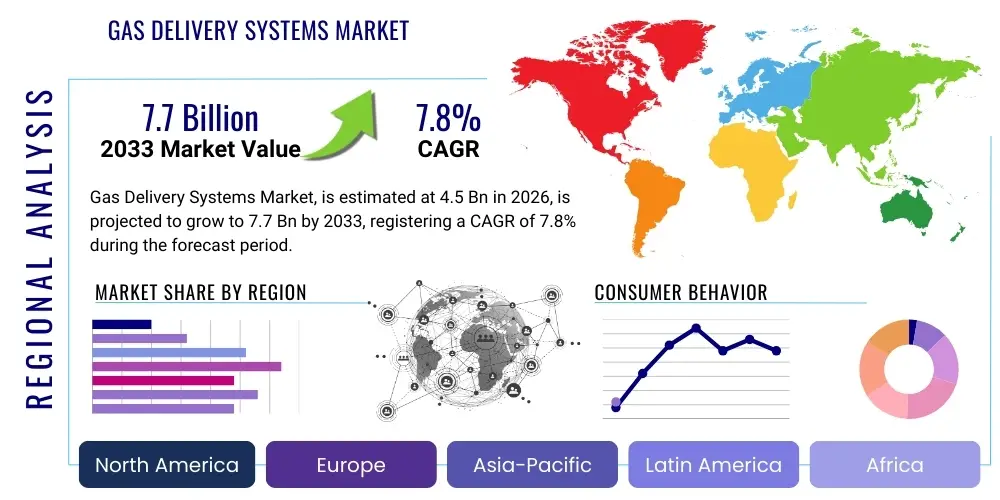

Gas Delivery Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442093 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Gas Delivery Systems Market Size

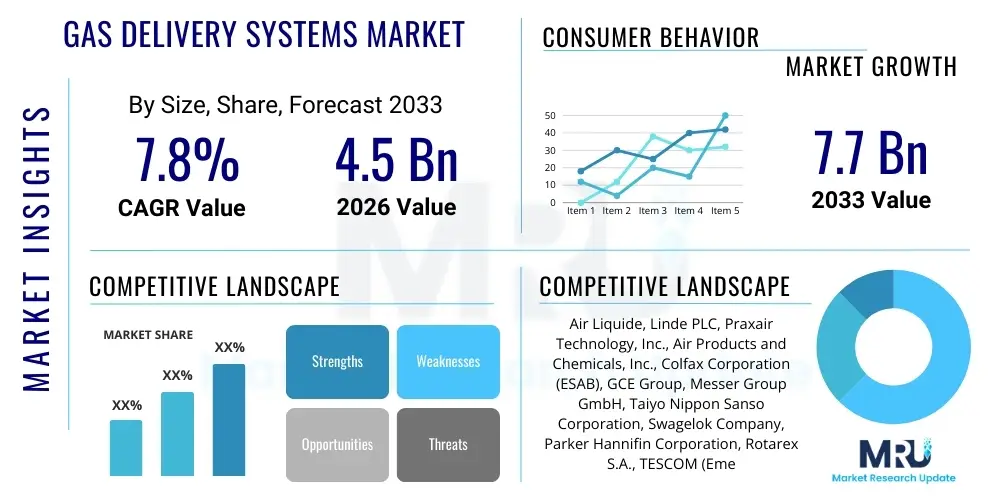

The Gas Delivery Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Gas Delivery Systems Market introduction

The Gas Delivery Systems Market encompasses the design, manufacture, installation, and maintenance of intricate piping, valves, regulators, purifiers, and monitoring equipment required to safely and efficiently transport high-purity and specialty gases from their source to the point of use. These systems are critical components across various high-tech and essential industries, ensuring precise flow, pressure control, and contamination prevention, particularly for sensitive processes like semiconductor fabrication, pharmaceutical manufacturing, and specialized medical applications. The necessity for ultra-high purity gas handling, especially for toxic or corrosive substances, drives continuous technological advancements in system materials and automated control mechanisms. The escalating demand for electronic devices and stringent regulatory standards governing industrial gas usage further underpin the market's fundamental growth trajectory, pushing manufacturers toward modular, automated, and fail-safe system designs that maximize uptime and minimize operational risk.

Products within this market range significantly in complexity, from simple laboratory gas cabinets and single-stage regulators to complex, fully automated bulk gas delivery units (BGDUs) used in large-scale industrial settings. Key applications include the delivery of process gases (like nitrogen, argon, and oxygen), fuel gases (like hydrogen), and highly specialized electronic gases (like silane and ammonia) which are integral to etching, deposition, and cleaning processes. The primary benefits derived from modern gas delivery systems include enhanced process efficiency through precise flow control, improved safety protocols due to leak detection and automatic shutoff capabilities, and maintenance of gas purity crucial for product yield, especially in microelectronics and biotechnology sectors. These systems are essential for maintaining the integrity of highly sensitive manufacturing environments where even minor impurities can lead to product failure or catastrophic process interruption.

Major driving factors fueling market expansion include the rapid global growth of the semiconductor industry, characterized by the construction of new fabrication plants (fabs) that require advanced, customized gas infrastructure capable of handling next-generation process requirements. Furthermore, the global shift towards renewable energy sources is accelerating the adoption of hydrogen as a clean fuel, necessitating robust and secure hydrogen gas delivery and dispensing systems across industrial and refueling infrastructure. Concurrently, the increasing aging population and rising prevalence of respiratory diseases are boosting demand for medical gas delivery systems in hospitals and healthcare facilities. These macro trends, combined with continuous innovation in materials science enabling safer handling of increasingly hazardous process gases, create a fertile environment for sustained market growth throughout the forecast period.

Gas Delivery Systems Market Executive Summary

The global Gas Delivery Systems Market is poised for significant expansion, largely driven by fundamental shifts in global business trends, including the massive governmental and private investment in advanced semiconductor manufacturing capacity globally, particularly in North America and Asia Pacific. Business trends reflect a clear preference for modular, highly automated, and localized gas delivery solutions that integrate seamlessly with Industry 4.0 principles, emphasizing predictive maintenance, remote diagnostics, and enhanced safety features. Key industry players are focusing on strategic collaborations and vertical integration to secure the supply chain for high-purity components, addressing regulatory pressures related to environmental impact and worker safety. The increasing complexity of gas mixtures required in cutting-edge manufacturing processes necessitates continuous research and development into sophisticated flow controllers and purifiers, thereby raising the technological barrier to entry and consolidating the market among established providers capable of offering turnkey solutions.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China, South Korea, and Taiwan, maintains the dominant market share due to the concentration of major semiconductor and electronics manufacturing hubs. However, North America and Europe are exhibiting accelerating growth rates, fueled by initiatives aimed at revitalizing domestic semiconductor production (e.g., the US CHIPS Act) and substantial investments in the hydrogen economy infrastructure. Regional trends also show a growing divergence in application focus: while APAC remains heavily focused on electronic gases, Europe and North America show robust growth in industrial and medical applications, coupled with emerging opportunities in carbon capture and green hydrogen generation infrastructure. These geographical expansions are leading to localized manufacturing and service hubs to meet immediate customer demands and navigate complex export controls related to specialized technology.

Segment trends reveal that the Equipment segment, particularly high-purity regulators, flow controllers, and gas panels, holds the largest market share due to their frequent need for replacement and upgrade cycles corresponding to process changes. However, the Services segment, encompassing installation, maintenance, and system calibration, is projected to register the fastest growth rate, reflecting the industry's shift towards outsourced expertise to manage increasingly complex and critical gas handling infrastructure. By Operation, automatic systems are quickly replacing manual setups, driven by the demand for repeatability, minimal human intervention in hazardous environments, and stringent quality control standards in end-use sectors like semiconductors and pharmaceuticals. In terms of Application, the semiconductor and electronics segment remains the largest revenue contributor, but the medical/healthcare segment is demonstrating resilient and steady growth, driven by long-term demographic factors.

AI Impact Analysis on Gas Delivery Systems Market

User inquiries regarding AI's influence on the Gas Delivery Systems Market primarily revolve around themes of system optimization, predictive failure, safety enhancement, and supply chain efficiency. Users frequently ask: "How can AI optimize gas flow rates and purity in real-time?" and "What is the role of machine learning in preventing regulator failure?" The consensus expectation is that AI will move gas delivery from reactive maintenance to fully autonomous, optimized operation. Key themes identified are the transition towards 'Smart Gas Management,' where algorithms analyze sensor data (pressure, flow, temperature, chemical traces) to dynamically adjust delivery parameters, ensuring peak efficiency and reducing waste. Furthermore, users anticipate that deep learning will be instrumental in identifying subtle operational anomalies that precede critical equipment failure, significantly boosting safety and reducing expensive downtime in sensitive manufacturing processes.

The application of Artificial Intelligence within gas delivery systems is fundamentally transformative, shifting operational paradigms toward condition-based monitoring and cognitive automation. By leveraging vast amounts of historical and real-time operational data, AI models can establish baseline performance metrics and instantly flag deviations indicative of potential leaks, material fatigue, or purity breaches. This capability is paramount in environments requiring ultra-high gas purity, such as EUV lithography processes in semiconductor fabs, where momentary contamination can ruin batches worth millions. AI integration extends the lifespan of expensive equipment like mass flow controllers and high-purity valves by ensuring they operate within optimal parameters, minimizing stress and wear while maximizing overall yield.

Beyond technical optimization, AI significantly impacts the supply chain logistics for specialty and bulk gases. Machine learning algorithms can accurately predict future consumption patterns based on production schedules, inventory levels, and historical seasonal demand fluctuations. This predictive capability allows gas suppliers and facility managers to optimize ordering, tank switching, and delivery schedules, minimizing stock-outs of critical materials and reducing the logistical carbon footprint associated with emergency deliveries. The integration of AI-driven control systems also supports regulatory compliance by maintaining impeccable digital records of all flow and pressure adjustments, simplifying audits and ensuring adherence to increasingly strict industrial safety standards.

- AI enables real-time dynamic flow and pressure optimization based on process stage requirements, minimizing gas waste.

- Predictive maintenance algorithms analyze sensor data (vibration, temperature, pressure spikes) to forecast equipment failure, increasing system reliability.

- Machine Learning (ML) enhances safety by rapidly detecting micro-leaks or sudden drops in purity, triggering automated emergency shutdown protocols faster than human operators.

- AI supports supply chain resilience by accurately forecasting consumption needs for critical specialty gases, optimizing inventory management and logistics.

- Cognitive automation facilitates remote system tuning and diagnostics, reducing the need for personnel presence in hazardous gas handling environments.

DRO & Impact Forces Of Gas Delivery Systems Market

The dynamics of the Gas Delivery Systems Market are primarily driven by the escalating global demand for high-purity materials in the semiconductor industry and the monumental push toward sustainable energy infrastructure, specifically the widespread adoption of hydrogen technologies. However, this growth is significantly tempered by restraints such as the substantial capital expenditure required for installing ultra-high purity systems, the extreme complexity involved in handling hazardous and specialized gases, and stringent international regulatory hurdles concerning safety and environmental protection. Opportunities abound in emerging markets and through the integration of advanced sensors and IoT capabilities, leading to smart, self-diagnosing gas delivery systems that address current operational inefficiencies. The interplay of these forces dictates market trajectory, with technological innovation in materials and automation serving as the core impact force driving competitiveness and market differentiation among key vendors.

Drivers include the continuous technological scaling in semiconductor fabrication, necessitating gas delivery systems capable of handling smaller nodes (5nm, 3nm, and below) which demand unprecedented levels of gas purity and flow precision. Furthermore, the global expansion of healthcare infrastructure, particularly in developing nations, increases the need for reliable medical oxygen and anesthetic gas delivery systems. The transition away from fossil fuels and the associated investment in green hydrogen production and utilization necessitate entirely new, high-pressure, corrosion-resistant infrastructure designed specifically for hydrogen transport and dispensing. These macro-economic drivers ensure sustained, high-value demand for robust, specialized gas delivery solutions across diverse industrial sectors globally, moving beyond traditional industrial gas applications into highly specialized domains.

Restraints primarily revolve around the initial high cost of system installation, particularly for ultra-high purity systems which require expensive materials (like stainless steel, specialized alloys) and sophisticated cleanroom installation procedures. Regulatory compliance represents a significant constraint; systems must adhere to diverse regional and international standards (e.g., ISO, ASME, SEMI) regarding pressure safety, material compatibility, and leak testing, leading to protracted design and certification cycles. Opportunities are abundant in the aftermarket services segment, including predictive maintenance, component upgrades, and calibration contracts, offering stable revenue streams for providers. Moreover, the development of modular, standardized systems suitable for smaller industrial applications or decentralized energy generation represents a viable opportunity for market penetration and risk diversification away from the capital-intensive semiconductor sector.

Segmentation Analysis

The Gas Delivery Systems Market is comprehensively segmented based on Type, Operation, Application, and End-Use Industry, providing a granular view of market dynamics and specialized demand centers. The core segments reflect the heterogeneity of industrial requirements, ranging from the fundamental components used in gas handling to the sophisticated, fully integrated systems serving mission-critical applications. Segmentation by Type, covering equipment and services, reveals the contrasting investment cycles between capital expenditure on physical hardware and operational expenditure on system maintenance and management. Operationally, the shift from manual to automatic systems is the most defining characteristic, driven by the paramount need for safety, precision, and efficiency in modern manufacturing environments. This layered segmentation approach allows suppliers to target specific value propositions to distinct industrial groups, maximizing market penetration.

The crucial differentiator in segment performance often lies in the required purity level and pressure handling capability, which directly correlates with component complexity and cost. For instance, the high-purity systems required for electronics utilize specialized metal seals (VCR fittings) and electropolished tubing, contrasting sharply with the lower-purity, larger-volume systems used in general industrial manufacturing. The Application segment highlights the specific gases being handled (e.g., electronic gases, fuel gases, medical gases), where each category demands unique safety and material compatibility considerations. Understanding these segmentation nuances is vital for market participants to align their product portfolios—such as developing high-pressure valves for hydrogen applications or ultra-high purity flow controllers for advanced deposition techniques—with precise industry needs, ensuring maximum relevance and competitive advantage in a highly technical market.

- By Type:

- Equipment (Regulators, Valves, Gas Panels/Sticks, Flow Controllers, Purifiers, Filters, Piping)

- Services (Installation, Maintenance & Calibration, Consulting, Training)

- By Operation:

- Manual Systems

- Automatic Systems

- By Application:

- Electronic Gases

- Industrial Gases (Inert Gases, Oxygen, Acetylene, etc.)

- Medical Gases

- Fuel Gases (Hydrogen, Natural Gas)

- By End-Use Industry:

- Semiconductors & Electronics

- Pharmaceutical & Biotechnology

- Oil & Gas

- Chemical & Petrochemical

- Healthcare & Medical

- Energy & Power (Including Hydrogen Infrastructure)

- Aerospace & Defense

Value Chain Analysis For Gas Delivery Systems Market

The value chain for the Gas Delivery Systems Market begins with raw material sourcing and component manufacturing, progresses through highly specialized assembly and testing, and culminates in installation, commissioning, and long-term maintenance services. Upstream analysis involves suppliers of specialized raw materials, primarily high-grade stainless steel, specialized nickel alloys, and polymers necessary for resisting corrosion and ensuring gas purity. Component manufacturers, which often specialize in high-precision parts like regulators, valves, and mass flow controllers, form the critical mid-stream section. These components require specialized manufacturing techniques, including precision machining, cleanroom assembly, and meticulous quality control protocols to meet stringent purity specifications demanded by end-users, particularly in the semiconductor and pharmaceutical sectors.

The core value addition occurs at the system integration stage, where specialized Gas Delivery System providers design, fabricate, and assemble complete gas panels, cabinets, and bulk delivery units tailored to specific application requirements (e.g., pressure, flow rate, gas type). Distribution channels are highly complex and often bifurcated into direct sales and indirect channels. Direct sales are preferred for large, custom, or turnkey projects involving major semiconductor fabs or petrochemical complexes, ensuring tight technical consultation and installation oversight. Indirect channels, involving technical distributors and authorized representatives, typically handle standard component sales and maintenance contracts for smaller or geographically dispersed industrial clients, providing localized support and faster fulfillment.

Downstream analysis focuses heavily on the post-installation phases, including commissioning, mandatory safety inspections, and ongoing system maintenance. Due to the critical nature of these systems, the services component, which includes calibration, leak testing, and certification, provides a significant, stable revenue stream. The successful delivery of value is highly dependent on effective collaboration between the system integrator and the gas supplier (which may be independent or integrated) and the ultimate end-user facility, especially regarding system redundancy and emergency protocols. Ensuring robust service support and rapid availability of replacement parts is a key competitive differentiator, directly influencing end-user choice in this high-consequence market.

Gas Delivery Systems Market Potential Customers

The primary end-users and buyers of Gas Delivery Systems are defined by their reliance on precise, reliable, and safe delivery of specialty or bulk industrial gases for critical manufacturing or operational processes. The semiconductor and electronics industries constitute the largest and most technically demanding customer base, requiring ultra-high purity systems for processes such as chemical vapor deposition (CVD), etching, and ion implantation, where gas purity directly impacts chip yield and functionality. Similarly, pharmaceutical and biotechnology companies are high-value customers, using specialized gases (like nitrogen for inerting, oxygen for fermentation, and various research gases) under strict regulatory compliance (e.g., FDA validation), necessitating certified and traceable delivery systems.

Beyond high-tech manufacturing, the Oil & Gas and Chemical & Petrochemical sectors represent substantial potential customers, particularly for large-volume bulk gas delivery and handling systems used in refining, process control, and inerting large storage tanks and reactors. These customers prioritize robustness, high flow rates, and adherence to severe environmental and safety standards (e.g., ATEX requirements for explosive atmospheres). The accelerating development of the hydrogen economy is rapidly expanding the customer base to include developers of hydrogen refueling stations, power plants utilizing hydrogen for energy storage, and industrial facilities adopting hydrogen as a clean fuel source, requiring specialized high-pressure delivery components.

Furthermore, the Healthcare sector, including hospitals, clinics, and emergency services, remains a foundational customer segment for medical gas delivery systems, including central manifold systems for oxygen, nitrous oxide, and medical air. These applications demand exceptional reliability and adherence to strict medical device standards. Specialized niche customers also include aerospace and defense contractors requiring precision gas handling for welding, propulsion testing, and specialized atmospheric control. The diversity across these end-use segments necessitates a highly customized approach from system providers, who must tailor material selection, component design, and service offerings to meet the unique safety, purity, and volume requirements of each distinct industrial buyer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Air Liquide, Linde PLC, Praxair Technology, Inc., Air Products and Chemicals, Inc., Colfax Corporation (ESAB), GCE Group, Messer Group GmbH, Taiyo Nippon Sanso Corporation, Swagelok Company, Parker Hannifin Corporation, Rotarex S.A., TESCOM (Emerson Electric Co.), Fujikin Incorporated, Ichor Systems, Inc., Applied Materials, Inc., Entegris, Inc., Matheson Tri-Gas, Inc., Valin Corporation, Critical Process Systems (CPS), and Ultra Clean Technology (UCT). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Delivery Systems Market Key Technology Landscape

The technological evolution within the Gas Delivery Systems Market is fundamentally centered on achieving superior purity, higher safety standards, and greater automation. A primary technological focus is on Ultra-High Purity (UHP) component design, specifically utilizing advanced materials such as electropolished stainless steel and specialized alloys to minimize surface area and prevent outgassing, which are critical sources of contamination in sensitive processes. Crucial technologies include advanced Mass Flow Controllers (MFCs) and Mass Flow Meters (MFMs) that incorporate digital signal processing and MEMS (Micro-Electro-Mechanical Systems) technology to achieve sub-percent accuracy and rapid response times, essential for complex gas mixing and sequential pulsing required in atomic layer deposition (ALD) and chemical vapor deposition (CVD) processes. The implementation of metallic seal technology, such as VCR fittings, remains standard to ensure leak-tight connections that withstand thermal cycling and high pressures without the need for elastomeric seals, which can be contamination sources.

Furthermore, sensor technology has undergone a significant transformation, moving toward smart, interconnected IoT devices embedded throughout the delivery infrastructure. Key innovations include highly sensitive trace moisture and particulate analyzers, capable of detecting impurities in the parts per billion (ppb) range in real-time. This integration facilitates proactive quality control, allowing systems to automatically divert off-spec gas before it impacts the manufacturing process. For safety, the adoption of specialized gas detection and monitoring systems, including infrared and electrochemical sensors, provides continuous environmental surveillance, coupled with automated purge and emergency shutoff systems. This advanced sensing capability is critical for handling increasingly hazardous gases, such as pyrophoric or highly corrosive substances used in advanced semiconductor manufacturing.

A significant emerging technology area is the development of robust, high-pressure handling infrastructure optimized for hydrogen fuel applications. This necessitates materials science advancements to counter hydrogen embrittlement and the integration of highly resilient valves and regulators capable of safely managing pressures up to 700 bar (10,000 psi) while maintaining structural integrity over long operational periods. Additionally, sophisticated software platforms are being deployed to integrate control of various system components, offering centralized remote monitoring, predictive analytics (driven by AI), and standardized data logging compliant with regulatory requirements. The trend is clearly towards modular, plug-and-play systems, reducing on-site installation time and complexity while enabling easier upgrades and maintenance cycles.

Regional Highlights

The Gas Delivery Systems Market exhibits significant regional variations in demand intensity, technological maturity, and application focus.

- Asia Pacific (APAC): APAC commands the largest market share globally, driven primarily by the colossal manufacturing footprint of the semiconductor and electronics industries in countries like China, Taiwan, South Korea, and Japan. Massive investments in new fabrication plants (fabs) and increased government support for localized technology production ensure sustained, high-volume demand for ultra-high purity gas delivery equipment and services. China’s ambitious goals for self-sufficiency in chip production are a key engine of growth in this region.

- North America: North America is characterized by robust growth, propelled by the resurgence of domestic semiconductor manufacturing facilitated by government incentives and strong investment in biotechnology and healthcare sectors. The region is a technological leader, emphasizing the adoption of advanced automation, AI-integrated delivery systems, and infrastructure development for the burgeoning hydrogen economy. Demand here is typically high-value, focusing on cutting-edge technology and high regulatory compliance.

- Europe: European market growth is stable, underpinned by established pharmaceutical and chemical industries, alongside aggressive initiatives supporting the green transition. Significant focus is placed on industrial gas delivery systems and emerging hydrogen infrastructure projects, especially in Germany, France, and the UK. Strict environmental and safety regulations drive demand for highly reliable, certified, and energy-efficient systems.

- Latin America (LATAM): The LATAM market represents an emerging opportunity, with growth concentrated in industrial applications, petrochemical processing, and expanding healthcare facilities, especially in Brazil and Mexico. While demand for ultra-high purity systems is lower than in APAC or North America, there is steady demand for standard industrial gas equipment and related services driven by infrastructure modernization.

- Middle East and Africa (MEA): The MEA market growth is intrinsically linked to the expansion of oil and gas processing capabilities and national diversification efforts leading to investment in petrochemical and metal industries. Significant opportunities are also emerging in large-scale solar and industrial projects, necessitating reliable bulk gas delivery infrastructure, particularly in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Delivery Systems Market.- Air Liquide

- Linde PLC

- Praxair Technology, Inc.

- Air Products and Chemicals, Inc.

- Colfax Corporation (ESAB)

- GCE Group

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Swagelok Company

- Parker Hannifin Corporation

- Rotarex S.A.

- TESCOM (Emerson Electric Co.)

- Fujikin Incorporated

- Ichor Systems, Inc.

- Applied Materials, Inc.

- Entegris, Inc.

- Matheson Tri-Gas, Inc.

- Valin Corporation

- Critical Process Systems (CPS)

- Ultra Clean Technology (UCT)

Frequently Asked Questions

Analyze common user questions about the Gas Delivery Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for ultra-high purity (UHP) gas delivery systems?

The primary driver is the rapid global expansion and technological scaling of the semiconductor and electronics manufacturing industries. Modern microchip fabrication requires gases delivered at sub-parts-per-billion purity levels, necessitating specialized UHP systems to prevent defects and ensure high manufacturing yield for advanced nodes (5nm and below).

How is the rising global focus on the hydrogen economy impacting the Gas Delivery Systems Market?

The hydrogen economy is generating significant demand for high-pressure (up to 700 bar), corrosion-resistant gas delivery infrastructure, including specialized valves, regulators, and piping materials. This involves major investment in fueling stations, production facilities, and industrial utilization systems designed to safely and efficiently handle hydrogen gas.

Which segment of the Gas Delivery Systems Market is expected to experience the fastest growth?

The Services segment (including installation, maintenance, calibration, and consulting) is projected to exhibit the fastest growth. This acceleration is due to the increasing complexity of installed systems, the necessity of mandatory regulatory compliance checks, and the shift towards predictive and outsourced maintenance models to maximize uptime in critical manufacturing environments.

What are the most crucial safety technologies integrated into modern gas delivery systems?

Crucial safety technologies include sophisticated automated leak detection systems, integrated pressure and flow monitoring sensors, specialized purging mechanisms for toxic gas removal, and programmable logic controllers (PLCs) that enable immediate automated emergency shutoff protocols (ESPs) to protect personnel and sensitive equipment from hazardous releases.

In the context of the supply chain, what are the biggest challenges faced by Gas Delivery System providers?

The biggest challenges involve sourcing specialized, high-grade components (like stainless steel alloys and UHP valve diaphragms) amidst global supply chain volatility and managing the complexity of technical talent required for cleanroom installation and certification. Geopolitical tensions also complicate the reliable distribution of critical, technologically advanced systems to major manufacturing hubs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager