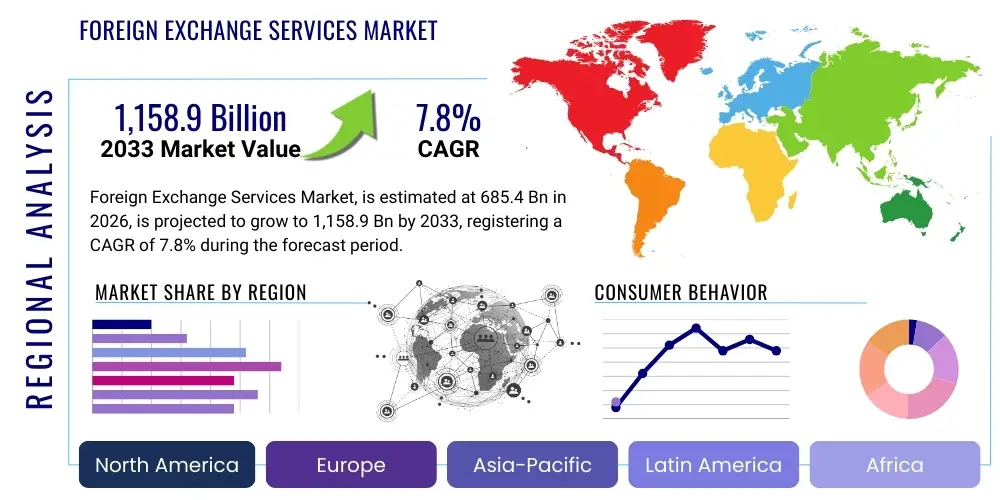

Foreign Exchange Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441379 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Foreign Exchange Services Market Size

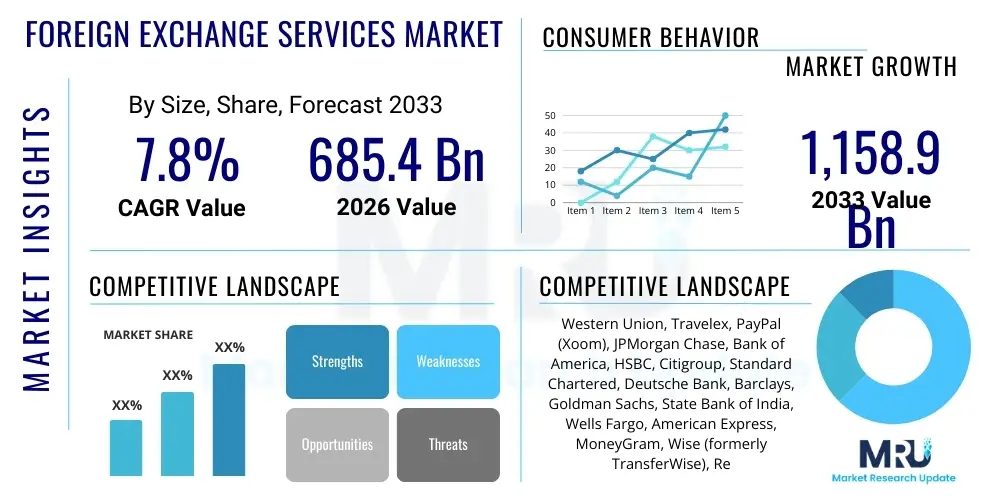

The Foreign Exchange Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 685.4 Billion in 2026 and is projected to reach USD 1,158.9 Billion by the end of the forecast period in 2033.

Foreign Exchange Services Market introduction

The Foreign Exchange (FX) Services Market encompasses a broad range of activities related to the conversion of one currency into another, facilitating international trade, investment, and travel. This market is pivotal to the global financial infrastructure, enabling businesses to manage cross-border transactions and individuals to remit funds or exchange travel money. The services include spot transactions, forward contracts, swaps, options, and futures, catering to diverse needs from immediate settlement to long-term hedging against currency risk. Service providers range from large global banks and institutional brokerage houses to specialized fintech companies and traditional money transfer operators, all operating within a dynamic and highly regulated environment.

The core product offered in this market is the efficient execution and settlement of currency conversions, often bundled with risk management solutions. Major applications span corporate treasury management, where multinational corporations utilize FX services to manage operational currency exposure; retail remittances, driven by global migration patterns; and investment banking activities, involving proprietary trading and hedging for clients. The increasing globalization of e-commerce has significantly expanded the demand for seamless, low-cost FX solutions for small and medium-sized enterprises (SMEs) conducting international sales, further cementing the market's foundational role in cross-border commerce.

Key benefits driving the market include enhanced price transparency, increased speed of transactions, and reduced frictional costs, particularly as fintech disruption forces traditional providers to modernize. Driving factors underpinning current growth include the rapid digitalization of payments, leading to a shift from physical cash exchanges to digital platforms; the continued rise in international tourism and migration; and the sophisticated financial engineering required to manage complex geopolitical and economic volatility. Furthermore, the accessibility provided by mobile applications and Application Programming Interface (API) driven banking is lowering barriers to entry for users, making FX services faster and more user-friendly than in previous decades.

Foreign Exchange Services Market Executive Summary

The Foreign Exchange Services Market is undergoing a rapid technological transformation, fundamentally shifting business trends away from traditional bank-led services towards agile, digital-first fintech platforms. A crucial business trend is the ongoing compression of margins on standard spot transactions, compelling service providers to differentiate through value-added services such as advanced algorithmic trading, personalized risk modeling, and seamless integration of FX execution into corporate enterprise resource planning (ERP) systems. Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance remain substantial operational burdens, yet those providers leveraging Artificial Intelligence (AI) and Machine Learning (ML) for automated compliance monitoring are gaining competitive advantages in efficiency and regulatory adherence. The trend towards instant payment settlement, supported by real-time gross settlement (RTGS) systems and nascent blockchain applications, is accelerating client expectations regarding transaction speed and transparency globally.

Regionally, the market displays heterogeneous growth trajectories. Asia Pacific (APAC) is emerging as the undisputed leader in volume and growth potential, driven primarily by massive remittance corridors, rapid expansion of intra-regional trade, and the burgeoning digital economies in China, India, and Southeast Asia. North America and Europe, while mature, remain dominant centers for institutional trading and complex financial derivatives, bolstered by deep liquidity and advanced financial infrastructure, with a strong focus on regulatory tech (RegTech) integration. Conversely, the Middle East and Africa (MEA) are experiencing significant organic growth, fueled by high volumes of migrant worker remittances and increasing foreign direct investment, though market fragmentation and regulatory hurdles persist across many smaller national markets.

Segmentation trends highlight a pronounced shift towards the Digital/Online Channel, which is rapidly cannibalizing the share held by traditional bank branches and physical exchange bureaus, especially within the retail and SME segments. By product type, sophisticated derivatives like forwards and swaps continue to dominate the institutional space, offering necessary hedging tools amidst increasing global volatility. The End-User segment analysis shows that the Corporate sector, particularly multinational enterprises managing intricate supply chains, remains the largest revenue generator, demanding highly customized solutions, whereas the Retail/Individual segment is growing fastest, driven by low-cost, high-speed digital remittances and cross-border e-commerce payments facilitated by integrated payment gateways and dedicated currency platforms like Wise or Revolut.

AI Impact Analysis on Foreign Exchange Services Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are enhancing trading accuracy, improving compliance efficiency, and lowering operational costs within the Foreign Exchange Services Market. Key user questions revolve around the effectiveness of AI-driven fraud detection systems, the performance benefits of algorithmic trading models over human execution, and the security implications of automated systems managing high-value transactions. There is also significant interest in understanding how AI can personalize risk assessment and currency hedging strategies for corporate clients. The underlying theme is a collective expectation that AI will deliver superior market insights and operational robustness, moving beyond simple automation to genuine intelligent decision-making, while simultaneously ensuring system reliability and mitigating potential bias in automated trading advice or credit risk models related to currency exposure.

The implementation of AI/ML technologies is fundamentally restructuring the competitive landscape by enabling unprecedented levels of efficiency and sophistication. In institutional trading, AI algorithms are capable of analyzing vast datasets—including market sentiment, macroeconomic indicators, and trade flows—in real-time, executing high-frequency trades with minimal slippage and superior price discovery compared to manual execution desks. This not only boosts profitability for major financial institutions but also contributes to overall market efficiency and liquidity. Furthermore, the application of natural language processing (NLP) to news feeds and economic reports allows automated systems to react instantaneously to market-moving events, granting an informational edge that human traders cannot match.

Beyond trading, AI's profound impact is visible in operational and risk management domains. Compliance teams leverage ML to screen transactions for suspicious activities (AML/KYC) with far greater accuracy and speed, dramatically reducing false positives and accelerating onboarding times for legitimate customers. In customer service, AI-powered chatbots and virtual assistants handle routine FX queries, reserving human expertise for complex hedging or regulatory issues. The deployment of predictive analytics, powered by ML, allows providers to forecast currency volatility with increased precision, enabling better proactive risk mitigation strategies for corporate clients and enhancing the design of structured financial products. This comprehensive integration of AI transforms the service from transactional execution to proactive financial partnership.

- AI-driven algorithmic trading enhances execution speed and minimizes latency, optimizing large institutional trades.

- Machine Learning models drastically improve AML and KYC compliance, identifying fraudulent patterns and reducing regulatory risk exposure.

- Predictive analytics enables more accurate forecasting of currency volatility, supporting sophisticated hedging strategies for corporate clients.

- Natural Language Processing (NLP) provides real-time analysis of geopolitical and economic news, informing instantaneous trading decisions.

- Chatbots and intelligent virtual assistants streamline customer support for routine currency inquiries and transaction tracking.

- Automation of middle and back-office functions using AI reduces operational expenditure and human error in settlement and reconciliation.

DRO & Impact Forces Of Foreign Exchange Services Market

The Foreign Exchange Services Market is driven primarily by the escalating pace of economic globalization, which necessitates seamless cross-border financial flows, coupled with the profound impact of digitalization that is democratizing access to complex FX products. Restraints often center on the inherent volatility of global currency markets, posing significant risk exposure for non-hedged participants, alongside the pervasive and increasingly stringent international regulatory framework focused on combating financial crime, which imposes high compliance costs. Opportunities lie in leveraging emerging technologies, particularly distributed ledger technology (DLT) for instantaneous settlement and expanding into underserved demographic and geographic segments, such as migrant populations in high-remittance corridors and SMEs previously neglected by large institutional banks. These forces interact dynamically, shaping the competitive intensity and the pace of innovation within the financial services ecosystem.

Key drivers include the dramatic rise in cross-border e-commerce, which mandates integrated FX solutions for international merchants, and the consistent growth of global migration, which fuels the high-volume retail remittance market. Further impetus comes from continuous technological innovation, where faster, API-driven solutions are displacing slower, opaque traditional banking processes. Conversely, the market faces significant headwinds from regulatory compliance requirements, notably the need to adhere to diverse and sometimes conflicting international rules such as GDPR, various national banking secrecy laws, and comprehensive global AML guidelines. Furthermore, the reliance on Correspondent Banking Networks (CBNs) in certain markets introduces friction, cost, and latency, acting as a structural restraint despite advancements in payment rails.

The high impact forces influencing market dynamics are threefold: technology adoption, regulatory change, and competition. Technology is the primary disruptive force, lowering transaction costs and challenging incumbents. Regulatory impact is equally critical; changes in interest rates or capital controls by central banks directly affect currency demand and liquidity, while major regulatory penalties for non-compliance can rapidly shift market share. Lastly, intensified competition from non-bank fintech disruptors is forcing traditional banks to either acquire new technologies or substantially restructure their operating models to remain relevant. The interplay of these forces ensures that the market remains highly competitive, demanding constant investment in compliance infrastructure and technological innovation to sustain growth and maintain customer trust, which is a paramount non-negotiable factor in currency handling services.

Segmentation Analysis

The Foreign Exchange Services Market is rigorously segmented across several dimensions, including the type of service provided, the nature of the end-user, the channel utilized for execution, and the underlying technology platform. This multi-faceted segmentation helps market participants tailor offerings, optimize pricing, and comply with specific regulatory requirements applicable to different client tiers. The primary segmentation by product type reflects the risk tolerance and time horizon of the client, ranging from immediate settlement in spot markets to complex hedging strategies utilizing forwards, swaps, and options. Understanding the nuances within each segment is critical for providers to allocate capital efficiently and develop targeted marketing strategies, particularly in the highly competitive retail remittance space versus the institutional treasury management sector.

The segmentation by end-user—Financial Institutions, Corporations, Retail/Individuals, and Government—is crucial as each group possesses vastly different requirements regarding transaction volume, regulatory oversight, need for personalization, and price sensitivity. Corporations demand advanced risk management tools and treasury integration, while retail users prioritize speed, convenience, and low fees. The channel segmentation highlights the rapid digital migration, where online platforms, mobile applications, and direct API links are quickly surpassing traditional over-the-counter and branch-based exchanges, reflecting a global preference for self-service digital access available 24/7. This digital shift mandates heavy investment in robust cybersecurity and intuitive user interfaces across all provider types.

Furthermore, technology segmentation, particularly the emergence of blockchain/DLT and AI/ML, serves as a powerful delineator of market capabilities and future potential. Providers leveraging these advanced technologies are positioned to offer superior settlement speed (DLT) and enhanced trading accuracy (AI), differentiating themselves from legacy systems. Geographically, segmentation is critical for compliance and liquidity management, requiring localized knowledge of financial regulations, capital control policies, and major trade corridors. The interplay between these segments defines market structure, where fintech platforms often dominate the retail digital channels, while large investment banks maintain dominance in institutional derivatives and complex, high-value interbank transactions.

- By Type:

- Spot Contracts

- Forward Contracts

- Foreign Exchange Swaps

- Currency Options

- Foreign Exchange Futures

- By End-User:

- Financial Institutions (Banks, Hedge Funds, Investment Managers)

- Corporations (Multinational Corporations, SMEs)

- Retail/Individual Customers (Remittances, Travel Money)

- Government and Public Sector

- By Channel:

- Online/Digital Platforms (Mobile Apps, Web Portals)

- Traditional Bank Branches/Over-the-Counter

- Independent Exchange Bureaus/Money Transfer Operators (MTOs)

- By Technology:

- Blockchain/Distributed Ledger Technology (DLT)

- Artificial Intelligence and Machine Learning (AI/ML)

- Application Programming Interfaces (APIs)

- Legacy Systems

- By Geography:

- North America (U.S., Canada)

- Europe (U.K., Germany, France)

- Asia Pacific (China, India, Japan)

- Latin America (Brazil, Mexico)

- Middle East and Africa (UAE, South Africa)

Value Chain Analysis For Foreign Exchange Services Market

The value chain for Foreign Exchange Services begins with upstream activities focused on liquidity provision and infrastructure development. Upstream market participants, primarily large global commercial and investment banks, act as major liquidity providers, determining the interbank exchange rates and facilitating the massive volumes necessary for market depth. This stage also involves core infrastructure providers, such as payment networks (SWIFT), electronic communication networks (ECNs), and institutional trading platforms that enable price discovery and execution. Efficiency at this stage is dictated by technology investments in low-latency trading systems and access to central bank clearing mechanisms, which minimizes operational risk and ensures immediate access to pricing feeds necessary for downstream distribution.

The midstream phase focuses on service packaging and distribution. This involves transforming the raw interbank rates into sellable products for specific end-user segments, incorporating necessary services like risk management, compliance checks (KYC/AML), and personalized execution platforms. Distribution channels are highly varied, encompassing direct sales through proprietary trading desks for institutional clients, branch networks for traditional retail banking, and increasingly, digital platforms and APIs for fintech partners. The choice of distribution channel significantly impacts the final cost to the end-user; digital channels reduce overhead, leading to lower spreads, while traditional channels carry higher operational costs but often provide comprehensive advisory services.

Downstream activities center on the end-user interaction, settlement, and post-transaction services. For retail clients, this involves the final delivery of the converted funds, either via credit to an account, cash pickup, or loading onto a prepaid card. For corporate clients, the downstream process includes integrated reporting, reconciliation services, and ongoing consultation regarding hedging strategies. Both direct channels (e.g., a corporation dealing directly with a bank treasury desk) and indirect channels (e.g., a retail customer using a third-party MTO or fintech app that relies on a large bank for underlying liquidity) play critical roles. The efficiency of the downstream process, particularly the speed of settlement and transparency of fees, is the primary driver of customer satisfaction and loyalty, directly influencing competitive positioning.

Foreign Exchange Services Market Potential Customers

The potential customer base for Foreign Exchange Services is incredibly diverse, segmented primarily into institutional, corporate, and retail buyers, each seeking different levels of service complexity and volume capacity. Institutional customers, including hedge funds, pension funds, central banks, and large asset managers, represent the highest volume segment, demanding sophisticated derivative products, deep liquidity, and ultra-low latency execution platforms to manage multi-billion dollar portfolios and satisfy fiduciary responsibilities. These buyers prioritize reliability, technological superiority, and counterparty risk minimization, often engaging in direct trading relationships with prime brokers and Tier-1 liquidity providers to optimize their financial market exposure and leverage currency movements for alpha generation.

Corporate customers form the second critical segment, encompassing multinational corporations (MNCs) and Small and Medium-sized Enterprises (SMEs) engaged in cross-border trade. MNCs require comprehensive treasury management solutions, including complex hedging instruments (forwards, swaps) to mitigate transactional and translational risk associated with their global supply chains and revenue reporting. SMEs, increasingly participating in e-commerce, require simpler, cost-effective digital payment gateways and transparent spot conversion services to manage vendor payments and international sales proceeds. For corporations, the key value proposition is not just the exchange rate, but the integrated ability to manage currency exposure seamlessly within their operational framework, often through API integration with banking partners.

The fastest-growing potential customer segment is the Retail/Individual category, dominated by migrant workers remitting funds back home, international tourists, and cross-border shoppers. This segment is highly price-sensitive and prioritizes convenience, speed, and the transparency of fees. Fintech platforms have successfully captured significant market share here by offering lower spreads and rapid, often instant, transfer times via mobile applications, bypassing traditional bank infrastructure. For these customers, accessibility in remote locations and ease of regulatory compliance documentation for minor transactions are key deciding factors, making technology platforms that simplify the user journey highly attractive and critical for future market expansion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685.4 Billion |

| Market Forecast in 2033 | USD 1,158.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Western Union, Travelex, PayPal (Xoom), JPMorgan Chase, Bank of America, HSBC, Citigroup, Standard Chartered, Deutsche Bank, Barclays, Goldman Sachs, State Bank of India, Wells Fargo, American Express, MoneyGram, Wise (formerly TransferWise), Revolut, CurrencyFair, OFX, Remitly, BNY Mellon, CLS Group, InstaReM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foreign Exchange Services Market Key Technology Landscape

The technological landscape of the Foreign Exchange Services Market is defined by intense competition in speed, security, and cost reduction, primarily driven by three transformative technologies: Distributed Ledger Technology (DLT), Artificial Intelligence/Machine Learning (AI/ML), and sophisticated Application Programming Interfaces (APIs). DLT, particularly blockchain applications like RippleNet, is fundamentally addressing the long-standing friction points associated with cross-border payments, namely settlement speed and intermediary costs. By providing a decentralized, immutable ledger, DLT promises near-instantaneous cross-border settlement (real-time gross settlement), bypassing traditional, slower correspondent banking networks, which is highly appealing for institutional clients demanding immediate fund mobility and transparency.

AI and ML technologies are embedded across the entire FX value chain, moving beyond simple automation into complex decision-making. In trading, ML algorithms are continuously refining models to predict short-term price movements and optimize execution strategies (e.g., dark pool routing and smart order routing), enhancing profitability and reducing market impact for large trades. Operationally, AI is critical for automating rigorous compliance checks (KYC/AML), flagging suspicious transaction patterns that human analysts might miss, thereby lowering operational risk and the hefty regulatory penalties associated with non-compliance. The effectiveness of AI in fraud detection provides a substantial competitive edge in securing high-volume transaction flows.

APIs form the backbone of modern FX service delivery, enabling modular and scalable integration of FX capabilities directly into third-party applications, corporate ERP systems, and specialized fintech platforms. This API-driven approach allows non-bank entities, such as e-commerce platforms or payroll providers, to offer embedded foreign exchange services seamlessly to their customers, a concept known as embedded finance. Furthermore, robust API frameworks facilitate data exchange between different service layers—from rate providers and liquidity aggregators to settlement mechanisms—ensuring a rapid, reliable, and standardized transaction flow, which is crucial for maintaining the "always-on" nature of global financial markets. The convergence of these technologies defines the modernization trajectory, prioritizing transparency and user experience.

Regional Highlights

- Asia Pacific (APAC): APAC represents the highest growth region globally, driven by massive volumes of migrant worker remittances, particularly within the South-South corridor, and the exponential growth of e-commerce across emerging economies like India, Indonesia, and Vietnam. China’s role in global trade and investment, coupled with rapid digitization, makes it a key driver. However, the region presents diverse regulatory environments, necessitating highly localized compliance strategies for providers operating across multiple national borders.

- North America: This region is characterized by high liquidity, technological maturity, and the dominance of institutional trading volumes centered in New York. The U.S. dollar's role as the global reserve currency ensures continuous high activity in spot and derivatives markets. Innovation here is concentrated on high-frequency trading platforms, advanced AI integration for market making, and sophisticated RegTech solutions to manage stringent U.S. financial regulations.

- Europe: Europe remains a pivotal hub, particularly the UK (London), which serves as the largest global center for FX trading volume, benefiting from deep expertise and a mature regulatory ecosystem. The market is highly competitive, marked by strong participation from both major banks and innovative European fintechs (e.g., Wise, Revolut) that are aggressively capturing the retail and SME segments across the fragmented Eurozone and non-Eurozone markets through lower pricing and superior digital offerings.

- Middle East and Africa (MEA): Growth in MEA is strongly fueled by inward and outward migrant remittances, especially to and from the Gulf Cooperation Council (GCC) countries, which employ a large expatriate workforce. Regulatory hurdles and fragmented payment infrastructures in Africa present challenges, but also massive opportunities for mobile money operators and fintechs utilizing simplified, low-cost transfer models to serve unbanked populations and improve financial inclusion.

- Latin America (LATAM): LATAM markets exhibit high currency volatility and are marked by periodic capital controls, which drives demand for hedging instruments. Digital adoption is accelerating, particularly in Brazil and Mexico, shifting users towards online platforms. The focus in this region is on reducing the cost and complexity of inter-regional payments and connecting local currency markets efficiently to major global hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foreign Exchange Services Market.- Western Union

- Travelex

- PayPal (Xoom)

- JPMorgan Chase

- Bank of America

- HSBC

- Citigroup

- Standard Chartered

- Deutsche Bank

- Barclays

- Goldman Sachs

- State Bank of India

- Wells Fargo

- American Express

- MoneyGram

- Wise (formerly TransferWise)

- Revolut

- CurrencyFair

- OFX

- Remitly

- BNY Mellon

- CLS Group

- InstaReM

- Fidelity National Information Services (FIS)

- Global Payments Inc.

Frequently Asked Questions

Analyze common user questions about the Foreign Exchange Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Foreign Exchange Services Market?

The primary driving factor is the accelerated globalization of trade and the explosive growth of cross-border e-commerce, coupled with widespread digital adoption. This necessitates continuous, low-cost, and instant currency conversion solutions for both corporate and retail users worldwide, placing digitalization at the forefront of market expansion and product innovation, particularly in high-volume remittance corridors.

How is Distributed Ledger Technology (DLT) impacting traditional FX settlement processes?

DLT, including blockchain solutions, fundamentally impacts FX settlement by offering the potential for instantaneous cross-border transactions. This bypasses the slower, capital-intensive correspondent banking system, reducing latency, lowering settlement risk (counterparty risk), and significantly decreasing transaction costs, thereby improving liquidity management for financial institutions and enhancing transparency for end-users globally.

Which end-user segment is experiencing the fastest rate of growth in the Foreign Exchange Services Market?

The Retail/Individual segment, driven predominantly by migrant remittances and cross-border e-commerce shoppers, is experiencing the fastest growth rate. This growth is sustained by the accessibility, competitive pricing, and user-friendly interfaces offered by dedicated fintech platforms and digital money transfer operators (MTOs), displacing reliance on conventional physical bank branches.

What are the main risks associated with using Foreign Exchange services?

The main risks include high volatility in currency markets, which can erode transaction value between initiation and settlement; counterparty risk, particularly in over-the-counter (OTC) transactions; and operational risks related to cybersecurity, regulatory non-compliance, and fraud. Mitigating these requires robust internal compliance systems and effective hedging strategies utilizing derivatives like forwards and options.

Why is Asia Pacific (APAC) considered the most significant region for future FX market growth?

APAC is considered the most significant growth region due to its large, increasing population engaged in high-volume trade, substantial migrant worker corridors generating massive remittance flows, and the rapid financial inclusion and digitalization occurring in major economies like China and India. These factors combine to create unparalleled demand for fast, efficient, and cost-effective currency services, driving investment and innovation across the region.

Foreign Exchange Services Market Size, Foreign Exchange Services Market introduction, Foreign Exchange Services Market Executive Summary, AI Impact Analysis on Foreign Exchange Services Market, DRO Impact Forces Of Foreign Exchange Services Market, Segmentation Analysis, Value Chain Analysis For Foreign Exchange Services Market, Foreign Exchange Services Market Potential Customers, Report Attributes, Market Size in 2026, Market Forecast in 2033, Growth Rate, Historical Year, Base Year, Forecast Year, DRO Impact Forces, Segments Covered, Key Companies Covered, Regions Covered, Enquiry Before Buy, Foreign Exchange Services Market Key Technology Landscape, Regional Highlights, Top Key Players, Frequently Asked Questions, spot contracts, forward contracts, currency swaps, currency options, retail remittances, corporate hedging, algorithmic trading, KYC, AML, DLT settlement, API integration, fintech disruption, North America FX market, European FX hub, APAC FX growth, MEA remittance market, LATAM currency volatility, Western Union, Travelex, JPMorgan Chase, Wise, Revolut, market insights report, market analysis, professional report, formal market summary, market trends 2026-2033, market drivers, market restraints, market opportunities, competitive landscape analysis, financial services technology, cross-border payments, global trade finance.

The market analysis indicates strong momentum due to technological advancements and global economic interconnectedness. Key technological adoption includes blockchain for real-time gross settlement and AI for enhanced fraud detection and compliance monitoring, particularly important given the stringent global regulatory environment surrounding Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. Institutional traders leverage sophisticated AI-driven algorithms for optimal execution, while retail users prioritize ease-of-use and transparent fee structures offered by digital challengers. Regional dynamics show APAC leading growth due to high remittance volumes and digitalization, contrasting with the maturity and institutional depth of North American and European markets. Understanding segmentation by service type (spot, forwards, options) and end-user (corporate, retail) is essential for providers developing targeted strategies for risk management and revenue generation. The competitive landscape is characterized by established global banks competing fiercely with agile fintech firms, forcing margin compression and service innovation across the entire value chain. Investment in cybersecurity and regulatory technology (RegTech) is non-negotiable for sustaining trust and regulatory adherence in this complex financial sector.

Market expansion is closely tied to infrastructure development, particularly the spread of high-speed internet and mobile banking penetration in emerging economies. The shift from physical cash exchanges to digital wallet transfers is accelerating the adoption curve for modern FX services. Corporate treasury departments are increasingly demanding customized FX overlays that integrate directly with enterprise resource planning (ERP) systems, allowing for real-time visibility into currency exposure and automated hedging operations. The opportunity for non-bank providers lies in capitalizing on specific niche markets, such as offering superior foreign exchange solutions for small and medium-sized enterprises (SMEs) previously underserved by high minimum transaction thresholds set by major banks. The influence of central bank digital currencies (CBDCs) remains a potential long-term disruptive factor that could further streamline cross-border payments, though its immediate impact is still being evaluated by market participants. Overall market growth is robust, driven by unavoidable global economic necessity and continuous technological refinement.

Risk mitigation remains central to the sector. Currency fluctuation hedging demands sophisticated quantitative analysis and customized financial instruments, primarily delivered by major investment banks. For retail users, protection against unexpected fee structures and exchange rate opacity is critical, which fintechs address through transparent, advertised spreads and clear fee disclosure before transaction execution. Regulatory convergence across major financial centers encourages standardized practices but simultaneously increases the complexity of multi-jurisdictional compliance for global operators. The competitive advantage increasingly belongs to firms that can combine technological superiority—fast, reliable execution—with impeccable regulatory standing and robust data security protocols. The transition toward embedded finance models, where FX services are integrated into non-financial platforms, represents a significant evolution in distribution strategy. This allows users to conduct necessary currency exchanges implicitly during e-commerce checkouts or payroll processes, streamlining the user journey and expanding the market reach beyond traditional financial touchpoints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager