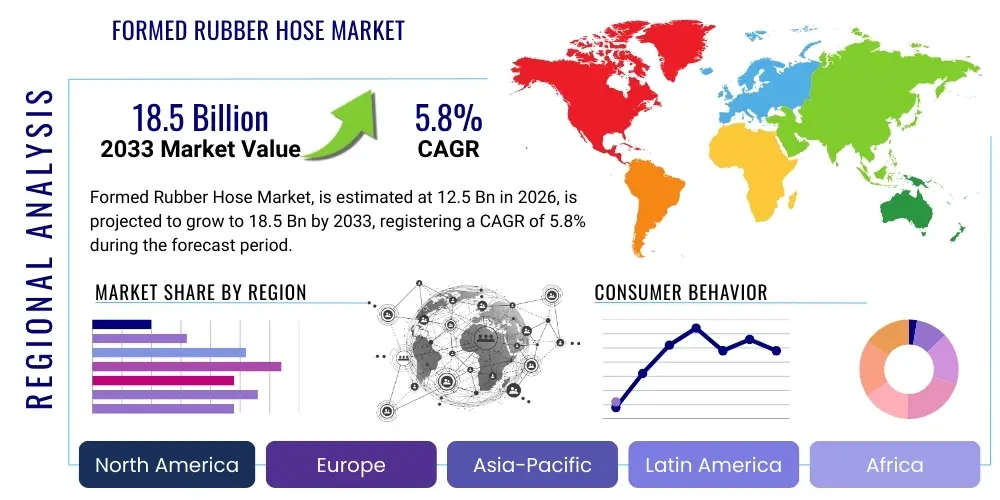

Formed Rubber Hose Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440975 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Formed Rubber Hose Market Size

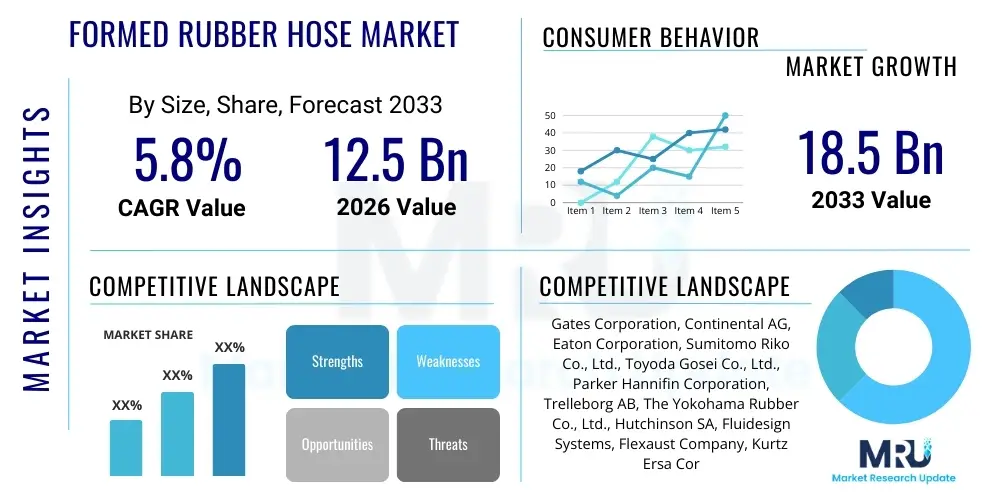

The Formed Rubber Hose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by robust demand from the global automotive industry, particularly the transition towards hybrid and electric vehicles, which require specialized thermal management and fluid conveyance systems. Furthermore, the persistent growth in industrial automation and heavy machinery sectors, necessitating reliable and high-performance formed rubber components, significantly contributes to this upward trajectory.

Formed Rubber Hose Market introduction

Formed rubber hoses are crucial fluid transfer components engineered to maintain specific shapes and geometries, ensuring optimal performance and fit within complex systems, primarily in the conveyance of various fluids such as coolants, air, oil, and hydraulic liquids. These specialized hoses are manufactured through processes like molding, braiding, or wrapping, using advanced elastomers like EPDM, silicone, nitrile, and fluoropolymers, depending on the required resistance to temperature, pressure, chemicals, and abrasion. The inherent benefits of formed rubber hoses, including exceptional flexibility, vibration absorption capabilities, and long service life under harsh operating conditions, make them indispensable across several high-stakes industries.

Major applications for formed rubber hoses span across the automotive sector—where they are used extensively in engine cooling systems, air intake systems, and brake lines—and the heavy industrial sector, including construction equipment, agricultural machinery, and aerospace fluid systems. The increasing complexity of modern vehicle architectures, coupled with stringent emission control standards, drives demand for superior material performance and precision in hose design. Manufacturers are increasingly focusing on lightweight, high-temperature resistant, and durable rubber compounds to meet these evolving operational requirements.

The principal driving factors stimulating market growth include the rebound of global automotive production, substantial infrastructure investment in emerging economies boosting demand for construction and mining equipment, and the continuous need for replacement and maintenance parts in the expansive aftermarket. Technological advancements in material science, specifically the development of thermoplastic elastomers (TPEs) and high-performance silicones, are also enabling manufacturers to produce hoses that offer enhanced thermal stability and reduced weight, thereby improving fuel efficiency and overall system performance.

Formed Rubber Hose Market Executive Summary

The global Formed Rubber Hose market is experiencing vigorous growth fueled predominantly by the automotive sector's pivot toward electric mobility and the expansion of heavy industrial operations worldwide. Business trends indicate a strong focus on strategic partnerships between raw material suppliers and Tier 1 automotive component manufacturers to secure the supply chain for advanced elastomers like hydrogenated nitrile butadiene rubber (HNBR) and specialty silicones, vital for high-voltage battery cooling circuits. Furthermore, manufacturers are investing in highly automated production techniques, such as mandrel-forming and advanced curing methods, to enhance precision and scalability, addressing the tight tolerances demanded by modern engine compartments and sophisticated machinery.

Regionally, Asia Pacific maintains its dominance, largely driven by massive vehicle production bases in China, India, and Japan, alongside significant construction and manufacturing output. North America and Europe are characterized by high demand for premium, performance-oriented formed hoses, particularly within the aerospace, defense, and specialized industrial sectors, focusing on durability and compliance with stringent environmental regulations. Segment trends highlight EPDM and silicone rubber types as frontrunners; EPDM remains cost-effective for standard cooling applications, while silicone dominates high-temperature and electric vehicle thermal management systems due to its superior heat resistance and flexibility.

The market faces concurrent challenges and opportunities. Restraints include volatile raw material pricing (synthetic rubber and carbon black) and the complexity of designing hoses for highly integrated engine systems. Conversely, the opportunity lies in the burgeoning electric vehicle market, where demand for custom-formed battery cooling and heating hoses is escalating rapidly. Companies successfully navigating these challenges are those that prioritize R&D in material composites, focusing on lighter, stronger, and more sustainably sourced elastomers to maintain competitive advantage and meet global regulatory standards.

AI Impact Analysis on Formed Rubber Hose Market

User queries regarding the impact of Artificial Intelligence (AI) on the Formed Rubber Hose market frequently center on how AI can optimize manufacturing processes, predict material failure, and revolutionize supply chain logistics. Common concerns involve the immediate application feasibility in traditional rubber molding operations and the potential for AI-driven material formulation to create superior, highly customized elastomers. The consensus expectation is that AI will not immediately replace the physical production of hoses but will dramatically enhance the efficiency, quality control, and predictive maintenance aspects of the industry, leading to substantial cost reductions and improved product longevity. Specifically, users are keen to understand how machine learning can analyze sensor data from industrial machinery to determine the optimal replacement cycle for specific hose types, moving from reactive maintenance to prescriptive maintenance models.

- AI-driven predictive maintenance modeling minimizes unexpected hose failure in critical industrial equipment.

- Machine Learning algorithms optimize rubber compounding recipes, enhancing thermal stability and chemical resistance based on application-specific stress profiles.

- AI integrates with Computer-Aided Engineering (CAE) to rapidly iterate and optimize complex 3D formed hose geometries for fluid dynamics and fitment.

- Automated visual inspection systems (AI-powered vision) enhance quality control, identifying micro-defects in curing and molding processes that human inspectors might miss.

- AI optimizes supply chain management by predicting demand fluctuations for specific elastomer types, reducing inventory costs and minimizing lead times.

- Robotic process automation (RPA) manages documentation and compliance checks required for highly regulated sectors like aerospace and medical devices.

DRO & Impact Forces Of Formed Rubber Hose Market

The dynamics of the Formed Rubber Hose market are shaped by several interconnected forces: strong demand from the automotive powertrain and cooling systems serves as the primary driver, necessitated by increasing vehicle production and the complex thermal management requirements of next-generation engines and batteries. This growth is significantly restrained by the inherent volatility in the pricing and availability of synthetic rubber raw materials, such as butadiene and isoprene, which are petrochemical derivatives. However, substantial opportunities arise from the proliferation of electric vehicles (EVs) and hybrid electric vehicles (HEVs), demanding specialized, durable hoses for battery thermal regulation circuits, offering a high-growth avenue for specialized product differentiation.

Impact forces on this market are substantial, originating from both internal industry structure and external macro-economic pressures. Internally, the high capital expenditure required for precise molding and mandrel forming equipment acts as a barrier to entry, concentrating market power among established global players. Externally, stringent global environmental regulations, particularly those concerning the use of certain chemicals (e.g., REACH regulations in Europe), force manufacturers to continuously reformulate and certify their materials, increasing operational complexity. Furthermore, the push towards lighter components in transportation necessitates significant R&D investment into composite materials and thin-walled hose designs that maintain pressure integrity while reducing weight.

The competitive landscape is further intensified by the forward integration of large chemical companies into the elastomer compounding business, putting pressure on traditional hose manufacturers' margins. Conversely, the rise of sophisticated 3D scanning and rapid prototyping technologies provides an opportunity for smaller, specialized firms to quickly develop custom-formed hoses for niche high-performance applications. The sustained recovery of global industrial machinery production, particularly in construction and oil and gas sectors, ensures a steady, diversified demand base, mitigating risks associated with reliance solely on the cyclical nature of the traditional internal combustion engine (ICE) automotive market.

Segmentation Analysis

The Formed Rubber Hose market is comprehensively segmented based on the type of elastomer utilized, the specific application it serves, and the end-use sector. Understanding these segmentations is critical for manufacturers aiming to target high-growth niches requiring specialized material properties. The material segmentation (EPDM, Silicone, Nitrile, etc.) determines the hose's operational parameters, such as maximum temperature resistance and compatibility with specific fluids. Application segmentation, particularly within the automotive sector, differentiates cooling/heater hoses from brake and fuel lines, each demanding unique physical characteristics and certifications. End-use segmentation (OEM vs. Aftermarket) dictates volume pricing, quality control standards, and distribution strategies, with OEMs demanding high-volume, standardized components and the aftermarket requiring diversity and fast availability for replacement parts.

- By Material Type:

- EPDM (Ethylene Propylene Diene Monomer)

- Silicone Rubber

- Nitrile Rubber (NBR)

- Neoprene (CR)

- Fluoropolymers (FKM, FPM)

- Others (e.g., HNBR, SBR)

- By Application:

- Automotive Cooling Systems (Radiator Hoses, Heater Hoses)

- Air Intake Systems

- Fuel and Oil Lines

- Brake and Clutch Systems

- Hydraulic Systems

- Air Conditioning Systems

- Industrial Fluid Transfer

- By End-Use Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Industrial Machinery and Equipment

- Construction and Mining

- Aerospace and Defense

- Marine

- Agriculture

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and Repair)

Value Chain Analysis For Formed Rubber Hose Market

The value chain for the Formed Rubber Hose market is characterized by a high degree of specialization and sequential processing, beginning with upstream raw material suppliers. Upstream activities involve the synthesis of basic petrochemicals to create synthetic rubbers (like NBR, EPDM, SBR) and sourcing natural rubber, alongside fillers (carbon black, silica), plasticizers, and curing agents. Price volatility and supply chain stability at this stage directly impact the final cost and profitability of the hose manufacturers. Integration of compounding—mixing the raw polymers with additives to achieve the desired physical properties—is a crucial step, often performed by specialized compounders or in-house by large hose manufacturers to maintain quality control and proprietary formulations.

Midstream activities focus on the core manufacturing processes: extrusion of the inner tube, application of reinforcement layers (textile braiding or spiraling), formation into complex shapes using mandrels or molds, and finally, vulcanization (curing) under heat and pressure. Efficiency and waste minimization during the forming and curing stages are critical for cost management, as these processes are energy-intensive and require specialized, high-precision tooling. Quality testing, including burst pressure testing, ozone resistance, and thermal cycle testing, is integrated throughout the production cycle to ensure adherence to strict industry and OEM specifications, particularly for safety-critical applications like brake lines.

Downstream distribution channels are segmented into direct and indirect routes. Direct distribution is predominantly used for OEM sales, where hose manufacturers deliver customized products directly to assembly plants (e.g., auto manufacturers) based on Just-in-Time (JIT) schedules. Indirect distribution involves sales to the vast and geographically dispersed aftermarket, utilizing global distributors, wholesalers, and specialized parts retailers. The effectiveness of the aftermarket channel relies heavily on robust inventory management, cataloging accuracy, and fast fulfillment capabilities. Achieving optimal channel synergy, balancing high-volume, low-margin OEM contracts with lower-volume, higher-margin aftermarket sales, is key to sustained profitability in the formed rubber hose sector.

Formed Rubber Hose Market Potential Customers

The primary end-users and buyers of formed rubber hoses are concentrated in sectors that rely heavily on fluid conveyance systems under demanding operating conditions, where safety, reliability, and longevity are paramount. The automotive sector represents the largest consumer, encompassing major Original Equipment Manufacturers (OEMs) such as Ford, Volkswagen, Toyota, and Tesla, who purchase millions of units annually for integration into new vehicles. This customer base requires bespoke, complex geometries and materials certified for specific powertrain or battery thermal management needs. Secondary automotive customers include Tier 1 and Tier 2 suppliers who integrate these hoses into larger assemblies before supplying the final OEM.

Beyond transportation, significant demand originates from heavy industrial consumers. This includes manufacturers of construction and mining equipment (e.g., Caterpillar, Komatsu), who utilize high-pressure hydraulic hoses for operational functions, and agricultural machinery producers (e.g., John Deere). These buyers prioritize resistance to extreme abrasion, weather, and pressure cycling. Furthermore, the aerospace industry, including defense contractors and commercial aircraft manufacturers (e.g., Boeing, Airbus), represents a high-value customer segment, demanding highly specialized, often fluoropolymer-based, hoses compliant with rigorous flammability and performance standards for critical fuel and hydraulic lines.

The aftermarket sector, comprising thousands of independent repair garages, franchised service centers, and parts distributors, constitutes the third major customer category. These customers focus on purchasing reliable, often standardized replacement hoses for vehicle and equipment maintenance, driving demand for widely available EPDM and standard silicone products. The growth in the installed base of vehicles and machinery globally ensures a continuous, non-cyclical demand stream from the aftermarket, providing essential revenue stability for hose manufacturers across economic fluctuations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 18.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gates Corporation, Continental AG, Eaton Corporation, Sumitomo Riko Co., Ltd., Toyoda Gosei Co., Ltd., Parker Hannifin Corporation, Trelleborg AB, The Yokohama Rubber Co., Ltd., Hutchinson SA, Fluidesign Systems, Flexaust Company, Kurtz Ersa Corporation, Semperit AG Holding, Bridgestone Corporation, Nichirin Co., Ltd., Misumi Group Inc., Colmant Cuvelier RPS, Hi-Tech Industries, Inc., Delphi Technologies (BorgWarner), Transfer Oil S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Formed Rubber Hose Market Key Technology Landscape

The technological landscape of the Formed Rubber Hose market is defined by advancements aimed at improving thermal resistance, reducing weight, and enabling complex geometrical customization. A crucial technology involves the use of high-performance elastomers like AEM (Acrylic Elastomer) and specialty silicones capable of operating continuously at temperatures exceeding 200°C, necessary for turbo-charged engines and battery components in electric vehicles. Furthermore, the incorporation of advanced reinforcement techniques, such as aramid fiber braiding and high-tensile polyester spiral wrapping, is essential to maintain structural integrity and burst pressure resistance while minimizing the hose wall thickness, contributing significantly to vehicle lightweighting initiatives demanded by emissions reduction targets.

Manufacturing innovation is heavily focused on automated forming and curing technologies. Precision mandrel-forming technology, often utilizing robotic arms for consistent shaping and removal, ensures highly repeatable geometries crucial for modern engine assembly. The shift from traditional salt-bath curing to highly efficient microwave or fluid bed curing reduces cycle times and enhances the homogeneity of the elastomer cross-linking. Furthermore, the integration of Computer-Aided Design (CAD) and Computational Fluid Dynamics (CFD) simulation tools allows manufacturers to virtually test the performance of complex formed hose designs, optimizing flow characteristics and minimizing pressure drop before committing to expensive tooling, thereby accelerating the product development lifecycle and reducing overall design costs.

Looking ahead, the emergence of multi-layer hose constructions and smart hose technology is gaining traction. Multi-layer hoses combine different materials—such as an impermeable inner layer (e.g., fluoropolymer) and a high-strength outer layer (e.g., EPDM)—to achieve superior combined performance attributes like chemical resistance and high pressure handling simultaneously. Smart hoses integrate micro-sensors to monitor internal pressure, temperature, and fluid flow, transmitting data wirelessly for real-time diagnostic and predictive maintenance purposes. This technological shift is especially critical for safety-critical systems in aerospace and heavy industrial hydraulics, enabling preemptive component replacement based on actual performance degradation rather than fixed time schedules.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily driven by China and India's expansive automotive manufacturing base and rapid infrastructure development. The high volume of two-wheeler and commercial vehicle production, coupled with significant investments in EV battery manufacturing, ensures continuous, escalating demand for high-volume, cost-effective formed rubber hoses, particularly EPDM and low-cost silicone variants.

- North America: This region is characterized by high demand for specialized, high-performance hoses for heavy-duty commercial vehicles, off-highway machinery, and the aerospace sector. Strict emission norms and a push towards advanced vehicle technologies drive the market towards fluoropolymer and high-grade silicone hoses for demanding applications requiring superior durability and chemical compatibility.

- Europe: Europe is defined by stringent safety and environmental regulations (e.g., Euro 7, REACH). The market exhibits strong demand for advanced rubber compounds utilized in premium passenger vehicles and the rapidly expanding high-voltage battery cooling circuits within the continent’s leading electric vehicle manufacturing hubs, necessitating robust and highly certified products.

- Latin America (LATAM): Market growth in LATAM is closely tied to commodity cycles and regional economic stability, impacting industrial machinery and automotive production (Brazil and Mexico). The region primarily demands standard-grade NBR and EPDM hoses for traditional applications and a growing aftermarket presence fueled by an aging vehicle fleet.

- Middle East and Africa (MEA): This region shows specialized growth in high-temperature resistant hoses required for oil & gas extraction equipment and industrial applications operating under extreme climate conditions. Investment in localized manufacturing capabilities is gradually increasing, moving away from complete reliance on imported components, particularly within high-growth industrial clusters in the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Formed Rubber Hose Market.- Gates Corporation

- Continental AG

- Eaton Corporation

- Sumitomo Riko Co., Ltd.

- Toyoda Gosei Co., Ltd.

- Parker Hannifin Corporation

- Trelleborg AB

- The Yokohama Rubber Co., Ltd.

- Hutchinson SA

- Fluidesign Systems

- Flexaust Company

- Kurtz Ersa Corporation

- Semperit AG Holding

- Bridgestone Corporation

- Nichirin Co., Ltd.

- Misumi Group Inc.

- Colmant Cuvelier RPS

- Hi-Tech Industries, Inc.

- Delphi Technologies (BorgWarner)

- Transfer Oil S.p.A.

Frequently Asked Questions

Analyze common user questions about the Formed Rubber Hose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for formed rubber hoses in the forecast period?

The central driver is the global increase in vehicle electrification (EVs and HEVs). These vehicles require highly sophisticated, specialized formed hoses, typically made from high-temperature resistant silicone or HNBR, for critical battery thermal management systems and cooling circuits.

How do EPDM and Silicone hoses differ in application and performance?

EPDM (Ethylene Propylene Diene Monomer) is cost-effective, offering excellent resistance to water and weather, making it ideal for standard radiator and heater hoses. Silicone offers superior high-temperature resistance and flexibility, making it essential for turbocharger coolant lines, high-performance engine bays, and EV thermal systems where operational temperatures are extreme.

What impact does raw material price volatility have on the market?

Volatile pricing of synthetic rubber components, such as butadiene and isoprene, directly affects the manufacturing costs and margins of hose producers. Manufacturers mitigate this through long-term supply agreements and optimizing compounding formulas to substitute expensive materials where technically feasible without compromising performance.

Which geographical region dominates the Formed Rubber Hose market?

The Asia Pacific (APAC) region dominates the global market, primarily due to the vast scale of automotive production, particularly in China and India, coupled with significant investment in heavy machinery manufacturing and infrastructure development, which sustains high demand for various formed rubber hose types.

What role does 3D modeling and simulation play in modern hose manufacturing?

Advanced 3D modeling and CFD (Computational Fluid Dynamics) simulation are crucial for rapid prototyping and validation. They allow engineers to accurately predict the geometric fitment, fluid flow efficiency, and pressure handling capabilities of complex formed hoses, minimizing tooling costs and significantly reducing the time-to-market for new designs.

The Formed Rubber Hose Market is fundamentally linked to the health and technological evolution of the global transportation and industrial sectors. As systems become more thermally complex and demanding, the reliance on high-performance, precision-formed elastomers increases, solidifying the market's critical role within the broader manufacturing ecosystem. The shift toward sustainable mobility mandates continuous material science innovation, focusing on lighter, more durable, and chemically inert composites to manage the rigorous demands of next-generation propulsion systems and battery technologies. Successfully navigating supply chain intricacies and regulatory hurdles remains paramount for industry leaders aiming to secure long-term contracts with key OEMs globally. Furthermore, the expansion of the industrial machinery sector, requiring high-pressure hydraulic and air hoses, provides a diversification pathway, ensuring the market's resilience against fluctuations in any single end-use sector. Strategic investment in automation and AI-driven quality assurance will define the competitive edge, allowing manufacturers to achieve the necessary precision and efficiency required for the high-volume, high-specification demands of the future market.

Technological differentiation is increasingly focused on developing specialized hoses for hydrogen fuel cell vehicles (FCEVs), which require materials resistant to high-purity hydrogen and extreme pressure cycles, presenting a niche, high-growth opportunity. Similarly, the integration of conductive or shielded materials into formed hoses for electric vehicles helps manage electromagnetic interference (EMI) issues, a growing concern in high-voltage environments. Market participants are leveraging digital twins and advanced sensing technologies not only to optimize their internal production but also to offer value-added services, such as lifetime performance monitoring for mission-critical applications in aerospace and heavy industry. This shift from simple component supply to integrated fluid conveyance solution provision is a key strategic trend reshaping the industry structure and driving up the average selling price (ASP) for highly engineered formed products. The robust aftermarket remains essential, acting as a buffer, with demand for replacement hoses offering stable revenue streams that offset the cyclical nature of OEM procurement. Companies prioritizing sustainability, including the use of bio-based or recycled content elastomers, will be strategically positioned to capture market share as global environmental stewardship becomes a dominant procurement criterion across all end-use industries.

The convergence of material science breakthroughs and sophisticated manufacturing processes is enabling the production of formed rubber hoses that can withstand unprecedented levels of chemical exposure, mechanical stress, and thermal variation. For instance, the use of proprietary surface treatments and anti-permeation layers is enhancing the performance of fuel hoses required to handle increasingly complex fuel blends containing bio-components. In hydraulic applications, the incorporation of highly durable synthetic fabrics, such as Kevlar or Dyneema, dramatically improves the fatigue life and pressure rating of the formed hose while reducing the component weight relative to traditional wire-braided constructions. These innovations are not merely incremental; they represent fundamental shifts in product capability that enable entirely new system designs within vehicles and industrial equipment. Furthermore, globalization of manufacturing means that formed hose suppliers must maintain consistent quality and rapid scalability across multiple international production sites, necessitating standardized production protocols and global certification management systems. The ability to manage these complex logistical and technical requirements will increasingly separate the market leaders from the niche players over the forecast period, emphasizing the strategic importance of centralized production control and globally standardized quality management processes for maintaining competitiveness in this high-specification market segment.

The transition toward autonomous driving systems introduces new demands for specialized formed hoses within sensor cooling and electronic control unit (ECU) thermal management systems. These applications require extremely tight dimensional tolerances and materials that are minimally reactive to specialized dielectric fluids, pushing the boundaries of traditional rubber compounding and forming techniques. Furthermore, the industrial sector is witnessing a renewed focus on factory safety and efficiency, driving demand for hoses that are visibly identifiable for quick inspection (e.g., highly colored external layers) and possess superior resistance to harsh industrial cleaning agents. The necessity for these high-performance attributes supports premium pricing structures and encourages significant investment in patented material technologies and unique processing methods. The market's future vitality is therefore intrinsically tied not just to overall volume growth, but more critically, to the ability of manufacturers to innovate continuously in niche, high-value segments where performance cannot be compromised. The ongoing development of additive manufacturing techniques, while currently limited for production-scale rubber components, holds promise for drastically reducing lead times and tooling costs for highly complex, low-volume formed hose prototypes required by advanced R&D projects in aerospace and performance automotive domains, foreshadowing a potential long-term technological disruption in traditional molding practices.

Consolidation among major Tier 1 suppliers is a defining trend, leading to a reduction in the total number of independent hose manufacturers but increasing the capabilities of the dominant players through strategic mergers and acquisitions focused on acquiring specialized expertise, such as high-pressure hydraulic forming technology or specific elastomer compounding intellectual property. This consolidation allows the resulting entities to offer a more comprehensive product portfolio to global OEMs, simplifying procurement processes for vehicle manufacturers. The aftermarket, while traditionally stable, is also being modernized through e-commerce platforms and digital inventory management, requiring suppliers to integrate their logistics systems closely with online distributors to ensure rapid order fulfillment and accurate parts matching, which is especially challenging given the vast array of unique formed hose geometries currently in use across various vehicle models and equipment types. This digitalization extends into the product lifecycle management, where digital traceability and serialization of high-value hoses are becoming standard practice, ensuring authenticity and providing crucial data points for warranty tracking and failure analysis. This level of traceability is becoming mandatory in highly regulated environments, reinforcing the focus on quality and process control throughout the entire value chain, from raw material sourcing to final installation and end-of-life management.

The ecological imperative is profoundly influencing material selection, accelerating research into sustainable alternatives to petrochemical-based rubbers. Bio-based elastomers derived from sources like natural oils or agricultural waste are emerging as viable options, particularly for non-critical, lower-temperature applications, appealing to OEMs committed to reducing their carbon footprint. However, the performance parity of these sustainable materials with established synthetics (like FKM or HNBR) in extreme conditions remains a challenge, limiting their adoption in high-stress applications such as turbocharger coolant lines or hydraulic braking systems. Furthermore, the design process for formed hoses is increasingly focusing on manufacturability for disassembly and recycling at the end of the product life cycle, aligning with circular economy principles. This includes minimizing the use of incompatible multi-material bonding agents and exploring vulcanization alternatives that allow for easier separation of rubber, textile, and metal components. Regulatory bodies are expected to further tighten restrictions on chemical substances used in compounding, particularly phthalates and certain heavy metals, necessitating proactive material substitution strategies by manufacturers globally to ensure ongoing product compliance and market access, driving continuous material innovation across the entire formed rubber hose landscape.

Market growth is also intimately linked to global construction trends and the massive investment in infrastructure projects, particularly in Asia and Africa. Large-scale construction and mining activities require robust, high-pressure hydraulic hoses that endure sustained vibration, extreme dust, and wide temperature variations. The move towards more powerful, energy-efficient heavy equipment necessitates hoses capable of handling higher operating pressures (e.g., up to 5000 PSI or more) and larger diameters, demanding highly specific reinforcement techniques and robust couplings. The replacement cycle for these heavy-duty hoses is often shorter than in passenger vehicles due to the extreme operational environment, contributing substantially to the aftermarket segment's revenue. Manufacturers are responding by offering specialized product lines with enhanced abrasion-resistant outer covers and proprietary material blends designed for maximum durability in off-highway environments. Simultaneously, the global air travel recovery and sustained defense spending ensure consistent demand for highly specialized, often fire-resistant and certified aerospace hoses, a segment characterized by low volume but extremely high value and profit margins, requiring stringent adherence to AS9100 quality standards and long-term product support commitment from the supplying companies.

In conclusion, the formed rubber hose market is transitioning from a traditional commodity components sector to a high-technology specialty domain driven by electrification, lightweighting, and industrial automation. Success hinges on a company's ability to integrate advanced material science (silicone, fluoropolymers, HNBR) with precision manufacturing processes (automated forming, advanced curing) and smart digital tools (CFD, AI quality control). The robust demand from the EV sector provides a powerful impetus for growth, compensating for potential slowdowns in traditional ICE applications. Strategic agility in managing the complex global supply chain for key elastomers and maintaining stringent quality controls necessary for safety-critical applications will be the differentiating factors for sustained leadership in this evolving global market. The long-term trajectory remains positive, underscored by the fundamental necessity of reliable fluid transfer in virtually all forms of complex machinery and transportation systems globally.

The ongoing industrial revolution, often termed Industry 4.0, is profoundly reshaping the operational efficiency and competitive dynamics of the formed rubber hose manufacturing sector. The integration of IoT (Internet of Things) sensors within production facilities allows for real-time monitoring of machine performance, mold temperature, and vulcanization duration, leading to immediate process adjustments that minimize scrap rates and ensure consistent product quality across large production batches. This capability is vital for maintaining the strict quality standards required by global OEMs, particularly in safety-critical applications. Furthermore, the implementation of sophisticated Enterprise Resource Planning (ERP) systems, linked directly to production data, enables manufacturers to achieve granular control over inventory and scheduling, optimizing raw material procurement and reducing overall operational lead times. This enhanced digital infrastructure provides a significant competitive advantage by allowing for faster response times to customized orders and fluctuating demand, essential characteristics for serving both the rapidly changing automotive sector and the just-in-time demands of major industrial equipment producers.

The competitive landscape is increasingly characterized by patent wars and intense R&D investment focused on proprietary material formulations that offer unique performance advantages, such as enhanced flexibility at extremely low temperatures (critical for Arctic operations) or extended resistance to aggressive chemical coolants and new battery electrolyte fluids. Large multinational players are strategically expanding their technical centers globally, aiming to co-develop solutions directly with regional OEMs, thereby locking in long-term supply contracts and ensuring their products meet localized performance and regulatory requirements. Smaller, specialized firms often differentiate themselves by focusing on niche high-performance markets, such as high-end motorsports or specialized medical equipment, where they can command premium pricing for bespoke, low-volume, high-specification formed hoses. This market structure, featuring a mix of global volume leaders and specialized technical innovators, fosters continuous improvement and broad application coverage across the entire industrial spectrum. The persistent push for vehicle lightweighting also forces continuous innovation in connection technology, moving away from heavy traditional clamps towards quick-connect and integrated coupling systems that further reduce total system weight and simplify assembly processes on the OEM production line.

Finally, the long-term geopolitical stability of key manufacturing and raw material sourcing regions introduces an underlying level of strategic risk for global hose suppliers. Disruptions in the supply of key synthetic rubber precursors, predominantly produced in petrochemical hubs, necessitate the development of robust, diversified sourcing strategies and potential localized compounding capabilities across multiple continents. Trade policies and tariffs can also influence the optimal manufacturing footprint, leading to strategic investments in facilities situated to serve major regional markets directly, such as the strategic positioning of plants within the NAFTA/USMCA zone or the European Union. These global considerations mandate sophisticated strategic planning that goes beyond typical market analysis, focusing heavily on supply chain resilience and regulatory compliance across diverse legal frameworks. The demand for formed rubber hoses, being inextricably linked to global production and mobility, ensures the market will remain dynamic, continuously adapting to shifts in manufacturing technology, material science, and international trade dynamics to maintain its foundational role in modern industrial and transportation infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager