Fortified Baby Food Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441281 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Fortified Baby Food Market Size

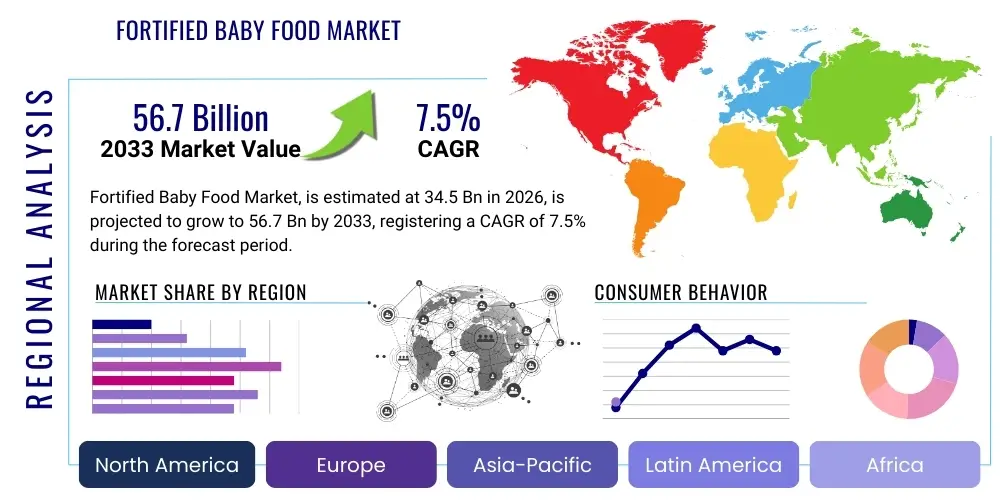

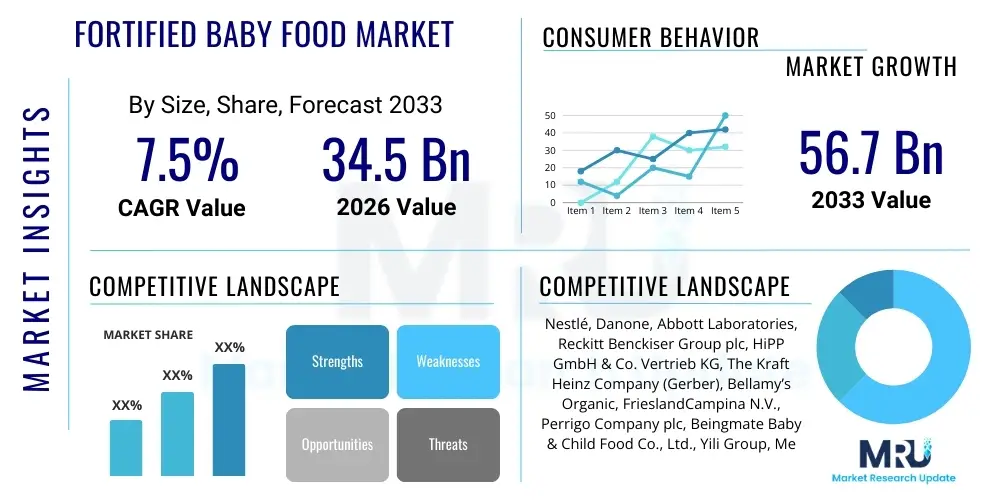

The Fortified Baby Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at 34.5 Billion USD in 2026 and is projected to reach 56.7 Billion USD by the end of the forecast period in 2033.

Fortified Baby Food Market introduction

The Fortified Baby Food Market encompasses a specialized range of pediatric nutrition products that have been enhanced with supplementary vitamins, minerals, functional ingredients, and micronutrients beyond standard formulation requirements. These products, which include fortified infant milk formulas, packaged cereals, purees, and ready-to-eat meals, are designed explicitly to address nutritional gaps often prevalent in early childhood diets, particularly in regions facing high rates of micronutrient deficiencies like iron-deficiency anemia or Vitamin D inadequacy. The primary objective is to optimize infant growth and cognitive development during the crucial 0-36 month developmental window, offering parents scientifically backed solutions for comprehensive nourishment.

Product descriptions within this segment emphasize clinical efficacy and ingredient transparency. Fortification often involves key nutrients such as DHA/ARA for brain development, probiotics and prebiotics for gut microbiota modulation, and essential vitamins (A, C, E) crucial for immune function. Major applications of fortified baby food span from providing complete nourishment for non-breastfed infants (via specialized formulas) to supplementing the diets of weaning babies with easily digestible, nutrient-dense solids and snacks. The market is highly regulated, necessitating strict compliance with international food safety and pediatric nutrition guidelines to ensure both efficacy and consumer trust.

The market’s substantial growth is primarily driven by socio-economic shifts, including rising disposable incomes in emerging markets, heightened consumer awareness regarding preventative health, and urbanization leading to increased demand for convenient, pre-prepared meals. A critical benefit of these products is their role in minimizing malnutrition and supporting optimal neurodevelopment, which positions them favorably among health-conscious millennial parents globally. Driving factors include sustained public health campaigns promoting better infant nutrition, continuous product innovation introducing advanced functional ingredients, and strong marketing focused on clinical validation and organic sourcing.

Fortified Baby Food Market Executive Summary

The global Fortified Baby Food Market is characterized by robust business trends centered on premiumization, sustainability, and technological integration, particularly in ingredient sourcing and supply chain validation. Manufacturers are increasingly focusing on clean label certifications and allergen-free formulations to capture the growing segment of discerning parents. Key industry movements include significant merger and acquisition activities aimed at consolidating market share and expanding geographical reach, particularly into high-growth Asian markets. Furthermore, the shift towards personalized nutrition solutions, leveraging data on individual infant needs, represents a pivotal business trend reshaping product development strategies across leading corporations.

Regional trends highlight dynamic growth disparities. Asia Pacific (APAC) currently dominates the market share, driven by large infant populations, rising middle-class disposable income, and increasing adoption of westernized feeding practices. North America and Europe, while mature, exhibit strong trends toward organic and plant-based fortified options, emphasizing transparency and ethical sourcing. Regulatory harmonization across various trade blocs is facilitating easier cross-border trade, though local regulatory frameworks—especially concerning formula marketing—continue to pose regional constraints. The Middle East and Africa (MEA) are emerging as high-potential regions due to governmental initiatives addressing malnutrition and rapidly improving retail infrastructure.

Segmentation trends indicate that fortified milk formula remains the largest segment by revenue, attributed to its necessity as a breast milk substitute. However, the fortified baby cereals and prepared meals segments are projected to record the highest growth rates, fueled by consumer demand for convenient weaning foods. Ingredient-wise, the fastest-growing segment is functional ingredients, specifically probiotics, prebiotics, and specialized fatty acids (DHA/ARA), reflecting parental priorities for gut health and cognitive development. Distribution channels are undergoing a transformation, with e-commerce witnessing accelerated expansion due offering unparalleled convenience and access to specialized niche products often unavailable in traditional retail settings.

AI Impact Analysis on Fortified Baby Food Market

Analysis of common user questions regarding AI's influence on the Fortified Baby Food Market reveals key themes revolving around safety assurance, personalized nutrition, and supply chain integrity. Users frequently ask: "How can AI prevent food contamination in baby food?" "Will AI allow for customizing formulas based on my baby's genetic needs?" and "Can AI improve the traceability of ingredients?" These questions highlight high consumer expectations that AI will enhance product safety standards far beyond current capabilities and provide highly individualized dietary recommendations. There is also significant interest in how AI tools can assist pediatricians and nutritionists in optimizing fortification levels and monitoring efficacy across diverse infant populations, ensuring regulatory compliance while simultaneously driving ingredient innovation and minimizing waste during production.

The application of Artificial Intelligence is revolutionizing multiple facets of the Fortified Baby Food supply chain and consumer interaction. In manufacturing, AI-powered predictive maintenance models minimize equipment downtime and reduce the risk of cross-contamination, ensuring higher purity standards. Furthermore, AI algorithms are crucial in analyzing vast datasets related to pediatric dietary intake and nutritional outcomes, allowing researchers to refine fortification mixes (e.g., optimizing iron absorption rates through complementary nutrient combinations) to maximize bioavailability and effectiveness. This data-driven approach moves the industry away from generalized formulas towards highly targeted, evidence-based nutritional solutions, enhancing both product quality and market responsiveness.

From a consumer engagement standpoint, AI is enabling sophisticated tools, such as mobile apps and chatbots, that offer personalized feeding schedules and product recommendations based on the infant's growth metrics, developmental milestones, and potential allergies. This level of customization, powered by machine learning, significantly elevates the customer experience and builds brand loyalty. Within the agricultural sourcing and logistics framework, AI contributes by analyzing weather patterns and crop yields to predict ingredient shortages or quality variations, thereby ensuring a stable supply of high-grade raw materials essential for maintaining the consistency and nutritional profile of fortified baby food products sold globally.

- AI-driven predictive quality control systems enhance food safety and purity levels.

- Machine learning algorithms enable the formulation of highly personalized nutritional profiles for infants.

- Optimized supply chain traceability through AI monitors ingredient origin and minimizes contamination risks.

- Enhanced consumer support via AI chatbots offering real-time feeding advice and product matching.

- Predictive analytics optimizes inventory and reduces food waste in production and distribution.

DRO & Impact Forces Of Fortified Baby Food Market

The dynamics of the Fortified Baby Food Market are profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. Key drivers include rising global awareness concerning the long-term cognitive benefits of early-life nutrition, coupled with increasing disposable incomes allowing parents to afford premium, fortified options. Restraints primarily involve stringent governmental regulations regarding product claims and labeling, which increase the complexity and cost of market entry, alongside persistent consumer preference for breastfeeding, which inherently limits the market for formula substitutes. Opportunities lie significantly in developing advanced functional ingredients, exploring niche segments such as organic and plant-based fortification, and expanding distribution channels in underserved emerging markets through digital platforms.

The Impact Forces determining market direction are generally high and multifaceted. The Threat of New Entrants remains moderate; while the profitability is attractive, the high capital requirement for R&D, compliance, and establishing consumer trust (a critical factor in baby care) acts as a substantial barrier. Supplier Power is moderate to high, particularly for specialized, patented functional ingredients (like certain probiotic strains or specialized oils) where sourcing can be limited, impacting manufacturing costs. Buyer Power is significant due to the high sensitivity of parents to price, quality, and brand reputation; consumers are highly informed and often rely on peer reviews and pediatric endorsements, compelling brands to maintain stringent quality control and competitive pricing structures.

The Threat of Substitutes is also moderate. While non-fortified conventional baby foods and homemade meals represent cost-effective substitutes, they often lack the guaranteed nutritional profile and convenience offered by scientifically fortified commercial products, limiting their competitive threat in the premium segment. Furthermore, the intensity of Competitive Rivalry within the fortified baby food sector is extremely high, dominated by a few multinational giants (Nestlé, Danone, Abbott) who aggressively invest in marketing, clinical trials, and rapid product innovation, constantly vying for shelf space and consumer loyalty, thus exerting constant downward pressure on pricing and upward pressure on quality standards across the industry value chain.

Segmentation Analysis

The Fortified Baby Food Market is comprehensively segmented based on product type, specific functional ingredients utilized in fortification, and the distribution channels through which these products reach the end consumer. This detailed segmentation allows manufacturers to target specific demographic and geographic consumer needs, enabling specialized product development and optimized marketing strategies. The analysis highlights the dominance of fortified formula due to its essential nature for non-breastfed infants, while simultaneously pointing to the rapid diversification into weaning foods enriched with functional components to support holistic infant development beyond basic caloric requirements.

- Product Type:

- Fortified Milk Formula (Standard, Specialty, Follow-on)

- Fortified Baby Cereals

- Fortified Prepared Baby Food (Purees, Pouches, Meals)

- Fortified Baby Snacks and Drinks

- Ingredient Type:

- Vitamins (A, B complex, C, D, E)

- Minerals (Iron, Zinc, Calcium)

- Functional Ingredients (Probiotics, Prebiotics, DHA/ARA)

- Proteins and Amino Acids

- Distribution Channel:

- Supermarkets and Hypermarkets (Mass Retail)

- Pharmacies and Drug Stores

- Convenience Stores

- Online Retail (E-commerce)

- Source/Origin:

- Organic

- Conventional

Value Chain Analysis For Fortified Baby Food Market

The value chain for the Fortified Baby Food Market is characterized by highly specialized and regulated steps, beginning with the meticulous sourcing of raw materials. Upstream analysis involves obtaining high-quality dairy ingredients (for formula), grains, fruits, and vegetables, often requiring specific certification (e.g., organic or non-GMO) and extensive testing for contaminants like heavy metals and pesticides, which is particularly critical given the vulnerability of the target consumer group. This stage also includes the procurement and synthesis of highly purified, specialized fortification ingredients such as microbial cultures (probiotics) and essential fatty acids (DHA), which are often proprietary and high-cost inputs, exerting considerable influence on overall production expenditure.

The middle segment of the value chain involves complex manufacturing processes, including blending, sterilization, pasteurization, and aseptic packaging, all conducted under extremely strict regulatory environments such as HACCP and ISO standards specific to infant products. Extensive investment in R&D and clinical trials is necessary here to validate nutritional claims and ensure ingredient stability throughout the product lifecycle. Downstream analysis focuses on effective distribution and retailing. Products require specialized handling (temperature control) and efficient inventory management due to shelf-life constraints and continuous demand patterns. Effective branding and detailed, compliant labeling are paramount for consumer trust and regulatory adherence in diverse international markets.

Distribution channels are categorized into direct and indirect methods. Direct distribution, although limited, may involve specialized pediatric clinics or proprietary online brand stores offering subscription models. The bulk of sales occurs through indirect channels, predominantly large supermarkets and hypermarkets (mass retail), which offer visibility and volume, and pharmacies/drug stores, which lend an aura of medical endorsement and trust. The e-commerce channel has rapidly gained prominence, facilitating direct-to-consumer relationships and enabling the efficient distribution of niche, specialty fortified products to geographically dispersed consumers, often bypassing traditional retail bottlenecks and providing personalized purchasing experiences.

Fortified Baby Food Market Potential Customers

The primary end-users and buyers of fortified baby food products are parents and legal guardians, generally falling within the demographic of 25 to 45 years old, with middle to high disposable income, who prioritize convenience and scientifically supported nutritional outcomes for their infants (0-36 months). This core group includes working parents seeking quick, reliable, and nutrient-dense feeding solutions, as well as highly educated millennials who are adept at researching ingredients and seeking out functional health benefits beyond basic caloric intake, often favoring brands with transparent sourcing and clean label attributes. The rapid shift toward nuclear family structures and reduced reliance on extended family for infant care further amplifies the need for packaged, easy-to-prepare options.

A significant secondary customer segment includes institutional buyers such as hospitals, neonatal units, and government feeding programs in regions focused on combating malnutrition and stunting. These entities often purchase specialized, fortified formulas designed for premature infants or those with specific metabolic conditions (specialty formulas), requiring high-volume contracts and stringent quality assurance. Furthermore, these products are increasingly utilized by caregivers in daycare centers and early learning facilities, demanding safe and easy-to-administer fortified meals and snacks that adhere to strict pediatric dietary guidelines established by health authorities.

Geographically, potential customers are concentrated in urban and peri-urban areas globally, where retail access is high and parents face time constraints. However, emerging markets, particularly in Asia and Latin America, represent the fastest-growing customer base. In these regions, the burgeoning middle class is rapidly shifting away from traditional feeding methods towards premium, scientifically backed fortified products, viewing them as essential investments in their child's health and future cognitive potential. Targeted marketing must address regional dietary norms and emphasize the specific micronutrients most deficient in local populations, such as iron and Vitamin A in developing countries, or Vitamin D in regions with limited sun exposure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 34.5 Billion USD |

| Market Forecast in 2033 | 56.7 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé, Danone, Abbott Laboratories, Reckitt Benckiser Group plc, HiPP GmbH & Co. Vertrieb KG, The Kraft Heinz Company (Gerber), Bellamy’s Organic, FrieslandCampina N.V., Perrigo Company plc, Beingmate Baby & Child Food Co., Ltd., Yili Group, Mead Johnson Nutrition (Reckitt), Biostime (Health and Happiness), Ausnutria Dairy Corporation Ltd., Kewpie Corporation, Hero Group, Inner Mongolia Junlebao Dairy Co., Arla Foods amba. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fortified Baby Food Market Key Technology Landscape

The manufacturing of fortified baby food relies heavily on advanced food processing and preservation technologies designed to maintain nutrient integrity and ensure microbial safety. Key technologies include Ultra-High-Temperature (UHT) processing and aseptic packaging, particularly critical for milk formulas and prepared pouches, which guarantees sterility while minimizing thermal damage to heat-sensitive vitamins and functional components like DHA and probiotics. Specialized microencapsulation techniques are increasingly being deployed. This process involves coating sensitive ingredients to protect them from degradation during processing and storage, thereby ensuring that the full nutritional benefit is delivered to the infant upon consumption and enhancing the shelf stability of highly reactive nutrients such as iron.

In the realm of ingredient innovation, fermentation technology is becoming pivotal for producing bio-active compounds and next-generation ingredients, such as specialized human milk oligosaccharides (HMOs) which mimic components found in breast milk. Furthermore, analytical technologies like High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) are essential for rigorous quality control, providing accurate and rapid testing of raw materials and finished products for contaminants, toxins, and precise nutrient levels, meeting the incredibly high safety thresholds mandated for pediatric nutrition. The deployment of robotics and automation in the packaging and quality assurance lines further reduces the risk of human error and contamination.

Digital technologies are also transforming the formulation and supply chain management. Advanced Enterprise Resource Planning (ERP) systems track every batch, allowing for granular traceability from farm to fork, which is crucial for handling rapid product recalls or managing safety alerts. Moreover, technologies related to sustainable packaging, such as bio-degradable or recyclable materials, are being integrated to address growing consumer demand for environmentally responsible products, forcing manufacturers to invest in new material science and filling equipment compatible with these sustainable alternatives while maintaining required barrier properties against moisture and oxygen.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, primarily driven by substantial population size, increasing urbanization, and the rapid growth of the middle-class segment in China, India, and Southeast Asia. The region exhibits a strong cultural preference for fortified milk formula, supported by rising consumer trust in international brands. Regulatory frameworks are rapidly evolving to align with global standards, yet localized marketing strategies are essential to address diverse regional nutritional needs and cultural feeding habits.

- North America: Characterized by high consumer expenditure on premium products, North America shows strong demand for organic, non-GMO, and plant-based fortified options. Innovation focuses heavily on specialized products addressing allergies, reflux, and digestive issues. The market is mature but exhibits steady growth fueled by the continuous introduction of functional ingredients like high levels of DHA and targeted probiotic strains, heavily influenced by pediatrician recommendations and health trends.

- Europe: Europe represents a highly regulated but stable market, particularly in Western countries like Germany, France, and the UK. Strict EU regulations regarding ingredient sourcing and permissible nutritional claims shape the competitive landscape. The market trend emphasizes clean-label products, locally sourced ingredients, and sustainable packaging, with companies like HiPP leading the way in organic fortified offerings and emphasizing eco-friendly production methods.

- Latin America (LATAM): Growth in LATAM is attributed to economic recovery, improvements in healthcare access, and government initiatives aimed at reducing infant mortality and malnutrition, particularly in Brazil and Mexico. The market is price-sensitive, balancing the need for fortification with affordability. Manufacturers often focus on fortifying basic staple baby foods with essential minerals like iron and zinc to address widespread deficiencies.

- Middle East and Africa (MEA): This region is highly dependent on imports for fortified baby food, especially specialized formulas. Market growth is substantial due to high birth rates, increasing health expenditure, and governmental focus on improving infant nutrition outcomes. Regulatory differences between the Middle Eastern nations and various African countries necessitate tailored market entry strategies, with major opportunities existing in the expansion of organized retail infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fortified Baby Food Market.- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Reckitt Benckiser Group plc

- HiPP GmbH & Co. Vertrieb KG

- The Kraft Heinz Company (Gerber)

- Bellamy’s Organic

- FrieslandCampina N.V.

- Perrigo Company plc

- Beingmate Baby & Child Food Co., Ltd.

- Yili Group

- Mead Johnson Nutrition (Reckitt)

- Biostime (Health and Happiness)

- Ausnutria Dairy Corporation Ltd.

- Kewpie Corporation

- Hero Group

- Inner Mongolia Junlebao Dairy Co., Ltd.

- Arla Foods amba

- Sichuan New Hope Dairy Co., Ltd.

- Royal Ahold Delhaize N.V. (Private Label Fortification)

Frequently Asked Questions

Analyze common user questions about the Fortified Baby Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of fortified baby food over homemade options?

Fortified baby food ensures precise, balanced delivery of essential micronutrients (like iron, zinc, and specific vitamins) at clinically recommended levels, offering consistency and addressing known nutritional deficiencies, which can be challenging to achieve accurately through standard homemade preparation.

Which ingredients are typically used for fortification in baby food?

Key fortification ingredients include essential minerals such as iron, calcium, and zinc; major vitamins like D, A, and C; and functional components designed for cognitive and gut health, particularly DHA/ARA fatty acids, prebiotics, and specific probiotic strains (e.g., Bifidobacterium).

How does the e-commerce channel influence the purchase of fortified baby food?

E-commerce significantly enhances market accessibility, particularly for specialty and organic fortified products. It provides convenience, subscription options, detailed product information, and allows parents to easily compare niche brands and specialized formulations unavailable in local physical retail stores.

What is the projected growth rate (CAGR) for the Fortified Baby Food Market?

The Fortified Baby Food Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period from 2026 to 2033, driven by increasing health awareness and demand for premium pediatric nutrition solutions globally.

What role does regulation play in the development of new fortified baby food products?

Regulations impose strict limits on ingredients, labeling, and permissible health claims, ensuring product safety and preventing misleading marketing. This high level of regulatory scrutiny necessitates extensive R&D, clinical validation, and rigorous quality control before new fortified products can enter the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager