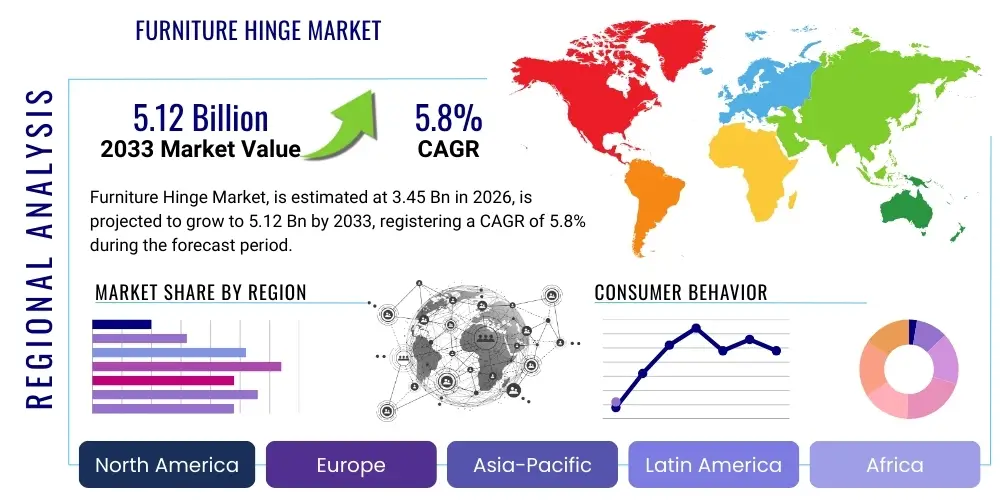

Furniture Hinge Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443466 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Furniture Hinge Market Size

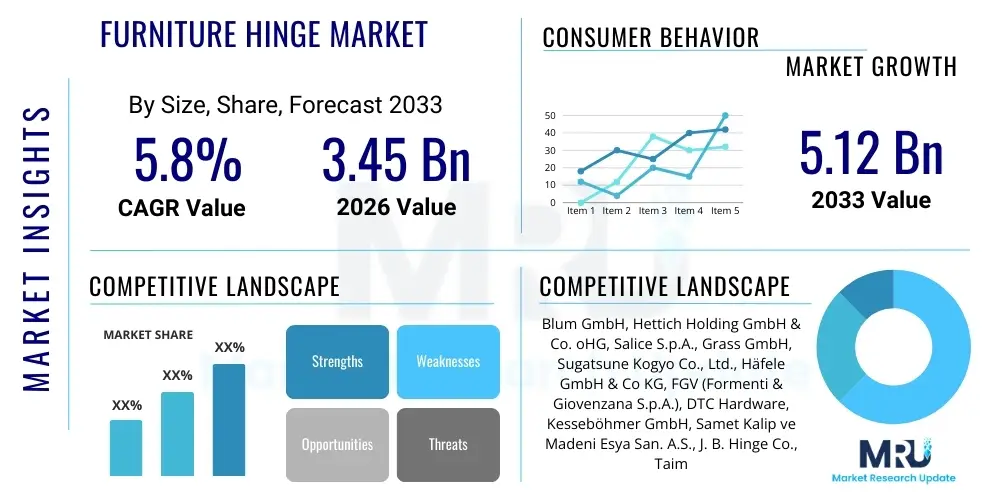

The Furniture Hinge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.45 Billion in 2026 and is projected to reach USD 5.12 Billion by the end of the forecast period in 2033.

Furniture Hinge Market introduction

The Furniture Hinge Market encompasses the global production, distribution, and consumption of various mechanical devices utilized for connecting two solid components, typically allowing for restricted angular rotation, predominantly employed in furniture items such as cabinets, wardrobes, and specialized storage units. These essential components provide functional movement, ensuring doors and panels open and close smoothly and securely. The product portfolio ranges from traditional butt hinges to highly sophisticated concealed and specialty hinges, including soft-close mechanisms and integrated damping systems, which address contemporary consumer demands for silence, safety, and longevity in household and commercial furnishings. Market maturity varies significantly by region, with established markets focusing on innovation and aesthetic integration, while emerging economies prioritize volume and basic functionality. The core objective of modern furniture hinges is to enhance the user experience by offering reliable performance and discreet integration into furniture designs, often requiring precision engineering and durable material selection.

Major applications of furniture hinges span residential, commercial, and institutional sectors. Residential use dominates the market, primarily driven by kitchen cabinet installations, wardrobe systems, and bathroom vanity units, where high cycle life and specific opening angles are critical performance indicators. Commercially, hinges are vital in office furniture (desk compartments, credenzas), hospitality settings (hotel wardrobe systems), and retail display units, requiring enhanced security features and robustness against heavy daily usage. The benefits conferred by high-quality furniture hinges include improved longevity of the furniture piece, enhanced safety through controlled movement (especially soft-close features), and significant aesthetic improvements, as modern hinges are often designed to be invisible or minimally intrusive to the overall furniture design. This focus on concealed functionality allows furniture manufacturers greater freedom in aesthetic design, integrating hinges seamlessly into sleek, minimalist styles popular today.

The market expansion is substantially driven by the continuous global growth of the real estate and construction sectors, particularly the rise in luxury apartment complexes and custom home building that necessitates high-quality, specialized furniture fittings. Furthermore, the increasing consumer preference for ready-to-assemble (RTA) furniture, which relies heavily on standardized, easy-to-install hinging mechanisms, contributes significantly to market volume. Technological advancements, such as the miniaturization of damping systems and the development of specialized materials that offer higher corrosion resistance and load-bearing capacity, are propelling the demand for premium hinge solutions. Regulatory compliance regarding safety standards, particularly concerning controlled door closing mechanisms in child-friendly environments, also acts as a key market driver, forcing manufacturers to innovate and adhere to stringent international quality benchmarks. These combined factors solidify the hinge as a crucial, albeit often overlooked, element in the overall furniture value proposition.

Furniture Hinge Market Executive Summary

The Furniture Hinge Market is characterized by robust expansion driven by urbanization, increasing disposable incomes in Asia Pacific, and a structural shift towards premium, soft-close hardware globally. Business trends indicate a strong focus on automation in manufacturing processes to maintain competitive pricing, while key players engage in strategic acquisitions and vertical integration to secure raw material supply chains and expand their geographical footprint. Technological innovation, specifically in hydraulic damping and modular hinge systems, is accelerating product differentiation, enabling manufacturers to cater to bespoke design requirements and higher load capacities. Regional trends highlight APAC as the fastest-growing market due to rapid residential construction and a burgeoning middle class demanding higher quality fittings, contrasting with the mature markets of North America and Europe, where growth is primarily sustained by replacement cycles and high-end customization. Segment trends show a clear preference for concealed hinges, particularly the soft-close variety, owing to their functional and aesthetic advantages, steadily eroding the market share of traditional butt hinges in new furniture installations. The underlying momentum suggests sustained growth, contingent upon stabilizing global supply chain logistics and continued investment in high-precision manufacturing capabilities.

AI Impact Analysis on Furniture Hinge Market

User queries regarding the influence of Artificial Intelligence (AI) on the Furniture Hinge Market primarily revolve around operational efficiency, customized product design, and predictive maintenance. Common questions include: "How can AI optimize hinge production lines?", "Will AI enable personalized hinge functions for smart furniture?", and "What role does machine learning play in predicting hinge failure and improving durability?" The analysis reveals that users are highly concerned with AI's ability to drive down manufacturing costs through process optimization while simultaneously expecting enhanced product complexity, such as hinges integrated into smart home ecosystems. Key themes emerging are the automation of quality control using computer vision, the utilization of generative design algorithms to create complex, lightweight hinge structures, and the adoption of predictive analytics for inventory management and supply chain resilience. Users anticipate that AI will fundamentally transform how hinges are designed, manufactured, and eventually maintained within smart furniture systems, pushing the industry towards 'Hinge 4.0'—a paradigm characterized by intelligent, self-monitoring components.

- AI optimizes manufacturing throughput and reduces defect rates through continuous monitoring and real-time adjustment of production machinery settings.

- Machine Learning algorithms analyze usage patterns in connected furniture, enabling predictive maintenance models for hinge replacement or adjustment before failure occurs.

- Generative Design powered by AI assists engineers in developing complex geometric structures for hinges that are lighter, stronger, and utilize less material, optimizing cost-efficiency.

- AI-driven supply chain platforms enhance inventory management, forecasting demand fluctuations based on construction project pipelines and retail sales data, improving logistics planning.

- Computer Vision systems are deployed for stringent, non-destructive quality assurance checks, verifying tolerances and finish quality faster and more reliably than manual inspection.

- Integration of AI into smart furniture facilitates dynamic hinge behavior, allowing for automatic adjustments in opening resistance or closing speed based on external environmental factors or user preferences.

DRO & Impact Forces Of Furniture Hinge Market

The Furniture Hinge Market dynamics are heavily influenced by the confluence of robust housing development, stringent quality demands, and operational cost pressures. Primary drivers include rapid urbanization, leading to increased demand for modular and space-saving furniture which necessitates specialized hinge mechanisms, and continuous product innovation focused on soft-close technology and integrated electronic functionality. Restraints primarily involve the volatility of raw material prices, particularly steel and specialized plastics, which impacts manufacturing margins, alongside the threat posed by counterfeit and low-quality products from unorganized sectors, undermining established brand pricing. Opportunities are abundant in the emerging markets of Southeast Asia and Africa, where construction activity is accelerating, and in the development of sophisticated hinges tailored for smart furniture and accessibility solutions. The collective impact forces show that while the market benefits significantly from macro-economic recovery and housing stimulus, it remains vulnerable to global trade barriers and fluctuating commodity prices, compelling manufacturers to invest heavily in resilient, localized supply chains.

The driving force of globalization and standardization of furniture design across international markets further compels hinge manufacturers to ensure their products comply with a wide array of certifications, making high-quality, multi-standard compliant products particularly attractive. Consumer readiness to pay a premium for features like silent operation and durability substantially elevates the market for high-end soft-close hinges, creating a self-reinforcing loop of quality improvement and pricing power for premium brands. However, a significant restraint is the relatively low barrier to entry for basic hinge manufacturing, leading to intense price competition in the economy segment, which pressure margins for standardized products. This necessitates that established players constantly shift their focus toward proprietary technology and patented designs to maintain profitability, thereby separating themselves from generic alternatives. The impact of these forces creates a dual-speed market: high-growth, high-margin niche segments driven by technology, and stable, low-margin segments characterized by volume sales and fierce pricing battles.

Market opportunities also lie in sustainability and circular economy principles. The push towards eco-friendly furniture production requires hinge manufacturers to develop products utilizing recycled or sustainable materials, offering a competitive edge to companies that successfully achieve material innovation without compromising mechanical integrity. Furthermore, the growing trend of retrofitting and renovation of existing residential and commercial spaces offers a consistent demand stream for replacement and upgrade hinges, particularly soft-close systems that improve the functionality of older cabinets. The cyclical nature of the construction industry, while an overarching driver, also presents an inherent risk; any significant global economic downturn leading to reduced housing starts can rapidly decelerate market demand. Managing the balance between cost-effective mass production and highly specialized, innovative product development remains the central strategic challenge for participants in the Furniture Hinge Market over the forecast period.

Segmentation Analysis

The Furniture Hinge Market is meticulously segmented based on product characteristics, material composition, application area, and end-user category, reflecting the diverse functional and aesthetic demands of the global furniture industry. Segmentation by Type is crucial, differentiating between concealed (European style) hinges, which offer invisible integration, and visible hinges like butt hinges and specialized overlay hinges. Material segmentation is vital as it dictates durability and load capacity, spanning traditional metals like steel and brass to modern, high-strength plastics. Application analysis focuses on the primary furniture types served, such as kitchen cabinetry, wardrobes, and specialized furniture doors. Analyzing these segments provides a clear pathway for strategic market entry and product development, allowing manufacturers to tailor solutions precisely to residential volume demands or specialized commercial requirements. The dominance of concealed hinges underscores the industry’s aesthetic shift towards minimalist design, requiring robust but discreet hardware.

- By Type:

- Concealed Hinges (35mm, 26mm cup diameter)

- Butt Hinges

- Specialty Hinges (e.g., Soft-close, Piano Hinges, Lift-up Systems)

- Overlay Hinges

- By Material:

- Steel (Stainless Steel, Cold-Rolled Steel)

- Brass

- Zinc Alloys

- Plastic/Nylon Components

- By Application:

- Cabinetry (Kitchen and Bathroom)

- Wardrobes and Closets

- Doors and Panels (Furniture Specific)

- Display Units and Others

- By End-User:

- Residential

- Commercial (Hospitality, Office, Healthcare)

- Institutional

Value Chain Analysis For Furniture Hinge Market

The value chain of the Furniture Hinge Market begins with upstream activities focused on raw material sourcing, predominantly steel (cold-rolled and stainless), zinc, brass, and specialized engineering plastics, where price volatility and supply security are critical management areas. This is followed by core manufacturing, which involves precision stamping, casting, forging, and specialized assembly, particularly for complex mechanisms like soft-close dampers, demanding high capital investment in automated machinery. Key differentiators at the manufacturing stage include patented damping technology, surface treatment (plating and powder coating), and quality control systems that ensure high cycle life standards. Manufacturers then pass products through diverse distribution channels, ranging from direct sales to large Original Equipment Manufacturers (OEMs) in the furniture industry to indirect distribution via wholesalers, specialized hardware retailers, and, increasingly, e-commerce platforms targeting DIY consumers and smaller carpentry workshops. Effective management of the supply chain, particularly minimizing logistics costs and ensuring rapid fulfillment for just-in-time furniture production, determines overall profitability.

Downstream analysis highlights the critical role of furniture manufacturers (OEMs), who constitute the primary institutional buyers, requiring large volumes of standardized or semi-customized hinges integrated into their production lines. These buyers demand stringent quality specifications, bulk pricing, and reliable delivery schedules. The secondary downstream users include professional carpenters, contractors, and remodelers, who typically purchase through local distributors and favor specialized or higher-end functional hinges. The shift toward direct-to-consumer (D2C) channels via online sales is reshaping the market dynamics, allowing smaller manufacturers and specialty brands to reach end-users without relying solely on traditional brick-and-mortar hardware stores. Furthermore, the role of installers and furniture assembly services is crucial, as the ease of installation (tool-free or clip-on mechanisms) is a significant selling point that reduces labor costs for the end-user or furniture company, influencing purchasing decisions heavily.

Distribution channels in the furniture hinge sector are stratified. Direct channels are utilized for high-volume, long-term contracts with major furniture brands (IKEA, Ashley Furniture, etc.), ensuring bespoke requirements are met efficiently. Indirect channels encompass a wider network, including specialized furniture hardware distributors (who often provide technical support and local inventory), general industrial suppliers, and major home improvement retail chains (e.g., Home Depot, Lowe's). The rising importance of digital distribution mandates robust e-commerce capabilities, optimized logistics for small parcel shipping, and comprehensive product information management (PIM) systems to handle the thousands of hinge variants (overlay specifications, mounting plates, finishes). Success in the value chain hinges on controlling material costs upstream, optimizing precision engineering in the midstream, and ensuring multi-channel distribution excellence downstream to capture both high-volume OEM demand and fragmented renovation/DIY requirements.

Furniture Hinge Market Potential Customers

The primary end-users and buyers of furniture hinges are segmented across institutional and consumer sectors, with Original Equipment Manufacturers (OEMs) being the most dominant purchasing entities. These OEMs include large-scale producers of kitchen cabinetry, bedroom sets, office furniture systems, and RTA (Ready-to-Assemble) furniture, demanding high volumes of standardized concealed hinges (e.g., 35mm cup) under strict long-term contracts. Architects, interior designers, and construction contractors also represent substantial potential customers, as they specify high-end, aesthetic, and performance-driven specialty hinges for custom residential projects, luxury commercial fittings (hotels, high-end retail), and institutional builds (hospitals, schools). This segment values reliability, specific aesthetic finishes (e.g., matte black, brushed steel), and advanced features like heavy-duty load capacity or push-to-open mechanisms, often sourcing through specialized distributors rather than mass retailers. Their purchasing decisions are highly influenced by compliance with building codes and the ease of long-term maintenance.

Secondary but rapidly growing potential customers are the professional carpentry and joinery workshops, along with dedicated remodelers and renovation service providers. These smaller enterprises require a diverse inventory of hinges to handle varied renovation projects, often prioritizing flexible purchasing options and local availability. They are heavy users of both concealed hinges for modern kitchens and traditional butt hinges for restoration work. Finally, the consumer segment, primarily the DIY (Do-It-Yourself) market, represents a crucial customer base, typically purchasing through retail chains or e-commerce platforms for small-scale repair, upgrade, or assembly of flat-pack furniture. The DIY consumer seeks hinges that are extremely easy to install (featuring clip-on or tool-free assembly mechanisms) and provide clear, understandable instructions, driving the demand for pre-packaged kits and highly standardized product dimensions. Catering to these diverse customer requirements necessitates a broad product catalog and flexible distribution strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.45 Billion |

| Market Forecast in 2033 | USD 5.12 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blum GmbH, Hettich Holding GmbH & Co. oHG, Salice S.p.A., Grass GmbH, Sugatsune Kogyo Co., Ltd., Häfele GmbH & Co KG, FGV (Formenti & Giovenzana S.p.A.), DTC Hardware, Kesseböhmer GmbH, Samet Kalip ve Madeni Esya San. A.S., J. B. Hinge Co., Taiming, ASSA ABLOY (Through relevant subsidiaries), Bosch Rexroth AG, Sayerlack, Roto Frank, Huwil, Jusen Hardware, Cebi International S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Furniture Hinge Market Key Technology Landscape

The technology landscape of the Furniture Hinge Market is fundamentally characterized by innovations aimed at enhancing functionality, user experience, and aesthetic integration, moving far beyond basic mechanical pivoting. The most critical technological advancement is the widespread adoption of soft-close and damping systems, typically achieved through integrated hydraulic or pneumatic mechanisms within the hinge cup or arm. These systems ensure that furniture doors close silently and gently, preventing damage and minimizing noise, and have become a standard requirement in premium and mid-range furniture globally. Continuous improvement in this area focuses on miniaturizing the damping cylinder size while maintaining optimal performance across varied door weights and temperatures. Furthermore, the development of tool-free installation and removal mechanisms, often referred to as "clip-on" or "quick-assembly" features, drastically reduces assembly time for furniture manufacturers and DIY consumers, acting as a major competitive advantage for hinge providers.

Material science and engineering precision are also crucial technological drivers. Manufacturers are increasingly utilizing higher-strength alloys and specialized coatings (e.g., nickel plating, corrosion-resistant treatments) to increase the cycle life and load-bearing capacity of hinges, particularly for large or heavy cabinet doors common in modern design. Precision stamping and high-speed automated assembly lines, often incorporating robotic manipulation, are necessary to meet the extremely tight dimensional tolerances required for modern concealed hinge systems to ensure perfect alignment and long-term stability. The concept of "zero protrusion" and specific opening angle limitations (e.g., 90-degree, 170-degree) requires highly precise engineering geometries that are optimized through computer-aided design (CAD) and simulation tools to minimize material usage while maximizing mechanical efficiency and stability under dynamic loads.

Looking ahead, the integration of smart technology represents the next frontier. This includes the development of electronically assisted opening and closing systems (e.g., 'push-to-open' with electronic assist) that can be linked to smart home systems or activated via voice command. While still niche, this trend signifies the fusion of traditional mechanical hardware with microelectronics. Another emerging technology is the development of hinges capable of wirelessly monitoring their operational status, reporting usage cycles, and predicting necessary maintenance to a centralized smart furniture hub, leveraging miniaturized sensors and low-power wireless communication protocols. These technological shifts necessitate significant investment in R&D and intellectual property protection, driving competition among leading global suppliers who strive to own the proprietary technologies that define the future of high-performance furniture fittings.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth for the Furniture Hinge Market, demonstrating the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid expansion is fundamentally driven by unprecedented levels of residential construction, particularly in populous nations like China, India, and Indonesia, which are experiencing accelerated urbanization and a massive influx of investment in infrastructure. The region is characterized by a high volume demand for affordable and mid-range hinges, although the premium segment, especially soft-close mechanisms, is rapidly gaining traction due to rising disposable incomes and changing consumer preferences towards imported design standards. Government initiatives supporting affordable housing and the booming RTA furniture manufacturing industry in countries like Vietnam further solidify APAC's dominance in volume production and consumption. Localized manufacturing capabilities are scaling up quickly, competing aggressively with established European players on price while steadily improving quality standards.

- Europe: Europe represents a mature and highly innovative market segment, acting as the global benchmark for quality and technological sophistication in furniture hardware. Countries such as Germany, Italy, and Austria host key industry leaders (Blum, Hettich, Salice) who focus intensely on R&D, patenting advanced soft-close technology, integrated lighting systems, and specialized hinges for high-end bespoke furniture. Market growth in Europe is predominantly driven by replacement cycles, renovation projects, and a strong preference among both residential and commercial sectors for premium, durable, and aesthetically superior products. Regulatory factors, especially stringent EU standards concerning product safety and environmental sustainability, influence manufacturing processes, pushing market players toward eco-friendly materials and robust, certified products.

- North America: The North American market is stable and characterized by a high adoption rate of premium concealed and soft-close hinges, largely utilized in custom cabinetry and high-end residential renovation projects. The market is highly sensitive to trends in the housing market, particularly existing home sales and kitchen remodeling activity. Demand for easy-to-install, durable products is paramount. While some volume production is domestic, a significant portion of hinges are imported, primarily from major European and Asian suppliers. The commercial segment, encompassing hospitality and institutional buildings, places strong emphasis on heavy-duty, certified hinges that comply with strict fire and safety regulations, ensuring consistent demand for specialized hardware solutions.

- Latin America (LATAM): The LATAM market offers moderate growth potential, constrained by economic volatility in key economies like Brazil and Mexico, but bolstered by expanding middle-class construction projects. The market preference leans towards cost-effective yet reliable hardware. Imported hinges compete with local manufacturers, requiring international players to adjust pricing and distribution strategies to navigate logistical challenges and localized competition. Improvement in urbanization rates suggests gradual adoption of more complex hinge mechanisms over time.

- Middle East and Africa (MEA): The MEA region is experiencing growth driven by large-scale commercial and luxury residential construction projects in the Gulf Cooperation Council (GCC) states (e.g., UAE, Saudi Arabia). This segment demands high-specification, visually appealing hinges suitable for luxury interior design. Conversely, the African sub-segment is highly price-sensitive, with demand concentrated on basic, functional hardware for mass housing projects. Political stability and oil price fluctuations heavily influence construction spending and, consequently, the demand for high-end furniture fittings in the Middle East.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Furniture Hinge Market.- Blum GmbH

- Hettich Holding GmbH & Co. oHG

- Salice S.p.A.

- Grass GmbH

- Sugatsune Kogyo Co., Ltd.

- Häfele GmbH & Co KG

- FGV (Formenti & Giovenzana S.p.A.)

- DTC Hardware

- Kesseböhmer GmbH

- Samet Kalip ve Madeni Esya San. A.S.

- J. B. Hinge Co.

- Taiming

- ASSA ABLOY (Through relevant subsidiaries)

- Bosch Rexroth AG

- Sayerlack

- Roto Frank

- Huwil

- Jusen Hardware

- Cebi International S.A.

- Siso A/S

Frequently Asked Questions

Analyze common user questions about the Furniture Hinge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for soft-close furniture hinges globally?

The primary driver is elevated consumer expectation for premium functionality and quiet operation in residential spaces, coupled with the increasing adoption of concealed hinges that aesthetically favor high-quality, integrated damping mechanisms to prevent door slamming and reduce wear and tear on furniture components.

Which type of furniture hinge holds the largest market share by volume?

Concealed hinges, also known as Euro hinges (typically 35mm cup diameter), hold the largest market share by volume. Their dominance is driven by widespread adoption in modern kitchen cabinetry and RTA (Ready-to-Assemble) furniture due to their adjustability, aesthetic discretion, and compatibility with integrated damping systems.

How is raw material volatility impacting the profitability of hinge manufacturers?

Volatile prices of raw materials, primarily cold-rolled steel, zinc, and specialized plastics, directly compress manufacturing margins. Manufacturers mitigate this by optimizing production processes, focusing on high-value, proprietary products, and securing long-term supply agreements or hedging strategies against commodity price fluctuations.

Which geographical region offers the most significant growth opportunities for new market entrants?

The Asia Pacific (APAC) region offers the most significant growth opportunities due to massive urbanization, rapid housing development, and rising disposable incomes. Countries like India and Southeast Asian nations present high volume potential in both mid-range and entry-level hinge segments, necessitating scalable and cost-competitive market strategies.

What are the key differences between butt hinges and concealed hinges in modern furniture design?

Butt hinges are visible, externally mounted, and primarily used for traditional doors and specific furniture restoration, requiring mortising. Concealed hinges are mounted internally, offering aesthetic discretion, superior three-way adjustability, and the ability to integrate modern features like soft-close damping, making them the standard for contemporary cabinetry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager