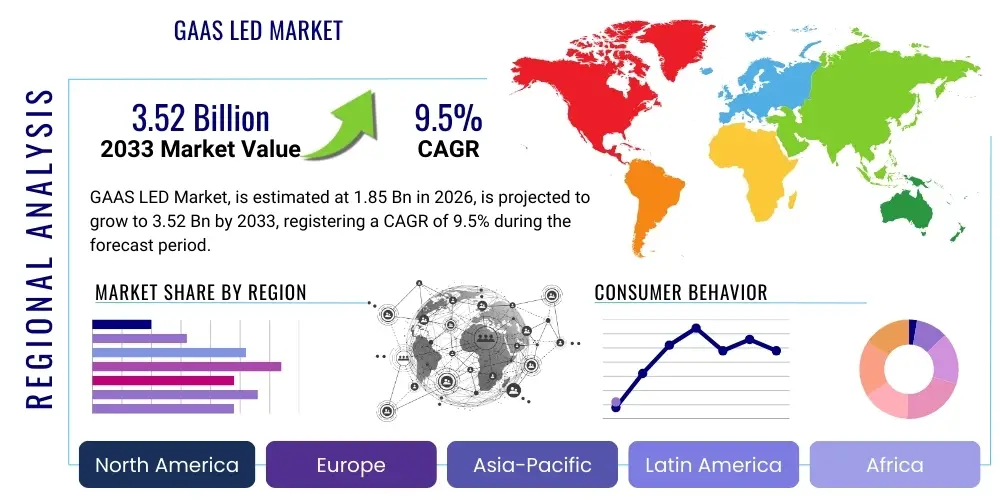

GAAS LED Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441845 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

GAAS LED Market Size

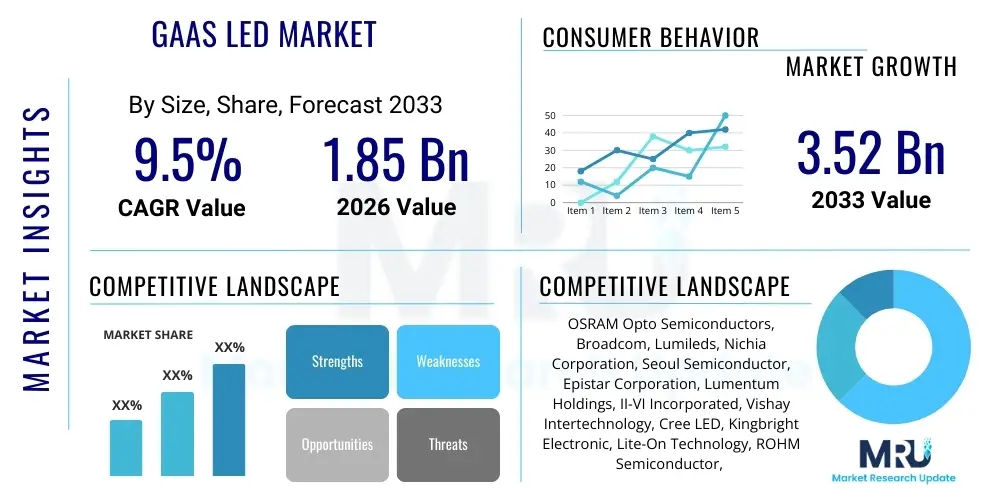

The GAAS LED Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.52 Billion by the end of the forecast period in 2033.

GAAS LED Market introduction

The Gallium Arsenide (GaAs) LED market encompasses semiconductor devices utilizing GaAs compounds, known for their superior performance in emitting light, particularly in the infrared and red spectrums. These specialized LEDs offer distinct advantages over standard silicon-based components, primarily due to GaAs’s direct bandgap, which facilitates highly efficient conversion of electrical energy into light. Key products include high-power infrared emitters used in specialized sensing and data transmission applications, as well as red LEDs crucial for display technologies and automotive interior lighting. The intrinsic material properties of GaAs enable faster switching speeds and higher operational temperatures, making them indispensable in demanding professional and industrial environments where reliability and performance are paramount.

Major applications driving the consumption of GaAs LEDs span several critical technological sectors. In the automotive industry, these LEDs are vital for proximity sensors, driver monitoring systems, and advanced light curtain safety features. The telecommunications sector heavily relies on GaAs-based components for high-speed fiber optic data transmission systems, requiring robust, high-efficiency infrared sources. Furthermore, their integration into medical devices, such as pulse oximeters and phototherapy equipment, highlights their precision capabilities. The expanding adoption of smart technologies and the Internet of Things (IoT) infrastructure continues to create new niches for GaAs LEDs, particularly in industrial automation and security surveillance systems where reliable infrared illumination is essential for night vision capabilities.

The market expansion is significantly propelled by technological advancements in epitaxial growth techniques, which reduce production costs and enhance device longevity. Benefits derived from GaAs LEDs include exceptional radiant flux output, high quantum efficiency, and narrow spectral linewidth, offering performance metrics unattainable by conventional materials in specific wavelengths. These factors, combined with the global push for energy-efficient electronic components and the exponential growth in demand for high-bandwidth communication infrastructure, firmly establish GaAs LEDs as critical enablers for next-generation electronic systems, sustaining robust market momentum throughout the forecast period.

GAAS LED Market Executive Summary

The GAAS LED Market is poised for substantial expansion, driven primarily by accelerating digitization across global industries and the continuous integration of advanced sensing capabilities in both consumer and professional electronics. Current business trends indicate a strong pivot towards high-power infrared GAAS emitters, capitalizing on the robust demand from sectors developing autonomous systems and advanced security infrastructure. Regionally, the Asia Pacific (APAC) area dominates production and consumption, fueled by established electronics manufacturing hubs in China, Taiwan, and South Korea, coupled with significant investments in 5G network deployment. North America and Europe demonstrate mature markets characterized by high adoption rates in premium automotive applications and sophisticated medical devices. Segment-wise, the Infrared GAAS LED segment is witnessing the fastest growth, underpinned by its irreplaceable role in VCSEL technology utilized for LiDAR in vehicles and facial recognition in smartphones, while the Automotive and Industrial Sensing application sectors collectively represent the largest market share, defining the immediate trajectory of market growth.

AI Impact Analysis on GAAS LED Market

User inquiries regarding AI's influence on the GAAS LED market center predominantly on three areas: how AI drives demand for specific components, whether AI-optimized design tools can reduce manufacturing costs, and the role of GAAS LEDs in next-generation AI-powered sensing platforms, such as advanced LiDAR and depth perception systems. The analysis reveals a symbiotic relationship: AI acts as a critical demand accelerator, requiring sophisticated hardware to process complex data inputs efficiently. High-resolution, high-speed sensing systems, essential for autonomous vehicles and smart robotics that utilize AI algorithms, rely heavily on the robust infrared output and rapid switching capability of GAAS LEDs. Furthermore, AI optimization tools are increasingly being deployed in the semiconductor fabrication process, enhancing yield rates and potentially lowering the unit cost of GAAS substrates, thereby making these specialized LEDs more economically viable for mass-market applications like smart home devices and consumer AR/VR equipment that integrate AI-driven tracking features. This synergy ensures sustained technological evolution and market relevance for GAAS components.

- AI drives demand for high-radiance infrared GAAS emitters necessary for LiDAR and Time-of-Flight (ToF) sensors used in autonomous AI systems.

- Integration of machine learning algorithms in semiconductor design enhances the efficiency and predictability of GAAS epitaxial growth, improving yield.

- AI-powered visual recognition systems in smartphones and security cameras necessitate sophisticated near-infrared GAAS illumination for accurate depth mapping and facial authentication.

- Predictive maintenance analytics, leveraging AI, extends the operational life of high-power GAAS LED industrial systems, optimizing replacement cycles.

- AI accelerates the development of advanced optical communication systems, where GAAS lasers and LEDs are critical for high-speed, low-latency data transmission required by cloud AI services.

DRO & Impact Forces Of GAAS LED Market

The GAAS LED market trajectory is significantly shaped by robust drivers, chief among them the global deployment of 5G infrastructure and the increasing incorporation of advanced safety and autonomous functionalities in vehicles, both of which require high-performance infrared components for connectivity and sensing. However, market expansion is moderated by substantial restraints, particularly the high cost associated with the fabrication of high-purity GaAs substrates and intense competition from alternative, lower-cost material technologies like Indium Gallium Nitride (InGaN) and specialized silicon photonics, especially in general lighting applications where GaAs’s advantages are less critical. These counteracting forces define a highly competitive but specialized market landscape. Opportunities, conversely, are emergent in the development of sophisticated biometric recognition systems and advanced human-machine interfaces, offering premium growth avenues.

Segmentation Analysis

The GAAS LED market is meticulously segmented based on product type, application, and geography, allowing for precise identification of high-growth niches and technological shifts. The Type segmentation distinguishes between Infrared, Red, and High-Power variations, reflecting differing spectral outputs and power requirements essential for specialized end-uses. Application segmentation highlights critical industries, including automotive, consumer electronics, medical, and industrial sensing, which are the primary consumption hubs for these specialized components. Geographic analysis further refines market understanding by assessing regional manufacturing capabilities, regulatory environments, and adoption rates, offering a comprehensive view of global market dynamics and investment priorities for market stakeholders.

- Type

- Red GAAS LEDs

- Infrared GAAS LEDs (Near-Infrared and Short-Wave Infrared)

- High-Power GAAS LEDs

- Application

- Automotive Lighting and Sensing

- Consumer Electronics (Smartphones, Wearables)

- Medical and Healthcare Devices (Oximetry, Phototherapy)

- Industrial Sensing and Automation

- Data Communication and Telecommunication

- Security and Surveillance Systems

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For GAAS LED Market

The value chain for the GAAS LED market commences with the upstream material supply, where raw Gallium and Arsenic are processed to create high-purity GaAs substrates, a specialized and often capital-intensive process controlled by a limited number of expert material providers. This is followed by epitaxial growth and chip fabrication, where compound semiconductor manufacturers deposit active layers on the substrate to form the LED chip, a stage demanding sophisticated technological expertise and precision engineering. Midstream activities involve packaging and assembly, where the bare chips are integrated into usable components (e.g., surface-mount devices or integrated modules) and tested for quality assurance, converting the chip into a sellable product. The effectiveness of this stage dictates the final performance characteristics, such as thermal management and operational lifespan.

Downstream activities focus on distribution and integration into end-user products. The distribution channel involves a combination of direct sales to large, specialized Original Equipment Manufacturers (OEMs) in sectors like automotive and telecommunications, and indirect channels utilizing technical distributors and value-added resellers (VARs) who cater to smaller industrial and consumer electronics clients. Direct sales channels are preferred for high-volume, custom-specification orders, ensuring specialized support and close collaboration between the component supplier and the OEM. Indirect channels provide broader market reach and localized inventory management, serving diverse application requirements efficiently, particularly in fragmented industrial sensing markets. The quality and reliability of these distribution networks are crucial for ensuring components reach demanding end-users in a timely manner.

The efficiency of the entire value chain is heavily dependent on strong integration between the substrate manufacturers and the LED fabricators to manage material specifications and control costs, which is highly sensitive due to the material's complexity. Continuous innovation in the packaging stage, particularly concerning thermal dissipation for high-power applications, provides significant competitive advantages. The final leg involves system integrators who incorporate the packaged GAAS LEDs into sophisticated systems like LiDAR units or optical data links, validating the performance in real-world environments. This detailed value flow underscores the technical barriers to entry and the specialized expertise required at every stage, from material purification to final systems integration.

GAAS LED Market Potential Customers

The primary end-users and buyers of GAAS LED products are large-scale Original Equipment Manufacturers (OEMs) operating within highly technical and specialized markets that demand superior infrared output and component reliability. Automotive manufacturers represent a key customer base, integrating high-power GAAS infrared LEDs into safety-critical systems such as autonomous driving sensors, driver attention monitoring, and in-cabin gesture control, where failure is unacceptable. Similarly, consumer electronics giants are crucial buyers, utilizing GAAS emitters for facial recognition modules in premium smartphones and depth sensing in high-end Augmented Reality (AR) devices and gaming consoles, relying on the speed and precision these components offer for sophisticated biometric security and interactive features.

Another significant segment comprises telecommunications and data infrastructure providers, specifically companies building 5G networks and data centers. These organizations purchase GAAS-based components, often in the form of Vertical-Cavity Surface-Emitting Lasers (VCSELs) derived from GAAS, for high-speed fiber optic transceivers and interconnects, where the requirement for ultra-fast data transfer and long operational life dictates the use of high-performance semiconductor materials. Medical device manufacturers, specializing in non-invasive patient monitoring equipment like advanced pulse oximeters and diagnostic imaging tools, also constitute a vital customer segment, valuing the specific, stable wavelengths provided by GAAS LEDs for accurate clinical measurements and therapeutic light applications.

Furthermore, industrial automation and security firms represent a consistently growing potential customer base. Industrial clients use GAAS LEDs in optical encoders, high-speed machine vision systems, and robust proximity sensors that must function reliably in harsh operating environments. Security and surveillance companies integrate these LEDs into night vision cameras and long-range perimeter defense systems, leveraging the superior radiant intensity of GAAS infrared sources. The demand profile across all these segments is unified by the need for high-performance, long-lasting, and wavelength-specific light sources that justify the specialized cost structure associated with Gallium Arsenide technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.52 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OSRAM Opto Semiconductors, Broadcom, Lumileds, Nichia Corporation, Seoul Semiconductor, Epistar Corporation, Lumentum Holdings, II-VI Incorporated, Vishay Intertechnology, Cree LED, Kingbright Electronic, Lite-On Technology, ROHM Semiconductor, TDK Corporation, Advanced Photonix, Sony Semiconductor Solutions, Coherent Corp., Schott AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GAAS LED Market Key Technology Landscape

The technological foundation of the GAAS LED market is centered on advanced compound semiconductor manufacturing techniques, particularly Metal-Organic Chemical Vapor Deposition (MOCVD) and Molecular Beam Epitaxy (MBE), which are essential for growing precise, multi-layered epitaxial structures on the GaAs substrate. MOCVD is the preferred method for mass production due to its high throughput and scalability, enabling the creation of complex device structures necessary for high-efficiency and high-power emitters. Recent technological focus has shifted toward optimizing these growth processes to reduce defect density and improve material uniformity, directly leading to enhanced LED performance characteristics such as higher radiant flux and extended operational lifespan. Furthermore, advancements in selective area growth techniques allow for the fabrication of complex photonic integrated circuits (PICs) utilizing GAAS technology.

A critical technical innovation driving current market growth is the development and optimization of Vertical-Cavity Surface-Emitting Lasers (VCSELs), which frequently use GaAs substrates. While technically lasers, VCSELs share foundational GAAS LED manufacturing processes and are vital for structured light applications in 3D sensing (e.g., facial recognition and LiDAR). VCSEL technology requires sophisticated wafer bonding and etching processes to create the mirrors and vertical cavity structure. Technological advancements here focus on increasing the output power and array density of VCSELs while ensuring efficient thermal management, which is essential for automotive LiDAR applications operating under stringent temperature requirements. The capability of GAAS to efficiently handle high current density makes it ideal for these high-power pulsed applications.

Finally, packaging technology constitutes a major area of innovation. For high-power GAAS LEDs, robust thermal dissipation solutions, including advanced ceramic substrates and specialized heat sinks, are crucial to maintain performance and reliability. Manufacturers are also implementing advanced optical design elements, such as molded lenses and reflectors, to precisely shape the beam profile for specific applications, ranging from narrow-angle beams for long-distance sensing to wide-angle illumination for near-field depth mapping. Integration of micro-optics directly into the LED package maximizes light extraction efficiency, a key factor in reducing overall power consumption and enhancing the competitiveness of GAAS components against alternative lighting and sensing solutions in the rapidly evolving electronics landscape.

Regional Highlights

Market dynamics for GAAS LEDs are highly heterogeneous across major global regions, reflecting variances in manufacturing infrastructure, technological adoption rates, and regulatory mandates regarding electronic component usage and safety standards.

- Asia Pacific (APAC): APAC remains the undisputed global leader in the GAAS LED market, driven by the massive concentration of consumer electronics manufacturing, particularly in China, South Korea, and Taiwan. The region benefits from lower operating costs and established, complex supply chains capable of high-volume production. Significant government investment in advanced telecommunications infrastructure, especially 5G and fiber optics, creates immense demand for GAAS-based VCSELs and high-speed infrared emitters. Furthermore, the burgeoning automotive sector in China and India is rapidly integrating advanced driver assistance systems (ADAS), fueling demand for automotive-grade GAAS sensing solutions, making it the fastest-growing consumption market globally.

- North America: Characterized by high technological maturity and significant expenditure on Research and Development (R&D), North America holds a dominant position in high-value, specialized segments. Demand is heavily concentrated in sophisticated defense applications, medical imaging, and the development of next-generation autonomous vehicle technology and LiDAR systems, particularly in Silicon Valley. The presence of major technology firms investing in AR/VR and advanced cloud computing infrastructure ensures continuous, high-specification demand. Rigorous automotive safety standards also necessitate the use of premium, reliable GAAS components in sensing applications.

- Europe: Europe is a key market, distinguished by its strength in the premium automotive sector (Germany, France) and stringent regulatory environment (e.g., GDPR, which impacts security and biometric systems design). The European market exhibits strong adoption of GAAS LEDs in industrial automation, machine vision, and sophisticated medical diagnostic equipment. Emphasis on energy efficiency and sustainable manufacturing practices further encourages the adoption of high-efficiency GAAS emitters, particularly within industrial sensing and optical measurement tools, although overall growth may be slightly slower than APAC due to lower mass production volumes.

- Latin America (LATAM): The GAAS LED market in LATAM is currently emerging, focusing primarily on consumer electronics assembly and expanding telecommunications infrastructure. Market growth is closely tied to overall economic development and increasing penetration of smartphones and basic smart security systems. While not a primary manufacturing hub for complex GAAS components, countries like Brazil and Mexico are important end-use markets, primarily importing finished goods containing GAAS LEDs for consumer applications and basic industrial sensing requirements.

- Middle East and Africa (MEA): The MEA region is showing promising growth, particularly in the Middle East, fueled by substantial investments in smart city projects (e.g., Saudi Arabia, UAE) and ambitious infrastructure initiatives. These projects require large-scale deployment of security and surveillance systems, driving demand for high-power infrared GAAS LEDs. In Africa, market penetration is nascent, largely restricted to mobile communication infrastructure and basic electronic assemblies, with growth potential dependent on stabilizing political economies and expanding access to high-speed data services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GAAS LED Market.- OSRAM Opto Semiconductors (A ams OSRAM Company)

- Broadcom

- Lumileds

- Nichia Corporation

- Seoul Semiconductor

- Epistar Corporation

- Lumentum Holdings

- II-VI Incorporated (Now Coherent Corp.)

- Vishay Intertechnology

- Cree LED

- Kingbright Electronic

- Lite-On Technology

- ROHM Semiconductor

- TDK Corporation

- Advanced Photonix

- TT Electronics

- Diodes Incorporated

- Shenzhen Fuman Electronics

- Quantum Devices Inc.

- Finisar Corporation (Now part of II-VI/Coherent)

Frequently Asked Questions

Analyze common user questions about the GAAS LED market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of GAAS LEDs over standard silicon-based components?

The primary advantage of GAAS (Gallium Arsenide) is its direct bandgap structure, which allows for extremely efficient conversion of electrical energy into light, particularly in the infrared and red spectrums. This results in much higher luminous or radiant efficiency and faster switching speeds compared to indirect bandgap materials like silicon or standard LEDs.

Which key application segment is driving the majority of growth in the GAAS LED market?

The Automotive Sensing and Communication segments are the primary growth drivers. The proliferation of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles requires high-reliability infrared GAAS components for LiDAR, proximity sensing, and driver monitoring. Concurrently, 5G network deployment demands high-speed GAAS VCSELs for fiber optic data transmission.

How does the high manufacturing cost of GAAS substrates impact market adoption?

The relatively high cost of producing high-purity GAAS substrates acts as a restraint, limiting their use primarily to high-performance, specialized applications (e.g., aerospace, high-end automotive, medical devices) where performance outweighs cost. This necessitates ongoing R&D into cost-efficient epitaxial growth techniques to enable broader commercial market penetration.

What role do Infrared GAAS LEDs play in modern consumer electronics?

Infrared GAAS LEDs are crucial for 3D sensing and biometric security features in modern consumer electronics, such as smartphones and AR/VR headsets. They provide the highly precise infrared illumination required for facial recognition, depth mapping (Time-of-Flight sensors), and gesture control functionalities.

Which geographic region dominates the production and consumption of GAAS LED components?

The Asia Pacific (APAC) region dominates both the production (due to centralized manufacturing hubs in Taiwan, China, and South Korea) and the consumption of GAAS LED components, driven by massive internal demand from the consumer electronics and telecommunications industries and rapid expansion of automotive safety technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager