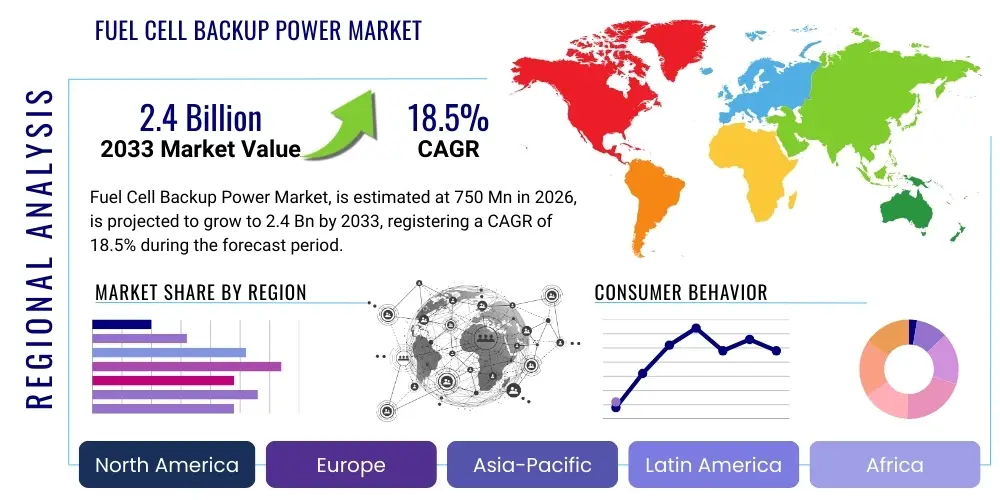

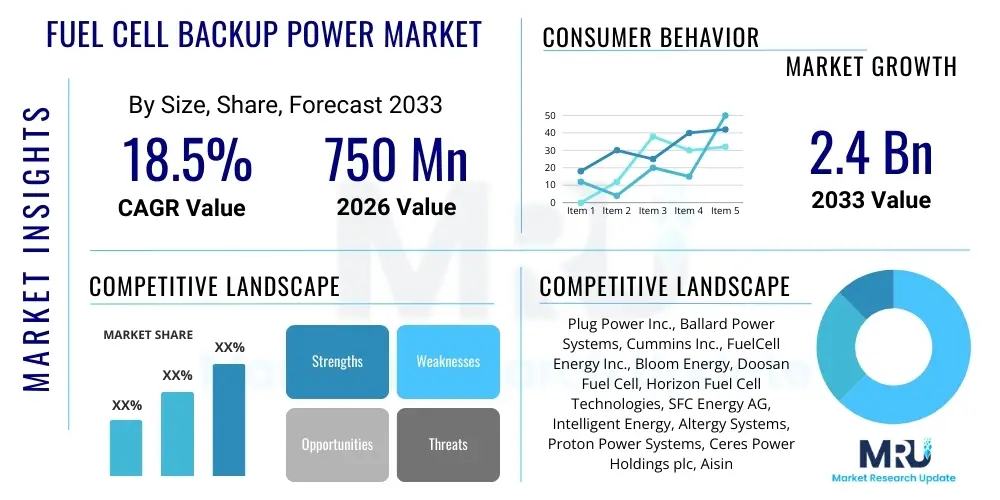

Fuel Cell Backup Power Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442446 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Fuel Cell Backup Power Market Size

The Fuel Cell Backup Power Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $750 million in 2026 and is projected to reach $2.4 billion by the end of the forecast period in 2033.

Fuel Cell Backup Power Market introduction

The Fuel Cell Backup Power Market encompasses energy generation systems that utilize electrochemical processes to convert chemical energy from a fuel (typically hydrogen) into electricity, providing reliable, clean, and often longer-duration power backup solutions compared to conventional battery or diesel generator systems. These systems are highly valued for their low emissions, minimal noise output, and rapid start-up capabilities, making them increasingly vital for critical infrastructure where sustained operation without interruption is paramount. The primary products within this market include Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), tailored for stationary applications.

Major applications of fuel cell backup power span across numerous sectors, predominantly focusing on telecommunications infrastructure, including cellular towers and data exchange centers, where high uptime is non-negotiable. Furthermore, they are extensively deployed in data centers, which require reliable, scalable, and environmentally compliant backup solutions to manage ever-increasing power demands. Beyond these, critical governmental facilities, medical centers, and utility substations are increasingly adopting fuel cell technology due to its superior energy density and reduced logistical burden compared to traditional diesel alternatives, which require constant refueling and maintenance.

Key benefits driving the adoption of fuel cell backup power include environmental compliance, particularly in urban areas sensitive to air quality, as they produce water and heat as byproducts, emitting zero or near-zero pollutants. Additionally, the technology offers significantly longer runtime capabilities, depending on the hydrogen fuel storage size, surpassing the typical 8-12 hour limitations of conventional batteries or the complex refueling schedules of diesel generators. This inherent reliability, coupled with falling production costs and increasing government initiatives promoting green energy solutions, fundamentally acts as a robust driver for sustained market growth across developed and developing economies.

Fuel Cell Backup Power Market Executive Summary

The Fuel Cell Backup Power Market is undergoing a rapid evolutionary phase, fundamentally driven by pervasive global trends toward decarbonization and the explosive growth of data-intensive industries, primarily telecommunications and cloud computing. Business trends indicate a strong shift from niche governmental applications to broad commercial adoption, fueled by strategic partnerships between fuel cell manufacturers and major telecommunication service providers seeking higher network resilience and lower operational expenditures associated with traditional power sources. Furthermore, the standardization of hydrogen infrastructure and the development of compact, high-efficiency fuel cell stacks are enhancing product viability and reducing total cost of ownership, making them competitive against established backup power technologies, consequently accelerating their market penetration across diverse industrial applications.

Regional dynamics exhibit significant variation, with North America and Asia Pacific emerging as central hubs for market expansion. North America, characterized by stringent environmental regulations and a high concentration of sophisticated data centers and 5G infrastructure deployment, remains the largest market in terms of revenue, favoring PEMFC technology for its quick response time and modular design. Conversely, the Asia Pacific region, particularly countries like China, Japan, and South Korea, is showcasing the fastest growth rate, propelled by aggressive governmental investments in hydrogen economy roadmaps and mass deployment of fuel cells in remote telecom towers and distributed generation projects. Europe also maintains a stable growth trajectory, underpinned by the European Union’s commitment to achieving net-zero emissions and promoting clean energy alternatives in critical societal infrastructure.

Segmental trends reveal that the Power Output segment focusing on 5 kW to 50 kW systems currently dominates the market, aligning perfectly with the typical power requirements of cellular base stations and small modular data centers. However, the >50 kW segment is anticipated to witness the highest compounded annual growth, reflecting the increasing demand from hyperscale data centers and large-scale utility substations requiring robust, sustained power delivery systems. Regarding fuel type, pure hydrogen remains the preferred medium for stationary backup power due to its high purity and performance characteristics, although ongoing research into methanol and natural gas reformers for fuel cells is gradually improving the logistical flexibility for installations in regions where pure hydrogen infrastructure remains underdeveloped, broadening the addressable market for SOFC technologies.

AI Impact Analysis on Fuel Cell Backup Power Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Fuel Cell Backup Power Market frequently center on themes of predictive maintenance, operational optimization, and smart grid integration. Users are keen to understand how AI algorithms can monitor complex electrochemical parameters in real-time to forecast potential stack degradation, thereby preventing unscheduled downtime—a critical concern in high-reliability applications like telecommunications. Key concerns also revolve around optimizing hydrogen consumption based on predicted load demands and environmental conditions, ensuring that backup systems are operated at peak efficiency and lowest operational cost. The underlying expectation is that AI integration will transform fuel cell backup power from passive, reactive systems into smart, proactive energy assets capable of dynamic interaction with both the local load and the broader electrical grid infrastructure.

AI's role in the Fuel Cell Backup Power Market is transformative, moving beyond simple data logging to advanced operational control and system longevity enhancement. By processing vast datasets related to temperature gradients, current density, voltage stability, and reactant flow rates across the fuel cell stack, AI models can detect subtle anomalies indicative of component stress or failure long before human operators or traditional monitoring systems can. This capability drastically reduces the reliance on routine, time-consuming manual inspections and ensures that maintenance actions are purely condition-based, optimizing resource allocation and maximizing the operational lifespan of expensive fuel cell stacks, directly improving the return on investment for end-users.

Furthermore, AI algorithms are crucial in developing sophisticated load prediction and energy management strategies for systems integrated into hybrid power solutions (e.g., fuel cell plus battery storage). These models analyze historical consumption patterns, external factors such as weather changes, and grid instability indicators to pre-condition the fuel cell system, ensuring it is ready to assume full load immediately upon a power outage or grid event. This proactive management capability minimizes transition time and enhances overall system reliability, positioning fuel cell backup power as a crucial enabling technology for resilient, future-ready critical infrastructure.

- AI enables real-time electrochemical optimization for maximum efficiency and longevity.

- Predictive maintenance algorithms reduce unplanned downtime and lower operational costs significantly.

- Smart load management enhances the integration of fuel cells into hybrid energy systems.

- AI optimizes hydrogen storage and consumption based on anticipated energy demand curves.

- Automated fault detection and diagnostics improve system reliability in remote locations.

DRO & Impact Forces Of Fuel Cell Backup Power Market

The Fuel Cell Backup Power Market is fundamentally influenced by a confluence of accelerating drivers, mitigating restraints, and compelling opportunities, all contributing to a complex interplay of market impact forces. Key drivers include stringent global mandates for reduced carbon emissions and the relentless demand for uninterruptible power supply (UPS) in burgeoning critical sectors such as data centers and 5G network infrastructure expansion. However, the market faces significant hurdles, primarily relating to the high initial capital expenditure associated with fuel cell systems and the lingering complexities of hydrogen storage and distribution logistics, which require substantial infrastructure investment. Opportunities are abundant, centered around technological breakthroughs that enhance stack durability, increase power density, and the strategic expansion into off-grid and remote applications where conventional power sources are prohibitively expensive or unreliable. The overall impact force is strongly positive, favoring long-term, sustained growth, provided infrastructure challenges are systematically addressed through collaborative governmental and private sector investments.

Drivers: The explosive global expansion of digital infrastructure forms the cornerstone of market acceleration. The rapid deployment of 5G networks, coupled with the exponential growth in cloud computing and edge data processing, necessitates robust, extended-duration backup power solutions that diesel generators often fail to provide efficiently or environmentally. Fuel cells meet this necessity by offering scalable, zero-emission power generation that can operate continuously for days, limited only by the fuel supply. Concurrently, increasing governmental focus on establishing hydrogen economies, evidenced by subsidies and regulatory support in major regions like the EU, Japan, and North America, substantially lowers the financial risk for early adopters and incentivizes manufacturers to scale production, driving down unit costs and solidifying the operational viability of these systems across diverse geographies.

Restraints: Despite technological maturity, the primary restraint remains the elevated upfront cost of fuel cell systems compared to established diesel generator or advanced battery solutions. The expense of platinum-group metal catalysts utilized in PEMFCs and the specialized materials required for SOFCs contribute significantly to this high CapEx. Furthermore, the pervasive challenge of hydrogen infrastructure—including production, transportation, and safe, high-density on-site storage—continues to limit mass deployment, particularly in regions lacking dedicated hydrogen pipelines or robust delivery logistics. Safety perceptions regarding hydrogen storage, though largely mitigated by modern engineering standards, also present a psychological barrier for some potential end-users, requiring extensive educational efforts to ensure broad confidence in the technology’s deployment.

Opportunities: Significant market opportunities are emerging from the growing global movement toward microgrids and decentralized energy systems. Fuel cell backup power units are ideally suited for these architectures, offering resilient, modular energy solutions for remote communities, military installations, and critical urban facilities seeking energy independence from volatile central grids. Furthermore, technological advancements in material science are steadily reducing catalyst loading and enhancing the power density of fuel cell stacks, promising smaller, lighter, and more cost-effective units. The burgeoning interest in utilizing fuel cells not just for backup but also for peak shaving and grid stabilization services opens up new revenue streams and enhances the economic justification for their installation, transforming them from mere emergency devices into valuable energy assets.

Segmentation Analysis

The Fuel Cell Backup Power Market is systematically analyzed based on key criteria including the type of fuel cell technology deployed, the specific end-user industry requiring the backup solution, and the effective power output capability of the system. This structured segmentation provides a granular understanding of market dynamics, revealing which technologies are gaining traction in specific applications and highlighting the varying deployment strategies across different industrial verticals. The Polymer Electrolyte Membrane Fuel Cell (PEMFC) segment typically commands the largest market share due to its quick start-up time and suitability for rapid-response applications, although Solid Oxide Fuel Cells (SOFCs) are increasingly favored in long-duration, high-efficiency stationary power roles where tolerance for various fuels is beneficial.

By End-User, the telecommunications sector remains the dominant consumer, driven by the critical necessity of maintaining network coverage 24/7, particularly as 5G rollouts demand more distributed, power-hungry base stations. However, the data center segment is poised for the most explosive growth, reflecting the global surge in cloud services and the crucial need for carbon-neutral backup power solutions capable of supporting massive server farms for extended periods during grid outages. Analyzing these segments helps stakeholders tailor product development—such as ruggedized, weather-tolerant units for remote telecom sites versus high-density, integrated systems for urban data centers—to maximize market relevance and penetration.

Understanding the market by Power Output is essential for sizing solutions correctly and predicting future technological requirements. The transition from small, sub-5 kW units (often used for surveillance or small remote nodes) towards the medium (5 kW to 50 kW) and high (>50 kW) power classes illustrates the market's maturity and its increasing adoption in larger, more demanding infrastructure. As fuel cell manufacturers achieve greater economies of scale and improve stack integration, the overall trend points towards a future dominated by higher-power modules capable of supporting entire facilities, which will be instrumental in achieving the projected growth trajectory of the market.

- By Type:

- Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- Solid Oxide Fuel Cell (SOFC)

- Phosphoric Acid Fuel Cell (PAFC)

- Others (e.g., Molten Carbonate Fuel Cell (MCFC))

- By End-User:

- Telecommunications

- Data Centers

- Utility & Power Generation

- Government & Military

- Commercial & Industrial Facilities

- Healthcare

- By Power Output:

- Less than 5 kW

- 5 kW – 50 kW

- Greater than 50 kW

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Fuel Cell Backup Power Market

The value chain for the Fuel Cell Backup Power Market begins with the upstream sourcing and production of critical raw materials, most notably hydrogen and specialized components such as membrane electrode assemblies (MEAs), catalysts (often platinum-based), bipolar plates, and sophisticated control electronics. Upstream analysis highlights the necessity of reliable and cost-effective hydrogen supply, which can be generated through steam methane reforming (SMR), electrolysis (green hydrogen), or other emerging processes. The secure and efficient supply of high-purity hydrogen is a paramount challenge and a key determinant of final system cost and operational viability, requiring robust partnerships between fuel cell system integrators and industrial gas suppliers to ensure uninterrupted fuel logistics, especially for large-scale deployments.

Midstream activities involve the design, manufacturing, and assembly of the fuel cell stacks and integrated backup power systems. This stage includes complex engineering processes to optimize thermal management, stack durability, and power conditioning capabilities to meet stringent industry standards for reliability (e.g., telecommunications network specifications). The distribution channel analysis reveals a dual structure: direct sales and engineering, procurement, and construction (EPC) models for large utility or data center projects, requiring direct engagement with the end-user. Conversely, indirect channels involve working through specialized value-added resellers (VARs) or regional distributors who manage system integration, installation, and ongoing maintenance for smaller commercial or remote telecom site deployments, leveraging local expertise and established service networks.

Downstream analysis focuses heavily on system deployment, maintenance, and long-term service contracts. Since fuel cell systems represent a significant capital investment and are deployed in mission-critical environments, ongoing maintenance and immediate technical support are crucial competitive differentiators. Successful market penetration relies on establishing comprehensive service networks capable of monitoring system performance remotely, executing condition-based maintenance (often supported by AI tools), and managing the scheduled replenishment or recycling of specialized components. The end-user demand for high reliability mandates that the downstream phase of the value chain is robust, ensuring minimal downtime and sustained performance throughout the operational lifespan of the backup power installation.

Fuel Cell Backup Power Market Potential Customers

The core customer base for Fuel Cell Backup Power solutions consists of organizations that manage mission-critical infrastructure where the cost of power downtime is extremely high, or where operational continuity is mandated by regulatory requirements. Primary end-users include major global and regional telecommunication service providers (Telcos) responsible for maintaining the resilience of cellular base stations, switching centers, and fiber nodes, especially in environments where grid power is erratic or nonexistent for prolonged periods. These customers prioritize runtime, environmental footprint, and minimal maintenance overhead, often seeking integrated solutions that package the fuel cell, hydrogen storage, and power conditioning electronics into a compact, deployable cabinet.

Another rapidly expanding segment of potential customers includes hyperscale and enterprise data center operators. These facilities demand backup power solutions that are not only highly reliable but also environmentally sustainable to meet increasingly strict corporate sustainability goals and regional regulatory requirements, particularly in major cloud hosting hubs. Data centers require high-power systems (>50 kW) capable of sustained operation during extended outages, moving beyond the traditional reliance on diesel generators to adopt cleaner, more modular fuel cell technologies that can scale with increasing power density demands of modern server architecture.

Furthermore, critical public infrastructure sectors such as utility companies, government agencies (including military and disaster relief operations), and healthcare facilities constitute significant potential customer groups. Utility companies utilize fuel cells for backup power at remote substations and control centers where immediate recovery from grid failure is vital for maintaining essential services. Hospitals and medical centers, bound by rigid patient safety protocols, require immediate, reliable, and quiet backup power systems, making zero-emission fuel cells an increasingly attractive alternative to noise- and vibration-producing generators, ensuring continuous operation of life-support and sensitive diagnostic equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $2.4 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Plug Power Inc., Ballard Power Systems, Cummins Inc., FuelCell Energy Inc., Bloom Energy, Doosan Fuel Cell, Horizon Fuel Cell Technologies, SFC Energy AG, Intelligent Energy, Altergy Systems, Proton Power Systems, Ceres Power Holdings plc, Aisin Corporation, Nedstack Fuel Cell Technology, GenCell Energy, SerEnergy, ReliOn Inc., Hyster-Yale Materials Handling (Nuvera), Viessmann Group (Viesmann), Toshiba Energy Systems & Solutions Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Cell Backup Power Market Key Technology Landscape

The technological landscape of the Fuel Cell Backup Power Market is primarily defined by the differentiation between low-temperature Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and high-temperature Solid Oxide Fuel Cells (SOFCs). PEMFCs dominate applications requiring high power density and rapid start-up, making them ideal for telecom base stations and quick-response backup needs. Recent innovations in PEMFC technology focus intensely on reducing the usage of expensive platinum catalysts, improving membrane durability, and enhancing thermal management systems to allow for extended operation under extreme environmental conditions, thereby lowering the total cost of ownership and making them more viable for remote deployments.

Conversely, SOFC technology operates at higher temperatures (600°C to 1,000°C) and is prized for its high electrical efficiency, fuel flexibility (ability to run on reformed natural gas, biogas, or hydrogen), and robust stack construction, making them preferred for long-duration stationary power and combined heat and power (CHP) systems, often utilized in larger data centers or industrial facilities. Technological advancements here center on developing new ceramic materials and stack designs that can tolerate rapid cycling and reduce the necessary operating temperature, thus improving system longevity and reducing the required warm-up time, which is traditionally a limitation compared to PEMFCs.

Further technological advancements impacting the market include the integration of advanced power electronics, which are critical for seamless transition between grid power and fuel cell backup, ensuring clean, conditioned power output necessary for sensitive IT loads. The development of modular system architectures allows end-users to scale power capacity incrementally, optimizing investment. Moreover, the evolution of fuel storage technology—specifically, high-pressure composite tanks and solid-state hydrogen storage solutions—is crucial for maximizing on-site energy density and reducing the physical footprint of the backup power installation, directly addressing logistical constraints in urban or space-constrained environments.

Regional Highlights

The regional analysis reveals distinct market maturity levels and growth trajectories driven by varied governmental policies, infrastructure development status, and sectoral demands across the globe.

- North America: This region maintains its leadership position, driven by stringent grid reliability standards and the immense concentration of mission-critical digital infrastructure, including major cloud provider data centers and the aggressive rollout of 5G networks across the U.S. and Canada. Government incentives, coupled with corporate mandates for sustainability, favor the adoption of zero-emission fuel cell solutions over traditional diesel generators. The market here is characterized by high demand for PEMFC technology in the 5 kW to 50 kW range for telecom and the burgeoning use of SOFCs for larger, sustained data center backup power.

- Europe: The European market demonstrates steady growth, strongly supported by the European Union’s commitment to achieving climate neutrality and robust hydrogen roadmaps established by countries such as Germany, the Netherlands, and the UK. Regulations limiting diesel generator usage in metropolitan areas, coupled with significant investment in green hydrogen production, are propelling the adoption of fuel cell backup power in public services, utility infrastructure, and specialized commercial applications. Standardization efforts across the region are also simplifying deployment and cross-border logistics.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive infrastructure development in China and India, alongside technological leadership in hydrogen energy demonstrated by Japan and South Korea. Rapid expansion of telecommunication networks in remote and dense urban areas, coupled with high vulnerability to natural disasters necessitating resilient power solutions, drives demand. Government support in South Korea and Japan, focused on achieving commercial viability of fuel cells across transportation and stationary power, cascades directly into the backup power segment, particularly favoring large-scale pilot projects.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by critical needs for grid independence and reliable power in remote locations. LATAM's growth is often tied to resource extraction industries and telecommunications expansion in rural areas. MEA, particularly the GCC countries, is exploring fuel cell technology as part of their long-term energy diversification strategies, capitalizing on potential low-cost hydrogen production from abundant solar resources, although infrastructure challenges remain a restraint in widespread adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Cell Backup Power Market.- Plug Power Inc.

- Ballard Power Systems

- Cummins Inc.

- FuelCell Energy Inc.

- Bloom Energy

- Doosan Fuel Cell

- Horizon Fuel Cell Technologies

- SFC Energy AG

- Intelligent Energy

- Altergy Systems

- Proton Power Systems

- Ceres Power Holdings plc

- Aisin Corporation

- Nedstack Fuel Cell Technology

- GenCell Energy

- SerEnergy

- ReliOn Inc.

- Hyster-Yale Materials Handling (Nuvera)

- Viessmann Group (Viesmann)

- Toshiba Energy Systems & Solutions Corporation

Frequently Asked Questions

Analyze common user questions about the Fuel Cell Backup Power market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of fuel cell backup power over traditional diesel generators?

The primary advantage is environmental performance, as fuel cells emit zero or near-zero pollutants (producing only water and heat), aligning with sustainability mandates. They also offer quieter operation, lower maintenance requirements, and potentially longer runtime capabilities, limited only by the available hydrogen supply.

Which fuel cell type is most commonly used for telecommunications backup applications?

Polymer Electrolyte Membrane Fuel Cells (PEMFCs) are most commonly utilized due to their ability to start up quickly, high power density, and efficient performance at the moderate power levels (5 kW to 50 kW) typically required by remote cellular base stations and networking equipment.

What is the major constraint affecting the large-scale deployment of fuel cell backup systems?

The major constraint is the high initial capital expenditure (CapEx) associated with fuel cell stack components, particularly catalyst materials, and the need for a robust, reliable, and cost-effective hydrogen storage and distribution infrastructure to ensure sustained operational continuity.

How is AI influencing the reliability and cost-effectiveness of fuel cell backup power?

AI significantly enhances reliability and reduces costs through predictive maintenance and operational optimization. AI algorithms analyze performance data to forecast component degradation, enabling timely, targeted maintenance actions and optimizing hydrogen consumption based on anticipated load, maximizing system efficiency and lifespan.

Which geographical region is expected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region is projected to experience the fastest growth, driven by rapid urbanization, massive infrastructure projects (especially 5G rollout), and strong governmental support and investment in hydrogen technology roadmaps across key economies like China, South Korea, and Japan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager