Galactoarabinan Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442438 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Galactoarabinan Market Size

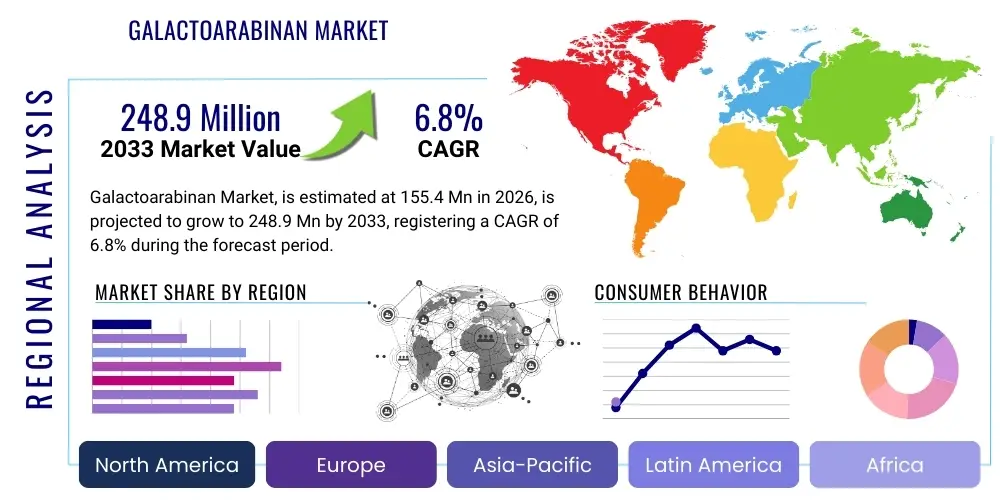

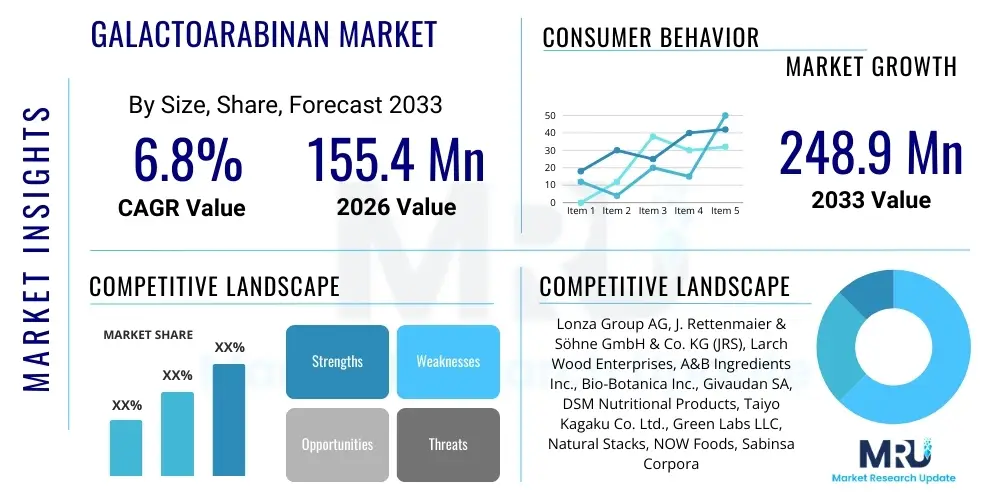

The Galactoarabinan Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 155.4 Million in 2026 and is projected to reach USD 248.9 Million by the end of the forecast period in 2033.

Galactoarabinan Market introduction

The Galactoarabinan market encompasses the production, distribution, and utilization of this natural polysaccharide derived primarily from the wood of the Larix tree species, specifically Western Larch (Larix occidentalis). Galactoarabinan, often marketed as larch arabinogalactan, is a highly branched, water-soluble biopolymer characterized by a backbone of galactan units linked to side chains of arabinose and galactose. Its unique structural configuration provides exceptional functional properties, positioning it as a versatile ingredient across multiple high-growth industries, including functional foods, dietary supplements, cosmetics, and pharmaceuticals. The inherent classification of Galactoarabinan as a dietary fiber, coupled with its significant prebiotic and immunomodulatory activities, drives its increasing adoption globally, moving it beyond niche applications into mainstream consumer products focused on gut health and immune support.

The primary applications driving market expansion are centered on its emulsifying, stabilizing, and film-forming capabilities in food matrices, and its hydration and soothing properties in cosmetic formulations. In the nutraceutical sector, Galactoarabinan is valued specifically for its ability to selectively stimulate the growth of beneficial gut bacteria, making it a critical component in prebiotic supplements and synbiotic products. Furthermore, research increasingly supports its role in enhancing overall immune function by activating certain immune cells, solidifying its position as a key ingredient in wellness and preventative health products. Product descriptions emphasize its natural origin, non-GMO status, and high purity levels, appealing directly to the clean label trends preferred by modern consumers.

Market growth is substantially driven by the rising consumer awareness regarding the profound link between gut microbiome health and overall systemic wellness, including immune system robustness. Regulatory approvals in key regions, particularly the Generally Recognized as Safe (GRAS) status in the United States and similar endorsements in Europe, have facilitated its seamless integration into various food and beverage categories. Manufacturing advancements focusing on sustainable extraction techniques and purification processes are also enhancing supply chain reliability and cost-effectiveness, further accelerating market penetration across developed and emerging economies seeking high-performance, natural functional ingredients.

Galactoarabinan Market Executive Summary

The Galactoarabinan Market is poised for robust expansion, reflecting strong business trends dominated by the surge in demand for natural, evidence-based functional ingredients. Strategic collaborations between raw material suppliers, predominantly located in North America where Larch wood is abundant, and global nutraceutical manufacturers are defining the competitive landscape. Key business trends include focused investment in clinical trials to substantiate health claims related to immune support and gut health, alongside significant efforts in developing specialized high-purity grades optimized for premium cosmetic formulations. Furthermore, the market is witnessing integration across the value chain, with leading players acquiring extraction technology specialists to secure proprietary methods that yield superior bioactivity and improved solubility profiles, thus reinforcing market leadership and differentiation based on product quality.

Regional trends indicate North America currently holds the largest market share, driven by high consumer spending on dietary supplements, stringent regulatory standards that favor natural GRAS-certified ingredients, and established industrial capacity for sourcing and processing Larix wood. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapidly growing populations, increasing disposable incomes, and a cultural shift towards preventative health and traditional medicine modernization, specifically incorporating high-fiber, natural polysaccharides into daily diets. Europe remains a mature market characterized by stringent cosmetic and food safety regulations, favoring high-quality Galactoarabinan derived from sustainable forestry practices, particularly for use in specialized medical nutrition products and premium clean beauty lines.

Segment trends reveal that the Application segment dominated by the Nutraceuticals and Dietary Supplements sub-segment, reflecting the strong consumer inclination toward prebiotic solutions. The Food & Beverage sector is also exhibiting rapid growth, leveraging Galactoarabinan’s dual functionality as both a source of fiber and an effective stabilizer in low-fat or reduced-sugar products. The Grade segment is increasingly segmented into pharmaceutical-grade and cosmetic-grade categories, indicating market maturation and the need for specialized purity levels tailored to specific industrial requirements. Future trends point towards enhanced customization of Galactoarabinan structure to optimize specific functional traits, such as increased viscosity or targeted delivery mechanisms within the gastrointestinal tract.

AI Impact Analysis on Galactoarabinan Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Galactoarabinan market reveals significant interest in three core themes: optimizing extraction and purification efficiency, accelerating R&D for novel applications, and improving supply chain resilience and traceability. Users frequently inquire about how AI-driven predictive modeling can enhance yield during the complex solvent extraction process, minimizing waste and energy consumption. There is also substantial curiosity regarding AI’s role in screening potential therapeutic uses—for instance, quickly analyzing large biological datasets to identify optimal Galactoarabinan derivatives for specific immunomodulatory effects or synergistic combinations with probiotics. Concerns revolve around the initial high cost of AI integration and the requirement for specialized data infrastructure to handle complex compositional analysis and quality control throughout the manufacturing lifecycle.

AI's primary influence is manifested through sophisticated predictive analytics. In raw material sourcing, AI algorithms can process geospatial data, climate patterns, and forest inventory metrics to optimize Larch harvesting schedules, ensuring maximal polysaccharide content and sustainable resource management. During manufacturing, AI-powered image recognition and spectroscopic analysis are revolutionizing quality control, enabling real-time monitoring of purity and compositional homogeneity, significantly reducing batch variability and ensuring compliance with pharmaceutical and food-grade standards. Furthermore, machine learning models are being deployed to fine-tune drying and grinding processes, critical steps that determine the final particle size and solubility characteristics, directly impacting the ingredient's functionality in end-user products.

The most transformative impact of AI is anticipated in product development and formulation. By utilizing neural networks to analyze complex interactions between Galactoarabinan and various formulation components (such as vitamins, minerals, or other functional fibers), R&D teams can rapidly predict stability, bioavailability, and sensory attributes. This capability dramatically shortens the time-to-market for innovative products, particularly in the competitive nutraceutical and functional food sectors. AI is also enhancing personalized nutrition platforms, where algorithms analyze individual gut microbiome data and suggest optimal dietary fiber intakes, including precise doses of Galactoarabinan, further driving targeted consumer demand.

- AI optimizes Larch wood harvesting schedules based on geospatial and climate data.

- Predictive modeling enhances extraction yield and minimizes solvent waste during purification.

- Machine learning algorithms enable real-time quality control checks for purity and consistency.

- AI accelerates R&D by simulating the interaction of Galactoarabinan with complex food matrices and biological systems.

- Blockchain integration, monitored by AI, improves supply chain traceability from forest to consumer.

- Automated spectroscopic analysis ensures adherence to specialized cosmetic and pharmaceutical grade specifications.

DRO & Impact Forces Of Galactoarabinan Market

The Galactoarabinan market dynamic is shaped by a confluence of influential factors, categorized as Drivers (D), Restraints (R), and Opportunities (O), which collectively dictate the market’s trajectory and competitive intensity. The primary drivers revolve around the documented health benefits, particularly its potent prebiotic activity and immunomodulatory properties, which align perfectly with prevailing global health and wellness movements focused on preventative care. Conversely, the market faces restraints stemming mainly from the geographically limited source of high-quality Larch wood, leading to potential supply chain vulnerabilities and volatility in raw material pricing, compounded by the presence of cheaper, synthetic alternatives in certain food thickening applications. Significant opportunities exist in expanding into clinical nutrition and advanced wound care markets, where its unique structural properties and biocompatibility offer distinct advantages over conventional biopolymers. These factors are continuously modulated by powerful external impact forces, including evolving regulatory scrutiny and increasing consumer demand for sustainability.

Drivers are strongly supported by rigorous scientific substantiation. The classification of Galactoarabinan as a soluble dietary fiber facilitates favorable labeling and marketing strategies in key regulatory zones. The versatility of its application, extending from being a functional binder in gluten-free bakery products to serving as an effective ingredient for moisture retention in anti-aging cosmetic serums, ensures broad market adoption. Further impetus comes from the clean label movement, where consumers actively seek natural, recognizable ingredients derived from botanical sources, giving Galactoarabinan a distinct competitive edge over synthetic gums or fibers. The continuous introduction of novel, specialized applications in pet nutrition and fermentation industries also contributes significantly to sustained demand growth.

Restraints are often operational and logistical in nature. The dependency on Western Larch sourcing, which is predominantly harvested in specific regions of North America, creates logistical challenges and subjects the global market to regional weather events or governmental forestry regulations. High capital investment required for state-of-the-art extraction and purification technologies, necessary to meet increasingly stringent purity standards (especially for pharmaceutical grades), acts as a barrier to entry for smaller manufacturers. Furthermore, while the health benefits are well-established, ongoing consumer education is essential to differentiate Galactoarabinan from general dietary fibers and justify its premium pricing compared to common fibers like inulin or pectin.

Opportunities are largely focused on technological innovation and market penetration. Developing microencapsulation techniques using Galactoarabinan offers the potential to protect sensitive ingredients (like probiotics) and enhance their targeted release within the gut. Expansion into personalized medicine, leveraging its specific prebiotic stimulation profile, represents a lucrative future pathway. The impact forces include robust competition from other functional fibers, requiring manufacturers to continuously prove cost-effectiveness and superior functionality. Additionally, increasing environmental awareness necessitates adherence to sustainable forestry certifications (e.g., FSC), impacting sourcing practices and operational costs, yet simultaneously strengthening the brand reputation among environmentally conscious consumers.

Segmentation Analysis

The Galactoarabinan market is comprehensively segmented based on its source material, the required grade and purity level, and the diverse range of end-user applications where its functional properties are utilized. Segmentation provides a critical framework for understanding market structure and identifying specific growth pockets, allowing suppliers to tailor product specifications and marketing efforts toward high-value sectors. The grade segmentation, particularly distinguishing between technical, food, cosmetic, and pharmaceutical purity levels, is crucial as it directly correlates with manufacturing complexity, regulatory compliance, and pricing strategies. Application segmentation highlights the increasing dominance of the nutraceutical industry, while the source segmentation reinforces the supply chain reliance on Larix species, although alternative botanical sources are under exploration.

The market structure is defined by the technical demands of end-use industries. For instance, the pharmaceutical and cosmetic segments require extremely high purity, low microbial counts, and specified molecular weight distribution, often achieved through specialized filtration and drying processes, thus commanding a premium price point. Conversely, technical grades, often used in less sensitive industrial applications like binding agents or adhesives, have lower purity requirements and represent the lower end of the pricing spectrum. This stratification ensures that manufacturers can optimize production methods to match the specific needs and regulatory constraints of each target market, maximizing profitability across the product portfolio.

Future growth will be driven by the convergence of segments, such as the rise of nutricosmetics—products blending nutraceutical benefits with cosmetic functionality. This trend leverages Galactoarabinan's dual role as a skin hydration agent when applied topically and an immune booster when ingested. Moreover, the segmentation based on formulation type (powder vs. liquid concentrates) is becoming increasingly relevant, catering to different manufacturing processes in the functional beverage and capsule markets. Analyzing these nuanced segment dynamics is essential for strategic market entry and competitive positioning in this highly specialized ingredient sector.

- By Source:

- Larch Tree (Larix occidentalis)

- Other Botanical Sources (e.g., Coffee, Cocoa)

- By Grade/Purity:

- Food Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Technical Grade

- By Application:

- Nutraceuticals and Dietary Supplements

- Food & Beverages (Bakery, Dairy, Confectionery, Functional Drinks)

- Cosmetics and Personal Care (Anti-aging, Moisturizers, Sunscreens)

- Pharmaceuticals (Binding Agents, Drug Delivery Systems)

- Animal Nutrition and Feed

- Industrial Applications (Adhesives, Emulsifiers)

Value Chain Analysis For Galactoarabinan Market

The Galactoarabinan value chain is complex and resource-intensive, beginning with the upstream sourcing of raw Larix wood and extending through highly specialized extraction and purification stages before reaching diverse downstream markets. The upstream segment is dominated by sustainable forestry operations and timber harvesting companies, primarily in North America, which supply the wood chips or sawdust containing the polysaccharide. Crucial challenges in this phase involve maintaining consistent raw material quality and complying with environmental regulations, which heavily influence input costs. Primary processors then use hot water or solvent extraction followed by multiple purification steps (such as ultrafiltration and spray drying) to isolate high-purity Galactoarabinan, requiring significant capital investment in processing facilities.

The midstream segment involves the refinement and formulation of the extracted ingredient. Specialized manufacturers focus on converting the crude extract into various grades—food, cosmetic, or pharmaceutical—each requiring specific quality control measures and certifications. This stage adds substantial value through proprietary processing techniques that enhance solubility, reduce viscosity, or standardize molecular weight, tailoring the product for specific end-user applications. Competition here centers on achieving cost-effective, high-yield extraction while meeting stringent global purity standards, particularly those mandated by regulatory bodies like the FDA or EFSA, ensuring the product's safety and efficacy for human consumption or topical use.

The downstream segment encompasses the distribution channels and end-user consumption. Distribution is bifurcated into direct sales to large, multinational food, beverage, and cosmetic manufacturers, and indirect sales facilitated by specialized ingredient distributors who handle smaller orders and manage localized logistics. These distributors play a vital role in providing technical support and regulatory assistance to regional formulators. The final consumption occurs across the diverse application sectors mentioned previously, with nutraceuticals being the most significant consumer. The efficiency of this value chain is increasingly reliant on establishing transparent partnerships between the initial source suppliers and the final end-product manufacturers to ensure consistent supply and rapid response to market demand shifts.

Galactoarabinan Market Potential Customers

Potential customers for Galactoarabinan are highly diverse, spanning sectors where natural functional ingredients offering prebiotic benefits, stabilization, or moisture retention properties are essential. The largest and fastest-growing customer segment is the nutraceutical industry, comprising manufacturers of dietary supplements focused on gut health, immune support, and fiber fortification. These buyers seek high-purity, clinical-grade Galactoarabinan to formulate capsules, powders, and functional shots, valuing its low glycemic index and verified prebiotic efficacy. Brand loyalty among these customers is often tied to demonstrated scientific backing and consistent product specifications, including solubility and organoleptic properties.

Another major segment includes large-scale food and beverage corporations, particularly those innovating in the functional food space, such as bakery, dairy alternatives, and health drinks. These customers utilize Galactoarabinan as a clean-label texturizer, emulsifier, and source of soluble fiber, especially in products targeting weight management or gluten-free consumers. Their purchasing decisions are primarily influenced by cost-in-use, ease of incorporation into existing manufacturing processes, and the ingredient's ability to maintain product quality (e.g., preventing phase separation or improving mouthfeel) without introducing unwanted flavors or colors.

The cosmetic and personal care industry represents a high-value, albeit smaller, customer base. Leading beauty brands focused on natural, anti-aging, and sensitive skin formulations purchase cosmetic-grade Galactoarabinan for its excellent water-binding capacity, film-forming properties, and perceived skin-soothing effects. Procurement managers in this sector prioritize supplier reliability, cosmetic regulatory compliance, and documentation supporting sustainability claims, often requiring highly refined, low-odor material that integrates well with complex emulsion systems. Finally, pharmaceutical companies utilize it as an excipient, binder, or stabilizer in controlled-release drug delivery systems, demanding the highest levels of purity and stringent regulatory documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.4 Million |

| Market Forecast in 2033 | USD 248.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group AG, J. Rettenmaier & Söhne GmbH & Co. KG (JRS), Larch Wood Enterprises, A&B Ingredients Inc., Bio-Botanica Inc., Givaudan SA, DSM Nutritional Products, Taiyo Kagaku Co. Ltd., Green Labs LLC, Natural Stacks, NOW Foods, Sabinsa Corporation, B&D Nutritional Ingredients, DuPont Nutrition & Biosciences, Vesta Ingredients, Inc., Santa Cruz Biotechnology, Inc., Chempoint, Ingredients By Nature, Fiberstar, Inc., Nexira. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Galactoarabinan Market Key Technology Landscape

The technological landscape surrounding the Galactoarabinan market is focused primarily on optimizing extraction yields, enhancing purity profiles, and developing specialized derivatives to improve functionality and stability in various end products. The foundational technology remains the solvent extraction process, typically involving hot water or pressurized liquid extraction from Larch wood chips. However, continuous innovation is driving the adoption of more advanced techniques such as Microwave-Assisted Extraction (MAE) and Ultrasonic-Assisted Extraction (UAE). These modern methods significantly reduce extraction time, lower energy consumption, and often result in higher yields of the polysaccharide while minimizing thermal degradation, thereby preserving its bioactivity and structural integrity.

Post-extraction purification is critical, particularly for cosmetic and pharmaceutical grades. Key technologies employed here include advanced membrane filtration systems, such as ultrafiltration and nanofiltration, which effectively separate the high molecular weight Galactoarabinan from lower molecular weight contaminants, phenolics, and residual processing solvents. The final drying process, essential for ensuring product stability and shelf life, relies on technologies like state-of-the-art spray drying or freeze-drying (lyophilization). Spray drying offers cost efficiency for high volumes, while freeze-drying is often reserved for premium, heat-sensitive grades used in high-end supplements or advanced drug delivery systems, guaranteeing superior solubility and particle morphology.

A burgeoning technological trend involves structural modification and targeted delivery systems. Research is focusing on enzymatically modifying Galactoarabinan to create derivatives with enhanced functional properties, such as specific molecular weights optimized for targeted colonic fermentation or increased viscosity for specialized cosmetic uses. Furthermore, microencapsulation technologies, including coacervation and electrospinning, are being explored to use Galactoarabinan as a carrier matrix. These technologies protect sensitive bioactives, like probiotics or vitamins, from harsh environments (e.g., stomach acid) and ensure their controlled release in the intended location within the digestive tract, significantly boosting the efficacy of synbiotic products and expanding its application in advanced medical therapies.

Regional Highlights

The Galactoarabinan market exhibits distinct regional growth patterns influenced by resource availability, regulatory environments, consumer health trends, and industrial application maturity. North America leads the global market due to the geographic concentration of Larix occidentalis resources, sophisticated processing infrastructure, and a robust, consumer-driven nutraceutical sector. The region benefits from early adoption of functional fibers and a strong tradition of supplement use, further reinforced by the FDA’s GRAS status for the ingredient. The presence of major market players involved in both sourcing and specialized extraction contributes to the region’s dominance.

Europe represents a mature and highly regulated market. Demand here is stable, driven primarily by the strong emphasis on preventative health, high-quality standards for cosmetic ingredients, and the robust medical nutrition sector. European consumers exhibit a preference for sustainably sourced and certified natural ingredients, pushing manufacturers towards stringent traceability and ethical sourcing practices. Germany, France, and the UK are key markets, utilizing Galactoarabinan extensively in fortified functional foods and premium personal care products, often demanding specialized low-viscosity grades for beverage applications.

Asia Pacific (APAC) is the fastest-growing market, characterized by rapid urbanization, increasing disposable incomes, and a cultural shift towards Western-style supplements and functional foods. Countries like China, Japan, and South Korea are experiencing massive growth in the dietary supplement and cosmetics sectors. While raw material sourcing is less prevalent in the region, the high demand for gut health products and clean-label cosmetics creates significant import opportunities. Regulatory harmonization across ASEAN nations and the increasing manufacturing capabilities of regional ingredient suppliers are key accelerators of market expansion in APAC.

- North America: Dominant market share; driven by abundant Larch resources, high consumer supplement adoption, and established regulatory framework (GRAS). Focus on immune support and dietary fiber applications.

- Europe: High maturity; characterized by stringent quality standards, strong focus on sustainable sourcing, and established use in medical food and premium cosmetic formulations.

- Asia Pacific (APAC): Highest growth rate; expansion fueled by burgeoning middle class, urbanization, demand for functional foods, and increasing local formulation capabilities in China and India.

- Latin America (LATAM): Emerging market; growth driven by increasing health awareness in Brazil and Mexico, focusing on incorporating natural fibers into everyday food products and beverages.

- Middle East and Africa (MEA): Niche adoption; growth primarily concentrated in urban centers, focusing on high-end imported nutraceuticals and specialized cosmetic ingredients due to limited local production capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Galactoarabinan Market.- Lonza Group AG

- J. Rettenmaier & Söhne GmbH & Co. KG (JRS)

- Larch Wood Enterprises

- A&B Ingredients Inc.

- Bio-Botanica Inc.

- Givaudan SA

- DSM Nutritional Products

- Taiyo Kagaku Co. Ltd.

- Green Labs LLC

- Natural Stacks

- NOW Foods

- Sabinsa Corporation

- B&D Nutritional Ingredients

- DuPont Nutrition & Biosciences

- Vesta Ingredients, Inc.

- Santa Cruz Biotechnology, Inc.

- Chempoint

- Ingredients By Nature

- Fiberstar, Inc.

- Nexira

- Cargill, Incorporated (through relevant division)

- Archer Daniels Midland Company (ADM)

Frequently Asked Questions

Analyze common user questions about the Galactoarabinan market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Galactoarabinan and what are its primary health benefits?

Galactoarabinan is a natural, water-soluble polysaccharide primarily extracted from the Western Larch tree. Its primary benefits include acting as a potent prebiotic fiber, supporting gut microbiome health, and demonstrating significant immunomodulatory effects, contributing to overall immune system support.

In which industry applications is Galactoarabinan most frequently used?

Galactoarabinan is predominantly used in the nutraceutical and dietary supplement industry for prebiotic formulations. It is also extensively utilized in functional foods and beverages as a source of soluble fiber and texturizer, and in cosmetics for its excellent film-forming and moisture retention properties.

How is the purity of Galactoarabinan typically measured and what are the different grades available?

Purity is typically measured by analyzing the percentage content of the polysaccharide and testing for contaminants and residual solvents. The market is segmented into various grades: Technical Grade, Food Grade, Cosmetic Grade, and Pharmaceutical Grade, with the latter requiring the most stringent purity and regulatory compliance.

What are the key drivers expected to propel the growth of the Galactoarabinan market?

The key drivers include rising global consumer awareness regarding the health benefits of prebiotics and dietary fiber, increasing demand for natural and clean-label functional ingredients, and growing scientific validation of its role in immune system enhancement and gut health maintenance.

Which geographical region dominates the Galactoarabinan supply chain and why?

North America currently dominates the supply chain due to the natural abundance of the primary source material, Western Larch, and the presence of advanced processing facilities. The region also benefits from established regulatory frameworks (GRAS status) supporting its use in functional food and supplements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager