Four Way Reversing Valve Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443140 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Four Way Reversing Valve Market Size

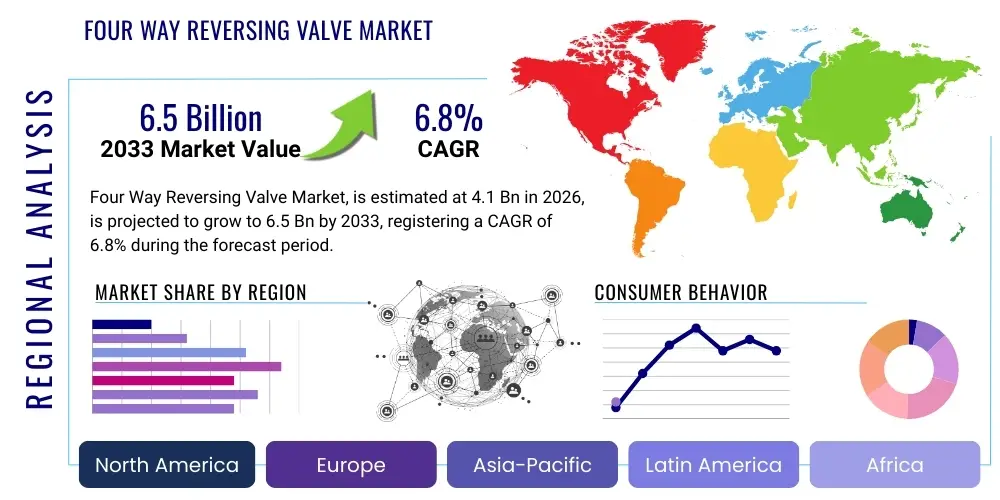

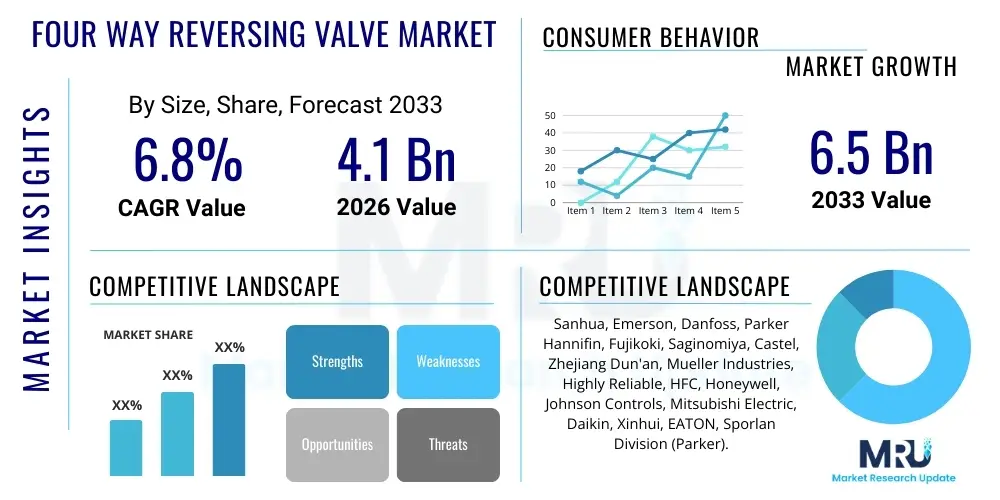

The Four Way Reversing Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Four Way Reversing Valve Market introduction

The Four Way Reversing Valve Market is central to the functionality of modern HVAC and refrigeration systems, specifically heat pumps and reversible air conditioners. These electromechanical components are essential for switching the flow direction of the refrigerant, thereby enabling the system to alternate between cooling and heating modes. This unique capability transforms a standard refrigeration cycle into a highly efficient, dual-mode climate control solution, making the valve a non-negotiable component in sustainable building technologies. Market growth is intrinsically linked to global mandates for energy efficiency, the accelerating adoption of heat pumps as substitutes for traditional fossil fuel-based heating systems, and continuous innovations in refrigerant technology requiring compatible valve designs.

Four-way reversing valves, often simply termed reversing valves, are typically utilized in residential, commercial, and industrial settings where precise temperature and climate control are paramount. Major applications include residential air conditioning units, commercial rooftop systems, variable refrigerant flow (VRF) systems, and specialized industrial chillers designed for dual-mode operation. The primary benefit derived from these valves is the enhanced versatility and energy efficiency of HVAC systems, allowing a single unit to provide comfort year-round regardless of seasonal changes. Furthermore, the increasing demand for high-efficiency and silent operation drives technological advancements in valve design, leading to the development of quieter, faster-switching, and more reliable components.

Driving factors for this market include rapid urbanization and the subsequent construction boom, particularly in the Asia Pacific region, coupled with stringent environmental regulations, such as the F-Gas regulation in Europe and similar mandates in North America, which favor highly efficient heat pump technologies. The ongoing transition toward low Global Warming Potential (GWP) refrigerants necessitates corresponding adjustments in valve materials and sealing mechanisms to ensure compatibility and system longevity. These infrastructural and regulatory forces collectively reinforce the sustained expansion and technological maturation of the Four Way Reversing Valve Market, positioning it as a critical element in the global shift towards electrified heating and cooling.

Four Way Reversing Valve Market Executive Summary

The Four Way Reversing Valve Market exhibits robust expansion driven by converging business trends centered on energy efficiency and climate policy compliance. Key business trends indicate a strong shift toward digitalization in manufacturing processes, emphasizing improved reliability, reduced maintenance cycles, and the integration of smart features within the valves themselves, allowing for remote monitoring and predictive maintenance. Strategic partnerships between valve manufacturers and original equipment manufacturers (OEMs) of heat pump systems are crucial for ensuring design compatibility and securing large-volume contracts. Market competition is intensifying, focusing not just on cost, but on critical performance metrics such as pressure drop, switching time, and operational lifespan under varied refrigerant conditions.

Regionally, the market is spearheaded by the Asia Pacific (APAC), primarily due to massive construction activity and escalating adoption of residential air conditioning and heat pump systems in countries like China and India. Europe shows exceptionally high growth rates driven by ambitious decarbonization goals and governmental subsidies promoting the rapid installation of heat pumps to replace gas boilers. North America remains a mature, yet steadily growing, market, characterized by large commercial HVAC installations and a preference for high-capacity, durable reversing valves. The regional trends highlight varied regulatory environments and consumer preferences, requiring manufacturers to tailor product specifications accordingly, particularly regarding capacity ranges and refrigerant compatibility (e.g., R32 vs. R410A phase-outs).

Segmentation analysis reveals that the Heat Pump application segment dominates the market share, reflecting the global trend toward electrification of heating. By type, solenoid-operated valves hold the largest share due to their cost-effectiveness and proven reliability in standard applications, though demand for high-capacity, high-efficiency hydraulic valves is rising in large commercial and industrial systems. The residential end-user segment continues to be the primary volume driver, while the commercial segment offers higher average selling prices (ASPs) due to the necessity for larger, more complex valve configurations. Future growth is expected to concentrate on compact, modular designs that facilitate easier integration into increasingly smaller and sleeker heat pump units, ensuring sustained relevance across all major segments.

AI Impact Analysis on Four Way Reversing Valve Market

User questions regarding the impact of Artificial Intelligence (AI) on the Four Way Reversing Valve Market frequently revolve around three core themes: How AI can optimize the manufacturing process for better quality control, the integration of AI-enabled diagnostics into HVAC systems utilizing these valves, and the potential for AI algorithms to manage and predict valve failure in the field. Users are seeking assurances that AI integration will lead to a reduction in manufacturing defects, enhance operational efficiency by minimizing unnecessary switching cycles, and fundamentally improve the reliability and longevity of heat pump systems where these valves are critical failure points. The primary expectation is that AI will transform the component from a purely mechanical device into a ‘smart’ asset capable of contributing data to holistic building energy management systems (BEMS).

- AI-driven Predictive Maintenance: Utilizing sensor data from the valve and surrounding system components (pressure, temperature, cycling rate) to predict potential mechanical failures before they occur, drastically reducing downtime in commercial applications.

- Manufacturing Quality Control: Implementing computer vision and machine learning models on the assembly line to instantly detect microscopic flaws in welds, seals, and component alignment, ensuring zero-defect output.

- Optimized System Control: AI algorithms managing the heat pump cycle dynamically, determining the optimal moment for the four-way valve to switch directions based on immediate load demands and external conditions, maximizing energy efficiency (AEO/GEO optimization).

- Supply Chain Resilience: Machine learning models predicting fluctuations in demand for specific valve types (e.g., R32 compliant) and optimizing inventory and raw material procurement, mitigating supply disruptions.

- Design Simulation and Iteration: AI assisting in computational fluid dynamics (CFD) and thermal analysis during the R&D phase to simulate performance under extreme conditions, accelerating the development of next-generation, low-pressure-drop valves.

DRO & Impact Forces Of Four Way Reversing Valve Market

The Four Way Reversing Valve Market is profoundly influenced by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and Impact Forces. The primary driver remains the global surge in demand for highly efficient heat pumps, underpinned by favorable governmental policies and subsidies promoting electrification over fossil fuels. Simultaneously, stringent energy efficiency standards imposed globally necessitate the use of optimized components like high-performance reversing valves to meet minimum seasonal efficiency ratings. Restraints primarily involve the volatility in raw material prices, particularly copper and steel, which directly impacts manufacturing costs, alongside the technical challenge posed by the ongoing transition to flammable, low-GWP refrigerants (e.g., R290), demanding specialized, highly reliable explosion-proof valve designs and materials.

Opportunities for market expansion are abundant, particularly in emerging markets where penetration of centralized HVAC systems is increasing, and in the retrofitting segment of developed economies replacing older, inefficient HVAC units. Furthermore, the miniaturization trend in HVAC systems opens up opportunities for manufacturers to develop highly compact and lightweight valves suitable for modular and residential applications. The development of intelligent valves that integrate seamlessly with IoT platforms for enhanced diagnostics and performance monitoring represents a significant avenue for value addition and market differentiation, moving the product beyond a simple mechanical function.

The key Impact Forces shaping the competitive landscape include technological obsolescence pressure, driven by the shift towards variable speed compressors and advanced system architectures (VRF/VRV), which require valves capable of handling broader pressure ranges and more frequent cycling. Secondly, regulatory pressure regarding refrigerant handling and energy consumption mandates continuous innovation in sealing technology and flow path optimization. Lastly, the macroeconomic force of global supply chain instability, exacerbated by geopolitical events, necessitates geographical diversification of manufacturing bases and robust inventory management strategies to maintain continuity of supply for OEMs globally, ultimately dictating market responsiveness and pricing dynamics.

Segmentation Analysis

The comprehensive segmentation of the Four Way Reversing Valve Market offers granular insights into key revenue streams and operational niches. The market is primarily divided based on the valve Type (Solenoid Operated, Hydraulic Operated), the Application area (Heat Pumps, Air Conditioners, Refrigeration Units), and the End-User sector (Residential, Commercial, Industrial). This structure allows stakeholders to precisely identify high-growth segments driven by specific technological needs or regulatory mandates, such as the accelerating demand for high-capacity hydraulic valves in large commercial chillers or the volume growth of solenoid valves in the mass-market residential heat pump segment.

- By Type: Solenoid Operated, Hydraulic Operated

- By Application: Residential Heat Pumps, Commercial Heat Pumps, Central Air Conditioning Units, Automotive HVAC, Industrial Refrigeration Systems

- By End-User: Residential, Commercial (Office Buildings, Retail, Healthcare), Industrial (Manufacturing, Cold Storage)

- By Refrigerant Type: R410A, R32, R290 (Propane), R600a, Others (Low GWP Blends)

- By Capacity: Low Capacity (Up to 3 Tons), Medium Capacity (3 to 10 Tons), High Capacity (Above 10 Tons)

Value Chain Analysis For Four Way Reversing Valve Market

The value chain for the Four Way Reversing Valve Market commences with upstream activities involving the sourcing of specialized raw materials, primarily high-grade copper, stainless steel alloys, and high-performance engineering plastics for seals and coils. Key upstream suppliers include metal refiners and specialized component manufacturers for solenoid coils and magnetic materials. Successful upstream management is crucial, as the quality and volatility of these raw materials directly influence the valve’s durability, performance under pressure, and final manufacturing cost. Manufacturers often seek dual-sourcing strategies and long-term contracts to mitigate risk associated with commodity price fluctuations, prioritizing suppliers that adhere to strict quality certifications (e.g., RoHS compliance).

The core manufacturing and assembly phase involves complex processes such as precision machining, specialized brazing, rigorous leak testing, and automated assembly of internal components. Leading manufacturers heavily invest in vertical integration, controlling the production of critical components like the solenoid coil and the main valve body to ensure stringent quality control and proprietary design protection. Distribution channels are varied, encompassing direct sales to major HVAC Original Equipment Manufacturers (OEMs), indirect sales through specialized HVAC component distributors and wholesalers, and increasingly, online B2B platforms for aftermarket service parts. The reliance on established global distributors is high, especially for reaching diverse maintenance, repair, and overhaul (MRO) markets.

Downstream activities center on the integration of the valve into final HVAC or refrigeration units by OEMs, followed by installation, commissioning, and subsequent aftermarket service. The direct channel (OEM sales) accounts for the vast majority of volume, driven by long-term supply agreements. The indirect channel, consisting of independent technicians and MRO providers, focuses on replacement and repair services. Effective downstream support requires manufacturers to provide detailed technical documentation, rapid spare parts availability, and specialized training for installers to ensure correct installation and optimal system performance, thereby influencing customer loyalty and brand perception in the highly competitive commercial HVAC sector.

Four Way Reversing Valve Market Potential Customers

The primary consumers and end-users of four-way reversing valves are the global manufacturers of heat pumps, reversible air conditioners, and related climate control systems. These Original Equipment Manufacturers (OEMs) represent the highest volume buyers, integrating the valves directly into their production lines for both residential and commercial units. Companies specializing in residential HVAC systems (e.g., Daikin, Mitsubishi Electric, Carrier) demand high-reliability, mass-produced valves optimized for R32 and R410A refrigerants, often prioritizing cost-efficiency and compactness. Conversely, OEMs focusing on commercial and industrial refrigeration (e.g., Johnson Controls, Trane, specialized chiller manufacturers) require high-capacity, heavy-duty valves capable of enduring high-pressure ratios and continuous operation in demanding environments.

Secondary potential customers include specialized contractors and distributors involved in the installation and maintenance of HVAC systems. These entities purchase valves for replacement purposes (MRO market). The MRO segment is characterized by demand for compatibility with legacy systems and rapid availability of parts, driving the need for strong distributor networks. Furthermore, emerging customers include specialized manufacturers focusing on sustainable and niche applications, such as geothermal heat pumps, small-scale refrigeration transport units, and automotive climate control systems, each demanding tailored valve specifications, focusing on robustness and specific capacity ratings required by the application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanhua, Emerson, Danfoss, Parker Hannifin, Fujikoki, Saginomiya, Castel, Zhejiang Dun'an, Mueller Industries, Highly Reliable, HFC, Honeywell, Johnson Controls, Mitsubishi Electric, Daikin, Xinhui, EATON, Sporlan Division (Parker). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Four Way Reversing Valve Market Key Technology Landscape

The core technology surrounding the Four Way Reversing Valve remains the precise control of refrigerant flow direction using an electromagnetic solenoid or hydraulic pressure to shift a slide mechanism within the valve body. Current technological innovation is focused less on the fundamental mechanism and more on optimizing operational efficiency, compatibility with new refrigerants, and longevity. A crucial development involves specialized valve designs optimized for high-pressure refrigerants like R32, necessitating reinforced body materials and enhanced sealing capabilities to prevent leakage and ensure system safety. Furthermore, manufacturers are employing advanced acoustic dampening materials and improved magnetic circuits to achieve quieter operation, which is critical for residential heat pump applications.

Another significant technological focus is the integration of Variable Refrigerant Flow (VRF) and Variable Speed Drive (VSD) compatibility. As systems cycle more frequently and operate under a wider range of pressure conditions, reversing valves must demonstrate exceptional durability and consistent performance across highly dynamic operating envelopes. This requires sophisticated material science, particularly for the internal components like the slider and main body connections, often utilizing proprietary low-friction coatings and specialized brazing techniques. The aim is to minimize pressure drop across the valve, thereby maximizing the overall efficiency of the heat pump system, a key metric for competitive differentiation in the global market.

The emerging technological trend involves the development of 'smart' reversing valves, incorporating integrated sensors for monitoring operational parameters such as coil temperature, switching frequency, and potential flow restriction. This technological advancement facilitates real-time diagnostics and enables predictive maintenance capabilities when integrated into centralized building management systems (BMS). Moreover, manufacturers are exploring digital valve actuation and advanced proportional control mechanisms, moving beyond simple ON/OFF solenoid control to offer fine-tuned flow regulation, though these proportional valves are currently higher cost and primarily restricted to specialized, high-precision applications within the industrial segment.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by massive urbanization, rising disposable incomes, and extreme weather conditions fueling high demand for air conditioning and heat pumps, particularly in China, Japan, and India. Governmental incentives promoting energy-efficient cooling solutions further accelerate the adoption of four-way reversing valves in high-volume, residential HVAC manufacturing.

- Europe: This region exhibits robust, policy-driven growth. The European Union's ambitious decarbonization targets and the phasing out of traditional gas boilers under directives like the F-Gas regulation mandate the transition to heat pumps, creating exceptionally high demand for reversing valves, especially those compatible with low-GWP refrigerants like R290 (propane).

- North America: A mature market characterized by stringent quality standards and a high prevalence of large-scale commercial HVAC systems. Demand is stable, driven by replacement cycles and the increasing incorporation of high-efficiency geothermal and air-source heat pumps, leading to strong demand for high-capacity and extremely durable reversing valves.

- Latin America (LATAM): Growth in LATAM is concentrated in key markets like Brazil and Mexico, fueled by construction expansion and increasing consumer adoption of mid-range air conditioning units. Market growth is sensitive to economic volatility but shows long-term potential due to climate patterns demanding year-round cooling.

- Middle East and Africa (MEA): This region is dominated by cooling needs, driving demand for robust and reliable air conditioning units. The development of large infrastructural projects and smart cities, particularly in the GCC countries, contributes to steady growth in commercial applications, requiring durable valves capable of handling high ambient temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Four Way Reversing Valve Market.- Sanhua Holding Group Co., Ltd.

- Emerson Electric Co. (Sporlan Division)

- Danfoss A/S

- Parker Hannifin Corporation

- Fujikoki Corporation

- Saginomiya Seisakusho, Inc.

- Castel S.p.A.

- Zhejiang Dun'an Artificial Environment Co., Ltd.

- Mueller Industries, Inc.

- Highly Reliable Electric Co., Ltd.

- Honeywell International Inc.

- Johnson Controls International plc

- Mitsubishi Electric Corporation (HVAC Components)

- Daikin Industries, Ltd. (Component Division)

- Xinhui Electric Co., Ltd.

- EATON Corporation

- Ranco (A global brand offering HVAC controls)

- Aalborg Instruments and Controls, Inc.

Frequently Asked Questions

Analyze common user questions about the Four Way Reversing Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Four Way Reversing Valve in HVAC systems?

The primary function is to redirect the flow of refrigerant within a heat pump or reversible air conditioner, allowing the system to switch seamlessly between heating mode (rejecting heat indoors) and cooling mode (absorbing heat indoors) using the same core components.

Which factors are driving the major growth in the Reversing Valve Market?

Key drivers include stringent global energy efficiency standards, substantial governmental incentives for heat pump adoption as a renewable heating source, and the rapid expansion of residential and commercial construction, particularly across Asia Pacific and Europe.

How does the transition to R32 and R290 refrigerants impact valve manufacturing?

The transition necessitates enhanced material compatibility and robust sealing technologies to handle the higher operating pressures of R32 and the increased safety requirements (due to flammability) associated with natural refrigerants like R290, driving up manufacturing precision.

What is the expected CAGR for the Four Way Reversing Valve Market through 2033?

The market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by sustained global demand for high-efficiency climate control solutions and the mandated phase-out of conventional heating systems.

What distinguishes Solenoid Operated valves from Hydraulic Operated valves?

Solenoid valves use an electromagnetic coil for actuation and are common in low-to-medium capacity residential units due to their cost-effectiveness, while Hydraulic valves use pressure differentials for smoother, higher-capacity shifting, favored in large commercial and industrial systems.

Competitive Landscape Analysis and Strategic Benchmarking

The Four Way Reversing Valve Market is characterized by a moderate level of consolidation, with a few large multinational corporations dominating the high-end, technologically advanced segment, while a significant number of specialized regional players, particularly in China and Southeast Asia, compete fiercely in the high-volume, cost-sensitive residential segment. Competitive differentiation is primarily achieved through product reliability, superior pressure handling capabilities, and adherence to various international certifications (e.g., UL, CE, CCC). Key strategic initiatives observed among market leaders include aggressive investment in automation to improve manufacturing precision and reduce unit costs, alongside continuous product development focused on miniaturization and weight reduction without compromising flow characteristics.

Strategic benchmarking reveals that manufacturers such as Sanhua and Danfoss prioritize global distribution networks and deep integration with major HVAC OEMs, offering standardized products globally while maintaining high-quality consistency. Smaller, specialized firms often focus on niche markets, such as valves optimized exclusively for specific low-GWP refrigerants (R290, R600a) or applications requiring extreme temperature resilience. Mergers and acquisitions remain a consistent feature of the landscape, often serving as a mechanism for large players to acquire specialized technology or expand geographical footprint, particularly into emerging manufacturing hubs in Southeast Asia. Pricing strategy is highly critical; while quality dictates price in the commercial segment, the residential market demands exceptional efficiency balanced with aggressive cost optimization.

Furthermore, intellectual property protection, particularly related to the design of the slider mechanism and the solenoid coil efficiency, constitutes a vital competitive barrier. Companies are increasingly seeking collaborative efforts with academic institutions and HVAC system developers to ensure that their valves are optimized for next-generation system architectures, such as advanced VRF systems requiring rapid and precise pressure modulation. The ability to supply a diverse product portfolio that covers a wide capacity range, from small residential units to large commercial chillers, provides a significant advantage, ensuring market resilience across diverse economic cycles and regulatory shifts. Compliance with evolving environmental regulations is now a prerequisite for market entry rather than a differentiator.

Detailed Analysis of Market Drivers

The foremost driver accelerating the growth of the Four Way Reversing Valve Market is the paradigm shift towards electrification in heating infrastructure worldwide, largely spearheaded by policy actions. Governments across major economies, particularly in Europe and North America, are actively legislating against the installation of new gas and oil boilers and providing substantial fiscal incentives, subsidies, and tax credits for the purchase and installation of highly efficient heat pump systems. Since the four-way reversing valve is indispensable for the dual heating and cooling function of an air-source or ground-source heat pump, this regulatory and financial impetus translates directly into exponential demand for these components. The drive for energy independence, particularly highlighted by geopolitical instability, further strengthens the case for domestically sourced, electric heating solutions, cementing the valve's position as a critical component.

A secondary, equally powerful driver is the global tightening of energy efficiency standards and building codes. Institutions like the EPA (USA) and the European Commission are continuously elevating Minimum Energy Performance Standards (MEPS) for HVAC equipment. Modern heat pumps must achieve higher Seasonal Energy Efficiency Ratio (SEER) and Heating Seasonal Performance Factor (HSPF) ratings, which places pressure on manufacturers to minimize energy losses in every component. Reversing valve manufacturers respond by engineering valves with minimal pressure drop and reduced internal friction, utilizing advanced simulation tools to optimize flow paths. This technological arms race, necessitated by regulation, ensures a constant stream of demand for premium, high-efficiency reversing valves that can handle increasingly complex system requirements without sacrificing thermodynamic performance.

Moreover, the rapid expansion of the construction sector in emerging economies, particularly across Southeast Asia and Latin America, contributes significantly to market volume. As urbanization rates soar and middle-class consumption increases, the installation of comfort cooling systems becomes standard practice in both residential and commercial buildings. While many initial installations may be basic air conditioners, the trend quickly moves towards reversible units (heat pumps) due to their versatility and better long-term cost of ownership, especially in regions experiencing both hot summers and cool winters. This inherent growth in the installed base guarantees robust, sustained OEM demand for reversing valves, ensuring market stability irrespective of temporary fluctuations in developed economies.

Detailed Analysis of Market Restraints

One of the most persistent restraints affecting the profitability and stability of the Four Way Reversing Valve Market is the severe volatility and high cost of critical raw materials, most notably copper and copper alloys, which are essential for the valve body, internal piping, and the solenoid coil windings. Fluctuations in global commodity markets, often exacerbated by international trade disputes and mining capacity constraints, lead to unpredictable cost structures for valve manufacturers. Since these valves are high-volume components sold into competitive OEM supply chains, manufacturers often face immense pressure to absorb these material cost increases rather than passing them entirely to the equipment builders, thereby squeezing profit margins, particularly for standardized products where differentiation is low.

A second major technical restraint involves the challenging transition toward environmentally friendly, low Global Warming Potential (GWP) refrigerants, such as R32 (mildly flammable) and R290 (highly flammable propane). These new refrigerants often operate at significantly higher system pressures than legacy refrigerants like R410A, requiring fundamental redesigns of the valve body and internal sealing mechanisms to ensure absolute integrity and prevent dangerous leaks. Furthermore, dealing with flammable refrigerants necessitates explosion-proof design considerations for the solenoid coil and hermetic sealing techniques, which increases complexity and manufacturing cost. The certification and testing processes for these new refrigerant-specific valves are lengthy and expensive, potentially slowing down the speed-to-market for innovative valve solutions and restraining immediate market adoption.

Finally, the threat of product substitution or technological disruption, while currently marginal, poses a long-term restraint. Although the four-way reversing valve is currently essential for dual-mode systems, continuous research into highly sophisticated, multi-circuit refrigeration systems or alternative heating technologies (e.g., advanced resistance heating or magnetic heat pumps) could potentially bypass the need for a mechanical reversing valve in certain high-end applications. While not an immediate threat, manufacturers must continually invest in R&D to maintain the relevance and cost-effectiveness of the valve compared to potential future system alternatives. Furthermore, reliability concerns, stemming from the fact that the reversing valve is often cited as a critical failure point in heat pumps, necessitates over-engineering, which can impact cost competitiveness.

Detailed Analysis of Market Opportunities

A significant opportunity for market expansion lies in the burgeoning smart HVAC and Internet of Things (IoT) ecosystem. As building automation systems (BAS) become standard in commercial and high-end residential construction, there is an increasing demand for 'smart' components. Reversing valve manufacturers can capitalize on this by integrating sensor technology into their products, allowing for the transmission of diagnostic data (e.g., cycling frequency, time elapsed between switches, temperature readings) directly to the central management system. This capability enables predictive maintenance, reduces operational costs for end-users, and positions the valve as an intelligent component contributing to overall energy optimization, thereby justifying higher average selling prices (ASPs).

The massive retrofitting and replacement market across developed economies presents a lucrative, sustained opportunity. Many established buildings in North America and Europe rely on aging HVAC infrastructure utilizing older refrigerant types (like R22 or R410A) and less efficient heat pumps. As these units reach the end of their operational lifespan, or as regulations mandate the replacement of high-GWP refrigerants, a substantial volume of replacement and upgrade work is generated. Manufacturers who can supply compatible, highly efficient valves for these retrofitting projects, especially those designed for drop-in low-GWP refrigerants, stand to gain significant market share beyond the new construction cycle. This segment requires robust supply chain management tailored to the MRO channel, rather than just OEM contracts.

Furthermore, the opportunity for innovation in specialized applications, particularly in sustainable transportation and thermal management, is growing. The electrification of vehicles (EVs) requires highly sophisticated thermal management systems that often rely on heat pump cycles for cabin heating and battery cooling. This niche demands extremely compact, lightweight, and vibration-resistant four-way reversing valves, requiring precision engineering and specialized manufacturing processes. Similarly, the cold chain logistics industry, focusing on sustainable refrigeration for food and pharmaceuticals, represents a growth vector for robust, small-capacity valves. Tapping into these non-traditional HVAC segments allows manufacturers to diversify revenue streams and capitalize on rapid technological transitions occurring outside of traditional building climate control.

Regional Deep Dive: Growth Strategies and Market Characteristics

The Asia Pacific market, particularly Mainland China, serves as the global manufacturing hub and the largest consumer of four-way reversing valves. Market characteristics here include high volume production, aggressive pricing competition, and intense focus on domestic OEM supply chains. Key growth strategies for multinational corporations in APAC involve establishing localized R&D centers to quickly adapt products to local climate demands and regulatory shifts (e.g., specific Chinese refrigerant standards). The enormous installed base of residential air conditioning units ensures continuous demand, but the market heavily favors cost leadership, pushing manufacturers to leverage extensive vertical integration and highly automated factories to maintain competitiveness.

In Europe, the market dynamics are driven almost entirely by legislative urgency and consumer preference for sustainability. Growth strategies revolve around rapidly transitioning product lines to be fully compliant with flammable, low-GWP refrigerants (R290) and focusing on valves optimized for exceptionally high Coefficient of Performance (COP) heat pump systems. European manufacturers and distributors prioritize high reliability and long warranties, positioning their products as premium components essential for achieving mandated efficiency targets. Strategic partnerships are often formed with installers and system integrators to provide detailed technical training, ensuring correct application and boosting brand trust within this rapidly evolving regulatory landscape.

North America requires a strategy focused on durability, large capacity, and technical compliance, particularly with codes such as ASHRAE and UL standards. The commercial sector dominates the high-value segment, demanding valves capable of continuous operation in heavy-duty environments. Manufacturers often differentiate themselves through superior customer service, rapid fulfillment, and strong relationships with large commercial HVAC system integrators like Johnson Controls and Carrier. Innovation often targets increasing the valve's lifespan and reducing maintenance requirements, aligning with the North American focus on long-term operational resilience and minimized total cost of ownership (TCO) in industrial and commercial installations.

Future Outlook and Key Recommendations

The future outlook for the Four Way Reversing Valve Market remains highly positive, underpinned by unstoppable global trends in decarbonization and electrification. The market will continue its technological trajectory towards miniaturization, improved efficiency (lower pressure drop), and enhanced intelligence through sensor integration. Geographically, while APAC will maintain its volume leadership, Europe is poised to be the fastest-growing region in terms of value due to premiumization driven by R290 adoption and high-efficiency mandates. The competitive environment will see increasing fragmentation in terms of regional specialties, but consolidation among top-tier global suppliers focusing on patented technology will likely continue.

For manufacturers aiming to secure a dominant market position, key recommendations include prioritizing investment in R&D specifically aimed at R290 and other natural refrigerant compatibility, focusing on maximizing safety features and longevity in high-pressure applications. Secondly, developing modular and easily integrated smart valve technologies is crucial for capturing value from the rapidly expanding IoT and BAS market segments. Finally, manufacturers must strategically diversify their supply chains, moving away from over-reliance on single geographical regions for critical raw materials and components, thereby mitigating geopolitical and commodity risk to ensure continuity of supply to major OEM partners globally.

A proactive approach to regulatory compliance, anticipating future tightening of F-Gas regulations or similar policies in nascent markets, will provide a significant competitive lead. Furthermore, focusing marketing efforts on communicating the Total Cost of Ownership (TCO) benefits derived from high-efficiency, reliable valves—rather than solely focusing on upfront unit cost—will be essential, particularly when targeting the discerning commercial and industrial end-user segments where long-term operational stability is paramount. The successful market player will be the one that balances technological innovation for efficiency with pragmatic cost management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager