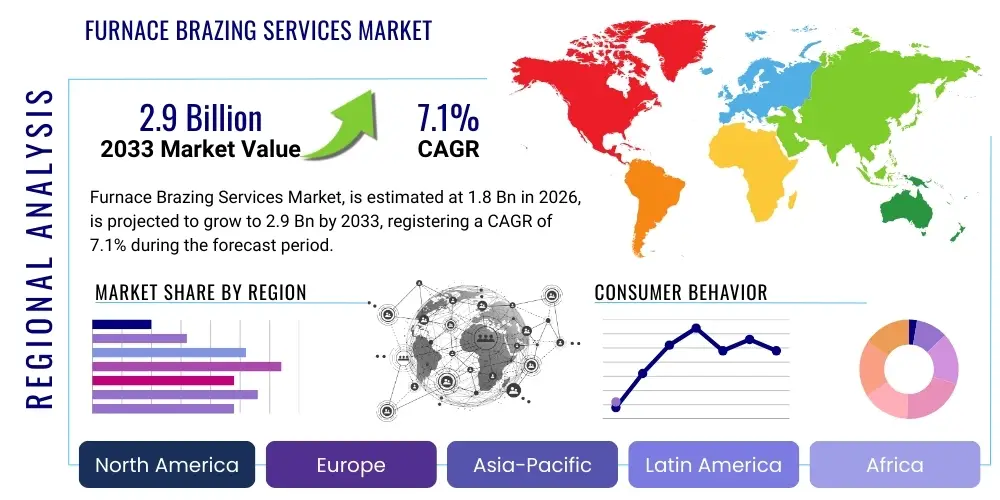

Furnace Brazing Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441420 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Furnace Brazing Services Market Size

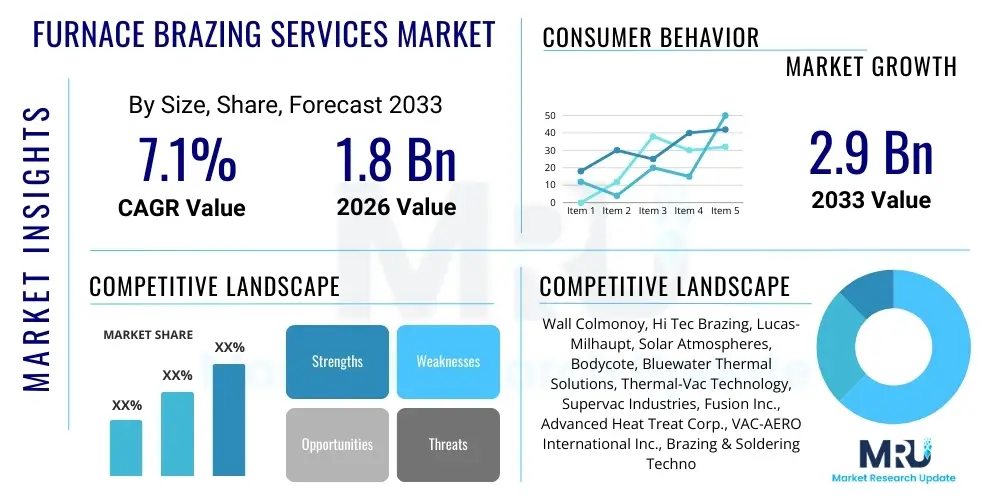

The Furnace Brazing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at $1.8 Billion USD in 2026 and is projected to reach $2.9 Billion USD by the end of the forecast period in 2033.

Furnace Brazing Services Market introduction

The Furnace Brazing Services Market encompasses specialized thermal joining processes performed in highly controlled furnace environments, primarily utilizing vacuum or protective atmospheres (such as hydrogen or inert gases) to achieve superior metallurgical bonding between components. This technique is distinguished by its ability to create strong, leak-tight, and visually clean joints without the oxidation or distortion commonly associated with traditional welding methods. The process involves placing a filler metal, which possesses a lower melting point than the parent materials, into the joint area. The assembly is then heated uniformly within the furnace until the filler metal melts and flows into the joint via capillary action, followed by solidification to form a robust bond. These services are crucial for complex, high-reliability assemblies where dimensional stability, internal cleanliness, and high joint strength are non-negotiable requirements, particularly in demanding engineering sectors.

Major applications of furnace brazing span critical components across multiple advanced industries. In aerospace, this includes fabricating high-performance heat exchangers, engine components (e.g., nozzles and vanes), and structural aerospace assemblies requiring extreme temperature and pressure resistance. Within the automotive sector, applications focus heavily on heating, ventilation, and air conditioning (HVAC) systems, as well as complex battery cooling plates and power electronics enclosures essential for electric vehicles (EVs). Furthermore, the medical device industry relies heavily on furnace brazing for miniaturized surgical instruments, titanium implants, and complex sensor housings, owing to the process's ability to ensure biocompatible and contamination-free joints necessary for patient safety and device longevity.

The key benefits driving market expansion include the ability to join dissimilar materials effectively (such as ceramic-to-metal or copper-to-stainless steel), the creation of multiple joints simultaneously in a single furnace cycle, and superior mechanical properties of the resulting joints compared to traditional fusion welding. Market growth is primarily driven by the global trend toward lightweighting in transportation, the increasing complexity of fluid management systems, and the relentless demand for high-performance, energy-efficient components across all industrial verticals. The need for precise thermal management solutions, especially in sophisticated electronics and power generation equipment, further accelerates the adoption of specialized furnace brazing services over conventional joining techniques.

Furnace Brazing Services Market Executive Summary

The Furnace Brazing Services Market is undergoing significant evolution, characterized by consolidation among service providers seeking economies of scale and geographic expansion, alongside a critical strategic shift toward fully automated, digitally monitored furnace systems. Business trends are dominated by specialization, where providers invest heavily in niche capabilities, such as proprietary fixturing techniques or expertise in advanced filler materials like nickel-based or gold-based alloys, catering specifically to high-margin sectors like defense and medical devices. The focus on enhancing process repeatability and reducing overall energy consumption through the implementation of advanced process control software and high-efficiency furnaces represents a core competitive differentiator in the modern service landscape, driven by stringent quality standards such as Nadcap and ISO certifications.

Regionally, the market exhibits divergent growth profiles. The Asia Pacific (APAC) region is projected to register the fastest growth, primarily fueled by massive industrialization, the proliferation of large-scale automotive manufacturing, and rapidly expanding electronics production hubs, particularly in China, South Korea, and India. Conversely, North America and Europe, while growing at a stable pace, prioritize highly complex, low-volume, and high-specification work, heavily influenced by expenditures in the aerospace, defense, and premium electric vehicle sectors. European market stability is underpinned by strict environmental regulations and a strong emphasis on precision engineering, necessitating advanced controlled atmosphere and vacuum brazing techniques for highly specialized industrial machinery and renewable energy components.

Segmentation analysis reveals a definitive trend favoring Vacuum Brazing, driven by its superior ability to handle reactive materials and produce contaminant-free joints, essential for critical aerospace and ultra-high vacuum applications. Among filler materials, Nickel-based Alloys segment maintains dominance due to their excellent strength and high-temperature resistance, crucial for jet engine components, while Copper-based Alloys see robust demand from the high-volume HVAC and automotive cooling systems segments. The increasing capital expenditure in electric vehicle manufacturing globally is positioning the automotive application segment as a primary growth accelerator, requiring specialized services for intricate heat sinks and battery thermal management modules designed for optimal performance and longevity in demanding operating environments.

AI Impact Analysis on Furnace Brazing Services Market

User questions related to AI integration in the furnace brazing domain frequently center on critical themes such as process consistency, cost reduction, and material integrity. Users consistently inquire, "How effectively can AI predict defects based on pre-braze component characteristics?" and "What is the return on investment for implementing machine learning algorithms to optimize complex, multi-stage temperature profiles?" Additionally, major concerns revolve around the ethical use of collected data and the need for explainable AI models to maintain Nadcap compliance and regulatory traceability. Key expectations highlight AI's role in shifting from reactive quality control to proactive process anomaly detection, ensuring tighter tolerance control, especially when processing expensive, mission-critical components, thereby minimizing scrap rates and maximizing furnace throughput.

The introduction of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operational paradigm of furnace brazing services, moving away from empirical, operator-dependent cycles toward predictive, data-driven thermal processing. AI algorithms are now deployed to analyze vast datasets collected during the brazing cycle—including temperature uniformity across the load, vacuum level stability, and gas flow rates—to instantly identify deviations that could compromise joint quality. This allows for real-time fine-tuning of parameters, significantly reducing the dependence on post-process inspection and accelerating the iterative development process for new material combinations and complex geometries. Furthermore, AI enhances predictive maintenance capabilities, analyzing equipment sensor data to forecast potential failures in pumps, heating elements, or control systems, thereby drastically reducing unplanned downtime and optimizing equipment longevity.

Beyond process control, AI is significantly impacting the pre-braze preparation and post-braze analysis phases. AI-powered image recognition systems are utilized for automated inspection of joint cleanliness and filler material placement prior to entering the furnace, ensuring setup consistency across large batches. Post-braze, ML models correlate process variables with non-destructive testing (NDT) results, enabling rapid feedback loops to optimize fixturing design and thermal profiles for future runs. This level of integrated intelligence ensures unparalleled quality consistency, crucial when servicing highly regulated industries like aerospace, where zero-defect manufacturing standards are mandatory, ultimately strengthening the value proposition of specialized brazing service providers.

- AI-driven real-time thermal profile correction enhances joint integrity and minimizes component distortion.

- Machine learning models optimize furnace energy consumption by calculating the most efficient ramp-up and soak times based on specific load thermal mass.

- Predictive maintenance analytics reduce furnace downtime by forecasting failure points in high-wear components like vacuum pumps and thermocouples.

- Automated visual inspection using computer vision rapidly identifies surface defects, filler metal displacement, and joint contamination prior to processing.

- Data analytics correlates material pedigree, process parameters, and final tensile strength, providing auditable traceability required by aerospace regulations.

- AI assists in complex load configuration and fixturing design, maximizing furnace utilization and ensuring uniform heat distribution throughout the batch.

- ML algorithms refine gas compositions and flow rates in controlled atmosphere brazing (CAB) to prevent specific oxidation reactions tailored to component geometry.

- Optimized scheduling and resource allocation powered by AI improves turnaround times for high-volume contract brazing services.

- Virtual simulation models, informed by AI, predict residual stresses and potential deformation, allowing engineers to adjust designs proactively.

- Enhanced inventory management for specialized and expensive filler metals, ensuring optimal stock levels based on predictive order forecasting.

- AI ensures compliance by automatically logging and verifying process parameters against industry standards (e.g., AMS, AWS specifications).

- Acceleration of R&D cycles for new alloy combinations and dissimilar material joining by rapidly testing and validating thermal profiles.

- Improved anomaly detection during the cooling phase, minimizing the risk of thermal shock and material embrittlement.

- AI supports the digital twin of the brazing furnace, allowing for simulation and optimization of future operational scenarios without physical testing.

- Refinement of root cause analysis following component failure by identifying the precise process variable responsible for the metallurgical flaw.

- Integration of AI systems with existing ERP and MES platforms to streamline operational workflows from quotation to delivery.

- Customized processing parameters tailored to the unique geometry and wall thickness of each component within a single batch.

DRO & Impact Forces Of Furnace Brazing Services Market

The Furnace Brazing Services Market is dynamically influenced by robust drivers, significant restraints, and clear opportunities, with competitive dynamics shaped profoundly by high technological barriers. Major drivers include the increasing global demand for high-integrity, lightweight assemblies, particularly driven by the transition to electric vehicles (EVs) necessitating complex battery cooling systems and lightweight aluminum structures, and sustained investment in sophisticated aerospace programs requiring superior component reliability. However, growth is tempered by substantial restraints, predominantly the extremely high initial capital expenditure required for acquiring and maintaining advanced high-vacuum furnaces and associated monitoring equipment, alongside the volatility in the pricing and supply chain complexities associated with specialized, high-purity filler metals like nickel and gold-based alloys. These high barriers to entry act as a significant stabilizing force for established market incumbents.

Opportunities for market expansion are centered on the rapid adoption of digitization and automation, allowing service providers to leverage AI and Industrial IoT (IIoT) for unprecedented process control, repeatability, and efficiency gains, particularly valuable in meeting the stringent quality requirements of the medical and defense sectors. Furthermore, the emerging market segment of post-processing services for components created via Additive Manufacturing (AM) presents a lucrative avenue, as brazing is frequently required to join complex AM parts or to enhance the integrity of printed structures, especially in high-temperature environments. Strategic geographical expansion into burgeoning manufacturing regions, specifically Southeast Asia and Eastern Europe, also provides substantial potential for growth.

Analysis of Impact Forces highlights a moderate to high threat of substitution, driven by advancements in alternative joining technologies such as highly sophisticated laser welding, friction stir welding, and advanced structural adhesives that are increasingly capable of handling complex assemblies, particularly in non-critical or lower-temperature applications. Supplier power remains moderate to high, concentrated primarily among manufacturers of specialized furnace equipment and patented filler metal alloys, often requiring long-term supply agreements. The power of buyers is significant, particularly large OEM clients in aerospace and automotive who demand high volumes, stringent quality controls (e.g., Nadcap approval), and competitive pricing structures, forcing service providers to continuously invest in efficiency and quality assurance to maintain contracts.

Segmentation Analysis

The Furnace Brazing Services Market is structurally segmented based on the specific processing environment, the type of filler material utilized, the application industry, and the end-user profile. Analyzing these segments provides critical insights into technological preferences and demand pockets. For instance, the choice between vacuum brazing and controlled atmosphere brazing is dictated by the parent material's reactivity and the joint's required purity. Similarly, the dominance of nickel-based alloys in terms of revenue reflects the market's high reliance on providing solutions for extreme temperature and high-stress applications in aerospace and power generation. The rapid expansion of the automotive sector, driven by EV adoption, is currently reshaping the demand landscape for high-volume, cost-effective services utilizing copper and aluminum alloys.

- By Type

- Vacuum Brazing: Essential for reactive materials and assemblies demanding ultra-clean, void-free joints (e.g., aerospace turbine components, medical implants).

- Controlled Atmosphere Brazing (CAB): Utilizes inert or reducing gases (e.g., Hydrogen, Nitrogen) for oxidation prevention; preferred for high-volume aluminum heat exchangers.

- Hydrogen Brazing: High-purity process for stainless steels and specialized metals, offering superior oxide reduction and joint cleanliness.

- By Filler Material

- Nickel-based Alloys: Used for high-temperature and high-strength applications, prevalent in jet engines and power generation turbines.

- Copper-based Alloys: Widely used for joining ferrous metals and copper components, critical for electrical and HVAC systems due to high thermal conductivity.

- Silver-based Alloys: Employed for lower temperature applications requiring good electrical and thermal conductivity, often used in electrical contacts and instrumentation.

- Aluminum Alloys: Crucial for lightweight automotive radiators and heat exchangers (CAB process).

- Gold-based Alloys: Utilized in microelectronics and medical implants requiring high corrosion resistance and biocompatibility.

- By Application

- Aerospace & Defense: High-reliability structural components, turbine parts, and complex heat exchangers.

- Automotive: Cooling systems, exhaust components, chassis parts, and EV battery cooling plates.

- HVAC & Refrigeration: Coils, condensers, evaporators, and compressors requiring hermetic sealing.

- Medical Devices: Surgical instruments, implants, and sensor housings requiring biocompatibility.

- Electronics: Heat sinks, semiconductor packaging, and microelectronic assemblies.

- Power Generation & Industrial Machinery: High-temperature furnace parts, boiler components, and tooling.

- By End-Use Industry

- Original Equipment Manufacturers (OEMs)

- Aftermarket and Maintenance, Repair, and Overhaul (MRO)

- Component and Tier Suppliers

Value Chain Analysis For Furnace Brazing Services Market

The value chain for furnace brazing services begins with robust upstream activities focused on securing high-quality, specialized raw materials and equipment. This segment is characterized by the high market power of suppliers, particularly those providing specialized, high-purity filler metals. Manufacturers of nickel, copper, and precious metal (silver/gold) brazing alloys operate in a highly technical market segment requiring proprietary formulations to meet specific application requirements, especially those governed by military or aerospace material specifications. Similarly, the equipment sub-segment, dominated by specialized high-vacuum and controlled atmosphere furnace manufacturers, exhibits high supplier concentration. These suppliers often provide crucial technical support, maintenance contracts, and advanced process control software, integrating deeply with the service providers’ operations and capital planning.

The core value addition occurs at the service delivery stage, where specialized brazing providers transform raw components into high-integrity assemblies. This stage involves sophisticated process engineering, including joint design review, meticulous pre-cleaning (degreasing and oxide removal), precise fixturing design to manage component movement during the thermal cycle, and execution of the optimized brazing cycle under strict atmospheric control. The complexity and value are amplified by the necessity of obtaining rigorous certifications, such as Nadcap for aerospace components, which validates the service provider’s quality management and technical competence. Quality assurance, encompassing visual inspection, helium leak detection, and non-destructive testing (NDT), is an integrated and highly critical component of the processing stage.

Downstream analysis reveals that distribution is overwhelmingly direct, reflecting the customized and high-value nature of the components being processed. Furnace brazing service providers typically engage in direct contractual relationships with Tier 1 and Tier 2 suppliers, as well as OEM clients across the aerospace, defense, and automotive sectors. The sensitivity of the components, coupled with required confidentiality and strict chain-of-custody protocols, limits the use of indirect distribution channels. This direct interaction facilitates rapid communication regarding quality specifications, design modifications, and scheduling, ensuring that the final brazed assemblies meet the exact performance criteria required by the most demanding end-users for seamless integration into complex final products.

Furnace Brazing Services Market Potential Customers

Potential customers for furnace brazing services are predominantly large, technically sophisticated entities requiring high reliability and performance specifications for their manufactured components. The aerospace and defense sector represents the largest and most demanding customer segment. These customers, including major aerospace OEMs and their supply chain partners, rely on furnace brazing for mission-critical parts such as jet engine heat exchangers, fuel manifolds, and structural airframe components. Their purchasing criteria are centered around service provider accreditation (Nadcap is mandatory), demonstrated competence in handling specialized materials (e.g., titanium, superalloys), and the capacity for meticulous quality documentation and long-term traceability, often prioritizing quality and technical capability over raw cost metrics.

The automotive industry, specifically the rapidly expanding electric vehicle (EV) segment, constitutes a major potential customer base driven by volume and efficiency needs. These customers require brazing services for high-volume production of complex aluminum heat sinks, battery cooling plates, and thermal management modules critical for EV performance and battery life. For automotive customers, the focus shifts towards scalability, cost-effectiveness, and the service provider’s ability to maintain high process repeatability across millions of units while adhering to tight delivery schedules. The shift away from internal combustion engines is creating a sustained and escalating demand for specialized aluminum CAB services globally.

Beyond transportation, major medical device manufacturers and industrial electronics firms represent crucial, high-value customer segments. Medical clients require the joining of small, intricate components, often involving dissimilar metals (e.g., Kovar to ceramic), demanding extremely high precision and assurance of biocompatibility and hermetic sealing for devices like pacemakers and complex surgical tools. Electronics and power generation customers require brazing for high-power semiconductor packaging, vacuum interrupters, and advanced tooling that operates under severe thermal cycling conditions. These customers value the service provider's expertise in specialized filler alloys (like gold-based solders) and proven capability in achieving vacuum-tight seals necessary for long-term operational integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion USD |

| Market Forecast in 2033 | $2.9 Billion USD |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wall Colmonoy, Hi Tec Brazing, Lucas-Milhaupt, Solar Atmospheres, Bodycote, Bluewater Thermal Solutions, Thermal-Vac Technology, Supervac Industries, Fusion Inc., Advanced Heat Treat Corp., VAC-AERO International Inc., Brazing & Soldering Technology, Inc., Pioneer Heat Treating, Specialty Brazing Inc., Engineered Thermal Solutions, Techmetals Inc., Precision Thermal Processing, Thermal Technologies, G&O Manufacturing Co., Aerospace Brazing Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Furnace Brazing Services Market Key Technology Landscape

The technological core of the Furnace Brazing Services market is defined by sophisticated control over atmosphere and temperature profiles, critical for achieving high-quality joints. High-Vacuum Brazing technology, which operates typically below 1x10-4 Torr, remains paramount for aerospace and medical components, as it completely eliminates oxidation and provides the cleanest, strongest bonds, particularly suitable for reactive materials like titanium and stainless steel. Technological advancement in this domain focuses on developing faster cycle times through optimized heating element design and the integration of highly sensitive residual gas analyzers (RGAs) to ensure atmosphere purity throughout the entire cycle. Simultaneously, Controlled Atmosphere Brazing (CAB) systems, primarily utilizing reducing atmospheres (like hydrogen or nitrogen/hydrogen mixes), are advancing toward continuous belt furnaces to meet the high throughput demands of the automotive and HVAC industries, requiring tighter process control systems to manage dew point and gas composition accurately.

Advanced monitoring and control systems are rapidly becoming standard, moving beyond simple temperature logging to integrated process verification. Modern furnace installations feature distributed control systems (DCS) incorporating multiple thermocouples placed strategically across the workload to map temperature uniformity in three dimensions, ensuring compliance with strict thermal uniformity standards (e.g., AMS 2750). The adoption of Industrial Internet of Things (IIoT) sensors enables continuous monitoring of critical parameters like pressure decay rates, coolant flow, and power consumption, transmitting data to cloud-based platforms for real-time diagnostics and analysis. This digitization supports the mandatory documentation and auditing processes required by stringent regulatory bodies, improving traceability and accountability across all processed batches.

Emerging technological trends include specialized techniques such as Active Brazing and Diffusion Brazing. Active Brazing utilizes filler metals containing active elements (like titanium or zirconium) to directly bond ceramics to metals without requiring prior metallization steps, opening up new possibilities in sensor technology and high-performance electronics. Diffusion Brazing, or Diffusion Bonding, is increasingly employed for superalloys where the joint strength must match the parent material, achieving metallurgical homogeneity by holding components at temperature until the filler material diffuses entirely into the base metals, eliminating the joint gap. These specialized processes represent significant technological differentiators for service providers catering to next-generation materials and extreme environment applications, demanding continuous R&D investment to maintain competitive edge and technical leadership in the market.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC is the fastest-growing region, driven by massive investments in automotive production (especially EVs in China and Korea) and the booming electronics manufacturing sector, utilizing high-volume CAB processes for thermal management solutions.

- China’s Manufacturing Hub: China leads market consumption in the APAC region, fueled by state-supported initiatives in high-speed rail, power generation, and increasing domestic aerospace component production, creating high demand for both vacuum and controlled atmosphere services.

- North American Aerospace Focus: North America holds a substantial market share, highly specialized in complex, high-reliability vacuum brazing services mandated by the mature and technologically advanced aerospace and defense industries, with a strong emphasis on Nadcap accreditation.

- US Defense Expenditure: Sustained defense spending in the United States drives continuous demand for furnace brazing of classified and mission-critical components, including specialized cooling jackets and weapon system parts requiring superior metallurgical integrity.

- European Precision Engineering: Europe is characterized by a strong focus on high-precision industrial machinery, luxury automotive components, and renewable energy technologies, necessitating services capable of meeting stringent German (e.g., DIN standards) and pan-European quality benchmarks.

- German Automotive Sector Demand: Germany remains a key European driver, where advanced manufacturing techniques are required for premium automotive heat exchangers, specialized tooling, and sophisticated medical devices, favoring high-purity hydrogen and vacuum brazing.

- Japan’s Advanced Materials: Japan shows high demand for brazing services related to cutting-edge electronics packaging and high-temperature superconductors, demanding expertise in gold and silver-based filler alloys and diffusion bonding techniques.

- Mexican Automotive Growth: The expansion of the automotive supply chain in Mexico is increasing the regional demand for high-volume brazing services for HVAC and general component assembly, positioning Mexico as a key emerging market in North America.

- Latin American Infrastructure Projects: Moderate growth in Latin America is linked to infrastructural developments, including power generation and industrial maintenance, driving demand for MRO services related to large machinery and heavy equipment.

- Middle East Defense and Energy: The Middle East, particularly the UAE and Saudi Arabia, sees significant revenue from defense-related MRO activities and expansion in the oil and gas sector (turbomachinery maintenance), relying on imported specialized brazing services.

- India’s Industrial Leap: India represents an emerging market with potential, driven by domestic manufacturing policy ('Make in India') focusing on automotive component production and nascent aerospace development, creating opportunities for new service provider investment.

- Regulatory Influence in North America/Europe: Strict adherence to safety and quality regulations (e.g., FDA requirements for medical devices, FAA standards for aerospace) in these regions ensures that high-quality, auditable furnace brazing remains the preferred joining method.

- Cost Competitiveness in APAC: Service providers in APAC increasingly compete on cost-efficiency and high throughput capability, benefiting from lower operational costs and a large manufacturing base, driving global outsourcing trends for non-critical components.

- Investment in Automation: North American and European service providers heavily invest in automation and AI to offset higher labor costs and ensure process repeatability, positioning them to handle the most technically challenging jobs.

- Scandinavia’s Energy Sector: Northern European nations utilize brazing extensively for specialized components in the renewable energy sector, particularly heat exchangers for geothermal and complex assemblies for offshore wind power.

- Africa’s Mining and MRO Needs: Market demand across Africa is concentrated in MRO services for mining equipment and heavy industry, typically involving repairs and refurbishment utilizing high-strength copper and nickel brazing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Furnace Brazing Services Market.- Bodycote PLC

- Solar Atmospheres, Inc.

- Wall Colmonoy Corporation

- Lucas-Milhaupt, Inc. (A division of Handy & Harman)

- Hi Tec Brazing, Inc.

- Bluewater Thermal Solutions

- Thermal-Vac Technology

- VAC-AERO International Inc.

- Advanced Heat Treat Corp. (AHTC)

- Supervac Industries

- Fusion Inc.

- Specialty Brazing Inc.

- Pioneer Heat Treating

- Engineered Thermal Solutions

- Techmetals Inc.

- Precision Thermal Processing

- Brazing & Soldering Technology, Inc.

- Thermal Technologies

- G&O Manufacturing Co.

- Aerospace Brazing Systems

Frequently Asked Questions

Analyze common user questions about the Furnace Brazing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of vacuum brazing over conventional welding techniques?

Vacuum brazing provides superior metallurgical cleanliness, eliminating oxidation without the need for flux, resulting in high-integrity, void-free, and hermetically sealed joints. It allows for the simultaneous joining of complex assemblies with minimal component distortion, essential for mission-critical parts like aerospace heat exchangers and medical implants.

How is the market influenced by the increasing production of Electric Vehicles (EVs)?

EV manufacturing is a major growth driver, specifically increasing the demand for Controlled Atmosphere Brazing (CAB) services for aluminum components. Brazing is critical for fabricating high-performance battery cooling plates and complex fluid management systems necessary for efficient thermal regulation and safety in modern electric powertrains.

Which regulatory standards are most critical for specialized furnace brazing service providers?

The most critical standard is Nadcap (National Aerospace and Defense Contractors Accreditation Program), which is mandatory for suppliers servicing the aerospace and defense sectors. Compliance with ISO standards (e.g., ISO 9001) and specific material specifications (e.g., AMS standards) is also crucial for maintaining quality and traceability across the industrial supply chain.

What role does AI play in improving the efficiency of furnace brazing operations?

AI implementation optimizes furnace utilization by predicting and correcting thermal deviations in real time, reducing energy consumption and minimizing scrap rates. Machine learning models enhance predictive maintenance, forecasting equipment failure and maximizing furnace uptime, thereby increasing overall operational efficiency and throughput for service providers.

What types of filler materials are driving the largest revenue segments in the market?

Nickel-based alloys represent a significant revenue driver due to their application in high-temperature, high-strength environments like jet engines and turbines. Copper-based and Aluminum alloys also contribute heavily, driven by high-volume applications in the HVAC, automotive, and electronics cooling sectors where thermal conductivity is paramount.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager