Forage Mergers and Dump Carts Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443592 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Forage Mergers and Dump Carts Market Size

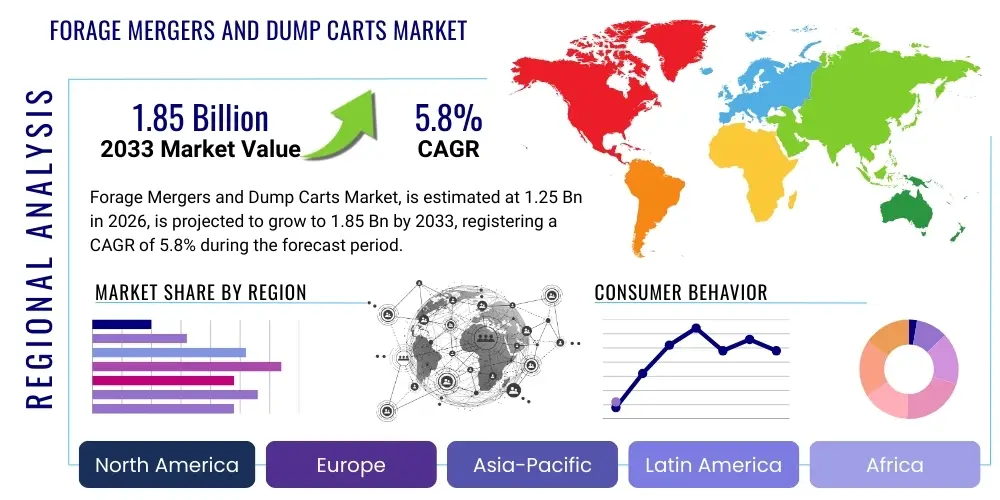

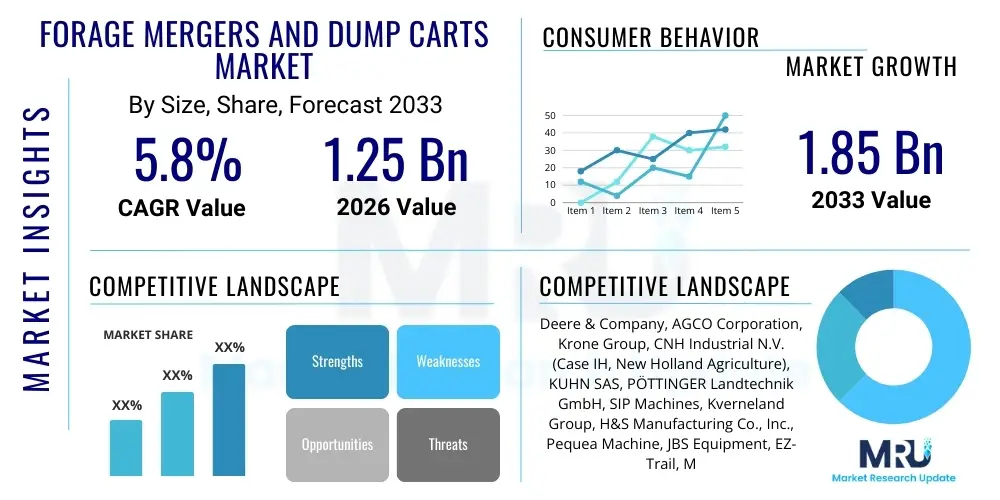

The Forage Mergers and Dump Carts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033.

Forage Mergers and Dump Carts Market introduction

The Forage Mergers and Dump Carts Market encompasses specialized agricultural machinery essential for modern, high-efficiency forage harvesting and transportation operations. Forage mergers, also known as hay mergers or central delivery mergers, are sophisticated implements designed to consolidate wide swaths of cut forage material (such as alfalfa, hay, and silage crops) into uniform windrows, significantly accelerating the subsequent baling or chopping process. These machines utilize belts and conveyors to gently handle the crop, minimizing leaf loss and maximizing nutrient retention, which is critical for producing high-quality animal feed. The design focus is on achieving speed, precision, and crop quality preservation across large fields, making them indispensable tools for large commercial farming operations and custom harvesting contractors who require rapid turnaround times and optimal resource utilization. The efficiency gains offered by modern forage mergers directly contribute to lower operational costs and enhanced feed quality, driving adoption in regions with intensive livestock production and high standards for feed integrity.

Dump carts, or agricultural dump trailers, complement the forage harvesting process by providing robust, high-capacity solutions for transporting harvested crops, particularly silage, grain, or other bulk materials, swiftly from the field to storage facilities or processing centers. These carts are engineered for heavy-duty use, featuring strong chassis, tandem or tridem axles for stability on uneven terrain, and powerful hydraulic tipping mechanisms for quick and efficient unloading. The synergy between high-speed forage mergers and robust dump carts creates a highly streamlined field-to-storage system, crucial for maximizing the value derived from short harvesting windows and reducing logistical bottlenecks. Continuous innovation in dump cart design focuses on reducing soil compaction through specialized high-floatation tires and optimizing volumetric capacity to handle the increasing density and volume associated with modern silage harvests, ensuring maximum efficiency per transport cycle across varied field conditions.

Major applications of this equipment span large-scale dairy farms, beef cattle operations, commercial hay and silage producers, and renewable energy sectors utilizing biomass crops. Benefits include superior crop quality preservation due to gentle handling by mergers, reduced fuel consumption per hectare due to increased operational speed and wider working widths, and significant labor savings achieved through mechanization and high-volume transport capability. Driving factors propelling market growth include increasing global population necessitating higher food production, the persistent necessity for precision agriculture tools to manage rising input costs, favorable governmental subsidies promoting farm modernization and equipment turnover in key agricultural regions like North America and Europe, and the continuous technological advancements introducing telemetry, integrated sensors, and automation into these heavy-duty implements, enhancing their monitoring, diagnostic, and predictive maintenance capabilities, thereby boosting reliability during critical peak usage times.

Forage Mergers and Dump Carts Market Executive Summary

The global Forage Mergers and Dump Carts Market is currently experiencing robust growth, primarily driven by evolving business trends centered around agricultural consolidation and the integration of smart farming technologies designed to maximize efficiency and resource allocation. Business trends indicate a strong shift towards larger, high-throughput machinery capable of processing thousands of acres efficiently, compelling manufacturers to invest heavily in developing models with increased working widths for mergers (e.g., triple mergers) and substantially higher payload capacities for dump carts (exceeding 30 cubic meters). This focus on enhanced scale and automation reflects the ongoing consolidation of agricultural land globally, where fewer, but larger, commercial entities dominate production and consequently demand equipment that minimizes operational bottlenecks and maximizes output during the highly time-sensitive harvesting season. Furthermore, rising input costs, particularly fuel and skilled labor, are rapidly accelerating the adoption of premium, efficiency-focused equipment that offers superior throughput and reduced downtime, thereby justifying the higher initial capital outlay through substantial long-term operational savings.

Regional trends highlight North America and Europe as dominant and mature markets characterized by high penetration rates and strong replacement demand, fueled by early adoption of advanced agricultural techniques, a high concentration of sophisticated commercial farms, and sustained government policies supporting farm machinery upgrades and technological integration. However, the Asia Pacific region, particularly major agricultural economies such as India and China, is projected to exhibit the highest incremental growth rate during the forecast period. This rapid expansion is fundamentally fueled by large-scale government-led mechanization initiatives, the modernization of traditional livestock farming practices to meet rising domestic demand for dairy and meat products, and a governmental focus on improving logistics and supply chain efficiency in food production. The Middle East and Africa (MEA) are also showing promising nascent demand, driven primarily by large-scale, corporate farming projects focused intensely on national food security, necessitating modern, reliable heavy-duty hauling equipment and high-efficiency forage preparation tools, despite intrinsic operational challenges related to climate and complex logistics.

Segment trends reveal a pronounced and growing preference for high-capacity, self-propelled forage mergers among elite commercial contractors due to their superior maneuverability, independence from high-horsepower tractors, and higher field speed capabilities, though trailed mergers remain the backbone for medium-sized operations due to their greater cost-effectiveness and flexibility. In the dump carts segment, innovation is focused heavily on durability and minimizing environmental impact, leading to a surge in demand for specialized chassis designs and high-floatation tires optimized to minimize soil compaction and preserve long-term soil health. Crucially, the integration of advanced telematics for real-time monitoring of cargo weight, GPS location tracking, and comprehensive operational efficiency metrics is now a standard feature in high-end carts. In terms of capacity, the segment of dump carts exceeding 30 cubic meters is seeing rapid uptake, aligning perfectly with the industry's critical need to transport maximum volume per single trip, thus improving overall harvest logistical efficiency.

AI Impact Analysis on Forage Mergers and Dump Carts Market

The integration of Artificial Intelligence (AI) and machine learning (ML) capabilities is increasingly viewed as a transformative force within the Forage Mergers and Dump Carts Market, generating significant discussion among farm managers, custom operators, and equipment manufacturers regarding its potential for operational optimization, yield prediction, and achieving truly autonomous field logistics. Common user questions often center on the immediate practicality of AI, specifically questioning how sophisticated sensors linked to deep learning algorithms can provide real-time forage quality assessment—for instance, instantaneously adjusting merger pick-up height, belt tension, or speed based on fluctuating crop density, moisture levels, and estimated nutrient profiles to critically minimize leaf shatter and maximize retained feed value. Users frequently inquire about the return on investment (ROI) and the inherent complexity of implementing high-level AI-driven telematics systems in rugged, heavy-duty machinery, questioning the necessary investment in technical training, the reliability of connectivity in remote agricultural settings, and the complex burdens associated with managing and securing vast datasets generated by these smart machines.

A substantial key theme repeatedly addressed by users and industry experts is the potential for achieving fully autonomous harvesting and hauling cycles. This involves autonomous dump carts coordinating their movements seamlessly and safely with self-propelled forage harvesters, utilizing advanced computer vision, LiDAR, and high-precision GPS guidance to navigate fields, detect obstacles, and execute precise loading and unloading procedures without human intervention. The regulatory implications and safety requirements for deploying such fully autonomous fleets on public roads (when moving between fields) are major concerns being debated. Overall, the core expectations users hold regarding AI's influence are focused on significantly reducing human dependency and error, maximizing quality control for the sensitive feed product, and crucially extending equipment lifespan through advanced, highly granular diagnostics that move beyond simple preventative maintenance into true predictive failure analysis for critical mechanical and hydraulic components within both mergers and carts.

- Real-time autonomous adjustment of merger parameters (e.g., belt speed, pressure, height) based on immediate crop scanning (density, moisture, nutrient estimation).

- Deployment of predictive maintenance algorithms trained on long-term operational data to anticipate and prevent failure of high-stress components like gearboxes and hydraulic systems.

- Enabling fully autonomous or supervised autonomous coordination between dump carts and harvesters using computer vision and high-precision RTK-GPS guidance for optimized, continuous flow logistics.

- Implementation of AI-driven route optimization and dynamic fleet management for dump carts, accounting for soil conditions, road restrictions, and silo capacity in real-time.

- Enhanced safety and obstacle avoidance capabilities achieved through machine learning interpretation of sensor inputs in complex, dynamic field environments.

DRO & Impact Forces Of Forage Mergers and Dump Carts Market

The dynamics of the Forage Mergers and Dump Carts Market are critically shaped by powerful market Drivers, inherent structural Restraints, and transformative technological and geographical Opportunities, collectively forming the key Impact Forces influencing strategic investment and procurement decisions across the agricultural sector. A primary Driver is the escalating and persistent global demand for high-quality animal feed, particularly nutritionally dense hay and silage, which necessitates the adoption of advanced handling technologies, like forage mergers, that maximize nutrient retention while significantly increasing harvest capacity and speed. This is further compounded by the continuous and rapid trend toward consolidation into larger farm sizes globally, driving an inescapable demand for high-throughput, capital-intensive machinery capable of operating efficiently across massive acreage. Additionally, increasing regulatory pressures favoring sustainable, efficient, and soil-friendly farming practices, coupled with governmental subsidy programs designed to incentivize the modernization and replacement of aging agricultural fleets in major producing economies, act as significant and persistent tailwinds, strongly encouraging farmers to invest in newer, more productive forage handling equipment. The high cost and increasing scarcity of manual agricultural labor worldwide also universally mandate the rapid adoption of highly mechanized solutions to maintain operational viability and cost competitiveness.

Despite these powerful drivers, the market faces significant structural Restraints that temper overall adoption rates. Foremost among these is the exceptionally high initial capital expenditure required for purchasing sophisticated, high-capacity machinery, especially complex self-propelled forage mergers and large-capacity articulated dump carts. This financial hurdle presents a substantial barrier to entry for smaller and even medium-sized farms, particularly in emerging markets where access to reliable, affordable agricultural credit and financing options is severely limited or highly costly. A secondary restraint is the inherent seasonality and resulting underutilization of these specialized machines; they are only utilized intensively for short, often critical, periods during the narrow harvesting season, which can significantly impact the perceived return on investment (ROI) calculation for cautious farm owners. Furthermore, the increasing technical complexity, involving the maintenance and effective operation of integrated sensor systems, sophisticated hydraulic controls, and advanced telematics, necessitates specialized technical training and highly skilled labor, resources which may not be readily available or affordable in all farming regions, thereby contributing to operational hurdles and reluctance among certain end-users to adopt the most technologically advanced solutions.

Opportunities within the market largely center on pivotal technological innovation and strategic geographic expansion into rapidly developing agricultural regions. The ongoing research and development into lighter, yet significantly stronger, composite and high-strength steel materials for dump cart construction offers clear opportunities to dramatically increase the operational payload capacity without commensurately increasing the overall vehicle weight, thereby concurrently improving overall fuel efficiency and substantially reducing detrimental soil compaction. Forage mergers present a compelling opportunity for enhanced integration with precision agriculture platforms, specifically allowing for variable windrow formation and tailored merging passes based on real-time yield mapping data and GPS coordinates, which optimizes the subsequent harvesting and chopping passes. Moreover, penetrating underserved, high-potential markets in Latin America, Southeast Asia, and Eastern Europe through the offering of flexible financing mechanisms and manufacturing simplified, ruggedized equipment models specifically tailored to handle challenging local operating conditions and lower average farm capital represents a massive and currently untapped growth avenue. Finally, the rising global focus on long-term environmental sustainability drives further opportunities in developing hybrid, electric, or alternative fuel drive systems for both dump carts and mergers, aligning the agricultural sector with global green initiatives and promising significantly lower long-term operating costs.

Segmentation Analysis

The Forage Mergers and Dump Carts Market is intricately segmented based on crucial product attributes, operational requirements, capacity demands, and specific end-user application needs, enabling manufacturers to efficiently target specific operational scales and complex budgetary requirements within the globally diverse agricultural landscape. A comprehensive understanding of these detailed segmentation nuances is fundamental for accurately grasping current market dynamics, as end-user purchasing decisions are heavily and directly influenced by the precise size and scale of the farming operation, the specific characteristics of the crop being harvested (e.g., density, fragility), and the required logistical throughput capacity of the overall harvesting system. Segmentation by product type clearly delineates the offerings, differentiating between high-performance self-propelled mergers, favored by large contractors, and more versatile, cost-effective trailed mergers. Concurrently, dump carts are categorized extensively by their load capacity, ranging from reliable medium-sized farm trailers suitable for smaller operations to enormous, highly specialized articulated off-road agricultural trailers designed and built specifically for the largest commercial contractors aiming for absolute maximum logistical efficiency.

Further essential granularity is achieved through sophisticated capacity segmentation, particularly for the dump carts, which shows a direct and strong correlation with the economic scale of the farming operation. Larger capacity models, typically exceeding 30 cubic meters, are experiencing rapid adoption and are increasingly preferred across North America and Western Europe due to the prevalence of massive corporate farms that prioritize high-speed transport and minimizing field trips. Conversely, smaller to mid-range capacity carts (below 20 m³) remain dominant in regions and economies characterized by smaller average landholdings and mixed farming operations where versatility is prized over sheer volume. The detailed end-user segment clearly reveals a strategic split between sophisticated large commercial farms, who routinely demand premium features such as integrated GPS guidance, automatic weight logging, and high-speed road travel capabilities, and dedicated custom harvesting service providers, who prioritize overall rugged durability, maximizing utilization rates, ease of rapid deployment across multiple client locations, and guaranteed quick parts availability.

The specific technology mechanism employed within the forage mergers segment also forms a critical area of differentiation, distinguishing between traditional, less gentle rake-based systems and the modern, high-efficiency belt/conveyor systems. The latter is rapidly gaining significant market traction globally due to its vastly superior crop handling characteristics, which are instrumental in minimizing high-value leaf loss in sensitive crops such as alfalfa and clover, thereby directly impacting the marketability, nutrient profile, and overall quality of the resulting feed produced. This continuous technological segmentation fundamentally guides OEM research and development efforts, directing resources towards maximizing operational throughput while simultaneously maintaining exceptional crop integrity, strategically catering to the sophisticated and evolving demands of the modern, intensive livestock feed industry where even marginal improvements in feed quality directly translate into enhanced animal performance and substantial profit margins for the farm operation.

- By Product Type (Forage Mergers):

- Trailed/Pull-Type Mergers

- Self-Propelled Mergers

- Triple Mergers (High Capacity)

- By Product Type (Dump Carts):

- Standard Agricultural Dump Carts (Fixed Chassis)

- High-Capacity Off-Road Silage Carts

- Articulated Dump Carts (Agricultural Use)

- By Capacity (Dump Carts):

- Below 20 m³

- 20 m³ - 30 m³

- Above 30 m³ (Focus on high-volume logistics)

- By End-User:

- Large Commercial Farms (Dairy, Beef, Hay Producers)

- Custom Harvesting Contractors (Service Providers)

- Agricultural Cooperatives and Rental/Leasing Companies

Value Chain Analysis For Forage Mergers and Dump Carts Market

The comprehensive Value Chain for the Forage Mergers and Dump Carts Market initiates with critical upstream activities, focusing intensely on the reliable sourcing of essential raw materials and specialized, high-precision components, which are foundational for dictating the quality, structural durability, and long-term operational performance of the final product. Key upstream suppliers include specialized steel manufacturers providing extremely high-grade, resilient alloys necessary for manufacturing the load-bearing chassis, structural frames, and heavy-duty axles, ensuring maximum tensile strength and durability under extreme operating loads. Further crucial inputs come from high-technology hydraulic component specialists supplying sophisticated, reliable systems required for the high-power tipping mechanisms and complex conveyor drive systems in the mergers, and expert tire manufacturers providing specialized high-floatation, low-compaction agricultural tires designed to minimize soil disruption. Maintaining strategic, long-term relationships with these specialized, quality-focused suppliers is absolutely critical, as their output directly determines manufacturing costs, overall product reliability, and eventual field performance. Leading manufacturers often make substantial investments in advanced supply chain logistics and inventory management systems to effectively mitigate the volatility inherent in global commodity prices and guarantee the timely, just-in-time delivery of high-precision parts, particularly the increasingly complex electronic sensors and control units that are central to modern, smart machinery.

The midstream phase encompasses the core manufacturing process, meticulous assembly, rigorous quality assurance, and final testing, typically executed by established, multinational agricultural equipment corporations or specialized high-end farm machinery firms known for their engineering prowess. Distribution channels are predominantly structured as indirect sales networks, heavily relying on deeply established, regionally authorized dealerships and large, independent distributors who possess indispensable local market knowledge, maintain comprehensive parts inventories, offer extensive financial services, and provide the specialized technical service capabilities that are critical prerequisites for the successful sale and support of high-value agricultural machinery. These dealer networks serve as the vital interface with the end-user, providing essential services including comprehensive pre-sales consultation, financing facilitation, after-sales maintenance, rapid parts inventory management, and expert technical support, all of which substantially influence the end-user's final purchasing decision and significantly determine the product's entire lifetime value and operational uptime. Direct sales channels, although considerably less common and generally reserved for specific situations, are selectively utilized by some Original Equipment Manufacturers (OEMs) for fulfilling unusually large fleet orders or securing direct contracts with the largest custom harvesting operations, strategically bypassing the intermediary channel for specific high-volume, low-margin transactions.

Downstream activities are entirely centered on the rigorous operational deployment by the end-users—the large commercial farms, massive agribusinesses, and demanding custom harvesting contractors who utilize the machinery under intense, highly time-sensitive field environments. Successful value delivery in the downstream chain is fundamentally determined by the equipment's demonstrable operational efficiency, its proven durability and resistance to wear, and the guaranteed availability of responsive, expert maintenance and repair support when needed. The value chain strategically extends well beyond the initial purchase and deployment, encompassing the entire product lifecycle, including the managed trade-in and eventual resale of pre-owned equipment, which is often effectively facilitated through the established dealer networks, and culminates in the responsible, environmentally compliant disposal or recycling of materials at the end of the equipment's useful life. The continuous integration of robust customer feedback loops is paramount in this downstream phase, actively enabling manufacturers to rapidly iterate design improvements, swiftly address any identified field failures, and proactively incorporate essential features requested by next-generation farming practices, thereby crucially reinforcing the overall market reputation, product loyalty, and facilitating sustained future sales growth and market leadership.

Forage Mergers and Dump Carts Market Potential Customers

Potential customers for the Forage Mergers and Dump Carts Market are precisely defined as those entities engaged in large-scale, industrial-level livestock production, substantial commercial feed preparation, and specialized agricultural contracting that necessitates the high-volume, efficient handling and movement of forage crops, grain, and other bulk materials. The primary and most demanding customer demographic consists of large commercial dairy farms and extensive beef feedlot operations concentrated in the major, high-yield agricultural belts across North America, Europe, and Oceania. These crucial end-users operate under intense pressure to ensure the fastest possible harvest and transport cycle to minimize potentially catastrophic weather-related crop risk and consistently guarantee the highest possible feed quality, making high-capacity dump carts and technologically sophisticated forage mergers absolutely essential, non-negotiable capital investments. Their complex purchasing decisions are meticulously driven by rigorous Return on Investment (ROI) calculations based heavily on projected throughput increases, measurable fuel efficiency improvements, and the critical objective of minimizing expensive labor inputs, thus strongly favoring premium, feature-rich equipment models equipped with the latest integrated automation and precision technology.

A secondary, yet highly influential and dynamic customer segment comprises professional custom harvesting contractors. These service providers typically manage and operate large, diversified fleets of specialized machinery and are hired by multiple individual farms or corporate clients to manage and execute the entire highly concentrated harvest season operations. Contractors prioritize maximizing machine uptime, ensuring extreme rugged reliability across various field conditions, facilitating ease of rapid transport between diverse client locations, and maintaining standardized, simplified maintenance procedures across their entire equipment portfolio to minimize operational complexity. Consequently, they are frequently the earliest and most demanding adopters of innovative agricultural technologies, such as advanced telematics, sophisticated integrated sensors, and high-level automation, recognizing that even marginal efficiency gains directly translate into significantly increased profitability and a crucial competitive advantage in securing high-value contracts across an intense season. The specific, demanding operational requirements of this critical segment often serve to dictate prevailing industry trends in equipment durability, connectivity standards, and necessary technological integration, continuously pushing OEMs towards achieving significantly higher standards of performance and reliability.

Furthermore, large corporate farming enterprises, major agribusiness conglomerates, and agricultural investment groups focused strategically on high-volume crop cultivation for specialized purposes such as industrial biogas production, ethanol manufacturing, or large-scale export markets represent a rapidly expanding customer base with unique procurement needs. These substantial entities operate under stringent, industrial-scale management principles, requiring centralized procurement processes for specialized, high-capacity equipment. Their focus is often rigidly fixed on fleet standardization (to simplify maintenance), securing long-term, guaranteed servicing agreements from the manufacturer, and acquiring highly customized solutions that precisely fit highly specific logistical and operational requirements, often related to proprietary processing facilities. Finally, governmental agricultural cooperatives and large state-backed farming initiatives in rapidly emerging economies, frequently supported by substantial state subsidies aimed at rapidly modernizing antiquated agricultural infrastructure, also represent a significant potential for large-scale, bulk purchasing of reliable, mid-range capacity equipment that offers a strong balance between operational performance and localized cost-effectiveness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, AGCO Corporation, Krone Group, CNH Industrial N.V. (Case IH, New Holland Agriculture), KUHN SAS, PÖTTINGER Landtechnik GmbH, SIP Machines, Kverneland Group, H&S Manufacturing Co., Inc., Pequea Machine, JBS Equipment, EZ-Trail, Meyer's Equipment Manufacturing Corporation, Art's Way Manufacturing Co., Inc., Unverferth Manufacturing Co., Inc., CLAAS KGaA mbH, Anderson Group, Alois Pöttinger Maschinenfabrik GmbH, Oxbo International Corporation, Balzer Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forage Mergers and Dump Carts Market Key Technology Landscape

The technological landscape of the Forage Mergers and Dump Carts Market is undergoing swift and significant transformation, fundamentally driven by the agricultural sector's relentless global push towards achieving unprecedented levels of precision, operational efficiency, and seamless digital connectivity. Key technologies currently being implemented are sharply focused on optimizing operational throughput, meticulously minimizing crop damage during handling, and providing robust, actionable data analytics to farm managers and operators. For forage mergers, the most critical innovations center on high-performance hydraulic systems that facilitate precise, variable speed control of both the belts and the specialized pick-up tines. This essential capability, increasingly facilitated by sophisticated integrated sensor arrays and powerful Electronic Control Units (ECUs), allows operators to precisely and instantaneously match machinery speed and intensity to real-time fluctuations in crop density and moisture content. This level of precise control is paramount for achieving perfectly uniform windrow formation and critically minimizing valuable leaf loss, especially in structurally fragile, high-value crops like dry alfalfa, thereby directly ensuring the highest quality feed product. Furthermore, the mandatory incorporation of high-accuracy GPS guidance systems allows mergers, particularly the large triple-merger units, to follow pre-mapped, complex field contours accurately, guaranteeing complete field coverage and minimizing costly overlap, which concurrently saves significant amounts of time, labor, and fuel resources.

In stark contrast, the technological focus within the dump carts segment is overwhelmingly concentrated on optimizing logistical efficiency and enhancing vehicle dynamic performance, particularly under massive load conditions. Advanced developments include intelligent, adaptive chassis control systems and state-of-the-art hydraulic suspension systems that actively monitor and adjust the load balance and ride height, which dramatically improves vehicle stability, maneuverability, and operator comfort when traveling at higher speeds, and simultaneously reduces undue stress and wear on the high-horsepower towing tractor during demanding field maneuvers and transport cycles. Load sensing technology represents another crucial advancement, providing the operator with accurate, real-time weight information to effectively prevent dangerous overloading scenarios and ensure strict compliance with increasingly stringent road weight regulations, while simultaneously feeding verified data back to the centralized farm management system for granular, accurate yield tracking and performance monitoring per specific field and crop type. The majority of modern, high-end dump carts now widely utilize standardized ISOBUS communication protocols, enabling flawless, plug-and-play connectivity and integrated control directly through the tractor’s existing universal terminal, which significantly reduces cabin complexity and vastly simplifies the overall operator interface, speeding up training and reducing errors.

The overarching and most influential technological trend spanning both product categories—forage mergers and dump carts—is the rapid and comprehensive adoption of sophisticated telematics and Internet of Things (IoT) connectivity platforms. This technology enables essential machine-to-machine (M2M) communication, which is absolutely crucial for coordinated, autonomous, or semi-autonomous coordinated field operations (e.g., a GPS-guided, self-driving dump cart synchronously following and positioning itself adjacent to a running forage harvester). Furthermore, comprehensive telematics packages offer powerful cloud-based data logging capabilities for in-depth diagnostics, minute-by-minute performance metrics tracking, asset management, and the generation of advanced predictive maintenance alerts based on operational anomalies. This decisive and ongoing technological shift—from simple, rugged mechanical equipment to highly sophisticated, data-generating smart implements—represents the fundamental transformation currently reshaping this entire market, critically enabling modern farmers and large contractors to implement complex, data-driven decisions that substantially enhance resource allocation, maximize operational efficiency, and ultimately lead to optimized profitability.

Regional Highlights

- North America (U.S., Canada): This is a highly mature market characterized by the presence of vast commercial farms, necessitating equipment focused on maximum working width and hauling capacity. Demand is strong for self-propelled mergers and high-capacity dump carts (>30 m³). The region leads in technological adoption, including AI, advanced telematics, and robust aftermarket services, ensuring frequent replacement cycles and continuous investment in efficiency-boosting equipment.

- Europe (Germany, France, UK): A technologically sophisticated market driven by strict environmental and sustainability regulations. Focus is heavy on machinery that minimizes soil compaction (requiring specialized running gear on carts) and maximizes fuel efficiency. Demand exists for high-performance trailed and triple mergers, supported by strong EU subsidies promoting precision agriculture tools and adherence to stringent quality standards for silage production.

- Asia Pacific (China, India, Australia): Poised for the most significant growth. Australia mirrors the high mechanization level of North America. China and India are rapidly modernizing their agricultural infrastructure, driving demand for mid-range capacity equipment backed by substantial government mechanization initiatives and the swift professionalization of the dairy and feed industries. Cost-effectiveness and reliable service networks are critical success factors here.

- Latin America (Brazil, Argentina): This region offers substantial, though often volatile, growth potential linked to massive land areas utilized for cattle ranching and major export crop production. Demand requires extremely durable, rugged equipment capable of handling vast distances and challenging, diverse terrains. Market entry strategies often focus on offering flexible financing solutions and equipment models designed for high endurance and minimal downtime in remote areas.

- Middle East & Africa (MEA): An emerging market where demand is concentrated in large-scale corporate agricultural projects, often government-backed, focused on achieving national food security goals. These projects require specialized, high-capacity equipment suited for intensive operations in arid or semi-arid climates, with a high emphasis on reliability and localized technical support due to logistical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forage Mergers and Dump Carts Market.- Deere & Company

- AGCO Corporation

- Krone Group

- CNH Industrial N.V. (Case IH, New Holland Agriculture)

- KUHN SAS

- PÖTTINGER Landtechnik GmbH

- SIP Machines

- Kverneland Group

- H&S Manufacturing Co., Inc.

- Pequea Machine

- JBS Equipment

- EZ-Trail

- Meyer's Equipment Manufacturing Corporation

- Art's Way Manufacturing Co., Inc.

- Unverferth Manufacturing Co., Inc.

- CLAAS KGaA mbH

- Anderson Group

- Alois Pöttinger Maschinenfabrik GmbH

- Oxbo International Corporation

- Balzer Inc.

Frequently Asked Questions

Analyze common user questions about the Forage Mergers and Dump Carts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between a forage merger and a traditional rake?

Forage mergers utilize belts and conveyors to gently lift and consolidate crop material, significantly minimizing leaf loss, preserving nutritional quality, and reducing soil contamination (ash content). Traditional rakes use tines that scrape the ground, leading to lower feed quality but representing a lower initial investment cost.

How does the capacity of dump carts influence farm profitability?

Higher capacity dump carts directly reduce the total number of trips required between the field and storage facility. This critical optimization saves time, decreases fuel consumption per ton harvested, minimizes labor costs, and substantially reduces equipment wear, thereby maximizing operational throughput and overall farm profitability during the concentrated harvest season.

What is the role of telematics and GPS in modern forage mergers and dump carts?

Telematics and GPS systems provide essential data on machine location, operational status, and performance metrics. In mergers, GPS ensures accurate swath formation and coverage, while in dump carts, telematics facilitates real-time logistical route optimization, advanced predictive maintenance scheduling, and precise digital documentation of harvested yield volume per specific field area.

Which geographic region is expected to drive the highest growth in the coming years?

The Asia Pacific (APAC) region, primarily driven by large-scale agricultural mechanization initiatives and the rapid growth of organized livestock farming in countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to expanding infrastructure investments and rising domestic demand for high-quality feed.

Are self-propelled forage mergers more cost-effective than trailed mergers?

Self-propelled mergers demand a significantly higher upfront capital outlay but offer superior speed, higher output capacity, enhanced maneuverability, and independence from a dedicated high-horsepower tractor. For very large commercial operations and custom contractors who prioritize maximum seasonal throughput, these efficiency gains typically render the self-propelled option more cost-effective over its extended equipment lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager