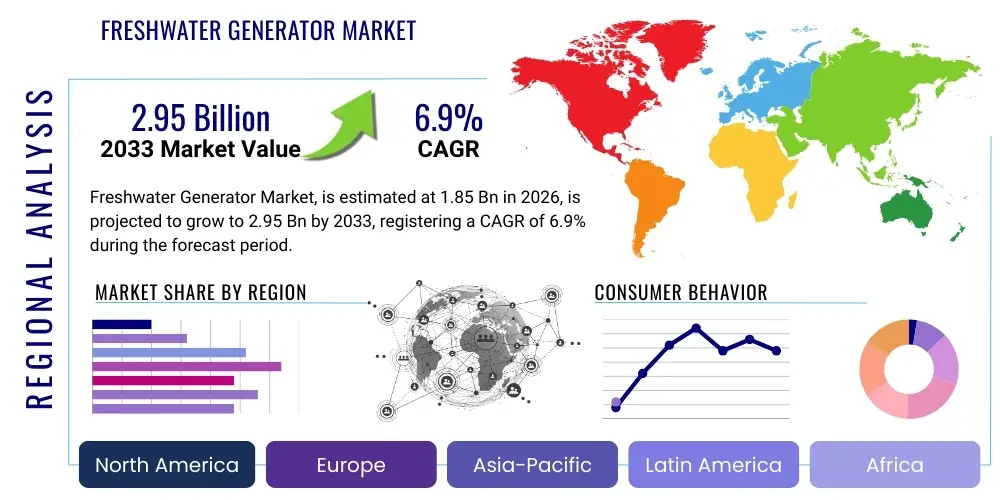

Freshwater Generator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443569 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Freshwater Generator Market Size

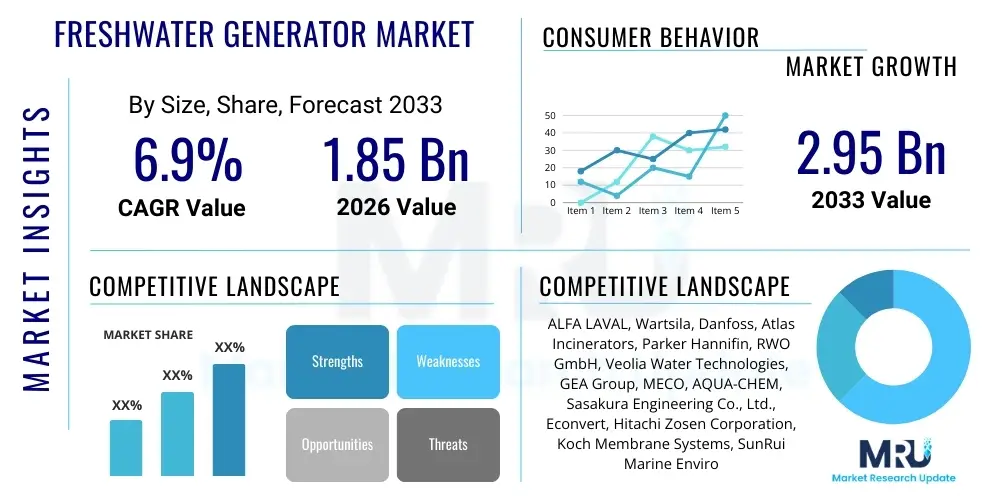

The Freshwater Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Freshwater Generator Market introduction

The Freshwater Generator Market encompasses the design, manufacturing, distribution, and maintenance of systems used primarily on maritime vessels and offshore platforms to convert seawater into potable or technical-grade freshwater. These generators are crucial for sustaining life support systems, industrial processes, and boiler feed water requirements on ships, especially during long voyages or in remote operational areas where shore-based water supply is impractical or unavailable. The technological evolution within this sector is driven by the necessity for enhanced energy efficiency, reduced maintenance, and compliance with increasingly stringent environmental regulations concerning discharge brine quality and operational footprint.

Freshwater generators typically utilize processes such as vacuum distillation (low-pressure evaporation), Reverse Osmosis (RO), or multi-effect distillation (MED). Vacuum distillation remains a popular choice in the marine sector, leveraging waste heat from the ship's main engine jacket cooling water to evaporate seawater at low temperatures, maximizing energy conservation and minimizing reliance on dedicated power sources. The increasing global maritime trade, coupled with a surge in naval defense expenditures and the expansion of the cruise and leisure shipping industry, provides a robust foundation for consistent demand across all major geographic regions. Furthermore, the longevity and reliability required for continuous maritime operations necessitate high-quality, durable generator units, driving market preference towards established manufacturers offering robust service networks.

Major applications of freshwater generators include commercial shipping (tankers, container ships, bulk carriers), naval vessels, luxury yachts, and offshore oil and gas installations such as drilling rigs and floating production storage and offloading (FPSO) units. The primary benefit these systems provide is complete autonomy from external freshwater supplies, significantly reducing operational costs associated with water bunkering and mitigating the risks associated with varying water quality across different ports. Driving factors include stricter water quality standards, the expansion of global shipping fleets, and technological advancements aimed at optimizing energy consumption and improving automation capabilities of the generating units, ensuring seamless integration with modern vessel management systems.

- Product Description: Systems converting saline water (seawater) into potable water using methods like vacuum distillation or reverse osmosis.

- Major Applications: Commercial shipping, naval fleets, cruise lines, offshore platforms, and coastal industrial facilities.

- Benefits: Operational autonomy, reduced water bunkering costs, consistent water quality, and efficient use of waste heat energy on vessels.

- Driving Factors: Growth in global shipping, demand for energy-efficient desalination, and stringent maritime operational standards.

Freshwater Generator Market Executive Summary

The Freshwater Generator Market is exhibiting stable growth, primarily fueled by the sustained expansion of the global maritime transport sector and the mandatory requirement for onboard water production capabilities, driven by regulations such as those imposed by the International Maritime Organization (IMO). Business trends indicate a strong shift towards highly efficient Reverse Osmosis (RO) systems, particularly in segments where waste heat is less readily available or where high-purity water requirements are paramount, such as in specialized offshore industrial processes. Key market players are concentrating their efforts on developing hybrid systems that combine the benefits of distillation and membrane technologies, allowing for flexibility based on the specific operational profile and energy matrix of the host vessel, thereby maximizing water output efficiency and minimizing the environmental impact of brine discharge.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, largely attributed to its significant shipbuilding capacity, the concentration of major global shipping lines, and increasing naval modernization programs, particularly in countries like China, South Korea, and Japan. Europe and North America, while mature markets, are experiencing growth driven by the replacement cycle of aging fleets and the burgeoning luxury cruise and yacht sectors, which demand advanced, quiet, and aesthetically integrated water production systems. Furthermore, regulatory frameworks in these mature regions are pushing manufacturers towards systems with optimized brine discharge and energy recovery mechanisms, setting new benchmarks for sustainability in the marine desalination industry.

Segmentation trends reveal that vacuum distillation technology maintains a leading share due to its proven reliability and cost-effectiveness when integrated with ship engine systems using waste heat, offering a compelling operational expenditure (OPEX) advantage over electrical reliance. However, the RO segment is the fastest growing, owing to its scalability, smaller physical footprint, and suitability for modular integration, appealing increasingly to smaller vessels, high-speed craft, and specialized naval applications requiring instant, high-volume freshwater supply without dependency on main engine operational temperature requirements. The end-user market remains dominated by commercial shipping, yet the offshore and naval segments are showing accelerated procurement rates due to strategic modernization and increased exploration activities in deeper waters globally.

AI Impact Analysis on Freshwater Generator Market

User inquiries regarding AI's impact on Freshwater Generators primarily center on predictive maintenance, operational optimization, and autonomous control systems. Users are concerned about how AI can enhance the longevity of expensive membrane filters and evaporator components, reduce downtime through early failure detection, and optimize energy consumption by intelligently managing the heat input and vacuum levels based on real-time operational variables (e.g., seawater temperature, vessel speed, engine load). A significant theme is the expectation that AI-driven analytics will transition maintenance from reactive to prescriptive, leading to substantial cost savings and improved regulatory compliance by minimizing the risk of system failure during critical voyages. Users also frequently ask about the integration of machine learning algorithms to fine-tune separation processes, especially in variable-salinity waters, ensuring consistent output quality.

The application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to revolutionize the operational efficiency and reliability of freshwater generator units. AI models can process vast amounts of sensor data collected from temperature probes, pressure gauges, flow meters, and salinity sensors simultaneously. By applying predictive analytics, these systems can forecast potential equipment failure—such as scaling formation in evaporators or fouling of RO membranes—significantly ahead of time, allowing maintenance teams to intervene proactively rather than reactively. This shift reduces unexpected downtime, minimizes the necessity for emergency repairs at sea, and ultimately extends the operational lifespan of the entire system, yielding considerable operational expenditure (OPEX) savings for vessel operators in the highly competitive maritime industry. Furthermore, AI facilitates the creation of digital twins for complex distillation and membrane units, enabling operators to simulate various operational scenarios and optimize performance settings remotely.

Beyond predictive maintenance, AI is crucial for optimizing the energy utilization of freshwater generators, particularly important given the maritime industry's drive towards decarbonization. Optimization algorithms can dynamically adjust operational parameters—such as maintaining the ideal vacuum level in vacuum distillers or optimizing cross-flow rates in RO units—to ensure maximum freshwater production per unit of energy consumed (either waste heat or electrical power). This continuous, intelligent adjustment surpasses the capabilities of traditional fixed or rule-based control systems, leading to energy savings sometimes exceeding 15% under variable operating conditions. The integration of neural networks allows the generator system to ‘learn’ the optimal operational profile for specific routes or environmental conditions, ensuring high water quality consistency while minimizing the volume and concentration of discharged brine, thereby supporting stringent environmental protection mandates.

- Real-time performance monitoring and anomaly detection.

- Predictive maintenance scheduling for evaporators and RO membranes.

- Optimization of energy consumption through dynamic parameter adjustment (AEO Focus).

- Automated fault diagnostics and remote troubleshooting capabilities.

- Enhanced water quality control using ML-driven sensor fusion.

- Creation of digital twins for system simulation and operator training.

DRO & Impact Forces Of Freshwater Generator Market

The Freshwater Generator Market is primarily driven by the persistent expansion of the global shipping fleet, which mandates compliant onboard water production capabilities, coupled with the increasing adoption of energy recovery technologies to improve operational sustainability and cost-effectiveness. The restraints are substantial, largely centered on the high initial capital expenditure (CAPEX) required for sophisticated units, particularly RO systems, and the intensive maintenance demands associated with membrane replacement and anti-scaling treatments in complex operational environments. Opportunities lie in the rapidly developing market for coastal and offshore renewable energy installations (e.g., wind farms), which require dedicated freshwater systems, and the potential for integrating advanced materials science to create more durable, lower-fouling components, reducing lifecycle costs significantly. The market forces converge around the fundamental requirement for operational independence at sea, balanced against the escalating costs of energy and the environmental pressures to minimize waste and maximize resource efficiency.

Drivers: A primary driver is the robust growth in international maritime trade, necessitating larger and more numerous commercial vessels, each requiring reliable and scalable freshwater generation capacity. Furthermore, global geopolitical dynamics are stimulating increased spending on naval defense and auxiliary fleet modernization, significantly boosting demand for specialized, high-capacity, and shock-resistant freshwater units. The rising cost of fuel necessitates the utilization of waste heat recovery systems, making vacuum distillation particularly attractive, as it converts otherwise wasted thermal energy into a valuable resource (freshwater). This circular economy approach within the vessel's energy management system strongly incentivizes the installation and upgrade of these generators. Moreover, the lack of reliable shore-based water supply in many emerging market ports reinforces the need for self-sufficient water production capabilities on all vessel types.

Restraints: Key restraints challenging market expansion include the high capital investment associated with large-scale RO units and the operational vulnerability of membrane-based systems to highly turbid or fouled seawater, which can lead to frequent, costly maintenance and replacement cycles. Energy-intensive nature of electrically-driven systems, especially RO, presents a significant operational cost concern, pushing operators to favor lower-OPEX alternatives where possible. Furthermore, the regulatory complexity concerning brine discharge, particularly in ecologically sensitive coastal zones, requires sophisticated controls and monitoring, adding to the system complexity and initial cost. The specialized nature of maintenance and the requirement for highly trained technical personnel to service advanced units also presents a bottleneck, particularly for smaller shipping companies.

Opportunity: Significant market opportunities are emerging from the growing offshore wind energy sector, which demands robust and self-contained freshwater solutions for maintenance and crew accommodation platforms far from shore. The increasing global focus on water scarcity issues is also propelling the adoption of smaller, modular freshwater generators for coastal industrial applications and island communities, transcending purely marine applications. Technological advances in nanofiltration and electrodialysis offer the potential for next-generation, highly selective, and energy-efficient systems that could circumvent some of the limitations of traditional RO and distillation technologies. Moreover, the trend towards digitalization and remote monitoring, leveraging IoT and AI, presents a substantial opportunity for manufacturers to offer high-value, recurring service contracts based on performance optimization and predictive maintenance, enhancing customer lifecycle value.

Segmentation Analysis

The Freshwater Generator Market is meticulously segmented based on key functional and technical characteristics, including Technology, Capacity, Application, and End-User, reflecting the diverse requirements of the maritime and offshore industries. Technology segmentation is paramount, differentiating between heat-driven distillation methods and pressure-driven membrane processes, each catering to distinct operational profiles regarding energy availability, water quality mandates, and installation constraints. Capacity segmentation allows manufacturers to tailor solutions ranging from compact units for yachts and small auxiliary vessels to industrial-scale generators designed for large cruise liners or FPSO units. Understanding these segment dynamics is critical for market players to accurately target growth areas and align product development with evolving industry standards and regulatory compliance requirements across varied geographical markets.

- By Technology:

- Vacuum Distillation (Evaporator)

- Reverse Osmosis (RO)

- Multi-Stage Flash (MSF) Distillation

- Multi-Effect Distillation (MED)

- Others (e.g., Thermal Vapor Compression)

- By Capacity:

- Up to 20 Tons/Day

- 20 to 50 Tons/Day

- Above 50 Tons/Day

- By Application:

- Potable Water

- Technical/Industrial Water (e.g., Boiler Feed)

- By End-User:

- Commercial Shipping (Container Ships, Bulk Carriers, Tankers)

- Naval and Defense Vessels

- Offshore Oil and Gas (Rigs, FPSOs)

- Cruise Ships and Ferries

- Yachts and Leisure Vessels

Value Chain Analysis For Freshwater Generator Market

The value chain for the Freshwater Generator Market commences with upstream activities involving the sourcing of high-grade raw materials, specifically corrosion-resistant metals like specialized stainless steels, titanium, and advanced polymer membranes crucial for distillation and RO systems, respectively. Key component manufacturers, who specialize in pumps, heat exchangers, and control systems, form the next layer. Suppliers must ensure strict adherence to marine-grade specifications and certification standards (e.g., classification society rules). Robust relationships with material and component suppliers are essential for managing costs, ensuring material quality, and mitigating supply chain disruptions, particularly those stemming from volatility in global metal commodity markets or shortages of specialized membrane materials.

Midstream activities focus intensely on design, manufacturing, assembly, and rigorous testing of the generator units. This stage is characterized by high levels of engineering expertise required to meet stringent maritime constraints concerning size, weight, vibration resistance, and energy efficiency. Manufacturers often integrate digitalization and automation into the assembly process to enhance quality control and scalability. The distribution channel is bifurcated: direct sales channels are typically employed for large, custom-engineered systems sold directly to major shipyards (OEMs) or specialized offshore operators. Indirect channels, utilizing specialized marine equipment distributors, agents, and local service providers, are critical for servicing the fragmented retrofit market and providing regional after-sales support and spare parts logistics, ensuring rapid response globally.

Downstream analysis highlights the critical role of installation, commissioning, and, most significantly, the after-sales service lifecycle. Installation is predominantly handled by shipyards during the construction phase or by certified marine repair facilities during dry-docking for retrofit installations. After-sales support, encompassing maintenance, membrane/component replacement, and technical consultancy, represents a substantial and recurring revenue stream for market participants. The long operational life of vessels necessitates a comprehensive, global service network, making strong ties with local service partners essential. End-users evaluate the generators not just on initial cost, but heavily on mean time between failure (MTBF), ease of maintenance, and the availability of global technical support, positioning service quality as a major competitive differentiator.

Freshwater Generator Market Potential Customers

The primary customers for freshwater generators are entities operating vessels or fixed structures in marine environments that require consistent and reliable sources of freshwater independent of land-based infrastructure. This end-user base is broadly segmented into commercial maritime operators, government naval and auxiliary fleets, and organizations involved in offshore resource extraction. Commercial shipping lines, ranging from vast container shipping enterprises and bulk commodity transporters to specialized chemical and LNG tanker fleets, constitute the largest volume segment. These customers prioritize reliability, energy efficiency (leveraging waste heat), and compliance with international maritime regulations. Their purchasing decisions are heavily influenced by the total cost of ownership (TCO) over the vessel's lifecycle, making low operational expenditure (OPEX) a crucial selling point for generator manufacturers.

A rapidly growing segment of potential customers includes the global fleet of cruise ships, ferries, and high-end luxury yachts. For cruise operators, the need for exceptionally high volumes of potable water for passengers and sanitary systems is paramount, driving demand for high-capacity and often redundant systems (e.g., combining large RO units with distillation capacity). Furthermore, the aesthetic and operational constraints of luxury yachts necessitate compact, quiet, and highly automated units, often requiring bespoke engineering solutions. These customers often possess less sensitivity to initial capital expenditure compared to commercial shipping, focusing instead on system integration, user interface sophistication, and redundancy features to ensure an uninterrupted, premium water supply experience for guests and crew.

Government and defense organizations represent another critical customer group, procuring systems for naval warships, coast guard vessels, and research vessels. These requirements are characterized by a demand for extreme robustness, shock resistance, specific military certifications, and often, enhanced automation for reduced crew dependency. In the offshore sector, customers include international oil companies and specialized service providers operating drilling rigs, production platforms, and FPSOs. These operations demand continuous, high-purity water for critical industrial processes (such as boiler feed and injection water) alongside potable water for personnel, often requiring containerized or highly modular solutions capable of operating reliably in harsh deepwater environments far from service ports. The procurement cycle for naval and offshore customers often involves long lead times and rigorous specification adherence, favoring manufacturers with established defense contracts and impeccable safety records.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | CAGR 6.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ALFA LAVAL, Wartsila, Danfoss, Atlas Incinerators, Parker Hannifin, RWO GmbH, Veolia Water Technologies, GEA Group, MECO, AQUA-CHEM, Sasakura Engineering Co., Ltd., Econvert, Hitachi Zosen Corporation, Koch Membrane Systems, SunRui Marine Environment Engineering Co., Ltd., Cummins, Mitsubishi Kakoki Kaisha, Ltd., Evac Group, Cathelco, Osmotech Marine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Freshwater Generator Market Key Technology Landscape

The technology landscape of the Freshwater Generator Market is predominantly defined by the continuous competition and co-existence of thermal distillation methods and membrane separation technologies, primarily Reverse Osmosis (RO). Vacuum Distillation remains the workhorse in deep-sea commercial shipping, capitalizing on the inherent efficiency of utilizing low-grade waste heat from main engine jacket cooling systems, thereby achieving high operational savings without requiring dedicated electrical power, which is a key economic factor for bulk carriers and tankers. Modern vacuum distillers feature compact plate-type heat exchangers and enhanced automation for managing vacuum levels, ensuring stable operation even under varying engine loads and seawater temperatures. Innovation in this area focuses on optimizing heat transfer surfaces and applying non-corrosive, lighter materials to reduce the unit's footprint and weight while improving long-term reliability.

Reverse Osmosis (RO) systems represent the fastest evolving technological segment, favored in applications where waste heat is insufficient, or extremely high-purity water is required, such as on specialized naval vessels or certain high-speed craft. Advances in RO are driven primarily by breakthroughs in membrane material science, leading to more durable, higher-flux, and fouling-resistant membranes that can operate effectively at lower pressures, drastically reducing energy consumption. The integration of sophisticated Energy Recovery Devices (ERDs) in large marine RO systems has further narrowed the energy gap with thermal methods, making RO increasingly viable for large-scale maritime application. Furthermore, the modular nature of RO allows for greater flexibility in installation and capacity scaling, appealing to both new build specifications and retrofit projects where space constraints are severe, alongside providing operational redundancy.

A critical emerging trend is the development and commercialization of hybrid freshwater generator systems that strategically combine distillation (like MED or VCD) with post-treatment RO or specialized filtration stages. These hybrid solutions offer superior flexibility, allowing operators to switch modes based on energy availability, required water quality, and specific environmental conditions (e.g., highly turbid coastal waters vs. clean open ocean). Furthermore, the integration of advanced sensors and IoT platforms is transforming system monitoring and control, moving away from manual adjustments towards self-optimizing, digitally managed operations. This allows operators to leverage remote diagnostics and AI-powered performance analysis to maintain peak efficiency, ultimately improving the mean time between failures and reducing reliance on manual intervention, which is particularly beneficial for unmanned or heavily automated vessel concepts currently being explored.

Regional Highlights

Geographical analysis reveals stark contrasts in market maturity, adoption rates, and regulatory influence across key regions. The Asia Pacific (APAC) region stands out as the global epicenter for shipbuilding and maritime activity, translating directly into the highest demand for new installations of freshwater generators. Countries such as China, South Korea, and Japan lead in commercial vessel manufacturing, driving volume sales for both distillation and RO technologies. Furthermore, rapid regional economic development and burgeoning naval modernization programs, particularly in South and Southeast Asia, ensure APAC remains the primary growth driver. The preference in APAC often leans towards cost-effective, proven technologies like vacuum distillation, although high-capacity RO is increasing penetration in the burgeoning LNG and specialized vessel segments.

Europe represents a highly mature yet innovative market, characterized by stringent environmental regulations and a strong focus on high-efficiency, low-footprint systems, driven by the substantial presence of major cruise lines and high-end yacht builders. European operators and shipyards are early adopters of advanced technologies, including hybrid systems and high-recovery RO units optimized for minimal brine discharge in sensitive areas. The emphasis here is on lifecycle cost and environmental performance, pushing manufacturers to integrate advanced materials and smart monitoring systems (IoT/AI). The replacement cycle of the vast European commercial fleet also contributes significantly to sustained demand for upgrades and retrofits.

North America maintains a consistent demand, primarily bolstered by robust offshore oil and gas operations and significant naval procurement and modernization efforts, which require specialized, high-specification generators. The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) countries, is experiencing accelerated demand linked to offshore exploration and specialized marine service fleets supporting the energy sector, often favoring robust, high-temperature tolerant systems. Latin America's growth is more moderate but stable, driven by commodity shipping and developing naval requirements, focusing on essential reliability and cost-efficiency rather than necessarily cutting-edge technology.

- Asia Pacific (APAC): Dominant market due to high shipbuilding volume (China, South Korea, Japan); strong demand in commercial shipping and naval modernization.

- Europe: Mature market focusing on advanced, high-efficiency hybrid systems; driven by cruise, yacht, and retrofit sectors; stringent environmental compliance.

- North America: Stable demand driven by offshore oil and gas, specialized vessels, and substantial naval fleet upgrades.

- Middle East & Africa (MEA): Growth tied to offshore energy exploration; preference for highly reliable systems designed for high-salinity waters.

- Latin America: Steady market growth supported by commodity export shipping and regional naval operational requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Freshwater Generator Market.- ALFA LAVAL

- Wartsila

- Danfoss

- Atlas Incinerators

- Parker Hannifin

- RWO GmbH

- Veolia Water Technologies

- GEA Group

- MECO

- AQUA-CHEM

- Sasakura Engineering Co., Ltd.

- Econvert

- Hitachi Zosen Corporation

- Koch Membrane Systems

- SunRui Marine Environment Engineering Co., Ltd.

- Cummins

- Mitsubishi Kakoki Kaisha, Ltd.

- Evac Group

- Cathelco

- Osmotech Marine

Frequently Asked Questions

Analyze common user questions about the Freshwater Generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Reverse Osmosis (RO) and Vacuum Distillation (VCD) generators for marine use?

The primary difference lies in the energy source and operational principle. VCD utilizes low-grade waste heat from the ship's engine cooling system, evaporating seawater at low pressure to condense freshwater, making it highly energy efficient in terms of electrical power use. RO systems use high-pressure pumps to force seawater through semi-permeable membranes, requiring significant electrical energy but offering independence from engine heat and flexibility in installation location. VCD is generally favored for large, slow-moving vessels, while RO is chosen for smaller vessels or those requiring modular, high-purity systems.

How do global regulations impact the design and adoption of new freshwater generation systems?

Global maritime regulations, particularly those from the IMO, increasingly influence system design by setting strict standards for water quality and, crucially, brine discharge concentration and temperature. Newer regulations encourage the adoption of highly efficient generators that minimize discharge volume and salinity shock to the environment. This regulatory pressure is a key driver for manufacturers to invest in hybrid and high-recovery RO technologies, ensuring compliance and minimizing the environmental footprint of vessel operations, which is becoming critical for global trade routes.

Which end-user segment drives the highest volume demand for freshwater generators globally?

The commercial shipping segment, encompassing container ships, bulk carriers, and tankers, drives the highest volume demand for freshwater generators globally. These vessels require reliable, large-capacity systems to support long-haul voyages and boiler feed water needs. While the cruise ship sector demands the highest capacity per vessel, the sheer volume of the global commercial fleet ensures that this segment dictates the overall market size and stability, primarily favoring robust, waste-heat driven distillation technology for cost efficiency.

What role does digitalization and IoT play in enhancing freshwater generator performance?

Digitalization and IoT integration enable advanced monitoring and control of freshwater generators. IoT sensors provide real-time data on parameters such as temperature, flow rate, and water conductivity, which, when analyzed using predictive maintenance algorithms (AI), allow operators to optimize performance, detect scaling or fouling early, and schedule maintenance proactively. This capability significantly reduces unplanned downtime, improves energy efficiency by fine-tuning operational parameters dynamically, and lowers overall operational costs by extending the lifespan of critical components like membranes and heat exchangers.

What are the primary maintenance challenges associated with marine freshwater generators?

The primary maintenance challenges depend on the technology. For vacuum distillers, scaling (calcium and magnesium carbonate deposits) on heat transfer surfaces is the main issue, requiring regular chemical or mechanical cleaning. For Reverse Osmosis systems, membrane fouling by biological matter or particulates and the necessity for costly membrane replacement are the significant challenges. Both technologies face corrosion issues due to the saline environment. Advanced anti-scaling dosing systems and high-quality pre-filtration stages are critical preventative maintenance measures used to address these pervasive operational hurdles and maximize system uptime in the harsh marine environment.

This concludes the Freshwater Generator Market Insights Report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager