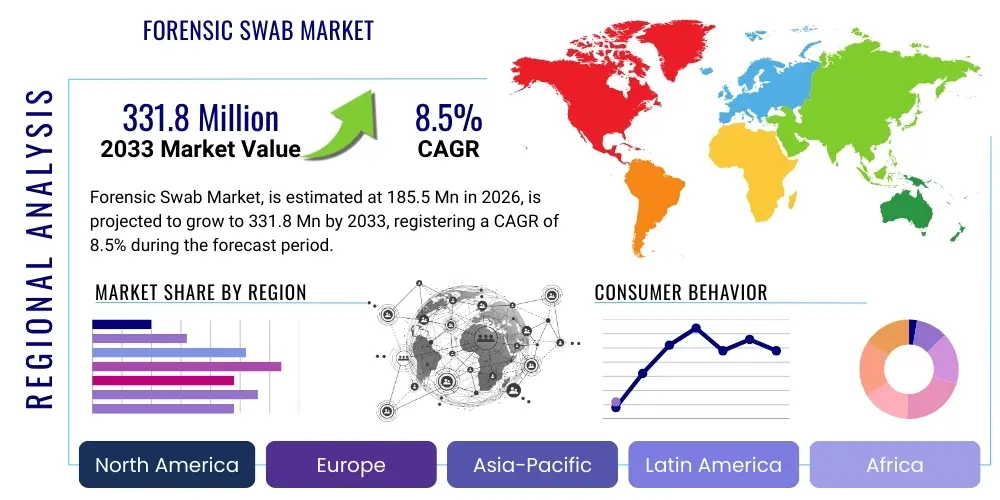

Forensic Swab Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441832 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Forensic Swab Market Size

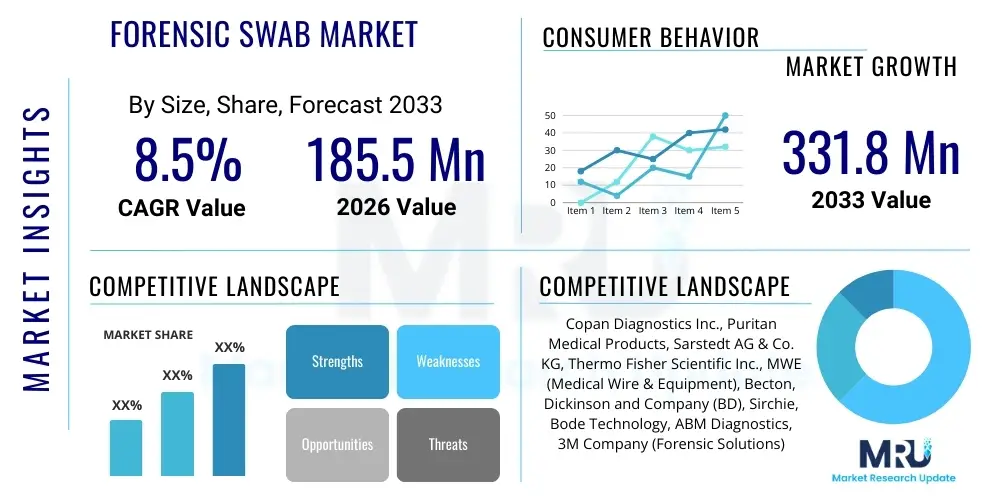

The Forensic Swab Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $331.8 Million by the end of the forecast period in 2033. This sustained growth trajectory is fundamentally driven by the escalating global crime rates requiring robust DNA evidence collection, coupled with significant technological advancements in swab materials and preservation media that enhance recovery yield and integrity. The shift toward higher-efficiency sample collection methods, particularly flocked nylon swabs, is contributing substantially to the overall market valuation increase, as these products offer superior elution capabilities compared to traditional cotton or polyester options.

Forensic Swab Market introduction

The Forensic Swab Market encompasses specialized tools designed for the collection, preservation, and transport of biological and trace evidence from crime scenes, victims, and suspects for subsequent forensic analysis, primarily DNA profiling. These swabs are critical components in the criminal justice system, ensuring the integrity of samples vital for identification and conviction. Key product categories include traditional swabs (cotton, foam, or polyester) and advanced flocked swabs, which utilize perpendicular nylon fibers to maximize sample uptake and release. Swabs are often packaged in sterile kits and integrated with proprietary stabilizing buffers or packaging systems to prevent degradation of nucleic acids during transit and storage, maintaining the chain of custody rigor required by legal standards.

Major applications for forensic swabs span sexual assault evidence collection (SARC kits), buccal (cheek) cell sampling for DNA databases, trace evidence collection (touch DNA), and recovery of bodily fluids such as blood or semen from surfaces. The continuous improvement in forensic science standards, necessitating higher sensitivity in DNA analysis, drives the demand for premium, low-DNA content (LCN) certified swabs. Furthermore, the global expansion of forensic DNA databases, such as CODIS in the US and the NDNAD in the UK, requires standardized and reliable methods for collecting reference samples, thus sustaining a consistent market for high-quality buccal collection devices. The utility of these products is inextricably linked to maintaining the highest level of sample purity and chain of custody documentation.

Driving factors for this market include increased government spending on forensic infrastructure, stringent regulatory requirements mandating the use of validated collection methods, and the growing application of rapid DNA technology which necessitates high-yield collection materials. The benefits offered by advanced forensic swabs, such as minimized risk of contamination, enhanced sample elution efficiency, and ease of use in diverse environmental conditions, solidify their essential role in modern investigative procedures. The market is also heavily influenced by regulatory bodies like the FBI (for CODIS standards) and various international standardization organizations that dictate acceptable thresholds for human DNA contamination within the manufacturing process, further reinforcing the shift toward specialized, quality-controlled products.

Forensic Swab Market Executive Summary

The Forensic Swab Market is characterized by robust growth stemming from the confluence of increased global security concerns and advancements in DNA profiling technology, which demands highly efficient and contamination-free sample collection. Business trends indicate a strong move towards automation compatibility, with manufacturers focusing on developing swab formats suitable for integration into automated DNA extraction platforms, optimizing laboratory workflow, and reducing human error. Furthermore, strategic partnerships between swab manufacturers and diagnostic kit providers are becoming crucial for offering bundled solutions to law enforcement agencies and private forensic laboratories. Investment in research and development is focused heavily on anti-microbial treatments and specialized preservation solutions integrated directly into the swab collection system to prolong sample viability under adverse conditions, a key factor in geographically challenging regions.

Regionally, North America maintains the dominant market share, primarily due to well-established forensic infrastructures, mandatory DNA collection laws, and significant expenditure on criminal justice resources. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by improving economic conditions, increased awareness of forensic science utility, and substantial governmental initiatives in countries like China and India to establish and expand national DNA databases. European growth remains stable, driven by the implementation of stringent data protection and privacy regulations (GDPR) which, paradoxically, place a higher evidentiary burden on the quality and integrity of collected samples. Middle East and Africa (MEA) show nascent growth, highly dependent on international funding and modernization efforts within their legal and law enforcement sectors.

Segmentation trends highlight the increasing preference for Flocked Swabs over traditional formats (cotton/foam/polyester), primarily due to their proven capability to capture and release a significantly higher percentage of biological material, critical for low-template DNA analysis. Application-wise, the Sexual Assault Collection Kits (SARC) segment remains a high-value area, requiring specialized, often bundled products. End-user segmentation shows that Government and Law Enforcement Agencies represent the largest consumer base, although private forensic laboratories are rapidly expanding their procurement volume as outsourced testing services gain traction globally. The market is experiencing competitive intensity centered around certification standards (e.g., free of human DNA, DNase/RNase free) and cost-efficiency for bulk procurement contracts.

AI Impact Analysis on Forensic Swab Market

Common user questions regarding AI’s influence on the Forensic Swab market typically center on whether automation driven by Artificial Intelligence and Machine Learning will render current collection methods obsolete, how AI can prevent sample contamination, and whether smart swabs capable of on-site preliminary analysis are imminent. Users are concerned about the integration costs and the reliability of AI systems in preserving the chain of custody. The analysis reveals that AI’s primary impact is not on the swab material itself, but on the downstream processing and validation phases. AI algorithms are increasingly being used to optimize forensic lab workflows, particularly in image analysis of swabs for trace evidence distribution mapping, predicting the likelihood of successful DNA extraction based on visual data, and automating quality control checks on manufactured swabs to ensure LCN compliance. While 'smart swabs' are still conceptual, AI integration facilitates faster, error-reduced handling and analysis of the evidence collected by conventional, high-quality swabs, significantly improving turnaround times and data reliability in large-scale forensic operations. AI is essentially accelerating the demand for higher consistency and standardization in the physical collection tool.

- AI optimizes manufacturing quality control, automatically detecting imperfections or contaminants in swab production.

- Machine Learning models predict optimal DNA extraction protocols based on sample type and environmental exposure, improving yield.

- AI-driven automation systems enhance the high-throughput processing of swabs in forensic laboratories, reducing manual handling time.

- Integration of Computer Vision with forensic imaging systems allows AI to analyze trace evidence distribution on the swab surface, guiding targeted extraction.

- AI aids in managing complex digital chain-of-custody documentation linked to each physical swab sample, reducing administrative errors.

- Predictive analytics driven by AI helps forensic labs manage inventory and forecast demand for specific swab types based on regional crime trends.

DRO & Impact Forces Of Forensic Swab Market

The Forensic Swab Market is strongly influenced by a robust set of drivers centered on mandatory governmental policies and technological necessity. The primary driver is the global increase in both property and violent crimes, necessitating systematic evidence collection and DNA analysis to secure prosecutions. This is compounded by legislation mandating the collection of DNA from arrested individuals in numerous jurisdictions, fueling demand for buccal collection kits. Technological improvements, particularly the advent of highly sensitive DNA analysis methods requiring minimal template DNA (such as LCN analysis), create a strong imperative for the adoption of high-efficiency flocked swabs that maximize recovery yield. The opportunity lies in emerging markets where forensic infrastructure is rapidly developing and in the integration of specialized swabs with rapid, portable DNA analysis instruments for field use, expanding the market scope beyond fixed laboratories.

Restraints primarily revolve around the stringent regulatory environment and the inherent cost sensitivity associated with public sector procurement. Manufacturers face significant challenges in achieving and maintaining certifications (e.g., ensuring swabs are human DNA-free), which requires expensive cleanroom manufacturing processes and rigorous quality control, driving up unit costs. Additionally, contamination risk remains a pervasive restraint; even highly controlled swabs can become compromised during collection or transport, leading to case dismissal and dampening confidence in the technology. Another restraint is the logistical complexity and bureaucratic hurdles associated with maintaining a strict, unbroken chain of custody documentation for every single swab used as evidence, which can be inconsistent across global regions.

The key impact forces driving market dynamics include the increasing regulatory pressure for quality standards (Purity and Performance), shifting from traditional sampling methods to advanced, high-yield materials (Technological Innovation), and the global rise in forensic outsourcing services (Commercialization and Adoption). The intersection of these forces dictates pricing power and competitive differentiation. Manufacturers who successfully leverage technology to reduce human DNA contamination risk while simultaneously improving collection efficiency and offering cost-effective, bulk procurement options are best positioned to capture market share. The enduring necessity of physical evidence collection ensures that, despite automation in processing, the forensic swab remains an indispensable tool, insulating the market from wholesale technological displacement.

Segmentation Analysis

The Forensic Swab Market is meticulously segmented based on product type, application, material, and end-user, reflecting the diverse needs of the forensic community. The segmentation by product type is critical, distinguishing between older, less efficient formats (like cotton and foam) and the newer, high-performance designs, predominantly flocked swabs, which are rapidly becoming the industry standard due to their superior elution characteristics crucial for modern DNA profiling. Application segmentation highlights the primary use cases, with Sexual Assault Kits (SARC) representing a specialized, high-value segment due to their comprehensive nature and critical legal importance, while buccal collection constitutes the highest volume segment driven by routine database collection programs. Understanding these segments allows manufacturers to tailor marketing strategies and R&D efforts towards high-growth niches and high-volume demand areas.

- By Product Type: Flocked Swabs, Traditional Swabs (Cotton, Foam, Rayon, Polyester)

- By Swab Material: Nylon Flocked, Polyester, Cotton, Foam

- By Packaging/Format: Individual Sterile Packaged Swabs, Kits (SARC Kits, Buccal Collection Kits), Pre-filled Tubes/Vials

- By Application: Sexual Assault Evidence Collection (SARC), Buccal Swabbing (Reference Samples), Trace DNA Collection (Touch DNA), Blood/Saliva/Fluid Collection, Post-Mortem Sample Collection

- By End-User: Government Forensic Laboratories, Law Enforcement Agencies (Police Departments, Federal Agencies), Private Forensic Laboratories, Academic & Research Institutions, Hospitals & Clinics (Medical Examiners).

Value Chain Analysis For Forensic Swab Market

The value chain for the Forensic Swab Market begins with upstream suppliers providing critical raw materials, primarily high-grade plastic polymers for handles (e.g., polystyrene, polypropylene), specialized fibers (nylon or polyester for flocking), and sterile packaging materials. Stringent quality control at this stage is paramount, as raw materials must meet ultra-low DNA contamination standards. Key activities involve the highly controlled manufacturing process, including injection molding of the handle, application of the flocked tips in cleanroom environments, sterilization (typically gamma irradiation or E-beam), and kitting, often incorporating proprietary preservation buffers. Manufacturers must invest heavily in cleanroom facilities (ISO 7/Class 10,000 or better) to ensure the final product is certified "Human DNA-free," which constitutes the primary source of value addition and cost elevation.

Midstream activities involve sophisticated inventory management and direct sales or distribution networks. Due to the critical nature of the product, distribution channels must be highly reliable, ensuring timely delivery while maintaining product sterility and integrity. Direct distribution is often preferred for large government contracts and specialized forensic labs to maintain better control over the supply chain and manage customized bulk orders. Indirect distribution utilizes specialized medical or laboratory supply distributors who possess the requisite regulatory knowledge and logistics infrastructure to handle temperature-sensitive or high-security products. Marketing and sales focus on providing validation data and contamination certificates, emphasizing product purity and performance metrics, such as DNA elution efficiency and compatibility with specific forensic instrumentation.

Downstream analysis focuses on the end-users: primarily government forensic laboratories and law enforcement agencies who utilize the swabs for evidence collection in the field and subsequent lab analysis. The final link in the chain involves disposal, with forensic materials often requiring specialized procedures due to their classification as biological evidence. Customer feedback loops are vital, as end-users provide crucial input on usability, kit composition, and compatibility with emerging DNA technologies (like Rapid DNA systems). Continuous interaction between manufacturers and end-users drives product innovation, particularly in designing ergonomic handles and optimizing collection media for enhanced field performance. The direct and indirect channels converge at the point of procurement, heavily influenced by government tendering processes that prioritize quality certification alongside competitive pricing structures.

Forensic Swab Market Potential Customers

The primary customers for forensic swabs are governmental bodies and institutions tasked with maintaining public safety and executing justice. Law enforcement agencies, including local police departments, state bureaus of investigation, and federal entities such as the FBI, constitute the largest procurement segment, demanding massive quantities of standardized swabs for both crime scene investigation and routine reference sample collection (e.g., booking stations). These customers require durable, easily deployable, and universally compatible products that meet federal DNA database standards, making bulk purchasing highly common and price sensitivity moderate, given the non-negotiable requirement for quality and certification.

A rapidly growing customer base includes private forensic laboratories that have secured outsourcing contracts from governments or legal firms to handle increasing case backlogs. These private labs often exhibit a higher demand for premium, technologically advanced swabs, such as specialized flocked swabs, as their business model depends on maximizing efficiency and obtaining high-yield results quickly. They also frequently purchase integrated kits that include barcoding capabilities and sophisticated preservation media to streamline their automated laboratory processes. Furthermore, medical examiners, coroners, and hospital facilities, particularly those managing sexual assault nurse examiner (SANE) programs, are crucial customers, procuring specialized Sexual Assault Collection Kits (SARC) which are highly regulated and often contain multiple swab types for different collection purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $331.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Copan Diagnostics Inc., Puritan Medical Products, Sarstedt AG & Co. KG, Thermo Fisher Scientific Inc., MWE (Medical Wire & Equipment), Becton, Dickinson and Company (BD), Sirchie, Bode Technology, ABM Diagnostics, 3M Company (Forensic Solutions), Hain Lifescience, HiMedia Laboratories, Q-Tip (Unilever), Zymo Research, Agilent Technologies, Promega Corporation, Roche Diagnostics, Qiagen N.V., EKF Diagnostics, Global Forensic and Biomedical Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forensic Swab Market Key Technology Landscape

The technological landscape of the Forensic Swab Market is dominated by advancements in material science designed to maximize sample recovery and preserve nucleic acid integrity. The shift from inert, low-elution materials like spun cotton or polyester to high-performance, Nylon Flocked Swabs represents the most significant technological evolution. Flocked swabs utilize a proprietary method to attach perpendicular nylon fibers to the tip, creating a soft, velvet brush-like structure that efficiently collects biological fluid via capillary action and offers superior release (elution) of cells during the extraction process. This technology is indispensable for processing low-template DNA (LTDNA) or 'touch DNA' samples, which often contain only minute amounts of genetic material. Manufacturers are continuously optimizing fiber length and density to further improve recovery rates and reduce inhibition during PCR amplification.

Beyond the swab tip material, technological focus is heavily placed on contamination control and integrated preservation systems. Swabs are increasingly manufactured in certified ISO 7/8 cleanroom environments and undergo rigorous testing to ensure they are free of detectable human DNA (LCN certification), DNase, and RNase. Furthermore, packaging technology now frequently incorporates stabilizing media or desiccants directly into the transport tube or kit. For instance, dry transport systems are preferred for buccal collection as they eliminate the risk of sample dilution, while integrated buffer systems are used for specific pathogen or fluid stabilization, ensuring sample viability over extended periods and under varying environmental conditions. Digital integration, though nascent, is also emerging, where swabs or their packaging are affixed with unique identifiers (e.g., RFID tags or highly detailed barcodes) that link directly to sophisticated electronic Chain of Custody (eCoC) tracking systems, enhancing security and accountability throughout the forensic process.

The integration of forensic swabs with downstream automation is also a key technological driver. Modern swab designs are being engineered with break points and handle geometry that are compatible with robotic liquid handling systems (e.g., automated DNA extractors like those from Qiagen or Promega). This compatibility is crucial for high-throughput government and private laboratories seeking to process thousands of samples efficiently. The development of forensic-grade materials that do not contain PCR inhibitors—substances that can hinder the DNA amplification step—is a non-negotiable technological requirement, requiring manufacturers to constantly refine both the plastic resin used in the handle and the adhesive used in the flocking process. Future trends point towards specialized chemistries embedded in the swab material itself that could potentially neutralize inhibitors or enhance immediate cell lysis upon contact with the extraction buffer.

Regional Highlights

The global distribution of the Forensic Swab Market demonstrates clear disparities in adoption rates and market maturity, largely correlating with levels of investment in criminal justice systems and adherence to international forensic standards. North America (predominantly the U.S. and Canada) holds the largest market share, driven by a mature legal framework, expansive national DNA databases (CODIS), mandatory DNA collection laws for arrestees, and the presence of numerous key market players who are pioneers in flocked swab technology. The region benefits from high government spending on forensic science and a strong emphasis on maintaining high-quality standards (LCN certification).

Europe represents the second-largest market, characterized by stringent regulations enforced by organizations like ENFSI (European Network of Forensic Science Institutes). Growth here is stable, supported by cross-border evidence sharing agreements (Prüm Convention) and continuous investment in modernizing forensic laboratories across countries like the UK, Germany, and France. European demand is heavily focused on ensuring complete compliance with privacy laws while prioritizing certified, low-contamination swab kits. The technological adoption rate for high-efficiency flocked swabs is exceptionally high across Western Europe, driven by the pressure to solve complex crimes involving trace evidence.

Asia Pacific (APAC) is projected to experience the fastest growth during the forecast period. This rapid expansion is attributable to increasing government initiatives in large economies like China, India, and Japan to establish and expand national DNA identification systems. Economic growth facilitates greater investment in law enforcement modernization, leading to the procurement of advanced forensic tools. While price sensitivity remains higher in this region compared to North America or Europe, the growing awareness of the utility of forensic evidence in legal proceedings is driving significant demand for high-quality, internationally certified products. Latin America and the Middle East & Africa (MEA) remain emerging markets, where growth is highly variable, depending heavily on political stability, international aid, and localized reform efforts aimed at strengthening judicial processes through better forensic capabilities. Procurement in these regions often involves large, infrequent tenders for standardized forensic collection kits.

- North America: Market dominance, driven by established CODIS system, mandatory DNA collection, and high R&D investment in advanced swab materials.

- Europe: Stable growth, supported by stringent quality standards, robust cross-border collaboration, and high adoption of automation-compatible products.

- Asia Pacific (APAC): Fastest growing region, fueled by governmental investment in new DNA databases (e.g., China, India) and rapid forensic infrastructure development.

- Latin America: Emerging market with growing need for standardized SARC kits and buccal swabs, constrained by variable government funding and regulatory complexity.

- Middle East & Africa (MEA): Nascent market primarily driven by security concerns and international partnerships aimed at judicial modernization and standardized evidence collection protocols.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forensic Swab Market.- Copan Diagnostics Inc.

- Puritan Medical Products

- Sarstedt AG & Co. KG

- Thermo Fisher Scientific Inc.

- MWE (Medical Wire & Equipment)

- Becton, Dickinson and Company (BD)

- Sirchie

- Bode Technology

- ABM Diagnostics

- 3M Company (Forensic Solutions)

- Hain Lifescience

- HiMedia Laboratories

- Q-Tip (Unilever)

- Zymo Research

- Agilent Technologies

- Promega Corporation

- Roche Diagnostics

- Qiagen N.V.

- EKF Diagnostics

- Global Forensic and Biomedical Solutions

Frequently Asked Questions

Analyze common user questions about the Forensic Swab market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between traditional and flocked forensic swabs?

Traditional swabs, typically cotton or polyester, trap samples within the fiber matrix, leading to poor release efficiency during DNA extraction. Flocked swabs utilize perpendicularly applied nylon fibers which act via capillary action to collect and hold samples on the surface, allowing for significantly higher (up to 95%) and faster elution of biological material, crucial for low-template DNA analysis. Flocked technology is essential for compliance with modern high-sensitivity forensic requirements.

Why is LCN certification crucial for forensic swab procurement?

LCN (Low Copy Number) certification ensures that forensic swabs are manufactured in ultra-clean environments and are demonstrably free of detectable human DNA. This certification is crucial because trace evidence collection often involves minute quantities of DNA, and contamination from the swab itself can lead to false positives, compromising the integrity of the evidence and potentially invalidating court proceedings. Procurement guidelines, especially those related to CODIS systems, increasingly mandate this certification.

How does the integration of Rapid DNA technology affect the demand for specific forensic swabs?

Rapid DNA systems require highly efficient and consistent sample input to produce accurate results quickly in the field. This increases the demand for specialized, pre-packaged buccal collection swabs that are optimized for direct integration into portable rapid analyzers. These swabs often include unique features like proprietary preservation buffers and specific handle geometries designed to ensure seamless robotic sample loading, enhancing the speed and reliability of real-time DNA profiling outside the traditional laboratory setting.

What are the key challenges in maintaining the chain of custody related to forensic swabs?

The key challenges include preventing cross-contamination during collection, ensuring secure storage throughout transit, and maintaining precise, verifiable documentation of every handler. Swabs, as physical evidence carriers, require stringent sealing, unique barcoding, and integration into robust Electronic Chain of Custody (eCoC) systems to prevent tampering or misidentification, which is critical for admissibility in court. Poorly managed custody is the leading cause of evidence suppression in forensic casework.

Which geographical region is expected to show the highest growth in the Forensic Swab Market and why?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is primarily fueled by massive infrastructural investments by major governments, particularly in China and India, aimed at establishing and expanding national DNA databases. Increased forensic awareness, modernization of law enforcement agencies, and a rising focus on scientific methods in judicial processes drive the substantial volume procurement of advanced forensic collection tools in this region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager