Garage Door Replacement Parts Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442764 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Garage Door Replacement Parts Market Size

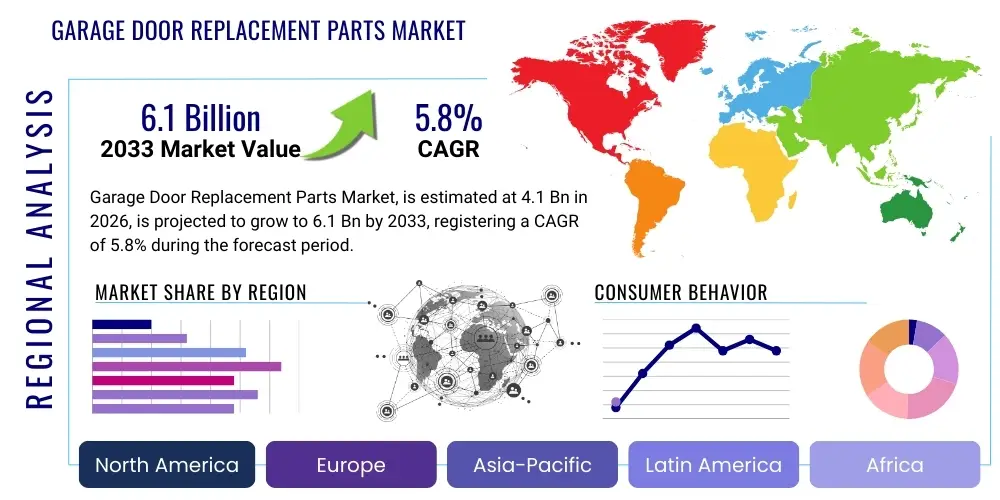

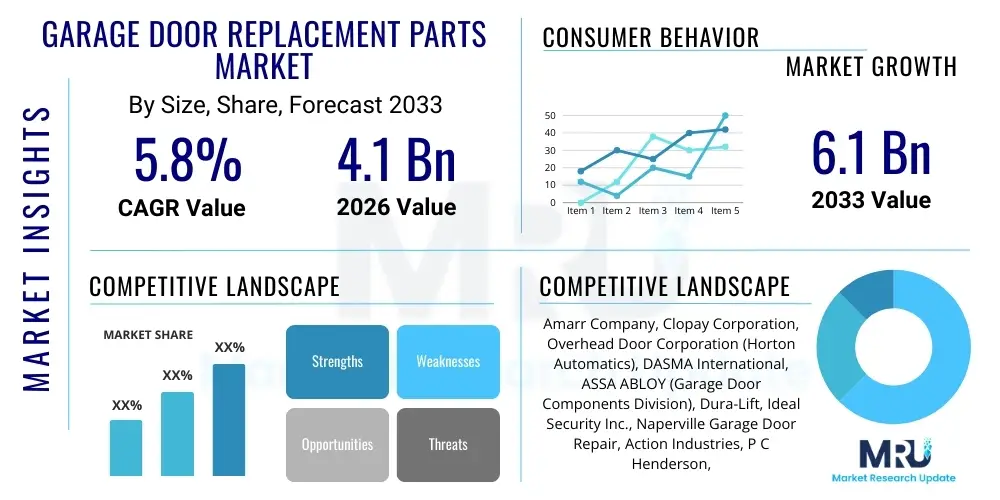

The Garage Door Replacement Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.1 Billion in 2026 and is projected to reach $6.1 Billion by the end of the forecast period in 2033. This growth trajectory is primarily driven by the aging infrastructure of existing residential and commercial properties globally, coupled with increasing consumer awareness regarding preventative maintenance and safety standards associated with automated garage systems.

The consistent demand for replacement parts is inherently linked to the operational cycle of garage doors, which typically involves high frequency usage resulting in wear and tear, especially concerning critical components like torsion springs, cables, and rollers. Furthermore, stringent building codes and insurance requirements often necessitate the timely replacement of malfunctioning or outdated components to ensure compliance and prevent accidents. The market's stability is underpinned by the essential nature of garage doors in modern logistics and secure access control for both vehicles and property assets.

Garage Door Replacement Parts Market introduction

The Garage Door Replacement Parts Market encompasses the sale and distribution of components required for the maintenance, repair, and upgrade of residential, commercial, and industrial garage door systems. These parts range from fundamental mechanical elements such as springs, cables, hinges, and rollers, to specialized electronic components like sensors, circuit boards, remote controls, and advanced opener motor assemblies. The market's vitality is sustained by the expansive installed base of garage doors globally, which mandates regular servicing due to the strenuous operational conditions these systems endure daily. Major applications include repairs necessitated by structural fatigue, accidental damage, or system upgrades to incorporate smart technology features.

The primary benefits derived from this market include enhanced property security, improved energy efficiency through better seals and weatherstripping, and extended lifespan of the overall garage door system, thereby avoiding costly full-door replacements. Driving factors contributing to market expansion include rising disposable incomes leading to greater investment in home maintenance, the accelerating trend of DIY repairs supported by readily available parts, and the increasing complexity of modern garage door openers that utilize sophisticated electronic and safety components prone to eventual failure. The necessity of maintaining operational continuity in commercial facilities, such as loading docks and industrial warehouses, further solidifies the steady demand for reliable, high-quality replacement components.

Garage Door Replacement Parts Market Executive Summary

The Garage Door Replacement Parts Market is characterized by resilient demand fueled by infrastructural aging and high frequency usage cycles. Current business trends indicate a significant shift towards digitalization, with online distribution channels gaining substantial traction, offering consumers and professional installers easier access to niche and specialized components. There is also a notable trend toward component standardization and the development of universal replacement parts, which simplifies inventory management for distributors and reduces repair times for end-users. The commercial sector is exhibiting growth, driven by expansion in logistics, e-commerce warehousing, and industrial facilities requiring durable, heavy-duty replacement springs and high-cycle components.

Regionally, North America and Europe maintain dominance, primarily due to well-established housing stock and rigorous safety regulations mandating periodic component inspections and replacements. However, the Asia Pacific region is demonstrating the highest growth velocity, propelled by rapid urbanization, increasing construction activity, and the growing adoption of automated garage systems in emerging economies. Segment trends reveal that torsion springs and cables remain the largest revenue generators due to their inherent susceptibility to operational fatigue, while the fastest-growing segment is attributed to electronic replacement parts, specifically sensors and remote programming units, driven by the integration of IoT and smart home technologies into garage door operation.

AI Impact Analysis on Garage Door Replacement Parts Market

Common user questions regarding AI’s impact on the Garage Door Replacement Parts Market frequently revolve around predictive maintenance capabilities, inventory optimization, and the potential for autonomous diagnostics. Users are keen to understand how AI algorithms can forecast component failure before it occurs, thereby minimizing downtime and improving safety. There is also significant interest in how AI can streamline the complex supply chain, matching fluctuating regional demands for specific parts, such as high-cycle rollers in industrial settings versus aesthetic panel inserts for residential properties. Key expectations center on AI-driven self-diagnosis systems integrated into smart openers that communicate the exact replacement part needed and its optimal procurement source, fundamentally altering the traditional repair consultation process and favoring specialized online distribution models.

The integration of Artificial Intelligence and Machine Learning (ML) is anticipated to transform the aftermarket supply chain, transitioning it from reactive repairs to proactive maintenance schedules. AI tools enable manufacturers and distributors to analyze operational data collected from smart garage door systems—tracking usage cycles, temperature fluctuations, and stress metrics—to accurately predict the remaining serviceable life of critical components like springs and motors. This predictive capability allows suppliers to maintain highly optimized, regionalized inventory, ensuring that necessary parts are available precisely when and where they are needed, significantly reducing lead times and improving customer satisfaction, particularly for commercial clients where operational uptime is paramount.

Furthermore, AI is expected to revolutionize diagnostic and repair procedures. Future garage door openers will likely incorporate ML algorithms capable of performing complex self-diagnostics. These systems will not only identify component failures with greater accuracy than current systems but also generate precise part identification numbers and installation instructions. This capability will empower both professional service technicians and technically inclined DIY users, minimizing misdiagnosis, reducing the need for multiple service visits, and ensuring that the correct, compliant replacement part is ordered and installed on the first attempt, thereby increasing efficiency across the service ecosystem.

- AI-driven Predictive Maintenance: Forecasting component failure (e.g., spring fatigue or motor burnout) based on usage data and stress analysis.

- Optimized Inventory Management: Utilizing ML to predict regional and seasonal demand spikes for specific replacement components, ensuring just-in-time supply.

- Automated Diagnostics and Troubleshooting: Smart openers using AI to self-diagnose malfunctions and communicate the exact required replacement part directly to the homeowner or service provider.

- Enhanced Manufacturing Efficiency: Applying AI in quality control during parts production to identify minute structural flaws in cables, rollers, and hinges, ensuring higher durability of replacement components.

- Personalized Service Recommendations: AI algorithms assisting consumers in selecting compatible replacement parts based on their specific garage door model, age, and environmental conditions.

DRO & Impact Forces Of Garage Door Replacement Parts Market

The dynamics of the Garage Door Replacement Parts Market are governed by a complex interaction of Drivers (D), Restraints (R), and Opportunities (O), forming the foundational Impact Forces. Primary drivers include the large, aging installed base of garage doors globally and the non-discretionary necessity of repairing critical security and access components upon failure. Restraints often manifest as market fragmentation, leading to challenges in standardizing parts across disparate manufacturers, and the influx of low-quality, non-certified generic components, which undermines consumer trust and product safety. Significant opportunities lie in the integration of smart components requiring specialized electronic replacements and the expanding e-commerce landscape that provides direct access to a wider selection of specialized parts. These forces collectively shape the market's trajectory, ensuring steady, non-cyclical demand for maintenance components while pushing stakeholders toward greater specialization and technological integration to overcome compatibility hurdles.

The inherent durability expectations of garage door systems often clash with the operational realities of intense daily usage, positioning wear-and-tear as the principal market driver. The frequency of component failure—particularly for high-stress items like springs and cables—ensures a consistent, cyclical repair market, irrespective of broader economic volatility. Furthermore, stringent regulatory environments, particularly in North America and Europe, mandate adherence to safety standards (e.g., sensor and auto-reverse mechanism functionality). Failure to maintain these components necessitates immediate replacement, functioning as a continuous catalyst for market activity.

Conversely, the primary restraints stem from the sophisticated nature of modern proprietary systems and the intense price competition fostered by generic parts manufacturers. Specific opener models often require highly specialized electronic replacement boards or uniquely engineered components, creating significant barriers to entry for smaller replacement parts suppliers and sometimes forcing consumers back to expensive Original Equipment Manufacturers (OEMs). Moreover, consumer preference for low-cost repairs can drive demand for uncertified components, creating quality control issues that ultimately increase long-term maintenance costs and pose safety risks, impacting the reputation of premium replacement brands.

Key opportunities are centered around market innovation, specifically the proliferation of IoT-enabled garage door openers. These systems require advanced sensors, specialized wiring harnesses, and complex circuit board replacements, opening up new, high-value segments for technology-focused suppliers. Additionally, the increasing reliance on professional installers utilizing specialized digital platforms for parts ordering and inventory tracking presents an opportunity for manufacturers to establish exclusive digital distribution partnerships, ensuring market penetration with authenticated, high-quality replacement units. The trend toward energy efficiency also drives demand for advanced weatherstripping and sealing components, which are often overlooked but represent a growing niche within the replacement parts market.

Segmentation Analysis

The Garage Door Replacement Parts Market is strategically segmented based on product type, application, and distribution channel, reflecting the varied nature of demand across the residential, commercial, and industrial sectors. Product type segmentation is crucial as it dictates material requirements, manufacturing complexity, and failure frequency; high-stress mechanical components like springs and cables dominate the volume and value contribution. Application segmentation provides insights into durability requirements, with commercial and industrial parts demanding higher specifications and cycle ratings compared to standard residential components. Understanding these segments is vital for manufacturers to tailor their production capabilities and distribution strategies effectively, ensuring optimized inventory flow and meeting the distinct needs of diverse end-user groups.

The complexity of modern garage door systems necessitates detailed segmentation, particularly within the electronic components category. As smart home integration becomes standard, the replacement of specialized connectivity modules, safety sensors, and proprietary control boards represents a high-growth area, distinct from traditional mechanical replacements. The replacement market is also influenced by door construction, with specialized parts needed for sectional doors, roll-up doors, and overhead tilt doors, which often utilize unique hinge and roller configurations. Accurate segmentation assists market participants in identifying underserved niches, such as heavy-duty parts for cold weather environments or specialized components for high-security installations, allowing for targeted product development and market penetration strategies.

- Product Type:

- Springs (Torsion Springs, Extension Springs, Specialty Springs)

- Cables and Drums

- Rollers (Nylon, Steel, Heavy-Duty)

- Hinges and Brackets

- Seals and Weatherstripping

- Opener Components (Motor Assemblies, Circuit Boards, Gears, Belts, Chains)

- Sensors and Safety Devices (Photo Eyes, Limit Switches)

- Remote Controls and Keypads

- Tracks and Railings

- Panels and Inserts (Aesthetic and Functional Replacements)

- Application:

- Residential

- Commercial (Retail, Office Buildings)

- Industrial (Warehouses, Loading Docks, Manufacturing Plants)

- Distribution Channel:

- Online Retail (E-commerce Platforms, Manufacturer Websites)

- Offline Channels (Specialty Garage Door Dealers, Hardware Stores, Home Improvement Chains, HVAC/Building Supply Distributors)

Value Chain Analysis For Garage Door Replacement Parts Market

The value chain for the Garage Door Replacement Parts Market begins with raw material extraction and specialized component manufacturing (upstream analysis), progresses through intricate distribution networks, and culminates in professional installation or consumer DIY repair (downstream analysis). Upstream activities involve sourcing high-grade steel, plastics, and electronic components, often requiring specialized processing for high-stress items like torsion springs where material quality dictates component lifespan and safety performance. Manufacturers operate either as OEMs, producing proprietary parts for specific door systems, or as aftermarket specialists, focusing on standardized and universal replacement units. The efficiency of this upstream process directly impacts the quality and unit cost of the final replacement component.

The midstream segment is characterized by complex logistical operations spanning warehousing, inventory management, and channel optimization. Distribution is segmented into direct and indirect channels. Direct distribution often involves large OEMs supplying authorized dealers and professional installation companies, ensuring product authentication and warranty compliance. Indirect distribution leverages large, national and international wholesalers, e-commerce giants, and big-box retail stores, catering primarily to the DIY segment and independent repair technicians. E-commerce platforms, functioning as an indirect channel, are increasingly critical, offering broad geographic reach and deep inventory of specialized and hard-to-find components.

Downstream analysis focuses on the point of consumption, involving both professional installers and end-users. Professional installers (often certified dealers or independent contractors) represent the largest revenue contributor, demanding bulk orders, technical support, and rapid fulfillment. The growth of the DIY repair segment, supported by online tutorials and standardized part availability, necessitates robust packaging, clear instructional materials, and easy-to-navigate online identification tools from distributors. The overall value chain is driven by the imperative of speed and accuracy, as a broken garage door necessitates immediate repair, making efficient distribution a competitive differentiator in the aftermarket landscape.

Garage Door Replacement Parts Market Potential Customers

The potential customer base for the Garage Door Replacement Parts Market is highly diversified, encompassing three primary end-user/buyer categories: residential homeowners, commercial entities, and professional installation/maintenance service providers. Residential customers are the foundational market segment, driving demand for standard components like sensors, remotes, and consumer-grade springs due to normal wear-and-tear and minor accidents. Their purchasing decisions are often influenced by immediate necessity, perceived value, ease of installation, and product longevity, with a growing subset opting for high-quality, long-cycle components as an investment against future failures. This segment increasingly utilizes online distribution channels to source parts directly.

Commercial and industrial customers constitute the high-value segment, requiring heavy-duty, certified components designed for extreme usage cycles and demanding operational environments, such as logistics hubs, refrigerated warehouses, and manufacturing facilities. These buyers prioritize minimal downtime, reliability, compliance with safety regulations, and long-term maintenance contracts, typically sourcing through authorized distributors or direct contracts with OEM parts suppliers. Their purchasing cycles are often preventative, driven by scheduled maintenance protocols rather than catastrophic failure, necessitating a stable, high-quality supply chain for high-performance rollers, specialized tracks, and robust motor components.

Professional installation and repair services (dealers, independent contractors, facility management groups) serve as a crucial intermediary, acting as the largest volume purchasers of replacement parts. These buyers require extensive inventory depth, volume discounts, reliable technical support, and rapid logistical services to efficiently manage their daily service routes and varied customer needs. They are highly discerning regarding component compatibility, certification, and warranty support, often forming strategic relationships with specific manufacturers or large regional parts wholesalers to secure consistent supply and favorable pricing structures. Their purchasing behavior dictates the success of new product introductions and distribution strategies within the aftermarket.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.1 Billion |

| Market Forecast in 2033 | $6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amarr Company, Clopay Corporation, Overhead Door Corporation (Horton Automatics), DASMA International, ASSA ABLOY (Garage Door Components Division), Dura-Lift, Ideal Security Inc., Naperville Garage Door Repair, Action Industries, P C Henderson, Raynor Worldwide, Linear LLC (Nortek Security & Control), Genie Company, Chamberlain Group, Wayne-Dalton, Stanley Access Technologies, Windsor Door, Safeway Door, Guardian Access Solutions, Mid-America Door. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garage Door Replacement Parts Market Key Technology Landscape

The technology landscape for the Garage Door Replacement Parts Market is rapidly evolving beyond purely mechanical components, increasingly focusing on integration with smart home ecosystems and advanced safety features. Key technological advancements include the miniaturization and increased reliability of photoelectric sensors, designed to meet rigorous safety mandates by providing precise obstruction detection and faster reaction times. Furthermore, materials science innovation is critical, focusing on developing higher-cycle torsion springs using specialized steel alloys and utilizing advanced polymers in rollers and hinges to reduce noise, improve operational smoothness, and extend component lifecycles, addressing the core consumer requirement for durable and quiet systems.

A significant area of technological focus is within the opener components segment, driven by the shift towards Wi-Fi and Bluetooth connectivity. Replacement circuit boards and smart connectivity modules now form a substantial part of the electronic parts market. These modules enable remote diagnostics, app-based control, and integration with voice assistants, requiring specialized technical expertise for replacement and calibration. The integration of brushless DC motors in replacement opener units is also gaining traction, offering superior energy efficiency, quieter operation, and significantly longer operational life compared to traditional AC motors, justifying a higher price point for premium replacement assemblies.

The manufacturing process itself is benefiting from technology, with precision engineering methods utilizing Computer Numerical Control (CNC) machinery ensuring high tolerance for critical parts like cables and drums, which are essential for balanced door operation. For specialized parts, 3D printing is emerging as a viable technology, particularly for low-volume, custom-fit or obsolete plastic components, offering rapid prototyping and localized manufacturing capabilities that streamline the availability of hard-to-find legacy replacement parts. This technological progression underscores the market's trajectory towards higher performance, connectivity, and enhanced diagnostic capabilities, fundamentally changing the nature of required replacement inventory.

Regional Highlights

- North America (US and Canada): Dominates the global market, characterized by a vast, mature residential housing stock where garage doors are standard features. High consumer awareness regarding safety standards, coupled with strong DIY culture and high labor costs, fuels the demand for replacement components across online and big-box retail channels. The region is also an early adopter of smart garage technology, driving revenue in electronic component replacements.

- Europe (Germany, UK, France): A mature market driven by rigorous safety regulations (e.g., EU machinery directives) and high standards for insulation and energy efficiency. Demand is consistent for weatherstripping, seals, and specialized components for insulated sectional doors. The professional installation segment is strong, favoring high-quality, certified OEM and aftermarket parts.

- Asia Pacific (China, India, Japan, South Korea): Exhibits the fastest growth rate, fueled by rapid urbanization and massive construction projects increasing the penetration of automated residential and commercial doors. While price sensitivity remains a factor, increasing disposable income and growing industrialization (especially in logistics hubs) are boosting demand for high-cycle industrial-grade replacement parts. Local manufacturing capability is rapidly expanding, intensifying regional competition.

- Latin America (Brazil, Mexico): Characterized by emerging market dynamics and varying levels of standardization. Demand is driven primarily by immediate repair needs and security concerns, focusing on mechanical components and basic opener parts. The market potential is increasing due to expanding middle-class construction and growing infrastructure investment.

- Middle East and Africa (MEA): A nascent market for advanced replacement parts, with growth concentrated in commercial and high-end residential construction in the Gulf Cooperation Council (GCC) countries. Demand is often specialized, requiring components resistant to extreme heat and dust, favoring high-performance materials in rollers, seals, and motors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garage Door Replacement Parts Market.- Chamberlain Group

- Overhead Door Corporation (Horton Automatics)

- ASSA ABLOY (Garage Door Components Division)

- Clopay Corporation

- Amarr Company

- The Genie Company

- DASMA International

- Dura-Lift

- Ideal Security Inc.

- Action Industries

- P C Henderson

- Raynor Worldwide

- Linear LLC (Nortek Security & Control)

- Wayne-Dalton

- Stanley Access Technologies

- Windsor Door

- Safeway Door

- Guardian Access Solutions

- Mid-America Door

- LiftMaster

Frequently Asked Questions

Analyze common user questions about the Garage Door Replacement Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Garage Door Replacement Parts Market?

The primary driver is the large, aging installed base of residential and commercial garage doors globally, combined with the inherent wear and tear on high-stress mechanical components such as torsion springs and cables due to high-frequency usage cycles. Regulatory mandates for safety sensor functionality also necessitate periodic component replacement.

How is the adoption of smart home technology impacting the replacement parts segment?

Smart home technology is driving a shift toward high-value electronic replacement parts, including specialized circuit boards, Wi-Fi connectivity modules, and advanced safety sensors. This trend requires suppliers to maintain inventory for complex, proprietary electronic systems rather than focusing solely on traditional mechanical components.

Which geographical region exhibits the fastest growth potential for replacement parts?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid urbanization, increasing construction of automated parking facilities, rising disposable incomes leading to automation adoption, and expanding industrial logistics infrastructure across countries like China and India.

What are the main challenges related to sourcing replacement components?

Key challenges include market fragmentation, leading to compatibility issues between parts from different manufacturers, and the influx of non-certified, low-quality generic parts. Identifying the exact proprietary component needed for older or specialty systems can also pose a significant hurdle for end-users and independent repair technicians.

How are new technologies like AI influencing garage door maintenance services?

AI is influencing maintenance by enabling predictive analytics, allowing smart garage door openers to forecast component failure based on operational stress data. This shift promotes proactive replacement scheduling, optimizing inventory management for service providers and reducing emergency repair downtime for high-use commercial customers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager