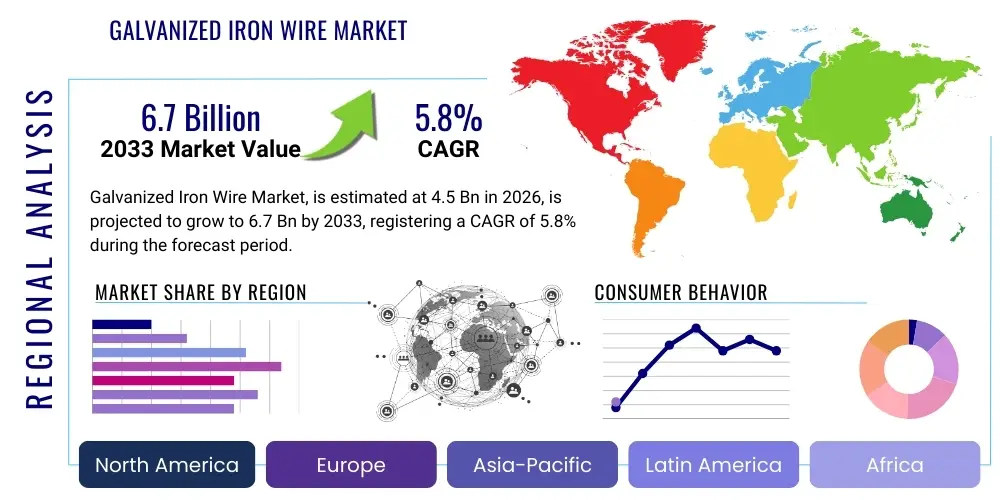

Galvanized Iron Wire Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442715 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Galvanized Iron Wire Market Size

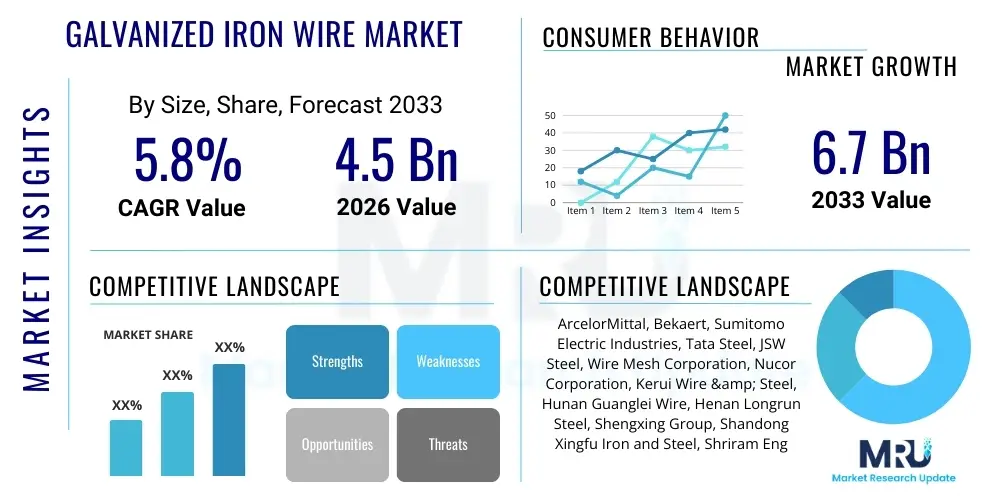

The Galvanized Iron Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Galvanized Iron Wire Market introduction

The Galvanized Iron Wire market encompasses the production, distribution, and utilization of iron wire that has undergone a galvanization process, typically involving hot-dip galvanizing or electro-galvanizing, to apply a protective zinc coating. This coating serves as a critical barrier against corrosion and rust, significantly extending the lifespan and performance characteristics of the underlying steel substrate. The product is fundamental to infrastructure development, agricultural practices, and various industrial applications where durability and resistance to environmental degradation are paramount. The inherent strength and flexibility of iron wire, combined with the superior anti-corrosion properties of zinc, make galvanized iron wire a preferred material over untreated wire in harsh or exposed environments, ensuring structural integrity and long-term cost efficiency for end-users globally.

Galvanized iron wire is manufactured in various gauges and tensile strengths, catering to specific application requirements ranging from thin binding wires to heavy-duty structural cables. The primary benefit derived from the galvanization process is the cathodic protection provided by the zinc layer; even if the coating is slightly damaged, the zinc sacrifices itself to protect the exposed iron, preventing localized rusting. Major applications span several crucial economic sectors, including the creation of chain link fencing, barbed wire, mesh, cable armoring, vineyards, and structural components in construction. The quality and uniformity of the zinc coating, measured in grams per square meter, are critical differentiators influencing market price and application suitability, with higher coating weights generally indicating superior longevity for exterior use.

Driving factors for sustained market growth are multifaceted, rooted primarily in rapid urbanization, increased infrastructural investments in developing economies, and the essential need for durable agricultural materials. Government initiatives promoting smart cities and resilient infrastructure necessitate high-quality, corrosion-resistant materials, directly fueling demand for galvanized iron wire in new construction and refurbishment projects. Furthermore, the global agricultural sector relies heavily on this material for effective crop support systems, boundary marking, and animal containment, particularly given the material's resistance to weathering and common chemical treatments. Technological advancements in the galvanization process, aiming for more environmentally friendly and cost-effective zinc application methods, also contribute positively to market expansion and accessibility.

Galvanized Iron Wire Market Executive Summary

The Galvanized Iron Wire market exhibits robust business trends characterized by a shift toward high-tensile strength and heavily galvanized products, reflecting the growing demand for materials with extended service life in critical infrastructure. Manufacturers are increasingly focused on adopting cleaner production methods, such as utilizing continuous annealing and pickling lines, to enhance product quality while reducing environmental impact, thereby addressing stringent global regulatory standards. Competition remains intense, driven by capacity expansion in Asia Pacific and continuous product innovation centered around specialty alloys for applications requiring enhanced flexibility or specific electrical conductivity properties. Strategic partnerships across the value chain, particularly between primary steel manufacturers and galvanizers, are becoming common practice to secure raw material supply and optimize production logistics, ensuring competitive pricing structures for high-volume orders.

Regional trends significantly influence market dynamics, with the Asia Pacific (APAC) region maintaining dominance due to unprecedented levels of infrastructural development and housing construction, particularly in China and India. The rapid pace of urbanization in Southeast Asia continues to bolster demand for construction-grade wire and fencing materials. Conversely, mature markets in North America and Europe emphasize replacement cycles and high-specification products for renewable energy infrastructure and specialized industrial applications, prioritizing quality and sustainability credentials over sheer volume. The Middle East and Africa (MEA) are emerging as high-growth regions, driven by large-scale government investments in oil & gas infrastructure, transportation networks, and mega-construction projects, creating substantial opportunities for international galvanized wire suppliers focusing on compliance with extreme climate specifications.

Segment trends highlight the critical role of the application landscape in shaping market demand. The construction sector, including both residential and commercial infrastructure, remains the largest consumer segment, favoring standard hot-dip galvanized wire for binding, mesh, and structural reinforcement. However, the telecommunication and power transmission sectors are driving increased demand for specialized galvanized steel strands and high-carbon wires used in cable armoring and messenger wires, requiring stringent quality control and certified tensile properties. Furthermore, the agricultural segment is showing steady growth, specifically for heavy gauge wires utilized in durable perimeter fencing and modern greenhouse structures, underscoring the necessity for products that offer optimal balance between cost-efficiency and environmental resilience against corrosive agricultural inputs.

AI Impact Analysis on Galvanized Iron Wire Market

Common user questions regarding AI's impact on the Galvanized Iron Wire Market often revolve around operational efficiency, quality assurance, and predictive maintenance within manufacturing facilities. Users are primarily concerned with whether AI can optimize the galvanization bath process—specifically controlling zinc consumption and temperature uniformity—to reduce costs and improve coating consistency, which is a key quality metric. Another major theme is the integration of machine vision and learning algorithms to detect micro-defects in real-time along the wire drawing and galvanizing lines, aiming for zero-defect production runs. Furthermore, stakeholders frequently inquire about AI's role in optimizing supply chain logistics, forecasting raw material (zinc and steel) price volatility, and automating inventory management based on complex, predictive demand models linked to global construction and commodity market cycles.

The adoption of AI and machine learning (ML) is gradually transforming the manufacturing landscape of galvanized iron wire, moving operations towards 'Industry 4.0' standards. AI systems are being implemented to analyze vast datasets collected from sensors along the production line, allowing for dynamic adjustments to wire drawing speeds, annealing temperatures, and flux composition. This real-time optimization leads to significant improvements in yield rates and energy efficiency. Predictive maintenance facilitated by ML algorithms anticipates equipment failures, particularly in high-stress areas like drawing dies and galvanization rollers, dramatically minimizing unplanned downtime and extending the service life of expensive machinery.

Beyond the factory floor, AI provides sophisticated tools for market strategy and sales optimization. ML models analyze macroeconomic indicators, governmental spending on infrastructure, and historical commodity price fluctuations to generate highly accurate demand forecasts, enabling manufacturers to optimize inventory levels and hedging strategies for raw materials. This analytical capability is crucial in a commodity-driven market like galvanized wire, allowing suppliers to respond proactively to geopolitical risks and trade policy changes. Ultimately, AI integration enhances the competitive edge of manufacturers through superior quality control, optimized resource utilization, and smarter, data-driven business decisions.

- Enhanced Process Control: AI algorithms optimize zinc bath temperature and immersion time for uniform coating thickness.

- Predictive Quality Assurance: Machine vision systems detect surface defects (e.g., skips, lumps) in real-time during production.

- Supply Chain Optimization: ML models forecast raw material (zinc, steel) needs and price fluctuations, aiding procurement strategy.

- Maintenance Forecasting: AI predicts potential failures in drawing machines and galvanizing equipment, reducing costly downtime.

- Energy Efficiency: Optimization of annealing furnace usage and energy consumption based on production load.

- Automated Inspection and Grading: Utilizing AI for automated classification and sorting of finished wire coils based on tensile strength and coating weight.

DRO & Impact Forces Of Galvanized Iron Wire Market

The Galvanized Iron Wire Market is primarily driven by robust global infrastructure spending and accelerated urbanization, particularly in emerging economies where residential and commercial construction demands are continuously escalating. The material's inherent advantage of superior corrosion resistance, offering a low maintenance and long service life solution compared to untreated materials, solidifies its indispensable role in fencing, binding, and structural applications exposed to weather elements. However, the market faces significant restraints, chiefly stemming from the high volatility and fluctuating prices of key raw materials—namely steel rod and zinc—which directly impacts manufacturing costs and profit margins. Furthermore, stringent environmental regulations regarding zinc usage and the waste generated from the galvanization process pose compliance challenges and necessitate investment in cleaner technologies, adding operational complexity.

Opportunities for growth are concentrated within the development of specialized, high-performance galvanized wire products, such as those optimized for solar panel mounting structures and high-tension utility cables. The increasing global focus on renewable energy infrastructure mandates materials capable of withstanding extreme environmental conditions for decades, creating a niche for premium, heavily coated wires. Market participants can also capitalize on the growing demand for advanced agricultural applications, including sophisticated trellis systems and durable livestock fencing that require specific mechanical properties and corrosion protection. Geographical expansion into rapidly developing regions across Africa and parts of Latin America, where basic infrastructural buildup is in its infancy, represents a critical avenue for long-term revenue growth and market penetration.

The impact forces driving the market are dominated by economic development and regulatory pressure. Economically, the market's trajectory is inextricably linked to global GDP growth and the stability of commodity markets; stable zinc and steel prices foster manufacturing stability, while economic downturns immediately depress construction and industrial demand. Technologically, innovation focuses on enhancing the coating adhesion and uniformity, leading to improved product performance that differentiates market leaders. Environmentally, the push towards green galvanization processes, minimizing waste water and airborne emissions, acts as a significant force, compelling producers to invest in closed-loop systems and sustainable resource management, ultimately favoring those companies demonstrating strong environmental compliance and operational efficiency.

Segmentation Analysis

The Galvanized Iron Wire market is comprehensively segmented primarily by the Process utilized (Hot-Dip Galvanized, Electro-Galvanized), the Type of steel used (Low Carbon Steel, High Carbon Steel, Medium Carbon Steel), and the diverse Application areas (Construction, Agriculture, Telecommunication/Power, Industrial, Others). Analyzing these segments allows market participants to tailor production and marketing efforts to specific end-user requirements and material specifications. For instance, the choice between hot-dip and electro-galvanization is crucial, as it dictates the coating thickness, surface finish, and cost—hot-dip offers superior protection for outdoor, high-corrosion applications, while electro-galvanization provides a smoother finish suitable for internal components and aesthetic purposes.

The segmentation by carbon content (Type) directly reflects the required mechanical properties of the final wire product. Low carbon wire is preferred for applications requiring high flexibility, such as binding and netting, whereas high carbon wire is essential for applications demanding high tensile strength and load-bearing capacity, commonly found in prestressed concrete reinforcement or suspension cables. Understanding the proportional growth across these types is vital for forecasting raw material demand and optimizing steel rod sourcing strategies. The increasing sophistication of infrastructure projects necessitates a higher volume of specialized high-carbon galvanized wire, marginally shifting the market equilibrium away from traditionally dominant low-carbon varieties.

Application segmentation remains the most critical determinant of market dynamics. The construction sector's steady demand ensures its leading market share, but rapid technological advancements in power transmission and telecommunications (requiring robust messenger wire and cable armor) are creating fast-growing sub-segments. Furthermore, the specialized industrial applications, including automotive components, spring manufacturing, and domestic appliances, though smaller in volume, often command premium pricing due to stringent tolerance and finish requirements. Strategic insight derived from this segmentation helps businesses prioritize R&D investments toward product specifications that align with high-growth application areas, maximizing returns on product development efforts.

- By Process:

- Hot-Dip Galvanized

- Electro-Galvanized

- Mechanically Galvanized

- By Type (Carbon Content):

- Low Carbon Galvanized Iron Wire

- Medium Carbon Galvanized Iron Wire

- High Carbon Galvanized Iron Wire

- By Coating Thickness/Weight:

- Standard Coating (Light)

- Heavy Coating (Jumbo)

- By Application:

- Construction & Infrastructure (Binding Wire, Mesh, Reinforcement)

- Agriculture (Fencing, Trellis Wire, Barbed Wire)

- Telecommunication & Power (Messenger Wire, Cable Armor)

- Industrial (Springs, Handles, Baskets)

- Others (Mining, Marine, Domestic Use)

Value Chain Analysis For Galvanized Iron Wire Market

The value chain for the Galvanized Iron Wire market commences with the upstream segment, dominated by the procurement and primary processing of core raw materials: steel wire rods (primarily mild steel or high carbon steel) and zinc ingots. Primary steel manufacturers and major zinc miners hold significant leverage in this initial stage, as the price and availability of these commodities fundamentally dictate the operational costs for galvanizers. Efficient sourcing, secured long-term contracts, and in-house steel rod drawing capabilities provide a competitive advantage to large integrated players. Technological sophistication in steel rod production, ensuring minimal impurities and optimal mechanical properties suitable for high-speed drawing, is a crucial element influencing the quality of the final galvanized product.

The midstream stage involves the specialized manufacturing processes, encompassing wire drawing (reducing the diameter of the steel rod), annealing (heat treatment to achieve desired flexibility), pickling (cleaning the wire surface), and finally, the galvanization process (hot-dip or electroplating). This segment is capital-intensive, requiring specialized equipment for continuous processing and rigorous quality control measures. Distribution channels then link these manufacturers to the end-users. Direct sales are common for large volume industrial buyers, infrastructure projects, and utility companies, allowing manufacturers to maintain tight control over delivery schedules and custom specifications. Indirect channels involve a network of regional distributors, wholesalers, and retailers, who play a vital role in reaching smaller construction contractors, agricultural dealers, and localized hardware markets, providing inventory buffers and localized cutting services.

The downstream analysis focuses on the final consumption sectors. The construction and agriculture segments drive the majority of demand, utilizing the wire for specific applications such as binding concrete reinforcement bars, creating durable fencing, and setting up complex crop trellises. Direct sales models benefit from established relationships with major construction firms and government agencies undertaking infrastructure bids. The indirect channel thrives by servicing the highly fragmented small-to-medium enterprise (SME) construction market and local agricultural suppliers. The efficiency of the downstream distribution network, including logistics for handling heavy, bulky wire coils and ensuring timely delivery to remote project sites, significantly impacts overall customer satisfaction and market reach across various regional geographies.

Galvanized Iron Wire Market Potential Customers

Potential customers for galvanized iron wire span a broad spectrum of industries, primarily dictated by the fundamental need for corrosion-resistant, high-strength metallic materials used in structural, protective, or containment applications. The largest cohort of customers resides within the building and construction sector, including residential developers, commercial infrastructure firms, and civil engineering companies. These entities procure substantial volumes of low-carbon galvanized binding wire used to tie rebar, and heavier gauge wires incorporated into concrete structures, wire mesh, and perimeter barriers. For these customers, key purchasing criteria include compliance with national building codes, certifications regarding zinc coating weight and adhesion, and reliable just-in-time delivery for large, scheduled projects to minimize site delays and material handling costs.

Another major segment of potential customers encompasses the utility and telecommunications industries, specifically companies responsible for power transmission, distribution networks, and optical fiber cabling. These customers require high-carbon galvanized steel strands for messenger wire applications, providing crucial mechanical support for overhead cables, as well as galvanized wire used for cable armoring to protect sensitive conductors from physical damage and environmental exposure. Their purchasing decisions are heavily influenced by technical specifications such as high tensile strength, minimal elongation under load, and certification for long-term reliability in varying climatic conditions. Furthermore, government agencies and municipal entities responsible for public works, road infrastructure, and utility maintenance are significant institutional buyers.

The agricultural and animal husbandry sectors represent a continuously growing base of end-users. Farmers, large-scale agribusinesses, and livestock operations purchase galvanized iron wire extensively for purposes such as farm fencing, vineyard trellis systems, orchard support structures, and containment cages. In this segment, the emphasis is placed on cost-effectiveness combined with durable coating thickness to withstand exposure to fertilizers, pesticides, and prolonged weathering. Finally, smaller, specialized industrial manufacturers utilize the wire for niche applications, including spring production, wire basket fabrication, and specialized fastening solutions, often requiring customized wire diameters and specific surface finishes, making consistency and specialized product availability crucial for maintaining their operational supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Bekaert, Sumitomo Electric Industries, Tata Steel, JSW Steel, Wire Mesh Corporation, Nucor Corporation, Kerui Wire & Steel, Hunan Guanglei Wire, Henan Longrun Steel, Shengxing Group, Shandong Xingfu Iron and Steel, Shriram Engineering, TrefilUnion, Kiswire Ltd., Paramount Wires, Global Wire Industries, Hebei Runfei Trade, Nippon Steel, Zamil Steel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Galvanized Iron Wire Market Key Technology Landscape

The technological landscape of the Galvanized Iron Wire market is heavily focused on refining the processes of wire drawing and zinc coating application to enhance product performance, consistency, and environmental sustainability. A key area of innovation is in continuous hot-dip galvanizing lines, where advancements include non-oxidizing pre-treatment furnaces and air-wiping technology. Non-oxidizing furnaces ensure the wire surface remains perfectly clean before entering the zinc bath, leading to superior adhesion and fewer defects. Air-wiping systems, which utilize precise air jets, control the thickness and uniformity of the zinc coating at high speeds, reducing material consumption and waste while ensuring the wire meets stringent coating specifications required for heavy-duty applications like bridge cable components or marine use.

Another pivotal technological advancement involves the development and application of advanced material science in the steel core. Micro-alloyed high-carbon steel rods are increasingly utilized to achieve ultra-high tensile strengths without compromising ductility, which is essential for specialized applications such as prestressed concrete wire and high-voltage transmission lines. Furthermore, researchers are exploring alternative or composite coating methods, such as Galfan (a zinc-aluminum alloy coating), which offers corrosion resistance superior to traditional pure zinc in certain acidic or marine environments. These technological shifts allow manufacturers to offer premium products with guaranteed service lives of 50 years or more, justifying higher pricing and catering to critical infrastructure projects globally.

Process automation and integration of digital control systems are central to modern wire manufacturing facilities. Sophisticated PLCs (Programmable Logic Controllers) manage the entire production chain, from initial rod drawing through final coiling and packaging, ensuring minimal human error and maximum operational consistency. Advanced systems monitor key parameters like chemical bath composition, wire temperature, and tension in real-time. This precision control not only enhances product quality but also significantly improves energy efficiency during the annealing and melting processes, contributing to lower operational costs and a reduced carbon footprint, aligning with global trends toward sustainable industrial production and resource optimization.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market volume due to massive government expenditure on infrastructure development (roads, rail, utility grids) and continuous growth in the residential and commercial construction sectors in economies such as China, India, and Indonesia. High urbanization rates translate directly into surging demand for fencing and binding wires.

- North America: Characterized by a mature market focused on replacement cycles, high-quality standards, and specialized applications. Demand is strong for high-tensile wire used in agricultural fencing (cattle ranching) and heavily galvanized wire utilized in cable support systems for aging power infrastructure refurbishment projects.

- Europe: Exhibits steady, moderate growth driven by strict regulatory requirements emphasizing long-life, environmentally compliant materials. Key demand segments include renewable energy infrastructure (solar farms, wind turbine supports) and specialized industrial applications requiring certified corrosion resistance and traceable material sourcing.

- Middle East and Africa (MEA): A high-potential growth region fueled by ambitious national development visions (e.g., Saudi Vision 2030) and resource expansion projects. Demand is particularly high for thick-coated, robust wire products that can withstand the intense heat, salinity, and sand erosion typical of the regional climate, especially in oil & gas and construction sectors.

- Latin America: Growth is highly dependent on commodity cycles and political stability. Major consumers include agricultural operations in Brazil and Argentina, which require extensive durable fencing, alongside steady, though fluctuating, demand from urban infrastructural projects in Mexico and Chile.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Galvanized Iron Wire Market.- ArcelorMittal

- Bekaert

- Tata Steel

- Sumitomo Electric Industries

- JSW Steel

- Nucor Corporation

- Wire Mesh Corporation

- Kerui Wire & Steel

- Hunan Guanglei Wire

- Henan Longrun Steel

- Shengxing Group

- Shandong Xingfu Iron and Steel

- Shriram Engineering

- TrefilUnion

- Kiswire Ltd.

- Paramount Wires

- Global Wire Industries

- Hebei Runfei Trade Co., Ltd.

- Nippon Steel Corporation

- Zamil Steel Industries

Frequently Asked Questions

Analyze common user questions about the Galvanized Iron Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hot-dip and electro-galvanized wire?

The primary difference lies in coating thickness and adhesion. Hot-dip galvanization involves submerging the wire in molten zinc, resulting in a thick, metallurgical bond offering superior corrosion resistance for heavy-duty outdoor and structural applications. Electro-galvanization uses an electrolytic process, yielding a much thinner, smoother, and brighter zinc coating that is suitable for light-duty, aesthetic, or indoor applications where precision and finish are prioritized over extreme durability.

Which application segment drives the highest demand for Galvanized Iron Wire globally?

The Construction and Infrastructure segment consistently drives the highest global demand. This sector utilizes galvanized iron wire extensively for crucial applications such as concrete binding, mesh reinforcement, highway barriers, and general perimeter fencing, directly correlating market growth with governmental infrastructure spending and global housing development rates, especially in Asia Pacific.

How does the volatility of zinc prices impact the profitability of galvanized wire manufacturers?

Zinc represents a significant portion of the variable manufacturing cost. High volatility in global zinc commodity prices directly compresses the profit margins of galvanized wire producers, especially those without effective raw material hedging strategies. Manufacturers must either pass these increased costs to end-users, potentially impacting competitiveness, or absorb the cost spikes, necessitating operational efficiency improvements like AI-driven process optimization to maintain profitability.

What technological advancements are enhancing the lifespan of galvanized iron wire products?

Key technological advancements include the adoption of zinc-aluminum alloy coatings (like Galfan) which offer up to three times the corrosion resistance of traditional pure zinc coatings, and improvements in air-wiping technology during hot-dip galvanization. These methods ensure greater coating uniformity and adhesion, enabling manufacturers to produce heavy-coated wires guaranteed for extended service lives, crucial for infrastructure and utility applications.

What role does the carbon content of the steel core play in galvanized wire selection?

Carbon content dictates the mechanical properties of the finished wire. Low carbon wire offers high ductility and flexibility, making it ideal for binding and netting. High carbon wire possesses superior tensile strength and rigidity, essential for high-load applications such as prestressed concrete reinforcement, cable armor, and durable high-tension agricultural fencing, requiring careful selection based on the specific load-bearing requirements of the end-use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager