Friction Stir Welding Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442059 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Friction Stir Welding Machine Market Size

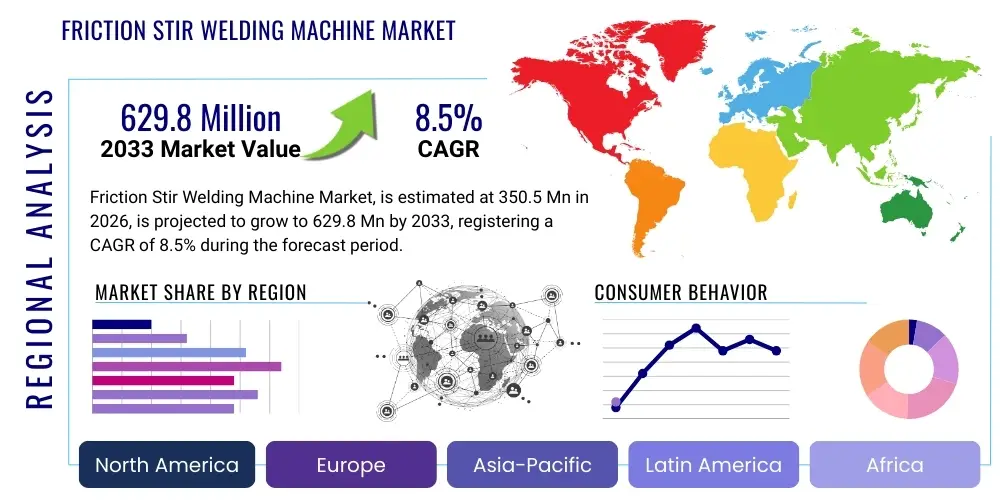

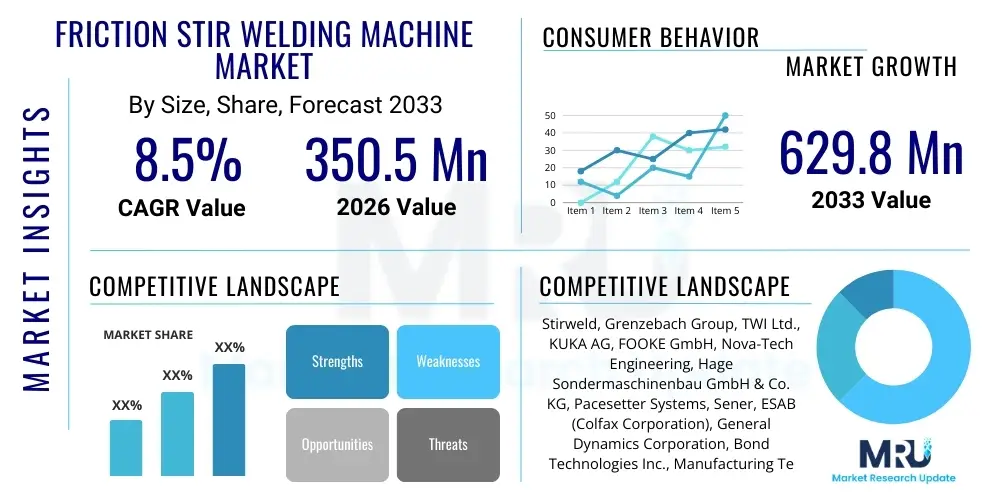

The Friction Stir Welding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 629.8 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing demand for high-strength, lightweight, and defect-free joints in critical industries, notably aerospace and electric vehicle manufacturing. The inherent advantages of Friction Stir Welding (FSW) over traditional fusion welding techniques, such as the ability to join dissimilar materials and produce environmentally sound bonds, position it as a key enabler for advanced manufacturing processes globally. Furthermore, the imperative for enhanced structural integrity in high-performance applications, coupled with regulatory pushes for carbon reduction across the transportation sector, ensures sustained investment in FSW technology upgrades and capacity expansion among key original equipment manufacturers (OEMs) and specialized fabricators worldwide. The market trajectory indicates a strong shift toward highly automated and customized FSW solutions capable of handling complex geometries and thicker materials with superior precision and repeatability compared to older generations of machinery.

Friction Stir Welding Machine Market introduction

The Friction Stir Welding Machine Market encompasses the manufacturing, sales, and service of specialized equipment designed to perform the solid-state joining process known as Friction Stir Welding (FSW). FSW is a revolutionary joining technology invented at The Welding Institute (TWI) that fundamentally differs from fusion welding by avoiding the melting point of the materials. Instead, it employs a non-consumable rotating tool consisting of a shoulder and a pin. This tool is plunged into the joint line, generating intense frictional heat that plasticizes the material without liquefying it. The mechanical stirring action of the pin then forges the material together, resulting in a fine-grained, high-integrity metallurgical bond with minimal residual stress and distortion. This capability is paramount in industries where weld quality and material integrity are non-negotiable, particularly when dealing with non-ferrous alloys like 5xxx, 6xxx, and 7xxx series aluminum, as well as magnesium and certain copper alloys, which are notoriously difficult to weld using conventional fusion methods due to issues like hot cracking and porosity. The resulting joints exhibit mechanical properties often superior to those achieved through traditional welding, particularly concerning fatigue life and tensile strength.

Friction Stir Welding machines span a broad spectrum of configurations, dictating their suitability for various production scales and component sizes. These range from small, vertical milling machine adaptations—often referred to as desktop or research FSW systems for laboratory use and small-scale production prototyping—to enormous, dedicated gantry-style machines capable of handling aircraft fuselage panels measuring tens of meters in length, common in Tier 1 aerospace manufacturing environments. More recently, the segment of multi-axis robotic FSW systems has experienced explosive growth, offering unparalleled flexibility for joining complex, three-dimensional structures, such as curved automotive battery casings or intricately shaped marine components. The diversity in machine types allows manufacturers to select equipment precisely matched to their specific volumetric and precision requirements, enhancing overall manufacturing efficiency and reducing time-to-market for new products, particularly in fast-paced sectors like consumer electronics and electric vehicles. The sophisticated control systems integrated into these machines, often incorporating Computer Numerical Control (CNC) capabilities, allow for precise control over tool tilt angle, plunge depth, rotation speed, and traverse rate, all critical variables for ensuring the consistency of the solid-state bond.

Major applications driving the market expansion include the production of structural components for aircraft wings and fuselage, high-speed rail car bodies, sophisticated automotive battery trays for electric vehicles (EVs) where thermal management and robust sealing are essential, and high-efficiency heat exchangers for industrial processes. The core benefits driving the sustained adoption of FSW machines are economic and metallurgical: the process is environmentally cleaner, requiring no filler materials or shielding gases (reducing operational costs), and it eliminates common fusion welding defects such as porosity, solidification cracking, and severe distortion, leading to superior mechanical properties and significantly improved fatigue resistance in the final product. Key market acceleration factors include stringent global environmental regulations mandating vehicle weight reduction, directly increasing the reliance on lightweight aluminum structures, coupled with continuous technological advancements in specialized FSW tooling materials (like PCBN or Tungsten Rhenium) that are extending the lifespan of the non-consumable tools and allowing for faster welding speeds across a broader range of high-strength alloys.

Friction Stir Welding Machine Market Executive Summary

The global Friction Stir Welding Machine Market is experiencing significant upward momentum driven by cross-industry mandates for lightweighting, structural integrity, and sustainable manufacturing practices. Current business trends indicate a profound strategic pivot toward the adoption of highly automated and flexible FSW systems. Manufacturers are increasingly favoring multi-axis robotic and integrated gantry configurations that offer higher degrees of freedom and facilitate seamless integration into modern, flexible manufacturing lines, particularly within high-volume automotive assembly plants focused on electric vehicle architectures. A key focus area for competitive advantage among machine builders is the sophistication of the process monitoring systems, incorporating advanced sensors and closed-loop feedback controls to achieve zero-defect production standards. Furthermore, strategic partnerships between FSW equipment manufacturers and major robotic integrators are becoming crucial to delivering turnkey, optimized manufacturing solutions to end-users globally, accelerating the move away from standard, dedicated FSW milling machines toward adaptable industrial robotic platforms.

Regionally, the Asia Pacific (APAC) market currently represents the epicenter of growth, primarily fueled by the unprecedented scale of electric vehicle battery manufacturing in East Asia, coupled with massive government-backed investments in advanced infrastructure, including high-speed rail and commercial aircraft assembly (e.g., COMAC in China). This demand necessitates high-throughput, large-format FSW machines. North America and Europe, while representing mature industrial economies, maintain high market valuation due to their dominance in the technologically demanding Aerospace and Defense sectors, where FSW is often required for material certification and critical structure production (e.g., SpaceX, Boeing, Airbus). The European market is further characterized by a strong commitment to Industry 4.0, driving demand for FSW machines with superior connectivity, data analytics, and integration with enterprise resource planning (ERP) systems. The Middle East and Africa (MEA) are poised for rapid growth, contingent upon the expansion of localized aluminum production facilities and major planned investments in renewable energy and complex defense projects.

Segment-wise analysis reveals that the Gantry-based FSW machine segment retains the largest revenue share, primarily due to its inherent stability and capacity to handle the heavy, large-scale workpieces characteristic of aerospace and railway industries, such as monolithic fuel tanks or long railway panel extrusions. However, the Robotic FSW segment is overwhelmingly forecasted to register the highest Compound Annual Growth Rate (CAGR). This acceleration is a direct reflection of the industry’s need for flexibility, enabling the welding of non-linear seams and complex 3D contours typical in modern vehicle bodies and heat management systems. By application, the Automotive segment, particularly stimulated by the EV battery manufacturing value chain (including cooling plates and battery pack sealing), and the highly specialized Aerospace & Defense segment remain the two most influential revenue contributors. These sectors continuously push the technological envelope, demanding machines capable of handling new high-strength alloys and dissimilar material combinations with micron-level precision and process repeatability, thereby underpinning the overall market's forward momentum and innovation cycle.

AI Impact Analysis on Friction Stir Welding Machine Market

Common user questions regarding AI's influence on the Friction Stir Welding Machine Market frequently center on its ability to enhance process reliability, reduce dependency on skilled labor, and automate quality inspection for critical components. Users are intensely interested in utilizing AI for predictive quality control, asking whether machine learning models can accurately predict the mechanical properties (like tensile strength and hardness) of a weld joint based purely on real-time sensor data, thus eliminating the need for destructive testing. Key concerns often relate to data handling and model robustness; specifically, how vast quantities of proprietary process data can be securely stored and analyzed, and how ML models can maintain accuracy when welding processes are frequently adjusted for new material batches or environmental changes. The overarching expectation is that AI will transform FSW from a highly empirical, parameter-sensitive process into a self-optimizing manufacturing tool capable of achieving near-perfect first-pass yield rates, significantly shortening the time required for new material process development and qualification, particularly in regulated environments like aerospace.

The implementation of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operational paradigm of FSW machines, driving them toward becoming fully intelligent and adaptive manufacturing cells integrated within the Industry 4.0 framework. AI algorithms are strategically deployed to analyze expansive datasets collected in real-time—including axial force, torque fluctuations, spindle speed variances, temperature distribution via thermal imaging, and tool vibration signatures. This analysis allows ML models to establish ultra-precise operational parameter maps. Crucially, this enables real-time adaptive control, where the machine autonomously makes micro-adjustments to parameters like plunge depth or tilt angle to counteract minor material variations or tool wear effects that would typically lead to defects. This level of autonomous, real-time control is vital for maintaining consistent weld quality across kilometer-long seams or complex, non-linear trajectories, substantially reducing scrap rates and accelerating the certification cycles required for high-stress aerospace and defense components.

Beyond process control, AI is revolutionizing maintenance and quality assurance protocols within the FSW domain. ML models analyze historical machine performance data and current acoustic emissions or power consumption patterns to implement highly accurate predictive maintenance strategies, forecasting precisely when a component might fail or when a tool requires replacement, thereby minimizing unscheduled downtime and optimizing tool inventory management. Concurrently, AI-powered vision systems, utilizing deep learning networks, are being integrated directly into the FSW workspace. These systems perform instantaneous, non-contact inspection of the weld surface immediately following the process. They can detect and classify minute surface flaws, kissing bonds, or inconsistent material flow profiles far more rapidly and consistently than human inspectors, generating rapid feedback loops that allow the control system to adjust subsequent welds instantly. The net result of this AI integration is a substantial enhancement in production reliability, a reduction in operating expenditures, and a decreased dependence on high-cost, specialized metallurgical expertise for routine production monitoring and quality auditing.

- AI-driven Predictive Maintenance: Analyzing machine health indicators (vibration, acoustic signature, load cells) to forecast tool wear and component failure with high accuracy, optimizing maintenance scheduling.

- Real-Time Adaptive Parameter Control: ML algorithms dynamically adjusting tool speed, tilt angle, and plunge depth based on immediate sensor feedback to ensure optimal material flow and bond integrity, mitigating process variation.

- Automated Quality Assurance (AQA): Deep learning vision systems performing instantaneous inspection of weld seams for micro-surface defects, kissing bonds, and profile inconsistencies, improving throughput dramatically.

- Process Optimization and Material Qualification: Using reinforcement learning and deep neural networks to determine optimal welding parameters for new or complex material combinations, significantly reducing experimental costs and qualification time.

- Digital Twin Integration: Utilizing AI to feed highly realistic process data into simulation models (Digital Twins), enabling remote monitoring, pre-emptive diagnostics, and scenario testing for novel FSW applications before physical trials.

DRO & Impact Forces Of Friction Stir Welding Machine Market

The Friction Stir Welding Machine Market is fundamentally propelled by the pervasive global mandate for structural lightweighting, particularly within highly competitive and regulated transportation sectors where material efficiency directly translates to operational economics and environmental compliance. The key driver is the transition to complex, lightweight non-ferrous structures (aluminum, magnesium, copper) in electric vehicles, high-speed trains, and modern aircraft, where FSW offers the only viable solution for creating high-strength, leak-proof joints without compromising material properties. This driver is powerfully reinforced by global climate goals and stringent fuel efficiency standards, making lightweighting an economic necessity, not merely a technical advantage. However, this growth is significantly tempered by the high initial capital investment required for dedicated FSW machinery, which often exceeds the financial capacity of small to medium enterprises (SMEs). Furthermore, the complex metallurgy and steep learning curve required to establish and certify FSW processes, especially for safety-critical components, act as a structural restraint, limiting rapid, widespread adoption across all manufacturing tiers.

The primary opportunity for market expansion resides in the burgeoning electric vehicle battery manufacturing ecosystem. FSW is critically employed in sealing battery packs and joining cooling plate assemblies, processes that demand unparalleled precision, consistency, and thermal stability. This opportunity is amplified by the potential integration of FSW with Additive Manufacturing (AM); FSW can be used as a superior post-processing or hybrid joining technique to enhance the structural integrity and sealing performance of AM parts, opening entirely new markets in specialized component fabrication. Moreover, developing portable and orbital FSW systems presents a significant opportunity to address previously inaccessible markets, such as on-site repair, pipeline joining, and shipbuilding, moving FSW capabilities beyond the constraints of fixed factory environments. The strategic pursuit of advanced tooling materials that extend tool life and enable faster traverse speeds is essential to fully capitalize on these volume-driven opportunities.

The market is constantly shaped by powerful internal and external impact forces. Internally, the accelerating rate of material innovation, particularly in difficult-to-weld high-strength aluminum-lithium alloys and metal matrix composites, compels FSW machine manufacturers to continuously invest in R&D to upgrade machine power, stiffness, and control systems. Externally, the regulatory landscape, especially the stringent airworthiness certification requirements mandated by bodies like the FAA and EASA, exerts intense pressure on machine accuracy and process repeatability, establishing extremely high barriers to entry for new market players. Furthermore, the industrial shift toward integrated, interconnected smart factory environments (Industry 4.0) is a defining force, demanding that FSW machines not only perform the weld but also provide comprehensive, real-time data logging and network integration capabilities. Competitive pressure is high, with key players striving to achieve technological differentiation through patented tool designs, AI-enabled control software, and offering full-service integration and training packages.

- Drivers: Intensified global demand for lightweight structures in EVs and aerospace; superior quality and reliability of FSW joints (fatigue resistance); governmental push for sustainable manufacturing and reduced carbon footprint; ability to reliably join dissimilar material systems.

- Restraints: Significant upfront capital expenditure and long return on investment cycle; process limitations regarding complex non-linear joint geometries and corner welding; reliance on specialized tooling and proprietary process knowledge; high cost of tooling materials for high-temperature applications.

- Opportunities: Explosive growth in the EV battery manufacturing supply chain (cooling plates and casings); utilization of portable and orbital FSW for field repairs and large-scale infrastructure; hybrid manufacturing applications combining FSW with Additive Manufacturing; expansion into shipbuilding and civil engineering applications.

- Impact forces: Strict regulatory compliance and certification processes (Aerospace and Defense); rapid development of specialized tooling materials (e.g., ceramics, PCBN); industrial automation trend (Robotics and Industry 4.0); pricing pressure driven by market competition in high-volume applications.

Segmentation Analysis

The Friction Stir Welding Machine Market segmentation reflects the technological complexity and diverse application needs across various heavy and light industries. The classification based on machine type—Gantry, Desktop, and Robotic—is crucial for understanding the operational focus of different market players. Gantry FSW systems, characterized by their immense stiffness, high force capacity, and ability to handle large dimensions, typically serve aerospace and naval applications where component size and structural precision are paramount. These systems often represent the highest capital investment segment. Conversely, Desktop FSW machines cater to the R&D, educational, and prototyping needs of material science labs and smaller fabricators, focusing on flexibility and ease of use for process development rather than mass production throughput.

The segmentation by application provides the most direct insight into market revenue streams and future potential. Historically, Aerospace and Defense has been the anchor segment, dictating the highest quality and technology standards due to the critical nature of aircraft structural components, such as fuel tanks, friction stir welded in one seamless pass. However, the Automotive segment has dramatically accelerated its market presence, becoming the primary growth engine driven by global mandates for lightweight, sealed, and robust battery enclosures for Electric Vehicles. The superior, void-free joining FSW offers for aluminum cooling fins and battery casings is indispensable for these applications. Other significant segments, such as Railway and Electronics, demand FSW for large aluminum extrusions (rail cars) and high-density thermal management solutions (semiconductor heat sinks), respectively, seeking enhanced thermal conductivity and material consistency.

Segmentation by material type underscores the fundamental strength of FSW technology in handling materials traditionally challenging for fusion welding. Aluminum alloys, ranging from low-strength commercial grades to highly engineered aluminum-lithium alloys, dominate the market share, corresponding directly to their ubiquitous use in transportation. The ability to join high-conductivity materials like copper (essential for EV motor windings and busbars) and magnesium alloys (increasingly used in automotive inner body structures for weight savings) further solidifies FSW's technological niche. Market participants must align their product development—specifically tool design and machine power ratings—to these material segments, as the processing requirements for, say, thick copper plate versus thin aluminum sheet necessitate fundamentally different machine kinematics and force control mechanisms, emphasizing the specialized nature of the entire FSW machine supply chain.

- By Type:

- Gantry FSW Machines (Large, high-force, high-stiffness systems for aerospace and railway applications)

- Desktop FSW Machines (Compact, R&D focused, used for material process development and small components)

- Robotic FSW Systems (Flexible, multi-axis, used for complex 3D contours and integration into automated lines)

- By Application:

- Aerospace & Defense (Structural panels, fuel tanks, internal component welding)

- Automotive (Electric vehicle battery trays, motor casings, body-in-white structures)

- Railway (High-speed train panel joining and body shell assembly)

- Marine (Ship deck panels, superstructures, specialized marine vessels)

- Electronics & Thermal Management (High-performance heat sinks, cooling plates)

- General Industrial Fabrication (Pressure vessels, pipe joining, architectural components)

- By Material Type:

- Aluminum Alloys (The largest segment, encompassing all major structural alloys)

- Magnesium Alloys (Focus on ultra-lightweight components)

- Copper and Copper Alloys (Critical for high-efficiency electrical and thermal applications)

- Steel and Titanium (Niche but growing segment requiring specialized high-force machinery)

- Dissimilar Materials Joining (E.g., Aluminum to Copper, Aluminum to Steel)

Value Chain Analysis For Friction Stir Welding Machine Market

The Friction Stir Welding Machine value chain commences with the highly specialized Upstream Component and Raw Material Suppliers. This tier is crucial for providing the core elements that define the machine’s performance and tool longevity. Suppliers furnish high-precision, high-torque servo motors, advanced multi-axis CNC controllers, and sophisticated sensor packages (e.g., load cells, thermal imaging systems). Most critically, they supply the highly engineered materials necessary for FSW tool fabrication, such as Polycrystalline Cubic Boron Nitride (PCBN), Tungsten Rhenium, or specialized high-speed tool steels. The proprietary nature of tool design and material handling means that key machine builders often engage in strategic, long-term relationships with a limited number of specialized tool material providers to ensure quality and supply chain resilience, representing a low-volume, high-value input stage.

The Midstream stage is dominated by the FSW Machine Manufacturers (OEMs) and System Integrators, who perform the core design, assembly, software development, and quality assurance of the complete welding platform. This stage requires deep mechanical, metallurgical, and control systems expertise. Manufacturers specialize in either standard systems (Desktop models) or highly customized, large-scale systems (Gantry and specialized Robotic cells), which requires extensive consultation and engineering work tailored to the client's specific application and material portfolio. Distribution channels for FSW machines are overwhelmingly direct, given the high unit cost, technical complexity, and the need for application-specific adjustments. The sales process involves specialized engineering teams performing detailed feasibility studies and technical demonstrations before purchase. Indirect distribution, leveraging authorized dealers or regional integrators, is generally confined to standardized smaller models or market entry strategies in emerging economies.

Downstream activities center on the End-Users, encompassing key sectors like Aerospace, Automotive, and Railway. This stage includes installation, commissioning, intensive operator training, and ongoing technical support, which form a significant and recurrent revenue stream through service contracts. The feedback loop from the downstream users is vital for driving upstream innovation, especially regarding new material joining challenges and demands for higher automation standards. The effectiveness of the FSW implementation heavily relies on the quality of the post-sales support, including software updates, calibration services, and the supply of consumable FSW tools. The overall value chain is characterized by strong vertical integration and intellectual property protection surrounding tool technology and specialized machine control algorithms, ensuring that value concentration remains high among the established machine OEMs who possess comprehensive technical know-how.

Friction Stir Welding Machine Market Potential Customers

The primary cohort of potential customers for Friction Stir Welding Machines consists of global Original Equipment Manufacturers (OEMs) and their specialized Tier 1 and Tier 2 suppliers operating within sectors defined by regulatory scrutiny and a high requirement for lightweight, durable structures. The most rapidly expanding customer segment is within the Electric Vehicle (EV) manufacturing ecosystem. This includes companies producing vehicle chassis, large-format aluminum castings, and, most critically, dedicated production lines for battery packs, where FSW is essential for creating reliable, hermetically sealed enclosures for lithium-ion cells and assembling complex fluid cooling plates. These clients typically procure highly automated, multi-station robotic FSW cells or specialized gantry systems optimized for speed and repeatability across long seam lengths, recognizing FSW as a strategic technology investment directly enabling competitive EV range and safety standards.

The second largest and most established customer base is the Aerospace and Defense industry, including manufacturers of commercial airframes (Boeing, Airbus suppliers), military vehicles, and space exploration hardware. These customers, due to the safety-critical nature of their products, demand machines with the highest level of stability, control system integrity, and extensive process documentation for rigorous certification. They predominantly purchase high-force, custom-built gantry systems capable of welding multi-meter-long panels for fuselage and wing structures using advanced aluminum-lithium alloys. Furthermore, governmental defense contractors invest in FSW for munitions casings, armored vehicle components, and naval applications where material integrity under stress is paramount, frequently requiring unique specifications for process monitoring and data logging.

Beyond transportation, specialized industrial fabricators and research entities represent a persistent demand pool. Railway manufacturers, particularly those involved in high-speed and metropolitan transit systems in Asia and Europe, are continual customers for large FSW machines used to join extruded aluminum body sections, minimizing weight and maximizing structural rigidity. Additionally, semiconductor and electronics cooling solution providers utilize desktop and small gantry FSW systems to fabricate high-performance, complex heat sinks and cooling systems made from high-conductivity copper and aluminum, where the void-free joint provided by FSW ensures optimal thermal transfer performance. Finally, material research centers and universities globally continuously invest in compact FSW machines to explore novel material combinations and process parameters, acting as vital incubators for future industrial applications and process standardization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 629.8 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stirweld, Grenzebach Group, TWI Ltd., KUKA AG, FOOKE GmbH, Nova-Tech Engineering, Hage Sondermaschinenbau GmbH & Co. KG, Pacesetter Systems, Sener, ESAB (Colfax Corporation), General Dynamics Corporation, Bond Technologies Inc., Manufacturing Technology Inc. (MTI), MTU Aero Engines AG, VDL Groep, Hitachi Zosen Corporation, EWI, FANUC Corporation, Comau SpA, BWI Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Friction Stir Welding Machine Market Key Technology Landscape

The technological landscape of the Friction Stir Welding Machine Market is undergoing a transformation characterized by the pursuit of higher speed, enhanced material flexibility, and superior process intelligence. The primary technological advancement revolves around the next generation of FSW tooling. There is an intensive global effort to develop and commercialize specialized, high-performance tool materials, such as Polycrystalline Cubic Boron Nitride (PCBN) and advanced refractory metal alloys (e.g., Tungsten-Rhenium), which are necessary for successfully applying FSW to high-melting-point materials like steels, titanium, and nickel alloys, thereby significantly expanding FSW's industrial reach beyond its traditional domain of aluminum. Simultaneously, proprietary tool designs, including threaded pins, scroll shoulders, and dynamically adjustable tools, are continuously optimized using computational fluid dynamics (CFD) and Finite Element Analysis (FEA) to improve material flow, minimize heat input, and reduce the requisite machine clamping force.

Another crucial technological pillar is the evolution of machine kinematics and control systems, driven by Industry 4.0 principles. Modern FSW machines feature exceptionally rigid frames, advanced vibration isolation systems, and multi-axis CNC controllers with microsecond processing speeds to ensure unparalleled positional accuracy and dynamic stability under high forging forces. Key advancements include the refinement of highly versatile Robotic FSW systems, which integrate high-payload, industrial robots with FSW heads, allowing for the welding of non-planar surfaces and complex three-dimensional contours, often critical in automotive and marine hull fabrication. Furthermore, the development of specialized FSW variants, such as Self-Reacting FSW (SR-FSW) or Bobbin FSW, eliminates the need for massive backing plates and significantly reduces the required external clamping force, making the process more scalable and applicable to thinner gauge materials and hollow structures.

Crucially, the integration of advanced process monitoring and data analytics systems is distinguishing leading machine manufacturers. Current FSW technology utilizes complex sensor arrays—including load cells to monitor axial and traverse forces, accelerometers for vibration analysis, and infrared cameras for thermal mapping—to generate comprehensive real-time process data. This data is leveraged through integrated software platforms that provide operators with critical insights into tool condition, material consistency, and weld quality metrics. The ultimate goal is achieving predictive process control: systems that can not only detect deviations but proactively compensate for them. This focus on intelligent, data-driven manufacturing ensures that FSW machines meet the stringent documentation and repeatability requirements demanded by aerospace qualification procedures and the high-volume efficiency targets of the automotive manufacturing sector, securing the long-term technological competitiveness of the FSW process against other joining methods.

Regional Highlights

The global FSW Machine Market is geographically diverse, with Asia Pacific (APAC) asserting dominant market influence, driven primarily by unparalleled investment in future-focused mobility solutions. China is the cornerstone of APAC demand, owing to its status as the largest global manufacturer and consumer of electric vehicles, which necessitates extensive deployment of FSW machinery for high-volume production of aluminum battery enclosures and structural components. Additionally, APAC government initiatives focused on expanding high-speed rail networks, coupled with growing regional capabilities in aerospace component manufacturing (especially in Japan, South Korea, and India), ensure a consistent and accelerating need for both standard gantry and flexible robotic FSW systems. The region benefits from strong governmental support for industrial automation and localized material production, translating into favorable conditions for adopting advanced manufacturing techniques like FSW at scale.

North America and Europe constitute the established, high-value segments of the market, characterized by demand concentrated in quality-critical and technology-intensive applications. North America's market resilience is rooted in the colossal Aerospace and Defense sector, where key industry players continuously invest in state-of-the-art FSW gantry machines to fabricate mission-critical structures, such as space vehicle components and advanced military aircraft wings, often driving demand for specialized FSW variants like SR-FSW. In Europe, the market is highly mature and innovation-focused, led by Germany, France, and the UK. European demand is driven by stringent environmental policies pushing for extreme lightweighting in automotive bodies, necessitating complex robotic FSW integrations for multi-material structures. The focus here is less on raw volume and more on developing specialized, highly flexible machines that comply with rigorous European industrial safety and quality standards, including seamless integration with factory automation systems.

Latin America and the Middle East & Africa (MEA) are pivotal emerging markets exhibiting robust long-term potential. Latin America, particularly Brazil and Mexico, presents growth opportunities linked to the localized expansion of major international automotive OEMs and increasing investment in regional infrastructure modernization, including light rail projects. Demand in MEA is strategically focused on large-scale infrastructure and industrial diversification goals, particularly in the Gulf Cooperation Council (GCC) nations. Investments in massive aluminum smelters are creating local downstream manufacturing opportunities that require FSW for projects such as high-efficiency solar energy thermal collectors, large desalination plant components, and defense modernization programs. Although these regions currently hold a smaller market share, the rate of infrastructure spending and industrial capacity building suggests they will offer the highest proportionate growth potential in the latter half of the forecast period, especially as FSW technology becomes more accessible and portable systems enter the market.

- Asia Pacific (APAC): Market leader by volume; primary driver is the explosive growth of EV battery manufacturing and massive investment in high-speed rail and localized aircraft production; concentrated in China and South Korea.

- North America: High-value market focused on Aerospace & Defense, demanding specialized, high-precision gantry systems and advanced material handling capabilities; significant R&D investment in military and space applications.

- Europe: Mature market characterized by high automation (Industry 4.0) and stringent quality requirements; focused on complex robotic FSW for advanced lightweight automotive structures and specialized marine applications.

- Latin America: Emerging market driven by local automotive assembly plants and investment in regional public transportation and energy infrastructure; potential focused on Brazil and Mexico.

- Middle East & Africa (MEA): High growth potential linked to industrial diversification, investment in solar energy projects, large-scale aluminum production, and specialized defense manufacturing modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Friction Stir Welding Machine Market.- Stirweld

- Grenzebach Group

- TWI Ltd. (Technology Licensing and Consultancy)

- KUKA AG (Robotic Systems Integration)

- FOOKE GmbH

- Nova-Tech Engineering

- Hage Sondermaschinenbau GmbH & Co. KG

- Pacesetter Systems

- Sener

- ESAB (Colfax Corporation)

- General Dynamics Corporation (In-house utilization and technology development)

- Bond Technologies Inc.

- Manufacturing Technology Inc. (MTI)

- MTU Aero Engines AG (Internal application development)

- VDL Groep

- Hitachi Zosen Corporation

- EWI (Engineering, research, and development)

- FANUC Corporation (Robotics supplier integrated into FSW systems)

- Comau SpA

- BWI Group

- Hyundai Heavy Industries Co., Ltd. (Utilization and customized integration)

- Trumpf GmbH + Co. KG (Indirectly through machine tool focus)

- Oerlikon Balzers (Tool coatings and materials)

- Kawasaki Heavy Industries, Ltd. (Robotic FSW solutions)

Frequently Asked Questions

Analyze common user questions about the Friction Stir Welding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of FSW over traditional fusion welding, especially in aluminum structures?

FSW is a solid-state joining process that avoids the melting point of the material, which is critical for aluminum alloys susceptible to hot cracking and porosity. This results in joints free of solidification defects, minimal thermal distortion, reduced residual stress, and superior mechanical properties, particularly high fatigue life.

Which industrial sector is currently driving the most significant global growth in FSW machine adoption?

The Automotive sector, driven intensely by the global transition to Electric Vehicles (EVs), is the key growth engine. FSW is essential for manufacturing large, hermetically sealed, high-integrity aluminum battery trays and complex thermal management systems required for maximizing EV safety and range.

How is the FSW machine market segmented by machine type, and which segment is growing fastest?

The market is segmented into Gantry, Desktop, and Robotic systems. While Gantry systems currently hold the largest market share due to their use in large aerospace components, the Robotic FSW segment is projected to exhibit the highest CAGR, reflecting the industry's pervasive shift toward flexible automation for complex, 3D geometries.

What technological advancements are critical for expanding FSW’s application to steel and titanium alloys?

Expanding FSW to high-melting-point materials relies critically on developing advanced tooling materials, such as Polycrystalline Cubic Boron Nitride (PCBN) and refractory metal alloys. These specialized tools must withstand the intense heat and mechanical loads necessary to plasticize steel and titanium without excessive wear.

What are the main financial barriers to entry for companies considering adopting Friction Stir Welding technology?

The main barriers are the substantial initial capital investment required for high-capacity FSW machines and the associated costs for specialized process training, tooling inventory, and the lengthy, rigorous qualification processes required to certify the weld process, particularly in regulated industries like aerospace.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager