a premium for perceived health benefits or natural origins, directing investment primarily into biotechnology-derived ingredients and specialty encapsulation systems designed for enhanced nutrient or flavor delivery, especially within the high-growth application areas such as ready-to-drink (RTD) beverages and plant-based substitutes. Furthermore, regulatory definitions significantly influence segment size, particularly concerning "natural" vs. "artificial" classifications across different jurisdictions.

Analyzing the functional categories, preservation and texture modification additives remain foundational due to their necessity in modern food manufacturing logistics, ensuring product safety and aesthetic appeal. However, high-value growth is concentrated in flavor enhancers (including natural savory flavor bases like yeast extracts and hydrolyzed proteins) and health-oriented functional additives (e.g., prebiotics, specific vitamins, and minerals). The application segmentation reveals that the Beverage segment is a powerhouse of flavor innovation, driven by low barriers to entry for new products and the constant search for novel, refreshing taste profiles. Similarly, the rapid commercialization of alternative protein sources necessitates advanced flavor masking and enhancement technologies, positioning the meat and dairy alternatives sector as a leading adopter of cutting-edge ingredient solutions.

Geographically, market segmentation confirms APAC’s role as the volume driver due to industrialization and dietary diversification, while North America and Europe lead in terms of innovation expenditure per capita and adherence to premium, clean-label standards. Understanding these segment dynamics is essential for market participants to tailor their portfolios, whether focusing on high-volume, cost-competitive staple additives for basic processed foods in developing regions or concentrating on specialized, high-potency natural extracts and delivery systems for premium health products in developed economies. The persistent trend of integrating flavor and function is blurring traditional segment boundaries, leading to convergence between additive categories like colorants that also offer antioxidant properties.

- By Type:

- Natural Flavors (Botanical Extracts, Essential Oils, Fermentation Products)

- Artificial Flavors (Chemical Synthetics)

- Natural Additives (Natural Sweeteners, Natural Colorants, Plant-Derived Preservatives)

- Artificial Additives (Synthetic Preservatives, Artificial Sweeteners, Synthetic Colorants)

- By Application:

- Beverages (Soft Drinks, Juices, Dairy Alternatives, Functional Drinks)

- Dairy Products (Yogurt, Cheese, Ice Cream)

- Bakery and Confectionery (Breads, Cakes, Candies, Chocolates)

- Meat and Seafood Products (Processed Meats, Ready Meals)

- Savory & Snacks (Chips, Extruded Snacks, Soups, Sauces)

- By Functional Category:

- Flavor Enhancers and Modulators

- Preservatives and Antioxidants

- Sweeteners (Caloric and Non-Caloric)

- Colorants and Stabilizers

- Texture Agents and Emulsifiers (Hydrocolloids)

Value Chain Analysis For Food Flavors and Additives Market

The value chain for the Food Flavors and Additives Market is complex, beginning with highly diverse upstream activities involving the sourcing of agricultural raw materials (botanicals, spices, fruits, chemical precursors) and specialized biotechnology inputs. The upstream analysis highlights that natural ingredient sourcing is often characterized by significant geographical dispersion, requiring sophisticated global procurement networks and strict adherence to fair trade and sustainability protocols. The volatility of agricultural commodities makes robust hedging and vertical integration strategies crucial for flavor and additive manufacturers to secure consistent quality and price stability. Manufacturers also engage heavily in basic research to discover new functional molecules or develop proprietary fermentation strains, which constitute high-value intellectual property within the upstream phase. This complexity necessitates strong partnerships with specialized agricultural producers and fine chemical suppliers.

The midstream stage, dominated by flavor houses and major ingredient suppliers, involves sophisticated transformation processes, including extraction, distillation, reaction, synthesis, encapsulation, and blending. This stage is capital-intensive, relying on advanced analytical chemistry and process engineering to create stable, potent, and safe finished ingredients. Distribution channels are highly specialized. Direct distribution is common for high-volume, highly customized, or technically sensitive ingredients, where manufacturers work directly with large multinational food and beverage companies (F&B) to co-develop specific formulations and ensure seamless integration into production lines. This direct model facilitates technical support and faster response to formulation changes. Conversely, indirect distribution, involving regional distributors and agents, caters predominantly to smaller or medium-sized F&B enterprises, offering localized inventory, technical blending services, and smaller minimum order quantities, especially vital in geographically fragmented markets.

The downstream analysis focuses on the integration of these ingredients into final products by F&B manufacturers, foodservice providers, and increasingly, nutraceutical companies. Success at the downstream level hinges on the ingredient manufacturer's ability to offer application expertise—understanding how a specific flavor or additive performs under various processing conditions (e.g., pasteurization, freezing, baking). Feedback loops from downstream users concerning product stability, consumer acceptance, and cost-in-use are critical for continuous product refinement. Effective distribution strategy must balance the need for global presence to serve multinational clients with the need for localized application labs and sales teams to support regional culinary preferences and specific regulatory adherence, ensuring the ingredients reach the end-user efficiently and accompanied by necessary technical guidance.

Food Flavors and Additives Market Potential Customers

The primary customers for the Food Flavors and Additives Market are the large-scale producers within the global food and beverage manufacturing sector, ranging from multinational corporations to specialized regional processors. These end-users utilize flavors to differentiate their products in crowded markets and additives to ensure safety, extend shelf life, and maintain consumer-acceptable texture and appearance. Within this category, companies producing soft drinks, processed dairy (yogurts, flavored milk), mass-market packaged snacks, and ready-to-eat meals represent the largest volume consumers. Their purchasing decisions are critically influenced by price stability, ingredient functionality under processing stress, and the supplier's capacity to deliver certified natural and clean-label alternatives that align with marketing narratives focused on health and wholesomeness. They require robust traceability and extensive documentation regarding the safety and origin of all supplied ingredients.

Another rapidly expanding segment of potential customers includes manufacturers focused on alternative proteins and specialized dietary products, such as plant-based meat and dairy substitutes, gluten-free, and ketogenic products. These customers pose unique technical challenges, particularly the need for specialized flavor modifiers that successfully mask the inherent off-notes (e.g., bitterness or beany flavors) often present in vegetable proteins like soy, pea, and rice. They seek innovation in functional additives, such as natural gums and specialized starches, required to replicate the mouthfeel and texture characteristics traditionally provided by animal fats and proteins. This group places a high premium on bespoke flavor solutions and collaborative R&D efforts, often necessitating closer supplier relationships than traditional food manufacturers.

Furthermore, the nutraceutical and dietary supplement industries represent a high-growth customer segment. While focused primarily on functional additives (vitamins, minerals, prebiotics, protein isolates), the palatability of these products is increasingly important for consumer compliance and repeat purchase. Thus, high-performance, natural flavors and specialized masking agents are essential for formulating powders, gummies, and functional beverages that are pleasant to consume, moving beyond the traditional medicinal taste profiles. These customers demand ingredients that are supported by clinical efficacy data, alongside food-grade quality certification, signifying a market segment that values both sensory quality and verifiable health claims derived from the additives themselves.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Givaudan, International Flavors & Fragrances (IFF), DSM-Firmenich, Symrise AG, Kerry Group, Archer Daniels Midland (ADM), Sensient Technologies, Takasago International Corporation, Mane SA, Robertet SA, Tate & Lyle, Corbion NV, Ingredion Incorporated, Ajinomoto Co., Inc., Döhler GmbH, BASF SE, Kalsec Inc., Naturex, Bunge Limited, Cargill, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Flavors and Additives Market Key Technology Landscape

The technological landscape of the Food Flavors and Additives market is undergoing a rapid transformation, moving away from traditional chemical synthesis towards advanced biotechnological and digital methodologies. A paramount technological focus is placed on bio-fermentation and cell culture techniques, enabling the scalable, sustainable, and consistent production of natural identical flavors and high-value functional ingredients like specialty proteins, natural colorants, and complex aroma molecules. This approach addresses the industry's twin challenges: minimizing reliance on volatile agricultural supply chains and meeting the stringent 'natural' and 'clean-label' criteria demanded by consumers and regulators. Advanced fermentation allows for the targeted creation of desired flavor metabolites using engineered microorganisms, ensuring purity and environmental sustainability superior to conventional solvent extraction methods.

Another crucial innovation involves encapsulation and delivery system technologies. Flavor and additive stability, especially during harsh food processing (e.g., high heat sterilization) and extended shelf life, is paramount. Technologies such as microencapsulation, nanoemulsions, and liposomal delivery systems are widely adopted to protect volatile flavor components, control their release kinetics (e.g., burst release upon chewing or gradual release over time), and enhance the bioavailability of certain functional additives. These advancements allow formulators to use less flavor or additive material while achieving a more intense, longer-lasting, and targeted sensory experience. Furthermore, specialized taste modification technologies, often utilizing complex amino acid mixtures or proprietary botanical extracts, are essential for overcoming the palatability issues associated with low-sugar, low-sodium, and high-protein formulations, thereby driving the technical feasibility of healthier product lines.

The integration of digital technology, collectively termed 'Flavor Informatics' or 'Computational Flavor Design,' is revolutionizing the speed of innovation. This includes the deployment of High-Throughput Screening (HTS) to quickly analyze the interaction of hundreds of molecules, alongside advanced chemometric modeling and AI. These digital tools analyze vast datasets of chemical compositions, sensory evaluation results, and market acceptance trends to predict successful flavor combinations and optimize ingredient blends before physical lab work even commences. This predictive capability dramatically cuts R&D timelines and cost, allowing companies to launch targeted flavor solutions faster than competitors. Coupled with advanced analytical equipment like comprehensive two-dimensional gas chromatography (GC×GC), which provides unparalleled resolution for identifying flavor components, the technological base is set to unlock the next generation of authentic, stable, and sustainable food ingredients.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by rapid economic growth, changing dietary habits towards packaged and Westernized foods, and massive populations in countries like China and India. The demand here is dual-focused: high-volume, cost-effective additives for mass-market products, and an escalating premium segment demanding authentic regional flavors and functional ingredients like traditional Chinese medicine botanicals. Regulatory harmonization across ASEAN nations is gradually simplifying market access, though local food standards remain highly diverse. The region is a vital hub for sourcing natural flavor materials and is quickly becoming a manufacturing center for global flavor houses.

- North America: North America is characterized by high consumer awareness regarding ingredient safety and a strong preference for "free-from" and clean-label products (e.g., non-GMO, no artificial colors). This region leads in adopting functional additives related to digestive health (prebiotics, fiber) and protein fortification. Innovation is rapid, particularly in customized flavor solutions for the booming plant-based alternative market and specialized dietary supplements. Regulatory environments, primarily governed by the FDA, drive transparency and necessitate robust safety dossiers for novel ingredients. The market is mature but highly responsive to trends like sustainability and sourcing ethics.

- Europe: The European market is highly regulated, primarily by the European Food Safety Authority (EFSA), which imposes some of the world's strictest approval processes for additives, significantly constraining synthetic ingredients and pushing innovation toward natural alternatives, particularly those derived through fermentation or enzymatic processes. Consumer demand is focused on organic certification, regional flavor authenticity (Protected Designation of Origin), and sustainable packaging/sourcing. The UK and Germany are significant markets for functional beverages and bakery flavor systems, while Southern Europe shows higher consumption of flavor components linked to traditional Mediterranean diets.

- Latin America (LATAM): LATAM offers significant growth potential, fueled by increasing urbanization and the resulting rise in convenience food consumption. Brazil and Mexico are the largest markets, exhibiting strong demand for cost-effective colorants, stabilizers, and flavor enhancers for high-volume processed foods, including soft drinks and savory snacks. The key challenge in this region is adapting formulations to extreme climatic variations (e.g., high humidity) that affect ingredient stability and ensuring compliance across numerous national regulatory bodies, requiring adaptable and robust additive solutions.

- Middle East and Africa (MEA): Growth in MEA is driven by high population growth and increasing affluence, particularly in the GCC countries, leading to greater consumption of imported and luxury processed goods. Halal certification for ingredients is a non-negotiable requirement, driving preference for plant-derived or fermentation-based additives and flavors. African markets present high-volume opportunities for basic additives, though infrastructure challenges and complex import logistics necessitate localized manufacturing or robust regional distribution partnerships. The market shows a growing interest in flavor profiles native to the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Flavors and Additives Market.- Givaudan

- International Flavors & Fragrances (IFF)

- DSM-Firmenich

- Symrise AG

- Kerry Group

- Archer Daniels Midland (ADM)

- Sensient Technologies

- Takasago International Corporation

- Mane SA

- Robertet SA

- Tate & Lyle

- Corbion NV

- Ingredion Incorporated

- Ajinomoto Co., Inc.

- Döhler GmbH

- BASF SE

- Kalsec Inc.

- Naturex (Givaudan)

- Bunge Limited

- Cargill, Inc.

Frequently Asked Questions

Analyze common user questions about the Food Flavors and Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards natural flavors and additives globally?

The primary driver is elevated consumer awareness and demand for clean-label products, seeking ingredients perceived as healthier, less processed, and free from synthetic chemicals. Regulatory mandates and certification requirements also strongly favor naturally sourced ingredients, compelling manufacturers to invest in advanced extraction and biotechnological methods for sustainable production.

How is biotechnology influencing the future of flavor creation?

Biotechnology, particularly precision fermentation and cell culture, allows for the scalable, environmentally sustainable production of highly consistent, complex, and natural-identical flavor molecules that were previously difficult or expensive to source from botanicals. This technology accelerates R&D and ensures year-round supply stability, bypassing agricultural volatility.

Which application segment shows the highest growth rate for flavors and additives?

The Beverage segment, especially functional beverages, plant-based dairy alternatives, and low-sugar refreshment drinks, demonstrates the highest growth due to continuous product launches requiring unique, intense flavor profiles and specific functional additives (e.g., stabilizers, natural sweeteners, and fortifying vitamins) to meet modern health trends.

What are the main challenges facing the supply chain for natural food ingredients?

Key challenges include extreme price volatility of agricultural raw materials due to climate change and geopolitical instability, coupled with stringent requirements for traceability, ethical sourcing, and purity validation. Securing consistent, high-quality natural extracts requires advanced risk management and diversification of sourcing regions.

How is Artificial Intelligence (AI) being utilized in market development?

AI is employed for predictive modeling of consumer taste preferences, rapid screening of potential flavor molecules (Flavor Informatics), and optimizing complex formulations to reduce sugar or sodium while maintaining palatability. This accelerates the R&D process, minimizing trial-and-error and enabling hyper-personalized product development strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager