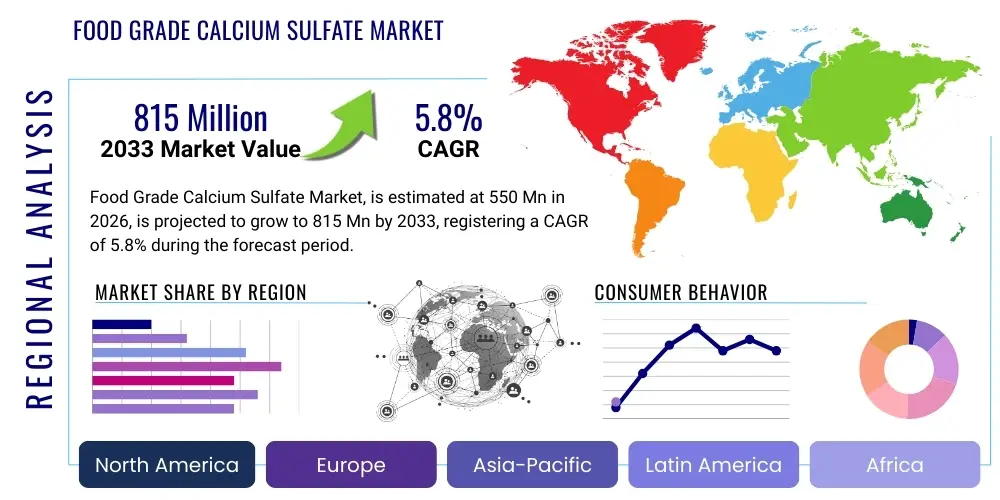

Food Grade Calcium Sulfate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443365 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Food Grade Calcium Sulfate Market Size

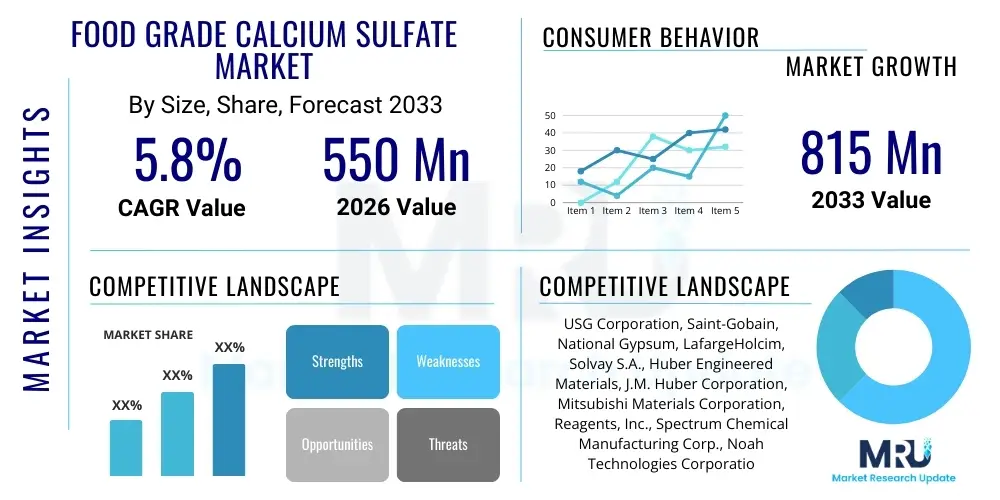

The Food Grade Calcium Sulfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 815 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the expanding applications of calcium sulfate, particularly its indispensable role as a firming agent, dough conditioner, and nutritional calcium source across the diverse food and beverage industry spectrum. The stability and efficacy of food-grade calcium sulfate as an additive in processes such as brewing and dairy processing solidify its market position, offering superior cost-effectiveness compared to several alternative mineral salts.

The steady increase in demand reflects broader demographic and industrial trends, including rising global consumption of processed and packaged foods that require standardized mineral profiles for quality and shelf stability. Specifically, the tofu manufacturing sector, which relies heavily on calcium sulfate as a traditional and effective coagulant, presents a substantial demand base, especially in the Asia-Pacific region. Furthermore, the burgeoning interest in fortified food products and dietary supplements across developed economies, aiming to address prevalent calcium deficiencies, significantly contributes to the escalating market valuation, positioning food-grade calcium sulfate as a crucial functional ingredient.

Market expansion is also supported by technological advancements in purification and particle size control, allowing suppliers to meet stringent food safety and quality standards (e.g., FCC certification). These refined products exhibit enhanced functional characteristics, such such as improved solubility and dispersibility, making them ideal for complex food formulations. Manufacturers are increasingly prioritizing traceable and naturally sourced ingredients, and as calcium sulfate can be sourced from natural gypsum deposits, it often aligns well with clean label initiatives, further strengthening its market penetration against synthetic alternatives.

Food Grade Calcium Sulfate Market introduction

The Food Grade Calcium Sulfate Market encompasses the supply and utilization of purified calcium sulfate (CaSO4), commonly known as gypsum (dihydrate form) or anhydrite (anhydrous form), specifically manufactured to meet strict regulatory standards for use as a direct food additive. This compound serves multiple critical functions within food processing, acting primarily as a firming agent (coagulant), dough conditioner, stabilizer, thickening agent, and nutrient supplement, making it a cornerstone ingredient in sectors ranging from baking and brewing to dairy and nutraceuticals. Its high efficacy and relatively low cost profile have established it as an essential component in global food manufacturing chains, ensuring product integrity and nutritional value.

Key applications of food-grade calcium sulfate include its use as a mineral salt in brewing to adjust water hardness and pH levels, thereby optimizing enzymatic activity during the mashing process, which is essential for achieving desired beer profiles. In the baking industry, it functions as a yeast food and dough strengthener, improving the texture and volume of bread. Crucially, in the production of tofu and certain cheeses, calcium sulfate acts as an effective coagulant, precipitating proteins to form the desired solid structure. These multifaceted functional benefits underscore its market importance and drive continuous demand across diverse product categories globally.

The market growth is substantially driven by the increasing global demand for processed foods, coupled with consumer preference for calcium-fortified products aimed at improving skeletal health. Benefits include its role in extending the shelf life of certain perishable goods, improving processing efficiencies, and contributing necessary mineral content without significantly altering flavor profiles when used correctly. Regulatory acceptance by bodies such as the FDA (as Generally Recognized as Safe - GRAS) and EFSA provides a stable framework for its widespread commercial adoption, positioning food-grade calcium sulfate as a highly valued, multi-functional additive crucial for modern food formulation and industrial scaling.

Food Grade Calcium Sulfate Market Executive Summary

The Food Grade Calcium Sulfate market is characterized by robust growth, propelled by strong demand from the baking, brewing, and plant-based protein sectors, particularly tofu manufacturing. Business trends indicate a movement towards vertically integrated supply chains, where primary gypsum miners are establishing specialized purification facilities to meet the stringent quality demands of the food industry, focusing on reducing heavy metal impurities to achieve certification standards such as FCC (Food Chemicals Codex). Regional trends show the Asia Pacific region dominating consumption, largely due to high domestic demand for tofu and traditional fermentation products, while North America and Europe lead in innovation concerning fortified products and specialty baked goods. The competitive landscape is moderately fragmented, with large industrial chemical producers competing alongside specialized food ingredient suppliers, increasingly prioritizing sustainable sourcing and advanced particle engineering.

Segment trends highlight the dominance of the dihydrate form (gypsum) due to its traditional use and superior handling characteristics, although anhydrous calcium sulfate is gaining traction for applications requiring higher concentration and lower moisture content, particularly in dry mixes and nutraceuticals. Application segmentation reveals that the baking and brewing industries remain the largest consumers, benefiting from its dual role as a mineral source and processing aid. However, the fastest growth is anticipated in the dairy alternatives and plant-based foods segments, driven by global dietary shifts favoring vegan and vegetarian products. Manufacturers are also focusing on optimizing calcium sulfate derived from synthetic sources (e.g., FGD gypsum) to ensure cost efficiency and sustainable supply, provided the purification standards can consistently satisfy food safety requirements.

From a strategic viewpoint, market players are emphasizing supply chain resilience and regulatory compliance as core competitive differentiators. Investment in quality assurance protocols and traceability systems is essential to mitigate risks associated with contaminants, given the highly sensitive nature of food ingredients. The market is also experiencing a subtle shift towards non-GMO certified and natural source verification, appealing to the premium segment of food manufacturers. Overall, the market outlook remains highly positive, supported by the compound's indispensable functionality in key food processing applications and the continuous global expansion of fortified and convenience food categories.

AI Impact Analysis on Food Grade Calcium Sulfate Market

Common user questions regarding AI's impact on the Food Grade Calcium Sulfate Market center on optimizing supply chain logistics, predicting raw material fluctuations (especially gypsum prices), enhancing quality control processes to detect micro-contaminants, and accelerating new product formulation trials. Users are particularly keen to understand how AI-driven predictive maintenance can reduce downtime in high-volume purification facilities and how machine learning algorithms can analyze complex regulatory databases across different jurisdictions (FDA, EFSA, CFIA) to ensure instant compliance checks. The overarching themes reflect expectations for efficiency gains, enhanced safety, and predictive insights that allow proactive management of inventory and quality metrics, moving away from reactive testing models towards integrated, real-time decision-making systems.

AI technologies, including computer vision and advanced data analytics, are increasingly being deployed in manufacturing facilities producing food-grade calcium sulfate to monitor particle size distribution and purity levels in real time. This capability drastically reduces batch inconsistencies and minimizes material waste by identifying deviations instantly, rather than relying on delayed laboratory results. Furthermore, predictive modeling utilizes historical performance data, geopolitical factors, and energy costs to forecast optimal production schedules and procurement strategies for raw gypsum, effectively buffering manufacturers against sudden cost volatility and ensuring a stable supply of high-purity product to downstream food manufacturers.

In the formulation segment, AI is employed to simulate the interaction of calcium sulfate with other complex ingredients, optimizing its functional performance (e.g., coagulation kinetics in tofu or dough strength optimization) without extensive physical experimentation. This capability accelerates R&D cycles for new food products, such as novel vegan cheeses or specific high-calcium nutritional beverages, where the precise mineral balance is critical. By automating routine data analysis and focusing human experts on complex problem-solving, AI contributes significantly to both operational efficiency and innovation velocity within the food-grade mineral additives sector.

- AI-driven Predictive Quality Control: Real-time monitoring of purity and particle size using machine learning models and sensor data, significantly reducing contamination risks.

- Supply Chain Optimization: Algorithms forecast gypsum raw material pricing and global logistics delays, optimizing inventory levels and procurement timings.

- Automated Regulatory Compliance: AI tools rapidly cross-reference formulation data against diverse international food safety standards (FCC, GRAS) to ensure market readiness.

- Process Efficiency Enhancement: Predictive maintenance schedules for purification equipment minimize unexpected failures and production downtime.

- R&D Acceleration: Machine learning simulates ingredient interactions, optimizing the functional efficacy of calcium sulfate in new food formulations (e.g., plant-based dairy).

DRO & Impact Forces Of Food Grade Calcium Sulfate Market

The Food Grade Calcium Sulfate market dynamics are primarily driven by the escalating global demand for convenience and functional foods, which necessitate reliable, cost-effective processing aids and nutritional fortifiers. The increasing popularity of plant-based diets, especially the high consumption rate of tofu, where calcium sulfate acts as an essential coagulant, represents a significant market driver. Conversely, the market faces headwinds from stringent and evolving global regulatory scrutiny concerning mineral additives and potential heavy metal contamination, requiring substantial investment in advanced purification technologies. The opportunity landscape is defined by the growing application scope beyond traditional sectors, including specialized nutritional drinks and gluten-free products, where its texturizing and stabilizing properties are highly valued. These forces—Drivers, Restraints, and Opportunities—create an impact matrix that demands continuous innovation in processing and robust quality assurance to ensure sustained growth and market resilience.

Drivers: The fundamental drivers include the irreplaceable functionality of calcium sulfate in fermentation and coagulation processes, particularly in high-volume industries like brewing and baking. Furthermore, the persistent global focus on addressing dietary calcium deficiency fuels the market, as calcium sulfate is a bioavailable and cost-effective source for fortification. The steady expansion of the global population and rising middle-class disposable incomes, especially in developing regions, translate directly into higher demand for packaged and processed foods that rely heavily on functional ingredients like calcium sulfate to maintain quality and shelf stability.

Restraints: Significant restraints include the presence of perceived substitutes such as calcium chloride, magnesium sulfate, and other mineral salts that can perform similar functions in specific applications, leading to competitive pricing pressures. More critically, the primary restraint is the regulatory challenge surrounding contaminant limits; food-grade calcium sulfate, especially if sourced from synthetic by-products (e.g., flue gas desulfurization—FGD gypsum), requires intensive, specialized purification to remove heavy metals like lead and arsenic, adding complexity and cost to manufacturing processes and occasionally leading to negative publicity if quality standards are breached.

Opportunities: Major opportunities lie in penetrating emerging application niches, such as the rapidly expanding market for high-protein, specialized nutritional bars and shakes, where calcium sulfate serves as both a mineral source and texturizer. Furthermore, innovation in microencapsulation and surface treatment technologies could enhance the functional properties of calcium sulfate, making it more effective in complex low-moisture or high-fat food matrices. Geographical expansion into underserved markets in Africa and Latin America, coupled with strategic partnerships with major global food manufacturers focusing on clean-label ingredients, also present fertile growth avenues.

Segmentation Analysis

The Food Grade Calcium Sulfate market is systematically segmented based on its chemical form, the source of the raw material, and its diverse applications across the food and beverage industry. Segmentation by form differentiates between the Dihydrate (Gypsum) and the Anhydrous form, each offering distinct functional attributes related to moisture content and chemical reactivity, influencing their suitability for wet processing versus dry mixing. Source segmentation is crucial for transparency and regulatory compliance, distinguishing between naturally mined gypsum and synthetically produced by-products, such as those derived from Flue Gas Desulfurization (FGD), requiring different purification standards and traceability protocols.

Application segmentation reveals the true breadth of market usage, with baking (as a dough conditioner and yeast food), brewing (as a water mineral adjuster), dairy and plant-based milk alternatives (as a coagulant and firming agent), and nutritional supplements representing the primary end-use categories. Understanding these segments is vital for market players, allowing them to tailor product specifications—such as particle size, solubility, and purity levels—to the specific needs of end-users. For instance, the brewing industry typically requires highly soluble grades for efficient water treatment, while the baking industry often uses finer powders for optimal dough incorporation and yeast activation.

The fastest-growing segment is anticipated to be the dairy alternatives and plant-based protein sector, driven by global trends in veganism and health-conscious consumption. This shift necessitates large volumes of food-grade coagulants like calcium sulfate to create structured products such as tofu, plant-based cheeses, and yogurt alternatives. Consequently, suppliers are increasingly focusing R&D efforts on producing specialized, ultra-high-purity calcium sulfate tailored for these burgeoning application areas, ensuring stability and texture in complex, novel food matrices while adhering to clean-label consumer demands.

- By Application:

- Baking (Yeast Food and Dough Conditioner)

- Brewing (Water Treatment/Mineral Adjustment)

- Dairy and Plant-Based Alternatives (Tofu Coagulant, Firming Agent in Cheese/Yogurt)

- Nutritional Supplements and Fortification

- Processed Foods (Stabilizer and Thickener)

- By Form:

- Dihydrate (Gypsum)

- Anhydrous (Plaster of Paris)

- By Source:

- Natural (Mined Gypsum)

- Synthetic (By-product Gypsum, primarily FGD)

Value Chain Analysis For Food Grade Calcium Sulfate Market

The value chain for the Food Grade Calcium Sulfate market begins with the extraction or sourcing of raw material, which is either naturally mined gypsum or synthetic gypsum (a by-product). The upstream analysis involves mining and preliminary crushing/washing of natural gypsum, or the collection and pre-treatment of synthetic sources, which must be rigorously characterized for impurities. The midstream involves complex purification and processing steps—including calcining, milling, particle size classification, and chemical refinement—to upgrade the industrial-grade material to meet stringent food-grade standards (e.g., removal of heavy metals and achieving high CaSO4 purity). This purification stage adds significant value and cost, requiring specialized infrastructure and quality control systems.

Distribution channels for the refined product are primarily direct sales to large, multinational food manufacturers (OEMs) and indirect sales through specialized food ingredient distributors, who often provide technical support and tailored blending services to smaller enterprises. Direct channels are preferred for high-volume commodities like brewing gypsum, ensuring bulk cost efficiency and tailored specifications. Indirect channels, relying on specialized distributors, are crucial for reaching diverse smaller end-users across geographies, offering localized inventory and shorter lead times, particularly in complex regional markets with varied regulatory environments.

Downstream analysis focuses on the end-use applications, where food manufacturers utilize the calcium sulfate as a functional additive. Key end-users include bakeries, breweries, tofu producers, pharmaceutical companies (for supplement coatings), and manufacturers of packaged snacks and dairy alternatives. The end-user’s purchasing decision is heavily influenced by factors such as supplier track record, consistency of purity documentation (FCC/Kosher/Halal certification), and technical support for integration into existing production processes. The final stage involves the consumer, whose growing demand for fortified and high-quality processed foods ultimately dictates the volume and specification requirements throughout the entire supply chain.

Food Grade Calcium Sulfate Market Potential Customers

Potential customers for food-grade calcium sulfate are highly concentrated within the industrial food and beverage manufacturing sectors, specifically those reliant on precise mineral control for processing efficiency, stabilization, or nutritional enrichment. The primary segment comprises large-scale industrial bakeries and milling operations, which utilize the product as a dough conditioner and essential yeast food, ensuring consistent fermentation rates and bread texture. Equally significant are global brewing corporations and microbreweries that require consistent mineral salts for water profile adjustments, impacting mash pH, enzyme performance, and final beer flavor complexity and stability.

Another major consumer base is the burgeoning plant-based food industry, particularly manufacturers of tofu, tempeh, and emerging plant-based cheese and yogurt alternatives. In these applications, food-grade calcium sulfate functions as the critical coagulant, determining the firmness and yield of the final product, driven by the expanding global acceptance of vegan and vegetarian diets. Furthermore, pharmaceutical and nutraceutical companies represent a high-value customer segment, incorporating calcium sulfate into dietary supplements, antacids, and mineral fortification blends where high purity and defined particle size are paramount for bioavailability and formulation integrity.

In summary, the end-users are diverse but united by the need for certified, high-purity mineral additives. Other specific end-user categories include manufacturers of fruit preserves and jams (where it acts as a firming agent to maintain fruit integrity), manufacturers of dry cake mixes and dessert preparations, and producers of specialty mineral waters requiring defined calcium levels. The continued expansion of functional and fortified foods ensures a perpetually diversifying customer landscape, moving beyond traditional core applications toward specialized, health-focused formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | USG Corporation, Saint-Gobain, National Gypsum, LafargeHolcim, Solvay S.A., Huber Engineered Materials, J.M. Huber Corporation, Mitsubishi Materials Corporation, Reagents, Inc., Spectrum Chemical Manufacturing Corp., Noah Technologies Corporation, Merck KGaA, Avantor, Inc., W. R. Grace & Co., SUEZ Water Technologies & Solutions, Kemira Oyj, Innophos Holdings Inc., Foodchem International Corporation, Boral Limited, Cal-Maine Foods, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Grade Calcium Sulfate Market Key Technology Landscape

The technology landscape for the Food Grade Calcium Sulfate market is predominantly focused on achieving and maintaining ultra-high purity levels required by food safety standards, particularly the removal of heavy metals like mercury, lead, and cadmium, which are often present in raw gypsum sources (both natural and synthetic). Key technologies employed include advanced chemical precipitation methods, highly controlled recrystallization processes, and sophisticated filtration and washing techniques, such as membrane filtration and multi-stage counter-current washing. These processes are critical for upgrading commodity-grade calcium sulfate derived from industrial by-products, like Flue Gas Desulfurization (FGD) gypsum, into viable food ingredients, ensuring cost-effective sourcing while adhering to regulatory mandates like FCC purity specifications.

Beyond basic purification, precision particle engineering technologies are increasingly important. Techniques such as spray drying, controlled crystallization, and fine milling (micronization) are utilized to produce calcium sulfate with specific particle size distributions (PSDs) and surface areas. These tailored physical characteristics are essential for optimizing functional performance in specific food applications; for instance, ultra-fine particles offer better suspension stability in liquid supplements, while specific crystalline structures might enhance flowability for dry blending in baking mixes. This technological refinement allows manufacturers to produce application-specific grades, optimizing their efficacy as coagulants, dispersants, or dough conditioners.

Furthermore, automation and digitization, often integrating AI and IoT sensors, represent a crucial technological advancement in modern production facilities. Automated systems monitor critical process parameters—pH, temperature, solubility, and contamination levels—in real time, enabling immediate corrective action and ensuring batch-to-batch consistency, which is paramount for food ingredient supply. Spectroscopic analysis techniques, such as ICP-MS (Inductively Coupled Plasma Mass Spectrometry), are foundational for advanced quality control testing, providing rapid, accurate quantification of trace impurities and ensuring compliance with the increasingly stringent global purity benchmarks required for safe human consumption.

Regional Highlights

The Food Grade Calcium Sulfate market exhibits distinct regional dynamics driven by local dietary habits, industrial structure, and regulatory environments, ensuring varying growth rates and demand characteristics across the globe. Asia Pacific (APAC) dominates the market in terms of volume consumption, primarily fueled by the massive production and consumption of traditional Asian foods, most notably tofu, which relies heavily on calcium sulfate as the primary coagulant. China, Japan, and Southeast Asian nations are significant consumers, driven by large populations and the cultural staple status of soy-based products. Rapid industrialization and urbanization in countries like India and Indonesia are also boosting demand from modern processed food sectors (baking and snacks), leading to substantial manufacturing expansion and increasing regional strategic importance.

North America and Europe represent mature markets characterized by high regulatory oversight and a strong focus on premium, functional, and fortified food products. Demand in these regions is primarily driven by the baking industry, the established brewing sector, and the rapidly accelerating nutritional supplements market, catering to health-conscious consumers seeking calcium fortification. European regulations, particularly those set by the European Food Safety Authority (EFSA), are extremely strict regarding additive purity and sourcing, compelling manufacturers to invest heavily in advanced purification technologies. These regions also lead innovation in plant-based dairy alternatives, where calcium sulfate plays a crucial role in texturizing and mineral balancing, demanding highly specialized, clean-label grades.

Latin America, the Middle East, and Africa (LAMEA) are emerging markets showing considerable growth potential, although starting from a lower base. Growth is linked to the modernization of local food processing industries, increasing adoption of Western-style packaged foods, and infrastructure investments improving logistics and distribution. Regulatory environments are often less harmonized than in North America or Europe, presenting both opportunities for rapid entry and challenges regarding product standardization. The expansion of global food and beverage multinationals into these regions is a key factor stimulating demand for certified food-grade additives, including calcium sulfate, required for ensuring stable manufacturing processes locally.

- North America: High demand from the nutraceuticals, baking, and specialty brewing sectors; strong regulatory framework (FDA GRAS); market characterized by innovation in fortification technology and clean-label initiatives.

- Europe: Driven by strict EFSA standards and high consumption in processed meat substitutes, specialized dairy alternatives, and artisan baking; focus on sustainable sourcing (Natural vs. Synthetic).

- Asia Pacific (APAC): Largest volume consumer, dominated by the tofu industry; massive growth projected due to rapidly expanding processed food market in China and India, and industrial brewing expansion.

- Latin America (LATAM): Emerging market with rising adoption of packaged goods; increasing foreign investment driving demand for consistent industrial food ingredients.

- Middle East and Africa (MEA): Growth linked to urbanization and shifting dietary preferences towards processed and fortified foods; market development relies on improved local logistics and regulatory standardization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Grade Calcium Sulfate Market.- USG Corporation

- Saint-Gobain

- National Gypsum

- LafargeHolcim

- Solvay S.A.

- Huber Engineered Materials

- J.M. Huber Corporation

- Mitsubishi Materials Corporation

- Reagents, Inc.

- Spectrum Chemical Manufacturing Corp.

- Noah Technologies Corporation

- Merck KGaA

- Avantor, Inc.

- W. R. Grace & Co.

- SUEZ Water Technologies & Solutions

- Kemira Oyj

- Innophos Holdings Inc.

- Foodchem International Corporation

- Boral Limited

- Cal-Maine Foods, Inc.

Frequently Asked Questions

Analyze common user questions about the Food Grade Calcium Sulfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of food grade calcium sulfate in food processing?

Food grade calcium sulfate primarily functions as a coagulant (especially in tofu), a firming agent, a dough conditioner (yeast food) in baking, a water mineral adjuster in brewing, and a calcium source for nutritional fortification and supplements. Its versatility across these functions drives high industrial demand.

Is food grade calcium sulfate considered safe for consumption, and what are the key regulatory standards?

Yes, food grade calcium sulfate is widely considered safe. It is approved globally by major regulatory bodies; in the U.S., it is classified as Generally Recognized as Safe (GRAS) by the FDA, and it must comply with stringent purity standards outlined in the Food Chemicals Codex (FCC) to limit heavy metal impurities.

How does the source (natural vs. synthetic) of calcium sulfate impact its market value and usage?

The source significantly impacts market value and regulatory scrutiny. Natural gypsum is often preferred for clean-label products, but synthetic sources (like FGD gypsum) offer cost-effectiveness. However, synthetic sources require more intensive, specialized purification technologies to remove industrial by-products and meet the FCC purity levels necessary for food application, influencing the final manufacturing cost.

Which application segment is expected to show the fastest growth rate for food grade calcium sulfate?

The Dairy Alternatives and Plant-Based Food segment is projected to exhibit the fastest growth. This is directly linked to the surging global demand for vegan and vegetarian protein sources, where calcium sulfate is an indispensable, high-performance coagulant for producing structured products like tofu, plant-based cheeses, and dairy-free yogurts.

What is the main challenge faced by manufacturers in the Food Grade Calcium Sulfate market?

The main challenge is consistently meeting extremely stringent global purity regulations, particularly concerning minimizing trace heavy metal contaminants. This necessitates continuous investment in highly advanced purification technologies, rigorous quality control, and detailed supply chain traceability to ensure product safety and compliance across diverse international markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager