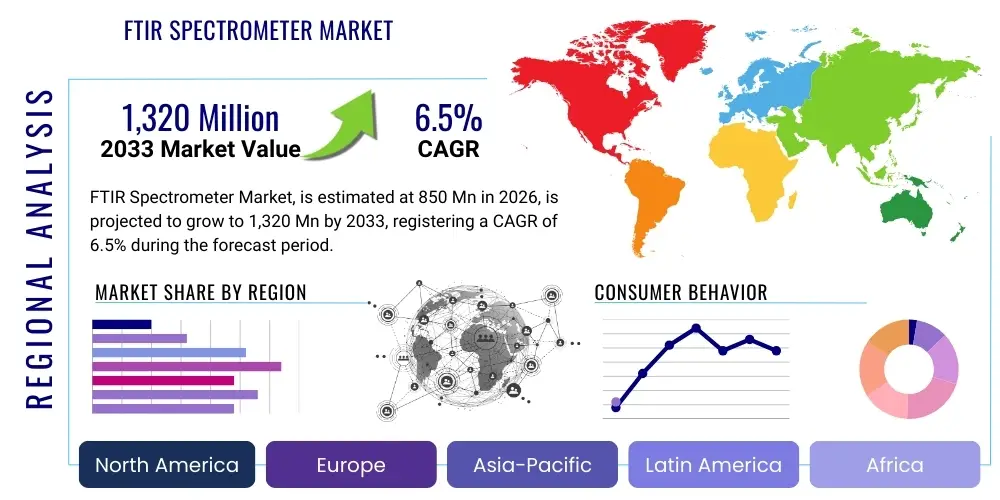

FTIR Spectrometer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442986 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

FTIR Spectrometer Market Size

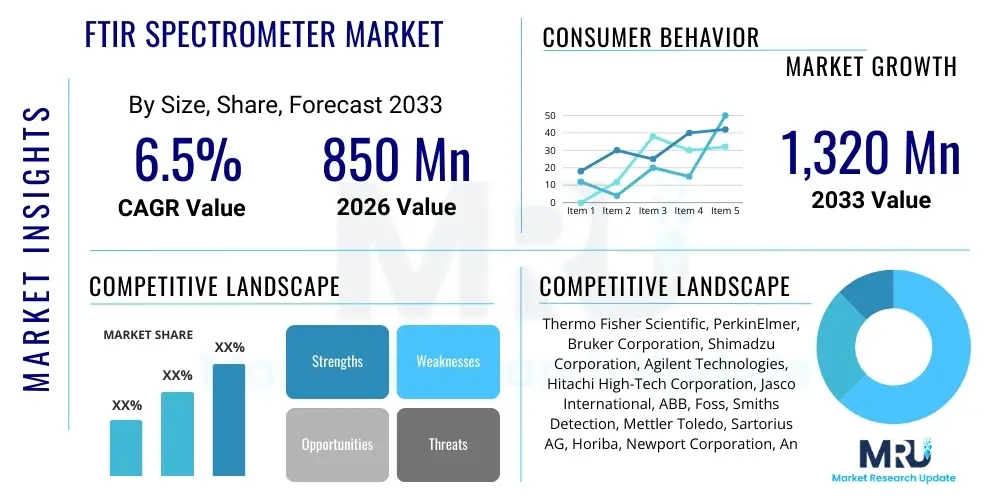

The FTIR Spectrometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,320 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by increasing demand for quality control and assurance across pharmaceutical and chemical industries, coupled with technological advancements leading to more compact and robust instruments. The market growth trajectory is also influenced by stringent regulatory requirements mandating detailed material characterization and analysis in emerging economies.

FTIR Spectrometer Market introduction

The Fourier-Transform Infrared (FTIR) Spectrometer Market encompasses instruments that utilize the principle of infrared absorption to identify chemical functional groups and determine material composition. This sophisticated analytical technique measures the absorption or transmission of infrared light as a function of the wavelength, creating a spectrum that acts as a unique chemical fingerprint for both organic and inorganic compounds. FTIR spectrometers offer significant advantages over traditional dispersive instruments, including superior signal-to-noise ratio, faster scan times, and higher resolution, making them indispensable tools in modern laboratories and industrial settings.

Major applications for FTIR technology span numerous sectors, including pharmaceuticals for drug discovery and quality control, petrochemicals for fuel analysis and polymer testing, and environmental monitoring for pollutant detection. Key benefits driving the adoption of FTIR systems include their non-destructive testing capability, minimal sample preparation requirements, and the ability to analyze samples in various states—solid, liquid, or gas. The versatility of the technology, combined with continuous improvements in hardware and software, positions FTIR spectrometers as essential instruments for materials science, forensics, and academic research.

Driving factors for market growth involve the expansion of R&D activities globally, particularly in areas like advanced materials and nanotechnology, where precise structural analysis is critical. Furthermore, the rising need for rapid and accurate contamination detection in food and beverage production, alongside the increasing complexity of synthesized materials requiring specialized identification methods, are significant catalysts. The continuous miniaturization of these devices, giving rise to portable and handheld units, is also broadening the accessibility and application scope of FTIR spectroscopy beyond centralized laboratories and into field operations.

FTIR Spectrometer Market Executive Summary

The FTIR Spectrometer Market is characterized by robust business trends centered on technological innovation, strategic mergers and acquisitions aimed at consolidating market share, and a pronounced shift toward integrated analytical solutions. Key business trends include the emphasis on developing hyphenated techniques, such as TGA-FTIR and GC-IR, which offer comprehensive analytical capabilities by combining thermal or chromatographic separation with infrared identification. Furthermore, manufacturers are focusing on enhancing software solutions with robust spectral libraries and machine learning algorithms to simplify data interpretation and improve the efficiency of non-expert users, driving greater adoption across diverse industrial settings.

Regional trends indicate that North America and Europe currently hold significant market share due to established pharmaceutical and biotechnology industries and high R&D spending. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by rapid industrialization, increasing governmental investment in quality control infrastructure, and the expansion of the chemical manufacturing base, particularly in countries like China, India, and South Korea. This shift is stimulating localized manufacturing and distribution partnerships, prompting global players to heavily invest in regional sales and support networks to capture the surging demand from emerging markets, especially in applications such as material science and clinical diagnostics.

Segment-wise, the market is primarily segmented by product type (benchtop, portable, and hyphenated systems), application (academia, industrial, government), and end-user. Benchtop systems currently dominate revenue due to their high performance and versatility in central laboratories, while portable and handheld devices are demonstrating the highest growth velocity dueating to their operational flexibility for on-site analysis and quality inspections in manufacturing environments. The life sciences and pharmaceutical sectors remain the most lucrative application segment, emphasizing high throughput and regulatory compliance, ensuring sustained demand for high-end, compliant FTIR solutions.

AI Impact Analysis on FTIR Spectrometer Market

Common user questions regarding AI's impact on FTIR spectroscopy center around enhancing data processing speed, automating complex spectral interpretation, and improving predictive maintenance for instrumentation. Users frequently inquire about how AI can handle large datasets generated by high-throughput screening, asking whether deep learning models can accurately identify novel or complex mixtures that standard spectral matching struggles with. A major concern is the reliability and transparency of AI-driven classifications, especially in highly regulated environments like pharmaceuticals. Overall, users expect AI to transition FTIR from a labor-intensive analytical technique to a rapid, predictive, and highly automated diagnostic tool, focusing on simplified workflows, enhanced accuracy in challenging sample matrices, and real-time decision making integrated directly into manufacturing processes.

AI's integration fundamentally transforms the operational paradigm of FTIR spectrometers by enabling advanced capabilities that transcend traditional spectral analysis. Machine learning (ML) models are deployed for rapid pattern recognition, allowing for instantaneous classification of materials, purity checks, and anomaly detection without requiring expert intervention to manually analyze specific absorption peaks. This automation drastically reduces the time required for quality control checks and allows instruments to be integrated seamlessly into production lines, facilitating Process Analytical Technology (PAT) initiatives. Furthermore, predictive algorithms utilize sensor data from the spectrometer to forecast potential hardware failures, thereby optimizing maintenance schedules and minimizing costly downtime for critical laboratory operations.

The application of deep neural networks in FTIR allows for highly accurate unmixing of complex samples and identification of trace components that would otherwise be masked by dominant signals. This is particularly crucial in environmental testing, forensic science, and polymer analysis where samples are often heterogeneous. AI also enables the development of smart spectral libraries that learn from previously analyzed data, constantly refining their classification accuracy. This iterative learning approach makes the instruments more powerful over time, driving greater value for end-users involved in complex material characterization and quality assurance, thereby expanding the potential scope and accuracy of non-destructive chemical analysis.

- Enhanced Data Interpretation: AI algorithms automate the identification of unknown compounds and complex mixtures, significantly speeding up spectral analysis.

- Real-Time Quality Control: Machine learning facilitates instantaneous pass/fail decisions in manufacturing environments, supporting Process Analytical Technology (PAT).

- Predictive Maintenance: AI monitors instrument performance indicators to anticipate and flag potential component failures, reducing downtime and operational costs.

- Spectral Unmixing: Deep learning models enable the accurate separation and quantification of components in highly complex and trace-level samples.

- Workflow Automation: AI manages instrument calibration, background checks, and automated reporting, minimizing manual user intervention.

DRO & Impact Forces Of FTIR Spectrometer Market

The FTIR Spectrometer market dynamics are shaped by a complex interplay of strong drivers related to regulatory mandates and technological advancements, significant restraints concerning high costs and technical complexity, and emerging opportunities in miniaturization and integration. The predominant driver is the escalating necessity for precise analytical techniques across highly regulated industries such as pharmaceuticals and medical devices, where FTIR provides verifiable quality documentation. However, the high initial investment required for high-performance benchtop models and the need for specialized training pose considerable restraints, particularly for smaller enterprises and research facilities in developing nations. Opportunities lie in the advent of affordable, portable systems and the penetration into non-traditional markets like agriculture and field testing, promising diversified revenue streams and broader market acceptance.

Key drivers include the global emphasis on food safety and security, which requires rapid contaminant screening and material authentication, a task where FTIR excels due to its speed and specificity. Furthermore, continuous innovation in the sensor technology, particularly the shift towards advanced detector materials like Mercury Cadmium Telluride (MCT) detectors, enhances sensitivity and shortens analysis times, making the instruments more competitive against alternative spectroscopic methods. The growing global focus on environmental regulations concerning air and water quality necessitates rapid, field-deployable analytical tools, positioning portable FTIR units as a critical solution for on-site monitoring and compliance checks across various industries.

Restraining factors include intense competition from alternative technologies such as Raman spectroscopy and Near-Infrared (NIR) spectroscopy, which sometimes offer lower cost or simpler operation for specific applications. Additionally, the technical complexity associated with interpreting highly resolved FTIR spectra often requires skilled personnel, which can be a barrier to widespread adoption in regions facing laboratory skill shortages. The impact forces indicate a trend where the pressure from industrial quality assurance needs outweighs the cost restraints, especially when coupled with the opportunities provided by technology convergence (e.g., hyphenated systems) and product miniaturization, ensuring that the net market direction remains upward, albeit with strategic shifts toward user-friendly, automated solutions to mitigate skill barriers.

Segmentation Analysis

The FTIR Spectrometer market is comprehensively segmented based on product type, technology, application, and end-user, reflecting the diverse operational needs across its user base. Product segmentation, covering benchtop, portable, and hyphenated systems, highlights the ongoing technological migration from centralized lab instruments toward flexible, on-site analytical devices. Technology segmentation includes traditional dispersive IR and the dominant Fourier-Transform technology, while the application segments underline the crucial role of FTIR in chemical characterization, material science, and life sciences. This granular segmentation allows market stakeholders to identify specialized growth niches, particularly those driven by rapid industrial expansion and increased regulatory scrutiny in specific vertical sectors globally.

The dominance of benchtop systems in terms of revenue is attributed to their unparalleled resolution and versatility, making them the standard instrument for high-stakes research and regulatory compliance testing. However, the portable and handheld segment is forecast to achieve the highest CAGR, primarily because these devices facilitate instantaneous quality checks at the point of need, reducing turnaround times in logistics and manufacturing without sacrificing critical analytical power. Furthermore, the segmentation by end-user, covering academic institutions, government bodies, and commercial enterprises (pharmaceuticals, chemicals, food & beverage), reveals that the commercial sector, led by pharmaceuticals, holds the largest market share due to its consistent need for high-precision validation and process control capabilities throughout the entire product lifecycle.

Understanding the interplay between technology and application is vital; for instance, mid-infrared spectroscopy, a core technology utilized in most FTIR systems, is preferred for detailed structural analysis of organic compounds, which drives its high adoption rate in polymer and chemical industries. Conversely, the rising use of attenuated total reflectance (ATR) sampling accessories within FTIR systems simplifies the analysis of opaque solids and liquids, significantly enhancing the operational efficiency across industrial quality control environments. The market’s resilience is sustained by the continuous integration of these technological advancements, which broaden the utility of FTIR, ensuring its continued relevance in evolving scientific and industrial landscapes.

- Product Type:

- Benchtop FTIR Spectrometers

- Portable and Handheld FTIR Spectrometers

- Hyphenated FTIR Systems (e.g., TGA-FTIR, GC-IR)

- Technology:

- Mid-Infrared (MIR)

- Near-Infrared (NIR)

- Far-Infrared (FIR)

- Application:

- Chemical and Petrochemical Analysis

- Food and Beverage Testing

- Pharmaceutical and Biotechnology

- Environmental Testing

- Polymer and Material Science

- Academic Research and Teaching

- End-User:

- Academic Institutions

- Industrial and Manufacturing Companies

- Research Laboratories and CROs

- Government and Regulatory Agencies

Value Chain Analysis For FTIR Spectrometer Market

The value chain for the FTIR Spectrometer Market begins with upstream activities focused on the procurement and manufacturing of highly specialized components, including infrared sources (like Globar or ceramic sources), sophisticated interferometer optics (Michelson interferometer being standard), and high-sensitivity detectors (such as Deuterated Triglycine Sulfate (DTGS) or high-performance MCT detectors). This stage is characterized by high technical expertise and stringent quality control, as the precision of these core components directly dictates the instrument's overall spectral performance and reliability. Manufacturers often rely on specialized third-party suppliers for highly refined optical materials (like KBr or ZnSe windows) and detector assemblies, creating critical dependency points within the upstream segment.

Midstream activities involve the complex integration, assembly, calibration, and software development required to transform components into a functional FTIR system. Companies dedicate substantial resources to R&D to enhance spectral resolution, develop robust sampling accessories (e.g., ATR, diffuse reflectance), and integrate user-friendly software that complies with regulatory standards like 21 CFR Part 11. Downstream analysis focuses on effective distribution channels, which are bifurcated into direct sales models, particularly for high-end systems requiring extensive post-sales technical support and training, and indirect channels utilizing regional distributors and specialized scientific equipment dealers for broader market penetration, especially in emerging or geographically dispersed markets.

Direct distribution is preferred for major pharmaceutical and petrochemical clients where customized solutions and high-level service contracts are necessary, ensuring close client relationships and tailored application support. Indirect channels, however, are critical for reaching academic labs, small to medium-sized enterprises (SMEs), and general quality control facilities, offering localized sales support and faster delivery logistics. The efficiency of the value chain is highly dependent on streamlined inventory management for specialized detectors and the quality of application support provided throughout the product lifecycle, which ensures high customer satisfaction and repeat business in this technologically driven niche.

FTIR Spectrometer Market Potential Customers

The primary potential customers for FTIR Spectrometers are organizations requiring reliable, non-destructive, and rapid chemical identification and quantification, spanning both research-intensive and production-focused environments. End-users in the pharmaceutical and biotechnology sector, including drug discovery labs, quality control departments, and contract research organizations (CROs), represent the most lucrative segment. These customers rely on FTIR for polymorph screening, raw material verification, active pharmaceutical ingredient (API) quantification, and packaging material testing, driven by stringent Good Manufacturing Practice (GMP) regulations and the necessity of ensuring product integrity and efficacy throughout the manufacturing pipeline.

The chemical and polymer industries are equally critical customers, using FTIR for identifying and characterizing plastics, elastomers, coatings, and composite materials. Their need for precise material specifications, quality assurance in raw polymer batches, and failure analysis of manufactured goods makes FTIR an essential tool in their industrial quality management systems. Furthermore, academic and governmental research institutions constitute a foundational customer base, utilizing these instruments extensively for foundational material science studies, environmental research (analyzing microplastics, air pollutants), and forensic analysis, driving demand for high-resolution, feature-rich benchtop systems capable of diverse experimental setups.

Emerging customer segments include the food and beverage industry, leveraging FTIR for adulteration detection, ingredient authentication, and nutritional analysis, alongside the rapidly growing clinical and diagnostics sector, where specialized IR applications are being developed for bodily fluid analysis and tissue characterization. The appeal of portable FTIR units is increasingly drawing customers from field-based operations, such as geological surveying and agricultural soil testing, expanding the customer footprint beyond traditional laboratory settings and into practical, on-site applications requiring immediate analytical feedback to support swift operational decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, PerkinElmer, Bruker Corporation, Shimadzu Corporation, Agilent Technologies, Hitachi High-Tech Corporation, Jasco International, ABB, Foss, Smiths Detection, Mettler Toledo, Sartorius AG, Horiba, Newport Corporation, Analytik Jena, Danaher Corporation, B&W Tek (a Metrohm company), Keit Spectrometers, Ocean Insight, Specac. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FTIR Spectrometer Market Key Technology Landscape

The core technology landscape of the FTIR Spectrometer market is defined by continuous innovation aimed at increasing sensitivity, improving speed, and facilitating ease of use. The fundamental technology relies on the Michelson interferometer, which is crucial for modulating the infrared light beam and converting the resulting interferogram into a recognizable spectrum using a complex mathematical process known as Fourier Transform. Recent technological advancements focus heavily on miniaturizing these optical components while maintaining or even surpassing the performance standards of traditional benchtop units. This miniaturization is critical for the development of portable and handheld instruments, which are driving the shift toward on-site analysis and integrated manufacturing solutions, fundamentally altering deployment strategies across various industrial sectors.

A significant trend is the evolution of detector technology. While economical DTGS detectors remain common, high-performance applications increasingly utilize cryogenic detectors, such as Mercury Cadmium Telluride (MCT), which offer dramatically higher sensitivity and faster response times, essential for rapid kinetics studies and low-concentration analysis. Furthermore, the development of robust, non-cryogenic detector alternatives is a major focus for manufacturers seeking to reduce the complexity and maintenance costs associated with high-performance units. Alongside hardware advancements, the proliferation of specialized sampling techniques, particularly Attenuated Total Reflectance (ATR) and Diffuse Reflectance Infrared Fourier Transform Spectroscopy (DRIFTS), has simplified sample preparation and broadened the range of materials that can be analyzed effectively, from highly viscous liquids to powdered solids.

Another pivotal area of technological focus is the development of hyphenated systems, such as the coupling of FTIR with thermogravimetric analysis (TGA) or gas chromatography (GC). These combinations enable sophisticated, multi-dimensional analysis, providing both thermal decomposition behavior and chemical structure identification (TGA-FTIR) or separating complex mixtures before identification (GC-IR). These combined techniques are highly valued in polymer degradation studies, environmental monitoring, and materials analysis, driving demand for integrated, multi-functional analytical platforms. The integration of advanced computational methods, including AI for spectral processing and predictive modeling, further solidifies the current technological direction, aiming for fully automated, intelligent spectroscopy solutions.

Regional Highlights

Regional dynamics play a crucial role in shaping the FTIR Spectrometer Market, driven by differential industrial maturity, regulatory frameworks, and R&D investment levels across global territories. North America, specifically the United States, currently commands a substantial market share due to the strong presence of major pharmaceutical and biotechnology companies, extensive governmental funding for research (e.g., NIST, NIH), and the early adoption of advanced analytical instrumentation. High expenditure on high-throughput screening and adherence to strict regulatory standards like FDA guidelines ensure a continuous demand for high-end, compliant FTIR systems in this region.

Europe represents another mature and lucrative market, fueled by robust chemical and automotive industries, particularly in Germany and the UK, alongside strong academic research sectors. European regulations, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), mandate comprehensive material characterization, which sustains the demand for FTIR spectrometers in material science and environmental monitoring. The region is also a key center for innovation, with significant focus on developing hyphenated techniques and automating laboratory workflows to improve efficiency and maintain a competitive edge in advanced manufacturing.

The Asia Pacific (APAC) region is poised for the most rapid growth during the forecast period. This acceleration is attributed to massive industrial growth, particularly in China and India, alongside increasing investments in domestic pharmaceutical manufacturing and quality infrastructure development. As regulatory standards tighten across APAC countries, the demand for reliable quality control tools like FTIR spectrometers escalates. Government initiatives supporting local R&D and the shift of global manufacturing bases to this region further amplify the market potential, especially for cost-effective benchtop units and rapidly deployable portable systems for industrial inspection.

- North America: Dominates the market due to strong pharmaceutical industry presence, high R&D spending, and stringent FDA compliance requirements, driving demand for premium benchtop and hyphenated systems.

- Europe: Characterized by mature chemical and automotive sectors; growth is supported by environmental regulations (e.g., REACH) and a strong focus on academic and materials science research, especially in Germany and France.

- Asia Pacific (APAC): Fastest-growing region, propelled by rapid industrialization in China and India, increasing governmental investment in analytical infrastructure, and growing adoption of quality control measures in emerging economies.

- Latin America (LATAM): Exhibits steady growth, primarily driven by expanding petrochemical and agricultural sectors, with increasing demand for affordable, robust systems for commodity testing and quality assurance.

- Middle East & Africa (MEA): Growth is tied to investments in oil & gas exploration, petrochemical refinement, and diversification efforts into pharmaceutical manufacturing, driving localized demand for specialized industrial analyzers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FTIR Spectrometer Market.- Thermo Fisher Scientific Inc.

- PerkinElmer, Inc.

- Bruker Corporation

- Shimadzu Corporation

- Agilent Technologies, Inc.

- Hitachi High-Tech Corporation

- Jasco International Co., Ltd.

- ABB Ltd.

- Foss A/S

- Smiths Detection Inc.

- Mettler Toledo

- Sartorius AG

- Horiba, Ltd.

- Newport Corporation

- Analytik Jena GmbH (Endress+Hauser Group)

- Danaher Corporation

- B&W Tek (a Metrohm company)

- Keit Spectrometers

- Ocean Insight

- Specac Ltd.

Frequently Asked Questions

Analyze common user questions about the FTIR Spectrometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of FTIR spectroscopy over traditional dispersive infrared systems?

FTIR offers superior benefits, including a higher signal-to-noise ratio, faster data acquisition speed due to the simultaneous measurement of all frequencies, and greater wavelength accuracy provided by the internal laser reference in the interferometer, making it ideal for high-resolution analysis.

In which end-user segment is the highest growth anticipated for FTIR Spectrometers?

The highest growth rate is anticipated in the Industrial and Manufacturing segment, particularly driven by increasing adoption in the pharmaceutical and polymer sectors for Process Analytical Technology (PAT) and real-time quality control using portable and hyphenated systems.

How is the miniaturization trend affecting the FTIR Spectrometer market?

Miniaturization is a key growth driver, leading to the development of robust, portable, and handheld FTIR devices. This trend expands the market's reach by enabling rapid, on-site material verification, quality checks in warehouses, and field-based environmental monitoring, moving analysis away from central laboratories.

What is the role of AI and machine learning in modern FTIR spectroscopy?

AI is crucial for automating complex spectral interpretation, rapidly identifying unknown compounds, performing quantitative analysis with greater accuracy in complex matrices, and implementing predictive maintenance for the instrumentation, thereby enhancing workflow efficiency and reducing operator reliance.

Which geographical region is expected to lead the future market expansion?

The Asia Pacific (APAC) region is projected to lead future market expansion, fueled by significant governmental investment in analytical infrastructure, rapid expansion of domestic pharmaceutical manufacturing bases, and tightening environmental and quality control regulations across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager