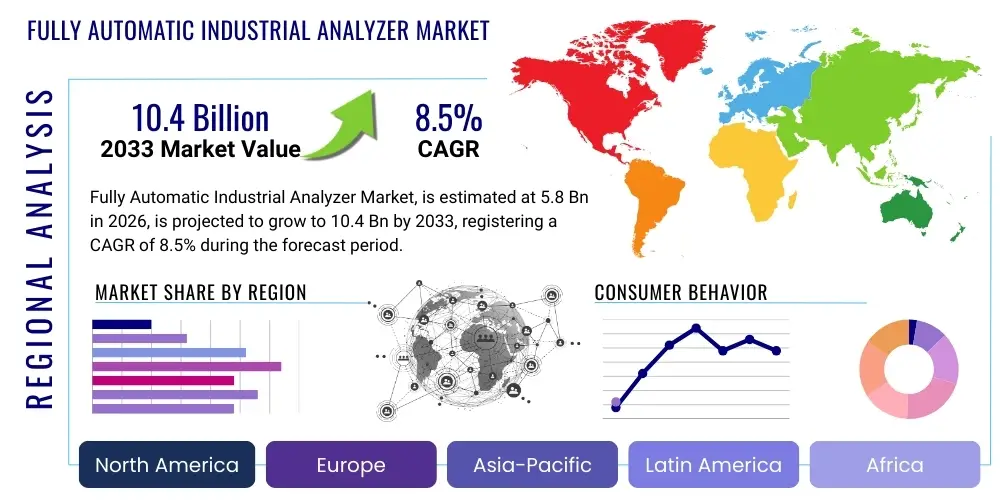

Fully Automatic Industrial Analyzer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442110 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Fully Automatic Industrial Analyzer Market Size

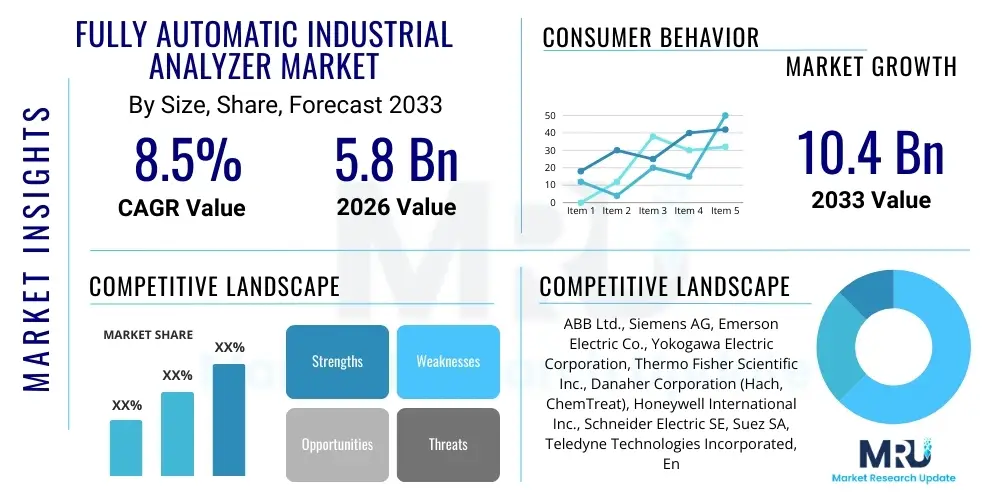

The Fully Automatic Industrial Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This robust expansion is fueled by increasing regulatory scrutiny across key industrial sectors and the imperative for real-time quality control and process optimization, particularly in energy and chemical production. The integration of advanced sensor technology and sophisticated data processing algorithms is fundamentally transforming how industrial measurements are conducted, moving from manual batch testing to continuous, inline monitoring.

The market is estimated at $5.8 Billion in 2026 and is projected to reach $10.4 Billion by the end of the forecast period in 2033. This significant valuation increase is reflective of the global industrial shift towards Industry 4.0 principles, where predictive maintenance and operational efficiency derived from precise analytical data are paramount. Investment in digitalization initiatives, especially in emerging economies undergoing rapid industrialization, contributes substantially to the overall market trajectory. Furthermore, the rising adoption of sophisticated spectroscopic and chromatographic techniques for complex matrix analysis ensures sustained high demand.

The market’s strong financial outlook is underpinned by replacement cycles in established industrial infrastructures, coupled with demand for novel analytical systems capable of handling harsh operating environments and complex chemical streams. Fully automatic industrial analyzers offer a superior return on investment (ROI) by minimizing human error, reducing reagent consumption, and enabling immediate process adjustments, thereby enhancing yield and product quality assurance across various manufacturing domains.

Fully Automatic Industrial Analyzer Market introduction

The Fully Automatic Industrial Analyzer Market encompasses highly sophisticated instruments designed for continuous, unattended, and real-time analysis of chemical, physical, and compositional properties within industrial processes. These analyzers are critical components of modern Process Analytical Technology (PAT) systems, ensuring that production specifications are met rigorously and efficiently. They integrate sample conditioning, analytical measurement, data acquisition, and often automated calibration routines into a single, seamless operation. Unlike laboratory-based analyzers, industrial versions are built to withstand extreme operating conditions, including high temperatures, fluctuating pressures, and corrosive atmospheres, making them indispensable for safety-critical and quality-intensive operations.

Major applications of these analyzers span across diverse heavy industries. In the petrochemical and refining sectors, they are essential for monitoring fuel quality, optimizing cracking processes, and ensuring compliance with stringent environmental regulations regarding emissions and effluent discharge. The chemical industry utilizes them for reaction monitoring, purity checks of bulk chemicals, and ensuring the efficient use of expensive catalysts. Furthermore, the environmental monitoring sector relies on these systems for continuous monitoring of air and water quality, providing verifiable data necessary for regulatory reporting and public health protection. The semiconductor, pharmaceutical, and food and beverage industries also leverage automatic analyzers for high-precision quality control where minute variations can significantly impact product viability or safety.

The primary driving factors for market growth include the global push for operational excellence, characterized by minimizing waste and energy consumption. Automation minimizes human interaction, reducing operational expenses and mitigating risks associated with handling hazardous materials. Furthermore, the mandatory implementation of continuous emission monitoring systems (CEMS) and wastewater treatment standards globally necessitates the deployment of robust and reliable automatic analyzers. These instruments offer unparalleled benefits, including rapid decision-making capabilities, improved process throughput, and enhanced data integrity, which are central to competitive manufacturing strategies in the current industrial landscape.

Fully Automatic Industrial Analyzer Market Executive Summary

The Fully Automatic Industrial Analyzer Market is experiencing significant transformation, driven by robust business trends emphasizing digitalization and integrated smart manufacturing ecosystems. Key market participants are focusing strategically on developing modular, multi-parameter analysis platforms that can adapt quickly to changing industrial feedstock and product specifications. There is a palpable shift towards subscription-based analytical services (Analysis-as-a-Service, or AaaS) and remote diagnostics capabilities, which lowers the initial capital expenditure for end-users while ensuring system uptime and peak performance. Merger and acquisition activities remain vibrant, focused on consolidating specialized technology expertise, particularly in advanced sensor fabrication and chemometrics software development, securing competitive advantage through comprehensive solution portfolios.

Regionally, the market dynamics are highly heterogeneous. Asia Pacific (APAC) dominates in terms of growth rate, fueled by massive infrastructure projects, rapid industrial expansion in China and India, and increasing environmental compliance enforcement across Southeast Asia. North America and Europe, while mature markets, maintain high revenue share due to substantial investment in sophisticated technologies like micro-electromechanical systems (MEMS) sensors and advanced predictive analytics models. These regions prioritize precision and reliability in highly regulated sectors such as pharmaceuticals and high-value specialty chemicals, necessitating continuous upgrades to advanced analytical instrumentation. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by growing oil & gas sector investments and infrastructure development requiring localized manufacturing capabilities.

Segment trends reveal that the Process Gas Analyzers category holds a dominant position, primarily due to global requirements for stack gas emission monitoring and stringent safety protocols in chemical processing. However, Liquid Analyzers, particularly those dedicated to water quality monitoring and complex chemical titrations, are expected to exhibit the fastest growth, propelled by global water scarcity issues and increased regulatory focus on industrial effluent management. Technology-wise, Fourier-Transform Infrared (FTIR) spectroscopy and Gas Chromatography (GC) systems remain crucial, but newer technologies leveraging artificial intelligence for spectral interpretation and drift compensation are rapidly gaining traction, ensuring greater accuracy and fewer maintenance interventions across all application segments.

AI Impact Analysis on Fully Automatic Industrial Analyzer Market

Common user questions regarding AI's impact on industrial analyzers primarily revolve around three core themes: How AI enhances measurement reliability and accuracy; whether AI can reduce the complexity and cost of routine maintenance and calibration; and the security implications of integrating AI-driven analytical platforms into existing operational technology (OT) networks. Users are deeply concerned with minimizing false positive alerts, which lead to costly and unnecessary process shutdowns, and maximizing the lifespan of expensive sensor components. Expectations are high regarding AI’s ability to interpret complex, multivariate data streams generated by industrial processes, moving beyond simple threshold alerts to provide true predictive intelligence about process deviations before they manifest as critical faults. The market is keenly watching AI’s role in accelerating the adoption of complex analytical techniques that previously required expert human intervention.

The deployment of Artificial Intelligence and Machine Learning (ML) algorithms is revolutionizing the Fully Automatic Industrial Analyzer market by enhancing data interpretation, optimizing predictive maintenance schedules, and enabling advanced anomaly detection. AI models, particularly deep learning networks, are capable of recognizing subtle, non-linear patterns in spectral data or time-series process variables that are often missed by traditional statistical methods, leading to dramatically improved measurement accuracy and specificity. This advanced capability is particularly vital in analyzing complex chemical matrices, such as crude oil fractions or multi-component wastewater streams, where baseline drift and matrix effects previously posed significant challenges to continuous automatic analysis.

Furthermore, AI is fundamentally changing the service model for these sophisticated instruments. By continuously monitoring the analyzer's internal health metrics—such as lamp intensity, detector noise, and flow rates—ML algorithms can predict component failure with high accuracy, enabling proactive servicing and minimizing unexpected downtime, which is extremely costly in continuous manufacturing environments. This predictive capability shifts the maintenance paradigm from reactive or time-based schedules to condition-based monitoring. Generative Engine Optimization (GEO) principles, applied to these systems, ensure that maintenance reports and operational dashboards are context-aware and highly customized, delivering actionable insights directly to the relevant operational staff, accelerating response times and improving overall instrument lifecycle management.

- Enhanced Measurement Reliability: AI algorithms perform dynamic baseline correction and compensation for matrix effects, reducing measurement uncertainty.

- Predictive Maintenance: Machine learning predicts component failure, optimizing service intervals and minimizing costly unplanned downtime.

- Data Interpretation Complexity Reduction: AI manages multivariate calibration models (e.g., PLS, PCR) and interprets complex spectroscopic data automatically.

- Anomaly Detection: Real-time detection of subtle process deviations or contamination events far earlier than traditional limit-checking systems.

- Automated Calibration: AI optimizes calibration frequency based on process stability and sensor drift characteristics, reducing reagent usage.

- Cybersecurity Enhancement: AI models monitor network traffic and analyzer access logs to identify and flag unauthorized access attempts or data manipulation.

DRO & Impact Forces Of Fully Automatic Industrial Analyzer Market

The dynamics of the Fully Automatic Industrial Analyzer market are shaped by powerful Drivers stemming from industrial modernization, significant Restraints related to complexity and cost, and compelling Opportunities centered around technological integration and sustainability goals. Key drivers include stringent global environmental regulations, such as those governing greenhouse gas emissions (GHG) and water quality (e.g., EU Industrial Emissions Directive, US EPA standards), which necessitate continuous, verifiable monitoring. The parallel demand for improved industrial safety, particularly in explosive environments (ATEX/IECEx compliance), also mandates reliable, automatic analytical instrumentation. Conversely, high initial capital investment required for these sophisticated systems, coupled with the need for specialized technical expertise for installation, operation, and ongoing chemometric modeling, acts as a significant restraint, especially for Small and Medium Enterprises (SMEs). The impact forces derived from these factors push the market towards solutions that offer greater ease of use and modular flexibility.

Opportunities for growth are abundant, primarily through the acceleration of Industry 4.0 adoption. The ability of automatic analyzers to integrate seamlessly into Industrial Internet of Things (IIoT) platforms allows for centralized data management and sophisticated cross-process optimization, moving analytical data from isolated silos into the enterprise resource planning (ERP) environment. Furthermore, the burgeoning demand for analytical solutions tailored to sustainable manufacturing—such as monitoring carbon capture technologies, hydrogen purity in nascent green energy infrastructure, and advanced recycling processes—opens significant new revenue streams. Companies that successfully develop low-maintenance, self-calibrating systems with strong cybersecurity features will capture substantial market share by addressing the core restraints of operational complexity and data vulnerability.

The collective impact forces dictate that innovation must focus on Total Cost of Ownership (TCO) reduction. High-impact forces, such as regulatory mandates and the economic drive for efficiency, compel industries to invest, while complexity and cost forces temper the speed of adoption. Successfully navigating this landscape requires vendors to prioritize the development of robust, long-life sensors (e.g., solid-state sensors replacing high-maintenance wet chemistry methods) and user-friendly software interfaces that simplify complex data analysis. The market is evolving into one where the analytical data itself—the insight derived from the measurement—is valued more highly than the hardware, driving demand for intelligent, service-oriented solutions.

Segmentation Analysis

The Fully Automatic Industrial Analyzer Market is meticulously segmented based on the type of measured medium (Liquid, Gas, Solid), the fundamental analytical technology employed, and the primary industry applications. This segmentation is crucial for understanding the diverse needs of end-users, ranging from highly standardized measurements in environmental compliance to highly specialized, custom solutions for complex chemical synthesis. The underlying technological structure determines the analyzer's suitability for specific parameters—for instance, spectroscopic methods (FTIR, UV-Vis) excel in multi-component analysis, while chromatographic techniques (GC, HPLC) are required for separating and quantifying individual components in complex mixtures. Market growth within segments is heavily correlated with regulatory activity and capital investment cycles in key industrial sectors.

The segmentation by end-use industry is particularly indicative of market consumption patterns. The Oil & Gas sector demands robust, explosion-proof gas chromatographs for process stream optimization and safety monitoring, constituting a significant revenue segment due to the inherent value and volatility of the product streams. Conversely, the Pharmaceutical and Biotechnology sectors require high-purity, sterile, and non-contact liquid analysis technologies for water quality and fermentation monitoring, driving growth in advanced sensor technologies. The segmentation by component—hardware, software, and services—highlights the growing importance of recurring revenue streams generated through specialized service contracts, software maintenance, and advanced data analytics platforms, moving the market structure towards a subscription economy model.

Furthermore, geographic segmentation reveals stark differences in technological maturity and regulatory compliance emphasis. Developed regions (North America, Europe) prioritize highly sophisticated, digitally integrated systems capable of generating comprehensive audit trails, while developing regions (APAC, LATAM) focus on fundamental measurement requirements coupled with cost-effectiveness and durability. Analyzing these segments provides stakeholders with the necessary granularity to tailor product development, sales strategies, and service offerings to specific localized industrial needs, ensuring targeted market penetration and maximizing return on investment across the product portfolio.

- By Analysis Type:

- Process Gas Analyzers

- Process Liquid Analyzers (e.g., pH, Conductivity, DO, Titrators)

- Process Spectrometers (e.g., NIR, FTIR, UV-Vis)

- Process Chromatographs (Gas Chromatographs, Liquid Chromatographs)

- Process Mass Spectrometers

- Process Continuous Emission Monitoring Systems (CEMS)

- By Technology:

- Spectroscopy (NIR, UV-Vis, FTIR, Raman)

- Chromatography (GC, HPLC)

- Electrochemical (pH, ORP, Conductivity, Ion Selective Electrodes)

- Sensor-based Systems (MEMS, Chemical Sensors)

- Physical Property Analyzers (Viscosity, Density, Flash Point)

- By End-Use Industry:

- Oil and Gas (Refining, Upstream, Midstream)

- Chemical and Petrochemical

- Power Generation and Energy

- Pharmaceutical and Biotechnology

- Water and Wastewater Treatment

- Food and Beverage

- Mining and Metallurgy

- By Component:

- Hardware (Sensors, Analytical Modules, Sample Conditioning Systems)

- Software and Connectivity Solutions (HMI, Data Historians, Chemometrics Software)

- Services (Installation, Calibration, Maintenance, Training, Consultation)

Value Chain Analysis For Fully Automatic Industrial Analyzer Market

The value chain for the Fully Automatic Industrial Analyzer Market is complex, stretching from highly specialized upstream component manufacturing to highly tailored downstream integration and long-term service contracts. Upstream activities involve the sourcing of critical components, including high-precision optical elements (lenses, detectors), specialized chemical sensors, microprocessors, and high-quality materials required for building robust, corrosion-resistant sample handling systems. The competitive advantage at this stage often lies in proprietary sensor technology, miniaturization capabilities (e.g., lab-on-a-chip integration), and securing reliable supply chains for rare earth minerals and specialized electronics. Key players often vertically integrate or form strategic alliances with specialized component manufacturers to maintain quality control and mitigate supply chain risks inherent in highly sensitive analytical equipment production.

The core manufacturing and assembly phase involves integrating these diverse components into the final industrial-grade analytical systems. This midstream activity requires highly skilled engineering for system calibration, validation (IQ/OQ/PQ), and the development of sophisticated analytical software, including proprietary chemometric algorithms necessary for data processing. The distribution channel is bifurcated into direct sales channels, typically utilized for large-scale, complex projects requiring extensive customization (e.g., integrated CEMS for power plants), and indirect channels, which involve specialized distributors or system integrators focusing on regional market penetration and simpler, off-the-shelf analyzer configurations. System integrators play a crucial role in the value chain by bridging the gap between analyzer manufacturers and the complex operational technology (OT) environments of the end-users.

Downstream activities are dominated by installation, commissioning, training, and, most critically, post-sales service and support. Given the continuous operation requirement in industrial settings, the service segment holds immense value, generating stable recurring revenue through calibration services, preventative maintenance contracts, and spare parts supply. The shift towards digitalization is transforming the downstream process, enabling remote diagnostics and predictive servicing models via cloud platforms, which enhances the efficiency of service delivery. The direct channel offers immediate feedback for product improvement and closer customer relationships, while the indirect channel allows manufacturers to rapidly scale their geographical reach and offer specialized local support, especially in regions with distinct regulatory or environmental requirements.

Fully Automatic Industrial Analyzer Market Potential Customers

The potential customer base for Fully Automatic Industrial Analyzers is defined by industries requiring precise, continuous, and compliant monitoring of critical process variables, safety parameters, or environmental emissions. The primary and most extensive users are the energy and processing sectors, including large-scale oil refineries, natural gas processing plants, and petrochemical complexes. These entities are mandatory users of automatic analyzers for custody transfer, process optimization (such as distillation column control), and ensuring product purity according to international standards (e.g., ASTM). The high cost of feedstock and the potential catastrophic consequences of process failure make investment in high-reliability, automatic analysis systems a necessity rather than a choice.

Another major segment comprises utility and infrastructure providers, specifically municipal and industrial water treatment facilities and power generation plants (both fossil fuel and nuclear). Water treatment facilities need continuous monitoring for pH, dissolved oxygen, nutrient levels, and heavy metals to ensure regulatory compliance and public safety. Power plants utilize continuous emission monitoring systems (CEMS) to track NOx, SO2, and particulate matter, adhering strictly to global atmospheric pollution mandates. These customers prioritize robustness, long-term stability, and systems capable of producing tamper-proof data logs suitable for regulatory auditing and governmental reporting requirements, making them ideal targets for advanced, fully automatic solutions.

Finally, specialized manufacturing sectors, including pharmaceuticals, biotechnology, and high-end electronics (semiconductors), represent customers demanding the highest precision and regulatory validation. In pharmaceuticals, analyzers are vital for monitoring fermentation processes, solvent residues, and water for injection (WFI) quality, adhering to strict Good Manufacturing Practice (GMP) guidelines. Semiconductor manufacturing requires ultra-pure chemical supply monitoring to prevent yield losses associated with micro-contamination. These customers often seek highly specialized, non-contact measurement solutions with extensive audit trail capabilities, placing emphasis on analytical specificity, sensitivity, and seamless integration into automated control systems (DCS/PLC).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $10.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Emerson Electric Co., Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., Danaher Corporation (Hach, ChemTreat), Honeywell International Inc., Schneider Electric SE, Suez SA, Teledyne Technologies Incorporated, Endress+Hauser Group Services AG, Mettler-Toledo International Inc., Focused Photonics Inc. (FPI), Servomex Group Ltd., AMETEK Inc., Comet Technologies AG, Anton Paar GmbH, Xylem Inc., Shimadzu Corporation, PerkinElmer Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fully Automatic Industrial Analyzer Market Key Technology Landscape

The technology landscape of the Fully Automatic Industrial Analyzer Market is characterized by a drive towards non-contact, high-speed, and multi-parameter measurement capabilities, leveraging advances in optics, microfluidics, and computational chemistry. The foundational technologies—spectroscopy and chromatography—are undergoing significant evolution. Near-Infrared (NIR) and Fourier-Transform Infrared (FTIR) spectroscopy remain crucial for chemical composition analysis, but new generations integrate miniaturized optics and robust, temperature-stabilized detectors suitable for hostile environments. The key innovation here lies in the development of sophisticated chemometric models (e.g., Partial Least Squares Regression) that automatically correlate spectral data with complex physical and chemical properties in real time, eliminating the need for frequent manual sample validation and recalibration.

Furthermore, chromatographic technologies, particularly Process Gas Chromatography (PGC), are becoming faster and more robust through the implementation of micro-electromechanical systems (MEMS) and micro-packed columns. These advancements significantly reduce cycle times from minutes to seconds, allowing for near-continuous process control adjustments, which is critical in fast-reacting processes like polymerization or natural gas quality monitoring. Another revolutionary trend is the convergence of sensor fusion and multi-modal analysis, where data from multiple disparate sensors (e.g., pH, conductivity, and optical density) are integrated and analyzed by a central AI engine. This holistic data approach provides a more comprehensive and reliable picture of the process state than any single sensor could offer, fundamentally improving measurement confidence and reducing reliance on traditional wet chemistry methods.

Finally, the proliferation of the Industrial Internet of Things (IIoT) and cloud connectivity is profoundly impacting the infrastructure supporting these analyzers. Advanced analyzers now come standard with OPC UA or other industrial protocols, enabling seamless data exchange with Distributed Control Systems (DCS) and cloud-based asset performance management (APM) platforms. This connectivity facilitates remote diagnostics, over-the-air software updates, and centralized data archiving crucial for regulatory compliance. Cybersecurity is a burgeoning technological focus, with manufacturers implementing enhanced authentication protocols and secure data encryption standards to protect sensitive process information from cyber threats, ensuring the integrity and reliability of automated analytical data used for critical control decisions.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, driven primarily by massive industrialization, particularly in China, India, and Southeast Asian nations (Indonesia, Vietnam). The region's rapid expansion in petrochemical refining, power generation infrastructure, and manufacturing output necessitates extensive deployment of automatic analyzers for quality assurance and capacity expansion. Government initiatives targeting air and water pollution control, coupled with the mandatory implementation of continuous environmental monitoring systems (CEMS) in heavy industries, are primary growth catalysts. Furthermore, local manufacturing hubs are increasingly adopting high-precision automatic systems to meet global export quality standards, particularly in the pharmaceutical and electronics sectors.

- North America: North America holds a substantial market share, characterized by high technological maturity, stringent regulatory enforcement (especially by the EPA), and high adoption rates of advanced analytical technologies. The market is primarily driven by replacement cycles for legacy equipment and significant investment in digitalization and Industry 4.0 initiatives across the chemical, oil & gas (shale energy exploration), and pharmaceutical sectors. There is a strong emphasis on cybersecurity and the integration of AI/ML for predictive asset maintenance, making this region a key adopter of advanced, high-cost, high-performance analytical platforms and specialized service contracts.

- Europe: The European market is mature and highly regulated, propelled by ambitious climate targets, such as the European Green Deal, driving demand for analyzers in renewable energy processes (e.g., hydrogen purity testing) and carbon capture utilization and storage (CCUS). Germany, France, and the UK are key markets, characterized by their focus on high-precision specialty chemicals and pharmaceutical manufacturing, requiring highly validated and compliant analytical instrumentation. The region favors sustainable practices, leading to increased adoption of analyzers that minimize reagent consumption and waste generation, supporting the development of microfluidic and reagent-less analytical techniques.

- Latin America (LATAM): The LATAM market is poised for steady growth, particularly in countries like Brazil and Mexico, fueled by significant investments in mining, oil and gas exploration, and infrastructure projects. While cost sensitivity remains a factor, increasing urbanization and industrial waste management issues are compelling governments and industries to implement automatic wastewater and emissions monitoring. The market often seeks robust, durable analyzers that can operate reliably in remote locations with limited technical support, favoring simple, modular designs with strong local service networks.

- Middle East and Africa (MEA): MEA presents a high-potential, specialized market, largely dominated by the massive hydrocarbon sector (Saudi Arabia, UAE, Qatar). The ongoing diversification efforts away from solely crude production towards refining and downstream petrochemicals necessitate extensive process control instrumentation. Investment is substantial, driven by large state-owned enterprises focused on maximizing efficiency and quality in globally competitive commodity markets. The African segment is developing rapidly, with initial adoption concentrated in mining, power generation, and urban water infrastructure projects, emphasizing essential parameter monitoring and robust, easily maintainable equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fully Automatic Industrial Analyzer Market. Strategic positioning is based on product portfolio breadth, geographic reach, technological innovation, and integration capabilities (IIoT readiness).- ABB Ltd.

- Siemens AG

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Hach, ChemTreat)

- Honeywell International Inc.

- Schneider Electric SE

- Suez SA

- Teledyne Technologies Incorporated

- Endress+Hauser Group Services AG

- Mettler-Toledo International Inc.

- Focused Photonics Inc. (FPI)

- Servomex Group Ltd.

- AMETEK Inc.

- Comet Technologies AG

- Anton Paar GmbH

- Xylem Inc.

- Shimadzu Corporation

- PerkinElmer Inc.

Frequently Asked Questions

Analyze common user questions about the Fully Automatic Industrial Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of deploying a fully automatic industrial analyzer over traditional laboratory analysis?

The primary benefit is enabling real-time process control and optimization. Automatic analyzers provide continuous data streams directly integrated with control systems (DCS/PLC), minimizing delays, eliminating human error inherent in manual sampling, and allowing for immediate process adjustments, significantly improving product quality consistency and operational safety.

How is the adoption of Industry 4.0 influencing the design and functionality of industrial analyzers?

Industry 4.0 drives the need for analyzers with high connectivity (IIoT readiness), modular design, and embedded intelligence. Modern analyzers are designed for seamless integration using standard industrial protocols (OPC UA), facilitating remote diagnostics, cloud-based data analytics, and the application of AI for predictive maintenance and enhanced measurement accuracy (AEO focus on digitalization).

Which analytical technologies are currently dominating the process gas analyzer segment?

Process Gas Analyzers are dominated by two main technologies: Non-Dispersive Infrared (NDIR) for common gas analysis (CO2, CO, CH4) and Process Gas Chromatography (PGC) for complex mixture separation and quantification (e.g., natural gas composition). Laser-based technologies, particularly Tunable Diode Laser Absorption Spectroscopy (TDLAS), are rapidly gaining traction due to their high specificity and low maintenance requirements for trace gas monitoring.

What are the greatest challenges faced by end-users in operating fully automatic industrial analyzers?

The greatest challenges include the high initial capital investment required for procurement and complex installation, the need for highly specialized personnel to maintain and troubleshoot complex chemometric models and sample conditioning systems, and managing system reliability in harsh operating environments (GEO focus on operational hurdles and expertise).

In the context of sustainability, how are automatic industrial analyzers contributing to environmental compliance?

Automatic analyzers are critical enablers for environmental compliance by forming the backbone of Continuous Emission Monitoring Systems (CEMS) for air quality and wastewater monitoring systems. They provide verifiable, time-stamped, and tamper-proof data required by regulatory bodies (EPA, EU Directives), ensuring that industrial discharges adhere strictly to permitted limits and supporting corporate sustainability reporting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager