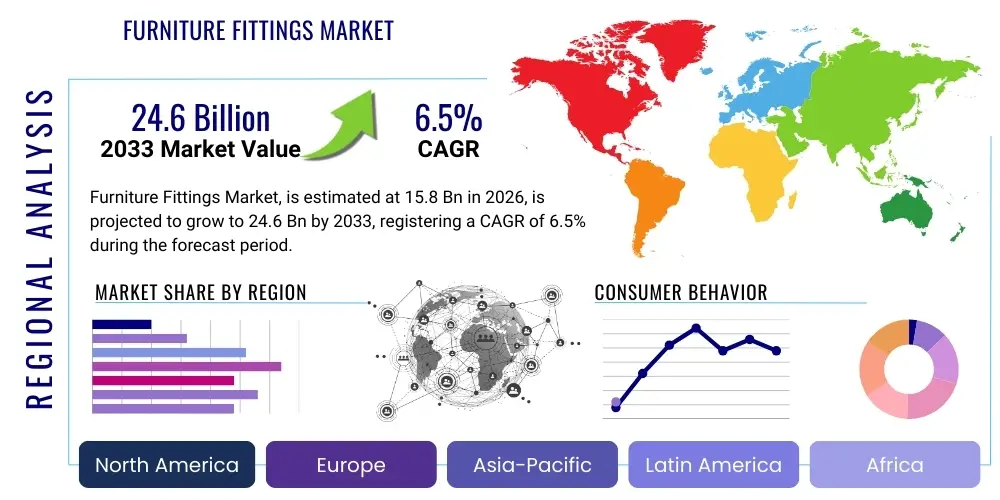

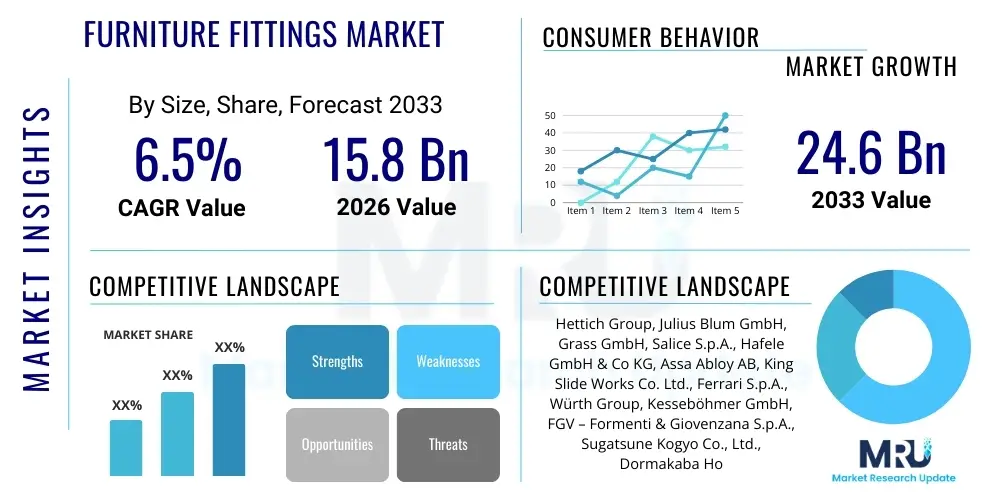

Furniture Fittings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443055 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Furniture Fittings Market Size

The Furniture Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 24.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for ready-to-assemble (RTA) and modular furniture, coupled with rapid urbanization and rising disposable incomes across developing economies, which fuel residential and commercial construction activities. The market growth trajectory is further supported by continuous technological advancements in fittings, focusing on enhanced durability, functionality, and aesthetic integration into modern furniture designs.

Furniture Fittings Market introduction

The Furniture Fittings Market encompasses all non-structural components critical for the assembly, movement, and functionality of furniture pieces, ranging from residential cabinets and seating to commercial office systems and hospitality fixtures. Key product types include hinges, slides, handles, locks, castors, connectors, and specialized lift systems designed to improve ergonomic usability and spatial efficiency. These products are essential in manufacturing processes across various materials, including wood, metal, glass, and plastic furniture. Major applications span the entire construction and interior design spectrum, prominently featuring residential remodeling, new housing projects, corporate offices, healthcare facilities, and retail environments. The primary benefit derived from high-quality furniture fittings is enhanced longevity, superior operational smoothness, improved safety, and the optimization of storage space through integrated systems.

Driving factors for this market are multi-faceted. The persistent trend toward micro-living spaces, particularly in metropolitan areas, necessitates the adoption of multifunctional and space-saving furniture, heavily reliant on advanced fittings like soft-closing drawer slides and integrated lift mechanisms. Furthermore, regulatory mandates focusing on product safety, coupled with evolving consumer expectations for premium features such as touch-to-open and motorized functionality, compel manufacturers to continuously innovate. The increasing standardization of furniture manufacturing, facilitated by advanced automation and precise engineering, also contributes significantly to the market's robust expansion, ensuring consistent quality and enabling mass production efficiencies crucial for catering to global demand.

Furniture Fittings Market Executive Summary

The global Furniture Fittings Market demonstrates dynamic growth, primarily steered by robust business trends emphasizing customization, modularity, and sustainability within the furniture industry. Key business trends include the shift towards digitally integrated supply chains, allowing for better inventory management and faster response times to design changes, and a notable focus on developing eco-friendly and recyclable fitting materials. Regional trends highlight Asia Pacific (APAC) as the epicenter of manufacturing and consumption, driven by massive infrastructure development and a booming middle class, while Europe continues to lead in technological innovation and premium product design, setting global standards for quality and soft-motion technology. North America exhibits strong growth fueled by high consumer spending on home renovation and the adoption of high-end, technologically sophisticated fittings. Segment trends indicate a rising preference for functional components (e.g., drawer slides and hinges) equipped with soft-close and push-to-open mechanisms, driven by luxury and convenience expectations, significantly impacting the hardware segment's revenue growth, while specialized lift systems are gaining traction in kitchen and living room applications to maximize vertical storage efficiency.

AI Impact Analysis on Furniture Fittings Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Furniture Fittings Market generally revolve around how AI can optimize the design and prototyping phases, enhance manufacturing precision, and revolutionize supply chain logistics, particularly in demand forecasting. Users frequently question the role of AI in predictive maintenance for complex motorized fittings, the personalization of consumer-facing hardware selection based on style preferences, and the potential for AI-driven automated quality control systems to minimize defects in high-volume production. Key concerns often center on the initial investment required for AI integration, the necessary upskilling of the workforce, and data privacy issues related to processing proprietary design and consumer usage data. Expectations are high regarding AI's ability to create more resilient supply chains, reduce lead times through optimized production schedules, and introduce entirely new categories of 'smart fittings' that adapt to user behavior or integrate seamlessly with home automation ecosystems.

The application of AI in furniture fitting design involves sophisticated generative algorithms capable of producing thousands of functional prototypes based on specified constraints such as load capacity, material properties, and dimensional limitations. This dramatically reduces the traditional time required for manual iteration and testing, leading to faster product introduction cycles. Furthermore, AI-powered computer vision systems are being deployed on production lines to perform real-time quality inspection, identifying microscopic flaws in surface finishes or minute dimensional inaccuracies in components like drawer slides or hinge mounting plates, ensuring adherence to stringent quality standards often demanded by premium furniture manufacturers.

In logistics and inventory management, AI algorithms analyze historical demand patterns, seasonal fluctuations, and external economic indicators to provide highly accurate sales forecasts. This predictive capability is crucial for fittings manufacturers, who often deal with thousands of SKUs (Stock Keeping Units) used globally by furniture assembly plants. By optimizing inventory levels and predicting component requirements, AI minimizes the risk of stockouts while substantially reducing warehousing costs. The cumulative effect of these AI applications is enhanced operational efficiency, reduced waste, and a significant improvement in the ability of manufacturers to respond rapidly to shifting market demands for specialized and customized furniture solutions.

- AI-Driven Generative Design: Accelerates the creation of complex, high-performance fitting geometries.

- Predictive Maintenance: Optimizes the lifespan of manufacturing machinery and minimizes unexpected downtime.

- Automated Quality Control: Uses computer vision for real-time defect detection in mass-produced components.

- Supply Chain Optimization: Enhances demand forecasting, inventory management, and route planning for global distribution.

- Personalized Hardware Selection: Recommends fittings to consumers or B2B buyers based on project specifications and aesthetic trends.

- Smart Fittings Development: Enables the integration of sensors and connectivity features into standard hardware for IoT applications.

- Manufacturing Process Optimization: Adjusts CNC machine parameters dynamically to maintain precision and throughput.

DRO & Impact Forces Of Furniture Fittings Market

The market dynamics of the Furniture Fittings Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include relentless urbanization, which fuels dense housing construction and consequently increases demand for space-saving modular furniture relying on high-tech fittings. The expanding middle-class population in emerging economies significantly boosts consumer expenditure on new furniture and home refurbishments, requiring durable and modern hardware. Furthermore, governmental initiatives promoting affordable housing and infrastructure development indirectly stimulate the demand for standardized, high-quality fittings. These forces collectively exert a powerful positive impact on market expansion, driving volume growth across all geographical segments.

Conversely, the market faces significant restraints that temper its growth potential. Volatility in the prices of raw materials, such as steel, zinc, aluminum, and certain polymers, directly impacts manufacturing costs and necessitates complex supply chain risk management strategies. The presence of numerous unorganized small-scale manufacturers, particularly in the APAC region, often leads to intense price competition, pressuring the profit margins of established, quality-focused industry players. Additionally, the complex nature of international trade regulations and tariffs poses logistical challenges for global distributors, slowing the movement of specialized components across borders and potentially increasing end-user costs.

Despite these challenges, substantial opportunities exist, primarily centered around technological innovation and market penetration. The burgeoning trend of smart furniture, incorporating connectivity and electronic features (e.g., motorized lift systems or integrated charging ports), creates lucrative niches for specialized electronic fittings. Moreover, increasing environmental consciousness drives opportunities for sustainable and recyclable material usage in fittings manufacturing, appealing to environmentally conscious consumers and adhering to stricter European Union regulations. Market consolidation through strategic mergers and acquisitions allows larger players to capture intellectual property, expand geographic reach, and achieve greater economies of scale, further cementing the long-term positive trajectory of the industry.

Segmentation Analysis

The Furniture Fittings Market is comprehensively segmented based on several key criteria, including Product Type, Material, Application, and Distribution Channel. This granular segmentation allows industry participants to target specific niches and understand evolving consumer preferences for functionality and aesthetics. The Product Type segmentation is critical, distinguishing between core functional components like hinges and slides, and external aesthetic elements such as handles and knobs. Functional fittings, particularly those incorporating advanced soft-closing technologies and concealed mounting systems, dominate the market share due to their essential role in defining the quality and user experience of modern cabinetry and furniture. Material segmentation highlights the shift from traditional metallic components (steel, aluminum, zinc alloys) towards advanced engineered plastics and composite materials in specific applications, driven by cost-effectiveness, weight reduction, and moisture resistance requirements, particularly in bathroom and kitchen furniture.

- By Product Type:

- Hinges (Concealed, Semi-Concealed, Special Application)

- Slides (Ball-Bearing, Roller, Undermount, Soft-Close)

- Knobs & Handles (Metal, Plastic, Ceramic, Wood)

- Connectors & Fasteners (Screws, Dowels, Minifix, Rafix)

- Locks & Catches (Magnetic, Mechanical, Electronic)

- Lifts & Support Systems (Gas Spring, Mechanical, Motorized)

- Castors & Legs

- Others (Shelving Supports, Decorative Components)

- By Material:

- Metal (Steel, Aluminum, Zinc Alloys, Brass)

- Plastics (ABS, PVC, Nylon)

- Others (Wood, Composites)

- By Application:

- Residential Furniture (Kitchen, Bedroom, Living Room)

- Commercial Furniture (Office, Hospitality, Retail, Institutional)

- By Distribution Channel:

- Offline (Direct Sales, Retail Stores, Specialized Hardware Outlets)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Furniture Fittings Market

The Value Chain for the Furniture Fittings Market begins with upstream activities involving the sourcing of primary raw materials, notably specialized steel alloys, zinc, aluminum, and high-grade engineering plastics. Key upstream suppliers include large metal refineries and chemical manufacturers. The procurement phase is highly sensitive to global commodity pricing and geopolitical stability, requiring robust supplier relationship management to ensure continuous supply and quality consistency. Midstream activities focus on the core manufacturing processes, which involve highly specialized techniques such as precision die-casting, cold forming, stamping, plating, and advanced surface finishing to achieve the required tolerances and aesthetic appeal, particularly for sophisticated components like soft-closing mechanisms and complex lifting systems. Manufacturers often invest heavily in CNC machinery and automation to maintain precision and minimize waste.

Downstream activities center on distribution and end-user assembly. The distribution channel is complex, featuring both direct and indirect routes. Direct distribution involves fittings manufacturers supplying large-scale Original Equipment Manufacturers (OEMs) in the furniture industry, such as major cabinet producers and modular furniture brands, often utilizing long-term supply contracts and tailored logistics solutions. Indirect distribution relies on an extensive network of wholesalers, regional distributors, and specialized hardware retailers who cater to smaller furniture workshops, custom builders, and the Do-It-Yourself (DIY) consumer segment. E-commerce platforms are increasingly serving as a critical indirect channel, providing global access to a vast catalog of specialized fittings, particularly for renovation and customized project needs.

The efficiency of the value chain is increasingly reliant on seamless integration between manufacturers and downstream partners through digital platforms. Effective channel management requires balancing the need for broad market penetration via retail networks with the demand for personalized service and technical support required by large OEMs. The critical success factor in the downstream segment lies in ensuring readily available inventory and providing detailed technical documentation and installation support, as the quality and correct installation of fittings significantly impact the final performance and reputation of the assembled furniture piece.

Furniture Fittings Market Potential Customers

The primary end-users and potential buyers in the Furniture Fittings Market are diverse, spanning both business-to-business (B2B) and business-to-consumer (B2C) segments, though B2B constitutes the overwhelming majority of volume. The largest segment of potential customers includes large-scale Original Equipment Manufacturers (OEMs) and contract furniture manufacturers who require massive volumes of standardized, high-quality fittings for their assembly lines. These customers demand stringent quality control, reliable supply chains, and competitive pricing, often entering into long-term strategic partnership agreements with fitting suppliers to ensure component compatibility and timely delivery for mass production cycles. Key examples include kitchen cabinet makers, modular wardrobe manufacturers, and global office furniture corporations.

A second crucial customer segment consists of professional interior designers, architects, and custom furniture builders. These buyers typically require specialized, high-end, or bespoke fittings that offer unique aesthetic qualities, specific functionalities (such as heavy-duty load capacities or complex movement kinematics), and often prioritize innovative features like electronic actuation or unique finishes. Their purchase decisions are heavily influenced by the fitting's design contribution to the overall aesthetic and functional outcome of a high-value, tailored project, making them less price-sensitive than volume OEMs but demanding of advanced technical support and product knowledge from the supplier.

Finally, the retail and DIY customer base represents the B2C segment, accessing fittings primarily through hardware stores, home improvement centers, and online platforms. These consumers typically purchase fittings for replacement, repair, or small-scale refurbishment projects, focusing on ease of installation, accessibility, and compatibility with standard dimensions. While individual purchases are smaller, the cumulative volume of this segment is substantial, particularly for commodity fittings like knobs, handles, and basic slides. Serving this segment requires strong retail presence, clear packaging, and accessible installation instructions to maximize consumer satisfaction and drive recurring sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 24.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hettich Group, Julius Blum GmbH, Grass GmbH, Salice S.p.A., Hafele GmbH & Co KG, Assa Abloy AB, King Slide Works Co. Ltd., Ferrari S.p.A., Würth Group, Kesseböhmer GmbH, FGV – Formenti & Giovenzana S.p.A., Sugatsune Kogyo Co., Ltd., Dormakaba Holding AG, Mepla-Alfit AG, Taiming Group, Siso Denmark A/S, ROCA Industry, Compagnucci High-Tech S.p.A., Godrej & Boyce Mfg. Co. Ltd., BMB Locks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Furniture Fittings Market Key Technology Landscape

The technology landscape of the Furniture Fittings Market is continuously evolving, focusing predominantly on enhancing user convenience, durability, and seamless integration into modern furniture aesthetics. A core technological advancement is the widespread adoption of soft-closing and damping systems, which utilize specialized hydraulic or air pistons integrated into hinges and drawer slides. This technology prevents drawers and doors from slamming shut, increasing product lifespan, minimizing noise, and contributing significantly to the perception of high quality in furniture. Manufacturers are continually refining these mechanisms to offer variable damping control and consistent performance across different load weights and sizes, making them a standard feature in high-end kitchen and living room cabinetry globally. The miniaturization and optimization of these mechanisms are ongoing research areas.

Another significant technological focus lies in actuation and mobility systems, particularly for vertical storage and multi-functional furniture. Motorized lift systems, utilizing small, powerful DC motors and precision gears, enable effortless opening of overhead cabinet doors (bi-fold, parallel, or vertical lift) or transformation of furniture components (e.g., adjustable height tables). These electronic fittings often incorporate sensor technology and control systems that allow them to be integrated with smart home environments or controlled via mobile applications. The development of slim-profile drawer slides, such as undermount and concealed slide systems, further reflects a drive toward aesthetics, maximizing interior storage space while completely hiding the functional hardware components, aligning with minimalist design philosophies dominant in contemporary interiors.

Furthermore, advancements in manufacturing technology, specifically high-precision Computer Numerical Control (CNC) machining and advanced material treatments, are critical. Precision manufacturing ensures highly accurate component dimensions, crucial for the reliable function of complex mechanical systems like tandem slides or heavy-duty hinges designed for large wardrobe doors. Surface treatment technologies, including advanced galvanization, powder coating, and specialized nickel or chrome plating, are utilized to enhance corrosion resistance, especially vital for fittings used in humid environments like kitchens and bathrooms. The use of advanced polymer composites for internal rollers and guides is improving motion smoothness and reducing friction, thereby guaranteeing the long-term, silent operation demanded by high-value residential and commercial clients.

Regional Highlights

The Furniture Fittings Market exhibits pronounced regional variances in terms of growth rates, technology adoption, and consumer preferences, heavily influenced by local construction activity and economic development patterns. Asia Pacific (APAC) dominates the market both in production volume and consumption value. Rapid urbanization, significant governmental investment in residential and commercial infrastructure, particularly in China, India, and Southeast Asian nations, and the explosive growth of middle-class consumer segments fuel the colossal demand for mass-market and mid-range furniture, driving the need for vast quantities of fittings. China remains the undisputed global manufacturing hub, characterized by massive production capacity and increasing technological sophistication, though price competition remains intense.

Europe represents a mature yet highly valuable market segment, known for technological leadership, product quality, and strict regulatory standards regarding safety and sustainability. Countries such as Germany, Austria, and Italy house many of the world's leading fitting manufacturers (e.g., Blum, Hettich, Salice), which drive innovation in high-end mechanisms, soft-motion technology, and specialized fittings for bespoke cabinetry. The European market exhibits a strong preference for durable, long-lasting products, leading to higher average selling prices and a sustained focus on premium, concealed hardware solutions.

North America is characterized by robust consumer spending on home improvement and renovation, along with a strong preference for large-scale kitchen and storage solutions. The demand here is primarily focused on heavy-duty, high-capacity fittings and those integrated with smart home technologies. While North America is a significant consumer, it relies heavily on imports from both European manufacturers (for high-end features) and APAC manufacturers (for volume and cost-effectiveness). Latin America and the Middle East & Africa (MEA) are emerging markets, displaying high growth potential driven by population expansion and ongoing large-scale construction projects in hospitality and residential sectors, though these regions are sensitive to economic fluctuations and reliant on established global supply chains for specialized hardware.

- Asia Pacific (APAC): Market dominance driven by high volume production, infrastructure boom, urbanization, and rising middle-class income, especially in China and India. Focus on achieving scale and improving quality standards.

- Europe: Hub of innovation, high quality standards, and premium product demand. Leads in soft-close technology, concealed hinges, and sustainable materials. Strong B2B segment catering to custom furniture makers.

- North America: High demand for premium features, heavy-duty slides, and smart integration (motorized systems). Driven primarily by renovation and high-value residential construction.

- Latin America (LATAM): Emerging market with strong growth potential linked to residential construction cycles; sensitive to economic volatility.

- Middle East & Africa (MEA): Growth stimulated by large-scale hospitality and residential projects; reliance on imported high-end fittings. Focus on durability in challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Furniture Fittings Market.- Hettich Group

- Julius Blum GmbH

- Hafele GmbH & Co KG

- Grass GmbH

- Salice S.p.A.

- Assa Abloy AB

- King Slide Works Co. Ltd.

- Ferrari S.p.A.

- Würth Group

- Kesseböhmer GmbH

- FGV – Formenti & Giovenzana S.p.A.

- Sugatsune Kogyo Co., Ltd.

- Dormakaba Holding AG

- Mepla-Alfit AG

- Taiming Group

- Siso Denmark A/S

- ROCA Industry

- Compagnucci High-Tech S.p.A.

- Godrej & Boyce Mfg. Co. Ltd.

- BMB Locks

Frequently Asked Questions

Analyze common user questions about the Furniture Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the soft-close fittings segment?

The soft-close fittings segment growth is primarily driven by increasing consumer demand for premium furniture features, improved user safety, noise reduction in living spaces, and the enhanced perception of quality and longevity associated with damped motion technology in hinges and drawer slides.

How is the adoption of modular and RTA furniture influencing the demand for fittings?

Modular and Ready-to-Assemble (RTA) furniture significantly increases demand for highly standardized, easy-to-install connectors and specialized fittings, as these components are essential for quick assembly, disassembly, and reconfiguration required by compact, multifunctional living solutions in urban environments.

Which geographical region holds the largest market share for furniture fittings?

The Asia Pacific (APAC) region holds the largest market share due to its vast manufacturing base, rapid infrastructural development, high population density, and surging residential construction activities, particularly in emerging economies like China and India.

What technological advancements are most crucial in modern kitchen cabinetry fittings?

The most crucial advancements include motorized and sensor-controlled lift systems for overhead cabinets, sophisticated silent-running undermount drawer slides for maximizing storage space, and integrated electronic locking mechanisms for enhanced security and convenience.

What is the primary constraint impacting the profitability of furniture fittings manufacturers?

The primary constraint is the volatile pricing of key raw materials, particularly steel and zinc alloys, which directly impacts production costs. This is often exacerbated by intense price competition from unorganized sector players, pressuring the overall operating margins of major manufacturers.

The global Furniture Fittings Market trajectory is intrinsically linked to global housing market performance and interior design trends. The shift toward minimalist aesthetics and multi-functional spaces necessitates fittings that are both highly efficient and visually concealed, driving technological competition among major European and Asian players. Innovation in material science focusing on lightweight, high-strength plastics and composites is gaining traction, particularly as manufacturers seek to mitigate the risks associated with metallic commodity price fluctuations and enhance product resilience against environmental factors such as moisture and temperature variations in global distribution. Furthermore, regulatory frameworks concerning product durability, safety standards (e.g., load-bearing capacity and anti-tip mechanisms), and environmental compliance (e.g., REACH regulations in Europe) continuously reshape product development efforts, pushing the market towards premiumization and greater standardization across product lines. The integration of advanced sensor technologies into fittings, while currently niche, represents a major long-term growth vector, transforming passive components into active elements within the smart home ecosystem, potentially unlocking significant revenue streams related to data services and maintenance alerts, thus extending the market scope beyond traditional mechanical hardware.

The industrialization of the construction sector, including the increasing preference for pre-fabricated and modular building solutions, provides a consistent, high-volume customer base for fittings manufacturers. These specialized construction methods require fittings that are engineered for precision installation and long-term durability, minimizing on-site adjustments. As supply chains become increasingly globalized and complex, logistics efficiency is becoming a competitive differentiator. Major players are investing heavily in establishing localized production and distribution hubs closer to key consumer markets (e.g., North America and specific high-growth regions in APAC) to reduce lead times, mitigate geopolitical supply risks, and offer tailored support services to local furniture OEMs. This localized strategy also helps in adapting product specifications quickly to meet distinct regional seismic or humidity standards, further cementing manufacturer commitment to local market nuances.

In the highly competitive landscape, strategic maneuvers such as mergers, acquisitions, and joint ventures are common, primarily aimed at expanding product portfolios, acquiring specialized technology patents (especially in electronic fittings), and consolidating distribution networks to achieve cost efficiencies. Small and medium-sized enterprises (SMEs) often focus on niche markets, such as custom hardware, specialized finishes, or components for bespoke luxury furniture, leveraging rapid prototyping and flexibility to serve designers who demand unique solutions not available from mass-market suppliers. Overall, the market remains robust, sustained by continuous innovation that elevates the functional performance and aesthetic contribution of fittings to modern interior design and architecture, making them indispensable components for value creation in the furniture industry.

The market for hinges, the largest sub-segment by product type, is undergoing significant refinement. While basic hinges remain essential for commodity furniture, the value segment is rapidly transitioning to 3D adjustable concealed hinges and specialized angle hinges that address complex cabinet door geometries. These advanced hinges offer tool-free mounting and precise adjustment capabilities post-installation, dramatically simplifying the assembly process for furniture manufacturers and installers, thereby reducing labor time and associated costs. The material composition of hinges is increasingly optimized, with robust engineering plastics being used in conjunction with metal to reduce weight while maintaining high load-bearing capacity, particularly important for large, modern doors that incorporate heavy materials like glass or mirror panels. Manufacturers are also focusing on creating standardized hinge patterns that allow for interchangeability across different product lines, simplifying inventory management for both the supplier and the furniture maker.

Drawer slides represent the fastest-growing functional component segment, fueled by the demand for deeper, wider, and fully extendable storage solutions in kitchens and wardrobes. The technology shift from basic roller slides to high-performance ball-bearing slides and sophisticated undermount systems is near complete in premium markets. Undermount slides, which are entirely hidden from view, offer superior load capacity and quiet operation, often incorporating highly engineered synchronization systems for wide drawers to ensure smooth, parallel motion. Furthermore, the development of specialized heavy-duty slides for industrial, medical, and office applications (e.g., filing cabinets or server drawers) provides critical expansion opportunities outside the traditional residential furniture sphere. Innovation here concentrates on extending the functional life cycle under maximum load, reducing operational force, and integrating advanced safety locking features, which are mandatory in professional environments.

Connectors and fasteners, though small in individual cost, are vital for the integrity of modular and RTA furniture. The trend is moving towards faster, non-visible, and more secure joining systems. Specialized cam and dowel locking systems, such as Minifix and Rafix, allow for furniture to be repeatedly assembled and disassembled without compromising structural integrity, a key requirement for multi-dwelling units and rented accommodations. Manufacturers are developing proprietary quick-assembly connectors that require minimal tools, sometimes incorporating pre-applied adhesives or self-aligning features, further streamlining the manufacturing and assembly process. The goal is to make furniture assembly simpler for the end-user while guaranteeing commercial-grade durability, which directly impacts customer satisfaction and reduces warranty claims for structural failure.

The segment concerning lift and support systems, including gas springs and motorized actuators, is experiencing explosive growth driven by ergonomic and space optimization needs. These fittings allow for easy access to high shelves or multi-layered storage units without manual straining. Motorized systems, particularly relevant in luxury kitchens, allow heavy cabinet fronts to glide open at the touch of a button or via remote control, aligning perfectly with the smart home narrative. Suppliers are working on silent, reliable motor units with safety stops and low energy consumption. The regulatory landscape around motorized systems is tightening, particularly concerning electrical safety and reliability, necessitating rigorous certification processes for market entry, thereby creating a barrier to entry for smaller, less established manufacturers who cannot meet these stringent testing requirements. This focus on reliability and advanced kinematics ensures that sophisticated functional fittings remain a high-value category within the broader market.

In terms of materials, the utilization of zinc die-casting alloys remains prevalent for complex, high-stress components such as hinge arms and drawer side frames due to their excellent balance of strength, castability, and cost. However, high-grade steel is necessary for bearing components and tracks where hardness and wear resistance are paramount. The increasing usage of engineering plastics (like high-density nylon and ABS) is noted in non-structural parts, guides, and internal mechanisms of soft-close systems, primarily to reduce operational noise and weight, and to provide inherent lubricity, thereby reducing wear on metal components. Sustainable sourcing of raw materials, including recycled metals and bio-based plastics, is emerging as a critical competitive factor, particularly in Europe where architects and commercial clients prioritize green building certifications and environmentally responsible supply chains. Manufacturers who can transparently demonstrate their commitment to reducing carbon footprint through material innovation are gaining a significant advantage in tendering for large institutional and commercial contracts.

The application segmentation underscores the differing needs of the residential and commercial sectors. Residential applications demand components focused on aesthetics, smooth operation, and moderate load capacity, with a heavy emphasis on concealed hardware. Kitchen and bedroom furniture dominate this demand, particularly in renovations. Commercial applications, encompassing offices, hospitals, and retail fixtures, require fittings engineered for extreme durability, very high cycle counts, and robust security features (e.g., heavy-duty locks and specialized castors for mobile systems). Office furniture, driven by ergonomic trends, specifically requires advanced wire management grommets and height-adjustable mechanisms relying on specialized lift columns, a segment with exceptionally high technological barriers to entry due to the complexity of the integrated electronics and mechanical synchronization required for safe, smooth operation.

Finally, the distribution landscape is diversifying. While traditional wholesale channels remain critical for serving local carpenters and medium-sized furniture shops, the growth of direct supply relationships with mega-furniture manufacturers (OEMs) is consolidating purchasing power. E-commerce platforms are increasingly facilitating access to a wider variety of specialized fittings globally, especially benefiting architects and custom builders looking for unique European or niche Asian hardware brands without navigating complex import logistics. This online channel demands high-quality digital catalogs, comprehensive technical specifications, and detailed installation videos to overcome the challenge of demonstrating the product's quality and functionality in a non-physical environment, forcing manufacturers to enhance their digital marketing and educational content offerings substantially to capture the online market share effectively and cater to a more digitally savvy customer base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager