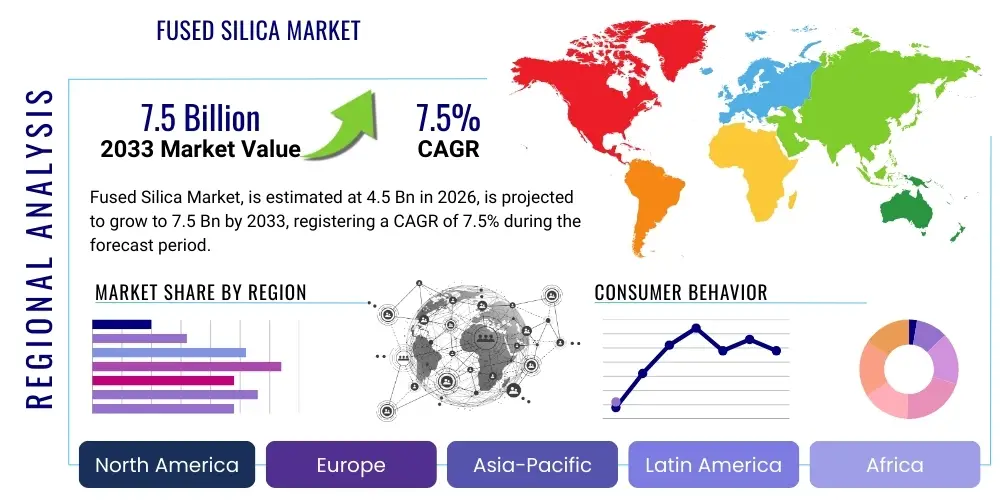

Fused Silica Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443288 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Fused Silica Market Size

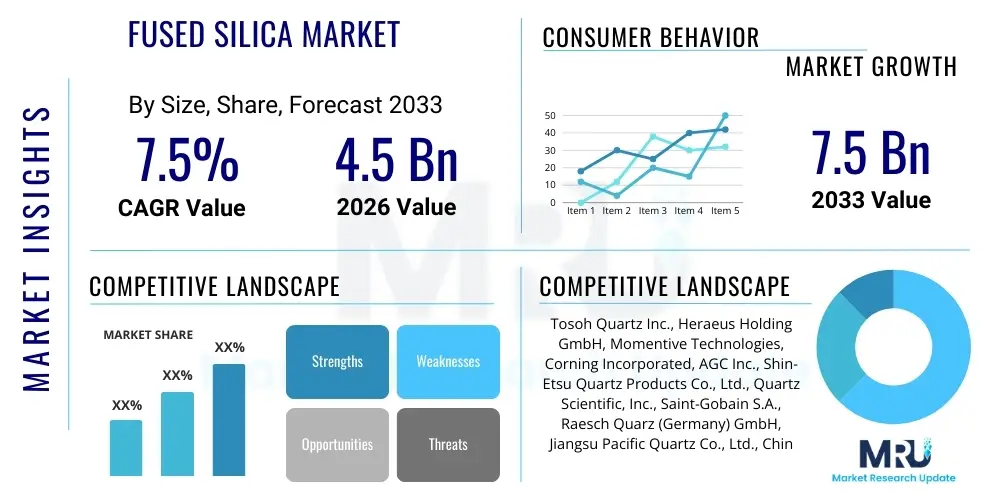

The Fused Silica Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.5 billion by the end of the forecast period in 2033.

Fused Silica Market introduction

The Fused Silica Market encompasses materials produced by fusing high-purity silica sand or synthetic silicon tetrachloride (SiCl4) at extremely high temperatures, resulting in a non-crystalline, vitreous material known for its exceptional thermal, optical, and chemical properties. This material exhibits near-zero thermal expansion coefficient, high resistance to thermal shock, excellent UV transparency, and superior electrical insulation capabilities, making it indispensable across technologically advanced sectors. The fundamental characteristics of fused silica, such as its high softening point (around 1600°C) and inertness to most acids, position it as a critical enabling material in demanding environments.

Major applications of fused silica span several high-growth industries. In electronics and semiconductors, it is essential for manufacturing components like crucibles for crystal growing, masking materials, and substrates due to its purity and thermal stability. The solar energy sector utilizes large quantities of fused silica for producing quartz glass tubes and high-purity crucibles used in the silicon ingot manufacturing process. Furthermore, its superior optical transmission characteristics make it crucial for high-performance optics, particularly in lasers, lithography systems, and telecommunication fibers. The demand is heavily influenced by rapid technological advancements in these end-use sectors, particularly the move towards smaller, faster electronic components and the expansion of 5G networks.

The driving factors propelling market growth are intrinsically linked to global industrial trends, notably the relentless demand for consumer electronics, the accelerating adoption of renewable energy sources, and significant investments in advanced telecommunication infrastructure globally. The inherent benefits, including exceptional chemical purity and thermal durability, solidify fused silica’s role where standard glass or ceramics cannot meet stringent performance requirements. Geographically, Asia Pacific, led by China, South Korea, and Taiwan, dominates consumption due to concentrated semiconductor and photovoltaic manufacturing hubs, positioning the region as the epicenter for future market expansion.

Fused Silica Market Executive Summary

The Fused Silica Market is characterized by robust growth, primarily fueled by the surging requirements of the global semiconductor industry and increasing worldwide focus on solar energy implementation. Key business trends indicate a substantial shift towards high-purity synthetic fused silica, driven by the stringent quality demands of advanced lithography and memory chip manufacturing. Strategic collaborations between material suppliers and semiconductor equipment manufacturers (SEMs) are becoming crucial for optimizing product formulations and ensuring a reliable supply chain. Furthermore, sustainability initiatives are pushing manufacturers to optimize energy consumption during the fusion process, though high production costs remain a significant industry challenge.

Regional trends highlight the overwhelming dominance of the Asia Pacific (APAC) region, which accounts for the largest share of market revenue and volume. This concentration is a direct result of extensive capacity expansion in wafer fabrication (fabs) and solar cell production, particularly in East Asia. North America and Europe are exhibiting steady growth, largely spurred by renewed emphasis on regionalizing semiconductor supply chains and significant R&D investments in high-end optics and aerospace applications. The Middle East and Africa (MEA) and Latin America currently represent nascent markets, poised for moderate future growth as infrastructure projects and localized manufacturing capabilities gradually develop.

Segment trends reveal that the Electronics & Semiconductor application segment retains the highest market share, driven by the continuous miniaturization and performance requirements of microchips. Within the product type segmentation, the demand for powder and granular forms used in refractory applications remains steady, while the ultra-high purity synthetic fused silica segment shows the highest CAGR due to its necessity in deep UV and excimer laser optics. Pricing dynamics are sensitive to energy costs and the supply of high-purity natural quartz, leading manufacturers to vertically integrate or secure long-term supply agreements to mitigate volatility.

AI Impact Analysis on Fused Silica Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) primarily influences the Fused Silica Market by optimizing complex manufacturing processes and drastically increasing demand from end-user industries like advanced computing and data centers. User inquiries often center around how AI-driven semiconductor design tools will necessitate even purer and more defect-free fused silica components, particularly for extreme ultraviolet (EUV) lithography systems essential for AI chip production. Concerns also revolve around whether AI can effectively predict material defects during high-temperature fusion, leading to improved yield rates and reduced waste. Users expect AI to revolutionize quality control and predictive maintenance within production facilities, ensuring that the demanding specifications required for AI hardware (GPUs, specialized accelerators) are consistently met.

The adoption of AI-enabled quality inspection systems, utilizing computer vision and deep learning algorithms, is transforming traditional quality assurance protocols. These systems can analyze microscopic surface defects and impurities in fused silica components far more rapidly and accurately than conventional human inspection, which is vital for maintaining the nanometer-scale precision needed in semiconductor manufacturing. Moreover, AI simulation tools are being employed in the design phase of advanced optical systems, allowing engineers to model thermal stress and transmission characteristics of fused silica under various operational conditions, thereby accelerating product development cycles and reducing the reliance on expensive physical prototypes. This technological integration is crucial for serving the exponentially growing data center market, which relies on fused silica optics for high-speed fiber optic networking infrastructure.

In terms of manufacturing efficiency, AI optimizes furnace temperature control, gas flow rates, and deposition processes during synthetic fused silica creation. By continuously analyzing sensor data streams, ML models can minimize energy consumption while ensuring homogeneous material properties throughout the batch. This operational efficiency is paramount given the energy-intensive nature of fused silica production. The overall impact of AI is two-fold: it drives up the volume and quality requirements for fused silica components used in AI infrastructure, and simultaneously provides the tools necessary for manufacturers to meet these heightened performance standards efficiently and cost-effectively.

- AI drives demand for ultra-high purity fused silica used in advanced AI accelerator chips (EUV lithography components).

- Predictive maintenance using AI minimizes downtime and maximizes yield rates in high-temperature fusing operations.

- AI-enabled computer vision systems automate and enhance microscopic quality control for defect detection in optical parts.

- ML algorithms optimize energy consumption and process variables (temperature, pressure) during synthetic fused silica production.

- AI simulation models accelerate the R&D cycle for new fused silica compositions utilized in complex optical networks required by data centers.

DRO & Impact Forces Of Fused Silica Market

The market dynamics of fused silica are primarily governed by its indispensability in critical high-technology sectors, countered by significant manufacturing complexities and cost challenges. Major drivers include the relentless expansion of the global semiconductor industry, particularly in advanced nodes requiring EUV compatibility, and the massive deployment of solar photovoltaic installations worldwide. Restraints predominantly center around the high capital expenditure required for establishing production facilities, the extremely energy-intensive nature of the fusion process, and the volatility in the supply chain of high-purity quartz raw materials. Opportunities lie in the burgeoning market for advanced fiber optics, specialized medical devices, and the adoption of synthetic fused silica for extreme environment applications like aerospace and high-power lasers. These forces collectively shape investment strategies and determine the competitive intensity within the industry.

The primary driving force is the technological shift toward advanced semiconductor manufacturing processes. As Moore's Law continues to push device scaling limits, the demand for pristine, defect-free materials like fused silica for masks, reticles, and handling tools becomes non-negotiable. This is complemented by supportive governmental policies and subsidies promoting solar energy, particularly in Asia, driving up the need for quartz crucibles and tubes essential for crystalline silicon production. Conversely, the high cost of energy significantly impacts the profitability of manufacturers, especially those relying on older fusion technologies, acting as a major restraint. Furthermore, developing consistent, high-quality synthetic fused silica requires complex chemical processes (like chemical vapor deposition, CVD), posing technological barriers to entry for new players.

The impact forces within the market are predominantly technological and regulatory. The rapid pace of innovation in optics and electronics continuously raises the bar for material purity and performance, compelling manufacturers to invest heavily in R&D. The transition from natural to synthetic fused silica, driven by purity requirements, significantly impacts upstream sourcing and processing methods. Regulatory scrutiny concerning environmental compliance in energy-intensive processes also exerts pressure, necessitating adoption of cleaner production techniques and higher energy efficiency. The long-term opportunities are most pronounced in niche, high-margin sectors such as specialized defense optics and semiconductor processing, which are relatively insulated from commodity price fluctuations, emphasizing the shift toward value-added products.

Segmentation Analysis

The Fused Silica Market is comprehensively segmented based on its Type, Form, Application, and geographic region, allowing for a detailed understanding of market dynamics within specific use cases. Segmentation by Type distinguishes between High Purity Fused Silica, essential for advanced optics and semiconductor components, and Standard Fused Silica, typically employed in refractory and basic lighting applications. The Form segmentation includes Powder, Lump, and Tube/Rod, reflecting different manufacturing processes and end-product requirements. The Application segmentation is crucial as it dictates material specifications, with Electronics & Semiconductors and Solar Photovoltaics being the dominant revenue generators, followed by Optics, Refractories, and Lighting sectors. Analyzing these segments provides strategic insights into areas experiencing the highest growth rates and demanding the most stringent quality control.

- By Type:

- High Purity Fused Silica

- Standard Fused Silica

- By Form:

- Powder/Granule

- Lump/Block

- Tube/Rod

- By Application:

- Electronics & Semiconductors (EUV Lithography, Crucibles, Wafer Carriers)

- Solar Photovoltaics (Quartz Tubes, Crucibles)

- Optics (Lenses, Prisms, Fiber Preforms)

- Refractories (Casting, Metallurgical Furnaces)

- Lighting (High-Intensity Discharge Lamps)

- Aerospace & Defense

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France)

- Asia Pacific (China, Japan, South Korea, Taiwan)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Fused Silica Market

The value chain for the Fused Silica Market is characterized by highly specialized processes, starting from the procurement of raw materials and culminating in distribution to specialized high-technology end-users. The upstream segment involves the mining and purification of high-purity natural quartz sand (for commodity grade) or the synthesis of chemical precursors like SiCl4 (for high-end synthetic fused silica). Material purification is a critical step, as even trace contaminants can compromise the optical or thermal performance required for semiconductor applications. This upstream stage is dominated by a few specialized mining and chemical companies capable of delivering ultra-pure feedstock, establishing a significant leverage point in the chain.

The core manufacturing process involves the melting and forming of the silica, which is energy and capital intensive. Manufacturers employ highly advanced fusion techniques (such as flame hydrolysis or electric arc fusion) to create the vitreous material in various forms (ingots, blocks, tubes). Midstream activities involve stringent quality control checks, particularly for bubble content, homogeneity, and transmission characteristics. Due to the precision required, manufacturers often possess proprietary technological know-how, creating significant barriers to entry and consolidating production among established players who can manage the technical complexity and high fixed costs.

The downstream distribution channel is largely direct for high-volume or highly customized products, such as semiconductor crucibles delivered straight to major silicon wafer manufacturers (like TSMC or Samsung) or solar cell producers. For smaller volumes or standardized products (like refractory materials), indirect channels involving specialized distributors and agents are utilized. The final stage involves end-user integration, where the formed fused silica is machined, polished, and incorporated into complex systems, such as optical lithography tools or specialized high-temperature furnaces. The close relationship between fused silica manufacturers and original equipment manufacturers (OEMs) in the semiconductor and optics sectors is vital for co-developing materials that meet future performance roadmaps.

Fused Silica Market Potential Customers

Potential customers for the Fused Silica Market are concentrated in industrial sectors that require materials offering exceptional thermal stability, chemical inertness, and superior optical performance under extreme conditions. The most significant segment of buyers comprises semiconductor fabrication plants (fabs) and integrated device manufacturers (IDMs) who purchase large volumes of fused silica for components like process tubes, boats, carriers, and high-ppurity crucibles necessary for silicon wafer production and advanced chip manufacturing processes. These customers demand the highest possible purity grades (often exceeding 99.999%), making them the premium segment of the market.

Another major buying group includes manufacturers of solar photovoltaic (PV) modules, specifically those involved in producing crystalline silicon ingots. These companies are high-volume purchasers of fused silica quartz tubes and crucibles that facilitate the growth of silicon crystals. The demand from this segment is highly sensitive to government subsidies and global energy transition policies. Furthermore, specialized optics companies, including those serving the telecommunication, medical device, and defense industries, constitute critical end-users. They procure precision-machined fused silica for components such as laser windows, high-speed fiber preforms, and specialized medical endoscopy lenses, prioritizing excellent UV transmission and refractive index homogeneity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 7.5 billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tosoh Quartz Inc., Heraeus Holding GmbH, Momentive Technologies, Corning Incorporated, AGC Inc., Shin-Etsu Quartz Products Co., Ltd., Quartz Scientific, Inc., Saint-Gobain S.A., Raesch Quarz (Germany) GmbH, Jiangsu Pacific Quartz Co., Ltd., China New Fine Industrial Co., Ltd., Lianyungang Guangwei Quartz Products Co., Ltd., Guartz Corp., Technical Glass Products, Atlantic Ultraviolet Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fused Silica Market Key Technology Landscape

The technological landscape of the Fused Silica Market is dominated by sophisticated manufacturing techniques aimed at achieving increasingly higher levels of purity and homogeneity, crucial for next-generation applications. Two primary production methods define the market: natural fusion and synthetic synthesis. Natural fusion involves melting high-purity natural quartz sand, often via electric arc or continuous melting furnaces, to produce standard-grade material primarily used in refractories and general lighting. This technology is mature but struggles to meet the stringent purity requirements of modern semiconductor fabrication due to inherent trace metal contaminants present in natural quartz deposits.

In contrast, the market for high-performance and ultra-high purity fused silica relies heavily on synthetic methods, predominantly Chemical Vapor Deposition (CVD) through flame hydrolysis of silicon precursors like SiCl4. Technologies such as the direct deposition of silica soot onto a substrate, followed by consolidation (vitrification), allow for the creation of glass with virtually zero metallic impurities and excellent optical transmission characteristics across the UV to IR spectrum. This synthetic approach is highly scalable and enables precise control over material properties, making it the technology of choice for producing fiber optic preforms, EUV components, and advanced optical windows.

Further technological advancements focus on post-processing techniques, including specialized annealing processes to relieve internal stresses and advanced polishing methods to achieve angstrom-level surface flatness necessary for lithography masks. Research is also heavily invested in optimizing doping techniques to fine-tune the material’s refractive index or thermal expansion coefficient for specific optical wave-guiding applications. The continuous drive towards smaller feature sizes in chips necessitates innovations in material structure to minimize defects and ensure stability under extreme temperature and pressure conditions inherent in fabrication tools. These high-tech processes require significant proprietary intellectual property and specialized equipment, reinforcing the competitive advantage of technologically advanced market leaders.

Regional Highlights

The Fused Silica Market exhibits significant geographical disparities in consumption and production capacity, directly correlated with global high-technology manufacturing footprints.

- Asia Pacific (APAC): APAC is the unequivocally dominant region, accounting for the largest market share and demonstrating the fastest growth rate. This leadership is driven by the massive concentration of semiconductor manufacturing capacity (especially in Taiwan, South Korea, and China) and the world's largest solar photovoltaic production base. Governments in countries like China and South Korea are heavily subsidizing domestic production capabilities across the electronics value chain, translating into explosive demand for fused silica components, particularly for crucibles and quartz glassware used in high-volume production lines.

- North America: North America represents a mature market, characterized by demand for high-end, specialized synthetic fused silica, driven primarily by advanced optics, aerospace, and defense applications. Recent governmental initiatives aimed at restoring domestic semiconductor manufacturing (e.g., the CHIPS Act in the US) are expected to significantly boost internal consumption of ultra-high purity materials. The region is a hub for innovation in CVD technology and hosts major material science companies focused on high-margin, niche products rather than commodity volumes.

- Europe: Europe holds a substantial market position, centered around high-precision industrial applications, advanced scientific instruments, and specialized optical fiber production. Germany, France, and the UK are key consumers, utilizing fused silica in specialized lighting, automotive sensors, and advanced research facilities. The region is focused on sustainable manufacturing practices, influencing investments in energy-efficient fusion technologies. Growth, while steady, is primarily concentrated in the high-purity synthetic segment serving industrial optics and specialty medical technologies.

- Latin America & Middle East and Africa (MEA): These regions currently hold smaller market shares but are poised for moderate growth due to increasing industrialization and infrastructure development. Demand is primarily generated by standard fused silica for refractory linings in metallurgy and glass manufacturing, as well as nascent solar energy projects. Investment in telecommunications infrastructure, especially fiber optics, is expected to be a future driver, particularly in large economies like Brazil and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fused Silica Market.- Tosoh Quartz Inc.

- Heraeus Holding GmbH

- Momentive Technologies

- Corning Incorporated

- AGC Inc.

- Shin-Etsu Quartz Products Co., Ltd.

- Quartz Scientific, Inc.

- Saint-Gobain S.A.

- Raesch Quarz (Germany) GmbH

- Jiangsu Pacific Quartz Co., Ltd.

- China New Fine Industrial Co., Ltd.

- Lianyungang Guangwei Quartz Products Co., Ltd.

- Guartz Corp.

- Technical Glass Products

- Atlantic Ultraviolet Corporation

- PPM Quartz Products LLC

- Zhuzhou Jingcheng Quartz Products Co., Ltd.

- Qsil GmbH

- Nippon Quartz Glass Co., Ltd.

- The 3M Company (Specialty Materials Division)

Frequently Asked Questions

Analyze common user questions about the Fused Silica market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between natural and synthetic fused silica?

The primary difference lies in purity and manufacturing method. Natural fused silica is produced by melting mined quartz sand and contains trace impurities, limiting its use in ultra-sensitive applications. Synthetic fused silica is created through chemical vapor deposition (CVD) of silicon precursors, resulting in exceptionally high purity (often >99.999%), making it ideal for EUV optics and advanced semiconductors.

Which application segment drives the largest demand for Fused Silica?

The Electronics and Semiconductor segment drives the largest and most critical demand. Fused silica is indispensable for semiconductor manufacturing tools, including process tubes, carriers, and high-purity crucibles used for silicon crystal growth, due to its thermal stability and chemical inertness.

How does the growth of Extreme Ultraviolet (EUV) lithography impact the Fused Silica Market?

EUV lithography significantly boosts the demand for ultra-high purity synthetic fused silica. EUV systems require materials with virtually zero defects and exceptional transmission characteristics in the deep UV spectrum for components like projection optics and mask substrates, thereby driving prices and innovation in the high-end synthetic segment.

What are the key restraints affecting market growth?

The key restraints include the substantial capital investment required to establish and upgrade high-purity production facilities, coupled with the extremely high energy consumption and operational costs associated with the high-temperature fusion process. Volatility in energy prices directly impacts manufacturer profitability.

Which geographical region dominates the consumption of Fused Silica?

The Asia Pacific (APAC) region dominates the consumption of fused silica. This is attributed to the concentration of global semiconductor fabrication plants (fabs) and the world's largest solar photovoltaic (PV) manufacturing bases located across China, Taiwan, and South Korea, driving massive volume demand.

This comprehensive market report provides an in-depth analysis of the Fused Silica Market, detailing growth drivers, technological advancements, and key competitive landscapes necessary for strategic decision-making in the advanced materials sector. The market's future trajectory remains intricately linked to global investments in microelectronics, renewable energy, and precision optics, solidifying fused silica's role as a foundational material for twenty-first-century technology.

The market environment continues to be highly competitive, with material innovation focused on optimizing the balance between thermal stability, optical performance, and cost efficiency. As demand accelerates for smaller node semiconductors and larger solar arrays, manufacturers must navigate complex regulatory environments and supply chain dependencies, particularly concerning ultra-high purity raw material sourcing. Strategic partnerships across the value chain, extending from quartz miners to end-product OEMs, are increasingly crucial for securing long-term growth and maintaining technological superiority in the synthetic segment.

Further research indicates that the long-term viability of high-purity fused silica production will depend on breakthroughs in low-energy fusion techniques and enhanced automation, potentially leveraging AI and machine learning for predictive quality control. This transition will be necessary to manage rising operational costs while simultaneously meeting the zero-defect standards imposed by next-generation applications such as advanced quantum computing hardware and highly complex medical imaging devices. The structural shift towards synthetic materials is expected to continue widening the gap between commodity and high-performance product segments.

The Fused Silica Market presents numerous avenues for investment, particularly in regions where semiconductor capacity is being localized or expanded, such as North America and Europe. However, investment risk remains elevated due to the specialized nature of the equipment and the requirement for highly skilled technical personnel. Companies that successfully navigate patent landscapes and secure reliable sources for precursors (SiCl4) will be best positioned to capitalize on the sustained, high-growth demand originating from the advanced electronics sector, ensuring market resilience even during macroeconomic fluctuations impacting other industrial sectors.

The increasing complexity of modern manufacturing necessitates materials that can withstand more extreme operating parameters. Fused silica excels in these environments, whether providing thermal insulation in high-temperature processes or maintaining high-fidelity optical pathways in advanced laser systems. The shift in the photovoltaic industry toward multi-gigawatt production facilities also dictates a move toward larger, more durable quartzware, driving demand for innovative forming techniques that reduce material stress and extend component lifespan in continuous operation settings. This focus on lifespan and performance consistency is paramount for total cost of ownership reduction in capital-intensive end-user industries.

Moreover, environmental sustainability is gradually becoming a key consideration in purchasing decisions, especially in Europe. Manufacturers demonstrating optimized energy use, reduced hazardous waste, and closed-loop material handling processes are gaining a competitive edge. While the purity requirement often necessitates highly controlled, energy-intensive processes, research efforts are exploring plasma torch methods and alternative high-efficiency melting technologies to mitigate the carbon footprint associated with large-scale fused silica production, reflecting a growing alignment with global ESG (Environmental, Social, and Governance) investment criteria.

The convergence of advanced manufacturing techniques and rigorous quality control protocols ensures that the Fused Silica Market remains highly selective. The technological complexity serves as a natural barrier to entry, protecting the market share of established, specialized manufacturers. This is particularly true in the production of specialized fused silica components used in medical applications, where regulatory approval and material traceability require years of dedicated development and verification, further solidifying the position of incumbent suppliers capable of meeting stringent compliance requirements globally.

The development of customized fused silica grades tailored for unique military and defense applications, such as missile domes and specialized sensor windows, adds another layer of complexity and value to the market. These niche demands require materials exhibiting specific mechanical strength, thermal properties, and electromagnetic transparency that are not readily achievable with standard production methods. This segment, though smaller in volume, provides significant revenue opportunities and fosters continuous R&D into enhanced material formulations and manufacturing precision. The intellectual property generated in these high-stakes fields often finds its way into commercial semiconductor and optics applications, creating a feedback loop of innovation.

The role of digitalization in the Fused Silica Market extends beyond internal optimization; it also impacts customer interaction and supply chain responsiveness. Digital platforms are increasingly used for tracking specific batch properties, ensuring material compliance, and facilitating just-in-time delivery to critical manufacturing hubs. This transparent and efficient supply chain management is highly valued by semiconductor and solar manufacturers, who operate under tight production schedules and cannot tolerate unexpected material shortages or quality deviations. Enhancing digital integration is key to improving overall market efficiency and customer satisfaction in a sector characterized by zero-tolerance quality standards.

In summary, the Fused Silica Market is characterized by high technical barriers, extreme purity requirements, and strong dependence on the health of the global semiconductor and solar industries. Future growth will be contingent upon successful technological transitions to lower-cost, higher-purity synthetic methods and the capacity of manufacturers to invest in automation and AI-driven quality assurance to meet the exponentially increasing precision demands of advanced computing infrastructure.

The strategic imperative for market participants is vertical integration or securing long-term, exclusive supply agreements for key raw materials, especially high-purity quartz and chemical precursors. This measure mitigates exposure to supply chain shocks and raw material price volatility, which have historically impacted profitability. Furthermore, focusing R&D efforts on emerging applications, such as fiber lasers and advanced telecommunication components, offers diversification away from the intense cyclicality often associated with the memory and standard logic chip sectors. Innovation in material handling and non-destructive testing methodologies is also critical for maintaining market leadership and satisfying evolving customer specifications.

The continuous push toward sustainability dictates that manufacturers explore processes that minimize energy footprint and waste generation. For instance, advanced recycling techniques for quartz components, particularly those used in semiconductor processing, are gaining traction as a means to recover high-value material and reduce overall dependence on virgin raw materials. While challenging due to potential contamination risks, successful implementation of closed-loop recycling systems could offer a substantial long-term cost advantage and align with corporate sustainability goals favored by institutional investors.

The political landscape, particularly the trade tensions and the global race for semiconductor sovereignty, heavily influences regional market dynamics. Government policies in North America and Europe aimed at bringing high-tech manufacturing back onshore create significant localized demand growth, providing immediate market opportunities for companies with established regional production capabilities or those willing to invest in new domestic facilities. This localization trend, however, may lead to temporary market fragmentation and potential inefficiencies before new regional supply chains become fully optimized.

The ongoing miniaturization in the electronics industry mandates that fused silica manufacturers continuously improve defect detection capabilities. Defects, even at the nanometer scale, can cause catastrophic failures in advanced semiconductor devices. Investment in advanced metrology equipment, such as atomic force microscopy (AFM) and ultra-high resolution optical profilers, is mandatory to meet these stringent quality requirements, reinforcing the notion that capital expenditure is a continuous necessity in this high-tech materials market.

Finally, the growing adoption of specialized optical fiber for sensor networks and high-definition medical imaging represents a long-term, structurally stable growth driver. These applications require fused silica with tightly controlled refractive indices and excellent mechanical resilience, offering manufacturers a premium market segment less susceptible to cyclical fluctuations compared to the broader consumer electronics market. Focusing on these high-margin, specialized fibers ensures diversification and stable returns, supporting overall market growth projections toward 2033.

The technological gap between manufacturers of natural fused silica and synthetic fused silica is widening. Synthetic production techniques allow for tailored properties, such as controlling the content of hydroxyl groups (OH content), which significantly affects UV transparency and thermal resistance. Low-OH fused silica is crucial for deep UV applications, while high-OH fused silica is preferred for certain infrared transmission requirements. This ability to chemically engineer the material’s properties ensures synthetic fused silica will capture a progressively larger share of the high-value market segments.

Furthermore, the competitive strategy increasingly involves securing intellectual property rights related to both material composition and proprietary fusion processes. Given the difficulty in achieving ultra-high purity consistently, patent protection around specific purification steps or deposition techniques offers significant market differentiation. Companies that dominate key patents in areas such as bubble-free fusion or specialized doping methods maintain strong negotiating power with large OEMs, allowing them to dictate pricing for high-performance components.

The industrial refractories segment, while slower growing, remains vital, utilizing standard fused silica powders and granules for lining induction furnaces and investment casting molds, particularly in the metallurgical industry. This segment benefits from fused silica's exceptional thermal shock resistance and low thermal expansion, ensuring furnace longevity and operational safety. Though revenue per unit volume is lower, the consistent, large-volume requirements of global metal production provide a steady base demand for the natural fused silica market.

In conclusion, the Fused Silica Market is positioned for robust expansion, predominantly in the synthetic, high-purity segment. Success hinges on advanced technological capabilities, efficient management of energy and raw material costs, and close integration with leading semiconductor and optics manufacturers. The market's resilience is underpinned by the essential nature of fused silica in technologies driving the future economy, from AI infrastructure to renewable energy sources.

The forecast period from 2026 to 2033 is expected to see increased capital spending by major players to expand synthetic production capacity in APAC and strategic localized expansion in North America and Europe, responding directly to governmental stimuli aiming to secure high-tech domestic supply chains. The drive toward sustainability and higher purity standards will continue to pressure smaller, less technologically advanced players, favoring large, vertically integrated corporations with established R&D platforms and global distribution networks. This dynamic suggests a gradual consolidation, with leaders leveraging patented technology to maintain price premiums in the highly sensitive application segments.

Continuous monitoring of geopolitical stability, particularly regarding trade flows between major manufacturing regions, is essential, as any disruption to the global supply of high-purity quartz sand or key chemical precursors could instantly escalate raw material costs and constrain production volume, affecting profitability across the entire value chain. Therefore, risk mitigation strategies involving diversified sourcing and regional inventory buffers are becoming standard operating procedures for leading market participants.

The increasing complexity of Fused Silica Market demands extends to logistics, requiring specialized handling and packaging to maintain the integrity and purity of the components during transit. For instance, highly polished optics components necessitate cleanroom environments for final packaging and shipping, adding complexity and cost to the distribution stage. Companies capable of managing this entire high-purity supply chain, from synthesis to cleanroom delivery, establish a significant competitive advantage over competitors relying on third-party logistics providers lacking specialized capabilities.

Final analysis of the long-term market outlook remains highly positive, driven by fundamental technological trends that necessitate fused silica's unique properties. Whether it is the need for more efficient solar power generation, faster data transmission through fiber optics, or the ultimate limits of semiconductor scaling, fused silica remains an irreplaceable enabler. The projected CAGR of 7.5% reflects confidence in sustained technological advancement and infrastructure expansion across key global economies, solidifying the material's critical role in the industrial landscape.

This detailed report provides a comprehensive foundation for strategic planning, highlighting the criticality of technological superiority, supply chain resilience, and alignment with global industry trends, particularly the massive requirements stemming from the AI and advanced semiconductor sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fused Silica Market Size Report By Type (First Grade Material, Second Grade Material, Third Grade Material, Fourth Grade Material), By Application (Solar Industries, Semiconductor and Electronics Industry, Refractories, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fused Silica Market Statistics 2025 Analysis By Application (Solar Industries, Semiconductor and Electronics Industry, Refractories), By Type (First Grade Material, Second Grade Material, Third Grade Material, Fourth Grade Material), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Polka Dot Beamsplitters Market Statistics 2025 Analysis By Application (Broadband Sources, Narrowband Sources), By Type (Fused Silica Polka Dot Beamsplitters, Glass Polka Dot Beamsplitters, CaF2 Polka Dot Beamsplitters), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fused Silica Sand Market Statistics 2025 Analysis By Application (Solar Industries, Semiconductor and Electronics Industry, Refractories, Ceramics), By Type (First Grade Material, Second Grade Material, Third Grade Material, Fourth Grade Material), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fused Silica Powder Market Statistics 2025 Analysis By Application (Glass, Casting and Smelting, Ceramics, Fireproof Materials), By Type (325mesh, 500mesh, 1250mesh, 2500mesh), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager