Fully Automatic Beverage Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441687 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Fully Automatic Beverage Machines Market Size

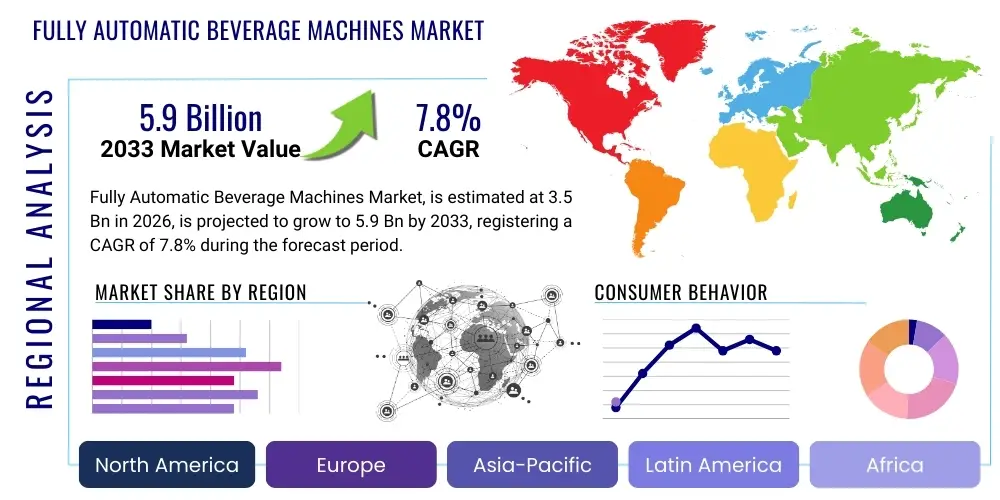

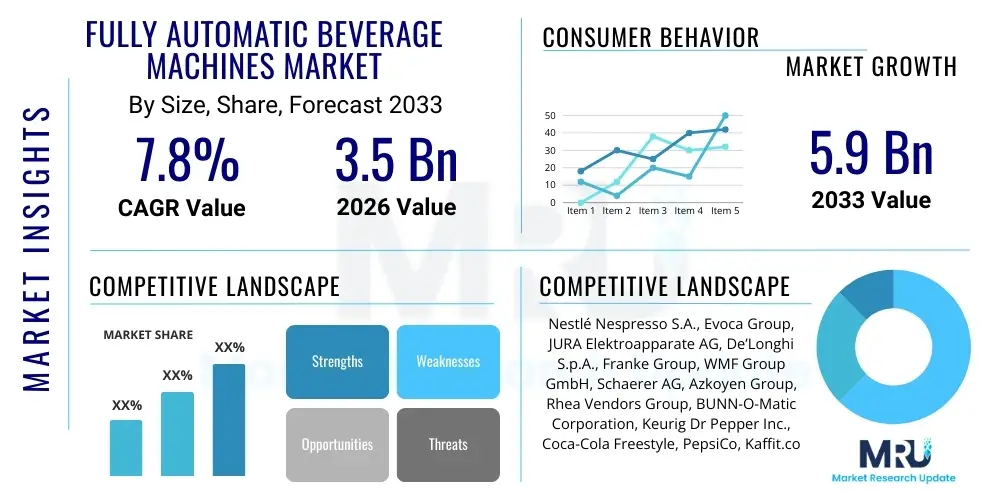

The Fully Automatic Beverage Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Fully Automatic Beverage Machines Market introduction

The Fully Automatic Beverage Machines Market encompasses advanced equipment designed for the automated preparation and dispensing of a wide variety of drinks, ranging from complex specialty coffee and espresso beverages to carbonated sodas, flavored juices, and customized hot chocolate formulations. These sophisticated machines represent the apex of beverage technology, integrating complex brewing cycles, precise volumetric dosing, advanced heating mechanisms, and rapid chilling capabilities controlled by robust electronic interfaces and often featuring predictive maintenance algorithms. The core value proposition of these systems lies in their ability to achieve industrial-scale consistency and high throughput while requiring minimal human intervention, thereby drastically reducing operational variability and ensuring a standardized product quality across geographically diverse outlets. The market extends across diverse product categories, including high-volume professional-grade equipment tailored for the demanding environments of Hotels, Restaurants, and Cafes (HoReCa), sleek self-service vending platforms optimized for public spaces, and sophisticated, compact solutions designed for modern office pantries and executive lounges, addressing the global premiumization trend in beverage consumption with technical efficiency.

Major applications of these fully automatic systems span the entire commercial and institutional landscape. In the commercial food service sector, deployment is critical for high-volume environments like Quick Service Restaurants (QSRs) and cinema complexes, where speed of service directly correlates with customer satisfaction and profitability. Corporate offices utilize these machines as essential tools for enhancing employee welfare and boosting morale, often opting for customizable bean-to-cup systems that offer premium drink options. Healthcare institutions and educational facilities deploy them for hygienic, reliable 24/7 service in common areas. The inherent benefit of these advanced machines is not merely in dispensing, but in their operational intelligence. They facilitate inventory management through real-time telemetry, track consumption patterns by product type and time of day, and integrate seamlessly with modern Point of Sale (POS) and inventory control systems. This digital integration transforms the beverage station into a data-driven nexus, enabling operators to fine-tune supply chain logistics for consumables, forecast demand fluctuations, and minimize waste, moving the operational focus from manual labor to strategic asset management and utilization analysis.

Key driving factors propelling the market expansion include the accelerating global trend toward urbanization, particularly in high-growth economies, which generates massive demand for quick, standardized, and reliable food and beverage options outside the home. The rising discretionary income across major consumer markets, coupled with evolving consumer tastes that favor exotic and personalized specialty beverages over traditional options, creates a strong pull for machines capable of complex recipe execution. Furthermore, technological advancements, such as the adoption of high-definition touch-screen interfaces, biometric access control for premium services, and increasingly complex programming that allows for micro-adjustments to flavor profiles based on ingredient input quality, further accelerate market penetration. These technological efficiencies are increasingly crucial in mitigating persistent challenges posed by global skilled labor shortages, positioning the fully automatic beverage machine not as an optional amenity, but as a critical infrastructure component for maintaining competitive quality and operational continuity in the fast-paced global hospitality and retail industries. The machine's ability to operate autonomously while maintaining impeccable standards of preparation represents a compelling argument for rapid capital investment by major global chains aiming for service uniformity and reliability.

Fully Automatic Beverage Machines Market Executive Summary

The Fully Automatic Beverage Machines Market is undergoing dynamic transformation characterized by intense technological competition and a pronounced focus on sustainability and digital integration. Global business trends highlight a significant shift towards "Machine-as-a-Service" (MaaS) models, where manufacturers offer integrated solutions covering machine leasing, maintenance, and proprietary consumable supply, shifting the capital expenditure burden from large, upfront purchases to predictable operational expenses for end-users. The imperative to reduce dependency on specialized personnel due to escalating labor costs globally is driving enterprises across all sectors to prioritize fully automated solutions capable of high-volume output with minimal technical oversight. Key manufacturers are aggressively investing in Research and Development (R&D) focused on developing advanced materials for prolonged operational lifespan, sophisticated water filtration systems optimized for beverage quality, and proprietary brewing mechanisms designed to enhance ingredient yield and energy conservation. This holistic approach towards machine lifecycle management and resource efficiency is defining the benchmark for market competitiveness in the forecast period.

Regionally, the market presents a segmented growth narrative. North America and Western Europe, defined by high maturity and deep market penetration, are prioritizing the replacement cycle of older equipment with new generations that offer enhanced connectivity, advanced analytics, and superior energy efficiency standards, driven by stringent regulatory frameworks and corporate sustainability goals. Conversely, the Asia Pacific (APAC) region is poised for explosive growth, driven by greenfield investments in new commercial and residential complexes and the rapid expansion of international QSR and coffee chain franchises into previously underserved metropolitan areas. Government initiatives supporting infrastructure modernization, combined with a rising digitally-savvy consumer base, accelerate the demand for connected vending solutions across transport and retail sectors in nations such as China, India, and rapidly developing Southeast Asian economies. These regional variances necessitate tailored product portfolios, ranging from robust, basic vending units in emerging markets to highly specialized, aesthetic, IoT-integrated machines in mature Western corporate environments.

Analysis of segment trends underscores the continuing dominance of the Hot Beverages segment, particularly highly customizable, fully automatic bean-to-cup coffee and espresso systems, which capture premium pricing and command strong brand loyalty based on perceived quality and freshness. However, the Cold Beverages segment is experiencing accelerated innovation, specifically in fountain systems capable of dispensing complex flavor combinations, personalized sweetness levels, and novel ingredient mixes (e.g., botanicals, functional supplements). This is largely driven by strategic collaborations between equipment manufacturers and global beverage conglomerates to create unique, customizable dispensing platforms that offer extensive beverage choice from a small physical footprint. Within end-use categories, the Commercial HoReCa sector maintains the largest segment share due to sheer volume demands, but the Office and Institutional segment is demonstrating remarkable proportional growth as employers globally recognize sophisticated, automatic beverage provision as a fundamental tool for talent attraction, employee amenity provision, and fostering an elevated, modern workplace culture, pushing the demand for sleek, low-noise, high-variety machines.

AI Impact Analysis on Fully Automatic Beverage Machines Market

User queries consistently target the transformative role of Artificial Intelligence (AI) and Machine Learning (ML) in upgrading fully automatic beverage machines from automated mechanisms to intelligent, adaptive retail and service platforms. Significant interest exists regarding AI's ability to dynamically optimize operational parameters—such as water pressure, infusion time, and temperature—in response to external variables like ingredient characteristics (e.g., humidity level of coffee beans) or ambient atmospheric pressure, ensuring optimal flavor extraction irrespective of environmental conditions. Operators are intensely focused on leveraging AI-driven predictive modeling to transition from routine, scheduled maintenance to condition-based servicing, significantly cutting operational costs associated with unnecessary preventative parts replacement. Furthermore, the integration of AI for advanced image processing and sensory analysis (using digital vision and electronic noses) to monitor hygiene, detect contamination risks, or ensure beverage consistency prior to dispensing, represents a key area of consumer expectation regarding future food safety standards in automated systems. The integration of robust security measures to protect the vast amount of usage, consumer preference, and payment data collected by these AI-powered machines is another critical theme addressed by industry participants.

The implementation of machine learning algorithms is enabling unparalleled levels of personalization that move beyond simple menu choices. AI analyzes complex datasets encompassing individual user preferences stored via loyalty apps, current purchase context, historical buying habits, and even external data feeds (like local events or traffic flow) to provide highly effective, context-aware suggestions, significantly boosting consumer engagement and impulse purchasing. For instance, a smart machine might recommend an iced latte during a mid-afternoon heatwave, or a high-caffeine espresso shot during high-peak office hours, dynamically adjusting its offerings to maximize consumer utility and operator revenue. This analytical capability also extends to waste reduction; by precisely forecasting demand minute-by-minute, AI systems can optimize ingredient preparation and usage, especially for highly perishable components like fresh milk or prepared fruit purees, dramatically improving sustainability metrics and reducing the operator's environmental footprint, a major corporate priority.

Ultimately, the impact of AI is fostering a competitive environment where the differentiation factor is no longer the machine's physical capability, but its intelligence and adaptive capacity. Manufacturers are racing to develop proprietary AI cores that can learn and optimize beverage preparation over time, effectively creating a self-improving appliance. This transition requires significant investment in cloud computing infrastructure to handle massive data streams, coupled with specialized edge computing capabilities embedded within the machine hardware to allow for immediate, real-time adjustments without reliance on constant cloud connectivity. The resulting intelligent machine functions not only as a dispenser but as a proactive retail manager, capable of maximizing sales, minimizing operational expenditure, and delivering a highly personalized, consistent, and hygienic beverage experience across highly varied global operational landscapes, solidifying AI as a cornerstone technology for future market development and segmentation.

- AI-driven Predictive Maintenance: Utilizing sensor data and ML algorithms to anticipate mechanical failures, dramatically reducing downtime and maximizing operational uptime, critical for high-volume commercial users, ensuring 99.9% service availability.

- Hyper-Personalization of Drinks: AI analyzes historical purchase data, time of day, and external factors (like ambient temperature) to suggest customized drink modifications, enhancing customer experience, driving impulse purchases, and potentially increasing average transaction value by up to 15%.

- Automated Quality Control: ML models monitor key brewing parameters (e.g., flow rate, water clarity, grind consistency, dissolved solids) in real-time, automatically adjusting machine settings to maintain the highest quality standards without human intervention, ensuring strict adherence to global brand standards.

- Inventory Optimization: AI integrates with supply chain management systems and telemetry to forecast ingredient usage (beans, milk, syrups) with high accuracy, automating replenishment orders, minimizing ingredient spoilage and stock-outs, leading to a typical 20% reduction in consumable waste.

- Dynamic Pricing Models: Algorithms adjust pricing based on location, time, demand elasticity, localized competition, and current stock levels, maximizing revenue generation, particularly in unattended vending and micro-market self-service environments, achieving optimal pricing strategy implementation.

- Voice and Gesture Interaction: Integration of sophisticated natural language processing (NLP) allows for hands-free ordering, improving accessibility for differently-abled users and significantly enhancing hygiene standards in public settings, aligning with post-pandemic consumer preference for minimal contact interfaces.

- Energy Efficiency Optimization: AI algorithms learn usage patterns to schedule deep sleep modes and pre-heating cycles precisely when needed, minimizing idle energy consumption and contributing significantly to lower utility bills and meeting increasingly strict environmental compliance targets globally.

- Remote Firmware Updates: ML infrastructure allows manufacturers to deploy security patches, new features, and recipe updates remotely and simultaneously across vast fleets of machines, ensuring software integrity and competitive feature parity without the need for on-site technician visits.

DRO & Impact Forces Of Fully Automatic Beverage Machines Market

The market dynamics for Fully Automatic Beverage Machines are strategically navigated through a complex framework of Drivers (D), Restraints (R), and Opportunities (O), which collectively exert strong directional impact forces on market trajectory. A primary and overwhelming driver is the global socio-economic pressure to achieve operational efficiency, largely fueled by rising minimum wages and a persistent shortage of skilled labor, particularly in the demanding and high-turnover hospitality sector. Businesses are increasingly viewing investment in high-end automatic machines as a long-term strategic investment to guarantee consistent labor cost control and standardized product output, irrespective of personnel changes. This driving force is further amplified by the consumer demand for instantaneous service coupled with customized options, a synthesis that only high-speed, programmable automatic systems can reliably deliver across a geographically dispersed network of locations, reinforcing the machine's role as a non-negotiable component of modern retail infrastructure globally.

Despite the powerful drivers, the market faces notable restraints that temper expansion, particularly within the SME segment. The prohibitively high initial capital expenditure (CapEx) for acquiring top-tier, fully automatic equipment, especially models incorporating advanced features like touch screens, IoT telemetry, and sophisticated brewing technologies, remains a significant barrier to entry for smaller independent operators. Furthermore, while the machines offer operational savings, they often necessitate reliance on proprietary consumables (e.g., specialized capsules, branded concentrate bags) and highly technical, manufacturer-certified maintenance protocols. This creates vendor lock-in and elevates the Total Cost of Ownership (TCO) over the equipment lifecycle, posing a restraint that businesses must carefully model. Additionally, navigating the fragmented regulatory landscape regarding food safety, material certifications (NSF, CE, UL), and complex electronic waste disposal standards across different continents adds complexity and cost to manufacturing and distribution efforts, demanding continuous compliance monitoring and product redesign iterations.

Opportunities for strategic expansion are predominantly centered on technological arbitrage and market diversification. The most compelling opportunity lies in capitalizing on the rapidly advancing IoT and AI capabilities to transform the service model into a lucrative subscription or usage-based platform, generating stable, recurring revenue streams from predictive maintenance, data analytics, and consumable supply agreements. Secondly, there is immense untapped potential in expanding beyond traditional QSR and office settings into emerging institutional niches, such as co-working hubs, military bases, high-tech manufacturing clean rooms, and public libraries, all of which require reliable, automated hydration and refreshment solutions. Furthermore, the development of multi-functional machines capable of processing ingredients for health-focused and functional beverages (e.g., personalized vitamin-infused drinks, specialized dietary protein shakes) allows manufacturers to tap into the booming global wellness and health food market, significantly broadening the addressable consumer base beyond conventional coffee and soda consumers and offering substantial margins for innovative product lines.

Segmentation Analysis

The comprehensive segmentation analysis of the Fully Automatic Beverage Machines Market provides granular insights into market dynamics, enabling manufacturers and suppliers to tailor product specifications, pricing strategies, and distribution channels to maximize efficacy within specific vertical markets. The complexity of segmentation reflects the diverse applications and technological requirements inherent in dispensing various beverage types globally. Segmentation by technology is crucial, differentiating between high-end bean-to-cup systems (prioritized in premium cafes and executive offices for quality) and robust concentrate/syrup systems (favored by QSRs for high-volume, cost-efficient output and minimal ingredient logistics). Understanding these technological preferences dictates component sourcing and production complexity, directly influencing the final product cost structure and maintenance requirements throughout the equipment's operational life cycle.

Further strategic segmentation occurs across the application spectrum. The Commercial segment demands machines engineered for extreme durability, continuous operation, and rapid service cycles, often requiring specialized integration with existing commercial kitchen equipment and energy management systems. Conversely, the Office and Institutional segment prioritizes user-friendliness, aesthetic design (to blend seamlessly into modern office environments), and high variety in beverage offerings to cater to diverse employee preferences. The Vending and Retail segment requires maximum autonomy, featuring robust anti-vandalism designs, advanced telematics for remote management, and sophisticated, secure payment gateway integrations to ensure continuous profitability in unstaffed public environments. Analyzing volume capacity also guides product selection; low-volume machines focus on compactness and aesthetic appeal, while high-volume systems emphasize tank capacity, rapid recovery time (the speed at which the machine is ready for the next dispense cycle), and component resilience under constant high pressure.

This structured segmentation is essential for effective market penetration. For example, a manufacturer targeting the European HoReCa market would emphasize bean-to-cup technology, adherence to strict EU hygiene standards (e.g., milk system sterilization), and energy efficiency, positioning the product at a premium price point. In contrast, a strategy targeting the APAC institutional segment would prioritize concentrate dispensing systems for logistical simplicity, robust construction for durability in high-traffic areas, and competitive pricing supported by simplified maintenance procedures. The accurate delineation of these segments allows for the precise allocation of marketing resources, specialized sales force training focused on vertical expertise, and targeted R&D investment towards the most technologically demanding or fastest-growing product categories, ensuring market relevance and long-term sustainable growth in a highly competitive global machinery market.

- By Beverage Type:

- Hot Beverages (e.g., Premium Specialty Coffee, Espresso, High-Temperature Tea Infusions, Customized Hot Chocolate Formulas)

- Cold Beverages (e.g., Post-Mix Carbonated Soft Drinks, Still and Sparkling Flavored Waters, Juices, Iced Teas, Functional Energy Drinks)

- Dual Function (Sophisticated systems capable of seamless, rapid switching and preparation of both hot and chilled beverages from the same unit)

- By Technology:

- Bean-to-Cup Systems (Utilizing fresh whole beans and grinding on demand for superior quality, demanding complex internal mechanism maintenance)

- Capsule/Pod Systems (Offering variety and convenience through pre-portioned, sealed containers, dominating the smaller office and home-use professional segments)

- Concentrate/Syrup Dispensing Systems (Commonly used for high-volume soda and juice distribution, relying on precise post-mix blending ratios for consistency)

- Powdered Mix Systems (Used for hot chocolate, soups, and certain tea varieties, prioritizing shelf stability and long-term storage viability in vending machines)

- By Application/End-User:

- Commercial (Full-Service Restaurants, Cafes, Quick Service Restaurants (QSRs), Hotels, High-end Catering Services - HoReCa, requiring high speed and durability)

- Office and Institutional (Corporate Offices, Large Educational Facilities, Hospitals, Government Buildings, focusing on variety, aesthetics, and low staff dependency)

- Vending and Retail (Public Transportation Hubs, Convenience Stores, Micro-Markets, Entertainment Venues, demanding robust design and advanced cashless payment integration)

- By Volume Capacity:

- Low Volume (Designed for daily output of 50-100 cups, suitable for small offices and executive suites, emphasizing low noise and sleek design)

- Medium Volume (Targeting 100-300 cups per day, typical for mid-sized corporate pantries and cafes, balancing capacity with footprint)

- High Volume (Engineered for 300+ cups per day, essential for airports, large QSRs, and convention centers, prioritizing speed, component resilience, and quick recovery time)

Value Chain Analysis For Fully Automatic Beverage Machines Market

The upstream segment of the Fully Automatic Beverage Machines value chain is characterized by high technological specialization and concentrated expertise. It commences with the sourcing of raw materials, particularly high-grade stainless steel (for boiler and fluid pathways to ensure hygiene and corrosion resistance), specialized polymers, and complex electronic components. Key strategic suppliers in this stage include manufacturers of proprietary heating elements (e.g., induction or thermal block technology for rapid, energy-efficient heating), high-pressure volumetric pumps (critical for espresso extraction), and sophisticated grinding mechanisms that must maintain micro-level particle consistency under heavy use. Original Equipment Manufacturers (OEMs) rely on a limited pool of certified, high-quality component providers, making long-term strategic supplier relationships and strict adherence to component quality standards paramount. Any disruption or quality lapse in this upstream layer directly impacts the performance integrity, warranty liability, and safety certifications of the final automatic machine, necessitating exhaustive quality control and traceability protocols in the supplier network management strategy.

The core manufacturing and assembly phase involves meticulous precision engineering, marrying the mechanical components with the complex electronic control units and user interfaces. This stage is heavily influenced by intellectual property rights related to brewing optimization, proprietary fluid dynamics, and energy-saving designs. Manufacturers often invest heavily in highly automated assembly lines to ensure repeatability and scale, essential for meeting global demand while maintaining competitive pricing. Post-manufacturing, the focus shifts to distribution logistics. Direct distribution is favored for large multinational accounts (like major hotel chains or global QSR brands), allowing manufacturers to manage complex customizations, control the pricing structure, and directly oversee installation and initial training. Indirect distribution relies on an extensive network of regional distributors and value-added resellers (VARs) who possess specialized local knowledge, manage localized inventory, and provide front-line technical support in markets where the OEM lacks a direct operational footprint, significantly expanding market reach into fragmented or geographically challenging territories.

The downstream component of the value chain is critical for long-term revenue generation and market reputation, centering on end-user experience and post-sale support. Direct channels facilitate immediate feedback collection on machine performance and customer satisfaction, which feeds directly into iterative product development cycles (closed-loop innovation). Indirect channels rely on the technical competency of the VARs for providing timely maintenance, spare parts supply, and localized customer service agreements. A major focus in the downstream market is the lucrative consumables supply chain—the proprietary coffee capsules, syrup concentrates, milk powders, or water filters essential for the machine's operation. Manufacturers often generate higher lifetime revenues from these recurring consumable sales and associated service contracts than from the initial hardware sale. Therefore, optimizing the logistics for rapid, reliable, and cost-effective delivery of these consumables to thousands of endpoints is a critical competitive necessity, ensuring that customer loyalty remains high and that machine usage is maximized throughout its deployed lifespan, guaranteeing sustained market presence and profitability.

Fully Automatic Beverage Machines Market Potential Customers

The segmentation of potential customers for Fully Automatic Beverage Machines revolves around their primary operational requirements, including transaction volume, required beverage complexity, and budget constraints. The dominant customer segment includes large, global commercial entities, primarily Quick Service Restaurant (QSR) chains, expansive hotel groups, and high-volume leisure complexes (e.g., casinos, cruise ships). These buyers require industrial-grade, highly durable machines capable of uninterrupted, high-speed dispensing (often over 500 servings per day) while maintaining precise control over recipe consistency to protect brand image across thousands of locations. Their procurement decisions are driven by sophisticated financial models focusing rigorously on minimizing operational labor hours, maximizing throughput during peak demand windows, and ensuring comprehensive telemetry compatibility for centralized asset management and regulatory compliance monitoring, viewing the machine as a critical, hard-working piece of continuous production equipment rather than a simple retail fixture.

A secondary, rapidly growing customer base comprises Institutional and Corporate buyers, including large technology firms, modern co-working spaces, major healthcare networks, and university campuses. For this cohort, the machines serve a dual purpose: they are essential functional assets and key components of employee/student engagement and well-being initiatives. These customers seek machines that offer a wide, customizable variety of beverages (from specialty coffee to functional hydration options), feature aesthetic appeal appropriate for modern interior design, and operate with minimal noise disruption. Procurement decisions in this area are increasingly influenced by ESG considerations, demanding machines with verifiable energy efficiency certifications, sustainable material sourcing, and capabilities that reduce waste (e.g., supporting reusable cups), positioning the investment as a demonstrable commitment to corporate social responsibility and staff quality of life.

The third significant market segment is the Retail Vending and Unattended Commerce sector, encompassing operators of micro-markets, public vending kiosks, and self-service stations located in high-traffic areas such as airports, metro stations, and large residential buildings. These buyers require equipment engineered for maximum autonomy, robustness against potential vandalism, and absolute transactional reliability. Crucially, these machines must integrate seamlessly with diverse, future-proof payment technologies, including mobile wallets and proprietary payment apps. The core purchasing criterion here is the machine’s ability to generate reliable passive income with minimized human interaction, demanding advanced IoT capabilities for remote fault resolution, security monitoring, and dynamic, cloud-based recipe updates, making the technology platform supporting the hardware far more important than the physical machine itself in the competitive landscape of unattended retail.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé Nespresso S.A., Evoca Group, JURA Elektroapparate AG, De’Longhi S.p.A., Franke Group, WMF Group GmbH, Schaerer AG, Azkoyen Group, Rhea Vendors Group, BUNN-O-Matic Corporation, Keurig Dr Pepper Inc., Coca-Cola Freestyle, PepsiCo, Kaffit.com (Eversys SA), Bravilor Bonamat B.V., Ditting Maschinen GmbH, Marco Beverage Systems Ltd., Curtis Global (Wilbur Curtis Company), Lavazza Professional (Flavia), Seaga Manufacturing Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fully Automatic Beverage Machines Market Key Technology Landscape

The technological core of the Fully Automatic Beverage Machines Market is founded on achieving highly precise, repeatable, and scalable fluid and thermal dynamics. Central to this is the adoption of advanced boiler and thermal block technologies, which minimize the energy required for rapid heating and maintain water temperature within a fraction of a degree, essential for optimal chemical extraction of flavor compounds in specialty coffee and tea. Manufacturers are increasingly integrating proportional-integral-derivative (PID) controllers into the heating systems to achieve this exacting temperature stability, surpassing the capabilities of older, less precise thermostat-based systems. Furthermore, high-pressure rotary pumps (often exceeding 9 bars for espresso preparation) combined with electronically controlled flow meters ensure volumetric consistency, compensating for variations in incoming water pressure or mineral content, thereby guaranteeing identical beverage quality across every transaction, a non-negotiable requirement for global chain operations demanding standardization.

The second dominant technological trend is the seamless integration of cyber-physical systems facilitated by the Internet of Things (IoT) infrastructure. Modern fully automatic machines are equipped with embedded Linux or proprietary operating systems supporting dedicated connectivity modules (4G/5G, Wi-Fi). This robust connectivity enables the collection of massive data sets on component wear, ingredient consumption, and machine operational status, feeding into sophisticated cloud-based management platforms. This technology shift is foundational to the successful implementation of predictive maintenance, where algorithms analyze sensor data (e.g., pump cycle times, temperature variance spikes) to predict component failure probability weeks in advance. This capability allows operators to schedule preventative service during low-demand periods, minimizing machine downtime—a crucial operational metric for high-volume commercial installations—and transforming the technical support model from reactive repair to proactive asset optimization.

Finally, user interface and customized dispensing technologies are crucial differentiators. High-definition capacitive touch screens, often incorporating antimicrobial surfaces, provide an intuitive platform for highly complex customization, allowing consumers to adjust milk foam density, flavor shot concentrations, and extraction volumes instantly, replicating the bespoke service of a skilled barista. Concurrently, advanced mixing and dispensing heads utilize proprietary nozzle designs and non-contact dispensing mechanisms to enhance hygiene and prevent cross-contamination between different beverage types, crucial for meeting stringent health standards. The convergence of these technologies—precision mechanics, advanced thermal management, high-speed networking, and intuitive interfaces—allows the fully automatic beverage machine to function not just as an appliance, but as an integral, intelligent, self-managing, and highly configurable retail unit, capable of adapting its offerings and operational state to maximize profitability and consumer satisfaction in real-time across the global marketplace.

Regional Highlights

- North America: This region sustains its leadership position in the global market, driven by exceptionally high labor costs that accelerate the transition to full automation across the HoReCa and corporate sectors. The U.S. market, specifically, is characterized by a strong demand for high-volume, multi-functional, cold beverage fountain systems (due to the pervasive QSR culture) alongside sophisticated, IoT-enabled bean-to-cup machines for premium office settings. Regulatory requirements, particularly surrounding NSF certification for hygiene and strict energy consumption standards, heavily influence product design. Manufacturers often prioritize offering comprehensive service contracts and MaaS models here, recognizing the high expectation for guaranteed uptime and minimal operational disruption, which is often facilitated by advanced remote diagnostic capabilities provided through the installed telemetry systems.

- Europe: Europe is a nuanced and mature market, marked by regional divergence in consumer preferences; Southern Europe retains a strong preference for high-quality espresso, driving demand for technologically precise, high-pressure brewing systems, while Northern Europe focuses more on filtered coffee and institutional dispensing solutions. Strict regulatory bodies (such as the European Food Safety Authority and various national labor laws) mandate adherence to rigorous hygiene and material safety standards, which are often stricter than global norms, influencing product lifespan and material choices. The drive towards sustainability is particularly aggressive in the EU, forcing manufacturers to innovate in areas like recyclable packaging support (moving away from single-use plastics) and low-energy consumption certifications (e.g., standby power reduction), making compliance a key competitive differentiator across the diverse European Union member states.

- Asia Pacific (APAC): The APAC region represents the engine of future market growth, characterized by massive infrastructure investments and a rapidly expanding, consumption-driven middle class eager to adopt Western-style convenience and specialty beverage culture. China and Southeast Asia are witnessing explosive installation rates in newly developed corporate parks, high-speed rail stations, and expanding retail malls. The market requires a bifurcated approach: high-end, aesthetically pleasing machines for luxury hotels and top-tier corporate offices, and extremely robust, price-competitive vending units designed to withstand the operational demands and climate variability of dense urban public spaces. Local manufacturers are emerging as significant competitors, often specializing in localized payment solutions and catering to regional beverage tastes (e.g., specialized tea extraction technologies or unique spice infusions), necessitating flexible supply chain operations for international market entrants.

- Latin America (LATAM): Growth in LATAM is concentrated in key urban centers, predominantly Brazil, Mexico, and Colombia, driven by the expansion of multinational franchises and burgeoning local hospitality investment spurred by recovering tourism sectors. The market is highly sensitive to total cost factors, leading to a strong demand for durable, easy-to-maintain mid-range automatic machines that offer a compelling balance between quality output and initial capital outlay. Logistics and localized technical service availability are major barriers to market entry outside of major city hubs, making strong partnerships with reliable local distributors who can provide rapid, technically certified repair services a non-negotiable requirement for successful market penetration, especially given infrastructural challenges that can affect power and water quality, demanding high-tolerance internal components.

- Middle East and Africa (MEA): This region exhibits high-value opportunities, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), driven by massive government investments in tourism, corporate headquarters relocation, and high-end residential development. The demand in MEA is skewed towards premium, custom-designed machines featuring luxury materials, advanced user interfaces, and the capacity to handle specific regional beverage preferences. Africa’s market remains largely nascent but promises strong long-term institutional growth, focusing on basic, robust vending solutions for educational and public facilities. Extreme heat and poor water quality in many parts of the region necessitate specialized, highly durable filtration systems and superior thermal management solutions built into the machines to ensure operational longevity and beverage quality in harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fully Automatic Beverage Machines Market.- Nestlé Nespresso S.A.

- Evoca Group

- JURA Elektroapparate AG

- De’Longhi S.p.A.

- Franke Group

- WMF Group GmbH

- Schaerer AG

- Azkoyen Group

- Rhea Vendors Group S.p.A.

- BUNN-O-Matic Corporation (BUNN)

- Keurig Dr Pepper Inc.

- Coca-Cola Freestyle (The Coca-Cola Company)

- PepsiCo (for fountain solutions)

- Kaffit.com (Eversys SA)

- Bravilor Bonamat B.V.

- Ditting Maschinen GmbH

- Marco Beverage Systems Ltd.

- Curtis Global (Wilbur Curtis Company)

- Lavazza Professional (Flavia)

- Seaga Manufacturing Inc.

Frequently Asked Questions

Analyze common user questions about the Fully Automatic Beverage Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Fully Automatic Beverage Machines Market?

The central growth driver is the increasing need for operational efficiency, standardization of product quality globally, and crucial labor cost mitigation in the commercial food service and institutional sectors. Fully automatic machines ensure consistent product quality, high throughput, and minimize reliance on expensive skilled staff, directly addressing pressing industry demands.

How is IoT technology transforming the maintenance and operation of these machines?

IoT enables advanced telemetry and real-time data collection on machine performance, inventory levels, and diagnostic fault codes. This crucial capability facilitates predictive maintenance using AI algorithms, allowing operators to proactively schedule services and component replacements, drastically reducing unexpected downtime and optimizing the routing of technical support teams globally for maximum asset utilization.

Which geographical region exhibits the highest growth potential for automatic beverage machine installations?

The Asia Pacific (APAC) region, specifically emerging and rapidly urbanizing economies like China and India, is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by massive investment in commercial infrastructure, rapid expansion of the middle class, and the swift modernization of retail and corporate consumption habits, creating a huge greenfield market.

What are the main restraints hindering widespread adoption of fully automatic beverage systems?

The primary restraints include the high initial capital investment required for purchasing high-quality automatic equipment and the potential for increased Total Cost of Ownership (TCO) due to reliance on specialized, proprietary consumables, complex software licensing fees, and the necessity of highly technical, often proprietary, maintenance contracts required to keep sophisticated systems running optimally.

Are sustainability features influencing purchasing decisions in this market?

Yes, sustainability is a critical and growing factor. Commercial and institutional buyers increasingly mandate machines that demonstrate verifiable waste reduction (e.g., favoring bulk ingredient systems over single-use pods), offer verifiable energy efficiency certifications (like those from the European Union or Energy Star), and utilize durable, recyclable materials, aligning procurement strategies with robust corporate ESG mandates.

How do fully automatic machines ensure high levels of hygiene in public settings?

Modern fully automatic machines incorporate advanced hygiene protocols, including automated self-cleaning cycles for milk and mixing systems, use of antimicrobial surfaces on touchpoints, non-contact dispensing nozzles, and integration with AI-powered sensors that monitor internal cleanliness, significantly reducing the risk of contamination and meeting stringent international food safety standards for unattended operation.

What role does advanced payment technology play in the vending segment?

Advanced payment technology is fundamental to the vending segment's success. Machines must integrate seamlessly with cashless systems, including NFC (tap-to-pay), QR codes, mobile wallets (e.g., Apple Pay, Google Pay), and proprietary loyalty apps. This ensures transactional speed, security, and broad consumer accessibility, maximizing transaction volume in unstaffed environments and providing essential sales data through the connected platform.

What is a "Bean-to-Cup" system and why is it popular in the HoReCa sector?

A "Bean-to-Cup" system is a fully automatic machine that grinds whole coffee beans immediately prior to brewing, offering the freshest possible beverage quality. It is popular in the HoReCa sector (Hotels, Restaurants, Cafes) because it delivers the quality expected by specialty coffee consumers with the operational efficiency and consistency of a fully automated system, crucial for handling peak service hours without compromising flavor or requiring a skilled barista.

How is competition evolving between traditional capsule systems and concentrate systems?

Competition is intensifying based on application. Capsule systems dominate smaller, premium office and personal-use settings due to variety and convenience, whereas concentrate/syrup systems are preferred in high-volume QSR and fountain environments, where logistics (storage, reduced per-serving cost) and sheer dispensing speed outweigh the premium freshness offered by capsules, driving innovation in both distinct technological paths.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager