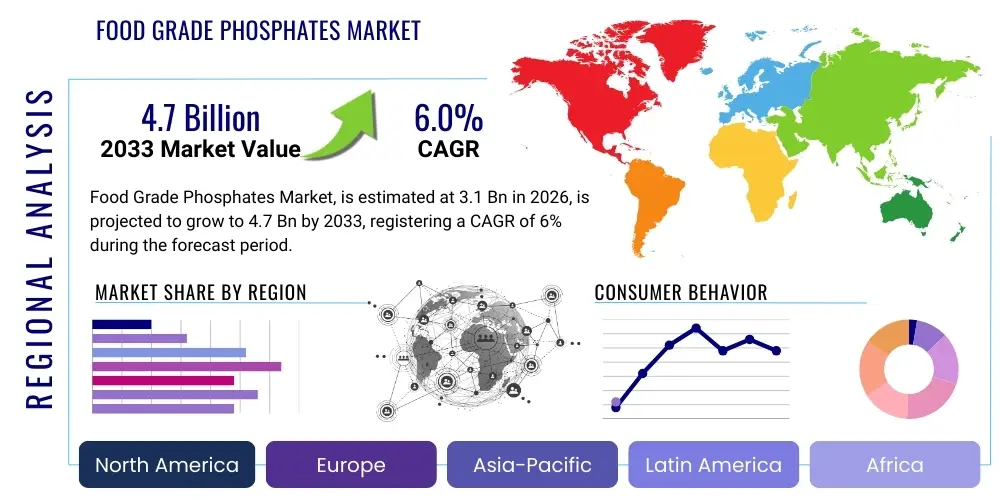

Food Grade Phosphates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440954 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Food Grade Phosphates Market Size

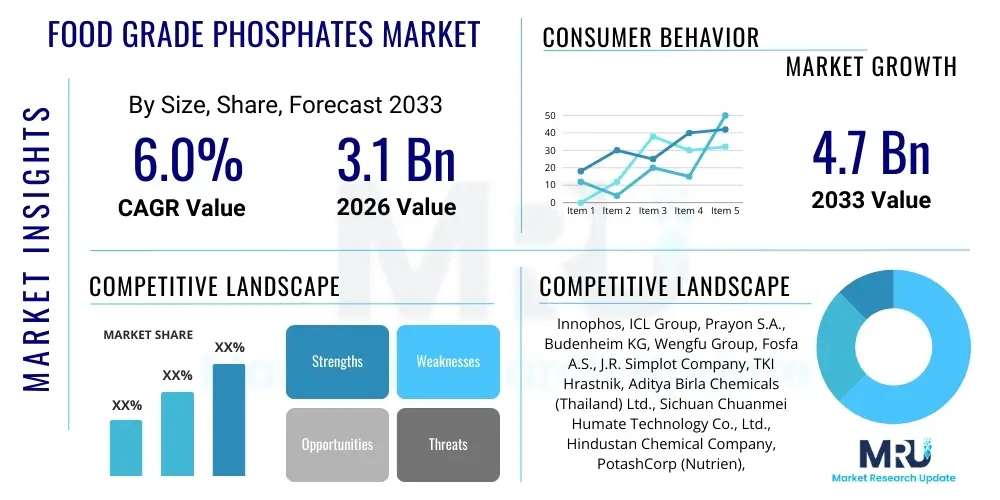

The Food Grade Phosphates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.7 Billion by the end of the forecast period in 2033.

Food Grade Phosphates Market introduction

Food grade phosphates are a critical category of functional food additives derived primarily from phosphoric acid and various mineral salts. These chemical compounds play indispensable roles across the food processing industry, acting as buffering agents, emulsifiers, leavening agents, and sequestrants. Their chemical versatility allows them to stabilize pH levels, improve texture, enhance water retention in meat products, and extend the shelf life of numerous packaged goods. The primary product descriptions include salts such as sodium tripolyphosphate (STPP), disodium phosphate (DSP), monocalcium phosphate (MCP), and potassium phosphates, each tailored for specific functional requirements in different food matrices.

Major applications of food grade phosphates span across highly dynamic sectors including bakery and confectionery, where they are essential leavening agents influencing rise and texture; meat, poultry, and seafood processing, where they enhance water binding capacity, reduce thaw loss, and improve tenderness; and dairy products, used as stabilizers and emulsifiers to prevent protein separation and maintain consistent texture in processed cheeses and milk derivatives. Furthermore, they are vital components in beverages, particularly soft drinks and sports drinks, for pH control and mineral enrichment, demonstrating their broad utility across the modern food landscape.

The core benefits derived from utilizing food grade phosphates are multifold, addressing both consumer expectations and industrial efficiency. Key driving factors include the escalating global demand for convenience foods and processed meat products, which rely heavily on phosphates for quality maintenance and storage stability. Urbanization, coupled with shifting dietary preferences toward ready-to-eat meals, directly fuels the necessity for these functional ingredients. Moreover, technological advancements in phosphate purification and formulation, offering clean-label alternatives and high-purity ingredients, contribute significantly to market expansion, ensuring compliance with evolving stringent global food safety and regulatory standards.

Food Grade Phosphates Market Executive Summary

The Food Grade Phosphates market exhibits robust growth driven fundamentally by global shifts in consumer consumption patterns toward convenience and processed foods, particularly rapid urbanization across emerging economies. Business trends highlight strategic investments in optimizing phosphate manufacturing processes to meet increasing purity requirements demanded by sensitive applications like infant formula and specialized nutraceutical products. There is a noticeable consolidation among major producers focused on backward integration to secure raw material supply (phosphate rock) and forward integration to offer highly specialized functional blends tailored to specific client needs, such as non-aluminum leavening systems or low-sodium phosphate options, reflecting a commitment to health-conscious market trends.

Regionally, the market dynamic is dominated by strong expansion in the Asia Pacific (APAC) region, primarily fueled by massive population growth, increasing disposable incomes, and the subsequent expansion of the processed food and beverage manufacturing base in countries such as China and India. While North America and Europe remain mature markets, they maintain significant market share through high per capita consumption of processed foods and stringent quality standards that necessitate high-grade functional ingredients. European regulatory shifts, particularly concerning specific phosphate intake limits, continually shape product formulation strategies, pushing innovation towards more efficient usage rates and alternative forms.

Segment trends underscore the dominance of Sodium Phosphates, especially sodium tripolyphosphate (STPP) and sodium acid pyrophosphate (SAPP), attributed to their exceptional effectiveness in meat processing and bakery applications, respectively. The Application segment sees the highest growth within the Meat, Poultry, and Seafood sector, reflecting the critical role phosphates play in maximizing yield, improving texture, and extending the storage life of perishable animal proteins. Concurrently, the Function segment emphasizes the rising demand for phosphates acting specifically as stabilizers and emulsifiers in dairy and beverage applications, critical for preventing product separation and maintaining homogeneity in complex food systems.

AI Impact Analysis on Food Grade Phosphates Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Food Grade Phosphates Market frequently center on themes of operational efficiency, supply chain resilience, and the potential for AI to accelerate R&D in novel phosphate applications or sustainable sourcing. Key concerns revolve around how AI can optimize complex chemical synthesis processes, minimizing waste and ensuring ultra-high purity required for specialized food additives. Users are also keen on understanding AI's role in predictive quality control (forecasting batch deviations), advanced demand forecasting (reducing inventory costs), and the potential for AI-driven food formulation software that automatically calculates optimal phosphate usage based on desired textural and stability outcomes, leading to less reliance on traditional trial-and-error methods and promoting precision ingredient usage.

- AI optimizes raw material procurement and logistics, minimizing price volatility exposure for phosphate rock sourcing.

- Predictive maintenance schedules enabled by AI minimize downtime in high-volume phosphate manufacturing plants, increasing operational efficiency.

- Machine learning algorithms enhance quality control by rapidly analyzing spectroscopic data to detect impurities or compositional variations in finished food grade salts.

- AI-driven food formulation tools assist R&D teams in calculating precise dosages of specific phosphate blends to achieve targeted functional properties (e.g., water holding, pH stabilization) with minimal material use.

- Enhanced market intelligence using AI models forecasts demand spikes in key end-use sectors (e.g., bakery or meat processing), enabling proactive production adjustments.

- AI supports sustainability initiatives by modeling optimized reaction pathways that reduce energy consumption and minimize effluent discharge during phosphate production.

DRO & Impact Forces Of Food Grade Phosphates Market

The Food Grade Phosphates market is governed by a dynamic interplay of factors stemming from global dietary shifts, regulatory scrutiny, and operational constraints inherent in the chemical industry. Drivers include the significant global rise in demand for convenience foods, where phosphates are indispensable for shelf life and texture; the expanding industrial livestock and poultry sectors, relying heavily on phosphates for yield maximization and preservation; and ongoing innovation resulting in new functional blends that address clean label and low-sodium trends. Restraints primarily involve stringent regulatory caps on phosphate intake in certain regions (especially Europe) due to health concerns related to high phosphorus consumption, volatile raw material pricing (phosphate rock), and the energy-intensive nature of chemical processing, which impacts production costs and environmental profiles.

Opportunities for market growth are strongly linked to the development and commercialization of highly specialized, high-purity phosphates for premium applications such as infant nutrition and pharmaceutical excipients, segments where margins are higher and demand for purity is absolute. Furthermore, the market benefits from increasing research into natural and bio-based alternatives or clean-label processing aids that, while chemically complex, aim to provide phosphate-like functionality while improving consumer perception. The expansion of food processing infrastructure in fast-growing emerging economies presents untapped potential for established global suppliers seeking new high-volume revenue streams, circumventing mature market saturation challenges.

Impact forces acting on the market are multifaceted, encompassing macroeconomic instability influencing commodity costs, geopolitical dynamics affecting global trade routes for raw materials, and sustained pressure from consumer advocacy groups demanding greater transparency regarding food additives. Regulatory harmonization, or lack thereof, across major trade blocs constitutes a key impact force, dictating export/import viability and formulation limits. Ultimately, the balancing act between meeting the technical functional needs of food processors (Drivers) while addressing consumer and regulatory health concerns (Restraints) is the dominant impact force shaping investment in R&D and influencing long-term market strategy, favoring companies capable of demonstrating both efficacy and safety.

Segmentation Analysis

The Food Grade Phosphates market is critically segmented based on the chemical Type, the specific Function they perform in food applications, and the major Application End-User industries they serve. This segmentation allows for precise market sizing and strategic targeting, reflecting the varied requirements across the highly diversified global food industry. The structural complexity of the market necessitates understanding segment-specific growth rates, as factors driving demand in the bakery sector (leavening agents) differ significantly from those in the meat industry (water binders/stabilizers), although the chemical base remains a phosphate salt.

The Type segmentation, encompassing Sodium, Potassium, Calcium, and Ammonium phosphates, reveals distinct market shares. Sodium phosphates dominate due to their ubiquitous presence across processed foods and cost-effectiveness, particularly within the meat and dairy segments. However, Potassium phosphates are witnessing accelerated growth, driven by the consumer demand for low-sodium products, leading manufacturers to substitute sodium salts with potassium equivalents where functional performance allows, thereby addressing hypertension concerns without sacrificing product quality or stability.

Application analysis shows that the Meat, Poultry, and Seafood segment holds the largest market share, highlighting the non-negotiable role of phosphates in protein functionality and extending preservation timelines for high-value perishable goods. Meanwhile, the Bakery and Confectionery segment remains highly stable, reliant on phosphates like Sodium Acid Pyrophosphate (SAPP) for controlled leavening rates. Strategic growth opportunities are particularly apparent in the Beverages and Dairy segments, where phosphates act as essential stabilizers, emulsifiers, and sources of mineral fortification, responding to trends in functional beverages and fortified dairy alternatives.

- By Type:

- Sodium Phosphate (Sodium Tri-polyphosphate (STPP), Disodium Phosphate (DSP), Monosodium Phosphate (MSP), Sodium Acid Pyrophosphate (SAPP))

- Potassium Phosphate (Dipotassium Phosphate (DKP), Monopotassium Phosphate (MKP), Tetrapotassium Pyrophosphate (TKPP))

- Calcium Phosphate (Monocalcium Phosphate (MCP), Dicalcium Phosphate (DCP), Tricalcium Phosphate (TCP))

- Ammonium Phosphate

- By Application:

- Bakery and Confectionery

- Meat, Poultry, and Seafood

- Beverages

- Dairy Products

- Processed Foods (Including Snacks and Ready-to-Eat Meals)

- By Function:

- Leavening Agents

- Emulsifiers and Buffers

- Stabilizers and Texturizers

- Sequestrants and Preservatives

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Food Grade Phosphates Market

The value chain for food grade phosphates commences with the upstream acquisition of phosphate rock, a non-renewable geological resource, which undergoes mining and beneficiation processes. This crude resource is then treated with sulfuric acid to produce phosphoric acid, the foundational intermediate chemical. The quality and purity of this starting material are paramount, as achieving food-grade standards requires rigorous purification stages to eliminate heavy metals (such as cadmium, arsenic, and lead) and other undesirable contaminants, making the upstream processing segment highly capital-intensive and subject to strict environmental regulations.

The midstream involves the conversion of purified phosphoric acid into specific phosphate salts (e.g., sodium, potassium, calcium) through complex chemical reactions, crystallization, and drying. Manufacturers specializing in food grade products invest heavily in dedicated production lines to prevent cross-contamination and ensure compliance with Codex Alimentarius and regional food safety standards. These manufacturers often create bespoke blends—mixtures of various phosphate salts designed to achieve specific multifunctionality (e.g., enhanced leavening power combined with buffering)—adding significant value through technical expertise and application knowledge.

Downstream analysis highlights the critical distribution channels and the ultimate consumption by end-users. Distribution is predominantly B2B, involving direct sales teams for major accounts (large multinational food corporations) and specialized chemical distributors for smaller processors. Direct sales allow for greater technical support and customized product development, while distributors provide essential regional coverage and efficient logistics for smaller batch sizes. The end-users—ranging from industrial bakeries to meat processors and beverage plants—integrate these phosphates into their formulations, valuing consistency, functionality, and regulatory compliance above all else. This downstream segment is characterized by strong customer loyalty based on proven product performance and reliable supply chains.

Food Grade Phosphates Market Potential Customers

The primary customers for food grade phosphates are large-scale industrial food manufacturers, multinational corporations specializing in processed goods, and companies operating within highly regulated segments such as infant nutrition. These buyers require high-volume, consistently pure, and technically supported ingredient supplies. The Meat, Poultry, and Seafood industry represents a cornerstone customer base, utilizing substantial quantities of phosphates like STPP and SAPP to optimize protein functionality, enhance succulence, and improve yields in products ranging from marinated chicken to frozen fish fillets, where minimizing thaw loss is financially crucial.

Another significant customer segment includes the global Dairy and Beverage industries. Dairy manufacturers purchase phosphates for stabilizing evaporated and condensed milk, maintaining the melt properties of processed cheese, and extending the storage life of milk proteins. Beverage companies, particularly those producing carbonated soft drinks, fruit juices, and sports drinks, use phosphates as essential buffering agents to control acidity, providing sharp flavor profiles and ensuring product stability, while also occasionally utilizing them for mineral fortification (e.g., calcium phosphates).

The Bakery and Confectionery sector constitutes a large and stable customer group, where the timely release of carbon dioxide for leavening is managed precisely by phosphates like SAPP and MCP. Instant food producers and companies specializing in ready-to-eat (RTE) meals are rapidly growing customer segments, driven by modern lifestyles. These customers prioritize multifunctional phosphate blends that can simultaneously stabilize complex sauces, prevent fat separation, and maintain the texture of diverse ingredients in microwaveable or shelf-stable preparations, thus demanding highly specialized and reliable functional ingredient solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Growth Rate | CAGR 6.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Innophos, ICL Group, Prayon S.A., Budenheim KG, Wengfu Group, Fosfa A.S., J.R. Simplot Company, TKI Hrastnik, Aditya Birla Chemicals (Thailand) Ltd., Sichuan Chuanmei Humate Technology Co., Ltd., Hindustan Chemical Company, PotashCorp (Nutrien), FOSFITALIA S.p.A., Chemische Fabrik Budenheim KG, KRONOS Worldwide, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Grade Phosphates Market Key Technology Landscape

The technological landscape of the Food Grade Phosphates market is defined by continuous process improvements aimed at enhancing product purity, optimizing manufacturing efficiency, and ensuring sustainable sourcing. A critical technological focus is on advanced purification and crystallization techniques. Manufacturers utilize sophisticated multi-stage filtration and ion-exchange systems to rigorously remove trace heavy metals and impurities from technical-grade phosphoric acid, ensuring the final product meets the stringent quality requirements for food-grade classification, particularly for segments like infant formula where safety margins are exceptionally tight. Novel crystallization processes allow for greater control over particle size and morphology, tailoring the physical properties of phosphate salts (such as solubility and dispersion rate) to specific customer application needs, thereby increasing functional efficacy.

Another major area of technological advancement involves the development of specialized phosphate blends using microencapsulation and advanced coating technologies. These processes are crucial for creating controlled-release functional ingredients, such as encapsulated leavening acids (e.g., SAPP), which ensure delayed action and consistent gas production throughout the baking cycle, optimizing the volume and texture of baked goods. This precise control over functionality is a key competitive differentiator, moving beyond simple bulk chemical supply towards tailored ingredient solutions. Furthermore, continuous process monitoring utilizing sensors and real-time analytical technologies (PAT - Process Analytical Technology) is becoming standard, ensuring immediate detection and correction of process variations, leading to higher batch consistency and reduced waste.

Sustainability and resource efficiency also drive technological investment. Given that phosphate rock is a finite resource and chemical processing is energy-intensive, technologies focused on utilizing alternative, recycled, or responsibly sourced phosphoric acid streams are gaining traction. Efforts include improving the efficiency of phosphate rock extraction and acidulation, and developing "green chemistry" synthesis methods that minimize solvent use and energy input during the conversion to specific salts. Lastly, the adoption of digitalization and automation across production facilities, leveraging IoT sensors and centralized control systems, minimizes human error, optimizes energy usage, and allows producers to maintain globally competitive cost structures while adhering to high environmental and safety standards.

Regional Highlights

- Asia Pacific (APAC): This region is positioned as the largest and fastest-growing market globally, driven by demographic factors including a massive, expanding consumer base, rapid industrialization, and significant investment in modern food processing infrastructure, particularly in China and India. The rising demand for convenience snacks, packaged meat, and processed dairy products among the burgeoning middle class is a primary market driver. Regulatory oversight is generally less restrictive than in Western markets, facilitating higher volume production and consumption, though standards are continually evolving toward global parity.

- North America: A mature market characterized by high consumer spending on processed foods and established multinational food companies. Growth is steady, focused heavily on innovation within the existing framework, particularly the development of low-sodium potassium phosphates and high-purity calcium phosphates for nutritional supplements and functional foods. Compliance with FDA regulations, which are comprehensive and strictly enforced, dictates the quality standards for all market participants.

- Europe: The European market is highly mature and defined by some of the most stringent regulatory frameworks globally, specifically regarding permissible daily intake levels of phosphorus additives (as dictated by the European Food Safety Authority - EFSA). This drives intense focus on efficiency and formulation minimization. The shift towards clean label ingredients and natural food claims pushes manufacturers to seek highly effective, lower-dose phosphate solutions or suitable alternatives, influencing R&D expenditures significantly towards innovation rather than volume expansion.

- Latin America (LATAM): This region presents substantial growth opportunities due to improving economic conditions, urbanization, and the corresponding shift from traditional cooking to processed and packaged foods, particularly in Brazil and Mexico. The local food processing sector is expanding, generating higher demand for basic phosphate additives in meat and dairy preservation applications, supported by favorable internal trade dynamics.

- Middle East and Africa (MEA): Growth in MEA is primarily segmented, with the Gulf Cooperation Council (GCC) countries showing strong demand linked to high-quality imported and domestically manufactured processed foods, often catering to affluent consumer tastes. Africa's market remains largely nascent but offers long-term potential as food safety standards and cold chain logistics infrastructure gradually improve across densely populated urban centers, increasing the viability of packaged goods distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Grade Phosphates Market.- Innophos

- ICL Group

- Prayon S.A.

- Budenheim KG

- Wengfu Group

- Fosfa A.S.

- J.R. Simplot Company

- TKI Hrastnik

- Aditya Birla Chemicals (Thailand) Ltd.

- Sichuan Chuanmei Humate Technology Co., Ltd.

- Hindustan Chemical Company

- PotashCorp (Nutrien)

- FOSFITALIA S.p.A.

- Chemische Fabrik Budenheim KG

- KRONOS Worldwide, Inc.

- Shifang Dingfeng Chemical Co., Ltd.

- Xingfa Chemicals Group Co., Ltd.

- Guizhou Phosphate Chemical Group Co., Ltd.

- Tianjin Zhongdeng Chemical Co., Ltd.

- Chengdu Huarong Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Food Grade Phosphates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of food grade phosphates in processed foods?

Food grade phosphates primarily serve as multi-functional ingredients: they act as leavening agents in baked goods, emulsifiers and stabilizers in dairy and processed cheese, sequestrants to bind metal ions, and crucial water-binding agents to enhance texture and yield in meat, poultry, and seafood products, thereby extending shelf life and improving quality.

Which type of food grade phosphate dominates the market in terms of volume?

Sodium Phosphates, including Sodium Tripolyphosphate (STPP) and Sodium Acid Pyrophosphate (SAPP), dominate the market volume due to their wide range of functional applications, cost-effectiveness, and established usage across the high-volume meat, dairy, and bakery segments globally.

How do regulatory changes, particularly in Europe, affect the phosphate market?

European regulatory bodies like EFSA impose strict limits on the maximum allowable daily intake and specific application levels of phosphates in certain foods. This pressure forces manufacturers to innovate, focusing on higher-purity, low-dose formulations or replacing sodium phosphates with alternatives like potassium phosphates to meet public health standards and maintain market compliance.

What role does the Meat, Poultry, and Seafood segment play in phosphate demand?

The Meat, Poultry, and Seafood segment is the largest application consumer because phosphates are essential for improving water retention capacity (reducing drip/thaw loss), maintaining pH stability during cooking and storage, and enhancing the binding properties of restructured meat products, directly impacting profitability and product quality.

What are the key technological trends influencing food grade phosphate production?

Key trends include adopting advanced purification methods (ion exchange, crystallization) to ensure ultra-high purity, developing microencapsulation technologies for controlled-release functionality (especially for leavening agents), and implementing AI and PAT systems for improved manufacturing efficiency and rigorous quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager