Garage Storage Organization System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443557 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Garage Storage Organization System Market Size

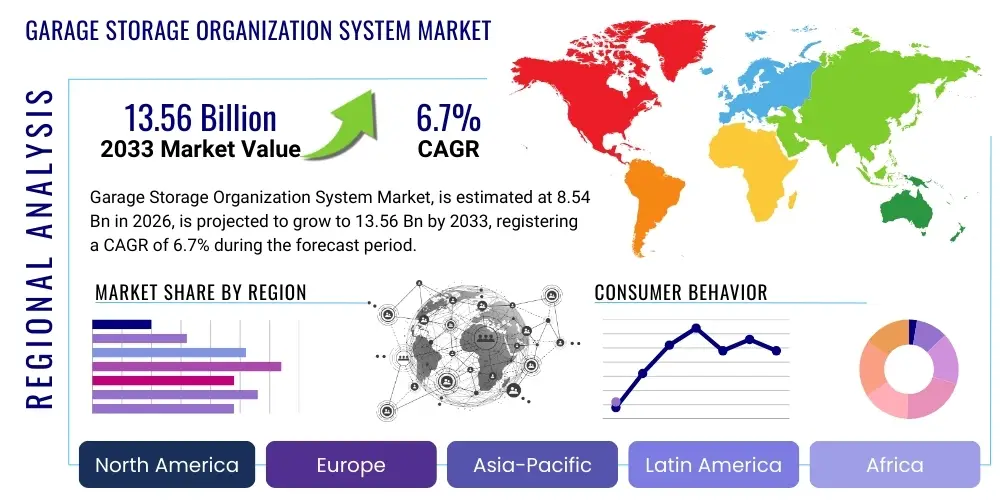

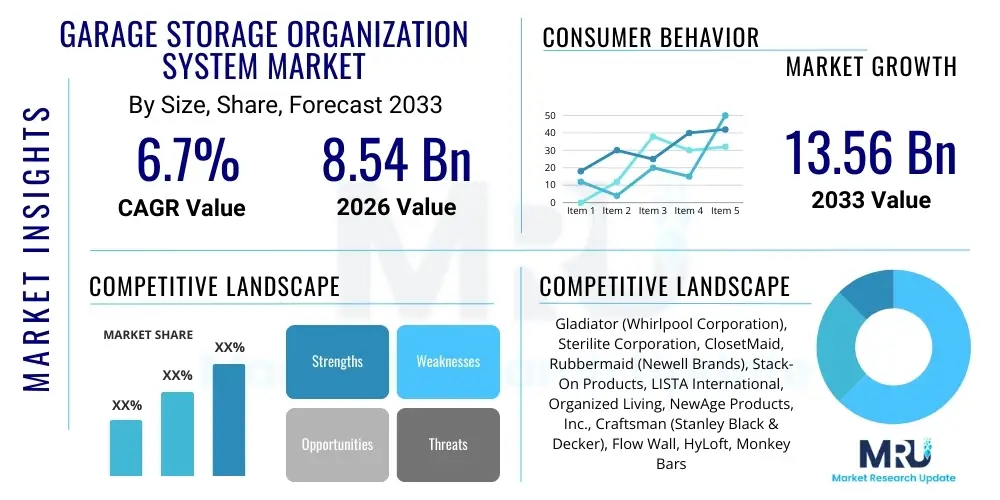

The Garage Storage Organization System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 8.54 Billion in 2026 and is projected to reach USD 13.56 Billion by the end of the forecast period in 2033.

Garage Storage Organization System Market introduction

The Garage Storage Organization System Market encompasses a range of products designed to maximize space efficiency, improve accessibility, and enhance the overall utility and aesthetic of garage spaces in residential, commercial, and industrial settings. These systems include modular cabinets, wall-mounted solutions like slatwall and pegboard panels, overhead storage racks, heavy-duty shelving units, specialized tool storage, and flooring options. The primary goal of these products is to transform the garage from a simple vehicle parking space into a highly functional area for storage, hobbies, or workspace, directly addressing the modern consumer need for decluttering and spatial optimization within increasingly dense urban and suburban environments. The versatility of these systems, offering customizable configurations based on specific user requirements and spatial constraints, is a core driver of their widespread adoption globally.

Product descriptions within this market vary widely, ranging from basic, cost-effective wire shelving units to sophisticated, custom-designed, built-in cabinet systems made from durable materials like steel, high-density polyethylene (HDPE), or high-grade wood composites. Major applications span residential garages, where homeowners seek to store seasonal items, sports equipment, tools, and bulk goods, and commercial applications, such as automotive repair shops, small warehousing operations, and specialty service businesses that require standardized, durable, and highly accessible storage for inventory, parts, and heavy equipment. The emphasis on high load-bearing capacity and resilience to typical garage environmental factors, such as temperature fluctuations and humidity, defines the technical specifications of premium offerings in this sector.

Key benefits derived from implementing these organization systems include enhanced safety by securing hazardous materials and tools, increased property value due to improved home aesthetics and functionality, and significant time savings through easier location and retrieval of items. Driving factors for market growth are strongly linked to the booming global home improvement sector, rising disposable incomes that allow for investment in home aesthetics and efficiency, the sustained trend towards larger average garage sizes in new residential construction, and the increasing popularity of DIY and hobbyist activities that necessitate dedicated, organized workspace. Furthermore, the aesthetic shift towards utilizing the garage as an extension of the primary living space, demanding solutions that blend high functionality with attractive design, continues to fuel innovation and market expansion across all geographic segments.

Garage Storage Organization System Market Executive Summary

The Garage Storage Organization System Market is characterized by robust growth, driven primarily by strong residential remodeling activity and the increasing demand for customized, high-end storage solutions. Business trends indicate a significant shift toward integrated digital services, where vendors offer online configurators and 3D visualization tools to aid consumers in designing and ordering tailored systems, enhancing the user experience and facilitating direct-to-consumer sales. Key market players are intensely focused on mergers and acquisitions (M&A) to consolidate market share, particularly acquiring niche specialty providers who focus on innovative modular designs or sustainable material sourcing. Furthermore, there is a pronounced push towards manufacturing systems that are simple to install and highly scalable, catering both to the professional installer and the burgeoning DIY demographic, thus expanding the accessible consumer base.

Regionally, North America maintains the dominant market share, largely due to high rates of homeownership, substantial spending on home organization, and the established presence of large retail distribution channels (Home Depot, Lowe's). However, the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, driven by rapid urbanization, rising middle-class disposable incomes, and the consequent demand for efficient space-saving solutions in countries like China and India, despite generally smaller average garage footprints compared to Western markets. Europe shows steady, mature growth, focusing heavily on eco-friendly and sustainably sourced wood and composite systems, often regulated by stricter environmental standards regarding material off-gassing and longevity. Latin America and MEA are emerging markets, primarily driven by commercial applications initially, with residential growth following as construction standards modernize.

Segment trends reveal that the Cabinet Systems segment, particularly those utilizing heavy-duty steel and composite materials, is experiencing rapid revenue growth, favored for their aesthetic appeal, durability, and secure storage capabilities. Concurrently, the Wall Organization Systems segment (Slatwall and Pegboard) remains highly popular due to its low installation complexity and high flexibility in accommodating various tools and accessories. In terms of material, the Plastic segment, specifically high-grade polyethylene (HDPE) utilized in bins and modular components, is gaining traction due to its resistance to moisture and ease of cleaning. The residential end-user category continues to hold the overwhelming majority of the market share, though commercial and industrial usage is showing specialized growth in high-load, heavy-duty overhead rack solutions designed for warehousing and parts storage.

AI Impact Analysis on Garage Storage Organization System Market

Common user questions regarding AI's impact on garage storage center around optimizing spatial planning, automating inventory management, and enhancing personalized product recommendations. Users are specifically concerned about how AI can move beyond simple visualization tools to offer genuine functional optimization, recommending optimal placement of items based on usage frequency, weight, and accessibility constraints. They seek AI-driven systems capable of analyzing historical usage patterns, perhaps through integrated sensors or computer vision, to proactively suggest structural adjustments or reorganize storage layout for maximum efficiency. The key themes revolve around achieving a truly "smart garage" environment where the organization system manages itself, alerts the user to misplaced items, and automates reordering of consumables or tools as they wear out, transitioning the market towards integrated, data-driven solutions rather than static physical structures.

The practical integration of AI involves complex algorithmic modeling tailored to three-dimensional space constraints and varied object characteristics. For consumers, AI tools can drastically reduce the time and effort involved in the design phase, moving from simple static planning to dynamic optimization that considers future needs and shifting inventory. For manufacturers, AI enhances operational efficiencies by predicting demand for specific modular components in different regions, optimizing supply chains, and refining product lines based on real-time feedback concerning component lifespan, load-bearing stress, and ergonomic suitability captured from smart prototypes and early adopters. This data-centric approach accelerates the development of next-generation, highly durable, and intuitively designed storage systems.

AI also plays a critical role in the distribution and retail aspects of the market. Virtual Reality (VR) and Augmented Reality (AR) applications, powered by AI spatial mapping algorithms, allow users to digitally place, customize, and visualize potential storage systems within their actual garage space, drastically improving conversion rates and minimizing post-purchase returns caused by size or aesthetic misalignment. Furthermore, advanced AI chatbots and recommendation engines are essential for customer service, guiding users through complex product configurations and ensuring that the selected system meets both structural requirements (wall type, ceiling height) and functional needs (car clearance, necessary aisle width), fundamentally transforming the purchase journey into an educational and highly customized experience.

- AI-powered spatial planning algorithms optimize complex garage layouts, maximizing storage density and ensuring compliance with fire and safety codes.

- Predictive maintenance analytics, leveraging sensor data, identify stress points in shelving or cabinet systems, signaling required reinforcement or replacement.

- Integrated computer vision systems enable automated inventory tracking, helping users locate misplaced tools or notify them when supplies need replenishment.

- AI-driven e-commerce platforms provide highly personalized product configuration recommendations based on user demographics, vehicle size, and declared hobby activities.

- Natural Language Processing (NLP) enhances customer support, providing instant, accurate technical guidance regarding installation and compatibility for DIY customers.

DRO & Impact Forces Of Garage Storage Organization System Market

The Garage Storage Organization System Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO) that shape its trajectory, ultimately dictating growth patterns and competitive intensity. A major driver is the global surge in residential renovation and home improvement projects, often focusing on maximizing existing space utility, coupled with the rising average size of garages in newly built homes, particularly in North America and Western Europe, which provides ample space for elaborate storage installations. This trend is further amplified by the cultural shift towards DIY activities and specialized hobbies, such as woodworking, cycling maintenance, or home brewing, which necessitate dedicated, organized workspaces. However, high initial capital expenditure associated with custom, high-quality modular systems, especially those using heavy-duty steel or specialized composites, acts as a significant restraint, limiting uptake among budget-conscious consumers or those in less affluent segments.

Opportunities within the market are substantial, primarily centering on technological integration and geographic expansion. The development of 'smart' garage integration, incorporating IoT sensors for inventory management, climate control, and smart security features into the storage architecture, represents a high-value opportunity, shifting products from static furniture to connected systems. Geographically, aggressive penetration into rapidly developing APAC markets, particularly those undergoing significant infrastructural and residential modernization, offers strong long-term revenue streams, provided solutions are adapted to smaller floor plans and local material preferences. Furthermore, the commercial sector, specifically small to mid-sized enterprises (SMEs) in manufacturing, logistics, and automotive repair, presents an untapped opportunity for standardized, robust, and scalable industrial-grade storage solutions, requiring specialized B2B marketing and distribution strategies distinct from the residential focus.

Impact forces currently shaping the competitive landscape include material supply chain volatility, which influences product pricing and availability, and the intensifying competition from large, vertically integrated furniture and home goods retailers entering the market with budget-friendly, mass-produced modular solutions. The COVID-19 pandemic significantly accelerated the work-from-home and stay-at-home trend, driving unprecedented demand for garage conversions and organization during 2020-2022, creating a high-impact residual demand for sophisticated organization systems post-pandemic. Sustainability regulations are also exerting force, pushing manufacturers towards recycled content, low Volatile Organic Compound (VOC) materials, and designing products for long-term durability and eventual end-of-life recycling, ensuring market competitiveness aligns with modern consumer environmental consciousness and regulatory compliance across key geographies.

Segmentation Analysis

The Garage Storage Organization System Market is extensively segmented by product type, material, application (end-user), and distribution channel, providing a granular view of market dynamics and consumer preferences across different tiers. The segmentation by product type is crucial, as consumers often seek specialized solutions for specific organizational tasks, leading to the dominance of systems that offer high flexibility and customization. The increasing complexity of consumer needs, moving beyond simple boxes to integrated, aesthetically pleasing, and functionally optimized setups, drives continuous innovation in both cabinet design and wall-mounted accessory systems. Analyzing these segments helps companies tailor their product development pipeline and marketing efforts to capture specific buyer personas, ranging from the dedicated professional hobbyist to the utilitarian homeowner.

In terms of application, the residential segment dominates, primarily driven by single-family homeowners seeking to maximize storage in their largest available storage space outside the main house, but the commercial segment, though smaller, demands higher quality, durability, and fire resistance, commanding premium pricing. Material segmentation highlights the trade-offs between cost, longevity, and aesthetics: steel offers unparalleled durability and load capacity, favored in commercial settings; high-density plastic is chosen for moisture resistance and affordability; while wood and composite materials appeal to the high-end residential market prioritizing custom looks and seamless integration with home interiors. The intersection of these segment trends reveals that the highest growth rate is often found in hybrid systems that combine the aesthetic appeal of composite cabinets with the structural integrity of steel framing.

- By Product Type:

- Cabinet Systems (Metal, Wood, Plastic, Composite)

- Shelving Systems (Open Wire, Heavy-Duty Racks, Adjustable Shelving)

- Wall Organization Systems (Slatwall Panels, Pegboard Systems, Rail Systems)

- Overhead Storage Racks (Fixed, Motorized Lift Systems)

- Storage Bins, Totes, and Containers

- Flooring and Matting Solutions

- Workbenches and Accessories

- By Material:

- Metal (Steel, Aluminum)

- Wood (Solid Wood, Engineered Wood)

- Plastic (Polypropylene, HDPE, PVC)

- Composite Materials

- By Application (End-User):

- Residential (Single-Family Homes, Multifamily Units)

- Commercial (Automotive Repair Shops, Small Warehouses, Professional Service Garages)

- By Distribution Channel:

- Offline (Home Centers and DIY Stores, Specialty Stores, Direct Dealer Network)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Garage Storage Organization System Market

The Value Chain for the Garage Storage Organization System Market begins with the upstream activities centered on raw material procurement, encompassing large volumes of steel and aluminum coil, various grades of plastic resin, wood lumber, and engineered composite materials. Suppliers of high-grade steel sheets and specialized coatings (e.g., powder coating for durability and rust resistance) hold significant power, as the cost and quality of these foundational materials directly impact the final product's load-bearing capacity and lifespan. Strategic sourcing focuses on securing materials that meet environmental standards (e.g., low-VOC woods) and ensuring consistency in quality, which is paramount for competitive pricing and regulatory compliance, particularly in European and North American markets. Manufacturers often engage in long-term contracts with specialized raw material processors to mitigate price volatility and secure predictable supply volumes necessary for large-scale production runs.

Midstream activities involve sophisticated manufacturing processes, including CNC metal fabrication, injection molding for plastic components, and precision cutting and assembly of wood and composite systems. Leading companies focus on optimizing production efficiency through lean manufacturing techniques, investing heavily in automation to reduce labor costs and ensure component precision required for modular compatibility across different product lines. Quality assurance is a critical step, involving rigorous stress testing for load capacity and testing for resistance to moisture, chemicals, and temperature extremes typically found in garage environments. This manufacturing stage includes both mass production of standard, off-the-shelf items sold through big-box retail, and customized, built-to-order cabinet and wall systems requiring greater design input and specialized assembly, often handled by dedicated in-house or outsourced fabrication teams.

Downstream activities involve extensive distribution channels, categorized as direct and indirect. The indirect channel relies heavily on large-scale Offline distribution through Home Centers (e.g., Home Depot, Lowe's) and large specialty hardware stores, which provide high-visibility retail placement and immediate availability, often favoring ready-to-assemble (RTA) solutions. The direct channel includes company-owned showrooms and specialized dealer networks that focus on professional consultation, custom design, and full installation services, targeting the higher-margin, premium residential and commercial sectors. The rise of Online distribution, facilitated by sophisticated logistics networks capable of handling large, heavy items, is fundamentally reshaping the market, allowing smaller, specialized manufacturers to compete globally and utilize drop-shipping models to bypass traditional retail intermediaries, resulting in improved margin capture and expanded geographic reach.

Garage Storage Organization System Market Potential Customers

Potential customers for Garage Storage Organization Systems primarily fall into two major categories: Residential End-Users and Commercial/Industrial End-Users, each possessing distinct needs, purchasing criteria, and willingness-to-pay thresholds. The Residential segment, constituting the largest consumer base, is typically comprised of middle to high-income homeowners, particularly those residing in single-family homes with two-car or larger garages. These buyers are motivated by the desire to declutter, enhance home aesthetics, increase property value, and create safe, accessible storage for seasonal items, tools, sports equipment, and household overflow. Their purchasing decisions are often driven by visual appeal, ease of installation (especially for DIY projects), customization options, and compatibility with existing home decor, leading them to prefer modular systems, high-quality composite cabinets, and aesthetically pleasing wall systems like Slatwall.

Within the Residential segment, a key sub-group is the dedicated hobbyist or skilled DIY enthusiast. These consumers often demand industrial-grade durability and highly specific organizational accessories, such as specialized tool chests, heavy-duty workbenches, and secure storage for high-value machinery. Their focus is less on general aesthetics and more on functional ergonomics, material strength (heavy-gauge steel preferred), and the ability to withstand frequent, heavy use and chemical exposure. Marketing strategies targeting this demographic must emphasize technical specifications, load ratings, and long-term warranties, often utilizing direct-to-consumer channels or specialty dealer networks that can provide expert advice on advanced configuration layouts and specialized equipment integration.

The Commercial/Industrial segment represents a critical high-value customer group, including owners and managers of automotive repair shops, specialized fabrication facilities, small logistics hubs, and service-based fleet operations. These buyers prioritize maximum durability, high load capacity, rapid component accessibility, and compliance with workplace safety standards. Decisions are based purely on return on investment (ROI), measured by inventory efficiency, reduced workplace injuries, and the longevity of the system under constant operational stress. Potential customers in this sector prefer standardized, interlocking systems, heavy-duty mobile tool storage, and specialized racking designed for parts and tires, often procured through large B2B contracts and specialized industrial suppliers who can manage large-scale installation and subsequent maintenance contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.54 Billion |

| Market Forecast in 2033 | USD 13.56 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gladiator (Whirlpool Corporation), Sterilite Corporation, ClosetMaid, Rubbermaid (Newell Brands), Stack-On Products, LISTA International, Organized Living, NewAge Products, Inc., Craftsman (Stanley Black & Decker), Flow Wall, HyLoft, Monkey Bars Storage, VersaLift, Schulte Corporation, Contur Cabinets, Haltbar, Knape & Vogt Manufacturing Company, StoreWALL, Seville Classics, Inc., Waterloo Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garage Storage Organization System Market Key Technology Landscape

The technological landscape of the Garage Storage Organization System Market is rapidly evolving beyond basic mechanical storage, incorporating advanced materials science and digital integration to enhance functionality, durability, and customer experience. A fundamental shift involves sophisticated material engineering, focusing on lightweight yet exceptionally high-strength components. This includes the widespread adoption of high-gauge, anti-corrosion treated steel for cabinet frames and shelving, utilizing advanced powder coating processes that resist chipping, moisture, and chemical exposure, crucial for longevity in harsh garage environments. Furthermore, engineered wood and composite panels are now utilizing thermal fusion laminates and melamine finishes to provide aesthetic appeal coupled with enhanced resistance to humidity and structural warping, bridging the gap between residential appearance and industrial durability requirements. The modular design technology has matured significantly, employing precision-engineered interlocking mechanisms that allow for tool-less or minimal-tool assembly, catering directly to the DIY market and reducing professional installation time, a key factor in consumer choice.

Digital technologies are increasingly central to the consumer decision and customization process. The prevalence of 3D modeling software and web-based configuration tools enables potential buyers to input exact garage dimensions and visualize various storage systems, ensuring perfect fit and optimal spatial utilization prior to purchase. This digital visualization technology leverages cloud computing power to render complex configurations in real-time and often incorporates AI algorithms to suggest optimal product combinations based on user needs, such as recommending heavy-duty shelving near high-frequency zones or specialized secure cabinets for chemical storage. This technological convergence significantly improves buyer confidence and reduces friction in the purchase cycle, particularly for complex, multi-component systems sold through online channels that lack traditional in-person consultation.

Looking ahead, the market is poised for significant disruption through the integration of Internet of Things (IoT) technologies, fundamentally transforming static storage into a 'smart' environment. Key innovations include smart inventory tracking systems utilizing RFID tags or integrated weight sensors in drawers and bins, notifying users of low stock levels for consumables like fasteners or cleaning supplies, or alerting homeowners if a high-value tool is missing. Motorized overhead storage racks, connected to mobile apps, allow users to safely raise and lower heavy items with precise control, enhancing safety and accessibility. Furthermore, integrated smart lighting and environmental monitoring sensors, which regulate humidity and temperature to protect stored items from degradation, are becoming standard features in premium, integrated garage organizational systems, positioning the garage as the next frontier for smart home integration and automated functionality, driving significant future revenue growth.

Regional Highlights

Regional dynamics heavily influence the demand and product types dominant in the Garage Storage Organization System Market, driven by factors such as home ownership rates, average garage size, and prevailing renovation culture. North America holds the largest market share due to its established culture of large home ownership and extensive garage spaces, often used for storage far beyond vehicle parking. The region exhibits high demand for comprehensive, built-in systems, including heavy-duty metal cabinets and sophisticated wall organization panels, supported by highly mature retail infrastructure and a robust network of professional installation services. The US market, in particular, drives innovation in DIY-friendly, yet highly durable, modular systems, capitalizing on high consumer confidence in home investment and customization, necessitating solutions that are both functional and aesthetically integrated with modern interior design trends.

Europe represents a mature but steady growth market, characterized by diverse regional preferences and stricter regulatory environments concerning material sustainability. Western European countries often favor aesthetically pleasing, high-quality wood and composite systems that adhere to low VOC emission standards, reflecting a general preference for natural materials and integrated design in smaller, more urbanized garage spaces. The UK and Germany are significant markets, focusing on efficient use of vertical space due to smaller average footprints, driving demand for high-capacity, space-saving overhead and rail systems. Eastern Europe is emerging, with growth tied to increasing middle-class disposable income and modernization of residential construction, adopting more cost-effective, durable plastic and basic metal shelving solutions initially, with luxury systems following market maturity.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, albeit from a lower base, fueled by rapid urbanization and the proliferation of compact apartment living that necessitates efficient, multi-purpose storage solutions. While traditional garage spaces are often smaller or non-existent in high-density urban centers, demand is strong in semi-urban areas and for specialized commercial workshops. Manufacturers must adapt to designing highly compact, vertically oriented systems (e.g., automated vertical racks and fold-down workbenches) that serve multiple functions within limited square footage. Meanwhile, Latin America and the Middle East & Africa (MEA) are developing markets, with initial growth predominantly in the commercial sector, supplying heavy-duty racking for industrial warehouses and automotive facilities. Residential adoption in MEA is slowly increasing, driven by luxury residential developments where high-end, temperature-resistant, and dust-proof systems are prioritized for protecting expensive tools and vehicles.

- North America: Dominant market share, high penetration of premium custom cabinet and slatwall systems, driven by high home remodeling expenditures and large garage sizes.

- Europe: Mature market, strong emphasis on sustainability, low VOC materials, and high demand for space-efficient, ergonomic designs in urban environments.

- Asia Pacific (APAC): Highest CAGR, rapid urbanization driving demand for compact, multi-functional, vertical storage solutions adapted to smaller residential spaces.

- Latin America: Emerging market, growth concentrated initially in commercial/industrial sector (automotive, logistics), with slower but steady residential adoption.

- Middle East & Africa (MEA): Growth driven by luxury residential projects and industrial storage needs, requiring robust, temperature and dust-resistant systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garage Storage Organization System Market.- Gladiator (Whirlpool Corporation)

- Sterilite Corporation

- ClosetMaid

- Rubbermaid (Newell Brands)

- Stack-On Products

- LISTA International

- Organized Living

- NewAge Products, Inc.

- Craftsman (Stanley Black & Decker)

- Flow Wall

- HyLoft

- Monkey Bars Storage

- VersaLift

- Schulte Corporation

- Contur Cabinets

- Haltbar

- Knape & Vogt Manufacturing Company

- StoreWALL

- Seville Classics, Inc.

- Waterloo Industries

- GarageTek

- Racor (The Home Depot)

- Aurora Storage Products

- Triton Products

- UltiMATE Garage Cabinets

Frequently Asked Questions

Analyze common user questions about the Garage Storage Organization System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for garage storage systems?

The primary driver is the accelerating trend of home organization and renovation, coupled with homeowners' increasing desire to maximize property utility and convert the garage into a functional, clean, and aesthetically pleasing extension of the living space, directly leading to investments in modular and customized storage solutions.

Which product segment holds the largest share of the Garage Storage Organization System Market?

Cabinet systems, particularly those made of heavy-duty metal and high-grade composites, hold the largest market share. This dominance is attributed to their superior durability, secure storage capabilities, and high aesthetic appeal demanded by residential consumers.

How is the adoption of smart technology impacting garage organization products?

Smart technology, including IoT sensors and AI-powered planning tools, is transforming static storage into 'smart garages' by enabling automated inventory tracking, facilitating personalized layout designs via virtual reality, and integrating motorization for safer, easier access to overhead racks.

What are the key differences between residential and commercial garage storage market segments?

Residential consumers prioritize aesthetics, ease of installation (DIY), and general decluttering, favoring customized cabinet and wall systems. Commercial users prioritize maximum load capacity, heavy-gauge steel durability, chemical resistance, and immediate operational efficiency, often opting for industrial shelving and specialized parts storage.

Which region is expected to exhibit the fastest growth in the forecast period?

The Asia Pacific (APAC) region is projected to show the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, rising middle-class disposable incomes, and the corresponding need for highly efficient, compact, and vertical storage solutions in dense urban environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager