Gantry and Cartesian Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441443 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Gantry and Cartesian Robots Market Size

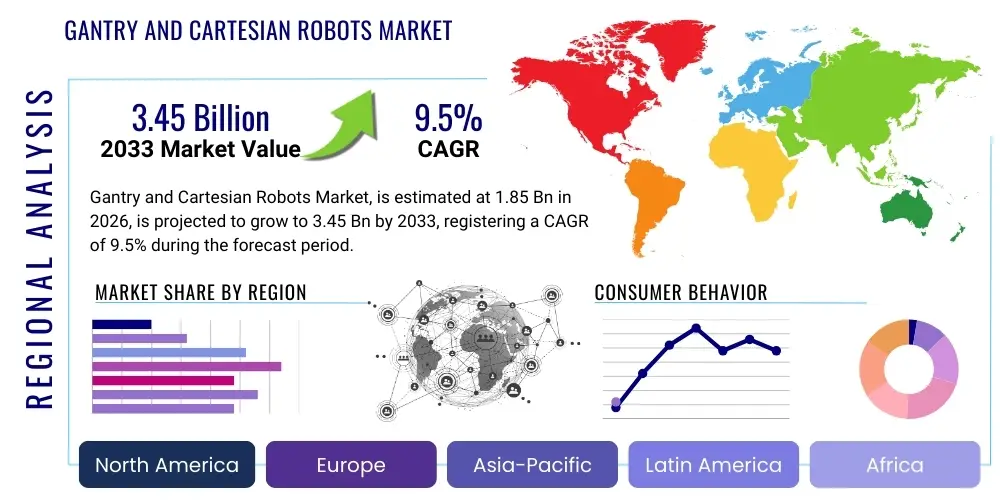

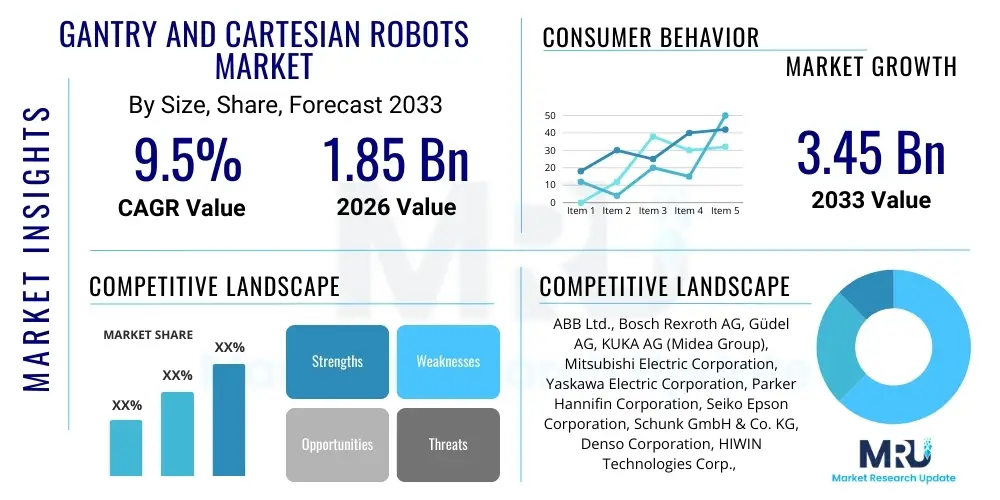

The Gantry and Cartesian Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.45 Billion by the end of the forecast period in 2033.

Gantry and Cartesian Robots Market introduction

The Gantry and Cartesian Robots Market encompasses robotic systems characterized by their linear movement along three primary axes (X, Y, and Z), often configured within a fixed frame or gantry structure. These systems utilize precise linear guides, servo motors, and advanced control software to achieve high accuracy, repeatability, and large working envelopes, making them ideal for tasks requiring large-scale handling or high-speed precision movements over a defined area. Unlike articulated robots, gantry and Cartesian systems excel in applications where footprint efficiency, scalability, and structural rigidity are paramount, particularly in demanding industrial environments where heavy loads or expansive work areas are common requirements. The inherent mechanical simplicity of these robots, combined with their modular design, allows for easy customization to fit diverse industrial processes, driving their adoption across specialized manufacturing and logistics operations.

Major applications of these robots span across numerous high-growth sectors, including electronics assembly, where precision pick-and-place operations are crucial for microcomponent handling; automotive manufacturing, for tasks such as adhesive dispensing, welding, and material handling of large parts; and pharmaceutical production, where strict adherence to sterile environments and traceability is mandated. Furthermore, the rapid expansion of e-commerce and subsequent demand for warehouse automation have cemented Gantry and Cartesian robots as foundational technology for high-speed automated storage and retrieval systems (AS/RS) and palletizing tasks. Their ability to handle significant payloads over extended distances with unwavering accuracy provides a crucial competitive advantage in throughput and operational efficiency compared to traditional manual labor or smaller fixed-base robotic solutions.

The primary benefit driving the market expansion is the superior volumetric utilization and scalability offered by these systems. Driving factors include the persistent global labor shortage in manufacturing and logistics, the accelerating pace of digital transformation leading to Industry 4.0 adoption, and increasing consumer demands for customized products requiring flexible manufacturing processes. Additionally, advancements in components such as lighter, stronger materials for gantry frames, higher-resolution encoders, and faster servo drive systems are continually improving robot performance parameters, making them attractive investments for companies seeking to optimize capital expenditure and long-term operational costs.

Gantry and Cartesian Robots Market Executive Summary

The Gantry and Cartesian Robots Market is experiencing robust growth fueled by macro-level business trends emphasizing supply chain resilience and decentralized manufacturing. Companies are increasingly investing in modular automation to mitigate geopolitical risks and escalating labor costs, shifting towards systems that offer flexibility and rapid deployment. Key business trends include the convergence of advanced motion control technology with software-defined manufacturing platforms, enabling faster retooling and simplified integration into existing production lines. This trend is particularly evident in the electronics and semiconductor industries, where the demand for ultra-precise, high-throughput handling systems is critical for next-generation fabrication processes. Furthermore, the focus on sustainable manufacturing is driving the adoption of energy-efficient linear motor technology, contributing to reduced operational carbon footprints and increased long-term viability of automated systems.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven primarily by massive investments in factory automation in China, South Korea, and Japan, especially within the high-volume electronics and automotive sectors. North America and Europe, while having higher initial automation saturation, are characterized by high-value applications, focusing on implementing complex, custom-engineered gantry systems for niche production runs, aerospace manufacturing, and advanced logistics hubs. Regional trends show a pronounced shift towards localized manufacturing (reshoring), which mandates the establishment of automated domestic facilities, thereby sustaining high demand for scalable robotic solutions that can manage varied product lines effectively. Regulatory environments in Europe, emphasizing worker safety and stringent quality control, further accelerate the replacement of potentially hazardous or inconsistent manual tasks with reliable, large-scale robotic systems.

Segment trends indicate that the four-axis and six-axis variants, which offer increased dexterity through rotational components mounted on the Cartesian structure, are gaining traction, particularly for complex assembly and dispensing tasks that require navigating obstacles. By application, material handling and assembly segments maintain the largest market share due to their broad applicability across diverse industries. However, the inspection and quality control segment is projected to exhibit the highest growth rate, driven by the integration of advanced 3D machine vision systems onto gantry platforms, allowing for rapid, non-contact measurement and defect detection across large product surfaces. The integration of collaborative safety features is also a defining trend, enabling larger gantry systems to operate safely alongside human workers, enhancing overall flexibility within automated zones.

AI Impact Analysis on Gantry and Cartesian Robots Market

User inquiries regarding AI's influence on the Gantry and Cartesian Robots Market center predominantly on themes of predictive maintenance, optimization of complex motion profiles, and the implementation of adaptive control loops. Users seek clarification on how AI can transition these traditional, high-precision mechanical systems into truly intelligent, autonomous workhorses. Key concerns revolve around the expected return on investment (ROI) from AI integration, the necessary computational infrastructure at the edge, and the challenges associated with standardizing data inputs across different gantry manufacturers. The overarching expectation is that AI will unlock new levels of efficiency, dramatically reduce unexpected downtime through condition monitoring, and enable robots to dynamically adjust their trajectories and processing parameters in response to real-time changes in the manufacturing environment or material properties.

The immediate impact of Artificial Intelligence (AI) is most visible in enhancing the reliability and throughput of gantry systems. Machine learning algorithms analyze vast streams of operational data, including motor current, vibration, and temperature readings from linear guides and bearing systems, to predict component failure with high accuracy. This capability shifts maintenance from scheduled downtime to predictive intervention, maximizing equipment uptime. For users operating large fleets of specialized Cartesian systems, this proactive approach translates directly into substantial cost savings and predictable production schedules, addressing a critical pain point associated with complex, high-speed machinery.

Furthermore, AI is instrumental in optimizing the robot's movement planning, particularly in highly dynamic environments such as automated warehouses. AI-powered algorithms can process inputs from multiple sensors—including LiDAR and high-resolution cameras—to generate the most efficient, collision-free paths in real-time. This sophisticated path planning, often referred to as trajectory optimization, ensures minimal acceleration and deceleration times while maintaining precision, thereby increasing overall cycle speed and reducing energy consumption per cycle. This advanced cognitive capability positions Gantry and Cartesian robots not merely as mechanical movers, but as intelligent, self-optimizing manufacturing assets.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by analyzing sensor data (vibration, heat, current) to anticipate mechanical failures in linear axes and drives.

- Enhanced Trajectory Optimization: Machine learning algorithms refine robot motion profiles for faster cycle times, lower energy use, and enhanced smoothness, particularly in complex 3D movements.

- Adaptive Process Control: AI enables real-time adjustment of dispensing volumes, welding parameters, or pick-and-place force based on variations detected in materials or environmental conditions.

- Advanced Machine Vision Integration: Deep learning models allow gantry systems to perform complex inspection, defect detection, and precise part localization in unstructured or semi-structured environments.

- Simulation and Digital Twin Integration: AI enhances the accuracy of digital twins, allowing manufacturers to simulate system performance under extreme conditions and optimize layout before physical deployment.

DRO & Impact Forces Of Gantry and Cartesian Robots Market

The market dynamics for Gantry and Cartesian Robots are shaped by a powerful confluence of drivers necessitating rapid industrial automation, restraints related to system complexity and capital investment, and significant opportunities emerging from technological convergence. Key drivers include the overwhelming need for ultra-high precision and high-throughput capabilities in specialized sectors like semiconductor fabrication and large-format additive manufacturing. The accelerating global shortage of skilled labor across manufacturing and logistics sectors compels companies to automate large-scale, repetitive tasks, which are perfectly suited for the expansive work envelope and structural rigidity offered by gantry systems. Moreover, the explosion of e-commerce necessitates rapid deployment of large-scale automated fulfillment centers, where Cartesian robots form the backbone of material flow and sorting infrastructure, thus exerting a strong positive impact force on market growth.

However, the market faces significant restraints, primarily stemming from the high initial capital expenditure required for designing, installing, and commissioning bespoke gantry systems. These systems often require extensive structural modifications to existing facilities, specialized integration expertise, and sophisticated control architecture, presenting a barrier to entry for Small and Medium Enterprises (SMEs). Another restraint is the mechanical complexity and maintenance requirements associated with long linear axes and multiple synchronous drives, which can lead to higher operational costs if not managed by specialized personnel. Furthermore, the inherent lack of dexterity (compared to articulated robots) means that Gantry and Cartesian robots are less suitable for tasks requiring intricate maneuvering in confined or highly dynamic spaces, limiting their versatility in certain non-standardized applications.

Opportunities for market expansion are substantial, rooted in the ongoing modularization and standardization of components. This trend allows manufacturers to offer more flexible, scalable, and faster-to-deploy systems, effectively lowering the integration barrier. The development of advanced, maintenance-free components, such as magnetic levitation drives and sealed linear guides, promises to reduce long-term operational costs. Crucially, the growth of new application areas, particularly large-area inspection (e.g., aerospace composite material testing) and high-volume bioprinting, opens new vertical markets where the precision and scale of gantry architecture are indispensable. The combination of strong drivers (automation demand) and exploitable opportunities (technological standardization) ensures a consistently positive trajectory for the market, mitigating the impact of capital constraints through enhanced long-term ROI calculations.

Segmentation Analysis

The Gantry and Cartesian Robots Market is comprehensively segmented based on axis type, component type, application, and end-use industry, providing a granular view of demand across the industrial landscape. Segmentation analysis is crucial for understanding specific technological preferences and investment patterns within key sectors. The segmentation by axis type, typically including two-axis, three-axis, four-axis, and six-axis configurations, highlights the trade-off between structural simplicity/cost and operational complexity/dexterity required for different tasks. Component segmentation focuses on the technological heart of the system—linear guides, actuators, control systems, and end-effectors—revealing trends in material science and motion control advancements. Understanding these segments is vital for vendors developing targeted solutions and for end-users seeking optimal performance-to-cost ratios for their specific operational needs.

Application-based segmentation demonstrates where the primary investment flows occur, with material handling, pick-and-place, assembly, and dispensing consistently forming the largest categories, reflecting the historical strengths of Cartesian architecture. The rapid growth observed in the inspection, welding, and surface finishing segments signals a trend towards utilizing gantry systems for high-precision processing tasks that require extended, stable reach. Finally, the end-use industry segmentation confirms the dominance of manufacturing sectors, specifically Electronics & Semiconductor, Automotive, and Heavy Machinery, due to their large-scale production requirements. However, emerging sectors like Pharmaceuticals, Biotechnology, and Logistics & Warehousing are showing accelerated adoption rates as they scale up automation to meet global supply chain pressures and regulatory demands for traceability and speed.

The strategic differentiation within these segments often lies in the software and integration capabilities. For instance, in the Electronics segment, the demand centers on high-speed servo drives and micro-precision linear motors, whereas in the Automotive segment, the focus shifts to systems capable of handling large, heavy chassis parts with extreme structural rigidity. Analyzing the cross-section of these segments allows market participants to tailor their offerings—such as developing application-specific robotic control packages or standardized modular components—to capture maximum value from evolving industrial requirements globally.

- Axis Type:

- Two-Axis (X-Y)

- Three-Axis (X-Y-Z)

- Four-Axis

- Six-Axis (Gantry with Rotary Joints)

- Component:

- Actuators/Drives (Servo Motors, Stepper Motors, Linear Motors)

- Linear Guides and Rails

- Control Systems (Controllers, Software, HMI)

- End-Effectors (Grippers, Dispensing Tools, Welders)

- Application:

- Material Handling and Logistics (Palletizing, AS/RS)

- Assembly and Manufacturing

- Pick and Place Operations

- Dispensing and Coating

- Welding and Cutting

- Inspection and Quality Control

- End-Use Industry:

- Electronics and Semiconductor

- Automotive

- Pharmaceuticals and Medical Devices

- Heavy Machinery and Aerospace

- Food and Beverage

- Logistics and E-commerce

Value Chain Analysis For Gantry and Cartesian Robots Market

The value chain for the Gantry and Cartesian Robots Market begins with the upstream suppliers responsible for providing highly specialized components, followed by system manufacturers, and culminating in the complex downstream activities of integration, distribution, and end-user service. Upstream analysis focuses on core technology providers who supply high-precision components critical to the robot’s function, notably specialized linear motors (including direct-drive linear motors), high-load capacity linear bearing systems, precision encoders, and advanced servo drives. The quality and reliability of these components directly dictate the precision, speed, and lifespan of the final robotic system. Suppliers in this phase are often globally specialized firms maintaining stringent quality control to meet the demanding specifications of robotics manufacturers, who require components capable of continuous high-speed, high-duty cycles.

Midstream activities involve the primary manufacturing and assembly of the gantry structures, control system development, and software integration. Robot manufacturers design the mechanical framework, source the components, and develop proprietary control software tailored for large-scale, multi-axis coordination. This stage adds significant value through system engineering and optimization. Distribution channels are twofold: direct sales are typically employed for highly customized, large gantry systems sold to Tier 1 automotive or aerospace clients, involving direct negotiation and specialized project management. Indirect channels, primarily utilizing system integrators and specialized distributors, handle standardized or modular Cartesian solutions, providing localized installation, customization, and after-sales support to SMEs and diverse industrial buyers. System integrators play a critical role as they bridge the gap between generalized robot hardware and application-specific client needs, often handling complex interfacing with existing factory infrastructure.

Downstream activities include installation, testing, maintenance, and ongoing software upgrades, constituting the final, crucial phase of value creation. After-sales service, predictive maintenance contracts, and spare parts supply represent a significant and growing revenue stream. The trend towards Industry 4.0 emphasizes software-as-a-service (SaaS) models for operational monitoring and optimization, increasing the reliance on continuous connectivity and digital services provided by the robot manufacturers and integrators. Efficient distribution and a strong network of certified integrators are vital for market penetration, ensuring rapid deployment and minimizing costly operational downtime for end-users who depend heavily on the continuous performance of their high-throughput robotic systems.

Gantry and Cartesian Robots Market Potential Customers

The primary consumers and buyers of Gantry and Cartesian robotic systems are concentrated in large-scale manufacturing and processing environments that require automated solutions characterized by expansive work envelopes, high payload capacities, and exceptional geometric accuracy. The foremost potential customers reside in the Electronics and Semiconductor industry, where gantry robots are indispensable for cleanroom operations, wafer handling, and precise component placement necessary for modern microelectronic fabrication. These customers prioritize repeatability, ultra-high cleanliness standards, and the ability to operate continuously under tight dimensional tolerances, viewing gantry systems as non-negotiable infrastructure investments to maintain manufacturing competitiveness and yield rates in a rapidly evolving technological landscape.

Another significant customer segment is the Automotive industry, encompassing vehicle manufacturers and their Tier 1 suppliers. These companies utilize gantry robots extensively for large-scale assembly processes, such as applying structural adhesives to vehicle bodies, performing high-precision welding operations on chassis components, and handling heavy engine or battery modules. The demand here is driven by the necessity for robustness, speed in assembly lines, and the capacity to manage the size and weight variations associated with increasingly complex vehicle designs, particularly the large form factors associated with electric vehicle (EV) battery packs and modules.

Furthermore, the rapidly expanding Logistics and E-commerce sector constitutes a massive, growing customer base. E-commerce fulfillment centers require automated solutions for high-speed sorting, palletizing, depalletizing, and movement within Automated Storage and Retrieval Systems (AS/RS). Cartesian robots are perfectly suited for these tasks due to their high volumetric efficiency and scalability, enabling companies to process massive daily order volumes with high efficiency. Other key buyers include pharmaceutical companies leveraging gantry systems for controlled dispensing and sterile packaging, and aerospace manufacturers utilizing these large platforms for non-destructive testing (NDT) and material deposition on oversized composite structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.45 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Bosch Rexroth AG, Güdel AG, KUKA AG (Midea Group), Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Parker Hannifin Corporation, Seiko Epson Corporation, Schunk GmbH & Co. KG, Denso Corporation, HIWIN Technologies Corp., Toshiba Machine Co., Ltd., Linear Transfer Automation Inc., Aerotech Inc., Applied Robotics Inc., Festo SE & Co. KG, HepcoMotion, Promess Incorporated, LinMot AG, Tectra Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gantry and Cartesian Robots Market Key Technology Landscape

The technological evolution of Gantry and Cartesian Robots is centered on improving speed, accuracy, reliability, and energy efficiency, primarily driven by advancements in linear motion components and control architecture. A core technology shaping the modern landscape is the utilization of advanced linear motors, particularly direct-drive linear motors. Unlike traditional ball screw or belt-driven systems, linear motors eliminate mechanical linkages, drastically reducing friction, wear, and maintenance requirements, while delivering unparalleled dynamic performance and micron-level positioning accuracy. This technology is critical for high-end applications in semiconductor and display manufacturing where nanometer precision is often a prerequisite. Furthermore, the development of magnetic levitation systems for ultra-clean, frictionless movement is emerging in highly specialized, contamination-sensitive environments, pushing the boundaries of what these systems can achieve in terms of acceleration and longevity.

Another fundamental technological focus involves the integration of sophisticated servo control systems and enhanced sensor feedback loops. High-speed digital signal processors (DSPs) are now standard, enabling controllers to execute complex, multi-axis motion synchronization in real-time, often managing hundreds of I/O points and multiple coordinate transformations simultaneously. This is essential for gantry robots operating in complex 3D workspaces or coordinating with external machine vision systems. The reliance on high-resolution absolute encoders and advanced vibration damping algorithms ensures the stability of the platform, especially crucial when handling delicate components or performing precise dispensing or measurement tasks over long travel distances, thereby maintaining the structural integrity and precision inherent in the design.

The overarching technological trend is the seamless integration of Gantry and Cartesian platforms within the broader framework of the Industrial Internet of Things (IIoT) and Industry 4.0 standards. This involves embedding connectivity protocols (such as OPC UA or MQTT) directly into the robot controllers, allowing for comprehensive data collection, remote diagnostics, and integration into factory-wide Manufacturing Execution Systems (MES). Machine vision systems, utilizing high-speed cameras and structured light or laser scanners, are increasingly mounted directly onto the gantry structure to provide real-time guidance, quality inspection, and enhanced adaptive control, transforming the robot from a simple actuator into an intelligent, sensing manufacturing tool capable of autonomous decision-making and optimization.

Regional Highlights

Regional dynamics heavily influence the Gantry and Cartesian Robots market, reflecting differing levels of industrial maturity, labor costs, and governmental automation incentives across the globe. Asia Pacific (APAC) dominates the global market both in terms of value and volume of installation. This leadership is primarily driven by China's massive manufacturing base and its aggressive national strategy, "Made in China 2025," which prioritizes automation across all industrial sectors, especially electronics, automotive, and high-volume consumer goods manufacturing. South Korea and Japan remain pivotal, focusing on high-precision gantry systems for semiconductor and display fabrication, maintaining technological excellence and high investment rates in advanced robotics infrastructure necessary for high-tech exports.

North America is characterized by robust demand originating from high-value manufacturing segments such as aerospace, defense, and specialized pharmaceutical production. The region emphasizes large-scale gantry systems capable of handling large, heavy, and complex components, driven by strong commitments to reshoring manufacturing operations and maintaining competitive advantages through advanced automation, particularly in logistics and fulfillment for the expanding e-commerce sector. Investments in the U.S. are focused on customized, flexible solutions that can adapt quickly to changes in product specifications and production volumes, with a strong emphasis on cybersecurity and industrial network reliability.

Europe, driven by Germany, Italy, and France, maintains a steady, mature market for Gantry and Cartesian systems. The demand here is fundamentally linked to high-quality engineering, stringent regulatory environments (such as those concerning worker safety and environmental standards), and the adoption of Industry 4.0 principles. European manufacturers often favor modular, energy-efficient robotic solutions that integrate seamlessly with existing sophisticated factory infrastructure. The focus is on precision machinery, specialized medical device manufacturing, and implementing high-speed automation solutions that align with the region's strong commitment to sustainable and technologically advanced production methods, ensuring continued investment stability in this region.

- Asia Pacific (APAC): Market leader due to expansive manufacturing base in China, leading position in semiconductor and electronics production in South Korea and Taiwan, and high investment in factory automation driven by government incentives.

- North America: Strong market for high-payload, customized gantry systems in Aerospace, Defense, and Automotive sectors; rapid growth fueled by massive investment in automated warehouses and e-commerce fulfillment infrastructure.

- Europe: Mature market driven by high-quality manufacturing standards (Germany, Italy); emphasis on precision engineering, modular systems, and advanced integration compliant with Industry 4.0 and strict safety regulations.

- Latin America (LATAM): Emerging market showing increased adoption in automotive assembly (Mexico, Brazil) and packaged goods manufacturing, driven by the need to modernize infrastructure and improve labor efficiency.

- Middle East and Africa (MEA): Nascent growth concentrated in logistics hubs (UAE, Saudi Arabia) and infrastructure projects, focusing on heavy material handling and advanced dispensing applications in construction and oil/gas sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gantry and Cartesian Robots Market.- ABB Ltd.

- Bosch Rexroth AG

- Güdel AG

- KUKA AG (Midea Group)

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Parker Hannifin Corporation

- Seiko Epson Corporation

- Schunk GmbH & Co. KG

- Denso Corporation

- HIWIN Technologies Corp.

- Toshiba Machine Co., Ltd.

- Linear Transfer Automation Inc.

- Aerotech Inc.

- Applied Robotics Inc.

- Festo SE & Co. KG

- HepcoMotion

- Promess Incorporated

- LinMot AG

- Tectra Automation

Frequently Asked Questions

Analyze common user questions about the Gantry and Cartesian Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Gantry robot over an articulated robot?

The primary advantage of Gantry robots is their structural rigidity, which enables superior accuracy and repeatability across a significantly larger working envelope, especially when handling heavy payloads. Articulated robots offer dexterity, but Gantry systems excel in scalability, volumetric utilization, and maintaining micron-level precision over long linear distances, crucial for tasks like large-format additive manufacturing or aerospace component handling.

Which industries are driving the highest demand for Cartesian robot installations?

The highest demand is driven by the Electronics and Semiconductor industry, due to the need for ultra-precision, high-speed handling in cleanroom environments. The Logistics and E-commerce sector also represents massive growth, utilizing Cartesian systems extensively in Automated Storage and Retrieval Systems (AS/RS) and high-throughput sorting/palletizing applications to manage complex fulfillment operations efficiently.

How is Industry 4.0 influencing the design and functionality of modern Gantry systems?

Industry 4.0 mandates the integration of advanced sensors and IoT connectivity, transforming Gantry systems into intelligent, data-generating assets. Modern designs incorporate embedded diagnostic capabilities, predictive maintenance algorithms, and standardized communication protocols (like OPC UA) to enable seamless remote monitoring, cloud-based performance optimization, and integration into factory-wide digital twin environments.

What are the main financial barriers to adopting Gantry and Cartesian robots for SMEs?

The main financial barrier is the high initial capital expenditure (CapEx) associated with custom engineering, complex installation, and the specialized, high-precision components required for large-scale systems. While modularization is lowering costs, SMEs still face challenges related to acquiring the necessary expertise for integration and maintaining specialized control software and hardware.

What key technological innovation is enhancing the precision of Cartesian systems?

The utilization of direct-drive linear motors is the key innovation enhancing precision. By eliminating mechanical transmission elements such as gears or ball screws, linear motors achieve higher dynamic response, zero backlash, faster acceleration, and maintain exceptional positioning accuracy (often sub-micron) over extended axes, vital for advanced manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager