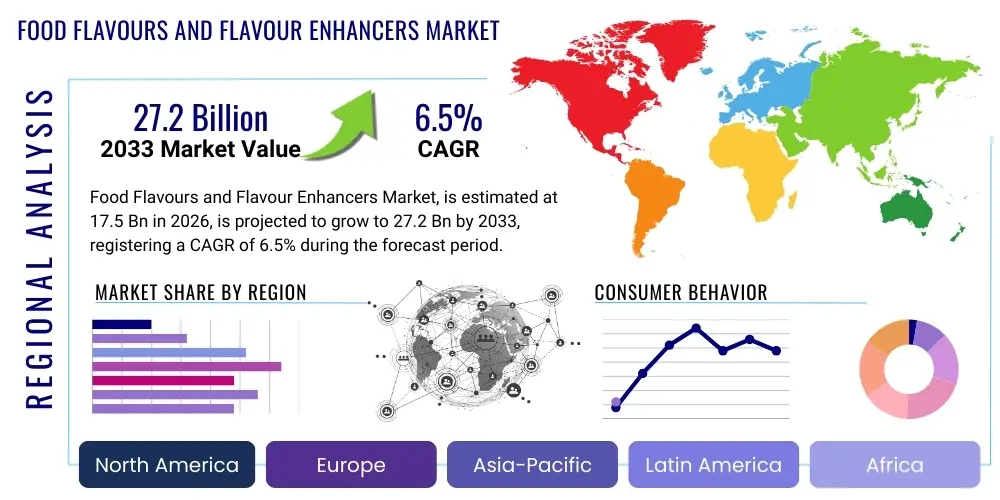

Food Flavours and Flavour Enhancers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441363 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Food Flavours and Flavour Enhancers Market Size

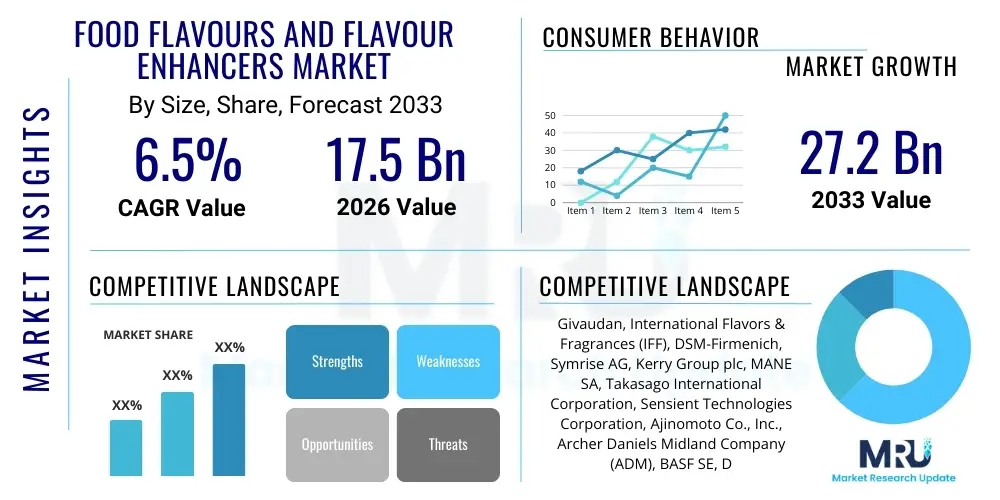

The Food Flavours and Flavour Enhancers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 27.2 Billion by the end of the forecast period in 2033.

Food Flavours and Flavour Enhancers Market introduction

The Food Flavours and Flavour Enhancers Market is a dynamic segment within the global food ingredients industry, focusing on the sensory enhancement of consumer products through meticulous taste and aroma modification. Flavours are complex formulations, often proprietary blends of aromatic chemicals, essential oils, extracts, and reaction flavors, meticulously developed by flavorists to achieve a desired sensory profile that remains stable across various challenging food matrices, including high-heat processes and long shelf life requirements. The critical function of these ingredients extends beyond mere palatability; they are essential for standardizing the taste profile of products made from variable agricultural raw materials, ensuring crucial brand consistency, and masking undesirable off-notes that may arise from processing or the inclusion of health-focused functional ingredients, such as specialized vitamins, minerals, or high-protein powders. This market is fundamentally categorized into natural, nature-identical, and artificial flavor compounds, with regulatory scrutiny and powerful consumer movements increasingly pushing innovation and investment towards the natural and sustainable sourcing methodologies to achieve clean-label status.

The evolving global diet, characterized by a rapid and continuous shift towards highly processed and convenience foods in densely populated urban centers worldwide, provides the underlying momentum for sustained market growth. As consumers increasingly prioritize ready-to-eat and quick-preparation solutions, the reliance on advanced, stable flavour systems to deliver authentic, high-quality, and diverse taste experiences becomes paramount for manufacturers worldwide seeking differentiation. Furthermore, the sustained global effort to combat public health issues related to the excessive consumption of sugar, salt, and unhealthy fats directly fuels demand for highly sophisticated flavour enhancers and specialized masking agents. These enhancers play a crucial, pivotal role in maintaining hedonistic consumer acceptance during aggressive product reformulation, allowing food scientists to significantly reduce unhealthy primary ingredients without causing noticeable detrimental effects on the final taste perception, thus successfully balancing stringent public health objectives with commercial viability in highly competitive retail spaces.

The technological benefits derived from employing advanced flavour and encapsulation technology are multifaceted, directly impacting production cost efficiencies, strengthening consumer loyalty, and increasing market agility. Flavor encapsulation technology, for instance, not only preserves the volatility and intensity of delicate aromatic compounds but also allows for highly controlled release mechanisms, creating layered, multi-stage sensory experiences in specialized products like chewing gum, premium confectionery, or sustained-release functional beverages. The continuous diversification of global flavour palettes, driven by globalization, robust digital consumer data tracking, and accelerating cross-cultural culinary exchange, necessitates specialized R&D to quickly replicate exotic and authentic ethnic tastes using readily scalable and cost-effective industrial ingredient systems. Therefore, flavour and enhancer manufacturers are now positioned as critical innovation partners for the global food industry, offering bespoke, highly tailored solutions targeted specifically to regional preferences, evolving legislative requirements, and the distinct technological constraints of various large-scale food production processes. The convergence of overwhelming consumer demand for authenticity and verifiable health benefits, coupled with rapid technological breakthroughs in industrial biotechnology and computational flavor synthesis, ensures this specialized market segment remains one of the highest growth areas within the broader food ingredients sector.

Food Flavours and Flavour Enhancers Market Executive Summary

Global business dynamics within the Food Flavours and Flavour Enhancers Market are currently defined by strong industry consolidation, intense technological competition, and a pronounced strategic pivot towards sustainable and natural sourcing. Major flavor houses are actively pursuing synergistic mergers, acquisitions, and strategic partnerships with smaller, highly specialized niche companies that possess proprietary expertise in highly sought-after areas, such as complex natural savory profiles, organic certification compliance across various global regions, or proprietary fermentation processes for next-generation clean-label ingredients. This robust M&A activity is specifically aimed at securing immediate access to stable, ethical, and unique raw material supply chains and accelerating the deployment of advanced flavor delivery systems like liposomal or spray-dried encapsulation, which promise both enhanced flavor stability and significant reduction in required dosage levels. Investment trends across the industry reflect a powerful strategic bias toward dedicated R&D focused on highly effective sugar and salt reduction technologies and premium flavor masking agents, recognizing these capabilities as immediate, high-value problem areas for global food and beverage corporations navigating both public health mandates and increasing governmental taxation pressures on high-sugar and high-sodium products.

Regionally, the disproportionate growth projected for the Asia Pacific (APAC) market is the primary driver of global volume expansion, fueled by immense population size, rapid economic development leading to increased disposable income, and increasing penetration of Western dietary habits and packaged food consumption, particularly across China, India, and Southeast Asian nations. The region is uniquely characterized by high existing consumption of traditional savory flavours and flavor enhancers (such as high-impact MSG, yeast extracts, and HVP) due to the prevalence of ethnic cuisine consumption and the burgeoning demand for convenience snacks and instant meal preparations. Conversely, mature markets in North America and Western Europe, while contributing slower volume growth, remain dominant centers for high-margin innovation, characterized by high price sensitivity for basic commodity flavors but significant willingness to pay substantial premiums for certified organic, non-GMO, and verifiably sustainably sourced natural flavor extracts, reflecting a mature consumer base that consistently prioritizes ethical consumption alongside superior sensory quality.

Analysis of segment performance underscores the critical, ongoing structural shift from bulk commodity products towards specialized, high-performance, and value-added ingredients. Within the origin segment, the natural flavours sub-segment is experiencing expansive double-digit growth, aggressively forcing even traditional synthetic flavour producers to rapidly recalibrate and diversify their product portfolios. Application trends highlight the massive growth trajectory of the Alternative Protein sector—encompassing plant-based meats, vegan dairy substitutes, and innovative cellular agriculture products—which requires entirely new generations of precise flavour and masking solutions to successfully overcome inherent sensory defects like beaniness or bitterness. The ongoing rapid transformation of the global food supply chain, driven by aggressive corporate sustainability goals and technological advancements like AI-driven formulation and precision fermentation, ensures continuous, swift evolution of the market structure, demanding exceptional scientific expertise, financial stability, and extreme operational agility from all key market participants.

AI Impact Analysis on Food Flavours and Flavour Enhancers Market

User queries regarding AI's influence in the Food Flavours and Flavour Enhancers Market frequently revolve around efficiency, novelty, and the personalization of taste experience. Common themes explored include how AI can dramatically accelerate the process of new flavour compound creation, whether advanced machine learning algorithms can accurately predict complex consumer acceptance of novel compounds across diverse cultural groups, and its essential role in optimizing complex, multi-stage flavor manufacturing processes. Users are deeply concerned about AI's capacity to handle the sheer chemical complexity of volatile flavor matrices and the ethical implications of automating sensory analysis traditionally performed by highly experienced human flavor experts (flavorists). Expectations focus heavily on AI-driven rapid prototyping, predictive modeling for supply chain stability of often-volatile natural raw materials, and precision formulation that meets highly specific health requirements, such as low-allergen or nutrient-enhanced products, thereby significantly streamlining arduous R&D cycles and substantially lowering the often prohibitive cost of innovation in this highly sensory-dependent industry.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the process of flavor discovery, formulation, and quality assurance within the market, addressing long-standing issues of prolonged time-to-market and sensory unpredictability. Flavorists historically relied on extensive empirical trials and human sensory expertise, a process that is resource-intensive, slow, and often limited by human cognitive biases and sensory fatigue. AI systems now analyze complex, proprietary data sets, including genomics of natural sources, vast chemical structure libraries, established consumer acceptance patterns (derived from massive behavioral market data), and real-time food processing parameters. This allows for the rapid identification of novel flavor combinations that are thermodynamically stable, regulatory compliant across multiple regions, and predicted to achieve high consumer preference scores, successfully shrinking the traditional R&D pipeline from years to mere months for certain highly complex profiles. The ability to simulate millions of ingredient interactions digitally before committing to physical lab work dramatically improves efficiency and reduces raw material waste.

- AI-Accelerated Discovery: Machine learning analyzes millions of molecular data points to predict novel flavour structures and identify bio-synthetic pathways for highly sustainable natural flavour production, bypassing traditional, lengthy trial-and-error methods.

- Predictive Consumer Acceptance Modeling: Advanced neural networks analyze aggregated consumer panel data, social media trends, and regional purchasing habits to accurately predict the commercial success rate of a new flavour compound before significant market investment, effectively minimizing commercial and launch risk.

- Optimized Formulation and Scaling: AI algorithms optimize complex ingredient ratios in intricate flavour systems, ensuring mechanical and chemical stability during severe industrial processing (e.g., pasteurization, high-heat extrusion) and facilitating seamless, consistent scale-up from pilot plant volumes to global commercial production capacity.

- Supply Chain Resilience: Predictive analytics anticipates quality degradation or critical shortages in geographically dispersed natural raw material supplies, allowing proactive procurement teams to implement dynamic sourcing strategies and effectively utilize alternative, chemically equivalent flavor precursors, ensuring continuous operations.

- Personalized Flavor Delivery: AI enables highly customized flavour matrices based on individual nutritional profiles, specific health goals (e.g., low-sodium or low-glycemic needs), or nuanced cultural preferences, supporting the powerful future trend towards hyper-personalized food manufacturing and specialized nutraceutical integration.

- Enhanced Regulatory Compliance: Sophisticated computational tools automatically screen and validate new flavour formulations against the complex regulatory guidelines of numerous jurisdictions (e.g., FDA, EFSA, Codex Alimentarius), significantly accelerating the arduous approval process and substantially reducing legal risk associated with global ingredient deployment.

- Automation of Sensory Analysis: High-tech electronic nose and tongue systems, coupled with advanced AI interpretation software, provide objective, high-throughput screening of flavor quality and consistency, effectively supplementing or replacing traditional human sensory panels in large-scale, routine quality control environments, ensuring batch-to-batch uniformity.

DRO & Impact Forces Of Food Flavours and Flavour Enhancers Market

The core drivers propelling the extensive expansion of the Food Flavours and Flavour Enhancers Market are intrinsically linked to overarching socioeconomic shifts and the pervasive, continuous modernization of the global food landscape. The accelerated pace of modern life, particularly evident in rapidly urbanizing nations across Asia and Africa, sustains an ever-increasing, non-negotiable reliance on packaged, convenience, and sophisticated ready-to-eat meals, where immediate flavor appeal and sensory consistency are the paramount purchasing determinants. Flavor manufacturers are rapidly capitalizing on the observed 'globalization of taste,' proactively utilizing digital platforms and sophisticated data analytics to track emerging global food trends—from highly specific fermented specialties to exotic regional spices—and rapidly incorporate these popular elements into stable industrial flavor formats that can be mass-produced. Furthermore, the immense R&D spending focused exclusively on accurately replicating the texture and complex taste of traditional meat and dairy in plant-based alternatives represents a singular, powerful market driver, as the consumer success and mainstream acceptance of these novel products hinges entirely on the efficacy of the applied flavour and masking systems to deliver a convincing, enjoyable sensory experience.

However, the flavour industry concurrently faces several severe structural and regulatory restraints that naturally temper growth rates and necessitate costly adaptation and extensive R&D investment. The most formidable restraint is the regulatory patchwork and inconsistent definition of 'natural' ingredients across key consuming regions. The definition and permissible usage levels of even supposedly "natural" flavors vary significantly between the European Union, the United States, and major Asian countries, creating high market entry barriers for global product standardization and substantially increasing compliance costs for multinational ingredient suppliers attempting to operate globally. Additionally, environmental and critical ethical concerns are significantly complicating the sourcing of high-value natural ingredients; factors such as deforestation risks, climate change affecting sensitive crop yields (e.g., high-quality vanilla beans, cocoa), and the necessity for certified fair trade practices introduce significant market volatility and long-term cost inflation for natural extracts, increasingly pushing manufacturers toward developing cost-effective, nature-identical substitutes through advanced biotechnological means, which themselves often face prolonged regulatory scrutiny related to novel food approvals.

Significant opportunities for massive market expansion are centered on addressing major consumer health pain points and rapidly leveraging technological breakthroughs in delivery and synthesis. A critical opportunity lies in the development of specialized flavour enhancers that can effectively cut sugar content by 30-50% in high-volume products like beverages and confectionery, while simultaneously maintaining crucial mouthfeel characteristics and sweetness perception. This capability is a significant opportunity for immediate market penetration in health-conscious economies burdened by sugar taxes. Furthermore, the rapid, specialized expansion of the global pet food and animal nutrition sector represents a burgeoning, often overlooked, application area, requiring complex savory flavors, palatability enhancers, and specialized masking agents to ensure nutritional products are consumed willingly. Key Impact Forces, particularly the rising, global consumer desire for radical transparency (demanding blockchain traceability of flavour origins) and the increasing influence of non-governmental organizations (NGOs) on sustainable and ethical sourcing practices, compel major companies to invest heavily in independent certifications and clear, understandable labeling practices to maintain essential brand trust and competitive advantage in this highly scrutinized ingredient industry. Geopolitical instability also severely impacts essential spice and botanical supply chains, demanding robust regional diversification strategies.

Segmentation Analysis

The Food Flavours and Flavour Enhancers Market is rigorously segmented based on essential product type, the crucial origin of the compounds, primary application area, and the physical form of the final ingredient, reflecting the highly diverse and specialized requirements of the entire end-use industry spectrum. Product segmentation clearly distinguishes between flavor enhancers (e.g., MSG, HVP, Yeast Extracts, Nucleotides) which modify inherent taste perception, and primary flavors (e.g., specific fruit, vegetable, sweet, or savory profiles) which introduce distinct taste and aroma characteristics. Origin is arguably the most crucial contemporary delineator, broadly splitting the market between synthetic/artificial and natural sources, with the latter category aggressively gaining market share due to global consumer preference and regulatory mandates. Application segmentation specifically highlights the market dominance of high-volume sectors like beverages and savory snacks, which demand highly specialized flavor chemistries that are stable under diverse and challenging industrial processing conditions and suitable for large-scale, cost-effective mass production. Analyzing these highly specialized segments is absolutely critical for manufacturers to strategically allocate their substantial R&D investment and successfully target specific, high-potential, and often niche consumer bases.

- By Product Type:

- Flavours

- Natural Flavours (Including Extracts, Essential Oils, Fermentation Products)

- Artificial/Synthetic Flavours (Nature-Identical Compounds)

- Flavour Enhancers

- Monosodium Glutamate (MSG)

- Hydrolyzed Vegetable Protein (HVP)

- Yeast Extracts (Rich in Umami Nucleotides)

- Nucleotides (Inosine Monophosphate (IMP), Guanosine Monophosphate (GMP), I+G)

- Others (High-Potency Sweeteners and Acidulants utilized strictly for flavor modification)

- By Origin:

- Natural (Sourced from plant, animal, or microbial materials through physical, enzymatic, or microbiological processes)

- Artificial (Synthesized chemically; includes Nature-Identical definitions)

- By Application:

- Beverages (Carbonated Soft Drinks, Juices, Energy and Functional Drinks, Alcoholic and Non-Alcoholic Beers)

- Confectionery Products (Chocolates, Gums, Candies)

- Dairy Products (Yogurts, Ice Cream, Cheese, Milk Alternatives)

- Bakery Products (Breads, Cakes, Cookies, Breakfast Cereals)

- Savory & Snacks (Potato Chips, Extruded Snacks, Instant Noodles, Soups, Ready-to-Eat Meals, Sauces and Seasonings)

- Meat & Seafood Products (Cured Meats, Processed Poultry, Fish Surimi, Plant-Based Alternatives)

- Animal Nutrition (Specialized Palatability Enhancers for Pet Food and Livestock Feed)

- Pharmaceuticals and Nutraceuticals (Masking bitter notes in supplements and medicines)

- By Form:

- Liquid (Emulsions, Solutions, Oil-Soluble Concentrates)

- Dry/Powder (Spray-Dried Flavours, Granulates, Encapsulated Powders)

- Paste (Used often in sauces and thick condiments)

Value Chain Analysis For Food Flavours and Flavour Enhancers Market

The upstream segment of the Food Flavours and Flavour Enhancers value chain begins with the highly diversified, global procurement of both natural and specialized synthetic building blocks. For natural flavours, this involves securing hundreds of specialized botanicals, rare spices, fruits, and proprietary fermentation by-products from geographically dispersed locations, demanding highly sophisticated, multi-tiered global supply chain management to systematically mitigate critical risk from unpredictable weather patterns, local political instability, and inherent inconsistencies in agricultural quality. Synthetic flavor components rely heavily on a smaller pool of specialty chemical manufacturers, often derived from refined petrochemical bases, where the primary emphasis is placed squarely on consistent purity, large-scale supply reliability, and optimal cost-efficiency. Crucially, the overwhelming strategic movement toward sustainable, bio-based sourcing has intensified specialized upstream partnerships with niche biotech firms to precisely produce key flavor precursors (like specific terpenoids or complex aldehydes) through controlled fermentation, thereby significantly reducing reliance on volatile agricultural commodities and dramatically enhancing long-term supply security.

The core value creation and intellectual property reside firmly in the midstream, where sophisticated flavor houses execute complex, proprietary chemical and biological processes. This highly scientific stage involves the rapid interpretation of massive consumer sensory data and the technical creation of scalable, stable flavor profiles. Key activities involve intensive extraction (using solvent, steam distillation, or expensive supercritical CO2 methods), intricate organic synthesis, essential flavor reaction chemistry (such as precise Maillard reactions to create high-impact savory or complex meat-like notes), and final blending. The mandatory application of advanced technologies, such as computational modeling for molecular optimization and micro- or nano-encapsulation techniques, represents a critical value-add, transforming inherently unstable raw extracts into functional ingredients that perform reliably in challenging, industrial-scale food processing environments. Intellectual property surrounding these proprietary flavor formulations, unique flavour delivery systems, and advanced encapsulation techniques is the primary, defining competitive differentiator in the specialized midstream sector, requiring constant legal protection.

Downstream distribution is rigorously characterized by essential close Business-to-Business (B2B) relationships due to the specialized, highly technical nature of the final ingredients. Large, global flavor suppliers often exclusively utilize a direct sales model, deploying highly trained application scientists and culinary technologists to integrate the flavour solution seamlessly into the client’s final food or beverage product matrix. This direct model facilitates critical collaborative formulation and problem-solving, ensuring the flavor performs optimally under the client’s specific factory setup and processing parameters. Indirect channels utilize specialized regional distributors who efficiently manage essential inventory, complex cold-chain logistics, and smaller, less complex transactions, typically servicing local food producers, artisanal bakeries, and regional dairies. The distribution network must accommodate strict, controlled storage conditions for sensitive liquid and volatile components, ensuring rapid delivery and minimizing transit time to rigorously preserve flavor integrity before final incorporation into the consumer product. The efficiency and reliability of this downstream logistics network directly correlate with the successful deployment of high-quality flavour systems worldwide.

Food Flavours and Flavour Enhancers Market Potential Customers

The primary and largest customers for food flavours and flavour enhancers are the major, large-scale industrial food and beverage manufacturers seeking consistent quality, optimal cost efficiency, and highly innovative sensory profiles for their mass-produced goods distributed globally. This dominant customer segment includes major global players in the soft drinks, ready-to-eat meals, and packaged snacks industries, who continuously require high-impact, technologically advanced, and thermodynamically stable flavor systems to rapidly differentiate their products in fiercely competitive retail environments. The dairy industry, encompassing massive producers of ice cream, processed cheese, and functional yogurt products, represents another extremely significant customer base, relying heavily on flavors to compensate for seasonal variations in raw milk quality and to rapidly develop new, on-trend product lines catering simultaneously to global health and indulgence trends, necessitating complex, layered flavor systems for consumer appeal.

A rapidly accelerating customer segment comprises companies singularly focused on the massive growth areas of alternative proteins and functional foods. Manufacturers of advanced plant-based meats, highly sophisticated vegan dairy substitutes, and specialized nutrition products (e.g., clinical meal replacements, high-protein bars) are fundamentally reliant on highly sophisticated flavour systems, flavor enhancers, and advanced masking agents to successfully neutralize or mask undesirable 'off-notes' inherently present in base ingredients (like soy isolate or pea protein concentrate) and to authentically mimic the complex, satisfying sensory attributes of traditional animal products. These highly specialized customers prioritize verifiable flavor efficacy, technological innovation, and stringent clean-label compliance above raw ingredient cost, aggressively driving the demand for advanced encapsulation and proprietary flavor masking technologies that offer unparalleled performance.

Furthermore, small and medium-sized enterprises (SMEs) operating in the regional bakery, bespoke confectionery, and specific local specialty food sectors constitute a substantial and geographically dispersed customer segment accessed primarily through specialized third-party distributors. While their individual volume needs are significantly lower than global conglomerates, they often require flexible, rapidly available flavour formats, smaller pack sizes, and extensive technical application support. These customers prioritize ease of use, guaranteed shelf stability, and accurate, authentic replication of regional or traditional taste profiles. Overall, the market caters to virtually any commercial entity involved in the transformative process of converting agricultural raw ingredients into consumer-ready, palatable, and highly appealing food or beverage products, demanding consistent sensory quality across all production scales and markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 27.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Givaudan, International Flavors & Fragrances (IFF), DSM-Firmenich, Symrise AG, Kerry Group plc, MANE SA, Takasago International Corporation, Sensient Technologies Corporation, Ajinomoto Co., Inc., Archer Daniels Midland Company (ADM), BASF SE, Döhler GmbH, Tate & Lyle PLC, Corbion NV, Ingredion Incorporated, Kalsec Inc., Synergy Flavors, Flavorchem Corporation, T. Hasegawa Co., Ltd., Robertet SA, Solvay S.A., ITC Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Flavours and Flavour Enhancers Market Key Technology Landscape

Advanced microencapsulation remains a cornerstone technology, continuously evolving to meet the dual demands of flavor protection and controlled release performance. Contemporary industrial research is heavily focused on developing sophisticated dual-layer and multi-core encapsulation systems using highly specialized biopolymers, complex hydrocolloids, and proprietary starch derivatives. These next-generation systems not only provide robust shielding for volatile flavors from external degradation factors such as oxidation, extreme heat, and moisture during processing but also facilitate precision timing of flavor release—an essential feature for products like premium confectionery or functional chewing gum where a sharp flavor burst is desired at specific consumption stages, or for effective, long-duration masking of persistent off-notes in highly mineralized protein powders. Furthermore, recent technological advances in nano-emulsion technology are allowing for the creation of completely water-soluble liquid flavors that remain physically stable and crystal clear in transparent beverage bases, significantly broadening the application potential within the high-growth functional water and clarity-focused beverage segments.

Industrial biotechnology represents arguably the most transformative technological shift currently sweeping across the flavour market. Metabolic engineering and synthetic biology platforms are being actively leveraged to genetically modify microbial hosts (such as specific strains of yeast or bacteria) to precisely produce high-value, complex aroma chemicals through highly controlled fermentation processes. This innovative method reliably yields "natural" flavors (under numerous global regulatory frameworks) at a small fraction of the environmental cost and severe supply volatility associated with traditional, resource-intensive agricultural sourcing. For instance, the reliable bio-production of specific terpenoids, lactones, or crucial pyrazines, previously extracted only from rare or seasonal botanicals, now offers unparalleled scalability and chemical purity previously unattainable through traditional extraction methods. This intense focus on "fermentation-derived ingredients" provides flavor houses with a predictable, environmentally sustainable, and ethically sound foundation for their high-margin natural flavor portfolios, aligning perfectly with the critical demands of the clean-label consumer base.

Finally, the critical convergence of high-throughput analytical screening technologies and advanced bioinformatics is dramatically revolutionizing the speed of flavour development. Rapid liquid chromatography (RLC) and highly sensitive advanced headspace analysis allow flavor chemists to swiftly and accurately map the volatile organic compound (VOC) profile of complex natural ingredients or rapidly benchmark competitor products. This high-dimensional chemical data is then immediately paired with sophisticated cloud-based computational chemistry and Artificial Intelligence platforms, enabling flavorists to accurately model molecular interactions, predict optimal solubility parameters, and precisely optimize synthetic reaction pathways before committing any resources to expensive physical lab work. This "digital flavor creation" paradigm minimizes raw material usage during the R&D phase, dramatically increases the rate of successful novelty creation, and ensures that finalized formulations are inherently thermodynamically stable and pre-validated as regulatory-compliant from the earliest design stages, creating a substantial and enduring competitive advantage for technology-forward market leaders.

Regional Highlights

The global distribution of the Food Flavours and Flavour Enhancers Market showcases distinct market maturity levels, diverse growth drivers, and highly differentiated regulatory environments across major geographic regions, necessitating tailored business strategies.

- Asia Pacific (APAC): APAC is emphatically projected to be the fastest-growing and largest regional market, driven by immense scale, rapid industrial economic development, and continuously increasing penetration of Western dietary habits and packaged food consumption, particularly in high-volume markets like China, India, and Southeast Asian nations. The region is uniquely characterized by high existing consumption and strong acceptance of savory flavours and flavour enhancers (like MSG and traditional yeast extracts) due to the deeply embedded prevalence of ethnic cuisine consumption and the surging, large-scale demand for affordable convenience snacks and instant ready-to-eat meals.

- North America: North America holds a substantial market share, dominated by high consumer awareness regarding health, wellness, and ingredient transparency. This awareness drives intense, premium demand for certified natural, clean-label flavours and highly specialized masking agents used extensively in low-sugar, low-sodium, and high-protein/nutritional formulations. Innovation in functional beverages, complex plant-based meat alternatives, and sophisticated savory snack flavourings is highly concentrated in this region, supported by robust private sector R&D investments and venture capital funding focused on food technology.

- Europe: Europe is characterized by the most stringent food safety regulations globally and a powerful, deeply entrenched consumer preference for certified organic, traceable, and sustainable ingredients, strongly pushing flavour companies to invest massive resources in certified natural sourcing and bio-based production methods. Key markets like Germany, the UK, and France show sustained high demand for complex flavour profiles suitable for premium dairy, bakery, and confectionery products, alongside highly sophisticated beverage flavour systems adhering strictly to tight EU E-number and additive limitations.

- Latin America (LATAM): LATAM is considered a high-potential emerging market, propelled by ongoing rapid urbanization and steadily rising disposable incomes, leading to structurally increased demand for affordable packaged foods and branded beverages. Brazil and Mexico are the primary market centers, exhibiting rapid growth in vibrant fruit flavours for soft drinks and regional snacks, often requiring cost-effective, highly concentrated, and exceptionally stable flavour solutions suitable for variable local production conditions.

- Middle East and Africa (MEA): Market growth in MEA is highly fragmented but growing rapidly in urban centers, driven by sustained population growth and economic modernization, particularly within the affluent GCC states (Gulf Cooperation Council). Demand focuses intensely on stable flavour systems suitable for harsh climatic conditions and a strong preference for complex traditional regional tastes, particularly in the dairy, beverage, and savory product segments, while strictly adhering to mandatory halal certification requirements across the region, adding complexity to formulation and sourcing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Flavours and Flavour Enhancers Market.- Givaudan

- International Flavors & Fragrances (IFF)

- DSM-Firmenich (resulting from the merger of DSM and Firmenich)

- Symrise AG

- Kerry Group plc

- MANE SA

- Takasago International Corporation

- Sensient Technologies Corporation

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Döhler GmbH

- Tate & Lyle PLC

- Corbion NV

- Ingredion Incorporated

- Kalsec Inc.

- Synergy Flavors

- Flavorchem Corporation

- T. Hasegawa Co., Ltd.

- Robertet SA

Frequently Asked Questions

Analyze common user questions about the Food Flavours and Flavour Enhancers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant trend driving the current market growth?

The most significant trend is the overwhelming global consumer demand for natural, clean-label flavour solutions and sustainable sourcing. This requires manufacturers to move away from synthetic additives toward flavors derived from advanced bio-fermentation, botanical extracts, and essential oils, often involving significant R&D investment.

How do flavour enhancers contribute to reduced sodium or sugar formulations?

Flavour enhancers, specifically umami compounds like yeast extracts or nucleotides, synergistically heighten the perception of inherent savory or sweet notes, effectively compensating for the significant reduction in primary taste agents like salt or sugar. This strategy is critical for successful large-scale product reformulation and maintaining consumer acceptance.

Which application segment holds the largest volume share for food flavours?

The Beverages segment (including soft drinks, juices, and functional drinks) typically holds the largest volume market share globally due to the sheer scale of production and the necessity for stable, consistent flavor delivery in high-volume liquid formats. However, the Savory Snacks and Plant-Based Alternatives sectors are exhibiting the highest compound annual growth rates.

What is the key technological challenge flavor houses must overcome today?

The most critical technological challenge is achieving stable, high-impact delivery of authentic natural flavors in processed foods, particularly under the stress of high-heat processing, extended shelf life, and exposure to moisture. Advanced microencapsulation technology is the current crucial solution being adopted to overcome the inherent volatility and rapid degradation issues associated with natural aromatic compounds.

How is Artificial Intelligence (AI) being utilized in this industry?

AI is primarily utilized in accelerating flavor discovery by analyzing complex molecular and sensory data, predicting optimal stable formulations, and modeling consumer acceptance profiles across different demographics. This capability drastically reduces R&D time, minimizes resource usage, and enhances precision in developing highly targeted flavour profiles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager