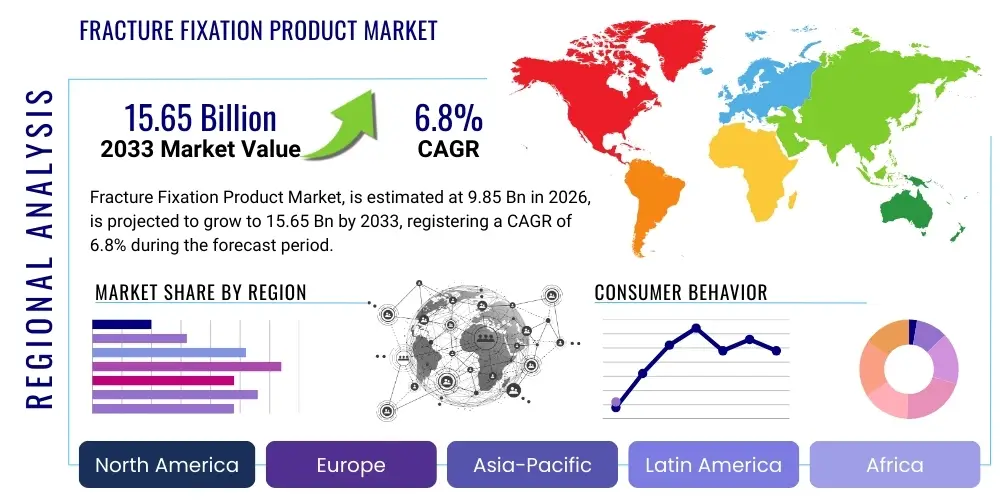

Fracture Fixation Product Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441754 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Fracture Fixation Product Market Size

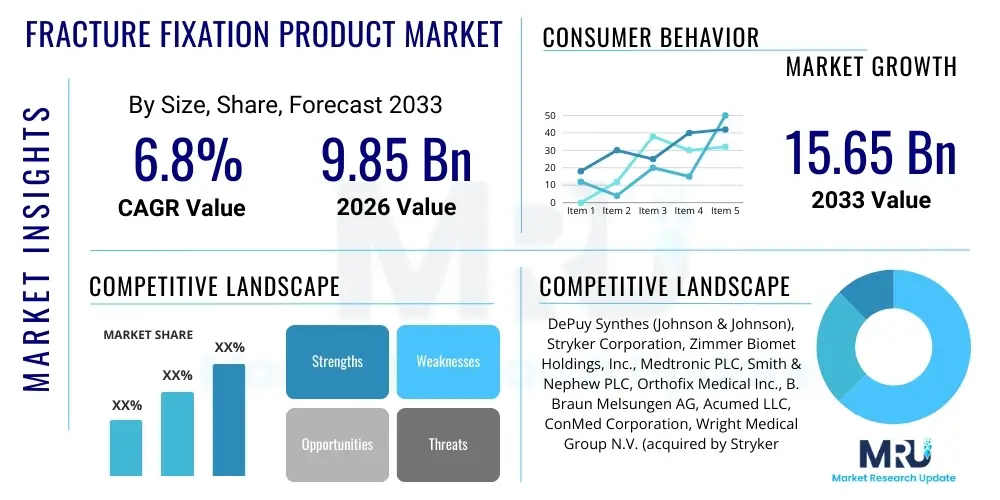

The Fracture Fixation Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.85 Billion in 2026 and is projected to reach USD 15.65 Billion by the end of the forecast period in 2033.

Fracture Fixation Product Market introduction

The Fracture Fixation Product Market encompasses a wide array of specialized medical devices designed to stabilize broken bones, facilitating the natural healing process and ensuring proper alignment. These products, ranging from internal fixation devices like plates, screws, rods, and pins, to external fixation systems, are critical components in orthopedic surgery and trauma care. The primary goal of these devices is to provide mechanical support to bone fragments, reducing pain, preventing further displacement, and enabling early mobilization of the patient, thereby improving clinical outcomes and reducing hospital stays. Advancements in biomaterials and minimally invasive surgical techniques continue to refine product offerings, pushing the standard of care toward faster recovery times and reduced surgical morbidity.

Major applications of fracture fixation products span the entire skeletal structure, addressing high-energy trauma, fragility fractures common in geriatric populations, sports injuries, and congenital deformities requiring corrective osteotomies. Key benefits derived from the effective use of these products include anatomical reduction of fractures, rigid fixation tailored to the specific biomechanical demands of the injured site, and restoration of limb function. The continuous evolution of materials, such as titanium and bioabsorbable polymers, enhances biocompatibility and reduces the need for subsequent removal surgeries, further driving product adoption across various clinical settings, including emergency rooms and specialized orthopedic centers.

The market is predominantly driven by demographic shifts, specifically the rapid increase in the aging global population, which is highly susceptible to osteoporosis and associated fragility fractures. Furthermore, the rising incidence of road traffic accidents, leading to complex trauma injuries, and the increasing participation in high-impact sports contribute significantly to the demand for advanced fixation solutions. Technological innovations, including 3D printing for patient-specific implants and the integration of smart sensors into devices for monitoring healing progress, are crucial factors shaping market growth, promoting safer, and more effective treatment modalities globally.

Fracture Fixation Product Market Executive Summary

The global Fracture Fixation Product Market is experiencing robust growth fueled by increasing worldwide trauma incidence, enhanced surgical techniques, and significant technological proliferation across developed and emerging economies. Business trends indicate a strong focus on consolidation among major orthopedic device manufacturers seeking to diversify product portfolios and acquire specialized technology firms focused on areas such as intramedullary nailing and complex plate systems. There is a palpable shift towards specialized and anatomically contoured implants designed to improve fit and reduce soft tissue irritation, translating into better patient compliance and superior surgical outcomes. Furthermore, pricing pressures, particularly in public healthcare systems, are compelling manufacturers to optimize supply chains and explore cost-effective manufacturing processes without compromising product quality or sterility standards.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated infrastructure, and rapid adoption of premium, cutting-edge devices, including biodegradable and custom-made implants. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, primarily driven by expanding access to advanced orthopedic care, massive population size, rising medical tourism, and improving reimbursement policies in key economies like China and India. European growth remains steady, underpinned by stringent quality regulations and a focus on evidence-based medicine, pushing manufacturers toward conducting extensive clinical trials to validate device performance and longevity. Latin America and the Middle East and Africa (MEA) present emerging opportunities, albeit hampered occasionally by fragmented healthcare access and slower regulatory approvals.

Segmentation trends highlight the persistent demand for internal fixation devices, especially intramedullary rods and plates, given their established effectiveness in providing rigid stability for long bone fractures. Within internal fixation, the locking plate segment continues its upward trajectory due to the advantages associated with fixed-angle construct stability, which is particularly beneficial in osteoporotic bone. The demand for bioabsorbable implants is gaining traction, driven by the desire to eliminate the necessity of removal surgery and its associated costs and risks. Material-wise, titanium alloys remain the preferred choice for their strength and biocompatibility, though cobalt-chromium and specialized stainless steel still hold significant market share for specific applications.

AI Impact Analysis on Fracture Fixation Product Market

User queries regarding the impact of Artificial Intelligence (AI) in the Fracture Fixation Product Market primarily revolve around how AI can enhance preoperative planning, optimize implant design, and improve surgical precision using robotics and navigation systems. Users are keenly interested in whether AI can accurately predict patient-specific fracture patterns and optimize implant geometry (e.g., plate length and screw placement) to minimize failure rates. There is also significant curiosity concerning the application of machine learning algorithms in analyzing post-operative radiographic images to detect signs of delayed union, non-union, or impending implant failure early on, thereby enabling proactive intervention. Key themes synthesized from user questions center on clinical efficiency gains, reduction in revision rates, and the financial implications of integrating complex AI-powered platforms into standard orthopedic operating procedures.

AI’s influence is expected to profoundly reshape the orthopedic implant lifecycle, starting from material selection based on stress modeling derived from deep learning algorithms applied to high-resolution scans. During the surgical phase, AI integrates seamlessly with surgical robotics and navigation platforms, offering real-time feedback and trajectory guidance to surgeons, especially during complex, multi-fragmentary fracture reduction procedures. This enhanced precision is crucial for improving screw placement accuracy and minimizing neurovascular damage, directly impacting the longevity and success rate of the fixation construct. Furthermore, AI-driven predictive analytics tools are being developed to assess patient risk factors (such as comorbidities and bone quality) pre-surgery, allowing surgeons to select the most appropriate fixation method and material for optimal outcomes.

The incorporation of AI into the manufacturing side is also critical, enabling generative design processes that produce lighter yet stronger customized implants, reducing waste and lead times. For market analysis, AI assists device manufacturers by identifying emerging regional fracture patterns and correlating them with demographic data, guiding R&D investments toward high-demand product categories. The long-term impact involves creating ‘smart implants’ integrated with miniature sensors whose data is processed by AI to monitor strain, temperature, and micromovement, providing invaluable data on the healing environment, moving the industry toward truly personalized orthopedic care pathways and significantly improving post-operative monitoring protocols.

- AI-enabled Preoperative Planning: Optimization of fracture reduction visualization and implant sizing/positioning, reducing operating room time.

- Robotic-Assisted Surgery Integration: Enhancing surgical precision through real-time navigation and optimized instrument control during complex fixations.

- Personalized Implant Design: Use of generative design and 3D printing guided by AI algorithms to create patient-specific fixation plates and rods.

- Predictive Analytics: Utilizing machine learning to forecast risk of non-union, infection, or implant failure based on large clinical data sets.

- Radiographic Analysis Automation: Rapid and consistent assessment of fracture healing progress and alignment status post-surgery.

- Supply Chain Optimization: AI-driven demand forecasting for specific implant types based on seasonal or regional trauma incidence data.

DRO & Impact Forces Of Fracture Fixation Product Market

The dynamics of the Fracture Fixation Product Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic decision-making for industry participants. The primary market driver is the undeniable demographic shift globally, characterized by an aging population with increased susceptibility to orthopedic conditions like osteoporosis, directly translating into a higher incidence of fragility fractures requiring surgical intervention. Concurrently, technological advancements are acting as a major catalyst, where innovation in biocompatible materials, bioabsorbable technology, and advanced surface treatments, which promote osteointegration, are consistently expanding the utility and effectiveness of fixation devices, making them suitable for a broader range of clinical scenarios and enhancing patient recovery trajectories.

Despite robust growth factors, the market faces significant restraints, most notably the high cost associated with premium orthopedic implants and complex surgical procedures, which often limit access in low and middle-income countries and impose substantial pressure on healthcare budgets even in developed economies. Furthermore, stringent regulatory pathways and lengthy approval processes, particularly for novel materials and specialized devices like bioabsorbables, create barriers to entry and slow the pace of market diffusion for critical innovations. The risk of post-operative complications, including implant failure, infection, and non-union, while declining due to improved technology, still poses a critical challenge that necessitates continuous improvement in product design and surgical technique training for practitioners worldwide.

Significant opportunities lie in the expansion of minimally invasive surgery (MIS) techniques, which utilize specialized instrumentation for fracture fixation, resulting in smaller incisions, reduced soft tissue damage, and quicker recovery times, appealing strongly to both surgeons and patients. The development and commercialization of 'smart' implants, incorporating sensing technology to monitor biomechanical loading and healing progress in real-time, represent a disruptive opportunity, promising to revolutionize post-operative care and data collection. Moreover, the vast, untapped markets in emerging economies, driven by improving healthcare infrastructure and growing public awareness regarding orthopedic trauma care, offer substantial long-term expansion avenues for manufacturers focusing on high-volume, cost-effective solutions tailored to local market needs and constraints.

Segmentation Analysis

The Fracture Fixation Product Market is systematically segmented based on Product Type, Material, Application, and End-User, allowing for detailed analysis of consumption patterns and strategic market positioning. The dominance of internal fixation products reflects their established effectiveness and versatility across various fracture types, while external fixators serve a crucial, though smaller, role, particularly in trauma management, temporary stabilization, and complex open fractures requiring staged procedures. Analyzing these segments provides essential insights for manufacturers aiming to align their research and development efforts with evolving clinical demands, such as the increasing preference for bioabsorbable materials in pediatric and specific adult applications to eliminate secondary surgical burdens.

Material segmentation reveals the enduring strength of metal alloys, predominantly titanium, due to their superior strength-to-weight ratio and exceptional biocompatibility, making them the standard choice for high-load-bearing applications like long bone fixation. However, the rapidly growing non-metallic segment, including bioabsorbable polymers and specialized carbon fiber composites, is capturing increased market share driven by clinical desire to mitigate stress shielding and avoid permanent foreign body presence. Furthermore, application segmentation highlights the significant demand generated by lower extremity fractures (tibia, femur, ankle), which are frequent consequences of trauma and age-related falls, requiring robust and specialized implants designed to withstand dynamic weight-bearing forces during recovery.

End-user segmentation clearly indicates that hospitals and trauma centers are the primary consumers of these products, given their capability to handle high-acuity surgical cases and their necessary infrastructure for complex orthopedic procedures. Ambulatory Surgical Centers (ASCs) are increasingly important, especially for elective or less complex fixations, reflecting a trend toward shifting procedures out of expensive hospital environments to reduce costs. Understanding these segment dynamics is critical for market participants to tailor their marketing strategies, distribution networks, and product portfolio to effectively address the specific volume, pricing, and clinical needs characteristic of each distinct segment, ensuring targeted outreach and maximized market penetration.

- By Product Type:

- Internal Fixation Devices

- Plates and Screws

- Intramedullary (IM) Nails

- Pins and Wires

- Locking Plates

- External Fixation Devices

- Circular Fixators

- Monolateral Fixators

- Hybrid Fixators

- Casting Supplies and Accessories

- Internal Fixation Devices

- By Material:

- Metallic Implants (Titanium, Stainless Steel, Cobalt-Chrome)

- Bioabsorbable Implants (Polymers like PLLA, PLGA)

- Non-Metallic Materials (Carbon Fiber Composites)

- By Application:

- Lower Extremity Fractures (Femur, Tibia, Fibula, Ankle)

- Upper Extremity Fractures (Humerus, Radius, Ulna, Clavicle)

- Spinal Fractures (Vertebral Fixation)

- Craniomaxillofacial (CMF) Fixation

- By End-User:

- Hospitals and Trauma Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Orthopedic Clinics

Value Chain Analysis For Fracture Fixation Product Market

The value chain for the Fracture Fixation Product Market begins with the sourcing and processing of high-grade raw materials, primarily medical-grade titanium alloys, specialized stainless steel, and advanced polymers. Upstream activities involve stringent quality control of these raw materials, ensuring traceability and compliance with ISO standards for biocompatibility and mechanical strength. Key focus areas at this stage include the development of proprietary alloys or surface treatments that enhance osteointegration and reduce the risk of biological rejection. Manufacturers typically maintain strong, long-term relationships with certified metal and polymer suppliers to ensure stable pricing and consistent quality input, which is foundational to the performance and regulatory approval of the final medical device.

The core manufacturing and assembly stage involves complex machining, forging, and additive manufacturing (3D printing) processes to create the diverse range of plates, screws, and rods, often requiring specialized coatings and sterilization. Downstream activities are crucial for market success, centering on logistics, inventory management, and the distribution channel. Due to the urgent nature of trauma care, efficient supply chain management is paramount to ensure implants are available to hospitals on a just-in-time basis. Distribution channels are generally segmented into direct sales forces for major orthopedic companies, offering extensive training and technical support to surgeons, and indirect distribution through specialized medical device distributors, particularly in regional or emerging markets where local knowledge is essential for market penetration.

Direct distribution allows manufacturers greater control over branding, pricing, and specialized surgical technique education, which is vital for complex locking plate systems and intramedullary nails. Conversely, indirect distribution leverages local regulatory expertise and existing hospital relationships, especially beneficial for reaching smaller clinics or navigating fragmented healthcare systems. The final stages of the value chain involve post-market surveillance, where devices are tracked for performance, complications are reported, and feedback loop mechanisms are used to inform continuous product improvement and iterative design changes. The high clinical and regulatory barriers emphasize the critical importance of a robust, compliant, and efficient value chain from material sourcing through to final surgical utilization and long-term patient follow-up.

Fracture Fixation Product Market Potential Customers

The primary consumers and end-users of fracture fixation products are healthcare providers focused on acute trauma management and reconstructive orthopedic surgery. Hospitals and large specialized trauma centers represent the largest volume segment, as they possess the necessary infrastructure, advanced imaging technology, and multidisciplinary surgical teams required to manage high-energy and complex polytrauma cases, often involving multiple or comminuted fractures. These institutions require a comprehensive inventory of diverse implant sizes, material types, and instrument sets to handle the unpredictable nature of trauma presentations, making them high-value targets for orthopedic device manufacturers.

Orthopedic surgeons are the critical decision-makers and direct buyers of these products, influencing purchasing decisions based on clinical outcomes, ease of use of the instrument system, material performance, and specialized training received. Furthermore, geriatric care facilities and rehabilitation centers indirectly drive demand by managing the post-operative recovery of fracture patients, often necessitating specialized, less-invasive fixation solutions that promote faster weight-bearing and mobilization, particularly for hip and proximal humeral fractures common in the elderly demographic. The adoption of modern techniques, such as periarticular plating and minimally invasive nailing, is highly dependent on the training and clinical preferences of the resident orthopedic and trauma surgical staff within these facilities.

Ambulatory Surgical Centers (ASCs) are emerging as significant potential customers, particularly for less severe, elective, or outpatient procedures like distal radius or ankle fracture fixations. The shift toward ASCs is driven by cost-containment measures and patient preference for convenience and shorter stay times. These facilities often prioritize standardization and ease-of-use in implant systems to streamline operations and reduce turnover time. Therefore, manufacturers focusing on product simplicity, robust instrument sets, and attractive pricing structures are strategically positioned to capture market share within the rapidly growing ASC segment across North America and Western Europe, where outpatient orthopedics is increasingly prevalent.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.85 Billion |

| Market Forecast in 2033 | USD 15.65 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic PLC, Smith & Nephew PLC, Orthofix Medical Inc., B. Braun Melsungen AG, Acumed LLC, ConMed Corporation, Wright Medical Group N.V. (acquired by Stryker), OsteoMed L.P., DJO Global (Colfax Corporation), Integra LifeSciences Holdings Corporation, Linc Spine, Globus Medical Inc., LimaCorporate S.p.A., Corin Group PLC, Vilex, Inc., In2Bones Global, Inc., WishBone Medical, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fracture Fixation Product Market Key Technology Landscape

The technological landscape of the Fracture Fixation Product Market is characterized by continuous refinement aimed at improving fixation rigidity, reducing biological response, and facilitating minimally invasive procedures. Key technological advancements include the widespread adoption of locking screw technology, which creates a fixed-angle construct between the plate and the screw head, significantly enhancing stability, particularly in osteoporotic bone where traditional non-locking screws often fail to achieve adequate purchase. This transition from standard compression plating to locked plating systems represents a fundamental shift in managing complex metaphyseal and periarticular fractures, offering improved biomechanical performance and reducing the incidence of implant pull-out under physiological loads, which is a significant clinical advantage.

Another pivotal area is the increasing utilization of bioabsorbable (or biodegradable) materials, primarily polymers such as poly-L-lactic acid (PLLA) and polyglycolide (PGA). These devices offer the unique benefit of gradually transferring stress back to the healing bone while eventually dissolving, thereby eliminating the need for a second surgery to remove the implant, a major concern for both patients and healthcare providers, especially in pediatric populations. While bioabsorbables currently face limitations regarding their mechanical strength and duration of fixation compared to metallic implants, ongoing material science research is focused on developing hybrid composites that maintain initial load-bearing capacity while offering a controlled absorption profile, promising future expansion into high-stress applications.

Furthermore, customized and patient-specific implant technology, driven by advanced imaging (CT, MRI) and 3D printing (Additive Manufacturing), is gaining traction. This allows for the production of anatomically exact plates and guides that perfectly contour to the patient's unique anatomy, optimizing reduction accuracy and minimizing surgical dissection time. Alongside implant design, the development of sophisticated surgical navigation and robotic systems, often incorporating augmented reality (AR) guidance, is enhancing the precision of screw placement and fracture reduction, reducing surgical risk, and promoting superior anatomical alignment, particularly in procedures involving pedicle screws or intra-articular fractures. These integrated technological systems are crucial differentiators in a competitive market focusing intensely on clinical efficacy and reduced complication rates.

Regional Highlights

North America currently holds the largest share of the Fracture Fixation Product Market, primarily driven by several factors that underscore its market maturity and advanced infrastructure. The region benefits from exceptionally high healthcare spending, widespread insurance coverage facilitating access to advanced and expensive orthopedic procedures, and a robust regulatory environment that quickly processes and adopts novel technologies such as customized 3D-printed implants and bioabsorbable fixation devices. Furthermore, the prevalence of sports injuries and a high rate of trauma incidents, combined with a sophisticated chain of trauma centers, ensures consistent high demand for premium fixation solutions. The United States, in particular, acts as a global leader in clinical trials and surgical innovation, setting the standard for product development and adoption across the orthopedic industry.

Europe represents the second-largest market, characterized by mature healthcare systems (particularly in Western Europe) and a strong focus on clinical validation and long-term product performance data, often enforced by rigorous bodies like the European Medicines Agency (EMA). While demographic aging is a major driver, leading to high volumes of hip and proximal extremity fracture treatments, the market faces strong pricing sensitivity due to centralized governmental healthcare purchasing systems. Countries such as Germany, the UK, and France are key consumers, demonstrating a high preference for reliable titanium fixation systems. Eastern Europe, conversely, offers growth opportunities as healthcare modernization continues and disposable income rises, enabling the gradual transition from basic fixation methods to more sophisticated locking plate technology.

The Asia Pacific (APAC) region is projected to experience the fastest growth during the forecast period. This rapid expansion is underpinned by the sheer size of the population, leading to an increasing absolute number of trauma and age-related fractures, coupled with significant improvements in healthcare infrastructure and disposable income in major economies like China, India, and South Korea. Government initiatives aimed at improving road safety and expanding insurance coverage are increasing the accessibility of advanced orthopedic treatments. While cost remains a sensitive issue, driving demand for locally manufactured, cost-effective alternatives, the growing presence of global market leaders establishing local manufacturing and distribution hubs is accelerating the adoption of high-quality internal fixation products throughout the region, gradually closing the gap with Western standards of care.

- North America: Market leader; characterized by high procedure volumes, rapid adoption of technological innovations (e.g., smart implants, robotics), and extensive healthcare spending. High incidence of trauma and sports-related injuries fuel demand.

- Europe: Second-largest market; driven by an aging population and high standards of care, with strong demand for locking plates and advanced intramedullary nails. Price sensitivity is a key factor, particularly in publicly funded healthcare systems.

- Asia Pacific (APAC): Fastest growing region; propelled by rapidly improving healthcare infrastructure, rising medical tourism, large patient pool, and increasing public and private investments in orthopedic care in China and India.

- Latin America (LATAM): Emerging market; characterized by localized demand growth, driven by increasing urbanization and associated traffic accidents. Market growth is often challenged by economic instability and variable reimbursement policies.

- Middle East and Africa (MEA): Developing market; fragmented but showing potential in Gulf Cooperation Council (GCC) countries due to high medical tourism rates and substantial government investment in healthcare infrastructure and specialized trauma centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fracture Fixation Product Market.- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Medtronic PLC

- Smith & Nephew PLC

- Orthofix Medical Inc.

- B. Braun Melsungen AG

- Acumed LLC

- ConMed Corporation

- Wright Medical Group N.V. (acquired by Stryker)

- OsteoMed L.P.

- DJO Global (Colfax Corporation)

- Integra LifeSciences Holdings Corporation

- Linc Spine

- Globus Medical Inc.

- LimaCorporate S.p.A.

- Corin Group PLC

- Vilex, Inc.

- In2Bones Global, Inc.

- WishBone Medical, Inc.

Frequently Asked Questions

Analyze common user questions about the Fracture Fixation Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Fracture Fixation Product Market?

The central driver is the global demographic shift toward an aging population, which leads to a significantly higher prevalence of fragility fractures (osteoporosis-related fractures), necessitating increased surgical fixation procedures worldwide.

How do locking plates differ from traditional non-locking plates, and what is their clinical advantage?

Locking plates use screws that thread into the plate, creating a fixed-angle construct, which offers superior stability and resistance to pull-out, making them crucial for managing fractures in osteoporotic or comminuted bone where traditional plates may fail.

What role does 3D printing technology play in the future of fracture fixation implants?

3D printing allows for the rapid creation of patient-specific, anatomically contoured fixation plates and guides. This customization enhances surgical accuracy, minimizes implant mismatch, and is key to improving outcomes for complex and highly variable fracture patterns.

Which product segment holds the largest market share, and why is it dominant?

Internal Fixation Devices, particularly plates, screws, and intramedullary nails, dominate the market share. They provide rigid, long-term stabilization necessary for most weight-bearing fractures, offering reliable mechanical support for bone healing.

Is the use of bioabsorbable implants increasing, and what is their main benefit?

Yes, the adoption of bioabsorbable implants is growing steadily. Their main benefit is that they eliminate the need for subsequent surgical procedures to remove the implant after the fracture has healed, reducing overall cost, risk, and recovery time for the patient.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager