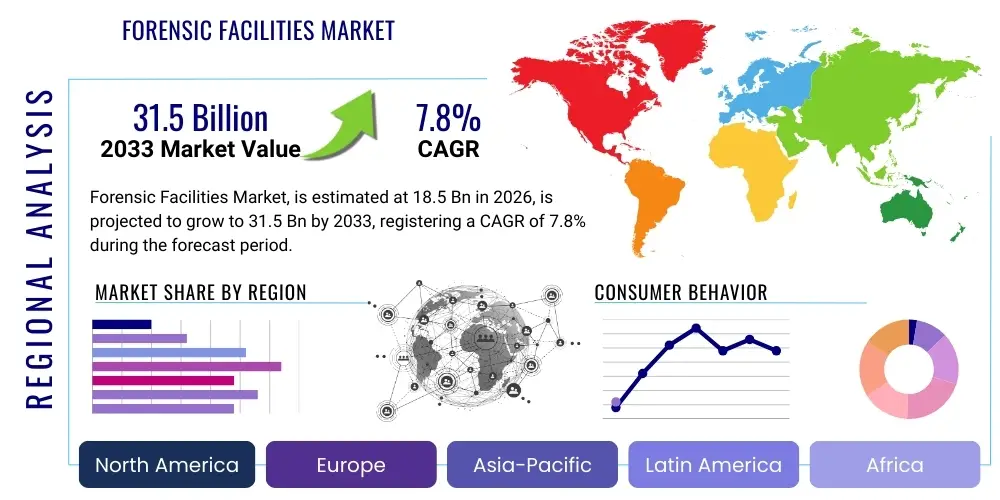

Forensic Facilities Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441206 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Forensic Facilities Market Size

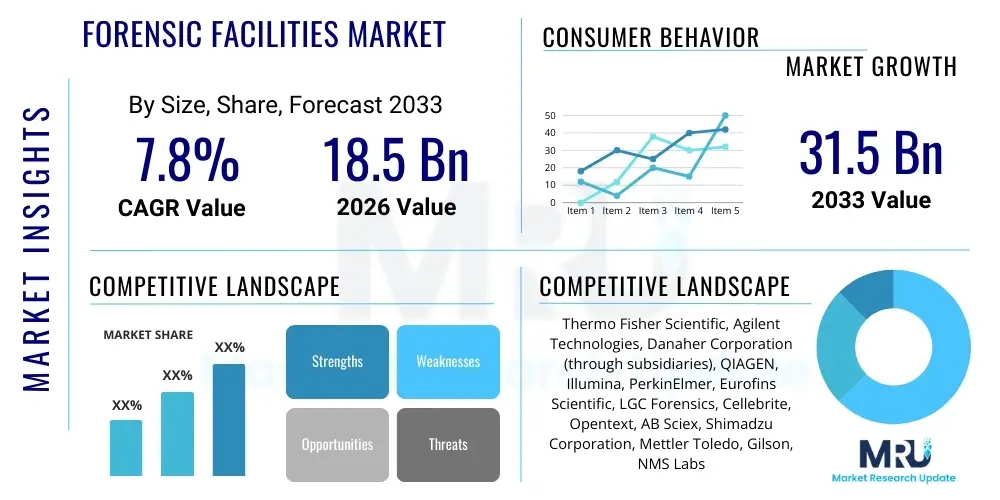

The Forensic Facilities Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 31.5 Billion by the end of the forecast period in 2033.

Forensic Facilities Market introduction

The Forensic Facilities Market encompasses the entire infrastructure, instrumentation, software, and specialized environments required to conduct forensic investigations and analyses for legal and regulatory purposes. These facilities include state-of-the-art laboratories designed for diverse disciplines such as forensic biology (DNA analysis), toxicology, chemistry, ballistics, trace evidence, and increasingly, digital forensics. The core function of these facilities is to provide accurate, reliable, and admissible evidence that supports criminal investigations and judicial proceedings. Key products within this market include specialized analytical instruments like high-throughput DNA sequencers, mass spectrometers, comparative microscopes, and advanced evidence management systems (LIMS).

Major applications of forensic facilities span public sector law enforcement agencies, including national police services, federal investigative bureaus, and governmental health departments requiring toxicology services. Furthermore, private sector demand is escalating, driven by insurance fraud investigation, corporate security breaches requiring digital forensics, and specialized legal consulting firms. The market is characterized by stringent regulatory requirements, particularly concerning evidence integrity, chain of custody documentation, and adherence to international standards such as ISO 17025. The complexity of modern criminal activities, including cybercrime and sophisticated narcotics manufacturing, mandates continuous technological upgrades within these facilities to maintain operational effectiveness.

The primary driving factors propelling market growth include the global increase in complex crime rates, substantial governmental investment in modernizing judicial and law enforcement infrastructure, and rapid technological advancements in analytical chemistry and genomic sequencing techniques. The continuous need for faster, more sensitive, and less destructive methods of analyzing trace evidence is forcing facility operators to adopt cutting-edge robotics and automation tools. Furthermore, the proliferation of digital data has created an enormous requirement for specialized digital forensic labs capable of handling petabytes of information securely and efficiently, thereby fueling both infrastructure development and specialized software deployment.

Forensic Facilities Market Executive Summary

The Forensic Facilities Market is undergoing significant transformation, primarily driven by the convergence of biological and digital evidence processing. Business trends indicate a strong shift towards public-private partnerships, where governmental agencies outsource specialized or overflow analytical services to accredited private laboratories, allowing public facilities to focus on core high-volume casework. Capital expenditure in this market is increasingly directed toward automated laboratory management systems (LIMS) and secure cloud-based data storage solutions, necessitated by the vast volume of data generated by Next-Generation Sequencing (NGS) and digital device examination. Vendors supplying integrated hardware-software solutions that meet stringent chain-of-custody requirements are poised for substantial growth. Furthermore, sustainable facility design, focusing on energy efficiency and minimized contamination risk, is becoming a critical consideration in new construction projects.

Regionally, North America maintains its dominance due to high levels of government funding dedicated to forensic science modernization, established regulatory frameworks, and the early adoption of advanced technologies like robotics and AI-driven analysis tools. Europe also represents a mature market, emphasizing standardization and cross-border cooperation in forensic data sharing (e.g., through mechanisms like PRÜM). However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment. This accelerated growth is primarily attributed to rising governmental investment in developing nations like India and China, focused on establishing modern, centralized forensic capabilities to handle increasing populations and complex judicial backlogs. Investment in specialized training and facility accreditation programs are hallmarks of the APAC market trajectory.

Segment trends reveal that the Digital Forensics segment is exhibiting the most rapid expansion, outpacing traditional segments like Ballistics and Toxicology. This growth is directly linked to the ubiquitous nature of electronic devices and the increasing reliance on digital evidence in virtually all criminal and civil cases. In terms of facility components, the Software and Services segment, including proprietary analytical software and data interpretation services, is growing faster than physical infrastructure construction. This trend underscores the industry's focus on maximizing efficiency and scalability through computational power rather than solely relying on physical laboratory expansion. Outsourcing of specialized toxicological analysis also represents a key segment trend, driven by the operational need for high throughput and specialized instrumentation that smaller, centralized public labs may lack.

AI Impact Analysis on Forensic Facilities Market

User queries regarding the integration of Artificial Intelligence (AI) into forensic facilities predominantly center on three main themes: automation efficiency, data analysis accuracy, and ethical implications related to bias and legal admissibility. Users frequently question how AI algorithms can handle the sheer volume of high-dimensional data (such as complex chemical spectra or genomic profiles) generated in modern labs, seeking reassurance that AI tools will accelerate backlog reduction without compromising the integrity of results. Concerns often revolve around the validation of machine learning models for court-admissible evidence, focusing on transparency (explainability or XAI) and ensuring models are free from implicit bias inherited from training datasets. Furthermore, inquiries highlight expectations that AI will revolutionize pattern recognition in ballistics and fingerprints and provide powerful predictive capabilities for criminal profiling and risk assessment, necessitating new infrastructure for high-performance computing (HPC) within facilities.

AI's influence is profound, transforming facility operations from evidence intake to final report generation. By automating repetitive and time-consuming tasks, such as initial chemical screening, comparison microscopy, or the sifting of vast digital datasets, AI allows human analysts to focus on complex interpretation and critical decision-making. This enhancement significantly increases the throughput capabilities of existing facilities, effectively managing case backlogs which often plague forensic systems globally. AI algorithms are also deployed in quality control, flagging inconsistencies in analytical runs or deviations from standard operating procedures, thereby strengthening the reliability and defensibility of the evidence produced.

However, the integration of AI mandates substantial investment in the underlying computational infrastructure. Forensic facilities must transition from standard desktop computing environments to robust, high-availability data centers equipped with specialized Graphical Processing Units (GPUs) optimized for machine learning operations. This infrastructural change, coupled with the need for specialized data scientists and forensic informaticians, drives market demand for advanced facility design, secure data pipelines, and validated software solutions. Successfully deploying AI requires facilities to establish strict governance frameworks to address the challenges of model drift and ensure that AI outputs meet the stringent Daubert and Frye standards for scientific evidence admissibility in legal settings.

- AI-driven automation reduces processing time for DNA profiles and toxicology screens.

- Machine Learning enhances pattern recognition in fingerprints, ballistics, and trace evidence analysis.

- Natural Language Processing (NLP) assists in rapid analysis of unstructured legal and investigative reports.

- AI enables predictive maintenance of high-cost analytical instrumentation within the facility.

- Adoption of Explainable AI (XAI) models is critical for maintaining legal transparency and trust.

- Increased demand for high-performance computing (HPC) infrastructure and secure cloud integration.

- AI algorithms assist in anomaly detection and quality assurance for evidence integrity checks.

DRO & Impact Forces Of Forensic Facilities Market

The Forensic Facilities Market is shaped by a confluence of influential forces. The primary drivers include the escalating global crime rates, particularly in areas like cybercrime and illicit drug trafficking, which necessitate constant expansion and modernization of analytical capabilities. Technological advancements, notably the commercialization of Next-Generation Sequencing (NGS) and highly sensitive mass spectrometry, demand facility redesigns to accommodate new equipment and enhanced cleanroom standards. Furthermore, judicial demands for stronger, statistically robust evidence and faster case resolution are compelling governments worldwide to invest heavily in modernizing antiquated forensic systems, thereby directly funding facility upgrades and new construction projects.

Restraints in the market largely revolve around prohibitive capital expenditure and complex regulatory environments. Building and operating highly specialized forensic labs, especially BSL-2 or BSL-3 environments for specific biological materials, requires massive initial investment in specialized HVAC, security, and specialized instrumentation. Furthermore, maintaining international accreditation (e.g., ISO/IEC 17025) imposes significant recurring operational costs and demands highly skilled personnel, leading to workforce shortages in many regions. The long procurement cycles associated with government tenders and the inherent reluctance within conservative judicial systems to rapidly adopt revolutionary, unvalidated forensic technologies also serve as significant market impediments.

Opportunities abound, particularly in the rapidly evolving Digital Forensics and Forensic Toxicology sectors. The explosion of IoT devices, cloud computing, and encrypted communications presents immense challenges and opportunities for providers of specialized facilities and tools focused on data extraction and analysis. Additionally, the shift towards personalized medicine and precision toxicology creates market opportunities for facilities specializing in complex human performance testing and novel psychoactive substance identification. Impact forces include the stringent requirement for compliance with chain-of-custody protocols, the political pressure to reduce case backlogs, and public scrutiny regarding forensic science integrity, all of which directly dictate investment priorities and technological adoption rates within these highly specialized governmental and private institutions.

Segmentation Analysis

The Forensic Facilities Market segmentation provides a granular view of investment priorities and operational focus across various end-users and service modalities. Key segmentation criteria include the type of facility ownership (public or private), the specific forensic discipline supported (biological, chemical, digital), and the components integral to the facility (equipment, software, infrastructure). Understanding these segments is crucial for suppliers of instruments and services, as the procurement process, regulatory compliance requirements, and technological readiness vary significantly across these submarkets. For instance, public facilities prioritize high throughput and standardization, while private labs often focus on specialized, niche services requiring cutting-edge, low-volume instrumentation.

The segmentation by discipline reflects the evolving nature of crime. While traditional segments like fingerprinting and firearms analysis remain foundational, the rapid expansion of molecular biology and cyber-related offenses has dramatically increased the investment allocation toward specialized DNA labs equipped with robotic liquid handlers and high-capacity sequencers, and highly secure digital data centers. This trend necessitates a modular approach to facility design, allowing for future expansion and reconfiguration based on emerging forensic challenges, such as the analysis of novel synthetic opioids or decentralized blockchain evidence. The market is thus defined by a dynamic interplay between foundational physical infrastructure and highly specialized, rapidly evolving analytical tools.

- By Facility Type:

- Public Forensic Laboratories (State, Federal, Municipal)

- Private Forensic Laboratories (Contract Research Organizations, Independent Labs)

- By Forensic Discipline:

- Forensic Biology/DNA Analysis

- Forensic Toxicology and Chemistry

- Digital and Cyber Forensics

- Trace Evidence and Materials Science

- Ballistics and Toolmark Analysis

- By Component:

- Analytical Equipment (Mass Spectrometers, Sequencers, Chromatographs)

- Software and Informatics (LIMS, Case Management Software, AI Analysis Tools)

- Infrastructure and Services (Facility Construction, HVAC, Security Systems, Evidence Storage)

Value Chain Analysis For Forensic Facilities Market

The value chain for the Forensic Facilities Market begins upstream with the suppliers of highly specialized scientific instrumentation and sophisticated software platforms. This segment includes major manufacturers of analytical chemistry equipment (mass spectrometers, GC/LC systems) and genetic analysis tools (NGS platforms). Upstream vendors also encompass specialized architectural and engineering firms that design accredited forensic facilities, ensuring compliance with strict security, contamination control, and environmental standards (such as vibration damping and specific temperature/humidity controls). Competition upstream focuses heavily on product innovation, integration capabilities (e.g., LIMS compatibility), and adherence to rigorous quality standards required for legal admissibility.

Midstream activities involve the actual construction, integration, and operational setup of the facility. This phase includes the physical construction of laboratories, installation of integrated security and access control systems, and the deployment of laboratory information management systems (LIMS) crucial for managing the chain of custody. Key midstream players include specialized construction contractors and system integrators who customize the facility layout to optimize workflow and evidence security. This stage is critical as the physical environment directly impacts the reliability and credibility of the forensic output. Compliance with local building codes, coupled with adherence to forensic accreditation standards, drives project complexity and cost.

Downstream, the value chain is dominated by the end-users: governmental forensic agencies, law enforcement bodies, and private firms providing expert witness services or specialized analytical consultation. Distribution channels for forensic services are predominantly direct, involving governmental contracts for public labs or direct service agreements for private labs. However, the distribution of forensic products (equipment, software) relies on both direct sales teams offering highly technical support and specialized indirect distributors who manage regional logistics and integration services. The effectiveness of the downstream segment relies entirely on the quality, speed, and legal admissibility of the forensic reports generated by the facility.

Forensic Facilities Market Potential Customers

Potential customers for forensic facilities and associated services are diverse but largely centered within the justice and public safety sectors. Governmental agencies represent the largest buyer segment, encompassing federal investigative bodies (like the FBI or similar national agencies), state and local police departments, and departments of health that operate toxicology and medical examiner facilities. These customers require end-to-end solutions, ranging from large-scale facility design and specialized equipment procurement to ongoing maintenance and staff training. Their purchasing decisions are highly influenced by governmental budget cycles, political mandates to reduce case backlogs, and the need to comply with evolving judicial precedents regarding evidence standards.

The second major customer segment includes the growing ecosystem of private entities involved in legal and corporate security affairs. This includes Contract Research Organizations (CROs) that offer outsourced toxicology or DNA testing, large legal firms requiring specialized digital forensics to handle complex civil litigation or e-discovery, and insurance companies investigating fraud claims. Private customers prioritize speed, discretion, and the specialized expertise that may not be available within public labs, particularly concerning niche analytical techniques or high-profile corporate security incidents. This segment often prefers flexible, service-oriented engagement models over large capital expenditures.

Educational and research institutions also form a niche but important customer base. Universities and academic hospitals require forensic facilities for research, training the next generation of forensic scientists, and providing specialized medical-legal services. While their procurement volume for large-scale infrastructure may be lower than government bodies, they represent a consistent market for sophisticated, cutting-edge analytical equipment and specialized software licenses necessary for educational and method development purposes. Maintaining accreditation for training purposes drives their investment in highly compliant, modern laboratory infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.5 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation (through subsidiaries), QIAGEN, Illumina, PerkinElmer, Eurofins Scientific, LGC Forensics, Cellebrite, Opentext, AB Sciex, Shimadzu Corporation, Mettler Toledo, Gilson, NMS Labs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forensic Facilities Market Key Technology Landscape

The technological landscape within forensic facilities is highly dynamic, driven by the need for increased sensitivity, speed, and accuracy in evidence processing. Next-Generation Sequencing (NGS) platforms represent a pivotal technology, enabling rapid analysis of highly degraded or low-quantity DNA samples, pushing facilities to integrate sophisticated bioinformatics pipelines and massive data storage capabilities. In toxicology and chemistry labs, high-resolution mass spectrometry (HRMS) coupled with advanced chromatography (LC-MS/MS and GC-MS) is standardizing the identification of novel synthetic drugs and complex metabolites, requiring specialized, vibration-isolated laboratory spaces and controlled environment chambers. The continuous drive toward automation, using robotic liquid handling systems, minimizes human error and significantly boosts sample throughput, thereby dictating facility layout and workflow design.

Beyond analytical hardware, informatics and software solutions are foundational to modern forensic facilities. Laboratory Information Management Systems (LIMS) are essential for maintaining a rigorous, auditable electronic chain of custody (eCoC) from evidence intake to final reporting, crucial for legal admissibility. The integration of advanced visualization and comparative analysis software for pattern evidence (fingerprints, ballistics) is mandatory. Furthermore, the specialized facilities dedicated to digital forensics rely heavily on proprietary tools for mobile device extraction (e.g., UFED technology), data carving, and secure data storage solutions (often involving decentralized or immutable ledgers to preserve data integrity) that operate within secure, air-gapped network environments to prevent evidence tampering or data breaches.

Future facility design is being shaped by the adoption of cloud infrastructure for data sharing and collaboration, particularly in multi-agency environments. While concerns over data security and jurisdictional constraints persist, secure private and hybrid cloud models are increasingly utilized for storing and processing large forensic datasets, such as raw genetic data or vast digital archives. Furthermore, the development of portable and rapid, on-site testing technologies (e.g., handheld spectrometers or rapid DNA analyzers) requires facilities to establish protocols for verifying and integrating field-generated data into the main laboratory workflow. Investment in high-performance computing (HPC) clusters is becoming non-negotiable for facilities leveraging AI and machine learning for advanced pattern analysis and predictive modeling.

Regional Highlights

Regional dynamics within the Forensic Facilities Market reflect variations in legal structure, governmental funding capabilities, and technological maturity.

- North America: Dominates the global market share, characterized by high governmental investment, particularly from federal agencies such as the FBI, Homeland Security, and state-level forensic science bureaus. The region leads in the adoption of cutting-edge technologies like rapid DNA analysis and fully integrated AI-LIMS systems. High demand for accredited private labs for specialized services (e.g., complex toxicology, proprietary digital extraction) drives continuous market expansion. Stringent judicial standards (Daubert standard) mandate constant technological validation and facility upgrades.

- Europe: Represents a highly mature market focusing heavily on standardization and cross-border cooperation. Organizations like ENFSI (European Network of Forensic Science Institutes) drive uniform facility quality standards (ISO 17025 compliance is mandatory). Key investments are directed towards improving digital forensic capabilities and establishing secure international databases for DNA and fingerprint sharing (Schengen information system). The market features strong public sector involvement with a high degree of integration between police and forensic services.

- Asia Pacific (APAC): Exhibits the highest growth trajectory, primarily driven by rapid urbanization, increasing awareness of forensic science necessity, and governmental mandates to modernize judicial systems in populous nations (India, China, Southeast Asia). Investment focuses on building new centralized facilities from the ground up, procuring standard analytical equipment, and establishing fundamental accreditation structures. While currently lagging in AI adoption compared to North America, APAC presents immense opportunities for infrastructure suppliers and training providers.

- Latin America: Market growth is steady but uneven, constrained by varying levels of governmental budgets and political stability. Investment is concentrated in major urban centers, often focusing on basic capabilities such as ballistics and routine toxicology. The private sector role is often limited, relying primarily on publicly funded institutions. The region requires solutions that address budgetary constraints, leading to demand for robust, maintainable, rather than necessarily bleeding-edge, technology.

- Middle East and Africa (MEA): This region is characterized by significant, targeted investments in specific nations (UAE, Saudi Arabia, South Africa) that prioritize establishing world-class forensic capabilities to support security and international commerce. These facilities often represent showcase projects incorporating the highest international security and technological standards, creating demand for premium equipment and turnkey facility solutions from international vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forensic Facilities Market, encompassing equipment manufacturers, software providers, and major service contractors.- Thermo Fisher Scientific

- Agilent Technologies

- Danaher Corporation (via subsidiaries such as Beckman Coulter and Leica Microsystems)

- QIAGEN N.V.

- Illumina, Inc.

- PerkinElmer, Inc.

- Eurofins Scientific

- LGC Forensics

- Cellebrite

- Opentext Corporation

- AB Sciex (a Danaher company)

- Shimadzu Corporation

- Mettler Toledo

- Gilson, Inc.

- NMS Labs (National Medical Services)

- General Electric Healthcare

- Sartorius AG

- Forensic Technology (a subsidiary of Ultra Electronics)

- 3M Company (Evidence collection systems)

- Lockheed Martin (Integrated facility solutions)

Frequently Asked Questions

Analyze common user questions about the Forensic Facilities market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving investment in new forensic facilities?

The modernization of forensic facilities is primarily driven by the increasing complexity of evidence, especially the exponential growth in digital data and the legal mandates for utilizing high-sensitivity analytical techniques like Next-Generation Sequencing (NGS) to reduce substantial case backlogs efficiently and accurately.

How is the Forensic Facilities Market segmented by discipline?

The market is typically segmented into core disciplines including Forensic Biology (DNA), Forensic Toxicology and Chemistry, Digital Forensics, Trace Evidence Analysis, and Ballistics. Digital Forensics is currently the fastest-growing segment due to the ubiquity of electronic evidence.

What role does the Laboratory Information Management System (LIMS) play in forensic facilities?

LIMS is a critical software component that manages the entire lifecycle of evidence, ensuring a secure and auditable electronic chain of custody (eCoC). It tracks samples, standardizes testing protocols, and generates validated reports necessary for legal admissibility under stringent accreditation standards like ISO 17025.

Which geographic region is expected to show the fastest growth in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate. This acceleration is fueled by significant government investments in establishing comprehensive, modern centralized forensic laboratories in major economies such as China and India to support judicial modernization and manage rising populations.

What are the main technical challenges facing forensic facility operators?

The main technical challenges include managing the high volume of complex data generated by advanced analytical instrumentation, integrating diverse specialized equipment via LIMS, ensuring the security and integrity of digital evidence, and recruiting and retaining highly specialized scientific and informatics personnel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager