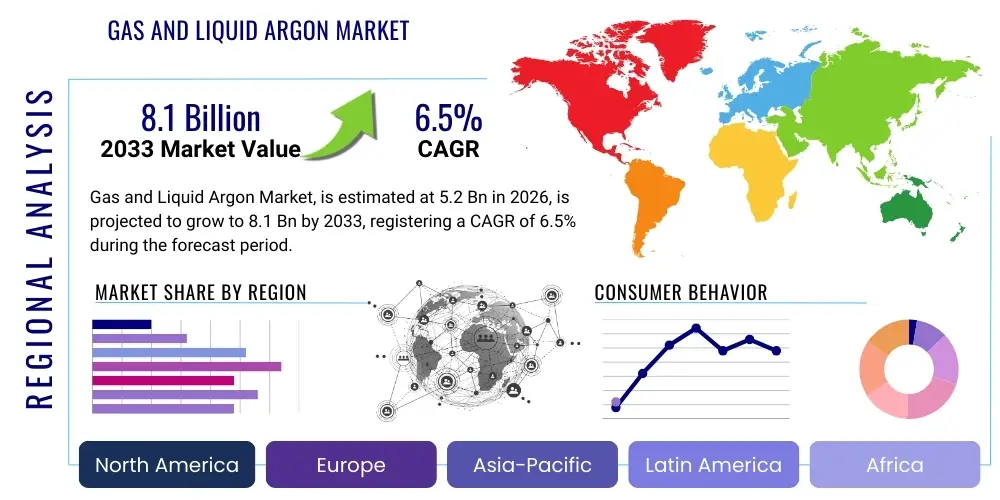

Gas and Liquid Argon Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443317 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Gas and Liquid Argon Market Size

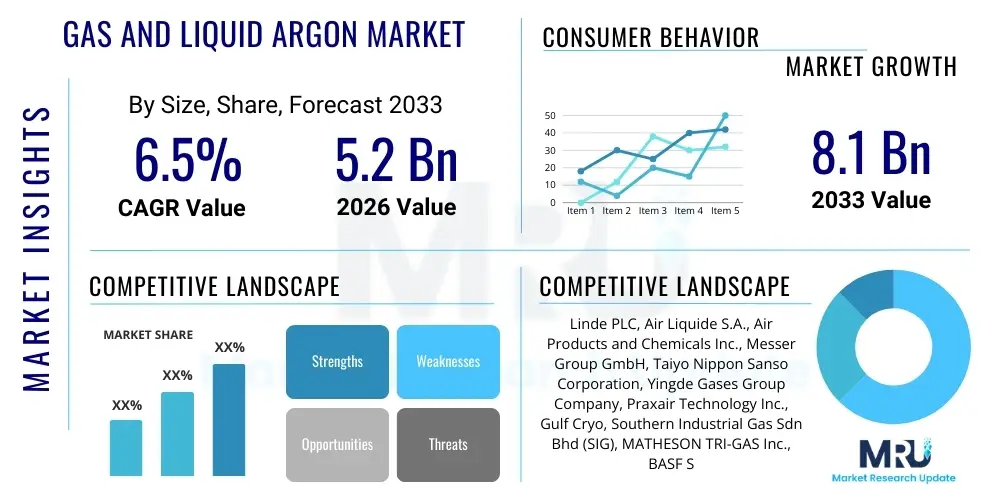

The Gas and Liquid Argon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Gas and Liquid Argon Market introduction

The Gas and Liquid Argon Market encompasses the production, distribution, and consumption of argon, a colorless, odorless, non-flammable noble gas extracted primarily through the fractional distillation of liquid air. Argon is the third most abundant gas in the Earth's atmosphere and is highly valued in industrial applications due due to its inert properties, making it an ideal protective atmosphere where reaction with other elements is undesirable. This inert characteristic is foundational to its use in high-temperature industrial processes, shielding operations, and specialized lighting. The market is driven significantly by the growth of sophisticated manufacturing sectors, particularly in electronics and metal fabrication, which require high-purity argon to prevent oxidation and ensure material integrity.

The product description spans two major forms: compressed gas argon (used typically in smaller volumes or specific laboratory settings) and liquid argon (LA), which is stored at cryogenic temperatures and transported in specialized tankers. Liquid argon dominates the bulk transport segment due to its efficiency in storage and distribution, catering mainly to large industrial consumers such as steel mills, semiconductor fabs, and advanced welding facilities. The purity level of the argon is a critical determinant of its market value and application suitability, with ultra-high purity (UHP) argon being essential for semiconductor manufacturing and specialized research.

Major applications for argon include serving as an inert shield gas in arc welding and plasma cutting (particularly for reactive metals like aluminum and titanium), providing an inert environment for crystal growth in semiconductor production (Czochralski process), and use in specialized lighting, such as fluorescent tubes and lasers. Furthermore, it is utilized in the steel industry for degassing molten metals and controlling the carbon content. The primary benefit of using argon lies in its chemical inertness, which ensures process consistency, improves product quality, and enhances safety in operations where reactive gases or moisture must be excluded. Driving factors include rapid expansion of the global electronics industry, increasing demand for higher quality fabricated metals, and advancements in 3D printing technologies that rely on inert environments.

Gas and Liquid Argon Market Executive Summary

The global Gas and Liquid Argon Market is characterized by steady expansion, propelled primarily by robust industrial growth in Asia Pacific and heightened technological requirements across mature markets in North America and Europe. Key business trends include consolidation among major industrial gas suppliers (Air Liquide, Linde, Air Products) aiming to optimize large-scale Air Separation Unit (ASU) infrastructure and distribution networks. There is a discernible trend towards long-term supply agreements with high-volume end-users, such as integrated circuit manufacturers and large steel producers, stabilizing revenue streams. Furthermore, increasing focus on high-purity argon production, necessitated by shrinking feature sizes in semiconductors and stringent quality standards in medical devices and specialized metallurgy, represents a significant value-add opportunity within the market.

Regionally, the Asia Pacific market exhibits the fastest growth due to massive investments in electronics manufacturing, automotive production, and infrastructure development, especially in China, South Korea, and Taiwan. North America and Europe maintain leading positions in terms of technological adoption and consumption of ultra-high purity grades, driven by mature aerospace, healthcare, and advanced R&D sectors. Regional trends also reflect variations in supply chain logistics; proximity to large ASU plants is crucial for cost optimization, leading to localized pricing structures and competitive advantages for regional distributors capable of efficient cryogenic transport.

Segmentation trends highlight the dominance of the metallurgy segment, which consumes the largest volume of argon for processes like AOD (Argon Oxygen Decarburization) and heat treating. However, the electronics segment, while lower in volume, commands the highest value due to the mandatory requirement for UHP argon. The demand for liquid argon is outpacing gaseous argon growth, reflecting increased industrial scaling and the need for efficient bulk delivery. Furthermore, the market is seeing niche growth in the 3D printing sector, where inert atmospheres are non-negotiable for additive manufacturing of reactive metal powders, signaling a shift towards advanced manufacturing consumption profiles.

AI Impact Analysis on Gas and Liquid Argon Market

User queries regarding the impact of Artificial Intelligence (AI) on the Gas and Liquid Argon Market frequently center on themes of operational efficiency, predictive maintenance for Air Separation Units (ASUs), and optimization of complex supply chains. Users are keenly interested in how AI can minimize energy consumption during cryogenic production—a highly energy-intensive process—and whether smart inventory management systems can reduce losses associated with storing and transporting cryogenic liquids. Key concerns revolve around the potential high initial investment required for integrating sophisticated sensors and AI algorithms into existing legacy infrastructure, particularly in older manufacturing plants. Expectations are high regarding AI's ability to ensure consistent ultra-high purity levels required by demanding end-users like semiconductor manufacturers, mitigating risks associated with contamination through real-time process monitoring and anomaly detection. The overarching sentiment is that while AI won't change argon's chemical role, it will revolutionize its production economics and logistical efficiency, directly impacting pricing stability and supply reliability.

- AI optimizes the operation of Air Separation Units (ASUs), reducing energy intensity in cryogenic distillation.

- Predictive maintenance algorithms minimize unplanned downtime of production facilities, ensuring stable argon supply.

- Enhanced quality control systems using AI image processing and sensor data verify ultra-high purity (UHP) argon required by the electronics sector.

- AI-driven demand forecasting improves cryogenic logistics, optimizing tanker routes and minimizing liquid argon boil-off (storage losses).

- Automation in packaging and cylinder filling processes, managed by AI, enhances safety and throughput efficiency.

DRO & Impact Forces Of Gas and Liquid Argon Market

The Gas and Liquid Argon Market dynamics are defined by a complex interplay of robust demand from high-growth industries and significant logistical and operational constraints. Key drivers include the exponential growth in global semiconductor fabrication, which critically depends on UHP argon for inert environments, and the continued expansion of metal fabrication technologies, particularly high-performance welding and specialized alloy production in the aerospace and automotive sectors. These demand forces are strengthened by the increasing adoption of additive manufacturing (3D printing) of reactive metals, which mandates the use of highly controlled argon atmospheres. Simultaneously, the market is restrained by the high capital expenditure required for building new Air Separation Units (ASUs) and the intensive energy requirements associated with cryogenic distillation, which makes profitability highly sensitive to volatile electricity prices. Supply chain complexity, specifically the challenges of safely transporting and storing liquid argon at extremely low temperatures, adds significant operational cost and risk.

Opportunities for market expansion are primarily found in emerging economies bolstering their manufacturing capabilities, leading to new localized demand centers. Furthermore, technological innovation in argon recycling and recovery systems offers a pathway to mitigate supply constraints and reduce overall production costs, presenting a significant long-term opportunity, particularly for captive production facilities. The integration of Industry 4.0 technologies, including advanced sensor systems and AI, allows for greater efficiency in production and distribution, offering competitive advantages to early adopters. These forces collectively shape the market's trajectory, emphasizing efficiency, technological purity, and reliable supply chain management as paramount competitive factors.

The overall impact forces are high and positive, driven by the indispensability of argon in advanced manufacturing processes. As global standards for material purity and process precision rise across industries like healthcare, space technology, and electronics, the demand for high-grade argon becomes increasingly inelastic. While restraints such as high energy costs and logistical hurdles are constant concerns, the compelling growth in end-use markets ensures sustained investment in supply infrastructure. The ability of manufacturers to efficiently scale production and reliably deliver UHP argon grades will be the dominant force determining market leadership through the forecast period, cementing argon's role as a critical industrial commodity.

Segmentation Analysis

The Gas and Liquid Argon Market is primarily segmented based on the form of the product (Gas and Liquid), the application areas (Metallurgy, Electronics, Welding and Fabrication, Healthcare, etc.), and the purity level required by end-users. This segmentation is crucial as it dictates pricing strategies, distribution methods, and required capital investment. The form segmentation reflects operational efficiencies, where liquid argon dominates bulk supply due to superior transport density, while gaseous argon caters to smaller-volume or specialized lab applications. Application segmentation demonstrates the diverse industrial reliance on argon's inert properties, ranging from massive tonnage consumption in steel refining to highly specialized, low-volume use in ophthalmic surgery. Purity level is perhaps the most economically significant segment, with Ultra-High Purity (UHP) argon demanding a substantial price premium owing to the rigorous purification processes and stringent quality control necessary for high-tech applications like semiconductor manufacturing.

- By Form:

- Liquid Argon

- Gaseous Argon

- By Purity:

- Standard Grade Argon (99.9% - 99.99%)

- High Purity Argon (99.999%)

- Ultra-High Purity (UHP) Argon (99.9995% and above)

- By Application:

- Metallurgy (Steel, Aluminum, Titanium Production)

- Welding and Fabrication (Shielding Gas)

- Electronics and Semiconductor Manufacturing (Inert Atmosphere)

- Lighting and Insulation (Double-pane windows, Fluorescent lighting)

- Healthcare and Medical (Cryosurgery, Diagnostic devices)

- Aerospace and Automotive Manufacturing

- By End-User Industry:

- Chemical Industry

- Manufacturing Industry

- Energy Sector

- Healthcare Sector

- Food and Beverage Industry

- By Distribution Channel:

- Tonnage (Pipeline)

- Bulk (Cryogenic Tankers)

- Cylinder/Packaged Gas

Value Chain Analysis For Gas and Liquid Argon Market

The value chain for the Gas and Liquid Argon market is dominated by large-scale capital investment in upstream infrastructure—specifically Air Separation Units (ASUs)—and highly specialized logistics in the downstream segment. Upstream analysis focuses on the raw material, which is atmospheric air, processed through complex cryogenic distillation cycles. The efficiency and energy consumption of the ASU are the primary cost determinants at this stage. Major industrial gas companies integrate these facilities strategically near large consumption hubs (e.g., steel mills or petrochemical complexes) to maximize efficiency and minimize transportation costs. Procurement involves managing substantial electricity contracts, as energy input is the single largest operating expense in argon production, making site selection and long-term energy pricing critical strategic decisions.

The midstream phase involves purification, liquefaction, and initial bulk storage. For ultra-high purity grades, additional purification steps, such as catalytic removal of trace impurities (oxygen, nitrogen, and moisture), are integrated post-distillation. Liquefaction is essential for efficient transport and storage, converting gaseous argon into liquid argon (LA) at -185.8 °C. Distribution channels are highly specialized: tonnage supply utilizes dedicated pipelines directly connecting the ASU to adjacent large consumers; bulk distribution relies on cryogenic tankers and rail cars designed to maintain temperature and pressure; and packaged gas utilizes high-pressure cylinders for smaller, localized users. The complexity of distribution necessitates proprietary fleet management and specialized handling protocols.

Downstream analysis centers on the end-user application and the supporting service infrastructure. Direct distribution involves industrial gas majors supplying directly to large clients under long-term contracts (e.g., semiconductor fabrication plants). Indirect distribution involves a network of authorized distributors who handle packaged gas cylinders and smaller bulk deliveries to local welding shops, medical facilities, and research laboratories. Value addition at the downstream level includes offering specialized blending services (argon-CO2 mixes for welding), technical support, safety training, and the leasing or maintenance of cryogenic storage equipment at the client site, ensuring reliable and safe product delivery to critical industrial processes.

Gas and Liquid Argon Market Potential Customers

Potential customers for Gas and Liquid Argon span a diverse range of capital-intensive and technology-driven industries where inert atmosphere control is non-negotiable for product quality and process safety. The largest volume consumers reside within the primary metals industry, particularly integrated steel producers utilizing basic oxygen furnaces and ladle metallurgy operations where argon is essential for decarburization, homogenization, and preventing oxidation of specialized alloys. These customers typically require tonnage or high-volume bulk supply, often facilitated by direct pipeline connections due to their continuous, massive consumption rates.

The highest value customers are concentrated in the electronics and semiconductor manufacturing sector. These end-users, including wafer fabricators and display manufacturers, demand ultra-high purity (UHP) argon to act as a protective atmosphere during crystal growing (silicon and germanium) and sensitive deposition processes. Even minute impurities can lead to device failure, driving these customers to establish rigorous specifications and pay significant premiums for guaranteed high-grade supply. Growth in advanced display technology (OLED, QLED) further elevates demand from this specialized customer base.

Other significant buyer groups include aerospace and defense contractors, who use argon extensively in specialized welding (TIG/MIG) of exotic materials like titanium and nickel alloys, ensuring weld integrity in high-stress components. Furthermore, medical and healthcare facilities use argon for cryosurgery (argon beam coagulation) and in diagnostic instrumentation. These diverse end-user profiles underscore the ubiquitous requirement for a chemically non-reactive, reliable medium across high-tech manufacturing globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Liquide S.A., Air Products and Chemicals Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Yingde Gases Group Company, Praxair Technology Inc., Gulf Cryo, Southern Industrial Gas Sdn Bhd (SIG), MATHESON TRI-GAS Inc., BASF SE, NovaAir Industrial Gases, Universal Industrial Gases, Inox Air Products Ltd., Air Water Inc., Gaschem Inc., Buzwair Industrial Gases, Calgaz, NexAir, Chengdu Huarong Chemical Industry Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas and Liquid Argon Market Key Technology Landscape

The Gas and Liquid Argon market's technology landscape is primarily defined by advancements in cryogenic air separation and purification processes, aimed at optimizing energy efficiency and achieving ultra-high purity standards. The core technology remains the Cryogenic Air Separation Unit (ASU), which utilizes distillation columns operating at extremely low temperatures to separate air components based on their boiling points. Recent technological focus includes developing advanced heat exchangers and distillation column designs that minimize operational pressure drop and thermal losses, directly translating into lower electricity consumption per unit of argon produced. Furthermore, modularization of ASUs allows for quicker deployment and scalability, catering efficiently to regional or intermittent industrial demands, especially in developing markets where rapid industrialization requires flexible gas supply infrastructure.

A secondary, yet critical, technological area is high-efficiency purification. Standard argon extracted from the main ASU column still contains trace levels of nitrogen, oxygen, and moisture, which are detrimental in high-tech applications. Advanced purification techniques, such as catalytic de-oxidation (using specialized catalysts to convert oxygen impurities into water vapor, which is then removed) and sophisticated adsorption systems (using molecular sieves or activated carbon), are necessary to achieve the UHP grades (e.g., 99.9999% purity) required for semiconductor manufacturing. Continuous monitoring technologies, often integrated with spectroscopic analysis and proprietary sensor arrays, ensure that gas quality remains strictly within specification throughout the production and distribution lifecycle.

Beyond production, the technology landscape also includes innovations in storage and distribution. This involves developing advanced materials for cryogenic tanks and piping that reduce "boil-off" losses—the natural evaporation of liquid argon due to heat transfer—thereby improving logistical efficiency and reducing product waste. Furthermore, the integration of telematics and IoT sensors into bulk transport tankers allows for real-time monitoring of temperature, pressure, and location, enhancing supply chain reliability and ensuring the product reaches the customer with guaranteed quality. Finally, technologies focused on argon recovery and recycling, particularly in high-volume applications like glove boxes or 3D printing chambers, are gaining traction as companies seek sustainability and cost reduction by capturing and repurifying used gas.

Regional Highlights

The consumption and production landscape of the Gas and Liquid Argon Market shows distinct regional characteristics, closely correlating with local industrial density and technological maturity.

- Asia Pacific (APAC): Dominates the market in terms of volume and growth rate, driven by colossal investments in electronics manufacturing (South Korea, Taiwan, China), automotive expansion, and massive infrastructure projects. China and India are key growth engines, continuously commissioning large-scale Air Separation Units to meet escalating domestic demand. The shift of global manufacturing hubs to APAC fuels the highest demand for both standard and high-purity argon.

- North America: A mature market characterized by high consumption of Ultra-High Purity (UHP) argon, particularly in the semiconductor, aerospace, and advanced R&D sectors. Market stability is ensured by robust regulatory frameworks and continuous demand from specialty manufacturing. The region leverages established, sophisticated pipeline networks for tonnage supply to major industrial clusters.

- Europe: Exhibits steady, quality-driven demand, focusing heavily on argon application in high-value metallurgy, healthcare (medical gases), and complex automotive manufacturing. Strict environmental regulations and high energy costs push producers toward technological efficiency and localized argon recycling initiatives. Germany, France, and the UK are primary consumers.

- Latin America (LATAM): A developing market with demand tied closely to regional steel production and petrochemical industries, primarily centered in Brazil and Mexico. Market growth is sensitive to commodity prices and industrial investment cycles, often relying on imported technology or localized mid-scale ASUs.

- Middle East and Africa (MEA): Growth is accelerating due to massive petrochemical complexes, oil and gas processing, and emerging fabrication industries, particularly in the Gulf Cooperation Council (GCC) countries. These regions benefit from lower natural gas prices (relevant for power generation in ASUs) and are strategically positioning themselves as industrial hubs, necessitating secure, local argon supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas and Liquid Argon Market.- Linde PLC

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Yingde Gases Group Company

- Praxair Technology Inc. (Subsidiary of Linde PLC)

- Gulf Cryo

- Southern Industrial Gas Sdn Bhd (SIG)

- MATHESON TRI-GAS Inc.

- BASF SE

- NovaAir Industrial Gases

- Universal Industrial Gases

- Inox Air Products Ltd.

- Air Water Inc.

- Gaschem Inc.

- Buzwair Industrial Gases

- Calgaz

- NexAir

- Chengdu Huarong Chemical Industry Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Gas and Liquid Argon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Ultra-High Purity (UHP) Argon?

The surging demand for UHP argon is primarily driven by the electronics and semiconductor industry, where it is essential as an inert carrier and protective atmosphere to prevent contamination during the manufacturing of integrated circuits and complex displays, ensuring high device yield and performance.

How is Argon typically produced for industrial use?

Industrial argon is overwhelmingly produced through the fractional distillation of liquid air using large-scale Air Separation Units (ASUs). This cryogenic process separates atmospheric air components—nitrogen, oxygen, and argon—based on their distinct boiling points.

What are the main logistical challenges in the Liquid Argon market?

The principal logistical challenge is maintaining the cryogenic temperature (approximately -186°C) required to keep argon in its liquid state, necessitating specialized, vacuum-insulated tankers and storage vessels, and minimizing boil-off losses during transport and storage.

Which geographical region holds the largest share in the Argon market?

Asia Pacific (APAC) holds the largest market share and exhibits the fastest growth rate, largely due to extensive industrialization, particularly the high concentration of semiconductor fabrication facilities and steel production capacity in countries like China, South Korea, and Taiwan.

In which industries is argon volume consumption highest?

The metallurgy industry, particularly the steel production sector, accounts for the largest volume consumption of argon, where it is used extensively in processes such as Argon Oxygen Decarburization (AOD) and ladle refining to achieve high-quality steel alloys.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager