Frozen Dessert Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442162 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Frozen Dessert Market Size

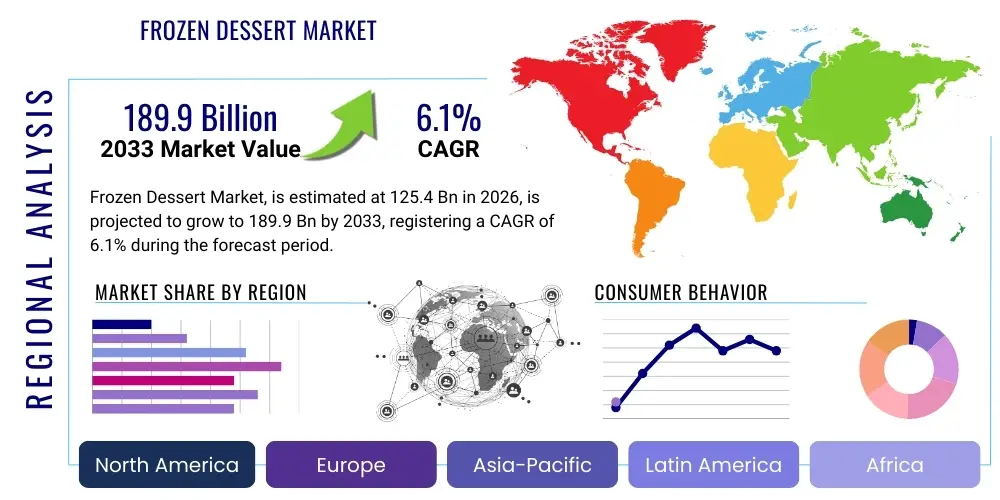

The Frozen Dessert Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 125.4 Billion in 2026 and is projected to reach USD 189.9 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by shifting consumer preferences towards premium, indulgent, and health-conscious alternatives, alongside robust growth in emerging economies.

Frozen Dessert Market introduction

The Frozen Dessert Market encompasses a wide variety of consumable products stored and served below freezing temperatures, including traditional ice cream, gelato, frozen yogurt, sorbet, sherbet, and novelties. These products serve primarily as treats, snacks, or dessert items across both developed and developing regions, catering to a diverse consumer base seeking indulgence, convenience, and increasingly, functional benefits. Major applications span retail consumption (supermarkets, convenience stores) and the foodservice industry (restaurants, cafes, quick-service restaurants), with year-round demand exhibiting seasonal peaks, particularly in warmer climates. The foundational product categories are characterized by their base ingredients—dairy or non-dairy—and their fat content, texture, and flavor profiles.

Driving factors for sustained market growth include rising global disposable incomes, especially in the Asia Pacific region, leading to increased discretionary spending on premium food items. Furthermore, manufacturers are successfully innovating by introducing healthier alternatives, such as reduced-sugar, low-fat, and plant-based (vegan) frozen desserts, appealing directly to the growing segment of health-conscious consumers and those with dietary restrictions like lactose intolerance. The increasing availability and efficiency of cold chain logistics, particularly in previously underserved rural areas, further facilitate product accessibility and market penetration, ensuring sustained availability and quality preservation of these temperature-sensitive products. Consumer demand for novel and exotic flavors also pushes continuous product line expansion.

The benefits associated with the frozen dessert market extend beyond mere indulgence; these products offer emotional satisfaction and serve as convenient, portion-controlled snack solutions. The market benefits significantly from its strong association with celebratory moments and comfort food status. The industry is highly dynamic, characterized by rapid flavor innovation, packaging optimization for single-serve convenience, and strategic brand positioning focusing on natural ingredients, sustainability, and ethical sourcing practices. This blend of indulgence and functionality ensures the frozen dessert category maintains a persistent and growing share within the overall packaged food industry.

Frozen Dessert Market Executive Summary

The global Frozen Dessert Market is experiencing a pivotal transformation marked by significant business trends centered on premiumization, functional ingredient integration, and heightened sustainability efforts. Geographically, the Asia Pacific region is poised for the most rapid expansion, fueled by urbanization, rising middle-class consumption, and the increasing adoption of Western dietary habits. North America and Europe, while mature, remain crucial centers for innovation, particularly in developing non-dairy alternatives and highly-specialized dietary products, such as keto-friendly or high-protein frozen treats. Business trends emphasize strategic mergers and acquisitions among major players seeking to consolidate market share and acquire specialized production capabilities, notably in the artisanal and plant-based segments. Furthermore, robust investment in direct-to-consumer (D2C) channels and enhanced cold chain logistics is defining competitive advantage.

Segment trends highlight a noticeable shift away from traditional, high-sugar ice cream towards healthier, alternative categories. The plant-based frozen dessert segment, utilizing ingredients like almond milk, oat milk, and coconut cream, is witnessing exponential growth and is highly attractive to investors due to its broad consumer appeal across vegan, flexitarian, and lactose-intolerant populations. In terms of distribution, the supermarket/hypermarket channel retains dominance, though the growth of online retail platforms and specialized frozen dessert outlets is accelerating, offering greater convenience and customized delivery options. Flavor innovation remains a persistent driver, with consumers increasingly favoring ethnic, complex, and seasonal flavor profiles over standard vanilla and chocolate offerings. The novelty segment, including ice cream sandwiches and popsicles, continues to attract impulse purchases, particularly among younger demographics.

Regulatory frameworks, especially concerning sugar labeling and ingredient transparency, are influencing product reformulation strategies across the board, driving manufacturers to adopt natural sweeteners and clean-label ingredients. Overall, the market's trajectory indicates sustained growth, underpinned by consumer willingness to pay a premium for high-quality ingredients, ethical sourcing, and products aligned with personalized nutritional goals. Success in this highly competitive landscape hinges on a company's ability to maintain agility in new product development (NPD), optimize supply chain efficiency under stringent cold chain requirements, and effectively leverage digital marketing strategies to engage target consumer groups.

AI Impact Analysis on Frozen Dessert Market

User queries regarding AI’s influence on the frozen dessert market frequently revolve around how artificial intelligence can address core industry challenges such as cold chain management failure, unpredictable consumer demand fluctuations, and the necessity for rapid, successful flavor innovation. Consumers and industry stakeholders are keen on understanding AI's role in optimizing complex, energy-intensive logistics and predicting hyper-localized preferences to minimize waste and maximize freshness. Key themes summarized from this analysis include the expectation that AI will revolutionize supply chain visibility, dramatically improve demand forecasting accuracy (especially considering seasonality and weather patterns), and accelerate the R&D process for novel ingredient combinations and flavor pairings that resonate with specific regional palates. There is also significant interest in using AI for optimizing energy consumption in large-scale freezing and storage facilities, aligning with corporate sustainability goals.

- Supply Chain Optimization: AI-driven predictive maintenance for refrigeration units and optimizing transportation routes to minimize temperature variance, reducing spoilage and ensuring product integrity across the cold chain.

- Demand Forecasting: Utilizing machine learning models to analyze vast datasets (weather, social media trends, sales history, competitor promotions) for highly accurate, granular predictions of consumer purchasing behavior by location and time.

- New Product Development (NPD): AI algorithms analyzing ingredient compatibility, flavor preferences, and nutritional constraints to rapidly suggest novel flavor combinations and functional formulations that meet emerging consumer dietary trends (e.g., keto, high-protein).

- Manufacturing Efficiency: Implementation of AI in factory automation to optimize freezing cycles, texture control, and quality assurance processes, leading to reduced energy consumption and consistent product quality.

- Personalized Marketing: Leveraging AI to segment customers and deploy targeted marketing campaigns based on purchasing habits and real-time behavioral data, enhancing conversion rates and brand loyalty.

DRO & Impact Forces Of Frozen Dessert Market

The dynamic expansion of the Frozen Dessert Market is fundamentally driven by increasing consumer disposable income globally and the strong trend towards convenient, ready-to-eat snack options that offer momentary indulgence. Manufacturers' relentless focus on product innovation, particularly the introduction of 'better-for-you' options such as low-sugar, dairy-free, and organic variants, significantly expands the market appeal beyond traditional demographics. However, market growth faces inherent restraints, primarily related to the high operational costs associated with maintaining a stringent, energy-intensive cold chain from production through to the point of sale, which exerts continuous pressure on profit margins. Furthermore, increasing public health campaigns targeting high sugar intake and obesity present a structural challenge, compelling companies to invest heavily in costly reformulations to meet evolving regulatory standards and consumer demands for healthier profiles.

Opportunities for exponential growth are concentrated within the plant-based and functional frozen dessert segments, catering to the rising prevalence of dietary restrictions and the holistic wellness movement. Developing regions, particularly those in the Asia Pacific and Latin America, represent untapped potential due to rapidly growing consumer bases and improving retail infrastructure capable of supporting frozen goods distribution. The key impact forces shaping the competitive landscape are the intensity of rivalry among established global players and agile start-ups specializing in niche dietary products, alongside the significant bargaining power of large retail chains demanding favorable pricing and promotional support. Technological advancements in sustainable packaging and freezing technologies offer crucial competitive advantages, enabling cost reduction and enhancing brand image related to environmental stewardship.

The interplay of these factors defines the strategic imperative for market participants: companies must balance the consumer desire for indulgent flavors with the necessity for healthier nutritional profiles, all while managing complex and costly logistical networks. Successful firms strategically mitigate restraints by adopting advanced automation and data analytics to optimize cold chain efficiency, while simultaneously capitalizing on opportunities through targeted mergers and acquisitions to quickly integrate novel ingredient technologies and specialized brands into their portfolio. This strategic balancing act determines sustained profitability and market leadership in the highly dynamic frozen dessert category.

Segmentation Analysis

The Frozen Dessert Market is meticulously segmented based on product type, flavor, ingredient profile, distribution channel, and geography, allowing for precise market analysis and targeted strategic planning. Product segmentation differentiates between traditional Ice Cream (premium, standard, and economy), Gelato (known for its density and low fat content), Frozen Yogurt (often perceived as a healthier alternative), Sorbet/Sherbet (typically dairy-free or low-fat), and Novelties (single-serve, impulse-driven products like sticks and cones). This diverse product portfolio caters to varying consumer preferences regarding texture, fat content, and price point. The overarching trend across all product types is the shift toward premiumization, where consumers are willing to pay more for high-quality, recognizable ingredients and unique flavor experiences.

Ingredient segmentation focuses heavily on distinguishing between Dairy-based and Non-Dairy/Plant-based alternatives. The surge in non-dairy options, driven by oat, almond, soy, and coconut bases, represents one of the most significant disruptive forces in the market, attracting flexitarians and vegans alike. Flavor segmentation remains highly fragmented, ranging from classic profiles (Vanilla, Chocolate, Strawberry) to complex, experimental, and regional-specific tastes (e.g., Matcha, Pistachio, Salted Caramel). The effectiveness of product positioning often relies on leveraging these segments—for instance, a premium, non-dairy, complex-flavored product targeting high-income urban millennials through specialized distribution channels. Analyzing these segmented markets reveals pockets of high growth, particularly within the non-dairy and functional dessert categories.

- By Product Type:

- Ice Cream (Regular, Premium, Super-premium)

- Gelato

- Frozen Yogurt

- Sorbet and Sherbet

- Novelties (Popsicles, Cones, Sandwiches)

- By Ingredient:

- Dairy-based

- Non-Dairy/Plant-based (Almond, Coconut, Soy, Oat)

- By Flavor:

- Chocolate

- Vanilla

- Fruit-based

- Nut/Seed-based

- Other Exotic Flavors

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail/E-commerce

- Foodservice/HORECA

Value Chain Analysis For Frozen Dessert Market

The Frozen Dessert Market value chain is inherently complex and capital-intensive, defined by the critical requirement of maintaining the cold chain across all stages. Upstream activities involve the procurement of core raw materials, predominantly dairy (milk, cream) or non-dairy substitutes (nuts, oats, coconut), alongside sweeteners, stabilizers, emulsifiers, and natural flavorings. Volatility in global commodity prices, especially for dairy products and specialized non-GMO ingredients, significantly impacts production costs. Manufacturers must establish stringent quality control and reliable sourcing networks to ensure consistency and meet 'clean label' consumer demands. Effective upstream management requires long-term contracts and hedging strategies to mitigate supply risk and cost fluctuations.

Midstream processing involves blending, pasteurization, homogenization, and the crucial freezing process, which determines the final product texture and quality. This stage utilizes specialized, energy-intensive machinery (freezers, batch processors) and relies heavily on R&D for texture optimization and overrun control. Downstream activities are dominated by the distribution channel, which is perhaps the most critical and complex part of the value chain. Distribution relies entirely on robust, interconnected cold storage facilities and refrigerated transport. Direct distribution via company-owned fleets or specialized logistics partners ensures temperature compliance, crucial for minimizing spoilage. Indirect distribution utilizes third-party logistics (3PL) providers and wholesaler networks, offering broader reach but requiring rigorous monitoring protocols.

The final consumption point is segmented between retail sales (supermarkets, convenience stores, and online platforms) and foodservice outlets (HORECA). Retail channels benefit from high-volume sales and promotional activities, while foodservice often drives premium branding and immediate consumption. The rise of e-commerce necessitates specialized final-mile delivery solutions, often involving highly insulated packaging and localized cold storage depots. Optimizing this complex, temperature-controlled supply chain through technology adoption (e.g., IoT temperature monitoring) is essential for maintaining product quality, enhancing brand reputation, and achieving competitive operational efficiencies in a market where logistics costs are disproportionately high.

Frozen Dessert Market Potential Customers

The primary end-users and buyers of frozen dessert products are broadly categorized into individual consumers across varying demographic segments and institutional/commercial food service operators. Individual consumers form the largest and most diverse segment, driven by factors such as age, disposable income, dietary preference, and cultural habits. Specific consumer groups include millennials and Gen Z, who are significant drivers of the premium and specialty dessert segments, often seeking unique flavors, plant-based options, and ethical sourcing. Families with children constitute a substantial market for traditional ice cream and novelties, focusing on value and convenience. Health-conscious adults, including those managing diabetes or lactose intolerance, drive demand for low-sugar, low-fat, and non-dairy alternatives, positioning them as high-value, niche buyers.

The second major category involves commercial buyers within the Foodservice (HORECA) industry, including full-service restaurants, fast-casual dining, cafes, catering companies, and specialized dessert parlors. These businesses procure frozen desserts for immediate consumption, requiring bulk packaging, consistent quality, and, increasingly, customized flavor profiles to complement their menu offerings. The demand from the foodservice sector is highly sensitive to economic fluctuations affecting consumer dining habits, but it offers a vital platform for brand visibility and testing new product concepts. Furthermore, institutional buyers, such as hospitals, schools, airlines, and corporate cafeterias, constitute a stable, high-volume segment focused primarily on bulk efficiency, nutritional compliance, and standardized quality.

In addition to these traditional segments, the burgeoning e-commerce channel is creating a new category of buyers—the digital consumer—who prioritize speed, convenience, and home delivery for personalized indulgence experiences. Catering to this segment requires robust digital marketing strategies and specialized last-mile cold logistics capabilities. Ultimately, the successful engagement of potential customers depends on manufacturers' abilities to tailor packaging, price, and product formulation to meet the specific needs and consumption contexts of these highly differentiated buyer groups, from a celebratory family tub purchased at a hypermarket to a high-end artisanal single-serve product delivered directly to an apartment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.4 Billion |

| Market Forecast in 2033 | USD 189.9 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, Nestlé S.A., General Mills Inc., Froneri International plc, Mars Incorporated, Blue Bell Creameries, Danone S.A., Turkey Hill Dairy, Wells Enterprises Inc., The Häagen-Dazs Company, Ben & Jerry’s Homemade Inc., Baskin-Robbins, Oatly Group AB, Halo Top International, Cado Ice Cream, Perfect Day Inc., Tofutti Brands Inc., Oatman Farms, Yasso Frozen Greek Yogurt, Jeni's Splendid Ice Creams. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Frozen Dessert Market Key Technology Landscape

The technological landscape in the frozen dessert market is focused on optimizing production efficiency, enhancing product quality, extending shelf life, and addressing sustainability mandates. A primary area of innovation involves advanced freezing techniques. Continuous freezing systems are being upgraded with optimized scraped-surface heat exchangers and high-pressure homogenization units to create finer ice crystals and improve texture, crucial for premium products like artisanal gelato and low-fat ice creams. Cryogenic freezing, utilizing liquid nitrogen or carbon dioxide, offers ultra-rapid freezing capabilities, minimizing crystal formation, which is particularly beneficial for high-end, smooth-textured products and reducing processing time, leading to significant quality improvements and energy savings in specific high-throughput operations. Furthermore, sophisticated control systems utilizing sensors and automation ensure consistent overrun (air incorporation) levels, which is vital for texture control and cost management.

Ingredient technology represents another core area of advancement. The growing success of the plant-based segment relies heavily on innovative hydrocolloids, stabilizing agents, and specialized protein isolates (e.g., pea, fava bean, precision fermentation whey) that successfully mimic the mouthfeel and stability traditionally provided by dairy fat and milk solids. Manufacturers are actively investing in R&D to overcome textural challenges inherent in non-dairy bases, specifically grit and iciness, using novel emulsification techniques and fiber-based stabilizers. Additionally, the development and integration of natural, non-nutritive sweeteners and sugar reduction technologies (such as allulose or stevia derivatives) are critical to meeting consumer demand for healthier profiles without compromising flavor integrity, which directly impacts the product formulation process and ingredient sourcing strategies across the industry.

Sustainability and packaging technology are increasingly central to competitive advantage. The industry is rapidly adopting biodegradable and compostable packaging materials (e.g., paperboard tubs with bio-based liners) to reduce plastic waste, responding directly to regulatory pressure and consumer environmental concerns. In logistics, the integration of Internet of Things (IoT) sensors and RFID tags into cold storage and transport vehicles provides real-time monitoring of temperature and humidity. This data enables predictive risk management for the cold chain, allowing immediate corrective action to prevent spoilage and ensuring compliance with strict temperature requirements, thereby drastically reducing product loss and improving overall supply chain reliability—a non-negotiable factor for successful market operation.

Regional Highlights

- North America: North America, particularly the United States, represents a highly mature yet innovative market segment characterized by high per capita consumption and strong demand for super-premium and functional frozen desserts. The region leads in the adoption of non-dairy alternatives (especially oat-based and almond-based products) and health-focused categories such as high-protein, low-calorie, and keto-friendly ice creams. Competition is intense, driven by continuous flavor innovation and strategic brand positioning, often leveraging sustainability and ethical sourcing claims. Cold chain infrastructure is highly advanced, supporting complex distribution models, including specialized e-commerce delivery.

- Europe: The European market is characterized by diverse consumption patterns, with Mediterranean countries showing strong preference for gelato and sorbet. Western Europe, led by the UK and Germany, is experiencing significant growth in the plant-based segment, influenced by robust vegetarian and vegan movements. Stringent regulatory environments regarding ingredient labeling and environmental policies drive innovation in packaging and sugar reduction strategies. The region sees strong segmentation between mass-market retail and premium, artisanal production, with a growing focus on organic and locally sourced ingredients.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive economic growth, rapid urbanization, and rising disposable incomes in populous countries like China and India. The market is transitioning from traditional, home-based desserts to Western-style frozen treats. Key drivers include the young demographic base, expansion of modern retail chains (supermarkets), and improving cold chain logistics, which is crucial for market penetration outside major metropolitan areas. Localization of flavors, incorporating ingredients like green tea (Matcha) and regional fruits, is a critical success factor for global players operating in this diverse region.

- Latin America (LATAM): Growth in LATAM is closely linked to economic stability and climate, with high seasonal consumption. Brazil and Mexico are leading markets, showing increased demand for premium imported brands alongside strong local competition. The market often utilizes aggressive pricing strategies in the mass market segment, but premiumization trends are gaining traction, particularly in urban centers where consumers seek out international or artisanal quality desserts. Infrastructure challenges related to electricity reliability and cold chain consistency can pose operational hurdles in certain territories.

- Middle East and Africa (MEA): The MEA region exhibits moderate but consistent growth, buoyed by high population growth and increasing expatriate presence in the Gulf Cooperation Council (GCC) countries. Consumption is driven by luxury and imported brands in the GCC, while South Africa is a key regional manufacturing hub. Climate plays a significant role in high year-round demand. Challenges include market fragmentation and reliance on imported raw materials, though localized production is increasing to serve regional flavor preferences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Frozen Dessert Market.- Unilever (Global leader with brands like Ben & Jerry's, Magnum, and Cornetto, driving innovation in both indulgence and plant-based categories.)

- Nestlé S.A. (Major presence globally, focusing on ice cream and frozen novelty segments, with strategic investments in nutritional and low-sugar formulations.)

- General Mills Inc. (Parent company of Häagen-Dazs, specializing in premium, super-premium ice cream offerings and global brand expansion.)

- Froneri International plc (A global joint venture between Nestlé and PAI Partners, focusing heavily on ice cream and frozen food distribution efficiency.)

- Mars Incorporated (Key player in the novelty segment with popular chocolate-bar branded frozen products, focusing on impulse purchases.)

- Blue Bell Creameries (Dominant regional player in the Southern US market, renowned for high-fat content traditional ice cream.)

- Danone S.A. (Primarily focused on frozen yogurt and dairy alternatives, leveraging expertise in functional foods and probiotic enrichment.)

- Turkey Hill Dairy (Regional US player specializing in conventional ice cream and frozen beverages, expanding distribution across the mid-Atlantic.)

- Wells Enterprises Inc. (Manufacturer of Blue Bunny and other private label brands, a major US producer focused on variety and broad market reach.)

- The Häagen-Dazs Company (Globally recognized premium brand, continually introducing high-end, complex flavor combinations.)

- Ben & Jerry’s Homemade Inc. (Known for social mission and unique flavor mixes, strongly positioned in the super-premium and ethical sourcing categories.)

- Baskin-Robbins (Global franchise specializing in custom ice cream cakes and a vast array of flavors, driving demand through retail outlets.)

- Oatly Group AB (Pioneering the oat-based frozen dessert segment, focusing on sustainable and vegan offerings with rapid global scaling.)

- Halo Top International (Market disruptor focusing on low-calorie, high-protein ice cream, capturing the health-conscious adult consumer segment.)

- Cado Ice Cream (Specializes in avocado-based, non-dairy frozen desserts, appealing to consumers seeking unique, healthy fat profiles.)

- Perfect Day Inc. (Technology company focused on using precision fermentation to create animal-free dairy proteins for frozen dessert applications.)

- Tofutti Brands Inc. (Established manufacturer of soy-based, kosher, and non-dairy frozen desserts and novelties.)

- Yasso Frozen Greek Yogurt (Leading brand in the frozen Greek yogurt bar category, known for low-calorie, high-protein snack solutions.)

- Jeni's Splendid Ice Creams (Artisanal, high-end ice cream brand focusing on whole ingredients and unique, highly curated flavor development.)

- Tillamook County Creamery Association (Farmer-owned cooperative known for premium, high-quality dairy-based ice cream in North America.)

Frequently Asked Questions

Analyze common user questions about the Frozen Dessert market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the frozen dessert market?

The primary drivers include rising disposable incomes globally, increasing consumer demand for convenient, ready-to-eat indulgence, and significant innovation in ‘better-for-you’ segments, such as plant-based and reduced-sugar formulations, catering to diverse dietary needs.

Which product segment is expected to show the fastest growth?

The Non-Dairy/Plant-based frozen dessert segment, utilizing bases like oat, almond, and coconut, is projected to exhibit the highest CAGR due to rising veganism, flexitarian diets, and increasing consumer awareness regarding lactose intolerance and environmental sustainability.

How is the cold chain impacting frozen dessert industry costs?

The stringent maintenance requirements of the cold chain—encompassing specialized storage and refrigerated logistics—constitute a major operational restraint, significantly increasing energy consumption, infrastructure investment, and overall distribution costs, particularly in developing markets.

What role does sustainability play in modern frozen dessert packaging?

Sustainability is a critical competitive factor. Manufacturers are rapidly transitioning to eco-friendly packaging solutions, including recyclable paperboard, bio-based plastic liners, and compostable materials, driven by consumer demand and regulatory pressure to reduce plastic waste and carbon footprint.

Which region offers the greatest market opportunity for new entrants?

The Asia Pacific (APAC) region offers the greatest market opportunity, fueled by rapid urbanization, expanding middle-class consumption, and improving cold chain infrastructure, making it ideal for both established brands and specialized niche product introductions targeting localized tastes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager