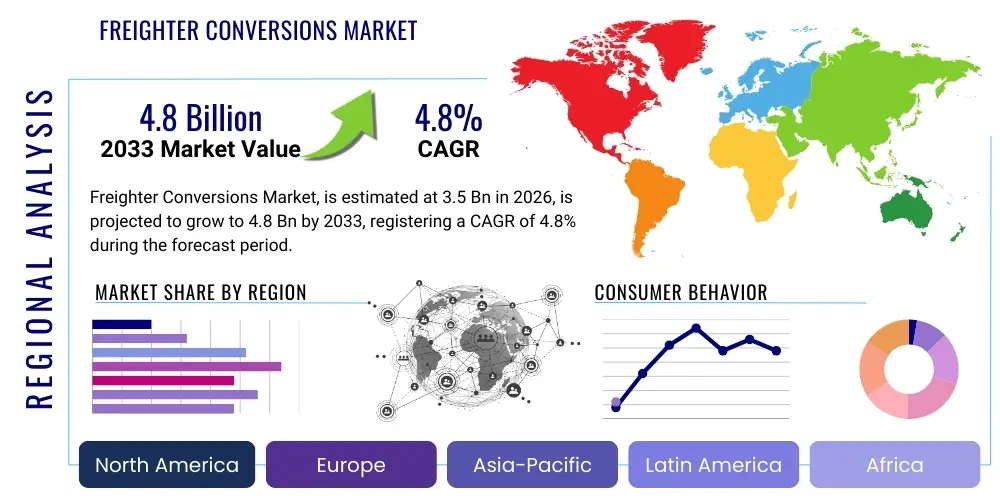

Freighter Conversions Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442210 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Freighter Conversions Market Size

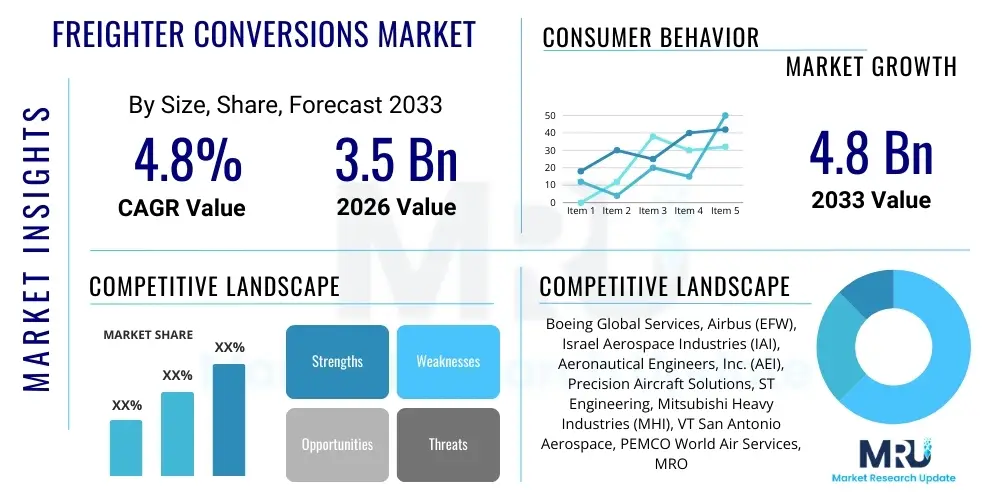

The Freighter Conversions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Freighter Conversions Market introduction

The Freighter Conversions Market involves the modification of existing passenger aircraft into dedicated cargo freighters, a crucial process driven primarily by the global demand for air cargo capacity and the economic viability of utilizing retired or older passenger jets. This process, often referred to as Passenger-to-Freighter (P2F) conversion, extends the operational life of the airframe, providing a cost-effective alternative to purchasing new production freighters, which require significantly higher capital investment and longer lead times. Key modifications typically include the installation of a reinforced main deck floor, a large side cargo door (SCD), strengthening of the fuselage structure, and often the replacement or modification of systems like air conditioning, fire suppression, and avionics to meet stringent cargo operational requirements, particularly concerning fire safety and load bearing capabilities.

Major applications of converted freighters are predominantly found in the burgeoning e-commerce sector, high-volume express logistics, and general global trade necessitating rapid transportation of high-value or time-sensitive goods. The benefits derived from P2F conversions are manifold, encompassing enhanced payload capacity and operational flexibility compared to combi-freighters, substantial reduction in acquisition costs, and crucially, faster time-to-market for carriers looking to quickly scale their cargo fleets. Furthermore, these conversions sustain a vital segment of the Maintenance, Repair, and Overhaul (MRO) industry, creating high-value engineering and modification jobs globally, thus bolstering the aerospace aftermarket ecosystem.

The market is primarily driven by powerful macroeconomic factors, including the sustained acceleration of cross-border e-commerce, which demands unparalleled speed and reliability in delivery networks, alongside global supply chain shifts necessitating agile air transport solutions. Additionally, the impending retirement of older, less fuel-efficient aircraft models across major passenger fleets provides a steady supply of suitable feedstock airframes for conversion. Regulatory harmonization and advancements in conversion technologies, which reduce downtime and improve modification efficiency, further act as critical catalysts supporting the steady growth trajectory observed within the global Freighter Conversions Market, positioning it as an indispensable component of the modern logistics infrastructure.

Freighter Conversions Market Executive Summary

The Freighter Conversions Market Executive Summary indicates robust expansion fueled by enduring strength in the express cargo and e-commerce segments, which have permanently reset expectations for air freight speed and capacity. Key business trends highlight a strategic shift toward conversion programs for Next-Generation narrowbody and smaller widebody aircraft, such as the A321P2F and 767-300BCF, moving beyond the historical reliance on legacy models like the 747 and MD-11. Market participants, predominantly MRO providers and specialized engineering houses, are focusing intensely on achieving faster turnaround times (TAT) and securing Supplemental Type Certificates (STCs) for emerging aircraft platforms, optimizing workflow efficiencies and reducing non-productive ground time, thereby maximizing asset utilization for cargo operators.

Regional trends reveal the Asia Pacific (APAC) region maintaining its status as the most dynamic market, largely due to explosive growth in intra-Asia trade and the massive domestic e-commerce markets in China and India, prompting an aggressive expansion of regional cargo fleets. North America and Europe continue to represent mature, high-demand centers, characterized by sophisticated logistics networks and a high concentration of primary integrators and leasing companies that heavily invest in feedstock acquisition and conversion slots. The Middle East, leveraging its strategic geographic position as a global transshipment hub, is also experiencing increased activity, with regional carriers strategically expanding their cargo divisions through P2F acquisitions to capitalize on East-West trade flows, thereby diversifying revenue streams beyond passenger operations.

Segment trends underscore the profound significance of narrowbody conversions, which are witnessing unparalleled demand, driven by their efficiency in regional and feeder operations, filling the gap left by older 737 Classic freighters, and providing flexible capacity for e-tailers requiring point-to-point delivery capabilities. Widebody conversions, while representing higher investment and capacity, maintain steady demand for long-haul intercontinental routes, particularly for high-density, volume-heavy cargo, though the focus is gradually shifting towards newer generation widebodies like the 777. The competitive landscape is intensely focused on intellectual property related to STCs, leading to strategic alliances between original equipment manufacturers (OEMs) and established MRO firms to ensure high-quality and reliable structural modifications, thereby mitigating operational risk for end-users, while leasing companies solidify their control over the available conversion slot capacity.

AI Impact Analysis on Freighter Conversions Market

Common user questions regarding AI's influence on the Freighter Conversions Market frequently revolve around how artificial intelligence can optimize the complex engineering phases, predict structural integrity issues in aging feedstock aircraft, and streamline the highly technical MRO processes required for conversion. Users are keenly interested in predictive maintenance algorithms applied post-conversion to maximize operational uptime, minimizing unscheduled maintenance, and specifically how AI-driven analysis of global air cargo demand patterns can inform strategic decisions regarding which specific aircraft models should be prioritized for P2F investment, ensuring maximum return on asset utilization. Concerns also focus on whether AI can reduce the certification timeline by assisting in rapid design validation and documentation management, lowering the substantial regulatory burden currently associated with obtaining Supplemental Type Certificates (STCs) for new conversion programs.

The integration of AI and machine learning is poised to profoundly transform the Freighter Conversions sector, primarily by enhancing the efficiency of the modification lifecycle and improving long-term fleet management. During the conversion phase, AI-powered tools can analyze immense datasets related to the structural history, fatigue records, and maintenance logs of the feedstock passenger aircraft, allowing engineers to precisely identify potential weak spots or required structural reinforcements with greater accuracy than traditional inspection methods. This predictive analysis minimizes risks during the often invasive structural modifications, ensuring the converted freighter meets its intended lifespan and stringent safety standards, moving conversion planning from reactive diagnosis to proactive prediction.

Post-conversion, AI systems are instrumental in optimizing the utilization and performance of the newly introduced cargo assets. AI algorithms can process real-time flight data, weather patterns, and cargo loading configurations to recommend optimal flight paths and fuel consumption strategies, thereby lowering operating costs for cargo airlines. Furthermore, within the operational domain, machine learning contributes significantly to predicting when specific components, such as the newly installed cargo doors or main deck floors, will require maintenance or replacement, transitioning carriers toward condition-based maintenance (CBM) protocols. This shift dramatically improves scheduling efficiency, reduces aircraft ground time, and ultimately enhances the overall payload throughput and reliability of the global air cargo network, maximizing the profitability derived from the converted assets.

- AI-driven predictive analysis of feedstock aircraft fatigue history and structural health to optimize conversion planning.

- Machine learning algorithms to streamline MRO scheduling, minimizing conversion downtime and slot inefficiency.

- Automated quality control using vision systems during structural assembly and large cargo door installation.

- Optimization of supply chain and logistics for conversion kits and specialized components through demand forecasting.

- Enhancement of certification processes via AI-assisted documentation review and design validation simulations.

- Real-time performance monitoring of converted freighters to enable condition-based maintenance (CBM).

DRO & Impact Forces Of Freighter Conversions Market

The dynamic interplay of Drivers, Restraints, and Opportunities (DRO) fundamentally shapes the trajectory of the Freighter Conversions Market, which is characterized by high capital intensity and stringent regulatory oversight. Primary drivers include the exponential growth in global e-commerce, particularly the last-mile and cross-border delivery segments, demanding flexible and resilient air cargo capacity, alongside the inherent cost efficiency of converting existing aircraft versus procuring new factory-built freighters. Significant market growth is also propelled by the ongoing cyclical replacement of aging passenger fleets, providing a large and steadily growing pool of suitable, high-quality feedstock airframes, especially within the Boeing 737, Airbus A320, and Boeing 767 families, ensuring a consistent supply for conversion programs over the forecast period.

However, the market faces notable restraints that temper accelerated expansion. The foremost challenge lies in the complex, time-consuming, and capital-intensive nature of obtaining Supplemental Type Certificates (STCs) for new conversion programs, which involves rigorous testing and regulatory compliance across multiple jurisdictions, presenting a high barrier to entry for new competitors. Furthermore, the availability of specialized MRO hangar space and highly skilled aerospace engineers capable of performing the complex structural modifications necessary for conversion often creates bottlenecks, leading to long waitlists for conversion slots, thereby constraining immediate market capacity expansion. Economic volatility and fluctuations in fuel prices also represent substantial impact forces, as they directly influence the residual value of feedstock aircraft and the operational profitability of converted assets for cargo operators.

Despite these challenges, significant opportunities exist for market stakeholders. The rapid emergence of new conversion programs focusing on modern, fuel-efficient, next-generation aircraft (like the A330 and 777-300ER), designed to cater to rising environmental standards, presents lucrative avenues for specialized MRO firms and lessors. Strategic partnerships between engineering design firms and global MRO networks to expand conversion capacity, particularly in high-growth regions like APAC, represent a key strategy for mitigating the current backlog. The growing acceptance of leasing converted freighters, driven by their lower capital expenditure requirements compared to purchasing new assets, provides leasing companies with a substantial opportunity to expand their fleets and service mid-tier cargo carriers seeking agile expansion strategies, diversifying their portfolio and stabilizing long-term revenue streams within the air logistics ecosystem.

Segmentation Analysis

The Freighter Conversions Market is comprehensively segmented based on three critical parameters: Aircraft Type, Conversion Type, and End-Use Application, allowing for detailed analysis of demand patterns and strategic investment areas within the air cargo sector. The segmentation by Aircraft Type is crucial, differentiating between widebody and narrowbody platforms, which determines the operational range, payload capacity, and suitability for specific air cargo missions, ranging from regional feeder routes to long-haul intercontinental express logistics. The segmentation by Conversion Type focuses on the source of the modification expertise and intellectual property, differentiating between OEM-driven programs (offering high standardization and integration) and Third-Party STC holders (providing competitive, specialized solutions), impacting market competition and technological advancements.

Analyzing the market through the lens of Conversion Type involves understanding the proprietary nature of the Supplemental Type Certificates (STCs), which dictate the engineering design and modification process. OEM conversions, typically offered by the original aircraft manufacturer or their authorized partners, are highly integrated and benefit from deep airframe knowledge, often appealing to primary carriers and integrators seeking factory support and seamless integration into existing fleets. Conversely, third-party STC conversions, provided by specialized engineering firms and MRO providers, offer competitive pricing and flexible scheduling, appealing primarily to aircraft lessors and smaller operators who prioritize cost-efficiency and quick access to conversion slots, thereby driving competitive differentiation based on price and lead time.

End-Use Application segmentation clarifies the primary consumer demand drivers, dividing the market into segments such as Express & Mail Carriers (driven by e-commerce speed requirements), General Cargo Carriers (focusing on bulk and heavier goods), and Freighter Leasing Companies (acting as intermediaries supplying assets globally). The pronounced shift towards express cargo has significantly elevated the demand for narrowbody converted freighters, optimizing regional networks, while robust global trade continues to support steady demand for high-payload widebody conversions, indicating a bifurcated market strategy focusing simultaneously on high-frequency regional operations and long-distance bulk transport capabilities.

- Aircraft Type:

- Narrowbody (e.g., A320 Family, 737 Family)

- Widebody (e.g., 767 Family, A330 Family, 777 Family)

- Conversion Type:

- OEM Conversions (Original Equipment Manufacturer)

- Third-Party Conversions (Independent STC Holders)

- End-Use Application:

- Express & Mail Carriers

- General Cargo Carriers

- Freighter Leasing Companies

- Military & Government Operations

Value Chain Analysis For Freighter Conversions Market

The value chain of the Freighter Conversions Market is intricate and highly specialized, beginning with the acquisition of suitable feedstock aircraft (upstream) and culminating in the deployment of the converted freighter by the end-user (downstream). The upstream segment is dominated by aircraft leasing companies and commercial airlines selling older aircraft at retirement. Key activities at this stage involve asset valuation, securing financing, and meticulous due diligence on the aircraft's maintenance history and operational cycles to ensure its viability for conversion. Specialized firms, including aircraft asset managers and brokerage houses, play a crucial role in matching available feedstock with conversion slot demand, optimizing the financial viability of the P2F process and ensuring the seamless transfer of ownership and regulatory paperwork, minimizing delays before the modification phase commences.

The core transformation phase centers around the conversion service providers—primarily large MRO facilities, specialized engineering firms, and companies holding the Supplemental Type Certificates (STCs). These entities are responsible for the complex structural and system modifications, including engineering design, airframe cutting for the large cargo door, floor reinforcement, and installation of cargo handling systems. This stage requires significant skilled labor, specialized tooling, and rigorous quality assurance compliant with global aviation safety standards. The distribution channel, while not traditional, primarily operates through direct contracts, where the lessor or cargo carrier directly contracts an STC provider and an MRO facility for the conversion work, ensuring clear communication and tailored project management to meet specific fleet requirements and scheduling demands.

The downstream segment involves the delivery of the newly converted freighter to the primary end-users: cargo airlines, express integrators, and leasing companies. Leasing companies often act as critical intermediaries, purchasing the feedstock, funding the conversion, and then leasing the converted aircraft to operational carriers globally, spreading the financial risk and enabling smaller carriers access to high-capacity cargo assets without substantial upfront capital outlay. Direct cargo operators, such as FedEx, UPS, and DHL, are also major downstream players, managing the full lifecycle of the aircraft from acquisition to operation. The success of the downstream operation relies heavily on the reliability and payload efficiency of the converted asset, which is directly linked to the quality of the upstream engineering and MRO execution, emphasizing the highly interdependent nature of the value chain segments.

Freighter Conversions Market Potential Customers

The primary potential customers and buyers within the Freighter Conversions Market are diverse but largely centered around global logistics providers and entities specializing in aircraft fleet management. Foremost among these are the major global express delivery integrators, such as FedEx, UPS, and DHL, whose business models are fundamentally reliant on owning and operating vast, highly reliable cargo fleets to maintain time-definite delivery promises globally. These integrators continually seek cost-effective methods to upgrade and expand their medium- and long-haul capacity, making P2F conversions of established widebody and narrowbody platforms a cornerstone of their fleet strategy, particularly in supplementing their factory-built fleet and maximizing flexibility within their complex hub-and-spoke networks.

Another crucial customer segment comprises aircraft leasing companies, which act as significant financial intermediaries in the aerospace market. Companies like GECAS (now AerCap), Atlas Air Worldwide Holdings (through subsidiary operations), and specialized freighter lessors invest heavily in P2F conversions as a means of extending asset life, increasing residual value, and meeting the growing global demand for leased freighter capacity, particularly from airlines lacking the capital for new aircraft purchases. Leasing companies are strategic purchasers of conversion slots, often placing multiple orders simultaneously to secure capacity for their future portfolios, thereby stabilizing demand for conversion services and providing substantial, predictable revenue streams to MRO providers and STC holders, driving the investment in future conversion technologies.

Finally, regional and national general cargo carriers, especially those operating in high-growth emerging economies like those in Asia Pacific and Latin America, represent a rapidly expanding customer base. These carriers often operate on tighter budgets and require aircraft tailored for regional, high-frequency operations, making narrowbody conversions (like the 737-800BCF or A321P2F) highly attractive. The conversion solution allows these carriers to quickly enter or expand their presence in the air freight market with established, reliable airframes that have significantly lower acquisition costs compared to new dedicated freighters, directly enabling their expansion efforts in fast-growing trade corridors and supporting domestic e-commerce fulfillment needs, solidifying their role as essential buyers in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boeing Global Services, Airbus (EFW), Israel Aerospace Industries (IAI), Aeronautical Engineers, Inc. (AEI), Precision Aircraft Solutions, ST Engineering, Mitsubishi Heavy Industries (MHI), VT San Antonio Aerospace, PEMCO World Air Services, MRO Holdings, Lufthansa Technik, GKN Aerospace, HAECO Group, Fokker Services, Airframe Conversions LLC, Commercial Jet, Gameco, Taikoo (Xiamen) Aircraft Engineering (HAECO Xiamen), Icelandair Technical Services, and Avianor. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Freighter Conversions Market Key Technology Landscape

The technological evolution within the Freighter Conversions Market is focused on enhancing precision, accelerating the conversion process, and maximizing the structural integrity of the modified aircraft. A primary technological advancement involves the extensive use of 3D scanning and computer-aided design (CAD) modeling during the initial engineering phase. Instead of relying solely on decades-old paper blueprints, high-definition 3D laser scanners are employed to create precise digital models of the feedstock aircraft fuselage, allowing engineering teams to accurately plan the structural cuts for the large cargo door installation and precisely design reinforcement components. This level of digital precision significantly reduces measurement errors, minimizes the need for iterative physical adjustments during the MRO phase, and ensures optimal fit and tolerance for all new structural elements, which is critical for safety certification.

Furthermore, advanced materials science and manufacturing techniques are increasingly being integrated into conversion programs. This includes the use of lightweight, high-strength composite materials for components such as the rigid cargo barriers (nets) and sections of the reinforced main deck floor, improving payload efficiency without compromising structural safety. Modern cargo handling systems, incorporating automated, electric roller beds and sophisticated tie-down mechanisms, are also key technological components, replacing older, heavier hydraulic systems. These advanced systems enhance the efficiency of loading and unloading operations, reduce the aircraft’s empty weight, and improve the overall operational flexibility for cargo carriers, ensuring the converted asset meets the performance metrics expected of modern logistics operations while adhering to strict regulatory requirements for fire suppression and cargo restraint.

Digitalization of maintenance documentation and the use of augmented reality (AR) in the MRO environment represent another key technology trend. Complex structural modifications generate immense volumes of mandatory documentation, and digital platforms facilitate faster approval and audit processes. AR tools are deployed by technicians on the hangar floor, overlaying digital engineering diagrams and step-by-step instructions directly onto the physical airframe, drastically improving the accuracy of complex tasks like riveting and welding. This technology minimizes human error, standardizes procedures across different conversion facilities, and significantly shortens the learning curve for specialized MRO staff, thereby reducing the critical path duration for the overall P2F modification cycle, which is a major commercial differentiator in this competitive service market.

Regional Highlights

Regional dynamics play a crucial role in shaping demand and supply within the Freighter Conversions Market, reflecting global trade patterns and the distribution of MRO capabilities.

- Asia Pacific (APAC): This region dominates the market in terms of projected growth rate and conversion demand, fueled by the explosive growth of regional e-commerce, particularly in economies like China, India, and Southeast Asia. APAC is both a major source of feedstock aircraft (as regional carriers retire older passenger jets) and the primary consumer of converted narrowbody freighters for high-frequency regional routes. The region hosts several prominent MRO hubs (e.g., Singapore, China, and India) that are actively expanding their conversion slot capacity through strategic partnerships and governmental support, positioning APAC as the epicenter of future P2F expansion.

- North America: Representing a mature and highly developed logistics market, North America maintains robust demand for both narrowbody and widebody conversions, primarily driven by the fleet requirements of global integrators (FedEx, UPS) and major leasing companies. The presence of leading STC providers and established MRO facilities ensures a high-quality conversion infrastructure. Demand here is characterized by the replacement of aging 757 and 767 fleets with modern 737NG and A330 converted platforms to maintain operational efficiency across vast continental distances and transpacific routes.

- Europe: Europe serves as a crucial hub for high-skilled MRO services and hosts key players in the conversion ecosystem, including engineering firms and major airline MRO subsidiaries. The demand is focused on supporting trans-Atlantic cargo operations and intra-European express mail networks. Regulatory rigor and the push for environmentally sustainable operations are driving carriers to seek conversions of newer generation, more fuel-efficient airframes (such as A320/A321 conversions), ensuring compliance with forthcoming environmental standards while maintaining capacity.

- Latin America (LATAM): This emerging market shows increasing potential, driven by growing domestic consumption, expanding agricultural exports, and strengthening trade links with North America and Asia. Carriers in LATAM are increasingly utilizing converted narrowbody freighters for regional connectivity and widebodies for international routes, often relying heavily on leasing companies for asset acquisition, creating growing opportunities for conversion providers willing to invest in regional MRO partnerships.

- Middle East and Africa (MEA): The Middle East acts as a critical global cargo hub, leveraging its strategic position for East-West transit trade. Major regional carriers are investing strategically in widebody conversions (e.g., 777-300ER P2F) to bolster their long-haul cargo capabilities. Africa presents long-term growth potential, particularly for smaller, robust converted freighters used for perishable goods and essential supplies, though logistical and infrastructure constraints currently limit large-scale conversion demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Freighter Conversions Market.- Boeing Global Services

- Airbus (Elbe Flugzeugwerke - EFW)

- Israel Aerospace Industries (IAI)

- Aeronautical Engineers, Inc. (AEI)

- Precision Aircraft Solutions

- ST Engineering

- Mitsubishi Heavy Industries (MHI)

- VT San Antonio Aerospace

- PEMCO World Air Services

- MRO Holdings

- Lufthansa Technik

- GKN Aerospace

- HAECO Group

- Fokker Services

- Airframe Conversions LLC

- Commercial Jet

- Gameco (Guangzhou Aircraft Maintenance Engineering Co.)

- Taikoo (Xiamen) Aircraft Engineering (HAECO Xiamen)

- Icelandair Technical Services

- Avianor

Frequently Asked Questions

Analyze common user questions about the Freighter Conversions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current high demand for freighter conversions?

The central driver is the sustained, rapid expansion of global e-commerce and express logistics, which necessitates reliable, cost-effective air cargo capacity that cannot be met solely by purchasing expensive, new production freighters. P2F conversions offer an optimal blend of cost, capacity, and speed-to-market.

Which aircraft types are currently dominating the Passenger-to-Freighter (P2F) conversion market?

Narrowbody aircraft, specifically the Boeing 737-800NG and the Airbus A321, are dominating due to their efficiency in regional and feeder operations required by e-commerce fulfillment. However, widebody conversions of the Boeing 767 and the emerging Airbus A330 also hold significant market share for long-haul intercontinental routes.

What is the typical timeframe required for converting a passenger aircraft into a freighter?

The conversion timeline generally ranges from 90 to 150 days, depending significantly on the aircraft type (narrowbody vs. widebody), the specific Supplemental Type Certificate (STC) program used, the complexity of structural modifications required, and the MRO facility's current slot availability and operational efficiency. Delays are commonly caused by long-lead item procurement.

What are the key technical challenges in obtaining a Supplemental Type Certificate (STC) for a new conversion program?

Key technical challenges include complex structural analysis required for cutting the fuselage and reinforcing the main deck and cargo door frame, proving compliance with stringent fire suppression and airworthiness regulations for the cargo deck, and extensive flight testing to validate modified performance parameters under all loading conditions.

How do leasing companies influence the overall Freighter Conversions Market?

Leasing companies are pivotal as they manage the financial risk by acquiring the feedstock passenger aircraft and funding the capital-intensive conversion process. They control significant conversion slots and stabilize market demand by providing converted assets to cargo carriers globally through operational leases, democratizing access to dedicated freighter capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager