Fuel Cell Commercial Vehicle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441500 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Fuel Cell Commercial Vehicle Market Size

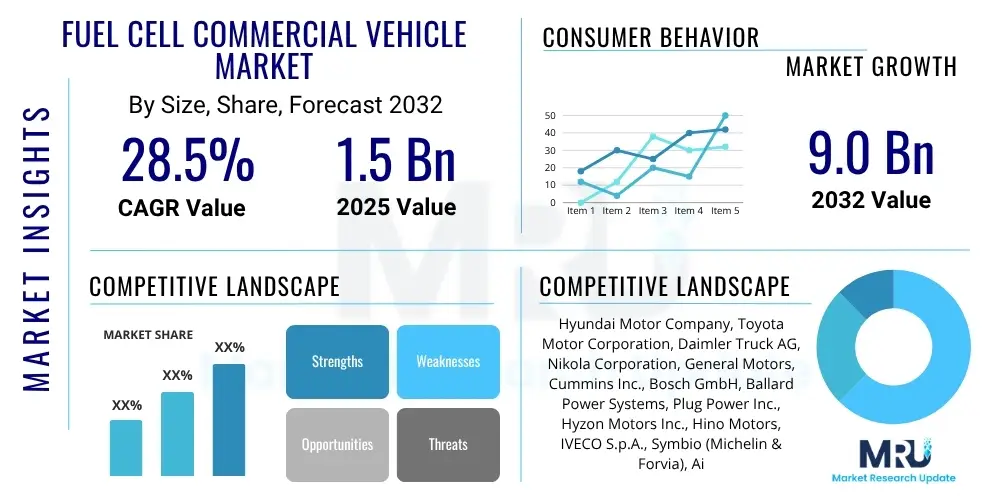

The Fuel Cell Commercial Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.2% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $12,500 Million by the end of the forecast period in 2033.

Fuel Cell Commercial Vehicle Market introduction

The Fuel Cell Commercial Vehicle (FCCV) Market encompasses heavy-duty Class 8 trucks, public transit buses, medium-duty vans, and specialty vehicles utilizing hydrogen fuel cells for primary propulsion. These vehicles represent a paradigm shift in commercial logistics, offering a viable, zero-tailpipe-emission alternative to internal combustion engine (ICE) vehicles while overcoming key limitations associated with large-scale battery electric vehicles (BEVs) in heavy transport applications. The underlying mechanism involves Polymer Electrolyte Membrane (PEM) fuel cells that electrochemically combine hydrogen and oxygen to produce electricity, heat, and the only emission—clean water vapor. This technological pathway is uniquely positioned to address the challenge of decarbonizing the high-energy-demand transportation sector, which relies heavily on vehicles that operate for long hours, require substantial range, and cannot afford prolonged downtime for refueling or charging.

The market's initial focus, heavily influenced by government mandates, centered on urban applications such as city buses, where scheduled routes and centralized fueling provide an optimal operational environment for early technology deployment. However, the subsequent and more impactful growth trajectory is centered on the heavy-duty truck segment, particularly long-haul freight and drayage. Key product descriptions highlight advanced hydrogen storage systems, often involving multiple composite tanks operating at 700 bar pressure, capable of holding up to 80-100 kg of hydrogen, which is sufficient for ranges exceeding 500-600 miles. Furthermore, these FCCVs incorporate sophisticated hybrid architectures, where the fuel cell stack acts as the primary power generator and a buffer battery pack manages transient power demands, regenerative braking, and auxiliary functions, thereby optimizing the fuel cell's performance profile for maximum efficiency and longevity under commercial duty cycles.

The collective benefits driving robust market expansion are multifaceted. Operationally, FCCVs provide rapid refueling capabilities—typically 10 to 20 minutes—crucial for maintaining fleet utilization rates comparable to diesel. Environmentally, they provide a zero-emission solution, directly supporting global climate treaty obligations and local air quality improvements in urban centers. Economically, as manufacturing scales and green hydrogen infrastructure matures, the Total Cost of Ownership (TCO) is projected to reach parity with diesel by the early 2030s, making them financially competitive without perpetual subsidies. Driving factors are intrinsically linked to policy mechanisms, including carbon pricing, vehicle retirement mandates, and massive public sector investment in R&D and infrastructure, all aimed at establishing a functional, continent-spanning hydrogen mobility ecosystem capable of supporting large volumes of freight and passenger transport.

Fuel Cell Commercial Vehicle Market Executive Summary

The Fuel Cell Commercial Vehicle market is transitioning from demonstration projects to commercial reality, marked by a significant increase in OEM commitments, large-scale fleet orders, and accelerating investment in hydrogen infrastructure development globally. Strategic business trends emphasize collaborative partnerships between traditional vehicle manufacturers (OEMs), Tier 1 suppliers specializing in power electronics and hydrogen storage, and major energy companies (Oil & Gas, Renewables) responsible for fuel supply. This ecosystem convergence is vital for de-risking the transition for fleet operators, often resulting in integrated offerings that bundle vehicle procurement, long-term maintenance contracts, and guaranteed fuel supply agreements at predictable pricing structures. Technological focus is intensely placed on stack cost reduction, enhanced component durability (especially the air compressor and humidifier), and leveraging advanced diagnostics, often AI-enabled, to ensure FCEVs achieve and surpass operational uptime targets historically set by reliable diesel platforms.

Regional trends delineate distinct paces and priorities. Asia Pacific (APAC), particularly China, Japan, and South Korea, maintains leadership through centralized national strategies that funnel capital into bus deployment and local hydrogen production, viewing FCEVs as a critical pillar of future energy security. Europe is experiencing explosive growth, driven by ambitious cross-border initiatives designed to connect major ports and industrial clusters with high-capacity hydrogen pipelines and refueling stations, focusing on the heavy-duty segment as mandated by aggressive EU emission targets. North America's growth is concentrated in key environmental hotbeds, notably California and the Pacific Northwest, with federal funding (H2Hubs) serving as the primary accelerant for establishing regional production and end-use infrastructure, prioritizing commercial route density over national coverage initially.

Segment trends underscore the strategic importance of the heavy-duty truck market, projected to capture the largest share of market value due to the technical limitations faced by BEVs in this application space. The bus segment continues to offer stability and visibility, acting as a reliable baseline for technology maturity. Trends within the technology segment show a clear preference for robust, modular PEM fuel cell systems that allow for scalability across various vehicle platforms, from medium-duty delivery vans to specialized terminal tractors. The shift towards green hydrogen sourcing is gaining significant momentum, transforming FCCVs into a truly net-zero solution and attracting ESG-focused investment capital, ultimately reducing the carbon intensity of the entire commercial transport logistics chain and enhancing long-term operational sustainability. This strategic diversification across vehicle types and power outputs allows manufacturers to cater specifically to unique commercial duty cycles, improving overall market penetration and efficiency.

AI Impact Analysis on Fuel Cell Commercial Vehicle Market

User queries regarding AI in the Fuel Cell Commercial Vehicle market predominantly center on improving operational efficiency, extending component lifespan, and optimizing fueling infrastructure. Key user concerns revolve around how sophisticated machine learning algorithms can enhance the performance and reliability of the complex fuel cell stack by compensating for degradation effects, predict failures in hydrogen storage systems using non-destructive monitoring techniques, and manage dynamic energy consumption patterns associated with heavy loads and varied terrain in real-time. Expectations are high regarding AI’s role in facilitating predictive maintenance, which is crucial for high-utilization commercial fleets where unplanned downtime is financially debilitating. Furthermore, users anticipate AI will be essential in optimizing the utilization of limited hydrogen refueling stations through sophisticated routing algorithms that minimize queue times and maximize energy management across distributed fleets, fundamentally reducing the Total Cost of Ownership (TCO) and speeding up commercial viability by ensuring maximum vehicle uptime.

- AI-driven predictive maintenance modeling reduces unplanned downtime by forecasting potential failures in the fuel cell stack, air compressors, and power electronics, analyzing real-time sensor data against historical degradation trends.

- Optimization of the hydrogen supply chain through machine learning, enabling accurate demand forecasting for refueling stations and optimizing hydrogen delivery logistics, minimizing supply disruptions.

- Intelligent route planning and logistics optimization factoring in real-time vehicle performance, hydrogen station availability, anticipated queue times, and optimal energy recovery strategies across extended freight corridors.

- Enhanced energy management systems (EMS) utilizing deep learning to maximize hydrogen efficiency based on dynamic driving conditions, payload variations, and predictive traffic flows, achieving higher miles per kilogram of hydrogen.

- Accelerated material science research and development through AI simulation, leading to the rapid creation of more durable and cost-effective catalysts, membranes, and bipolar plates, significantly lowering stack manufacturing costs.

- Advanced driver assistance systems (ADAS) integrated with fuel cell performance data to provide proactive feedback, optimizing driver behavior for maximum fuel efficiency and reduced component stress.

DRO & Impact Forces Of Fuel Cell Commercial Vehicle Market

The Fuel Cell Commercial Vehicle Market is powerfully driven by global climate action mandates and the unparalleled operational suitability of hydrogen for heavy-duty long-haul transport, positioning it favorably against battery electric alternatives where range and payload are critical. Regulatory actions, such as the EU's mandates for CO2 emission reduction in heavy-duty vehicles by 90% by 2040, create a non-negotiable transition pathway for fleet operators, making FCEVs a necessary compliance tool. Furthermore, the inherent advantage of hydrogen—its high energy density—translates directly into maximizing available freight payload and ensuring optimal route flexibility, essential features that diesel transport currently provides and BEVs struggle to match for cross-continental routes. This alignment of robust technology with stringent climate regulation forms the primary impetus for market acceleration. However, widespread adoption is significantly constrained by the high initial capital expenditure associated with both the vehicles and the nascent hydrogen refueling infrastructure, presenting a formidable barrier to entry for many potential fleet customers, particularly small to medium-sized enterprises (SMEs) lacking access to subsidized funding or large-scale procurement agreements.

Drivers: Stringent regulatory pressures, notably the EU’s ‘Fit for 55’ package and ZEV mandates in North America, compel commercial fleets to transition away from fossil fuels. The superior energy density of hydrogen compared to batteries makes it the preferred zero-emission solution for long-range heavy trucking and high-utilization applications like port drayage and municipal waste collection, segments that require high operational redundancy and fast turnaround times. Moreover, increasing corporate sustainability commitments (ESG goals) from major global logistics companies necessitate the integration of zero-emission vehicles across their supply chains, driven by investor pressure and brand positioning. The ongoing maturation of fuel cell stack technology, including improvements in catalyst durability, reduced PGM loading, and increased stack efficiency (currently exceeding 60% system efficiency under optimal conditions), further strengthens the commercial case for FCEVs, steadily improving the reliability and reducing the lifecycle cost compared to earlier generations.

Restraints: The most substantial restraint remains the underdeveloped, fragmented hydrogen refueling infrastructure, particularly the lack of high-capacity, high-pressure (700 bar) stations strategically located along major transit corridors necessary to support large commercial fleets engaging in hub-to-hub logistics. The current cost of hydrogen production and distribution, particularly blue or gray hydrogen, can lead to unfavorable Total Cost of Ownership (TCO) compared to diesel, a situation exacerbated by volatile natural gas prices impacting steam methane reforming processes. While green hydrogen offers a sustainable solution, its current production volume and cost are not yet scalable enough to meet the projected demand of the commercial transport sector autonomously. Additionally, the high upfront acquisition cost of FCEVs, often 2-3 times that of their diesel counterparts, requires substantial, long-term government subsidies and innovative financing models (e.g., fuel leasing agreements) to bridge the pricing gap, hindering autonomous market growth and increasing reliance on public sector financial intervention in the short to medium term. Safety perception related to high-pressure hydrogen storage, though technically addressed through advanced composite tank technology and rigorous certification (e.g., ECE R134), also requires continual public and commercial education.

Opportunities: Significant market opportunity lies in developing integrated hydrogen production and dispensing hubs located strategically near high-volume commercial vehicle routes (e.g., ports, distribution centers) and leveraging existing renewable energy sources (wind and solar) to drive down the cost of green hydrogen electrolysis. The potential for green hydrogen offers a truly circular and sustainable solution, attracting premium investment and regulatory support from environmental funds. Strategic partnerships between OEMs, fuel suppliers (e.g., energy majors), and financial institutions (utilizing specialized green financing or leasing models) can dramatically reduce the financial burden on fleet operators, facilitating faster scaling and risk mitigation. Furthermore, expanding fuel cell application beyond conventional transport into non-traditional commercial uses, such as refrigerated transport units (requiring high, consistent power for cooling), specialized construction equipment, or heavy airport ground support equipment, presents untapped niche market segments with favorable duty cycles for hydrogen power. Innovation in liquid hydrogen (LH2) storage also presents an opportunity for ultra-long-haul applications to maximize payload.

- Drivers:

- Global mandates for decarbonization of the transport sector, specifically focusing on heavy-duty vehicle emissions (e.g., EU CO2 reduction targets).

- Superior operational characteristics (range, payload retention, quick refueling) crucial for long-haul and high-utilization logistics applications.

- Increasing corporate ESG commitments necessitating zero-emission supply chain integration.

- Technological advancements reducing PGM usage and enhancing PEM fuel cell stack durability and efficiency (targeting 25,000+ operational hours).

- Restraints:

- Prohibitively high upfront capital cost of fuel cell commercial vehicles and required maintenance infrastructure.

- Severe bottleneck caused by the nascent, strategically fragmented high-pressure (700 bar) hydrogen refueling network.

- Current high cost of hydrogen fuel, which negatively impacts the Total Cost of Ownership compared to traditional fuels, despite lower energy taxes.

- Complexity and costs associated with scaling the green hydrogen supply chain to meet anticipated commercial demand.

- Opportunity:

- Development of decentralized green hydrogen production and large-scale dispensing hubs (H2Hubs) near major freight corridors.

- Strategic public-private partnerships to finance and de-risk high-volume commercial corridor infrastructure development.

- Expansion into specialized, off-road commercial vehicle segments (e.g., mining, port operations, construction equipment).

- Implementation of innovative financing and leasing models to mitigate the initial capital expenditure risk for fleet operators.

- Impact Forces:

- Supply Chain Integration: Necessity of vertically integrating hydrogen production (utility and energy majors) directly to vehicle manufacturing (OEMs) and end-user fleet operations (logistics), creating integrated ecosystems.

- Regulatory Harmonization: Need for standardized safety protocols, infrastructure specifications, and certification regimes globally (e.g., fuel quality standards) to enable cross-border freight transport efficiency.

- Technological Cost Reduction: Relentless market pressure to achieve TCO parity with conventional vehicles through significant scale, automation in manufacturing, and material innovation.

Segmentation Analysis

The Fuel Cell Commercial Vehicle market is systematically segmented based on vehicle type, focusing intensely on the specific operational requirements and duty cycles of different commercial applications. The heavy-duty truck segment (Class 8 or Heavy Goods Vehicles, HGV) constitutes the most valuable long-term market due to the indisputable technical fit of hydrogen in solving the range, weight, and fast refueling challenges critical for long-haul logistics. FCEV trucks in this class are specifically designed to carry 40-ton payloads over 500 miles, a requirement where large batteries would consume too much payload capacity and necessitate extensive downtime for charging. Concurrently, the bus segment remains foundational, acting as a critical early market and providing visible demonstration of fuel cell technology maturity in urban environments, often supported by dedicated municipal funding and predictable return-to-base fueling operations.

Segmentation by power output is essential as commercial vehicle duty cycles vary widely, ranging from under 150 kW for smaller, urban delivery vans or medium-duty refuse trucks, up to and exceeding 300 kW for high-performance, mountainous terrain heavy-duty tractors. This power segmentation drives decisions regarding the optimal sizing of the fuel cell stack and the corresponding battery buffer pack (hybrid architecture), ensuring efficiency and durability. The technology split remains critical, differentiating the widely adopted Polymer Electrolyte Membrane (PEM) cells—favored for rapid start-up, responsiveness, and temperature suitability for transport—from Solid Oxide Fuel Cells (SOFCs), which, while highly efficient, are typically reserved for constant load applications or integrated Auxiliary Power Units (APUs) that generate electricity for cooling, heating, or non-traction power.

The segmentation by range capability directly reflects the target mission profile and is crucial for infrastructure planning. Short-range FCEVs (< 300 km) often serve last-mile delivery or port operations, benefiting from localized, dedicated refueling stations. Medium-range (300–600 km) FCEVs target regional distribution, requiring refueling stations near major industrial parks. In contrast, long-range (> 600 km) FCEVs are the primary target for backbone freight corridors, driving the massive investment needed for high-capacity hydrogen supply across national boundaries. This multi-faceted segmentation allows OEMs and infrastructure developers to accurately forecast demand and allocate resources efficiently across the evolving hydrogen mobility ecosystem, ensuring that deployment aligns with customer operational needs and regulatory incentives, thereby stabilizing market growth.

- Vehicle Type:

- Buses (City Buses, Intercity Coaches): High utilization, predictable routes, foundational early adoption segment driven by municipal green policies.

- Heavy-Duty Trucks (Class 8/Heavy Goods Vehicles): High growth potential segment, driven by long-haul logistics needs requiring high range and payload capacity; requires 700 bar infrastructure.

- Medium-Duty Trucks (Class 4-7): Regional distribution and specialized vocational vehicles (e.g., dump trucks, utility vehicles); bridging segment between LCVs and heavy haulage.

- Light Commercial Vehicles (Vans, Pickups): Last-mile delivery and utility fleets, often requiring smaller fuel cell stacks and shorter range capability.

- Specialty Vehicles (Forklifts, Port Tractors, Refuse Trucks): Closed-loop systems and high-torque operations, often using dedicated, localized fueling infrastructure.

- Power Output:

- < 150 kW: Suitable for LCVs and smaller city buses; focus on efficiency and compact design.

- 150 kW – 300 kW: Standard power range for regional Medium-Duty and initial Heavy-Duty Truck models; balancing performance and stack size.

- > 300 kW: Required for high-performance, long-haul Class 8 trucks operating in diverse topographies (e.g., mountainous routes) and high-payload transport.

- Technology Type:

- Polymer Electrolyte Membrane Fuel Cell (PEMFC): Dominant technology for vehicle traction due to rapid transient response and high power density.

- Solid Oxide Fuel Cell (SOFC): Niche application, typically used for Auxiliary Power Units (APUs) or stationary power, due to high efficiency at constant loads and fuel flexibility.

- Others (e.g., Alkaline Fuel Cell, PAFC): Currently limited commercial applications in transport due to operational temperature or complexity constraints.

- Range Capability:

- Short Range (< 300 km): Urban delivery and dedicated port/terminal operations.

- Medium Range (300 km – 600 km): Regional freight distribution and intercity bus routes.

- Long Range (> 600 km): Backbone logistics, requiring robust, corridor-based refueling infrastructure.

- Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Nordics)

- Asia Pacific (China, Japan, South Korea, Australia)

- Rest of the World (Latin America, Middle East, Africa)

Value Chain Analysis For Fuel Cell Commercial Vehicle Market

The value chain for the Fuel Cell Commercial Vehicle Market is fundamentally complex, requiring seamless coordination across distinct industrial sectors: materials, component manufacturing, vehicle assembly, and energy provision. Upstream activities begin with the highly specialized procurement and processing of critical raw materials. This includes Platinum Group Metals (PGMs), which are essential for the catalysts used in the PEM stack, specialized carbon fibers for constructing Type IV high-pressure hydrogen storage tanks (700 bar), and technical polymers for the proton-conducting membranes. Reducing the reliance on these expensive or supply-constrained materials through R&D (e.g., non-PGM catalysts) is a primary strategic objective at this stage. Furthermore, the upstream involves the highly capital-intensive production of hydrogen itself, utilizing either established methods (steam methane reforming, requiring Carbon Capture and Storage for "blue" hydrogen) or emerging methods (electrolysis powered by renewables for "green" hydrogen). The sourcing and delivery of certified green hydrogen significantly influence the market’s ultimate sustainability profile and TCO.

The midstream focuses on the integration and assembly process. This stage encompasses the manufacturing of individual components—the Membrane Electrode Assemblies (MEAs), bipolar plates, air compressors, and humidifiers—which are then assembled into the complete fuel cell stack. OEMs or dedicated Tier 1 suppliers (like Ballard or Plug Power) manage this highly technical process. The integration stage involves mating the fuel cell power module and the high-pressure hydrogen storage system with the electric drivetrain and vehicle chassis, a process demanding expertise in high-voltage engineering, thermal management, and sophisticated software controls for power management. Distribution channels for FCCVs rely heavily on direct commercial sales and fleet contracts, especially for large orders (e.g., 100+ trucks), as these direct transactions often incorporate customized service agreements, maintenance support, and crucial hydrogen supply contracts bundled by consortiums. Indirect distribution through commercial dealerships is less common currently but is expected to grow for smaller fleet sales and LCVs as the technology becomes more standardized and widely available.

Downstream market activities include sales, highly specialized after-sales servicing, maintenance contracts, and the critical operation of the hydrogen infrastructure. Unlike traditional vehicles, FCCVs require technicians trained specifically in high-pressure hydrogen safety and fuel cell system diagnostics, creating a specialized service network demand. The viability of the downstream market is entirely dependent on the strategic deployment of Hydrogen Refueling Stations (HRS) capable of dispensing high volumes of 700 bar hydrogen reliably and efficiently. Investment here is often driven by government matching funds and collaborations between logistics companies (guaranteeing demand) and energy suppliers (guaranteeing supply). Optimizing this entire chain through digital tools, predictive maintenance, and streamlined logistics is crucial to moving beyond pilot phases and achieving long-term commercial sustainability for the entire ecosystem, ensuring a reliable end-to-end user experience for commercial operators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $12,500 Million |

| Growth Rate | CAGR 45.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hyundai Motor Company, Toyota Motor Corporation, Daimler Truck AG, Nikola Corporation, Hyzon Motors, Ballard Power Systems, Cummins Inc., Symbio (Michelin/Faurecia), PACCAR Inc., Foton Motor, China Hydrogen Energy, Hyster-Yale Materials Handling, Plug Power, Bosch, Powercell Sweden AB, MAN SE, Volvo Group, IVECO, Honda Motor Co., Ltd., CERES Power. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Cell Commercial Vehicle Market Key Technology Landscape

The core technology driving the Fuel Cell Commercial Vehicle market remains the Polymer Electrolyte Membrane Fuel Cell (PEMFC), a highly dynamic and responsive system essential for handling the rapid load changes experienced in commercial transport (acceleration, braking, grade climbing). Continuous technological refinement is focused on enhancing the intrinsic durability of the fuel cell stack, primarily targeting degradation mechanisms within the Membrane Electrode Assembly (MEA), which is often the lifecycle limiting factor. Current R&D efforts aim at significantly reducing the Platinum Group Metal (PGM) loading in the catalyst layer, possibly substituting up to 80% of current PGM requirements through advanced catalyst supports and structured electrodes, which is essential for drastically lowering manufacturing costs and securing the supply chain against volatile metal prices. Successfully achieving operational lifetimes of 25,000 to 30,000 operating hours is the industry benchmark required for FCEVs to compete effectively on reliability and TCO with traditional diesel powertrains in the long-haul sector.

A second crucial area of innovation revolves around the efficient and safe storage of hydrogen. Advanced engineering of high-pressure hydrogen storage systems, typically constructed as Type IV composite tanks (carbon fiber reinforced plastic liners) operating at 700 bar, is necessary to achieve the requisite energy density for long-haul range. Research is also intensifying in the management of the fuel cell's Balance of Plant (BoP), particularly the air compressor, humidifier, and heat exchangers. These components consume a significant portion of the parasitic power and their efficiency directly impacts the overall fuel economy (km/kg H2). Improving the efficiency of the air compressor and developing compact, highly effective thermal management systems are vital for maintaining the stack at its optimal operating temperature (typically 60-80°C) and maximizing hydrogen utilization across varied climates and duty cycles.

Furthermore, the integration of digital technologies, particularly within the vehicle control unit (VCU) and fleet management systems, is rapidly becoming a technological differentiator. Advanced algorithms utilizing machine learning are employed to optimize the power split between the fuel cell stack and the battery buffer pack, maximizing overall efficiency during transient load conditions and extending the stack's service life by minimizing high current ripple and temperature spikes. Digitalization also extends to the hydrogen infrastructure; intelligent dispensing systems and remote monitoring technologies ensure high uptime for refueling stations and optimize logistic routing for fleets based on real-time hydrogen availability, queue times, and pressure capacity across the network. The synergistic development of both hardware (stack, tanks) and software (controls, fleet telematics) is essential for scaling the FCEV market successfully. The exploration of Solid Oxide Fuel Cells (SOFCs) for specialized, stationary applications or range-extending APUs continues, offering higher electrical efficiency (up to 70%) at constant loads, though their high operating temperature limits their direct use in dynamic motive power applications dominated by PEMFCs.

Regional Highlights

Regional dynamics are highly heterogeneous, dictated by varying regulatory incentives, public funding for infrastructure, and local manufacturing capabilities. Asia Pacific (APAC) currently dominates the market volume, largely spearheaded by China's comprehensive national energy plan supporting hydrogen-powered buses and logistics vehicles, along with significant governmental commitments in South Korea and Japan to establish a hydrogen society. China leverages its strong industrial base to rapidly deploy fuel cell technology in state-owned fleets, while South Korea focuses on establishing a robust hydrogen economy from production to end-use. This region benefits from centralized planning and aggressive emission reduction goals, making it the global leader in deployed units and localized supply chain integration.

Europe is experiencing substantial growth, underpinned by coordinated policy frameworks like the European Green Deal and initiatives such as the Clean Vehicles Directive, which mandate zero-emission targets for public procurement. The strategy here focuses heavily on developing hydrogen valleys and establishing cross-border corridor infrastructure, notably the "H2-Backbone," designed to enable long-haul FCEV trucking from major shipping ports through key industrial centers like Germany, France, and the Netherlands. European OEM collaboration (e.g., Daimler, Volvo) and government financing mechanisms are key catalysts, aiming to overcome the initial infrastructure hurdle and accelerate adoption among pan-European logistics providers, emphasizing sustainability and supply chain transparency.

North America, though slower initially, is rapidly accelerating, primarily driven by specific regional regulatory environments such as California’s Advanced Clean Trucks (ACT) rule, which mandates high percentages of ZEV sales. Deployment efforts are concentrated around high-volume transportation hubs—ports, rail yards, and major freeway corridors (e.g., I-5). The U.S. government’s Bipartisan Infrastructure Law provides substantial funding for clean hydrogen production (H2Hubs) and fueling stations, expected to significantly reduce the cost of hydrogen fuel and drive commercial fleet adoption throughout the forecast period. The Middle East and Africa (MEA) region is exhibiting early stage interest, particularly in nations leveraging abundant solar and wind resources to establish green hydrogen hubs for localized deployment, often focusing on export potential which creates a secondary need for local FCEV transportation solutions.

- Asia Pacific (APAC): Market leader driven by national strategies (China, Japan, South Korea). Focus on rapid deployment in municipal bus fleets and intracity logistics. Strong OEM presence and government subsidies facilitating scale, positioning it as the key manufacturing hub.

- Europe: Rapidly growing due to stringent decarbonization targets (Euro 7 standards and Fit for 55) and dedicated funding for hydrogen corridors (H2-Backbone). High penetration expected in the heavy-duty segment (Germany, France, Netherlands) enabled by public-private infrastructure investment.

- North America: Emerging market with strong regulatory support in key freight hubs (California, New York). Infrastructure funding (H2Hubs) is the critical catalyst, enabling large-scale private fleet commitments, focusing on long-haul Class 8 trucks along strategic economic corridors.

- Middle East and Africa (MEA): Nascent market, primarily focused on utilizing local renewable energy for green hydrogen production, potentially creating localized FCEV fleets for distribution and internal transport within newly established industrial zones like NEOM in Saudi Arabia.

- Latin America: Slow development currently, with adoption restricted to pilot programs in resource-rich nations exploring hydrogen production potential (e.g., Chile, Brazil), awaiting major infrastructure and regulatory commitments necessary for commercial viability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Cell Commercial Vehicle Market.- Hyundai Motor Company

- Toyota Motor Corporation

- Daimler Truck AG

- Nikola Corporation

- Hyzon Motors

- Ballard Power Systems

- Cummins Inc.

- Symbio (Michelin/Faurecia)

- PACCAR Inc.

- Foton Motor

- China Hydrogen Energy

- Hyster-Yale Materials Handling

- Plug Power

- Bosch

- Powercell Sweden AB

- MAN SE

- Volvo Group

- IVECO

- Honda Motor Co., Ltd.

- CERES Power

Frequently Asked Questions

Analyze common user questions about the Fuel Cell Commercial Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Fuel Cell Commercial Vehicles (FCCVs) over Battery Electric Vehicles (BEVs) for logistics?

FCCVs offer significantly longer range and much faster refueling times (comparable to diesel), making them operationally superior for high-utilization, long-haul heavy-duty trucking where minimizing downtime and maximizing payload are critical requirements that current BEV technology struggles to meet.

What are the main financial barriers to the mass adoption of Fuel Cell Commercial Vehicles?

The chief financial barriers are the high initial vehicle acquisition cost compared to conventional diesel trucks and the substantial capital expenditure required to establish a widespread, high-capacity 700 bar hydrogen refueling infrastructure necessary to support large commercial fleets efficiently.

Which geographical region leads the global Fuel Cell Commercial Vehicle market in terms of deployment?

The Asia Pacific region, particularly China, Japan, and South Korea, currently leads the market due to robust government hydrogen strategies, early investment in fuel cell bus fleets, and established manufacturing capabilities for fuel cell systems and related vehicle components supported by strong national mandates.

How is the Total Cost of Ownership (TCO) expected to evolve for Fuel Cell Commercial Vehicles?

TCO parity with diesel vehicles is projected to be achieved between 2030 and 2035, driven primarily by the decreasing cost of green hydrogen production through economies of scale, mass production of fuel cell stacks, and increasing vehicle utilization rates that offset the initial high capital cost.

What specific type of fuel cell technology is dominant in the commercial vehicle market?

The Polymer Electrolyte Membrane Fuel Cell (PEMFC) technology is dominant, as it provides the necessary high power density and fast dynamic response required for motive applications in heavy-duty commercial transportation, making it ideal for variable load cycles found in trucking and bus operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager