Fruit and vegetable planing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441883 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Fruit and vegetable planing Market Size

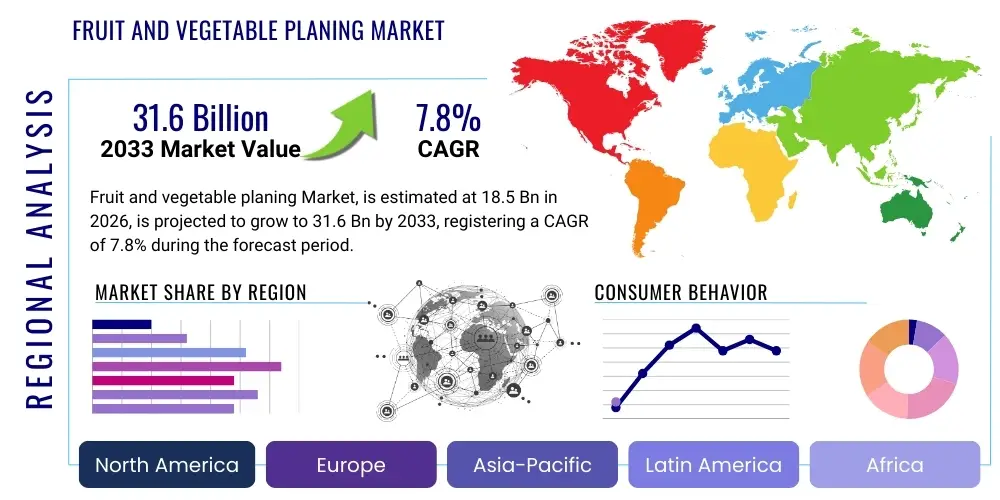

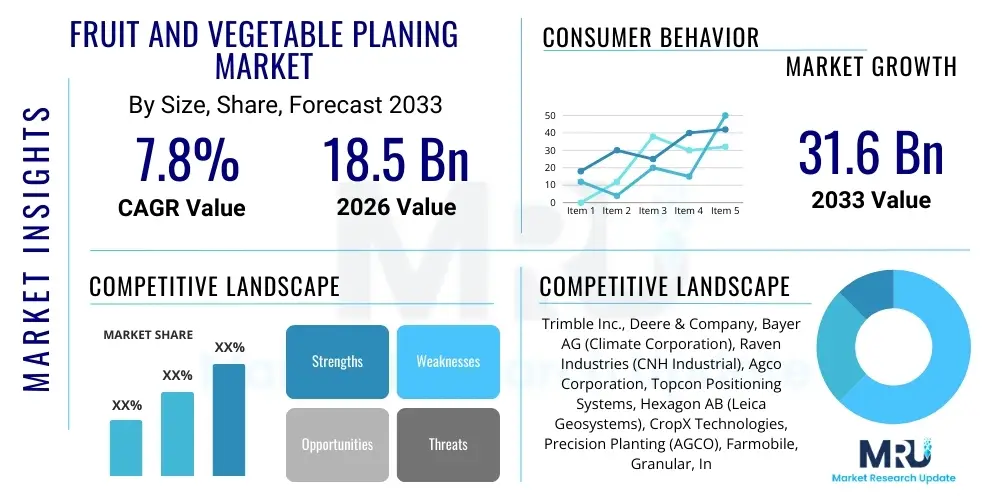

The Fruit and vegetable planing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $31.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for fresh produce, coupled with the critical need for enhanced operational efficiency and resource optimization across the agricultural supply chain. Market expansion is particularly pronounced in regions facing acute labor shortages and those adopting precision agriculture techniques to maximize output from limited arable land.

The valuation represents the total expenditure on specialized planning software, precision farming equipment (such as automated seeders, variable rate applicators), data analytics platforms dedicated to yield forecasting, and associated consulting services focused on optimizing planting schedules, nutrient management, and harvesting logistics. The transition from traditional, manual planning methods to integrated digital planning ecosystems is a major catalyst. Investments are increasingly channeled towards integrating IoT sensors, drone imagery, and predictive modeling capabilities, ensuring better alignment between planting density, expected environmental conditions, and projected market demand, thereby minimizing post-harvest losses and improving profitability for large commercial farms and agribusinesses.

Fruit and vegetable planing Market introduction

The Fruit and vegetable planing Market encompasses the specialized technologies, equipment, and strategic services designed to optimize the entire pre-production and growth cycle of fruit and vegetable crops. This market is crucial for modern agriculture, addressing complexities such as climate variability, resource scarcity (water and land), and the necessity for high-quality, standardized output required by global retail chains. Key products include sophisticated GIS mapping tools, yield forecasting software, automated planting machinery equipped with GPS guidance, and comprehensive crop management systems that facilitate data-driven decision-making from soil preparation through to harvest scheduling. These tools provide unparalleled accuracy in determining optimal planting dates, varietal selection, irrigation schedules, and nutrient application rates, fundamentally transforming traditional farming into a highly efficient industrial operation.

Major applications of these planing technologies span large-scale commercial farming operations, greenhouses, vertical farms, and cooperative farming enterprises focused on staple crops like tomatoes, potatoes, berries, and leafy greens. The primary benefits include significant improvements in yield per hectare, drastic reductions in input costs (fertilizer, water, pesticides) due to precision application, reduced operational downtime, and enhanced traceability and quality compliance, which is vital for meeting stringent international food safety standards. The core driving factors fueling market adoption include burgeoning global population growth demanding increased food supply, rapid technological advancements in sensor technology and machine learning, governmental initiatives promoting sustainable and smart agriculture practices, and the continuous pressure on farming enterprises to counteract rising labor costs and ecological constraints.

Furthermore, the market's evolution is heavily influenced by the adoption of sustainable farming practices. Planing solutions are integral to environmental stewardship by enabling farmers to minimize chemical runoff and water usage. By precisely mapping soil conditions and nutrient requirements, planning systems ensure inputs are applied only where and when necessary. This strategic resource allocation not only lowers operational expenses but also enhances the long-term viability and productivity of agricultural land. The necessity for integrated supply chain planning, linking production schedules directly to processing and distribution timelines, further solidifies the role of specialized fruit and vegetable planing technologies in the global food system.

Fruit and vegetable planing Market Executive Summary

The Fruit and vegetable planing Market is characterized by robust growth, driven primarily by the transition towards precision agriculture and the integration of IoT and AI into farm management systems. Business trends indicate a significant shift among leading technology providers towards subscription-based software-as-a-service (SaaS) models for farm management platforms, prioritizing data analytics and predictive capabilities over purely hardware sales. Consolidation is evident, with major agricultural machinery companies strategically acquiring smaller software and sensor technology firms to offer holistic, end-to-end planning solutions. Sustainable agriculture mandates and escalating input costs are compelling agribusinesses globally to invest heavily in efficient planning technologies, ensuring market buoyancy across developed and rapidly developing economies.

Regionally, North America and Europe maintain market leadership, primarily due to high levels of technological maturity, established infrastructure for precision farming, and favorable regulatory environments supporting agri-tech innovation and data utilization. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration in APAC is fueled by modernization efforts in countries like India and China, large-scale government subsidies promoting mechanization, and the urgent need to boost domestic food security through intensified, efficient farming methods. Latin America is also emerging as a key growth area, particularly in commodity export-focused segments where optimizing large field operations is critical for international competitiveness.

In terms of segment trends, the Software and Services component dominates the market revenue, reflecting the growing value placed on actionable data and predictive intelligence for planning. Within the Technology segment, sophisticated sensor networks and drone-based imaging solutions are seeing heightened adoption due to their role in real-time crop health monitoring, which directly informs dynamic planting and nutrient plans. The market remains competitive, with established agricultural equipment manufacturers competing fiercely with specialized agricultural software developers. Future success hinges on developing seamless integration capabilities between disparate farm systems (e.g., planning, irrigation, harvesting equipment) and ensuring user-friendly interfaces that facilitate easy adoption by farm managers.

AI Impact Analysis on Fruit and vegetable planing Market

Common user questions regarding AI's impact on the Fruit and vegetable planing Market often revolve around predictive accuracy, return on investment (ROI), and the displacement of human expertise. Key themes include "How accurately can AI predict yield given localized weather data?" "What are the costs associated with implementing AI-powered planning systems?" and "Will AI integration simplify or complicate existing farm management workflows?" Users are keenly interested in AI’s capability to automate complex decision-making, such as dynamic adjustment of planting density based on real-time soil moisture and historical yield patterns, ensuring optimal resource allocation. The summary indicates high user expectation for AI to fundamentally revolutionize risk management and forecasting, enabling planning cycles that are adaptive rather than static, thereby driving unprecedented levels of efficiency and resilience in crop production.

- Enhanced Yield Forecasting: AI algorithms process historical data, satellite imagery, and weather forecasts to predict yields with precision, optimizing planting quantity.

- Automated Irrigation Scheduling: Machine learning models analyze soil moisture, evapotranspiration rates, and specific crop needs to determine exact watering times and volumes, minimizing water waste.

- Dynamic Nutrient Management: AI identifies nutrient deficiencies at the subplot level, generating precise, variable-rate prescriptions for fertilizer application during the planting phase.

- Optimized Crop Rotation Planning: Algorithms analyze market trends, soil health dynamics, and disease pressure to recommend the most profitable and sustainable sequence of crops over multiple seasons.

- Disease and Pest Detection: Deep learning applied to drone or satellite imagery detects early signs of crop stress or infection, allowing for preemptive protective measures during the growth phase.

- Robotic Planting Coordination: AI optimizes the path planning and operational execution of autonomous planting machinery, maximizing coverage efficiency and minimizing overlap.

- Risk Mitigation Planning: Predictive analytics models simulate adverse weather events (drought, frost) and recommend preparatory actions or insurance strategies based on localized probability.

DRO & Impact Forces Of Fruit and vegetable planing Market

The dynamics of the Fruit and vegetable planing Market are shaped by a strong interplay between technological innovation and agricultural necessity. Key drivers include the global imperative to increase agricultural productivity amidst shrinking resources, the necessity for high-quality produce to meet stringent consumer and regulatory standards, and the widespread adoption of digital infrastructure in rural areas. However, growth is tempered by significant restraints, primarily the high initial capital investment required for implementing sophisticated precision planting equipment and the steep learning curve associated with adopting complex data analytics platforms. Opportunities lie primarily in developing affordable, scalable solutions suitable for small and medium-sized farms in emerging markets and integrating biological planning data (e.g., microbiome health) into standard forecasting models. These forces collectively propel the market forward while demanding continuous innovation from vendors to overcome adoption barriers.

The primary impact force driving current market momentum is demographic change, specifically the aging farming population in developed economies and increasing urbanization globally, which necessitates technological substitution for manual labor in intensive field operations. Furthermore, climate change acts as a critical external force, increasing the volatility of yields and making advanced planning and risk mitigation tools indispensable. This pressure pushes farmers toward adopting sophisticated technologies that can model and adapt to unpredictable environmental shifts. Vendors who successfully offer integrated planning solutions that address labor scarcity and climate resilience simultaneously are poised for substantial market share gains.

Restraints are particularly pronounced in regions where reliable internet connectivity and digital literacy among farming communities are low. Data privacy and ownership concerns also present a barrier, as farmers hesitate to share sensitive operational data required for high-accuracy predictive planning. The market is thus bifurcated, with advanced systems dominating industrialized agriculture and simpler, low-cost planning solutions penetrating emerging markets. Strategic partnerships between technology providers and local agricultural extension services are critical to mitigating the educational barrier and fostering widespread adoption necessary to sustain long-term growth.

Segmentation Analysis

The Fruit and vegetable planing Market is comprehensively segmented based on technology type, application scope, service deployment model, and regional presence, reflecting the diversity of needs within the global agricultural sector. Understanding these segments is vital for businesses seeking to tailor their offerings, whether focusing on high-precision hardware for large corporate farms or scalable software services for smaller cooperative setups. The primary segmentation dimensions reveal a market increasingly moving away from standalone equipment toward integrated, data-driven service packages, where the software component drives the highest margin and long-term customer engagement, dictating future market strategy for key players.

- By Technology Type:

- Hardware (Precision Seeders, Variable Rate Applicators, Sensors, Drones)

- Software (Farm Management Information Systems (FMIS), GIS/Mapping Tools, Predictive Analytics Platforms)

- Services (Consulting, Integration and Implementation Services, Data Analysis Support)

- By Crop Type:

- Fruits (Berries, Citrus, Stone Fruits, Melons)

- Vegetables (Leafy Greens, Root Vegetables, Solanaceous Crops, Cruciferous Vegetables)

- By Farm Size:

- Large Farms (Above 1,000 Hectares)

- Medium Farms (100 to 1,000 Hectares)

- Small Farms (Below 100 Hectares)

- By Deployment Model:

- Cloud-Based

- On-Premise

Value Chain Analysis For Fruit and vegetable planing Market

The value chain for the Fruit and vegetable planing Market commences with upstream suppliers providing core technological components such as advanced GPS/GNSS receivers, high-resolution sensors, specialized microprocessors, and sophisticated agricultural software libraries. These components are integrated by technology developers and agricultural machinery manufacturers to create the final planning systems and equipment. Upstream market dynamics are characterized by technological specialization and high intellectual property value, where reliability and precision of core sensor technology are paramount for system performance. Key players in this stage include specialized electronics manufacturers and geospatial data providers.

The midstream involves the core market players—the Farm Management Information System (FMIS) providers and machinery companies—who assemble, market, and distribute the planning solutions. Distribution channels are varied, including direct sales to large agribusinesses, specialized agricultural equipment dealerships, and, increasingly, software subscription portals for digital services. The effectiveness of the distribution network, particularly the availability of localized technical support and training for complex software, significantly influences market penetration. Partnerships with local distributors who possess deep regional agricultural knowledge are essential for navigating localized compliance and soil variation requirements.

The downstream analysis focuses on the end-users—commercial growers, independent farmers, and large food processors who utilize the planning data and equipment. The value generated at this stage is maximized yield, reduced operational risk, and compliance assurance. Feedback loops from these end-users back to the technology developers are critical for continuous product improvement, especially concerning user interface design and real-world performance accuracy. Indirect beneficiaries include agricultural financing institutions and crop insurance companies who leverage the high-quality planning data to better assess risk and offer tailored financial products, thereby completing the robust cycle of the modern agricultural planning ecosystem.

Fruit and vegetable planing Market Potential Customers

Potential customers for the Fruit and vegetable planing Market are diverse, ranging from large multinational agribusinesses to independent smallholder cooperatives, with purchasing decisions primarily driven by the scale of operation and the intensity of farming practices. The primary end-users, or buyers, are commercial farm managers and agricultural operational executives responsible for maximizing profitability and efficiency across vast tracts of cultivated land. These customers are heavily focused on ROI metrics related to input savings (water, fertilizer) and measurable increases in yield quality and volume. Their purchasing criteria often prioritize system scalability, data integration capabilities, and the vendor’s reputation for providing reliable technical support and predictive accuracy.

A rapidly growing segment of potential customers includes large institutional investors and corporate entities engaged in agricultural land management. These buyers require sophisticated planning solutions not just for operational optimization but also for strategic resource allocation, compliance reporting, and long-term sustainability planning to meet Environmental, Social, and Governance (ESG) mandates. For this segment, the ability of the planning system to integrate seamlessly with financial modeling software and provide transparent, auditable records is a deciding factor. Additionally, government-funded research institutions and large-scale agricultural testing centers also represent key buyers, purchasing these technologies for experimental and educational purposes to advance local farming practices and disseminate best-practice knowledge.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $31.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble Inc., Deere & Company, Bayer AG (Climate Corporation), Raven Industries (CNH Industrial), Agco Corporation, Topcon Positioning Systems, Hexagon AB (Leica Geosystems), CropX Technologies, Precision Planting (AGCO), Farmobile, Granular, Inc. (Corteva Agriscience), Bosch Rexroth AG, Yara International ASA, Sentera, Inc., Growmark, Inc., Taranis, Farmers Edge Inc., SST Development Group, AgJunction. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fruit and vegetable planing Market Key Technology Landscape

The technological landscape of the Fruit and vegetable planing Market is highly dynamic, characterized by the convergence of agricultural engineering, data science, and telecommunications. Central to this landscape is the widespread deployment of the Internet of Things (IoT), involving networks of sophisticated ground sensors (measuring soil pH, moisture, and nutrient levels) and atmospheric sensors that feed real-time environmental data into centralized Farm Management Information Systems (FMIS). These systems form the backbone of planning, enabling highly localized and immediate adjustments to planting parameters. Furthermore, advanced robotics and autonomous machinery, guided by RTK (Real-Time Kinematic) GPS, ensure sub-centimeter accuracy in planting, spacing, and variable rate application, drastically improving resource efficiency compared to previous generations of equipment.

A crucial enabling technology is the integration of High-Resolution Geospatial Imagery, primarily sourced from drones, low-orbit satellites, and fixed-wing aircraft. This imagery, processed through specialized spectral analysis software, allows farmers and planners to assess crop vigor, identify localized stress points, and precisely map terrain variations that influence planting decisions. The data output from these imaging systems fuels the predictive analytics engines, which use Machine Learning (ML) algorithms to forecast yields and optimize operational logistics, such as predicting ideal harvesting windows and managing labor resources efficiently based on anticipated crop readiness. The transition to 5G connectivity is also playing a transformative role, enabling the necessary high-speed data transfer required for real-time decision-making in large field operations.

Beyond field-based technology, the planning market relies heavily on sophisticated software tools utilizing cloud computing for data storage and processing. These platforms offer simulation capabilities, allowing farm managers to test various planting scenarios (e.g., higher density vs. lower density, different varietals) against forecasted climate models before committing resources. Cybersecurity and data integrity are growing technological considerations, necessitating robust encryption and authentication protocols, particularly as farm data becomes integral to financial reporting and compliance. The future of the technology landscape is focused on seamless, plug-and-play interoperability between different vendors' hardware and software systems, moving toward truly standardized digital farming ecosystems.

Regional Highlights

- North America: This region holds a dominant share of the market, primarily driven by the extensive adoption of large-scale precision farming techniques and favorable government subsidies promoting technological upgrades. The U.S. and Canada are leaders in integrating satellite imagery and autonomous vehicles for large-area fruit (e.g., citrus, berries) and vegetable (e.g., corn, potato) planning. High labor costs necessitate advanced mechanization, making sophisticated planning systems essential for competitive agribusiness operations.

- Europe: Characterized by stringent environmental regulations and a strong push toward sustainable agriculture, the European market shows rapid adoption of planning solutions focused on minimizing environmental impact, such as precise nitrogen application planning and water management tools. Countries like the Netherlands, Germany, and France are pioneering the use of planning technology in high-tech greenhouse environments and closed-loop vertical farms, focusing on optimized resource efficiency and controlled environment agriculture (CEA) planning.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. Growth is powered by modernization efforts in China and India, aimed at increasing farm output to feed rapidly growing populations. The market here is driven by the need for scalable, affordable planning solutions suitable for medium and small landholders, often supported by large-scale government digitization projects focused on improving irrigation efficiency and yield predictability for staple vegetables.

- Latin America: This region, particularly Brazil and Argentina, demonstrates strong demand for sophisticated planning technologies, especially for export-focused fruit production (e.g., tropical fruits) and large commodity vegetable farms. The emphasis is on maximizing operational efficiency across massive land parcels, leveraging GNSS systems for accurate mapping and logistical planning to ensure timely harvests for international markets.

- Middle East and Africa (MEA): The MEA market is seeing steady growth, mainly concentrated in areas facing severe water scarcity. Planning solutions here are critical for optimizing limited resources, focusing heavily on specialized planning for desert and semi-arid conditions, including advanced irrigation scheduling and selecting climate-resilient crop varietals. Government investment in food security projects is the main catalyst.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fruit and vegetable planing Market.- Trimble Inc.

- Deere & Company

- Bayer AG (Climate Corporation)

- Raven Industries (CNH Industrial)

- Agco Corporation

- Topcon Positioning Systems

- Hexagon AB (Leica Geosystems)

- CropX Technologies

- Precision Planting (AGCO)

- Farmobile

- Granular, Inc. (Corteva Agriscience)

- Bosch Rexroth AG

- Yara International ASA

- Sentera, Inc.

- Growmark, Inc.

- Taranis

- Farmers Edge Inc.

- SST Development Group

- AgJunction

- 365FarmNet GmbH

Frequently Asked Questions

Analyze common user questions about the Fruit and vegetable planing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Fruit and vegetable planing Market?

The primary driver is the accelerating global necessity for precision agriculture adoption, spurred by increasing operational costs, persistent agricultural labor shortages, and the critical need to boost yields sustainably to meet rising global food demand.

How does AI contribute to improving fruit and vegetable planning accuracy?

AI utilizes machine learning and deep learning algorithms to process vast datasets—including weather history, soil metrics, and satellite imagery—enabling highly precise yield forecasting, optimized irrigation, and dynamic adjustment of planting strategies in real-time.

Which segment of the market (Hardware or Software) is expected to generate the highest revenue?

The Software and Services segment is projected to generate the highest long-term revenue, driven by increasing farmer reliance on sophisticated Farm Management Information Systems (FMIS) and subscription-based predictive analytics platforms essential for data-driven decision-making.

What are the key restraint challenges facing widespread adoption of planning technology?

Key restraints include the substantial initial capital investment required for implementing precision planning hardware and the challenges associated with interoperability between different systems and platforms from various vendors in the complex agricultural technology ecosystem.

Why is the Asia Pacific region anticipated to demonstrate the fastest growth rate?

The APAC region's accelerated growth is fueled by large-scale government initiatives promoting agricultural modernization and mechanization, coupled with the urgent requirement for enhanced productivity and efficiency in major farming economies like India and China.

The extensive adoption of planning technology is fundamentally transforming farm profitability by mitigating inherent agricultural risks. For instance, advanced planning models can simulate the effects of extreme weather events, recommending optimal planting times to avoid critical developmental stages during anticipated high-stress periods. This proactive risk management capability is invaluable, especially in regions prone to climate volatility. Furthermore, the ability to generate detailed audit trails of planting and application activities is increasingly crucial for farmers aiming to comply with international trade standards and organic certification requirements, thereby opening access to premium global markets.

The market structure is becoming increasingly competitive, pushing solution providers to focus heavily on platform integration and seamless user experience. Farmers are increasingly demanding systems that can communicate effortlessly with their existing machinery fleets, irrespective of the manufacturer. This demand has spurred the development of open-source standards and API (Application Programming Interface) connectivity within the agri-tech sector, moving away from proprietary, closed systems. Successful vendors are those who offer comprehensive, integrated digital ecosystems rather than isolated tools, ensuring that planning data flows smoothly into execution systems for planting and nutrient application.

Looking ahead, the next wave of innovation in the Fruit and vegetable planing Market will center on hyper-local data modeling and integration with genomics. Utilizing planning systems capable of incorporating genomic data specific to particular crop varietals will allow for highly tailored nutrient and water planning, maximizing the genetic potential of the seed. This sophisticated level of planning moves beyond basic field mapping to complex biological engineering guided by digital intelligence. Moreover, the push for vertical and indoor farming, especially for high-value crops, requires completely customized planning software optimized for controlled environment agriculture, presenting a niche yet rapidly expanding segment.

The financial viability of adopting these complex planning systems is often scrutinized through rigorous cost-benefit analyses. While initial investment is high, the long-term operational savings often justify the expenditure within a few seasons. Key metrics used to evaluate ROI include the reduction in pesticide use per hectare, decrease in water consumption, and the quantified increase in marketable yield. These tangible benefits are crucial for convincing skeptical farm owners to transition from traditional methods to technologically advanced planning protocols. Furthermore, favorable financing schemes offered by agricultural banks, often incentivized by sustainability targets, are lowering the barrier to entry for medium-sized operations globally.

In conclusion, the Fruit and vegetable planing Market is poised for sustained exponential growth, anchored by the confluence of global food security demands, regulatory pressures toward sustainable farming, and relentless technological advancement. The shift from reactive farming management to proactive, predictive planning, underpinned by AI and IoT, defines the current competitive landscape. Market participants must prioritize integration, user education, and localized support to capture the burgeoning opportunities across diverse agricultural systems worldwide, ensuring that their solutions offer demonstrable value in terms of efficiency, risk mitigation, and environmental stewardship, positioning the agriculture industry for a resilient and productive future.

The deployment models also play a significant role in market accessibility. Cloud-based solutions are gaining traction rapidly, offering subscription flexibility, lower upfront hardware costs for software, and continuous, seamless updates to predictive models and databases. This accessibility is particularly appealing to smaller farms that cannot afford extensive on-premise IT infrastructure. Security and data latency remain critical considerations for cloud deployment, especially in regions with unstable internet connectivity. However, the benefits of shared computational power and immediate access to global knowledge bases far outweigh the limitations for most sophisticated planning operations, driving the cloud model to become the industry standard for scalable farm management platforms. This continuous technological migration reinforces the high growth forecast for the software and services sub-segments.

Sustainability mandates, driven by consumer preference and legislative action, are influencing product design within the planning market. New planning software must explicitly incorporate environmental impact assessments, such as calculating carbon footprints per unit of produce or optimizing nitrogen use efficiency. This functionality transforms the planning tools from merely maximizing profit to balancing economic viability with environmental responsibility. Companies that can provide certified, auditable data demonstrating improved environmental performance through their planning systems gain a substantial competitive advantage, particularly when targeting large retailers and European markets with strict ecological procurement policies.

The integration of biotechnology with planning tools represents a frontier area. For example, systems are being developed that utilize spectroscopic analysis of leaf samples or soil microbiological assays to provide highly specific planning inputs, far beyond standard chemical analysis. This deeper biological understanding, when integrated into predictive models, allows for unprecedented precision in nutrient timing and placement, effectively micro-managing the crop's physiological needs throughout its lifecycle. Such specialized planning capabilities are particularly valuable for high-margin specialty crops where quality and uniformity are premium factors, solidifying the market's trajectory toward hyper-personalized agricultural management.

The complexity of data management within the planning ecosystem demands continuous investment in training and technical support infrastructure. Farmers need systems that not only generate accurate planning outputs but also translate complex data visualizations into actionable, easy-to-understand instructions for field staff. Market leaders are therefore investing heavily in localized training programs and multilingual interfaces. The success of a planning solution is often less about the sophistication of the underlying algorithm and more about the ease of integration into daily farm operations, highlighting the necessity of human-centered design principles in agricultural technology development.

Furthermore, regulatory compliance planning is becoming a standalone service offering within the market. As global food safety and traceability requirements become stricter, specialized planning modules that automate the recording of every input (seed type, planting date, nutrient batch) and link it geographically to the field plot are highly valued. This ensures that in the event of a product recall or audit, the farm can instantaneously provide a complete, verified history of the produce. This regulatory functionality reduces administrative burden and operational risk for large commercial growers, justifying the premium pricing associated with advanced planning software packages.

In summary, the interplay of digital integration, sustainability pressures, and economic necessity fuels the dynamic expansion of the Fruit and vegetable planing Market. The future is characterized by AI-driven, highly integrated, and user-centric planning platforms that cater not only to productivity gains but also to the complex demands of modern supply chain transparency and environmental stewardship, cementing the market’s status as a critical enabler of resilient global food production systems.

The continued technological evolution focuses heavily on increasing the spatial resolution and frequency of data collection. For instance, swarms of small, inexpensive sensors deployed throughout the field offer much finer-grained data than traditional, centralized weather stations or aggregated satellite data. Planning software must evolve to handle this massive increase in data volume and velocity, integrating sophisticated edge computing capabilities to process data locally before transmission to the cloud. This trend enhances the real-time responsiveness of planning systems, moving the industry closer to truly autonomous, self-optimizing farming operations where human intervention is minimized.

Venture capital investment remains strong in the agri-tech sector, particularly targeting startups developing specialized AI tools for niche fruit and vegetable planning challenges, such as optimizing pollination logistics or forecasting the precise maturity window for delicate berry crops. This influx of capital facilitates rapid product innovation and competitive differentiation, compelling established market players to accelerate their own R&D cycles. Mergers and acquisitions are expected to continue, as established machinery giants seek to internalize these cutting-edge software capabilities rather than relying on external partnerships, thereby consolidating control over the integrated hardware-software planning ecosystem.

The adoption rate across different crop types reflects the value proposition. High-value specialty crops (e.g., premium avocados, organic berries) show higher and quicker adoption of advanced planning tools because the potential return on investment from preventing crop loss or optimizing quality is significantly higher. Conversely, commodity vegetables may utilize more basic, generalized planning systems. This difference in application intensity creates segmentation opportunities for vendors to offer tiered planning solutions tailored to the economic sensitivity and technical complexity of the specific crop value chain.

Finally, the market must address the global variance in agricultural infrastructure. Planning solutions destined for Africa or parts of Southeast Asia must be robust enough to function reliably with sporadic internet access and lower levels of existing mechanization. This necessity drives innovation in offline data processing capabilities and simplified interfaces compatible with basic mobile technology. Successfully navigating these infrastructural disparities through regionally adapted planning tools will be essential for achieving true global market saturation and meeting the universal need for efficient food production.

Further elaborating on the opportunities, the expansion of Controlled Environment Agriculture (CEA), including vertical farms and advanced greenhouses, presents a distinct, high-growth sub-market for specialized planning solutions. Traditional field planning software is inadequate for the hyper-optimized environment of CEA, which requires planning for light recipes, CO2 injection, closed-loop nutrient recirculation, and 24/7 climate control based on predictive energy consumption models. Specialized planning platforms for CEA maximize output density and minimize the massive energy expenditure associated with indoor farming, representing a crucial pathway for highly urbanized regions to secure local, high-quality vegetable supply.

The competitive differentiation amongst key players is increasingly reliant on data ownership and partnership networks. Companies that successfully aggregate the largest, most diverse datasets—including satellite, sensor, meteorological, and genomic information—possess a fundamental advantage in developing superior predictive models. Strategic partnerships with meteorological services, seed developers, and chemical suppliers enable a more holistic planning service, integrating supply chain logistics and biological inputs directly into the farmer's operational schedule. This convergence of information services reinforces the shift from simply selling a product to providing a comprehensive, integrated decision support system.

The impact of planning technologies extends significantly into post-harvest logistics. By providing precise forecasts of yield quantity, quality grade, and expected maturity timing months in advance, planning systems enable food processors, logistics companies, and retailers to optimize their resource allocation—staffing, transportation, and cold storage capacity—far more efficiently. This upstream visibility reduces wastage throughout the downstream supply chain, generating substantial economic value and demonstrating the systemic importance of accurate pre-harvest planning tools in the entire global food system infrastructure.

In addressing the challenges related to initial investment, vendor financing models, leasing arrangements for expensive machinery, and pay-per-use software subscriptions are becoming common strategies to lower the immediate financial burden on farmers. Furthermore, governmental agricultural subsidy programs, particularly those linked to environmental stewardship goals (e.g., reducing carbon emissions through optimized fertilizer use), often cover a significant portion of the cost for adopting certified planning technologies, effectively accelerating market adoption rates across various farm sizes.

The core proposition of the Fruit and vegetable planing Market is shifting from mere cost reduction to total resilience and sustainability management. Modern planning ensures not only efficient use of inputs but also adherence to soil health protocols and biodiversity goals. By digitally recording and optimizing crop rotations, soil restoration periods, and cover cropping, planning systems help farmers certify the long-term ecological viability of their operations, moving agriculture towards a data-driven, regenerative model and ensuring the sector can reliably meet future consumer and environmental demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager